Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Source link

Sell

On-chain data shows the Bitcoin supply in profit has reached levels that led to some tops in the past, like the peak of the April 2019 rally.

Bitcoin Supply In Profit Has Shot Up Following BTC’s Latest Run

As pointed out by an analyst in a CryptoQuant Quicktake post, Bitcoin supply in profit has hit very high levels after the asset’s latest rally. The “supply in profit” here refers to a metric that measures the percentage of the total circulating BTC supply that’s currently carrying some amount of unrealized gain.

This indicator works by going through the transaction history of each coin (more precisely, each UTXO) on the blockchain to see what price it was last moved at. Assuming that the previous transfer of the coin was the last time it changed hands, the price at that instance would act as its current cost basis.

As such, if the previous transfer price for any coin was less than the spot value of the cryptocurrency right now, then that particular coin would be holding a profit currently. The supply in profit sums up all such coins and calculates what percentage of the total supply they make up for.

A counterpart indicator called the “supply in loss” does the same for coins of the opposite type (that is, those with a cost basis lower than the current price). This metric’s value can also simply be found by subtracting the supply in profit from 100 (since the total supply must add up to 100%).

Now, here is a chart that shows the trend in the Bitcoin supply in profit over the past few years:

The value of the metric seems to have been going up in recent days | Source: CryptoQuant

As displayed in the above graph, the Bitcoin supply in profit has naturally shot up recently as the asset’s price has gone through its rally. After the latest continuation of the run towards the $57,000 level, the metric has hit the 95% mark.

This means that 95% of all UTXOs in existence is carrying a profit at the moment. This may not entirely be a positive thing, however, if history is anything to go by.

As the quant has highlighted in the chart, the BTC rally that started in April 2019 topped out just as the supply in profit hit the same high levels as right now. Similarly, the local top in 2020 at the beginning of the last bull market also coincided with these levels.

The reason behind this pattern is likely to be the fact that investors in profit are more likely to sell their coins at any point. Thus, when a large percentage of holders are carrying gains, the probability of a mass selloff can spike up.

That said, in the 2017 and 2021 bull runs, as well as during the November 2021 peak, the indicator did manage to surpass these levels for a while before the top was encountered.

As such, it remains to be seen if the current rally is similar to the likes of the April 2019 run, in which case a top might be hit here, or if it’s a proper bull run, meaning that there might still be a while to go before the peak.

BTC Price

At the time of writing, Bitcoin is trading around the $56,500 level, up 8% over the past week.

Looks like the price of the asset has enjoyed a sharp rally today | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In a recent technical analysis by crypto analyst Ali Martinez, known on social media as @ali_charts, a potential sell signal has been identified on the three-day chart for Cardano (ADA) against the US dollar. This analysis, shared on X on February 23, suggests caution among ADA traders due to the appearance of a bearish signal from the TD Sequential indicator.

Martinez’s chart showcases the TD Sequential indicator presenting a ‘9’ signal, a classic sell indication that suggests the current trend may be exhausted and a reversal could be imminent. This signal is highlighted on the candlestick that has been forming over the last three days, marked by a red rectangle surrounding a green candlestick.

The ‘9’ setup, traditionally seen as a sign to take profits or to prepare for a trend change, implies that ADA’s recent upward momentum may face a setback. The analysis further notes that this is not the first instance of such a signal appearing on Cardano’s chart.

Previous occurrences of the TD Sequential ‘9’ sell signal were followed by price corrections for ADA. Traders may be particularly vigilant now, as the chart indicates that the last two signals of this nature were succeeded by downward price action. Martinez remarked:

The TD Sequential indicator shows a sell signal on the #Cardano 3-day chart. It’s important to note that the last two times this indicator signaled bearish, ADA experienced a price correction!

How Low Could Cardano (ADA) Price Retrace?

