Investors pile into a currency-hedged Japan ETF on Thursday for protection as the Japanese yen falls on a historic BOJ policy shift.

Source link

Seeking

Sam Bankman-Fried’s Parents Ask Court to Dismiss FTX’s Lawsuit Seeking to Recover Funds

Joseph Bankman and Barbara Fried, the parents of Sam Bankman-Fried, have asked a court to dismiss a lawsuit by the bankrupt cryptocurrency exchange FTX seeking to recover funds it alleges were fraudulently transferred.

FTX sought to “recover millions of dollars” from Bankman and Fried in September 2023. Less than two months later, their son, Bankman-Fried, was found guilty on all seven charges of defrauding customers and the United States. His sentencing is expected in March.

Bankman and Fried, both professors at Stanford Law School, argued that Bankman did not have a fiduciary relationship with FTX and did not serve “as a director, officer, or manager,” and even if a fiduciary relationship existed with FTX to plausibly allege a breach, according to a Jan. 15 court filing.

Significantly, the court filing argued that it is not enough for FTX to plead that the parents “knew or should have known.” Instead, the filing argued that FTX should have produced specific facts showing “actual knowledge” that the parents “knew certain actions would result in a breach of fiduciary duty.”

In the September 2023 lawsuit filing, FTX did not state the total amount Bankman and Fried may have misappropriated, but it did provide certain line items: Bankman received an annual salary of $200,000 for his role as a senior adviser to the FTX foundation, more than $18 million for the property in the Bahamas and $5.5 million in FTX Group donations to Stanford University, which the university has said will be returned.

Seeking up to 11% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

The headwinds are piling up on our economic horizon, just a few blurs of cloud right now, at the edge of the horizon – and we just don’t know what’s coming next. The headwinds include factors we all know about: persistent inflation, the Fed’s higher interest rates and tighter monetary policy, the tighter business and consumer credit environment, and the fast-rising government debt which at $33.57 trillion already measures 103% of the total GDP. We’ve been reading about these headwinds for several years now; what we don’t know is if, or when, they will coalesce into a storm.

In the words of Jamie Dimon, the CEO of JPMorgan, “This may be the most dangerous time the world has seen in decades. While we hope for the best, we prepare the Firm for a broad range of outcomes so we can consistently deliver for clients no matter the environment.”

The bottom line is that investors need to take defensive postures with their portfolio additions. And that will naturally lead investors toward high-yield dividend stocks. These income-generating equities offer some degree of protection against both inflation and share depreciation by providing a steady income stream.

Against this backdrop, some top-rated analysts have given the thumbs-up to two dividend stocks yielding up to 11%. Opening up the TipRanks database, we examined the details behind these two to find out what else makes them compelling buys.

Blackstone Secured Lending (BXSL)

First up is Blackstone Secured Lending, a business development company, or BDC, operating under the larger cover of the Blackstone asset management firm. BXSL operates in the financial services sector, providing capital and credit services to private companies in the US market and across a wide range of sectors including veterinary care, the insurance industry, and cable communications distributors. The top sectors represented in BXSL’s portfolio are software and healthcare.

By the numbers, BXSL’s portfolio holds $9.3 billion in investments, at fair value. These are composed mainly of first lien senior secured loans, 98.4% of the total, and 98.7% of the total is made in floating rate instruments. BXSL has current investments in 180 companies, as of the end of 2Q23.

That was the last reported quarter, and in it, BXSL realized some $290 million in total investment income. This was up 55% year-over-year and beat the forecast by $14.5 million. At the bottom line, BXSL reported a net investment income of $1.06 per share, a result that was 3 cents per share ahead of the estimates. The NII exceeded the company’s regular dividend payment – marking the 17th quarter in a row that BXSL has achieved full coverage of the common share dividend.

BXSL has recently increased its common share regular dividend by 10% to 77 cents, which is scheduled to be paid out this coming October 26. At an annualized rate of $3.08, this dividend offers a robust yield of 11.5%, surpassing the average dividend yield of S&P-listed companies by more than 5x.

Truist analyst Mark Hughes has been impressed by BXSL’s high quality portfolio and its ability to maintain its dividend. The 5-star analyst writes of the stock, “The high quality of Blackstone Secured Lending’s portfolio is underscored by its low proportion of PIK income and high dividend coverage. This positions the company to both grow net asset value (NAV) on a consistent basis and to maintain a stable and attractive dividend yield; historically this has been the formula for BDCs to trade at a premium to NAV… Blackstone Secured Lending shares are compelling on a price-to-NAV basis, we believe, particularly when evaluated in the context of the company’s return on equity and the quality of its investment portfolio…”

Looking ahead, Hughes rates BXSL shares a Buy, and his price target, now set at $29, implies the stock will gain 8.3% in the year ahead. The total return will approach ~20% when the dividend is added to the upside. (To watch Hughes’ track record, click here)

Overall, the 9 recent analyst reviews on this stock include 6 Buys over 3 Holds, for a Moderate Buy consensus rating. (See BXSL stock forecast)

Equitrans Midstream (ETRN)

Next up on our ‘dividend list’ is Equitrans, a midstream company in the oil and gas sector. Midstream firms hold a vital link in the energy chain, moving hydrocarbon products from production regions and wellheads to the refineries, terminal points, and storage farms where retailers can pick it up for sale to the end users. Equitrans focuses its operations in the Appalachian region, specifically the area where Pennsylvania, Ohio, and West Virginia come together. This is one of America’s richest natural gas production regions and forms the core of this company’s extensive midstream network.

