Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

Source link

Sets

Nvidia sets stock market record with $247 billion addition to market cap in one-day – Bloomberg

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Hong Kong sets deadline for crypto exchange licensing applications or face shutdown

Hong Kong’s Securities and Futures Commission (SFC) told unregistered Virtual Asset Trading Platforms (VATPs) within its region to submit their licensing applications by Feb. 29 or close their businesses by May 31, according to a Feb. 5 notice.

The financial regulatory authority reaffirmed this deadline for cryptocurrency trading firms while advising investors to engage with licensed platforms in the region. As outlined by the SFC, crypto traders can verify the regulatory standing of these platforms by March 1 via its “List of licensed virtual asset trading platforms” or on the “List of virtual asset trading platform applicants.”

“Investors should check the regulatory status of a VATP from time to time and in any event on 1 March 2024. This is because VATPs operating in Hong Kong which have not submitted their licence applications to the SFC by 29 February 2024 MUST close down their businesses in Hong Kong by 31 May 2024 pursuant to the transitional arrangements under the SFC’s regulatory regime for VATPs,” SFC added.

Last year, Hong Kong initiated its cryptocurrency licensing framework for virtual asset trading platforms, paving the way for licensed exchanges to provide retail trading services. Notably, the city-state has licensed two platforms, including HashKey and OSL.

Meanwhile, the regulatory authority diligently scrutinized applications from 14 crypto entities, including OKX, Bybit, and HKVAEX. The SFC emphasized that the application process does not guarantee approval, cautioning investors to exercise prudence when engaging with these platforms.

These initiatives reflect Hong Kong’s commitment to fostering a pro-crypto environment. Recently, the Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) unveiled a comprehensive regulatory framework for stablecoins. Additionally, authorities have expressed preparedness for spot Bitcoin exchange-traded fund (ETF) products, further solidifying Hong Kong’s stance in the evolving crypto landscape.

The post Hong Kong sets deadline for crypto exchange licensing applications or face shutdown appeared first on CryptoSlate.

Royal Caribbean’s Icon of the Seas, the world’s largest cruise ship, heads to the dock during its first arrival into PortMiami on Jan. 10, 2024.

Pedro Portal | Tribune News Service | Getty Images

The world’s largest cruise ship set sail from Miami, Florida over the weekend, embarking on a seven-day island-hopping trip through the tropics for its maiden commercial voyage.

Onlookers gathered Saturday as Royal Caribbean International’s behemoth — named the Icon of the Seas — left the Port of Miami to great fanfare.

Complete with eight “neighborhoods,” seven swimming pools, six waterslides and a total of 20 decks, the ship embarked on its inaugural cruise seeking to capitalize on surging travel demand.

Remarkably, the ship is roughly five times the size of Titanic and has a maximum passenger capacity of 7,600.

It cost $2 billion to build, measures nearly 1,200 feet (365 meters) from bow to stern, and weighs 250,800 metric tons.

At a briefing earlier in the month, Royal Caribbean Group CEO Jason Liberty described the Icon of the Seas as the “biggest, baddest ship on the planet.”

The launch of the giant floating resort has sparked renewed concerns about the environmental impact of cruise tourism.

The ship is built to run on liquified natural gas, which burns more cleanly than other conventional marine fuels but contains high levels of methane.

Royal Caribbean’s “Icon of the Seas,” billed as the world’s largest cruise ship, sails from the Port of Miami in Miami, Florida, on its maiden cruise, January 27, 2024.

Anadolu | Anadolu | Getty Images

Methane is about 80 times more potent than carbon dioxide when it comes to warming the atmosphere, and scientists have warned that methane emissions must be dramatically reduced to avoid the worst of what the climate crisis has in store.

“It’s a step in the wrong direction,” Bryan Comer, director of the Marine Program at the International Council on Clean Transportation (ICCT), was quoted by Reuters as saying.

