An eclipse like the one on April 8 won’t happen again until 2044, so millions of Americans are paying to get a glimpse of Monday’s total solar eclipse.

Source link

set

Bitcoin’s growing status as ‘digital gold’ set to attract new investors

As the Federal Reserve maintains a cautious stance on interest rate cuts, Bitcoin’s emergence as a ‘digital gold’ has garnered increased investor attention, setting the stage for heightened adoption expectations, Coinbase said in its latest market research on April 5.

Institutional Research Analyst David Han believes Bitcoin’s growing status as digital gold will attract new investors looking for a hedge against macroeconomic uncertainty.

According to the report, this perspective has gained further prominence over the past day against the backdrop of the Fed’s recent communications, which have led to a broader market recalibration, affecting digital and traditional assets alike.

Digital Gold

The Federal Reserve’s recent communications suggest a measured approach to future interest rate adjustments, a stance that has coincidentally seen gold outshine other asset classes. This development, Coinbase asserts, may cast Bitcoin in a favorable light among investors seeking alternatives amid inflationary concerns and interest rate uncertainties.

Han said the market’s hawkish reaction to the Fed’s recent commentary highlights a significant shift from the optimism at the start of the year, reflecting deeper uncertainties across financial landscapes.

Within this framework, Bitcoin’s resilience and potential for adoption come into sharper focus, suggesting a pathway through macroeconomic turbulence.

According to Han, the introduction of spot bitcoin ETFs in the US market represents a pivotal development, enhancing the flagship crypto’s appeal by broadening access and potentially stabilizing price volatility through increased institutional participation.

This milestone, coupled with Bitcoin’s comparison to gold in times of economic uncertainty, positions it uniquely as a safe haven for investors navigating the current climate of inflation concerns and geopolitical risks.

Growing acceptance

Han highlights the strategic significance of Bitcoin’s growing acceptance and the implications for market volatility and investment strategies.

The enhanced liquidity and investor base attributed to the Bitcoin ETFs marks a transformative shift in the crypto market’s structure, contrasting with previous cycles and suggesting a more mature phase of market evolution.

The broader crypto and DeFi sectors also reflect these complex trends, with developments like Maker’s Endgame initiative signaling rapid innovation yet inviting scrutiny over governance and risk. The ongoing dialogue within the DeFi community, especially concerning decentralized stablecoins, highlights the intricate balance between innovation, market stability, and regulatory engagement.

As Bitcoin navigates the implications of the Fed’s policies, its role and acceptance in the financial ecosystem are poised for significant scrutiny and potential expansion. The intricate balance of macroeconomic factors, investor sentiment, and technological advancements will continue to shape the landscape for Bitcoin and the wider crypto market.

Mentioned in this article

Latest Alpha Market Report

Xuirin Finance Set to Revolutionize DeFi With KYC-Free Debit Cards, P2P Lending and Much More

Looking to get involved with a platform that can change the face of decentralized finance forever? Xuirin Finance is revolutionizing the DeFi landscape through its innovative offerings like KYC-free debit cards, P2P lending, and so much more. Supporters can take part in the first stage of its presale right now. Xuirin Finance to Offer Futuristic […]

Looking to get involved with a platform that can change the face of decentralized finance forever? Xuirin Finance is revolutionizing the DeFi landscape through its innovative offerings like KYC-free debit cards, P2P lending, and so much more. Supporters can take part in the first stage of its presale right now. Xuirin Finance to Offer Futuristic […]

Source link

Are You Looking to Buy a Beaten-Down, Magnificent, No-Brainer Stock Owned by Warren Buffett and Cathie Wood That’s Set to Soar Like an AI-Powered Rocket Today?

You’ve been Rickrolled by a mildly plausible article title. Those keyword-packed headlines work, don’t they?

But there’s no guaranteed market-beating stock idea here. Legendary growth investor Buckminister Goldshanks hasn’t found “the eighth wonder of the world,” preparing to mortgage his mansion and buy more.

It’s just The Motley Fool, back with an April Fool’s joke. And you bought it!

Let’s be honest, we ALL want that magical stock that’s cheap, poised for world domination, AND endorsed by investing legends. But as tempting as those headlines are, they’re usually a recipe for April Fool’s style disappointment.

While we at The Motley Fool are all for hunting down those magnificent, no-brainer stocks set to soar, it’s crucial to remember the Foolish principles of investing. Diversify, think long-term, and yes, even on April Fool’s Day — especially on April Fool’s Day — keep your skepticism handy.

