Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Deribit FZE, an entity owned by crypto derivatives platform Deribit, has secured a conditional virtual asset service provider from the Dubai virtual assets regulator. The license, which covers spot and derivative trading, will remain non-operational until Deribit meets the regulator’s localization requirements. Meeting Dubai’s Localization Requirements Deribit FZE, a wholly owned entity of the crypto […]

Source link

service

Disney, Fox and Warner Bros. team up to launch new sports streaming service

Walt Disney Co.’s ESPN, Fox Corp. and Warner Bros. Discovery Inc. are teaming to create a joint sports streaming service.

The as-yet unnamed service, which could be available as early as the fall and offer a sort of Hulu model for sports, comes amid an explosion in sports-streaming rights and audiences.

The service would essentially be a skinny bundle of the companies’ linear channels, including ESPN, ESPN2, ESPNU, SECN, ACCN, ESPNEWS, ABC, Fox, FS1, FS2, BTN, TNT, TBS, truTV, as well as the ESPN+ streaming service.

“The launch of this new streaming sports service is a significant moment for Disney

DIS,

and ESPN, a major win for sports fans, and an important step forward for the media business,” Disney Chief Executive Bob Iger said in a statement late Tuesday. “This means the full suite of ESPN channels will be available to consumers alongside the sports programming of other industry leaders as part of a differentiated sports-centric service.”

Added Warner Bros.

WBD,

CEO David Zaslav: “This new sports service exemplifies our ability as an industry to drive innovation and provide consumers with more choice, enjoyment and value and we’re thrilled to deliver it to sports fans.”

Each company will own one-third of the platform, according to Disney, in a deal reminiscent of the original Hulu, which started off as a joint venture between ABC, Fox and NBCUniversal.

The service will have a new brand with an independent management team, and will be available to bundle with Disney+, Hulu and Max subscriptions.

“We’re pumped,” Fox

FOX,

CEO Lachlan Murdoch said. “We believe the service will provide passionate fans outside of the traditional bundle an array of amazing sports content all in one place.”

More details, including pricing, will be announced later.

Prominently missing from the deal are Comcast Corp.

CMCSA,

which owns NBCUniversal and its sports lineup that includes NFL football and the Olympics, and Paramount Global

PARA,

which owns CBS — which carries the NFL and college football, among other sports.

The new service will showcase thousands of high-profile sporting events and include all four major sports leagues — the NFL, NBA, MLB and NHL — as well as college football and basketball, golf, tennis, cycling, soccer and UFC.

Shares of Disney slipped 1% in extended trading Tuesday, while Fox shares jumped 5% and WBD gained 3%.

Mike Murphy contributed to this report.

An independent contractor wearing a protective mask and gloves loads Amazon Prime grocery bags into a car outside a Whole Foods Market in Berkeley, California, on Oct. 7, 2020.

David Paul Morris | Bloomberg | Getty Images

Amazon is piloting a new grocery subscription for members of its Prime program, the company said Thursday, marking the latest recalibration of its online supermarket offerings.

Members of the company’s Prime program will have the option to pay $9.99 per month to get unlimited grocery delivery from Whole Foods and Amazon Fresh on orders more than $35. They’ll also have access to 30-minute pickup on orders of any size. To start, the service is rolling out in Denver, Colorado; Sacramento, California; and Columbus, Ohio.

“We’re always experimenting with features to make shopping easier, faster, and more affordable, and we look forward to hearing how members who take advantage of this offer respond,” Tony Hoggett, who leads Amazon’s physical stores business, said in a statement.

Amazon is betting Prime members will want to pay an additional monthly charge for fresh food to be dropped at their doorstep without pesky delivery fees. A Prime subscription costs $139 per year, or $14.99 per month, in the U.S., and the membership’s perks include free, speedy shipping and access to video streaming. With the add-on grocery subscription, the offering could drive bigger, and more frequent, food orders among Prime members.