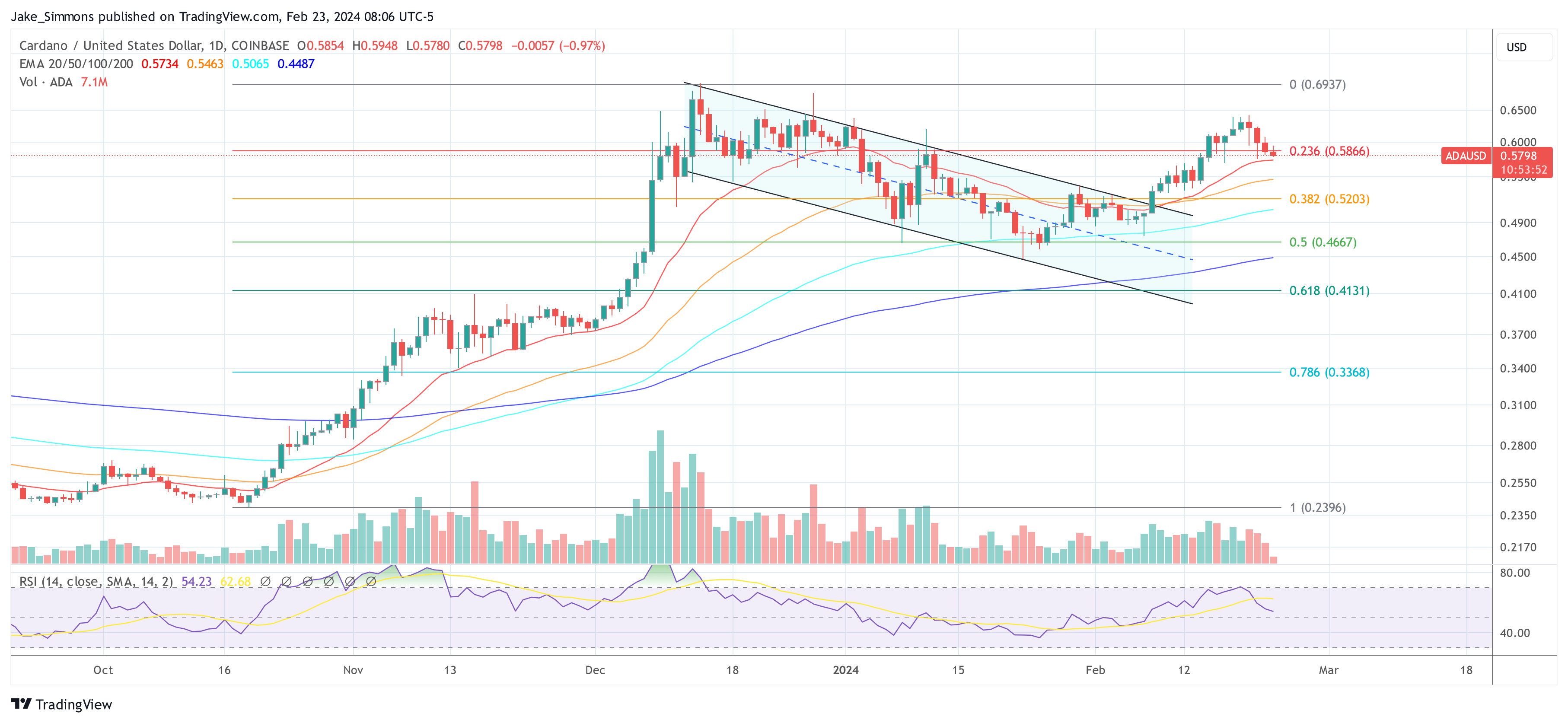

As of February 23, 13:06 UTC, the ADA/USD pair shows a complex interplay between bullish and bearish signals on the daily time frame. The chart presents a constricted pattern following a descent from a local high.

The ADA price is currently trading at $0.5790. Importantly, the price is above the 20-day Exponential Moving Average (EMA) at $0.5733, the 50-day EMA at $0.5462, the 100-day EMA at $0.5065 and notably, the 200-day EMA at $0.4487. The positioning above these EMAs can be a sign of an underlying bullish sentiment in the market.

The Fibonacci retracement levels, drawn from the peak to the trough of the recent move, highlight significant levels of potential support and resistance. The 0.236 level at $0.5866 is immediately overhead, acting as a minor resistance level. The 0.382 level at $0.5203 and the 0.5 level at $0.4667 are key support zones to watch if a bearish reversal occurs.

A break below these levels could signal a deeper retracement towards the 0.618 level at $0.4131 or even the 0.786 level at $0.3368. However, the most crucial support at the moment is the 20-day EMA which could forebode a changing trend.

Notably, the volume has been relatively consistent, with a slight decrease in trading volume accompanying the recent price consolidation. This could indicate a lack of conviction among traders. Confirming this, the Relative Strength Index (RSI) is at 54, indicating neither overbought nor oversold conditions. The RSI trend is neutral, providing no clear directional bias at the moment.

In conclusion, while there are hints of bearishness, there are still good arguments to be bullish on Cardano and not wait for a larger correction. However, if the price does not hold above several key EMAs on the daily chart, the trend change could be confirmed.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Gold miner Polymetal looks to sell Russian operations for $3.69 billion amid nationalization fears

Gold miner Polymetal International on Monday said it had struck a deal to sell the entirety of its Russian mining business for $3.69 billion, with a view to fully exiting the Russian Federation due to the combined threats of Western sanctions and nationalization by Putin’s government.

If approved by shareholders, Polymetal will sell the business to Russian mining company JSC Mangazeya Plus, with a view to re-focusing its operations towards Kazakhstan where it currently runs two mines that account for around one-third of its total production.

The Anglo-Russian gold miner, which was founded in St Petersburg in 1998, said the sanctions-compliant agreement would see JSC Mangazeya Plus pay it $1.48 billion in cash and also agree to settle the Russian segment’s $2.21 billion debts.

Shares in Polymetal International fell 6% on Monday in Moscow, having lost 11% of their value over the past 12 months and 66% of their value since the start of the Russia’s invasion of Ukraine in early 2022.