To be clear, no stock is truly worthy of the breathless promotion that brought you here. Cathie Wood’s and Warren Buffett’s stock portfolios have some stocks in common, but none that match our headline. For example, one name that they have in common dabbles in AI-driven financial services, but it has nearly tripled in 52 weeks and trades at 56 times earnings, so there’s no “beaten-down” quality and we wouldn’t call it a “no-brainer” buy today. (If you must know, the stock in question is Nu Holdings. Interested? Here’s a Foolish primer on how to research stocks.)

The reality is that no single stock can deliver every investor’s dream scenario. Let’s say someone actually made an unbelievable number of eyeball-magnet promises about a single stock in a headline that wasn’t meant as a joke. You would probably assume they had a nice bridge to sell you. And the stock should do your dishes, too.

99% of the time, you’d be right.

The Motley Fool way

That doesn’t mean there aren’t fantastic opportunities out there. Instead of chasing the impossible, our analysts and contributors focus on a realistic set of tactics that add up to a healthy investing strategy.

-

Diversification for the win: Serious investors should hold at least a couple of dozen stocks in their portfolios, spread across various industries, geographic markets, and company-size cohorts.

-

Undervalued potential: Great companies that have hit a rough patch can create a buying opportunity for long-term investors.

-

The right mix: It can pay off to find stocks with some of the qualities Buffett loves (solid fundamentals) and a dash of the growth potential that thrills Wood.

-

A long-term mindset: Buffett’s favorite holding period is “forever,” and The Motley Fool tends to agree. The real magic of long-term buy-and-hold investing comes from compound returns over many years as you let your winners run.

-

Doing your homework: No stock is worth a blind bet. Research is key to separating long-term winners from flash-in-the-pan hype. The more you know, the better you’ll get at picking great investments. Remember, Buffett has said he reads 500 pages of financial filings a day. He didn’t become the Oracle of Omaha by blind luck.

Find your Foolish treasure

Investing shouldn’t be about chasing get-rich-quick schemes. If you can focus on building wealth over time through smart choices, you’ll be much better off.

And there is plenty to be excited about in this market, even if there aren’t any magic-wand ideas ready to make everyone smarter, happier, and richer all at once. Wall Street entered an official bull market in January, stretching back to the last bear market’s bottom in October 2022. Everyone is excited about AI stocks, stock splits, and initial public offerings. Even the crypto market sprang back to life recently, driving the leading digital assets to fresh all-time highs.

Investors are feeling the joy. The American Association of Individual Investors’ (AAII) latest investment sentiment survey saw the market mood leaning heavily bullish. It’s springtime for stock investors, and there’s no telling how far this bull market will run. Just keep a Foolish mindset and do your homework before hitting the “buy” button on any particular stock idea. Remember, great investors aren’t trying to time the market — they just give their money a lot of time in the market.

Happy April Fool’s Day, and happy stock hunting!

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has nearly tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of March 25, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool recommends Nu. The Motley Fool has a disclosure policy.

Are You Looking to Buy a Beaten-Down, Magnificent, No-Brainer Stock Owned by Warren Buffett and Cathie Wood That’s Set to Soar Like an AI-Powered Rocket Today? was originally published by The Motley Fool

Amid the recent momentum displayed by the meme-inspired cryptocurrency Dogecoin (DOGE), Rekt Capital, a crypto trader and analyst, has identified a new trend that could propel DOGE’s price to the $0.3 price mark in the short term.

Dogecoin (DOGE) Inititate New Macro Uptrend

Over the past few weeks, Dogecoin has been performing fairly well, triggering optimism and expectations for more price growth. Due to this, the top meme currency in the world in terms of overall market valuation has always generated discussion within the sector.

DOGE’s recent spike in price resulted in the conclusion of its Macro Downtrend, according to Rekt Capital. However, the breakout has triggered DOGE into a new Macro Uptrend on the upside.

Additionally, DOGE Monthly would recapture historical support if it closed above the red $0.20 price level. As a result, it would provide more momentum for a move towards the $0.30 range and even further.

The post read:

Dogecoin has ended its Macro Downtrend and begun a new Macro Uptrend. And if DOGE Monthly Closes above the red ~$0.20 level, it would reclaim historical support that could offer further fuel for a move towards the $0.30+ area.

It is worth noting that it took Dogecoin less than two weeks to break out from the macro downtrend after entering the area. Rekt Capital pointed out that the crypto asset successfully retested its support after breaking its macro downtrend two weeks ago.

During this period, the analyst underscored DOGE was still in the retest phase because the coin was still declining. Furthermore, the meme coin was moving sideways within a new macro range he dubbed black-red, around $0.12 and $0.20.