Amazon has tweaked its fee-free delivery threshold for Fresh and Whole Foods orders in recent years amid mounting costs. In October, the company lowered its threshold for free Fresh grocery delivery to orders over $100, after setting the minimum at $150 months earlier. In 2021, the company introduced a $10 service fee for Whole Foods delivery orders to Prime members.

Prior to the fee changes earlier this year, the company offered free Amazon Fresh grocery delivery on orders above $35 at no extra cost for Prime members.

Amazon has been determined to cement itself as a grocery destination for shoppers. Since acquiring Whole Foods Market in 2017 for $13.7 billion, it has launched its own chain of Fresh supermarkets, and it’s taken steps more recently to unify its online and brick-and-mortar grocery operations, while appealing to a broader swath of consumers. Last month, the company opened Fresh grocery delivery to people without Prime anywhere in the U.S., after testing the feature in a handful of cities.

Don’t miss these stories from CNBC PRO:

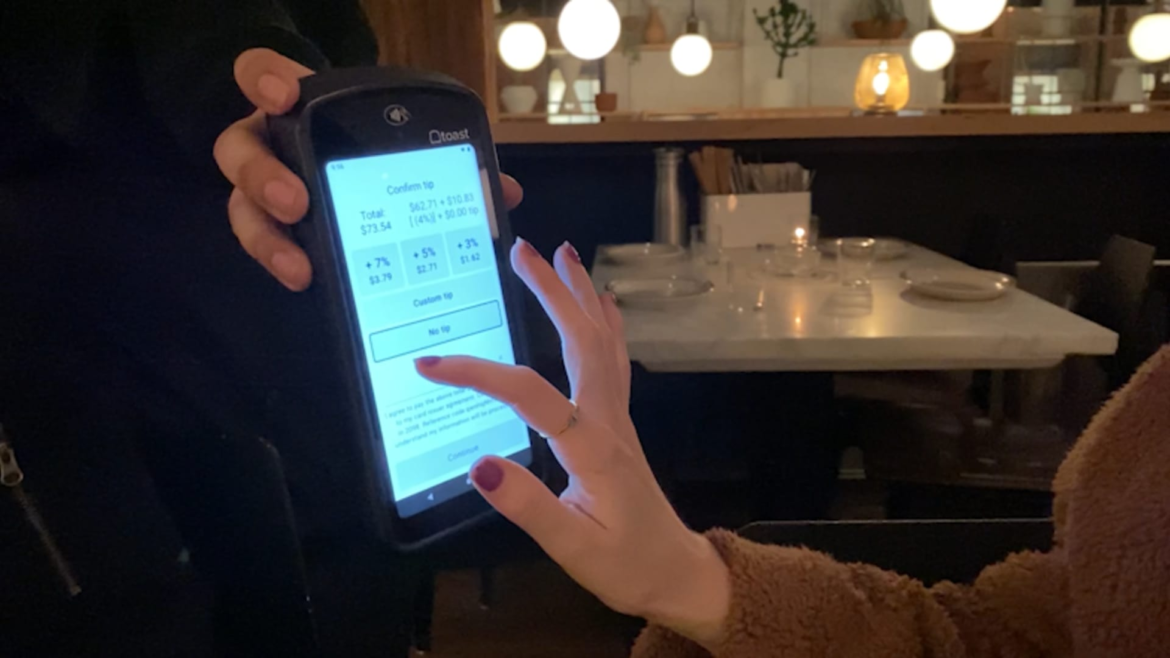

Tipping once rewarded good service. Now it predicts how you’re treated

Instacart operates similarly; shoppers see a list of batches that are available to them in their area, as well as the expected customer tip, and they may select the one they want to shop, according to the company.

Uber drivers may not see the expected tip in advance, but at one point they could see a rider’s tip history, or whether they were a “top tipper,” which may have factored into who drivers chose to pick up.

“It was a wonderful tool for a driver,” said Sergio Avedian, a driver and senior contributor at The Rideshare Guy, a blog aimed at helping rideshare drivers earn more money.