“We would estimate that using LNG as a marine fuel emits over 120% more life-cycle greenhouse gas emissions than marine gas oil,” he added.

The ICCT released a report last week warning that methane emissions from LNG-fueled ships were higher than current regulations assumed, noting the use of LNG as a marine fuel is “rapidly growing.”

Royal Caribbean International says that every kilowatt of energy used for the Icon of the Seas “is scrutinized for energy efficiencies and emission reductions.”

People wait for Royal Caribbean’s “Icon of the Seas,” billed as the world’s largest cruise ship, to set sail from the Port of Miami in Miami, Florida, on its maiden cruise, January 27, 2024.

Marco Bello | Afp | Getty Images

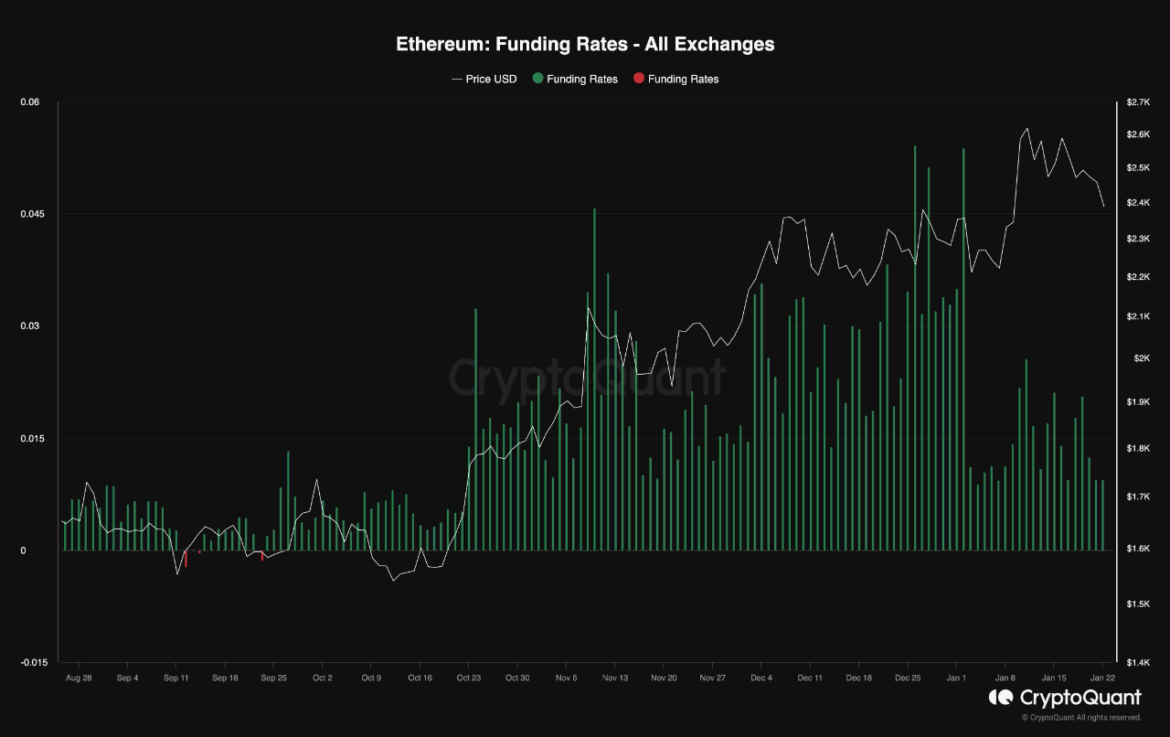

An analyst has explained that the latest cooldown in the Ethereum futures market could suggest there is potential for a price rise to resume for ETH.

Ethereum Funding Rates Have Seen A Decline Recently

An analyst in a CryptoQuant Quicktake post explained that the ETH funding rates have seen a cooldown from their previously overheated levels. The “funding rate” refers to the periodic fees that futures contract holders on derivative platforms currently exchange with each other.