Equitrans’ transport assets mainly move natural gas and natural gas products out of the Appalachian Basin; the company describes its network as holding a strategic position capable of ‘debottlenecking’ the Basin. In particular, the company’s Mountain Valley Pipeline (MVP) and MVP Southgate projects promise the growth needed to improve the key link between natural gas sources and the major US demand markets.

At bottom, this means the company is routinely capable of generating profits and cash. Yet, in its last financial report, for Q2, the company’s total revenue came to $318.5 million, down 3% from the prior-year quarter and missing the forecast by almost $7.9 million. But – the company’s bottom line was sound, at 9 cents per share by non-GAAP measures, a result that beat the forecast by 4 cents per share.

This company has a dividend history going back to 2019, and the dividend has been held stable since 2020. That current stable payment is 15 cents per common share, or 60 cents annually, and the dividend yield is 6.3%.

Writing on this stock from Goldman Sachs, industry expert John Mackay likes Equitrans’ extensive footprint and notes that its assets are attractive to investors and M&A firms alike.

“Given ETRN’s strategic gathering and transmission footprint in the Appalachian Basin, relative EV size, and cash flow clarity from an MVP resolution, we see ETRN as a potential M&A target. ETRN’s assets are highly strategic in our view in the core of the SW Marcellus and Utica with interconnections into all major interstate pipelines in the region – and are supported by long term MVCs with IG counterparties… With an EV size of ~$[12]b, we believe the relative size appears manageable for larger midstream players,” Mackay opined.

Going forward, these comments back up the Goldman Sachs analyst’s Buy rating, which comes with an $11.50 price target, suggesting a gain of almost 21% on the one-year horizon. That return can reach 27% with the dividend added in. (To watch Mackay’s track record, click here)

Overall, Equitrans boasts a Strong Buy rating from the analyst consensus, and it is unanimous – based on 3 recent positive share reviews. (See Equitrans stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Seeking Stability? Goldman Sachs Says These 2 ‘Blue Chip’ Stocks Are Less Vulnerable to Rising Rates

Policies can have a ripple effect, often going beyond their initial intent. We’re seeing this now from the Federal Reserve, which has made it clear that, in response to stubbornly persistent inflation, it will be holding interest rates higher for longer.

This trend aligns with observations made by David Kostin, Chief US Equity Strategist at Goldman Sachs. Kostin points out that stocks have shown a strong return on equity (ROE) over the past several decades, reflecting a positive combination of profitability and efficiency. However, these prosperous times may be coming to an end as higher interest rates start impacting corporate activities.

“If rates continue to rise or stay higher for longer,” Kostin states in his recent note, “increased borrowing costs would disincentivize companies from taking on greater amounts of leverage.”

To guide investors, Kostin has listed a range of stocks that he believes are “less vulnerable to rising rates and offer stability amid greater macro uncertainty.” Prominent among his picks are credit card issuers and processors. These companies have been benefiting from strong consumer spending in recent years, and the industry giants among them possess the deep resources necessary to weather the impact of rising interest rates. Let’s take a closer look at two of these ‘blue chip’ names.

Mastercard (MA)

We’ll start with Mastercard, one of the market’s true ‘blue chip’ stocks. With a market cap of $374 billion, Mastercard is currently the third-largest of the major credit card issuer/processor companies (Visa and JPMorgan Chase hold the first and second spots, respectively) and has been an industry leader since its founding in 1966.

The company has over 3,900 clients in more than 120 countries and handles more than 125 billion purchase transactions annually at more than 80 million merchant locations.

Mastercard will report its 3Q23 results late this month – but a look at the Q2 results is informative. In Q2, Mastercard showed several solid metrics, starting with the gross dollar volume of $2.3 trillion, up 12% year-over-year. Cross-border transaction volumes were up 24%, and the company’s adjusted net revenue came to $6.3 billion, up 14% from the $5.5 billion in 2Q22, and beating the forecast by $130 million. The company’s bottom line, reported as a non-GAAP adjusted diluted EPS of $2.89, was 6 cents ahead of the expectations.

Among the bulls is Goldman Sachs analyst Will Nance, who sees future growth potential as the key story.

“We continue to see strong tailwinds for MA over the next several years, especially given its greater leverage to the emerging markets, where card penetration is lower, as well as the company’s strategic focus on value added services. With shares currently trading at 27x 2024E P/E, shares are trading roughly in-line with history, and appear cheap relative to the market (even excluding FAAMG). We believe the company’s superior growth profile screens as attractive and would lean into any further weakness over the next few months,” Nance opined.

Looking ahead, Nance rates MA stock a Buy, and his $456 price target implies a one-year upside potential of ~15%. (To watch Nance’s track record, click here)

Overall, big-name stocks like Mastercard never lack for Wall Street attention, and there are 20 recent reviews of MA shares with a breakdown of 19 to 1 favoring Buy over Hold for a Strong Buy consensus rating. The stock is currently priced at $397.67 and its average price target of $462.72 is slightly more bullish than the Goldman view, suggesting ~16% gain in the next 12 months. (See Mastercard stock forecast)

Visa Inc. (V)

Next up is Visa, the world’s largest credit card issuer with a market cap approaching $493 billion and more than 4.2 billion branded VISA cards in use, issued by more than 15,000 financial institutions.