In August 2023, the company abandoned its London listing and re-domiciled from Jersey to Kazakhstan’s capital Astana, with a view to avoiding Russia imposed rules that designated Jersey an “unfriendly jurisdiction” in response to Western sanctions.

Polymetal said it will let shareholders vote on the agreement at its upcoming annual general meeting on 7 March, as the company said the sell-off would help avoid risks including those posed by the operations being expropriated or nationalized by the Russian government.

In a statement, Polymetal said it believes a deal to sell its Russian operations “presents the most viable opportunity for the Group to restore shareholder value by removing or substantially mitigating critical political, legal, financial and operational risks.”

The striking of the deal marks the end of an arduous process faced by Polymetal in finding a sanctions-compliant buyer for its Russian operations, after it vowed to exit that country following the outbreak of war.

Polymetal’s push to divest from Russia was made more urgent by the U.S. Department of State’s decision to impose sanctions on its Russian subsidiary in May 2023, which blocked U.S. citizens from interacting with that unit.

The process of selling off its Russian assets has been more difficult due to stringent rules imposed by authorities in both Moscow and Washington on any company looking to exit Russia.

Polymetal said it had received confirmation from the U.S. Office of Foreign Assets Control (OFAC) that those involved in the sale to JSC Mangazeya would not be subject to sanctions, and made clear that any payment would be made via sanctions-compliant financial institutions.

JSC Mangazeya Plus is the mining subsidiary of the Mangazeya commodities conglomerate, which is controlled by Russian billionaire Sergey Yanchukov, who started his career as an oil trader in Ukraine.

If completed, the deal will see Polymetal retain its position as the second largest gold miner in Kazakhstan, in controlling two mines with an estimated 11.3 million ounces of gold.

FTX to Sell Subsidiary Acquired for $10M to Coinlist for $500K Amid Bankruptcy Proceedings

FTX Trading Ltd. and its affiliates have announced a plan to sell a subsidiary it acquired for $10 million to Coinlist for $500,000, court documents filed on Feb. 9, 2024 show. The latest motion, filed in the United States Bankruptcy Court for the District of Delaware, details the proposed sale in order to maximize the […]

FTX Trading Ltd. and its affiliates have announced a plan to sell a subsidiary it acquired for $10 million to Coinlist for $500,000, court documents filed on Feb. 9, 2024 show. The latest motion, filed in the United States Bankruptcy Court for the District of Delaware, details the proposed sale in order to maximize the […]

Source link

7 Reasons to Sell Nvidia, Wall Street’s Hottest Artificial Intelligence (AI) Stock

For the past three decades, there have been no shortages of next-big-thing investment trends to captivate the attention of Wall Street and investors. Everything from the advent of the internet to game-changing applications such as genome mapping has changed the course of innovation.

At the moment, there’s no next-big-thing investment trend hotter than artificial intelligence (AI).

AI involves using software and systems to oversee tasks that would generally be handled by humans. What makes AI such a game changer is machine learning, which allows these systems to “learn” over time and become more efficient at their tasks. AI has applications in virtually every sector and industry, which is likely why the researchers at PwC believe it can add up to $15.7 trillion to global gross domestic product by 2030.

Nvidia is the face of the artificial intelligence revolution

Though there are dozens of publicly traded companies that can benefit from the AI revolution, none has been a hotter commodity for investors than semiconductor stock Nvidia (NASDAQ: NVDA).

The company has rapidly become the infrastructure backbone of the AI movement. Its A100 and H100 graphics processing units (GPUs) allow for split-second decisions to be made by AI systems in high-compute data centers. In July, analysts at Citigroup opined that Nvidia could account for “at least 90%” of AI-accelerated data-center GPU share.

It’s an especially exciting time for Nvidia, given that its production of A100 and H100 chips should meaningfully grow in the current calendar year (Nvidia’s fiscal year ends in late January). Specifically, a sizable ramp up in chip-on-wafer-on-substrate capacity by chip-fab giant Taiwan Semiconductor Manufacturing should help Nvidia meet more of its customers’ demands in fiscal 2025.

The proof is in the pudding that Nvidia has been the AI stock to own. Shares have surged a whopping 367% and added well over $1.3 trillion in market value since the start of 2023. Nvidia’s sales are expected to climb from a reported $27 billion in fiscal 2023 to an estimated $93.7 billion by the end of fiscal 2025.

Yet despite this jaw-dropping ascent, all I see are a growing number of reasons Nvidia will disappoint investors. Though the company’s stock has proven me wrong thus far, here are seven reasons to sell Wall Street’s hottest artificial intelligence stock.

1. Nvidia is about to become its own worst enemy

Perhaps one of the most logical reasons to sell shares of Nvidia is the irony that increasing output of its A100 and H100 chips will almost certainly weigh on its gross margin.