When the value of this metric is positive, it means that the long contract holders are paying a premium to the shorts to hold onto their positions. Such a trend implies that most traders share a bullish sentiment right now.

On the other hand, the under zero indicates that a bearish sentiment is currently dominant in the futures market, as the short traders are overwhelming the longs.

Now, here is a chart that shows the trend in the Ethereum funding rates over the last few months:

The value of the metric seems to have been low in recent days | Source: CryptoQuant

As displayed in the above graph, the Ethereum funding rates have been mostly positive during the last few months, implying that traders on the futures side of the market have mostly been bullish about the asset.

The few times that the metric did dip into the negative inside this period didn’t turn out to be anything major, as the indicator only attained low red values and rebounded back inside the green territory without too much wait.

The chart shows that during some phases of this lasting period of bullish sentiment, the metric attained particularly high values. “However, it’s crucial to note that elevated values in funding rates raise concerns about a potential overheated state in the perpetual markets, signaling the possibility of an impending long-squeeze event,” notes the quant.

A “squeeze” is an event in which a sharp swing in the price triggers a large number of liquidations, which in turn feed into this price move, elongating it and causing further liquidations.

When such a cascade of liquidations affects the long side of the market (that is, the price move in question is a rapid drawdown), the event is known as a “long squeeze.”

Generally, the side of the futures market most heavily dominated by traders is likelier to fall prey to a squeeze. Thus, when the funding rates are highly positive, a long squeeze can be more probable.

Recently, though, as Ethereum has gone through its latest correction, so have the funding rates. Although they are still positive, their magnitude may no longer be associated with an overheated market, and the risk of a long squeeze would have thus fallen.

“Consequently, there exists the potential for the price to resume its upward trajectory following the completion of the ongoing correction stage,” explains the analyst.

ETH Price

Ethereum has declined by around 5% during the past week as its price has now fallen under $2,400.

Looks like the price of the coin has been sliding off recently | Source: ETHUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin (BTC), the largest cryptocurrency in the market, has encountered a significant downturn following the waning hype around exchange-traded funds (ETFs), resulting in a 9% decline over the past fourteen days.

However, Glassnode co-founders remain optimistic, asserting that the recent price corrections align with historical patterns and could propel Bitcoin to new heights, nearly doubling its current all-time high (ATH) of $69,000.

Healthy Market Correction?

In their latest analysis, the co-founders of the blockchain analytics firm posted on X (formerly Twitter), highlighting Bitcoin’s movement to the 6.618 Fibonacci Extension after a Bull Flag Correction.

They draw parallels between the current correction and similar market conditions observed in late 2017 and 2020. The question arises: Will history repeat itself in 2024, and will Bitcoin reach its 6.618 Fibonacci Extension during this bullish market, setting a target of approximately $120K?

Examining the chart above, the analysis by the Glassnode co-founders reveals a comparable price correction following Bitcoin’s breakout above the $10,000 price level, which initiated the bull trend that propelled the cryptocurrency to a $15,000 increase before reaching its current ATH of $69,000.

Likewise, Bitcoin exhibited a similar bull flag pattern after surpassing the $29,000 price level, leading to a 22-month high of $48,900 on January 11. Notably, this surge occurred shortly after the approval of Bitcoin spot ETFs by the U.S. Securities and Exchange Commission (SEC).

Considering these developments, the key to Bitcoin’s future trajectory lies in maintaining support around the $40,000 level and further consolidation above it. If these conditions are met in the coming months, Bitcoin has the potential to reach the 6.618 Fibonacci extension, pushing its price as high as $120,000.