Visa handled approximately 269 billion payment transactions in the 12 months that ended this past June 30, conducted through more than 100 million merchant locations in 200 countries globally. There are not many companies that operate on this scale, in any niche.

Visa saw strong performance in the last reported quarter of the company’s fiscal year 2023, which ended in June. The quarter showed a top-line net revenue of $8.1 billion, up 12% year-over-year, and came in $40 million ahead of the estimates. The company’s non-GAAP net income was $4.5 billion, or $2.16 per share; that EPS figure was 4 cents per share better than had been expected.

The company has seen a strong annualized increase in its payments volume of 9%, driven by its ‘cross-border transactions excluding intra-Europe,’ which were up 22%. Total processed transactions were 10% year-over-year.

Checking in again with Will Nance, we find that the Goldman Sachs analyst is sanguine on Visa’s potential going forward. He writes of the company, “Overall, trends in the business continue to be relatively stable and the company sees significant runway remaining for the core consumer payments business, while making progress with new flows (~10x larger opportunity than consumer payments)… We view the space as attractive, with macro sentiment improving and with valuations at relative lows.”

Nance quantifies his bullish stance with a Buy rating on V, while his $286 price target indicates his confidence in a 21% upside on the one-year horizon. (To watch Nance’s track record, click here)

Overall, Visa has picked up 24 reviews recently from the Street’s analysts, and these include 20 Buys and 4 Holds for a Strong Buy consensus rating. The stock’s average target price of $281.91 implies a one-year gain of ~19% from the current share price of $236.96. (See Visa stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Seeking up to 8% Dividend Yield? Wedbush Suggests 2 Dividend Stocks to Buy

Many investors find it beneficial to include real estate investment trusts, or REITs, in their portfolios. These companies bring a suite of advantages that can’t be overlooked. To start with, they offer a sound way to buy exposure to real property, landholdings, without actually buying real estate. REITs are also known as champion dividend payers, as they’re required to distribute up to 90% of their taxable income to shareholders – and dividends make a convenient mode of compliance.

For Wedbush analyst Richard Anderson, these basic facts about REITs make them indispensable. But some quirks of current conditions make them even better, in his view.

First, a number of REITs have been underperforming recently, offering investors low-cost entry points. And second, while the Federal Reserve has hinted that it will hold rates at high levels for longer, it has also indicated that the current round of rate-tightening is behind us now – and Anderson points out that US REITs tend to outperform after a round of higher interest rates. The combination of higher rates in a more stable environment is beneficial for these stocks.

Anderson doesn’t leave us with a macro view of the industry. The analyst delves into the micro level, selecting two REIT stocks, both of which are high-yield dividend payers, offering a dividend return of up to 8%. We ran them through the TipRanks database to see what makes them stand out.

Healthcare Realty Trust (HR)

The first high-yield dividend payer we’ll look at is Healthcare Realty Trust, a real estate investment trust that specializes in, you guessed it, medical office space. The company’s portfolio makeup makes it clear that HR is the leader in the medical office building REIT niche. The company owns 714 properties across 35 states, totaling almost 42 million square feet of usable, leasable space.

HR has focused its efforts on major urban areas, with properties in the fast-growing metro area of Dallas, Texas, making up 9.7% of the medical office building portfolio, or 3.308 million square feet. Other metros where Healthcare Realty Trust has a major presence include Houston, Texas; Boston, Massachusetts; and Charlotte, North Carolina.

This company assumed its current form through a merger completed in July of last year. That transaction, a merger with Healthcare Trust of America, put HR in a class of its own by combining two of the country’s largest owners of medical office spaces into the leading pure-play medical office building REIT.

On the financial side, HR generated total revenues of $338.1 million in the last reported quarter, 2Q23. This was in line with the results from 4Q22 and exceeded the forecast by $8.3 million. At the bottom line, as far as dividend investors are concerned, the company delivered a normalized funds from operations (FFO) per diluted share of 39 cents. This was down from 42 cents in 4Q22, and it slightly missed the estimates by one cent per share.

However, the FFO fully covered the 31-cent common share dividend, which was last paid out in August. At the annualized rate of $1.24 per common share, the dividend is yielding 8.4%, more than double the current annualized inflation number.

Turning to Anderson, and the Wedbush view of this stock, we find that the analyst is appreciative of the business model, particularly the stability inherent in medical office buildings. He writes, “MOBs [medical office buildings] have been the beneficiary of the movement of care into outpatient settings versus the much higher costs associated with inpatient (i.e., care inside the hospital) services… MOBs tend to produce low single -digit yet highly visible/stable rent growth – an attractive asset class during periods of uncertainty (aka, risk -off). During 2Q23, the company experienced strong leasing volume which was in part a function of the larger footprint created by the merger. Although same store growth is being hampered by elevated expenses (guidance down 50bps versus previous), we view the stability of the story as remaining very much intact.”