Prior to the breakout, Rekt Capital stated that DOGE is taking all the appropriate steps to validate its new macro uptrend. Given that the token has broken through strong resistances, it could be headed for a new peak in this cycle.

Potential Catalyst For The DOGE’s Performance

Rekt Capital’s forecast came in light of DOGE witnessing a significant increase to $0.22, its highest level in the past 2 years. It is believed that the upswing was triggered by rumors that the asset could be incorporated into Elon Musk‘s X platform very soon.

Ever since the rumors developed, Dogecoin’s price has doubled in less than a month, suggesting interest growth from investors. Dogecoin is currently the eighth-largest crypto asset by market value, with a market cap of $31.087 billion, following its remarkable price explosion.

Presently, Dogecoin is trading at about $0.21, with a notable $5.157 billion trading volume in the past day. Despite the recent price development, DOGE is still more than 50% down from its all-time high of $0.74.

The resurgence of Dogecoin in the rapidly evolving cryptocurrency space is indicative of the dynamics of the market. This huge increase also reflects the general state of the market, showing investors’ ongoing interest in meme coins today.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Quick Take

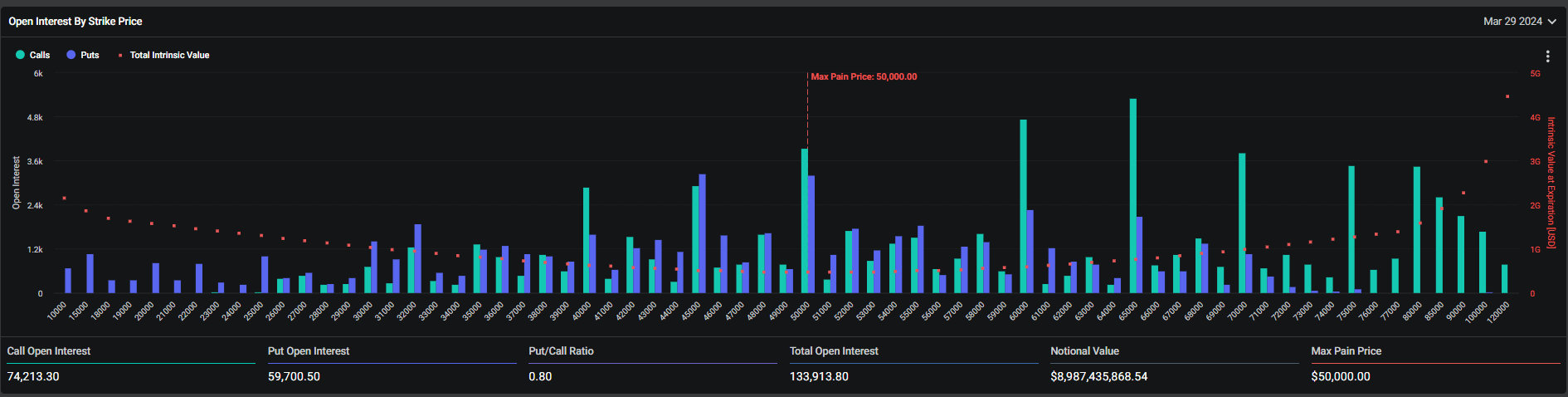

Deribit data indicates that nearly $9 billion worth of Bitcoin (BTC) options are due to expire on March 29, the last Friday of the month, with the total open interest amounting to 133,914 BTC. The put/call ratio is reported at 0.80, signifying more calls in circulation compared to puts, and reflects bullish market sentiment — for every 100 calls, there are 80 puts. Call open interest stands at 74,213 BTC, outstripping put open interest, which totals 59,701 BTC.

Deribit’s figures highlight the relevance of the put/call ratio with Bitcoin’s price at roughly $67,000, significantly surpassing the ‘max pain’ point of $50,000, indicating that a considerable number of call options are presently in the money.

The disparity between the elevated current price of BTC and its strike prices may suggest a prior underestimation of its volatility. There is also a marked concentration of open interest in calls at the upper strike prices, starting at $75,000, which could have implications for future volatility perceptions and options pricing.

The post $9 billion in Bitcoin options set to expire on March 29 appeared first on CryptoSlate.

Alphabet is set to pop 15% as Google is a clear winner in AI, Wedbush says

-

Alphabet stock could see a big surge as Google is a “clear winner” in AI, according to Wedbush.

-

Analysts pointed to multiple advantages the Google parent has over other firms in the AI space.

-

More upside could lie ahead if Alphabet expands partnerships and issues more guidance on AI projects.

Alphabet stock is primed for a big jump, as Google will emerge as a clear winner in the artificial intelligence race that’s gripped Wall Street, Wedbush analysts said in a recent note.