Uber phased out the top tipper rider designation earlier this year. The company did not immediately respond to a request for comment.

“Drivers depend more and more on tips these days,” Avedian said. Still, his tips average only about 12% to 13% of the fare, he estimated.

‘Tip fatigue’ is real

In most cases, consumers face more opportunities to tip for a wider range of services than ever before, a trend also referred to as “tip creep.” But recent surveys show shoppers are experiencing “tip fatigue” and starting to tip less — while resenting tipping prompts even more.

Two-thirds of Americans have a negative view of tipping, according to a report by Bankrate, especially when it comes to the predetermined point-of-sale options.

“Consumers are dissatisfied with the current state of tipping, and a lot of it has to do with being asked to give tips before service rather than after,” Lynn said.

However, tipping in advance is not entirely new, he added. “People have long given bartenders generous tips as a bribe for future services, like getting a more generous pour.”

New York City is months away from introducing the first zone-based tolling program in the U.S.

The project, which begins in the spring of 2024, will increase the tolls drivers pay to enter points of Manhattan south of 60th Street.

The final price of the toll is not yet determined. People close to the process believe it ultimately may cost between $9 and $23 to enter or exit the central business district by personal car. By law, passenger vehicles are taxed once a day. Commercial and ride-share vehicles will be tolled per trip.

“The strategies that we’re talking about are not anti-car,” said Janette Sadik-Khan, former commissioner of New York City’s Department of Transportation. “If you don’t have any other choice than to drive, that’s not a good outcome.”

The toll may produce up to $15 billion for investment within the aging MTA system. Much of the cash will go toward the MTA’s 2020-24 Capital Program. For example, some of the proceeds will finance four new Metro-North stations for communities in the Bronx.

“Expansion tends to be the sexy and fun thing, which we’ve done. But the kind of stuff that our customers don’t see is power upgrades, track upgrades and signal upgrades,” said Richard Davey, president of New York City’s Transit Authority.

The MTA is also speeding up investment in clean bus technology. The agency expects to begin experimenting with hydrogen fuel cell bus technology in 2025.

“The manufacturer that the hydrogen technology uses is zero emission. That’s a nascent technology,” said Davey to CNBC.

Regional planners expect to see environmental benefits with the new toll in place. For example, particulate matter emissions from stop-and-go traffic can stoke diseases such as asthma.

The MTA study of the toll cites the experiences in other global cities including Milan, London, Singapore and Stockholm. “In London, they’ve had a reduction of nearly 20% in particulate matter pollution,” said Julie Tighe, president of the New York League of Conservation Voters. “There’s a 15% reduction in particulate matter in Stockholm, which resulted in a 50% reduction in asthma.”

“In Stockholm, it was very unpopular,” said Mollie Cohen D’Agostino, a researcher at the University of California, Davis campus. “It just narrowly got enough support to get past that first trial period vote. Then it got significantly more support in the second vote … people actually liked it.”

Watch the video above to see how New York City is spending cash raised by its massive new toll.

A private gauge of China’s service activities fell to its lowest level in eight months, signaling that the service sector’s growth may have lost steam.

The Caixin China services purchasing managers index slid to 51.8 in August from 54.1 in July, Caixin Media Co. and S&P Global said Tuesday.

However, the index remained above the 50 mark, which separates an expansion in activity from contraction, for the eighth consecutive month.

The subindexes for business activity and total new orders remained above 50 for the eighth consecutive months, but both readings were lower than July’s. The subindex for export orders fell into contraction for the first time since December, said Caixin.

Employment in the service sector continued to expand in August but growth slowed, Caixin said.

“Service providers remained optimistic, expressing confidence in the market outlook. But overall optimism was limited, as the August reading for their expectations about future activity recorded the lowest reading since November,” said Wang Zhe, an economist at Caixin Insight Group.