Anderson goes on to give HR shares an Outperform (i.e. Buy) rating, and his price target of $17 implies the stock will gain ~15% on the one-year time frame. Add in the dividend, and the potential return exceeds 23% for the year ahead.

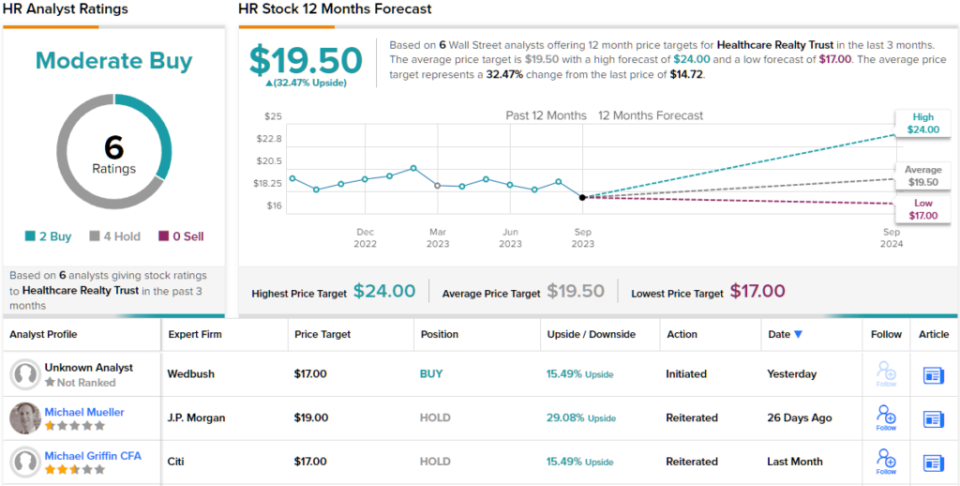

Overall, HR gets a Moderate Buy consensus rating from the Street, based on 6 recent analyst reviews that include 2 Buys and 4 Holds. The shares are trading for $14.72 and their $19.50 average price target suggest a solid 12-month gain of ~32%. (See HR stock forecast)

Apartment Income REIT (AIRC)

Next on our list is Apartment Income REIT, another specialist REIT. As the name suggests, this company focuses on owning and managing apartments and multi-family apartment developments. The company operates in 8 core metropolitan areas and owns 73 communities in 10 states, plus DC, comprising a total of 25,739 apartment homes on its properties. AIRC can boast of a 62% tenant retention rate, which is high for the high-turnover apartment segment.

Like HR above, this company can rely on the advantages of scale. In addition to its substantial real estate holdings, it boasts a market cap of $4.45 billion and $2.3 billion in available liquid assets. The company has also developed a qualitative edge by focusing on the needs of the residents in its properties, selecting a high-quality tenant base that is satisfied with the apartment homes. It’s a solid foundation for ‘best-in-class property management.’

This business model has also led to consistently high revenues. AIRC has seen its top line exceed $200 million in each of the last four quarters. In the most recent reported quarter, 2Q23, the company had total revenues of $214.6 million, up almost 17% year-over-year and $2.8 million above expectations. The company’s FFO of 62 cents per share was up 3% from the previous year and beat the forecast by 2 cents per share.

These results support AIRC’s dividend payment, which was declared in July at 45 cents per share, paid out at the end of August. The dividend has an annualized rate of $1.80 per common share and a solid yield of 6%.

Tenant retention and a sound business model have brought this REIT to Anderson’s attention, and he writes of it for Wedbush: “During 2Q23, AIRC reported strong tenant retention of 62% which helps reduce downtime while saving on expenses. The AIRC platform is structured to allow top line NOI to matriculate smoothly to bottom line FFO, absent the noise of short -term dilutive forces from development activities. The company identifies the ‘Air Edge’ as its ability to apply an improved operating model onto previously acquired assets, thereby enhancing the growth profile beyond the initial point of the investment. For example, 2021 acquisitions have since produced 30% NOI growth and 420bps of margin expansion. All in, AIRC is a solid/safe multifamily story with an improving leverage profile.”

These comments back up his Outperform (i.e. Buy) rating on the stock, while his $37 price target points toward a one-year share gain of 24%. Based on the current dividend yield and the expected price appreciation, the stock has 30% potential total return profile.