The firm added Alphabet stock to its “Best Ideas List” and raised its price target on the Google parent from $160 to $175 per share. That implies a 15% upside from the stock’s current levels, with Alphabet trading around $152 a share on Friday morning.

“We believe the perceived structural risks to Google Search are overstated and continue to view Alphabet as a net beneficiary of generative AI,” analysts said in a note on Friday.

The new price target is largely because of Alphabet’s “multifaceted” edge over other competitors in the AI race, Wedbush said, such as its wide breadth of available data to train AI models and its massive user base across its products, like Android, Search, and YouTube.

The company could also soon be collaborating with Apple to incorporate its Gemini AI into iPhones.

Shares of the tech titan have lagged the gains of other Magnificent Seven names like Amazon and Microsoft, which are up 18% and 14%, respectively year-to-date, and the stock has underperformed the wider Nasdaq which is up by about 11% for the year.

However, sentiment over Alphabet’s AI endeavors has improved, analysts said, citing more upbeat commentary on Google in recent months. Meanwhile, Alphabet shares are still up over 6% since the start of the year. That displays some resilience in the stock, despite controversy arising in March after Gemini was known to create historically inaccurate images.

The stock could see more upside catalysts in the future, Wedbush said, adding it was looking for the Google parent to issue more guidance on its business model for its Search Generative Experience, deeper “cost reengineering” to develop its AI projects, as well as more partnerships to develop AI models with other firms.

“We continue to view Alphabet as a secular winner within the digital advertising industry with broad exposure and durable market share of overall media spending,” analysts added.

Wedbush has been bullish on Alphabet and the broader AI-fueled rally for months. AI is likely spawning a new 1995-style tech bull market, Wedbush analysts said in a previous note, predicting tech stocks could soar another 33% in 2024.

Read the original article on Business Insider

Bank of England set to hold rates, but falling inflation brings cuts into view

The Bank of England in the City of London, after figures showed Britain’s economy slipped into a recession at the end of 2023.

Yui Mok | Pa Images | Getty Images

LONDON — The Bank of England is widely expected to keep interest rates unchanged at 5.25% on Thursday, but economists are divided on when the first cut will come.

Headline inflation slid by more than expected to an annual 3.4% in February, hitting its lowest level since September 2021, data showed Wednesday. The central bank expects the consumer price index to return to its 2% target in the second quarter, as the household energy price cap is once again lowered in April.

The larger-than-expected fall in both the headline and core figures was welcome news for policymakers ahead of this week’s interest rate decision, though the Monetary Policy Committee has so far been reluctant to offer strong guidance on the timing of its first reduction.

The U.K. economy slid into a technical recession in the final quarter of 2023 and has endured two years of stagnation, following a huge gas supply shock in the wake of Russia’s invasion of Ukraine. Berenberg Senior Economist Kallum Pickering said that the Bank will likely hope to loosen policy soon in order to support a burgeoning economic recovery.

Pickering suggested that, in light of the inflation data of Wednesday, the MPC may “give a nod to current market expectations for a first cut in June,” which it can then cement in the updated economic projections of May.

“A further dovish tweak at the March meeting would be in line with the trend in recent meetings of policymakers gradually losing their hawkish bias and turning instead towards the question of when to cut rates,” he added.

At the February meeting, two of the nine MPC decision-makers still voted to hike the main Bank rate by another 25 basis points to 5.5%, while another voted to cut by 25 basis points. Pickering suggested both hawks may opt to hold rates this week, or that one more member may favor a cut, and noted that “the early moves of dissenters have often signalled upcoming turning points” in the Bank’s rate cycles.

Berenberg expects headline annual inflation to fall to 2% in the spring and remain close to that level for the remainder of the year. It is anticipating five 25 basis point cuts from the Bank to take its main rate to 4% by the end of the year, before a further 50 basis points of cuts to 3.5% in early 2025. This would still mean interest rates would exceed inflation through at least the next two years.

“The risks to our call are tilted towards fewer cuts in 2025 – especially if the economic recovery builds a head of steam and policymakers begin to worry that strong growth could reignite wage pressures in already tight labour markets,” Pickering added.

Heading the right way, but not ‘home and dry’

A key focus for the MPC has been the U.K.’s tight labor market, which it feared risked entrenching inflationary risks in the economy.

January data published last week showed a weaker picture across all labor market metrics, with wage growth slowing, unemployment rising and vacancy numbers slipping for the 20th consecutive month.

Victoria Clarke, U.K. chief economist at Santander CIB, said that, after last week’s softer labor market figures, the inflation reading of Wednesday was a further indication that embedded risks have reduced and that inflation is on a path towards a sustainable return to target.