China’s official nonmanufacturing PMI, which includes both service and construction activity, dropped to 51.0 in August from 51.5 in July, official data showed last week.

Write to singaporeeditors@dowjones.com

Robinhood strikes deal with U.S. Marshal Service to buy back shares seized from Sam Bankman-Fried

Robinhood‘s proposed deal to repurchase shares seized from Sam Bankman-Fried by the U.S. Marshal Service (USMS) has been approved by a federal court in the Southern District of New York.

As a result, Robinhood will be allowed to buy back shares seized from Bankman-Fried’s Emergent Fidelity Technologies for $605.7 million, according to a statement released by the company.

After FTX and Emergent filed for bankruptcy protection last year, the U.S. government took custody of Bankman-Fried’s Robinhood shares. In February, Robinhood announced its plan to repurchase the stake.

Cash, stocks, and crypto

According to the agreement, Robinhood will buy back 55.3 million shares at $10.96 each, utilizing corporate cash from its balance sheet, which featured over $6 billion in cash and investments as of its latest quarterly report.

Bankman-Fried, who previously held a 7.6% stake in Robinhood, had expressed no intentions of gaining control over the trading platform. He had voiced enthusiasm about Robinhood’s business prospects, hinting at potential partnerships with the platform. However, the sudden bankruptcy of FTX led to the seizure and dissolution of his fortune, which was once estimated to be around $26 billion.

The FTX founder sought to retain ownership of Robinhood shares worth $450 million. He vehemently disputed the bankrupt exchange’s “legal claims” over the assets, insisting that he and Gary Wang were the primary holders of the shares, not Alameda Research or any other entities implicated in the FTX bankruptcy.

Robinhood has demonstrated robust strength within the crypto market, underlined by its substantial holdings in Bitcoin (BTC) and Ethereum (ETH). According to reports by Arkham Intelligence, Robinhood holds the fifth-largest wallet on Ethereum, amounting to $2.54 billion in ETH and more than 100 ERC-20 tokens collectively valued at over $177 million.

The trading app company also owns the third-largest Bitcoin wallet globally, holding about $3 billion worth of BTC.

Binance has confirmed the news, stating it would shift its focus to its main products and long-term goals.

Binance has decided to close its buy-and-sell service Binance Connect amid challenges its provider faced with support for card payments. Starting from August 16, Binance Connect is no longer available.

Binance has confirmed the news, the announcement has also been revealed by BNB Chain-based platform Biswap in a tweet.

Dear Biswappers,

The Biswap team keeps abreast of the latest DeFi news and aims to inform you right away.

After a thorough consideration, @binance has made a difficult decision to disable @Binance_Connect on 15 August due to its provider closing the supporting card payments… pic.twitter.com/HcooyLn4sg

— Biswap (@Biswap_Dex) August 15, 2023

As Binance has stated, it will shift its focus to its main products and long-term goals.

Binance representative commented:

“We periodically review our products and services to ensure that our resources continue to be focused on core efforts that align with our long-term strategy. In the last six years, Binance has grown from being an exchange to a global blockchain ecosystem with multiple business lines. We consistently adapt and modify our business approach in response to changing market and user needs.”

Launched in March 2022, Binance Connect (formerly Bitfinity) was connecting traditional finance to world-leading and emerging blockchains, transforming how businesses and people send and receive money around the world. Its aim was to create an open, financial world where people from all walks of life and businesses, big or small, can participate and realize their financial goals.

Serving as the official fiat-to-crypto payments provider for Binance, Binance Connect supported as many as 50 cryptocurrencies and major payment methods, including Visa and Mastercard. The service was also supposed to be the hub for the exchange’s non-fungible tokens (NFTs) checkout solution. The feature was not added.