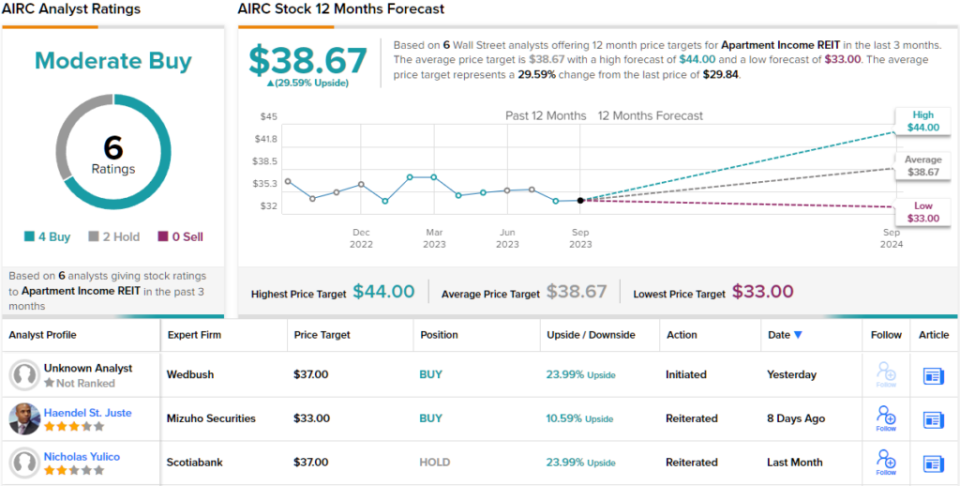

Overall, there are 6 recent analyst reviews on record for AIRC, breaking down 4 to 2 in favor of Buys over Holds for a Moderate Buy consensus rating. The stock is currently trading for $29.84 and has an average target price of $38.67; this combination implies ~30% upside potential going out to the one-year horizon. (See AIRC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Seeking up to 10% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

Dividend stocks are the multi-purpose tool of the markets. They offer investors a two-pronged path towards profitable returns, including a measure of defense against tough market conditions along with a steady source of passive income. It’s an attractive combination.

The best dividend stocks will give an inflation-beating income based on the dividend alone, backing it up with a long-term history of reliable payments. It’s a win-win situation for investors: when the stock goes up, you’ll make money, but when it goes down, you can still make money.

The Street’s analysts are not shy about recommending high-yield dividend payers, and we’ve found two among their recent calls with dividend yields reaching up to 10%. That’s a solid return right there, but these equities also feature ‘Strong Buy’ ratings from the analysts – so let’s dip into the data from TipRanks and find out just what makes them such compelling portfolio additions.

Sunoco LP (SUN)

First up is Sunoco, one of America’s great brand names. The company has a long history in the energy industry, mainly as a producer and provider of motor fuels. Sunoco’s product lines include multiple formulations of gasoline, diesel fuels, and jet fuels, all offered in both branded and unbranded labels. The company manages a distribution network comprised of gas stations, convenience stores, independent dealers, and commercial distributors, with more than 10,000 locations across 40 states.

Sunoco’s fuel retail operations are backed up by the usual ‘value added’ products in the gas stations and convenience stores, including snacks and beverages, and the company also provides fuel dispenser equipment for gas stations and fleet customers.

In an important nod to the expanding ‘green’ economy, Sunoco has been developing reclamation solutions for transmix fuels – that is, gasoline, diesel, and jet fuels that mixed in the transport pipeline, rendering them unusable. The company collects these mixed fuels for processing into usable products, reducing both fuel waste and damage from environmental pollution.

With all that said, Sunoco’s latest quarterly update was something of a mixed bag. The company reported $5.75 billion at the top line in 2Q23, a total that was down 26% year-over-year, although the figure beat expectations by $28 million. The bottom line, while profitable, was not as upbeat; the 78-cent EPS figure came in 47 cents per share under the forecast.

For dividend investors, a key metric to note is the distributable cash flow, which was reported at $175 million for Q2, a favorable comparison to the $159 million from the prior-year second quarter. This supported a Q2 dividend declaration of 84.2 cents per common share, or $3.36 annualized. At the annualized rate and current share valuations, the dividend is yielding 7.1%, more than double the average dividend found among S&P 500 companies, and almost double the 3.7% annualized inflation reported for August.

For Justin Jenkins, 5-star analyst from Raymond James, Sunoco is notable for its ability to remain profitable and to generate cash, both features that will support a continued high-yield dividend. He writes of the company, “We remain constructive on Sunoco given strong execution, confidence in the continuation of increased profitability, and the upside potential from medium-term business optimization and M&A opportunities. These efforts, along with capital/cost discipline, have allowed for considerable free cash flow generation, positioning the balance sheet with solid flexibility, which will be utilized to further grow the business (organically and inorganically). While the macro backdrop is still ‘throwing curve balls,’ we see a stable-to-positive volume trend in 2023 supported by elevated fuel margins. This is complemented by a healthy slate of attractive bolt-on acquisitions and organic projects that generate long-term value, while further M&A could add to upside.”

Jenkins goes on to rate SUN shares as Outperform (a Buy), with a $53 price target that indicates room for 12% upside in the next 12 months. (To watch Jenkins’ track record, click here.)

The 5 recent analyst reviews on SUN include 4 Buys against 1 Hold, for a Strong Buy consensus rating. Going by the $51 average price target, the stock has a one-year upside potential of 7.5%; add in the dividend, and the total return potential here approaches 15%. (See Sunoco’s stock forecast.)

Ares Capital Corporation (ARCC)

The next stock on our list is Ares Capital Corporation, a BDC, or business development company. These firms are specialty lenders, providing credit and financing services for small- and mid-market businesses that won’t necessarily qualify for services from the traditional commercial banks. ARCC’s combination of capital funding, credit services, and provision of financial instruments is essential for its client base, and fills a vital niche in the American small business landscape.

Since going public in 2004, ARCC has invested over $21 billion in 475 companies, and generated a shareholder return of 12%. The company boasts a market cap exceeding $10.7 billion, making it the largest publicly traded BDC in the US markets. The portfolio behind this performance is both diverse and well-balanced, with a healthy composition of assets. Of the total, 22% is in software and services, 11.3% is in healthcare services, and 8.7% is in commercial and professional services. Other sectors represented in the portfolio include power generation, insurance, and consumer durables. Just under 42% of the portfolio is in first lien senior secured loans, and another 18.1% is in second lien senior secured loans.