“Nevertheless, services inflation is largely tracking the BoE forecast since February, and remains elevated. As such, we do not expect the BoE to conclude it is ‘home and dry’, especially with April being a critical point for U.K. inflation, with the near 10% National Living Wage rise and many firms already having announced, and some implemented, their living wage-linked pay increases,” Clarke said by email.

“The BoE needs data on how broad an uplift this delivers to pay-setting, and hard information on how much is passed through to price-setting over the months that follow.”

Santander judges that the Bank could decide it has seen enough data to cut rates in June, but Clarke argued that an August trim would be “more prudent” given the “month-to-month noise” in labor market figures.

This sentiment was echoed by Moody’s Analytics on Wednesday, with Senior Economist David Muir also suggesting that the MPC will need more evidence to be satisfied that inflationary pressures are contained.

“In particular, services inflation, and wage growth, need to moderate further. We expect this necessary easing to unfold through the first half of the year, allowing a cut in interest rates to be announced in August. That said, uncertainty is high around the timing and the extent of rate cuts this year,” Muir added.

Shiba Inu, the meme coin sensation, is making headlines once again. With its sights set on a major achievement – a staggering $100 billion market cap – Shiba Inu has captured the attention of the crypto community.

This audacious ambition has been fueled by data from IntoTheBlock, shedding light on the coin’s potential. Additionally, renowned investor Jake Gagain has made a bold prediction, further igniting excitement within the crypto community.

$SHIB Will Be The First 100 Billion MC Memecoin. pic.twitter.com/YogeSb2E7q

— JAKE (@JakeGagain) March 15, 2024

Shiba Inu: Growing Interest, Volatile Trading

According to analysis from IntoTheBlock, SHIB has witnessed a surge in the number of addresses holding the token. This surge indicates a growing interest and adoption of Shiba Inu among retail investors, who are eager to partake in the meme coin revolution.

Moreover, there has been a notable increase in the number of large transactions involving Shiba Inu tokens, suggesting institutional investors and whales are actively engaging with the coin.

SHIB market cap currently at $14.5 billion. Source: CoinMarketCap

IntoTheBlock’s data reveals a concentration of wealth among the top holders of Shiba Inu. Approximately 50% of the total supply is held by the top 100 addresses, indicating the potential influence these large holders may have on the market dynamics and price movements of Shiba Inu. This concentration of wealth can play a significant role in shaping the future trajectory of the coin.

Total crypto market cap is currently at $2.4 trillion. Chart: TradingView

Trading activity surrounding the memecoin has also been a focal point of the analysis. The data highlights the volatility of Shiba Inu’s trading volume, with periods of intense fluctuations followed by relative stability. This volatility can be attributed to various factors, including market sentiment, news events, and overall market conditions.

SHIB $100 Billion Milestone

In the midst of this excitement, renowned investor Jake Gagain has made a bold prediction: He firmly believes that Shiba Inu has the potential to surpass Dogecoin and reach a remarkable $100 billion market cap. This prediction has sparked both enthusiasm and skepticism, as the rivalry between Shiba Inu and Dogecoin intensifies.

SHIB 30-day price action. Source: CoinMarketCap

Taking all these factors into account, the journey towards the billion-dollar market cap for Shiba Inu is not without its challenges. While the recent surge in market cap and the accumulation by large holders are positive indicators, the volatility and concentration of wealth present potential risks that need to be navigated.

Nevertheless, the resilience and determination exhibited by the memecoin, coupled with the growing interest from retail and institutional investors, provide a strong foundation for its pursuit of the $100 billion milestone.

Shiba Inu’s quest for a $100 billion market cap represents a paradigm shift in the world of meme coins. Backed by data from IntoTheBlock, which highlights growing adoption, concentration of wealth, and trading activity, as well as the bold prediction from Jake Gagain, SHIB has positioned itself as a formidable contender in the cryptoverse.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

PRESS RELEASE. The team from Betmax Entertain is thrilled to announce the launch of a new crypto casino – Bombastic, a next-generation online crypto casino that brings together the dynamic world of cryptocurrencies with thousands of games including Slots, Blackjack, Poker, Roulette, and more. With Bitcoin’s recent price volatility in sharp focus, the release of […]

PRESS RELEASE. The team from Betmax Entertain is thrilled to announce the launch of a new crypto casino – Bombastic, a next-generation online crypto casino that brings together the dynamic world of cryptocurrencies with thousands of games including Slots, Blackjack, Poker, Roulette, and more. With Bitcoin’s recent price volatility in sharp focus, the release of […]

Source link