New All-Time Highs Expected For Bitcoin

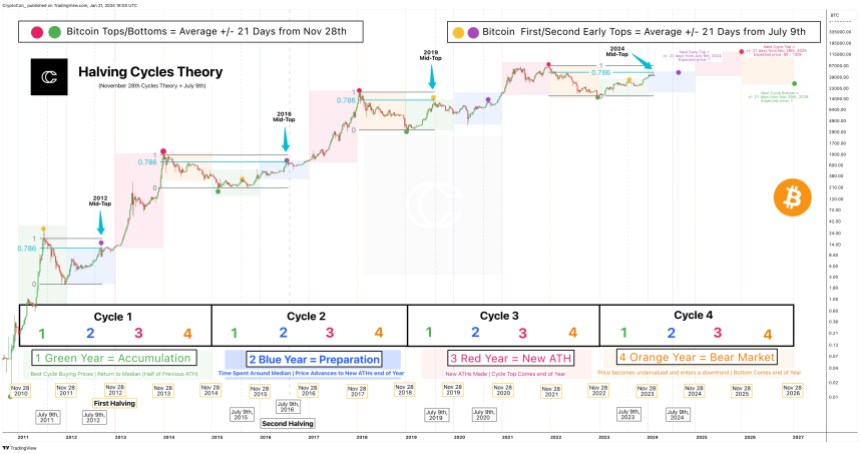

Like Glassnode co-founder’s recent price analysis, crypto analyst Crypto Con also relies on historical patterns to gauge the future price action of BTC. According to Crypto Con, the mid-top of this Bitcoin price cycle occurred slightly faster than previous cycles but slower than the third cycle.

Notably, this mid-top represents the only instance where it occurred outside of an early top, as indicated by the purple and yellow dots on the chart provided by the analyst.

Despite the 2019 mid-top occurring a year earlier than expected, the cycle top still manifested within the usual timeframe, plus or minus 21 days from November 28th, 2021.

Crypto Con stresses that there is currently no evidence apart from complex theories to support the notion of an accelerated cycle. The analyst cautions against assuming that ETFs prevent potential Bitcoin price corrections.

After November 28th, 2024, Crypto Con predicts the emergence of new all-time highs for the Bitcoin price of $90,000 or $130,000 and significant growth for the cryptocurrency market.

At the time of writing, BTC is trading at $40,590, down 2.5% in the past 24 hours. If this level is breached, Bitcoin could drop towards the $37,650 level as it is the next major support for the cryptocurrency.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

SEC sets strict year-end deadline for final changes to spot Bitcoin ETFs, confirms first wave of approvals to come in January

The U.S. SEC has set a strict deadline of Dec. 29 for companies hoping to launch exchange-traded funds (ETFs) tied to spot Bitcoin price, Reuters reported Dec. 23, citing people familiar with the discussions.

This significant development emerged from a high-level meeting on Dec. 21, where SEC officials engaged with representatives from leading financial entities, including BlackRock, Grayscale Investments, ARK Investments, and 21 Shares.

Representatives of the exchanges on which the new products might trade, including Nasdaq and Cboe, and lawyers for the issuers, also attended the meetings, according to meeting memos.

First wave of approvals

A key detail from the meetings was the confirmation that the SEC plans to begin approving the ETF applications in early January.

According to executives from two of the firms, the officials told the attendees that any firm missing the deadline will not be included in the initial wave of potential approvals slated for early January 2024.

The final submissions from the companies are expected to address comprehensive details, including technical specifications, fee structures, and initial funding strategies for these ETFs.

ARK and 21 Shares have been transparent about their proposed fee, setting it at 0.80% for their collaborative ETF.

The industry eagerly anticipates the upcoming decision on ARK and 21 Shares’ joint ETF proposal, which is due by Jan. 10, 2024. It’s believed that the SEC might approve multiple applications in tandem, potentially paving the way for the first-ever spot bitcoin ETFs in the U.S. market.

Change in regulatory stance

The urgency of the Dec. 29 deadline marks a crucial shift in the SEC’s approach to overseeing the nascent cryptocurrency market. Historically cautious, the watchdog has previously rejected numerous applications for spot bitcoin ETFs, citing concerns over market manipulation and investor protection.