For investors, results are what matter most. Ares reported 2Q23 total investment income of $634 million, up from $479 million in 2Q22 – for a y/y gain of 32% and beating the forecast by $11 million. At the company’s bottom line, Ares posted earnings of 58 cents per share, 1 cent ahead of the estimates and well above the 46 cents per share from 2Q22. The company boasted $411 million in cash and liquid assets as of June 30, 35% better than it had at the end of 2022.

A profitable business and solid cash holdings support the company’s Q3 dividend, which was declared on July 25 for a September 29 payout. The dividend, of 48 cents per common share, annualizes to $1.92 and yields 10%. The company has a dividend history stretching back to 2004, with regular quarterly payments interspersed with variable special distributions.

KBW analyst Ryan Lynch notes Ares’s history of generating returns and surviving the ups and downs of credit cycles. He says of the stock, “ARCC has a great underwriting and credit quality track record, and has generated some of the best economic returns in the sector, and has a best-in-class credit platform. ARCC has one of the longest track records and has operated through multiple credit cycles with very good results. ARCC’s dominant platform and broad, long-standing relationship with sponsors will help ARCC continue to capture a significant market share of the growing direct lending market. ARCC has the best liability structure which is low-cost, diverse, long-dated, and flexible with multiple investment grade ratings which have funded and will continue to help fund their portfolio growth.”

Looking forward, Lynch gives ARCC an Outperform (Buy) rating, linked with a $21 price target. This suggests an 8.5% upside potential on the one-year time horizon. (To watch Lynch’s track record, click here.)

The Strong Buy consensus rating on ARCC is based on 10 analyst reviews, including 9 Buys and 1 Hold. The shares are currently trading for $19.33 and their average price target, at $20.75, implies a 12-month gain of 7%. With the dividend in the mix, investors can realize a 17% return on ARCC. (See Ares Capital’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Seeking at Least 9% Dividend Yield? This 5-Star Analyst Suggests 2 Dividend Stocks to Buy

“What lies ahead for the stock market?”

That’s the burning question on the minds of every market and economic expert out there, and it’s undoubtedly a challenging one.

Inflation has moderated to a reasonable 3% annually, and the job market is showing signs of strength. Stocks are surging, indicating that investors have factored in the risk of a potential recession. However, this leads to a problem highlighted by B. Riley’s chief investment strategist, Paul Dietrich. He points out that the latest earnings figures are lagging far behind the surging positive sentiment. This discrepancy between market optimism and lukewarm earnings could spell trouble for investors.

“It doesn’t take a stock market historian to know that something terrible will happen when the stock market surges and the S&P 500 companies’ earnings decline -6.8% in Q2 2023,” Dietrich opined. “According to FactSet, the quarter will mark the most significant earnings decline reported by the index since Q2 2020 when the Covid pandemic closed down the country. This was the third consecutive straight quarter of year-over-year earnings declines. That is officially an ‘earnings recession.’”

As Dietrich sees it, the decline is real and its only a matter of time before it impacts sentiment and investing activity.

A cautious approach would naturally pull investors toward dividend stocks, the classic defensive play. Dividends offer a steady, passive income stream, providing investors with a degree of protection – and usable cash – for an uncertain market environment.

Following this cue, B. Riley’s 5-star analyst, Bryce Rowe, is going bullish on two dividend stocks in particular. These dividend payers offer high yields of 9% or more and present compelling investment theses. Let’s take a closer look.

Blue Owl Capital Corporation (OBDC)

First up is Blue Owl Capital, a business development corporation operating under the umbrella of the larger Blue Owl Capital asset manager. Formed in the first half of 2021 through a SPAC merger between Owl Rock and Dyal Capital with Altimar Acquisition, the new firm has been shifting its branding to the Blue Owl name earlier this month.

Under the Blue Owl branding, the business development corporation gets a new ticker and a place in the larger Blue Owl organization, while retaining its existing BDC portfolio and historical financial records. Like its BDC peers, Blue Owl Capital Corporation invests in small- and mid-sized business enterprises, providing access to capital for firms that have difficulty entering the traditional banking system. The company’s portfolio contains 187 companies and boasts a fair value of $13.2 billion. The portfolio is made up of 85% senior secured investments, and 98% is in floating rate debt investments.

The company will release its 2Q23 financial results on August 9, but we can look back at Q1 to see where Blue Owl stands now. The top line, of $377.6 million, was up almost 43% year-over-year and beat the forecast by $12.7 million. At the bottom line, the company’s non-GAAP EPS figure was 45 cents per share, showing a 45% growth compared to the previous year and beating the estimates by 2 cents per share.

Financial results are not the only data point that Blue Owl inherited from the old Owl Rock name; the company also retains its dividend history. The last dividend payment, declared on May 10 for a July 14 payout, was set at 33 cents for the regular quarterly common share payment, including a 6 cent irregular payment. The company’s regular dividend annualizes to $1.32 per common share and yields 9.34%; it has added an irregular dividend payment in each of the last three quarters.