During the first half of Nvidia’s fiscal 2024, the company’s cost of revenue declined as data center sales soared. What this tells investors is that the entirety of Nvidia’s data center gains were derived from a substantial increase in pricing power predicated by AI-focused GPU scarcity. Even by the end of the company’s fiscal third quarter, the cost of revenue had risen only modestly on a year-over-year basis.

With Nvidia now able to meet more of its customers’ demands, the price of its A100 and H100 chips will fall. Although revenue is undoubtedly headed higher, we’ve likely seen a peak in the company’s gross margin.

2. External competition is heating up

This probably goes without saying, but Nvidia’s overwhelming success in high-compute data centers will encourage aggressive competition from businesses itching to get their piece of the pie.

In June, Advanced Micro Devices (NASDAQ: AMD) introduced its MI300X AI-GPU, which will be a direct competitor to Nvidia. AMD CEO Lisa Su views these AI-accelerating chips as a more than $150 billion addressable opportunity by 2027. Though AMD launched the MI300X last year, it’ll really begin ramping up production in 2024.

Likewise, Intel (NASDAQ: INTC) plans to go head-to-head with Nvidia. This past December, Intel introduced its Gaudi3 generative AI software chip, which is expected to ship sometime this year. Gaudi3 will be a direct competitor to Nvidia’s H100 chip. In other words, Nvidia’s days as the lone wolf in AI-accelerated data centers are over.

3. Internal competition is ramping up, too

Perhaps what’s even more worrisome than external competition is that many of Nvidia’s biggest customers have ambitions of developing AI-accelerated chips of their own.

For example, social media company Meta Platforms (NASDAQ: META) is one of Nvidia’s largest customers by total revenue. Meta, which has its sights set on becoming a key player in virtual and augmented reality, intends to deploy a second-generation version of an in-house AI-GPU chip into its data centers this year. In-house developed infrastructure is designed to lessen Meta’s reliance on Nvidia over time.

Similarly, Microsoft (NASDAQ: MSFT), which is Nvidia’s largest customer by total revenue, unveiled its own custom AI chip for large language models (LLMs) last year. Microsoft’s Azure Maia AI chip will compete directly with Nvidia’s H100 GPUs targeted at generative AI software. Like Meta, Microsoft’s in-house-developed AI chips are being launched in 2024.

4. Regulatory restrictions put a ceiling on Nvidia’s growth potential

A fourth reason to sell shares of Nvidia is the increasing pressure the company is facing from U.S. regulators.

In response to initially announced export restrictions of AI-driven GPUs to China, Nvidia developed slower versions of its top chips. The company’s goal with its A800 and H800 chips was to capture billions of dollars in preorder demand from China, which is a key market for the company’s success.

In October 2023, the U.S. Department of Commerce announced a second round of export curbs that would restrict the specifically developed A800 and H800 chips to China. Although Nvidia isn’t the only chip developer impacted by these export restrictions, they could ultimately cost the hottest name in AI billions of dollars in potential sales each quarter.

5. Insiders aren’t buying — why should you?

Another reason to steer clear of Nvidia or bid its stock adieu is that executives and board members have done nothing but sell their shares for more than three years.

To be fair, there are a lot of reasons for insiders to sell stock, and some of them are completely benign. For example, options have to be exercised within a defined time frame, otherwise they expire. Executives and directors may receive a significant portion of their compensation in stock and stock options. Shares may be regularly sold to have capital handy to cover their federal tax bills.

But there’s only one reason insiders buy stock: They believe shares are undervalued. No insider has purchased shares of Nvidia stock since Chief Financial Officer Colette Kress added a mere 200 shares in December 2020. If insiders won’t buy, why should you?

6. History isn’t on its side

Nvidia and the artificial intelligence movement are also squaring off against history, which is thus far undefeated.

As I pointed out earlier, there have been an assortment of next-big-thing trends that have garnered plenty of attention on Wall Street over the past 30 years. Unfortunately, every single one of these trends endured an early-stage bubble. This is to say that the uptake or acceptance of new innovations or technologies didn’t match investors’ lofty expectations.

While many of these next-big-thing trends worked out well for select businesses over the long run, the short term can be bumpy. AI is unlikely to be an exception to what’s seemingly the rule.

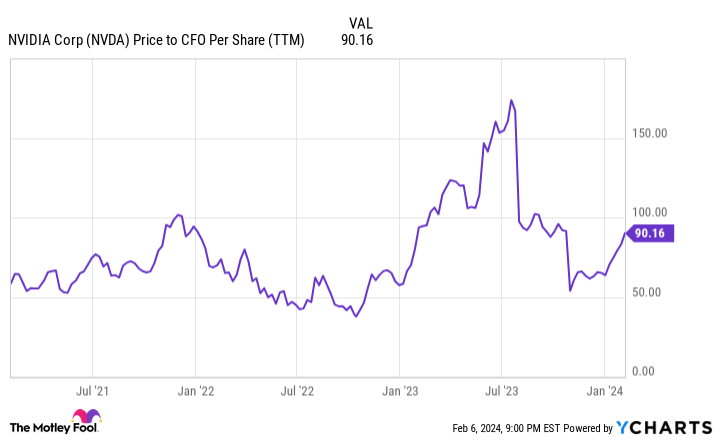

7. It’s priced for perfection in an imperfect industry

Last but not least, Nvidia is priced for perfection in an industry that’s full of unknowns.