However, recent developments, including a pivotal federal court ruling against the SEC’s rejection of Grayscale’s ETF proposal, have indicated a possible shift in regulatory perspectives.

The introduction of spot bitcoin ETFs could represent a watershed moment, offering a regulated pathway for mainstream investors to tap into the crypto market.

The cryptocurrency industry and financial markets are now keenly awaiting the SEC’s decisions in early January, which could potentially herald a new era in cryptocurrency investment and further integrate digital currencies into the global financial system.

An analyst has explained how Ethereum is retesting a breakout zone currently and that this might lead toward a price target of $3,500.

Ethereum Is Retesting The Breakout Line Of An Ascending Triangle

As pointed out by analyst Ali in a new post on X, Ethereum may be preparing for a further climb right now as it’s retesting the breakout zone of an ascending triangle.

An “ascending triangle” is a pattern in technical analysis that, as its name implies, resembles a triangle. The pattern involves a horizontal line made by connecting highs and a slant line that strings together higher lows.

When the price retests the upper, horizontal level, it could be probable to feel some resistance. On the other hand, a touch of the lower level could lead to the price rebounding back up.

A break out of either of these lines suggests a potential sustained continuation of the trend. Naturally, an escape out of the triangle towards the upside implies bullish momentum, while a fall under means bearish momentum.

Like the ascending triangle, there is also the “descending triangle,” which is a similar pattern except for the fact that the two levels are switched around (as the prevailing trend is towards the downside).

Now, here is the chart shared by Ali that displays how the price is interacting with an ascending triangle right now:

Looks like the asset's value has plunged back towards the triangle in recent days | Source: @ali_charts on X

As is visible in the graph, Ethereum found a bottom at the lower line of this ascending triangle pattern back in October. Following this low, the asset turned itself around with a sharp rally and went on to challenge the upper line.

The cryptocurrency succeeded in finding a break above the triangle and observed a continuation of the bullish momentum, exploring new highs for the year. Recently, though, the asset has slumped back again and has now fallen towards the triangle’s breakout line.

So far, the line has provided support to the asset, as its price has been able to remain above it. The analyst believes that this retest could be a sign that the coin is preparing for a further rally.

“The price range between $2,150 and $1,900 could be the ideal zone for accumulation before ETH sets its sights on a higher target of $3,500,” explains Ali. From the current price, such a target would mean a rally of almost 60% for the asset.