Turning to the B. Riley view, as articulated by top analyst Bryce Rowe, we find that he is impressed by Blue Owl’s combination of low share price, solid dividend, and strong business. In Rowe’s words, “We see the risk/reward profile as favoring reward given our view of limited downside potential with a discounted valuation, the supportive earnings environment, healthy dividend coverage, and the size and scale of Blue Owl’s direct lending platform that we believe should allow the company to take advantage of the ongoing shift from more traditional financing sources to private debt. Based on $1.59/share of projected regular and supplemental dividends (3Q23– 2Q24), Blue Owl Capital trades with an ~11% dividend yield and at 92% of NAV.”

Rowe goes on to give Blue Owl stock a Buy rating, while his $15.25 price target suggests an 8% upside for the year ahead. Based on the current dividend yield and the expected price appreciation, the stock has ~17% potential total return profile. (To watch Rowe’s track record, click here)

Overall, Blue Owl Capital Corporation has picked up 8 recent Wall Street analyst reviews, including 7 to Buy and 1 to Sell, for a Strong Buy consensus rating. (See OBDC stock forecast)

FS/KKR Capital Corporation (FSK)

Next up is FS/KKR, another business development corporation working with private middle market firms in the US small business sector. FS/KKR focuses mainly on senior secured debt and has a lesser interest in subordinated debt, with a long-term goal of providing the best possible risk-adjusted returns for its investors.

FS/KKR has put an overwhelming majority of its portfolio into senior secured debt, accounting for 69% of the total. Of the debt investments, 89% are floating rate. FS/KKR has investments in 189 companies, with a median company earnings of $114 million as of the end of Q1. By fair value, this BDC’s portfolio is worth $15.3 billion.

When we turn to the company’s financial results, it’s clear that FS/KKR can generate a profit even while revenues appear shaky. Over the past few years, the top line has been volatile while earnings have shown a modest increase. The last reported quarter was 1Q23, and the firm’s top line, total investment income, came in at $456 million, a figure that was up 15% year-over-year and $11.56 million ahead of forecasts. The bottom line EPS, in non-GAAP terms, was 81 cents per share, which was 6 cents per share better than had been estimated.

Even better for dividend investors, this company’s bottom line provides full coverage for the regular dividend. In the Q1 report, FS/KKR declared a total dividend payment of 70 cents per common share. This included a 64 cent base payment and a 6 cent supplemental distribution, and it was paid out earlier this month. Taken together, the 70 dividend annualizes to $2.80 and gives an impressive yield of 13.85%. Along with this high dividend payment, FS/KKR also declared a 15 cent special distribution, with the payment scheduled in three tranches of 5 cents each: one in May, one at the end of August, and one at the end of November.

Checking in with Bryce Rowe, we find the B. Riley analyst taking an upbeat view of this stock, and giving particular note to the earnings support for the high dividend, and the company’s likely ability to maintain that payment going forward. Rowe writes of FS/KKR, “We see the risk/reward profile as favoring reward given the deep P/NAV discount that should likely limit downside, the supportive earnings backdrop, a dividend yield of [approximately] 14% based on projected dividends 3Q23-2Q24, an attractive capital structure, sufficient liquidity, and FSK’s positioning to benefit from borrowers shifting from more traditional sources for financing solutions to private debt providers.”

Taking his stance forward, Rowe rates FSK stock a Buy, with a $21 price target pointing toward a roughly 4% upside on the one-year horizon. The real attraction for investors here is the strong dividend yield.

Overall, FSK gets a Moderate Buy rating from the consensus of Wall Street analysts, based on 7 recent reviews that break down to 2 Buys and 5 Holds. (See FSK stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Seeking at Least 8% Dividend Yield? Analysts Suggest 2 Stocks to Buy

Since hitting bottom last October, the S&P 500 has bounced back strongly – in fact, it’s up approximately 25% from that trough. A rally of that magnitude meets the definition of a bull market, and some economists are saying we’re experiencing just that.

A word of caution, however, comes from investment firm Wells Fargo. In a recent warning to investors, investment strategy analyst Austin Pickle notes that a recession is likely in the near future, and says, “With stock valuations full, we believe prices are unlikely to sustain recent highs as the economy rolls over.”

Pickle goes on to list three factors that are likely to push markets down in 2H23 or 1H24. First, the analyst notes that the Fed is still locked into raising interest rates. Even though the rate of inflation is falling, the Fed is almost certain to implement another 0.25% bump this month, putting rates at their highest level since 2007. Second, the economy hasn’t yet fallen into a recession. Historically, stocks tend to bottom after a recession hits – and after the Fed starts cutting rates in response. And finally, the current rally isn’t healthy. It’s been driven mainly by a small group of megacap tech stocks, a base too narrow to support a large rally.

It’s a mindset that naturally turns us toward dividend stocks. These are the traditional defensive investment plays, offering steady payouts to shareholders that guarantee an income stream whether markets go up or down.

Against this backdrop, some Wall Street analysts have given the thumbs-up to two dividend stocks yielding no less than 8%. Opening up the TipRanks database, we examined the details behind these two to find out what else makes them compelling buys.