Based on Wall Street’s cash-flow consensus for fiscal 2024 (the company has yet to release its fourth-quarter operating results), Nvidia is valued at a jaw-dropping 63X cash flow. It’s also trading at 90X trailing-12-month cash flow. It’s almost hard to believe that Nvidia was regularly valued at less than 20X cash flow as recently as 2014, 2015, and 2018.

Given the factors described above, I’d expect gross margin erosion to take shape in fiscal 2025 and for increasing external and internal competition to lower Nvidia’s sales ceiling and taper its growth rate.

There are considerably smarter ways to take advantage of the AI revolution than buying or holding Nvidia stock.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Intel and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

7 Reasons to Sell Nvidia, Wall Street’s Hottest Artificial Intelligence (AI) Stock was originally published by The Motley Fool

Bankrupt FTX wants to sell $175 million claim against Genesis to aid creditor repayment

FTX bankruptcy estate intends to sell its $175 million general unsecured claim against the collapsed crypto lender Genesis, according to a Feb. 2 court filing.

FTX proposed to divest these claims through public auctions or private transactions, either in entirety or in parts, with single or multiple purchasers. The generated funds would be used to facilitate debt repayment and also restructure its financial obligations to creditors.

This development aligns with FTX’s recent commitment to not resurrecting the platform, opting to liquidate assets as part of the ongoing efforts to compensate customers affected by its 2022 collapse.

Data from Claims Market showed that over $1 million in customer claims were trading at over 65 cents on the dollar as of the end of January.

FTX creditors have until Feb. 15 to voice objections to this proposed claim sale.

Genesis filed for Chapter 11 bankruptcy protection in January after the failure of FTX triggered mass customer withdrawals on its platform.

Genesis and FTX, initially engaged in substantial reciprocal claims, eventually settled with the failed exchange, holding a $175 million claim against the collapsed lender. Under the settlement agreement, both parties also relinquished other claims held against each other. Genesis Global Capital, the crypto lending arm of Genesis, had previously extended loans exceeding $2.8 billion to Alameda.

Genesis settles SEC lawsuit.

A recent court filing revealed that Genesis reached a $21 million settlement with the U.S. Securities and Exchange Commission (SEC) concerning the now-defunct Gemini Earn investment product.

“The proposed settlement will, among other benefits to the Debtors’ estates, resolve the Civil Action Claim filed by the SEC in these Chapter 11 Cases and eliminate the risks, expenses, and uncertainty associated with protracted litigation against the SEC,” the filing stated.

The filing further explained that the $21 million settlement would be disbursed after Genesis fully pays “all other allowed administrative expense, secured, priority, and general unsecured claims.”

The SEC had alleged that Gemini and Genesis violated U.S. securities laws through the crypto lending program.

Meanwhile, the company is still embroiled in a lawsuit filed by the New York Attorney General, which also involves DCG and Gemini, over allegations of fraud.

MakerDAO Co-Founder Cashes Out, Sends MKR Wobbling After $4.5 Million Sell

Despite starting the year strong, MKR has encountered a choppy path in recent weeks, leaving investors with a mixed bag of signals to decipher. While the decentralized finance (DeFi) leader has maintained its position above key support levels, concerns have emerged surrounding a prominent wallet’s sizeable token sale and a declining trading volume.

Maker Resilience Faces Uncertain Shadows

On the bright side, Maker has demonstrated resilience amidst broader market downturns. After a notable surge on January 24th, the token has held its ground, defying predictions of a deeper correction. This steadfastness has fueled optimism among some analysts, who predict a continued upward trajectory for MKR throughout 2024.

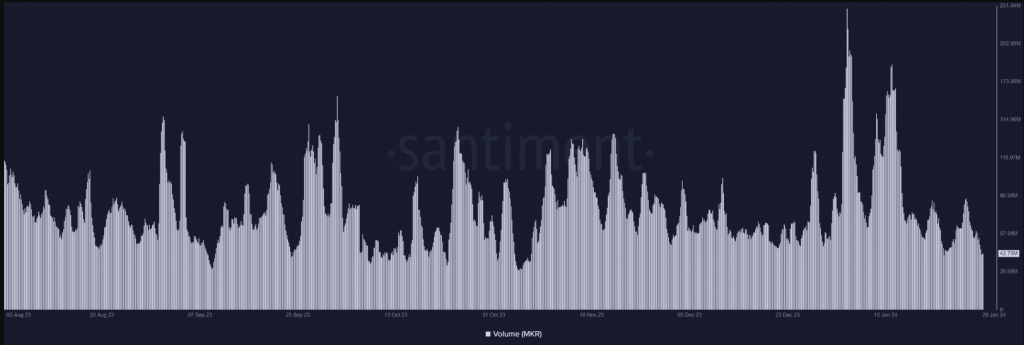

However, a recent development has cast a shadow of uncertainty. Data from on-chain analytics firm Spot on Chain revealed that a well-known wallet, reportedly associated with a MakerDAO co-founder, unloaded a hefty 2,235 MKR over the past two days. This translates to a staggering $4.5 million at press time, sparking fears of a potential “whale dump” that could trigger a price slump.