Binance’s Legal Battles

One of the world’s largest crypto exchanges is currently facing challenges caused by regulatory scrutiny around its business. Earlier this year, Binance faced lawsuits filed by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) accusing the company of misleading investors through opaque business practices. The violations included operating unregistered exchanges, broker-dealers, and clearing agencies, misrepresenting trading controls and oversight on the Binance.US platform, as well as the unregistered offer and sale of securities. In total, SEC filed more than a dozen charges against Binance this year so far.

According to SEC, Binance has been manipulating its Know-Your-Customer (KYC) processes to conceal its US customer base and avoid regulatory oversight. Besides, the company has been accused of encouraging its US customers to use virtual private networks (VPNs) to hide their locations and bypass restrictions. Out of Binance’s 62 million global customers, only 25 million had submitted KYC documentation.

European regulators turned out to be not really welcoming as well. In June, Germany’s Federal Financial Supervisory Authority (BaFin) reportedly denied the Binance exchange’s application for a crypto custody license. Besides, Binance withdrew its application with the Financial Market Authority of Austria. Earlier this year, Binance also exited the Netherlands after failing to secure regulatory approval, as well as abandoned its Cyprus and UK registrations.

next

Binance News, Cryptocurrency News, Editor’s Choice, News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.

Nvidia's Newest Service Makes It Easier Than Ever to Train AI — What Investors Need to Know

Nvidia (NASDAQ: NVDA), the company traditionally known for designing chips for high-end video game graphics on PCs, has ushered in a new era of AI. The generative AI chatbot ChatGPT quickly picked up tens of millions of users starting in late 2022, creating ballooning interest in other generative AI services — nearly all of which are “trained” using Nvidia semiconductor systems.

What followed was an epic financial report unlike anything seen before. Cloud infrastructure companies are all scrambling to buy as many AI training chips as they can get their hands on. But Nvidia has a new way to access its hardware that makes AI easier and more affordable to train than ever before: DGX Cloud.

Let’s get up to speed on what generative AI services like ChatGPT are. AI-powered software has been around for decades, quietly working behind the scenes to do things like organize and present information on the internet or auto-fill words while users type in a word document.

Continue reading

North Korean hackers exploited shared cloud service to rob crypto firms

North Korean state hackers exploited a cloud services provider called JumpCloud to steal funds from crypto companies that use its services, Reuters reported on July 20.

Reuter’s confidential sources indicate that the North Korean state-backed hackers had a specific focus on cryptocurrency companies. However, the report did not disclose the names of the impacted companies or the exact quantity of cryptocurrency purportedly stolen.

Crowdstrike, a cybersecurity firm collaborating with JumpCloud to probe the incident, attributed the attack to a group known as Labyrinth Chollima. Although the representative from Crowdstrike did not confirm if any cryptocurrency was stolen, he noted the group’s history of targeting cryptocurrency companies.

In an update on July 20, JumpCloud announced North Korea as the perpetrator of the attack, It also disclosed that less than five of the company’s 200,000 corporate clients, and less than 10 devices, were affected.

Previously, the company described a spear-phishing campaign conducted by a “sophisticated nation-state sponsored threat actor.” The company said that the attack began on June 22 and said that it detected those activities on June 27.

JumpCloud said that it did not find any indication that customers were affected at that time. The company nevertheless updated credentials and took extra steps to preserve security; it also contacted law enforcement. However, on July 5, the company discovered additional activity that affected its customers, who were then informed of the situation.

JumpCloud says attackers are advanced

JumpCloud called the attackers “sophisticated and persistent adversaries with advanced capabilities” and said the best defense involves sharing information.

JumpCloud said that the attack vector involved data injection into its commands framework. The attack was found to be highly targeted and specific to certain customers. The attack produced a list of IOCs (Indicators of Compromise), which JumpCloud has shared.

North Korean attackers have been involved in other crypto attacks including those against Axie Infinity and Horizon Bridge. Estimates from Chainalysis suggest that North Korean groups stole $1.7 billion amidst $3.8 billion in broader crypto thefts in 2022.

The post North Korean hackers exploited shared cloud service to rob crypto firms appeared first on CryptoSlate.