OneMain Holdings (OMF)

We’ll start in the financial services sector with OneMain. This online banking and finance firm focuses on consumer services in the subprime banking and loan market. OneMain offers a wide range of financial services, especially personal loans and insurance products, to a consumer customer base that sometimes lacks access to the traditional banking system. OneMain uses a careful vetting system to screen its customers and boasts that its screening process has kept defaults at an acceptable rate. In addition to its online presence, OneMain also reaches out to customers through a network of physical locations, with approximately 1,400 branches across 44 states.

On the financial side, OneMain reported its 1Q23 results at the end of April, showing some mixed results. The top line revenue came to $1.03 billion; this was in-line with expectations, flat year-over-year, and just missed the forecast, coming in $2.6 million below expectations. The company’s bottom line earnings showed a split. The non-GAAP measure came in at $1.46 per share, missing by 19 cents, while the GAAP EPS of $1.48 was 5 cents better than the estimates.

OneMain had $18.5 billion in outstanding debt balances at the end of Q1, along with $544 million in cash and liquid assets. Of that cash total, $177 million was not available for general corporate uses. The company has $385 million set aside as provision for finance receivable losses. While this sum is lower than equivalent provisions in the last three quarters, it is significantly higher than the $238 million set aside for this purpose at the end of 1Q22.

Turning to the dividend, we find that OneMain declared its last payment on April 25 of this year, for $1 per share. The dividend annualizes to $4, and gives a strong yield of 8.6%.

This consumer credit company has caught the attention of JMP’s 5-star analyst David Scharf, who sees the overall risk/reward here as favorable. Scharf notes that OneMain is outperforming its competition on customer applications, and maintaining discipline on expenses.

“We continue to be encouraged by the improving credit profile that has emerged since the mid-2022 tightening; the increased application volumes and share gains resulting from weakened competition; the maintenance of expense discipline; elevated capital generation; and the improving funding profile. We continue to believe that the company’s 2023 guidance is somewhat conservative, both in terms of loan loss reserves and portfolio growth, and we already saw the target for receivables growth raised to the high end of the range after just one quarter,” Scharf opined.

“When the positive attributes noted above are combined with a discounted current year P/E below 6x and a dividend yield above 10%, we see a very compelling risk/reward trade-off for shares of OMF,” the analyst summed up.

Looking ahead, Scharf gives OneMain stock an Outperform (i.e. Buy) rating, and his $55 price target implies a one-year upside potential of 18%. Based on the current dividend yield and the expected price appreciation, the stock has ~27% potential total return profile. (To watch Scharf’s track record, click here)

Overall, OneMain gets a Strong Buy rating from the Street, based on 12 recent analyst reviews that include 9 Buys and 3 Holds. (See OMF stock forecast)

Global Medical REIT (GMRE)

The next stock on our list is a real estate investment trust, a REIT. These are perennial dividend champs, and Global Medical puts an interesting twist on the REIT model: the company focuses on medical facilities and properties. The company boasts a heavy footprint, including 188 owned buildings, with 4.9 million leasable square feet, and 274 tenants. Global Medical’s real estate assets are valued at approximately $1.5 billion, and the company collects an annualized base rent of $114.9 million.

The firm has seen its revenues increase over the past several quarters, while earnings per share are sliding down. This can be seen in the company’s last quarterly financial release, from 1Q23. GMRE reported a top line of $36.2 million, up more than 13% from the year-ago quarter but sliding in just under the forecast by $340,000. The company’s bottom line, a net income of $700,000 attributable to common shareholders, gave an EPS of 1 cent per share. This was in-line the forecast, but was down sharply from the 4-cent EPS reported in 1Q22.

Dividend-minded investors should watch the company’s funds from operations, or FFO, as this metric reflects available cash. Global Medical reported an FFO of $15.1 million, or 22 cents per share for Q1, and an adjusted FFO, or AFFO, of $16 million, translating to 23 cents per share. The company had $4.6 million in cash and cash equivalents on hand as of March 31 this year, compared to $4.02 million at the end of 2022.

On June 9, the company declared its common stock dividend payment for 21 cents per share, and paid it out on July 11. The dividend annualizes to 84 cents, and yields a robust 8.6%. The company has been paying out the 21-cent dividend for the last 6 quarters, and has been paying out a slowly increasing dividend since 2016.

Covering this stock for Stifel, 5-star analyst Stephen Manaker sees plenty of potential for investors to grab onto. He writes, “We rate GMRE Buy, believing the stock represents an attractive value, despite limited near-term growth and above-average leverage. We still view the REIT as a long-term growth story, buying assets in secondary markets, markets that larger institutional investors typically avoid. While the tenants might not have an investment grade rating, GMRE’s focus on the profitability of a tenant in a specific location (among other underwriting criteria) has proven to be successful.

“The REIT should be able to sell some of these assets with proven tenants, allowing for the recycling of capital into higher yielding investments. This could help the REIT grow earnings without necessarily increasing the size of the balance sheet or accessing expensive capital,” the analyst added.

Alongside his Buy rating, Manaker gives GMRE shares a price target of $11, implying a 13% upside in the next 12 months. (To watch Manaker’s track record, click here)

Overall, GMRE gets a Moderate Buy rating from the analyst consensus, based on 7 recent reviews. These break down to 4 Buys and 3 Holds. (See GMRE stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.