Wallet 0xa58 (linked to @RuneKek, #MakerDAO cofounder) has sold 2,235 $MKR for 4.542M $DAI at $2,032 on average in the past 2 days.

Currently, the wallet still holds 2,430 $MKR ($4.92M), and may keep selling.

The $MKR price has been down ~3.39% (2D), since the first sale.

Want… pic.twitter.com/iW2A0pMLHx

— Spot On Chain (@spotonchain) January 28, 2024

Adding to the mixed picture is a decline in trading volume. After reaching a high of $84 million on January 25th, activity has steadily dwindled, currently hovering around $43 million. This dampened trading enthusiasm could indicate waning investor confidence or simply be a temporary lull.

Source: Santiment

A glimmer of hope emerges when examining exchange netflow. Despite the sizable wallet sale, the overall flow of MKR has been dominated by inflows, suggesting that more tokens are being withdrawn from exchanges than sold. This trend, while not as pronounced as the previous outflow witnessed on January 25th, hints at potential accumulation by longer-term holders.

MKR market cap currently at $1.786 billion. Chart: TradingView.com

MKR Technical Struggles Ahead

On the technical front, Maker’s daily chart paints a picture of recent struggle. Following the January 24th gains, prices have embarked on a descent, shedding over 3% by January 27th. This marks the steepest decline since the downtrend began two days prior. The continuation of this selling pressure, particularly if fueled by further whale offloads, could pose a significant challenge for MKR’s immediate future.

MKR price action today. Source: Coingecko

At the time of writing, MKR was trading at $1,939, down 2.6% and 0.7% in the last 24 hours and seven days, data from Coingecko shows.

Maker’s early 2024 journey has been characterized by both encouraging signs and potential pitfalls. While the token’s resilience and positive long-term outlook offer reasons for optimism, the recent whale sale and declining volume inject a dose of caution.

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Tron network is a decentralized blockchain platform that aspires to create an expansive and interconnected global digital content ecosystem. At its core, Tron leverages its native cryptocurrency, TRX, to facilitate seamless transactions and interactions within the network.

An outstanding advantage of the Tron (TRX) network lies in its exceptional scalability and impressive transaction processing capacity. This remarkable feature enables Tron to process a substantial number of transactions swiftly, ensuring the smooth execution of smart contracts and decentralized applications (DApps). The network’s scalability is of utmost importance as it plays a vital role in supporting the expansion of its ecosystem and meeting the growing needs of both users and developers.

Tron (TRX) empowers developers to create and launch decentralized applications (DApps) through the integration of smart contracts into its framework. These versatile DApps span across diverse sectors, including finance, gaming, social media, and more. Tron equips developers with essential tools, resources, and support, enabling them to craft cutting-edge and fully operational applications. This fosters a dynamic developer community, driving ongoing expansion and diversification within the Tron ecosystem.

Tron’s emphasis on digital content is a distinguishing feature of the network. It aims to revolutionize the entertainment industry by directly connecting content creators and consumers without the need for intermediaries. The platform empowers creators by enabling them to distribute their content and monetize it through direct interactions with their audience.

The network (TRON) relies on a delegated proof-of-stake consensus mechanism for its security. Validators in the network are rotated every six hours, chosen by users who stake their TRX tokens.

To combat software bugs, Tron involves its community through the Bug Bounty Program. Users can contribute to development and earn rewards by reporting bugs and vulnerabilities. The Tron Foundation generously provides TRX rewards as an incentive, fostering a collaborative environment for network security.

This article delves into the fundamental features of the TRON network and explores its significant potential within the TRON ecosystem while also providing guides on how to buy, sell and trade on the network.

Features Of The TRON Network

Delegated Proof-of-Stake (DPoS) Consensus: The DPoS is a consensus mechanism utilized by the TRON network to enable its users to vote for representatives responsible for validating transactions and securing the network. This system guarantees swift transaction confirmation and streamlined network operations, enabling scalability and suitability for high-demand applications.

Smart Contracts and DApps: TRON offers a platform for the creation and implementation of smart contracts, which are self-executing agreements governed by predetermined rules. These smart contracts serve as the foundation for developing decentralized applications (DApps) that automate processes, enhance peer-to-peer interactions, and introduce trailblazing functionalities in sectors including finance, gaming, social media, and more.

Developer-Friendly Environment: TRON fosters a developer-friendly ecosystem by equipping developers with essential tools, resources, and support to build innovative and functional DApps. It offers user-friendly programming languages, software development kits (SDKs), and comprehensive documentation to optimize the development process. This commitment to developers encourages a vibrant community, promotes collaboration, and fuels ongoing growth and diversification within the TRON ecosystem.