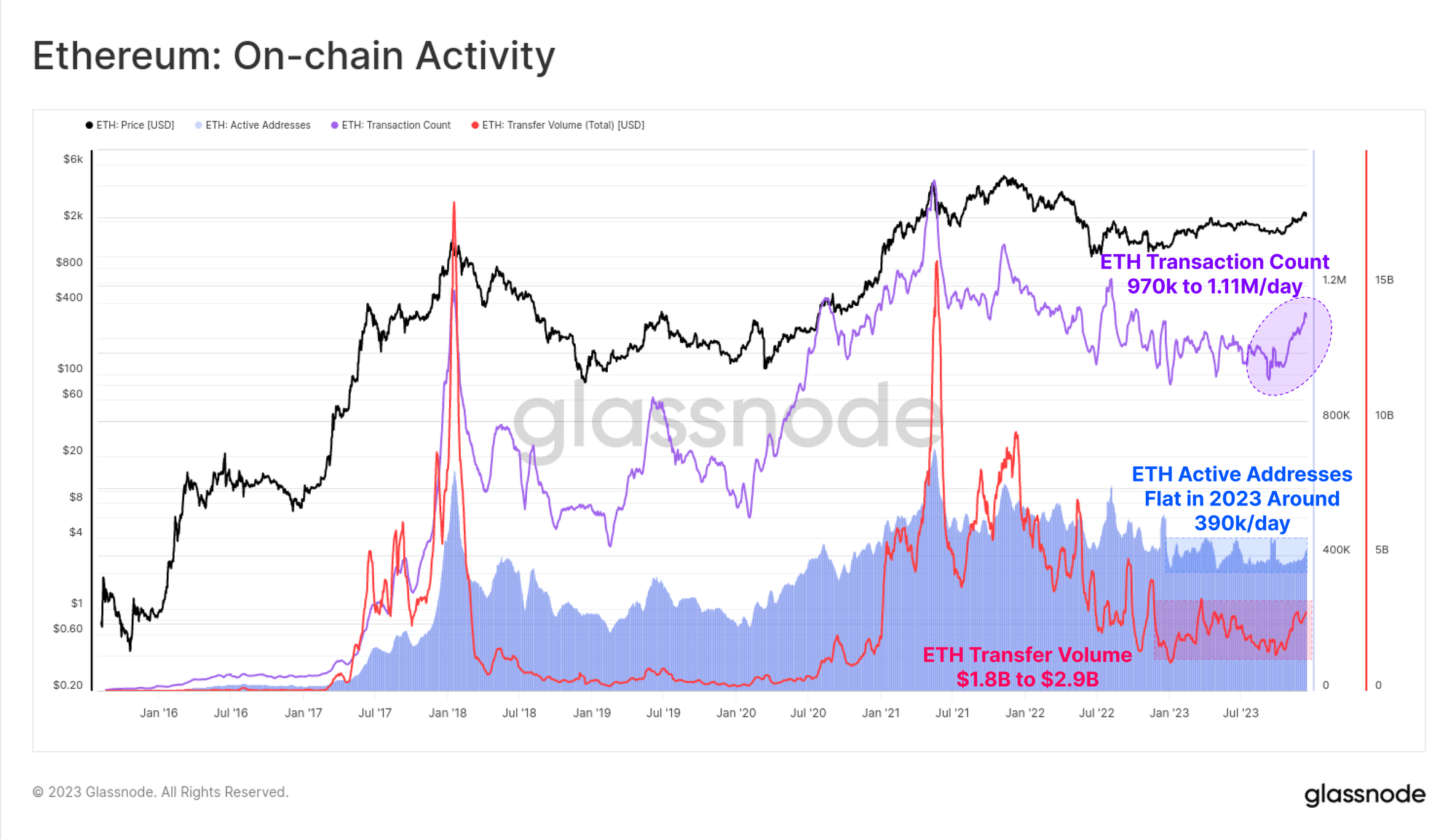

October, the month when Ethereum turned itself around off the triangle’s slope, was also an inflection point for the asset in terms of on-chain activity, as the analytics firm Glassnode has explained in its latest weekly report.

The trend in three on-chain indicators for ETH | Source: Glassnode's The Week Onchain - Week 51, 2023

From the chart, it’s visible that the Ethereum transaction count and transfer volume have both been trending up since the inflection point a couple of months back, which could be bullish for the price.

ETH Price

Ethereum has gone a bit stale recently as it has been consolidating around the $2,200 mark.

The price of the coin appears to have been moving sideways recently | Source: ETHUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Evernode, a layer-2 network developed on the XRP Ledger (XRPL), has recently provided crucial updates concerning its airdrop for XRP holders. The project, which integrates smart contract capabilities with XRPL, has revised its launch to December 18, 2023, following technical challenges. On the same day, the airdrop is expected to take place.

Evernode Launch Date Announced

The revised launch date of December 18, 2023, is primarily due to delays with the XUMM wallet’s integration in supporting account cloning on the Xahau network. This network is a recent addition as a sidechain to the XRPL.

Situated within this new framework is Evernode, a pioneering project on Xahau. Evernode is the first major project built on Xahau, marking the first major initiative developed using the Hooks feature that Xahau introduces to the broader XRP Ecosystem.