Scalability and Throughput: One of the main purposes of the TRON network is that it is purposefully built to efficiently process a substantial number of transactions with exceptional throughput. Its infrastructure facilitates swift transaction execution, ensuring seamless operations for smart contracts and decentralized applications (DApps). This scalability plays a vital role in meeting the increasing adoption and requirements of users and developers.

Global Accessibility: TRON’s decentralized architecture guarantees worldwide accessibility, enabling individuals from across the globe to engage with the network. The platform’s infrastructure is intentionally designed to be accessible to anyone with an internet connection, promoting inclusivity and fostering a digital ecosystem without any geographical boundaries.

Direct Creator-Consumer Interaction: TRON enables content creators to engage directly with their audience without intermediaries. This direct connection fosters a more intimate and transparent relationship, allowing creators to better understand their audience’s preferences and tailor their content accordingly.

Ownership Rights: TRON acknowledges the significance of content ownership for creators and leverages the immutability and transparency of blockchain technology to safeguard their intellectual property rights. By doing so, TRON empowers creators to retain control over their content and ensures they are duly compensated for its utilization.

Monetization Opportunities: TRON empowers content creators by enabling them to directly monetize their content. By leveraging smart contracts and digital tokens, creators can receive payments directly from their audience, bypassing the need for third-party payment processors. This direct monetization approach allows creators to retain a greater share of their earnings and exert more control over their revenue streams.

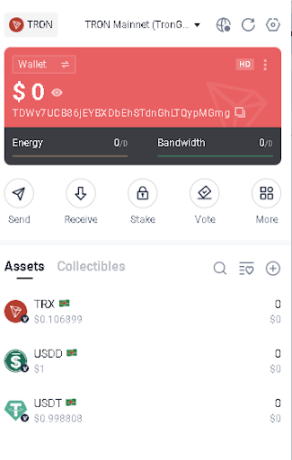

How To Get Started On The Tron Network

To buy and sell tokens on the TRON network, you will first need to get a TRON-compatible wallet like Tronlink. In this article, we will give examples using Tronlink. It is a popular TRON wallet extension and is readily accessible on leading browsers such as Google Chrome.

Related Reading: How To Buy, Sell, And Trade Tokens On The Optimism Network

With TronLink, users can effortlessly create and oversee TRON wallets, securely store TRX, as well as other TRC-10/TRC-20 tokens, and seamlessly engage with TRON DApps, all within the convenience of their browser interface.

To add your TronLink Wallet as a browser extension, simply click on the “Add to Chrome” icon located in the top right corner, as demonstrated below. This step will ensure that your TronLink Wallet becomes seamlessly accessible within your browser.

Once installed and set up, Open the TronLink extension in your browser. You will be prompted to either create a new wallet or import an existing one. If you’re new to TronLink, select the option to create a new wallet and follow the instructions to set up a password.

It is imperative to back up your wallet to ensure you can recover your funds in case of any unforeseen circumstances. TronLink will provide you with a unique set of recovery phrases during the wallet creation process. Write down and securely store these phrases in a safe place. (Do not store it on your device).

Trading On The TRON Network

The Tron network is capable of supporting various decentralized applications. Tron is often used to transact, as TRX transactions come with very low fees.

In order to engage in trading activities on the TRON network, it is essential to have TRX tokens in your wallet. TRX serves as the native cryptocurrency of the TRON network and is indispensable for executing trades, interacting with decentralized exchanges, and participating in decentralized finance (DeFi) protocols.

Hence, prior to initiating any trading or transactions on the TRON network, it is crucial to ensure that your wallet is adequately supplied with TRX tokens.

The next step is to fund your wallet. You can add TRX or other TRC-10/TRC-20 tokens to your TronLink wallet. Click on the “Receive” button in your Tronlink wallet to generate a wallet address; tokens will be available in your wallet almost immediately.

You can obtain TRX using popular cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) from cryptocurrency exchanges like Binance and transfer it to your TronLink wallet address.

Note that users can also access various DEXs interfaces like SunSwap through their Tronlink wallet by clicking on the “More” button in the same row as the “Receive” button.

How To Buy and Sell Tokens Using SunSwap

SunSwap is a decentralized trading protocol built on the TRON network, with the objective of facilitating automated liquidity provision and establishing an inclusive financial market accessible to all users. By utilizing the decentralized nature of blockchain, SunSwap enables users to participate in liquidity provision by depositing their TRON-based tokens into liquidity pools.

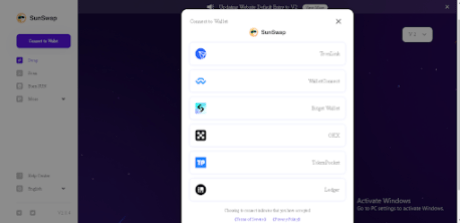

To protect your wallet from malicious activity, ensure that you are on the correct SunSwap website. To get started, visit the correct SunSwap website and click on the “Connect Wallet” option at the top left corner, as in the image below:

Then, select your preferred wallet (In this case, Tronlink):

Once connected, Users can commence trading activities as SunSwap is automatically linked to the TRON networks because it is a TRON-based DEX.

After accessing the SunSwap interface, the next step is to select the tokens you want to trade. SunSwap operates on a system where you can exchange your TRON-based tokens directly with other tokens.

Click on the “Select token” button to select the trading pair you want to trade against.

For example, if you want to buy USDT using TRX, select TRX – USDT, enter the amount, then click on “swap” or “trade now” and then you can go to your Tronlink wallet to confirm the transaction.

Tracking Token Prices on The TRON Network

Avedex is a powerful on-chain tool for TRON network users, offering comprehensive market insights for specific tokens. It provides valuable information such as price data, contract details, and advanced analytics tools. Traders can analyze price trends, liquidity, and token fundamentals to make informed trading decisions.

Additionally, Avedex allows for token comparison, user reviews, and rating systems, enhancing the decision-making process. With integration to TRON wallets and notification features, Avedex streamlines the trading experience, enabling users to stay updated and act promptly.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

Overall, Avedex empowers TRON traders with reliable information and tools to navigate the market effectively and make well-informed trading choices.

Conclusion

In conclusion, the TRON (TRX) network offers a decentralized blockchain platform that prioritizes the creation of a global digital content ecosystem. With its scalable infrastructure and high transaction processing capacity, TRON enables the swift execution of smart contracts and decentralized applications (DApps) across various sectors. The network’s developer-friendly environment provides essential resources and support for developers to build innovative DApps, fostering a vibrant community within the TRON ecosystem.

To engage with the TRON network, users need a TRON-compatible wallet like TronLink. They can obtain TRX tokens from various popular exchanges, transfer them to their TronLink wallet, and then trade on platforms like SunSwap for decentralized trading.

Overall, the TRON network offers a robust ecosystem for buying, selling, and trading tokens, while its focus on digital content and developer support makes it an attractive platform for creators and users alike.

Featured image from X.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Expert Calms Mt. Gox Bitcoin Liquidation Worries, Says “Creditors Aren’t Likely To Sell Soon”

The ongoing saga of the Mt. Gox exchange casts a shadow over the Bitcoin community, even years after its dramatic collapse. Recent developments have stirred the pot again, with Mt. Gox reaching out to former users to confirm ownership of accounts linked to Bitcoin payments.

This move comes amid ongoing efforts to compensate creditors, primarily in Japanese yen, through their PayPal accounts. With the repayment process expected to continue this year, the crypto community remains on edge regarding the implications of releasing Mt. Gox’s substantial Bitcoin holdings, amounting to 142,000 BTC and 143,000 BCH, in addition to 69 billion yen.

Expert Optimistic Take On Gox Coin Release

Amid the swirling rumors and speculation, renowned Bitcoin advocate and CEO of Jan3, Samson Mow, has stepped forward to offer his perspective, seeking to alleviate concerns regarding the potential market impact of unlocking “Gox coins.”

Mow believes creditors’ long wait has cultivated resilience to prevent a sudden, mass sell-off of these assets. According to Mow, even if some creditors decide to sell, the market is well-equipped to “absorb” the impact without significant disruption.

Gox coins unlocking isn’t really a factor. Creditors having to force HODL for a decade aren’t likely to sell soon. What about buyers of claims? They may have sought fiat gains initially, but had a front row seat to #Bitcoin NgU and should now be thinking “sell for gains in what?”

— Samson Mow (@Excellion) January 24, 2024

This view was echoed in response to a user named Spoonman on X, who suggested that around half of the creditors might be inclined to sell. Mow confidently stated that such selling would not co-occur, reinforcing his belief that the market can handle the situation smoothly.

Even if some sell, they aren’t going to do it all at once. Market can absorb it all easily regardless.

— Samson Mow (@Excellion) January 24, 2024

Bitcoin Unexpected Reversal

Interestingly, the Bitcoin market has recently shown signs of recovery, defying some analysts’ expectations of a continued downturn. At present, Bitcoin is experiencing a 3% increase over the past 24 hours, with its trading price hovering above $40,000

However, it’s important to note that this uptick follows a significant decline, with Bitcoin down by 5.7% over the past week and over 10% in recent weeks.

This modest recovery contradicts the bearish forecast presented by Bitfinex in their latest Alpha Report, which anticipated further market downturns. Bitfinex analysts pointed out the vulnerability of Bitcoin’s price due to the reduced profitability of short-term holders.

According to the analyst, this group of investors’ potential reaction to the market conditions could lead to critical support levels being tested at around “$38,000 and $36,000,” as per the report.

However, contrary to prediction, Bitcoin has surged slightly far away from these highlighted support zones. For context, the asset currently trades for $40,037 at the time of writing.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.