Regarding the launch, Evernode stated, “We’re now targeting launch on 18 December 2023… XUMM has been unexpectedly delayed in supporting the cloning of XRPL Accounts on Xahau. We can’t finalize our airdrop until this happens. We believe this will be ready by 18 December, but it is obviously beyond our control and may still change.”

Besides that, Evernode informed the community about a notable achievement. The project’s three Hooks have been successfully audited, an important milestone in ensuring the network’s security and functionality.

Additionally, the project has established the Xahau address for issuing Evers tokens: rEvernodee8dJLaFsujS6q1EiXvZYmHXr8. For users and airdrop participants, it is crucial to verify this address to avoid scams.

Snapshot Details And Eligibility For XRP Holders

The airdrop’s eligibility was determined by a snapshot taken on September 1, 2023, at Ledger #82237135. This snapshot recorded the XRP balances on the mainnet at 6:00 PM AEST (8:00 AM UTC). Eligibility for the airdrop includes XRP holders who held up to 50,000 XRP in a non-custodial wallet or used Bitrue or Uphold at the snapshot time.

Evers tokens will be airdropped into the Xahau account based on XRP holdings in the corresponding XRPL account on the snapshot date. Moreover, the projects’ update further mentioned the commencement of the “formal process” of airdrop preparation on November 27, along with the promise of a tool to assist users in registering and calculating their Evers token allocation based on XRP holdings at the time of the snapshot.

The Evers token (EVRS) has a maximum supply of 72,253,440. The airdrop will distribute 20,643,840 Evers among various stakeholders, including 5,160,960 to XRP holders, 5,160,960 to founders, 5,160,960 to beta testers, and 5,160,960 to the Evernode project itself.

The remaining 51,609,600 EVRS tokens will be held inside the Evernode Registry Hook. They will be distributed as rewards to hosts in 10 epochs of 5,160,960 Evers over 118 years.

Evernode’s launch is anticipated to be a major addition to the XRPL ecosystem. The introduction of a layer-2 network and sidechain could expand development possibilities, leading to more advanced dApps and potentially increasing user engagement with XRPL.

At press time, the XRP price has posted a bullish breakout from its downtrend channel in the shorter timeframe, trading at $0.6185.

Featured image from Shutterstock, chart from TradingView.com

China sets sights on Morocco as North African nation becomes centre of EV revolution

Just outside the Moroccan city of Tangier, a Chinese-backed manufacturing and technology hub is finally taking shape, after six years of delays.

The Mohammed VI Tangier Science and Technology City lies just 27km (16.8 miles) from the southern tip of the Spanish coast across the Strait of Gibraltar, strategically positioned where Africa faces Europe at the intersection of the Atlantic Ocean and the Mediterranean Sea.

First proposed in 2016 when Morocco’s King Mohammed VI met Chinese President Xi Jinping in Beijing, the US$1 billion tech city is eventually expected to host around 200 Chinese companies, all clamouring to gain easy access to Europe and Africa as part of China’s multibillion-dollar Belt and Road Initiative.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

After the initial Chinese sponsor – aviation giant Haite Group – withdrew in 2021 over issues concerning the project scale and ownership of the city, the plan finally got off the ground last year following a Moroccan government deal with other China-based firms.

Chinese ambassador to Morocco Li Changlin said that project – “which the two heads of state are jointly concerned about” – had made “significant progress” and was “1699815608 ready to receive investment from China and other countries”.

“China is expected to become a key participant in Morocco’s electric vehicle industry and contribute to Morocco’s industrialisation process,” Li wrote in an article on November 1 marking the 65th anniversary of bilateral diplomatic relations.

Observers said Morocco’s proximity to Europe, abundance of critical minerals, tax incentives and free-trade agreements with both the EU and the US have attracted a growing number of Chinese companies to build supply chains there, so as to strengthen China’s leadership in the EV sector.

For instance, Chinese battery parts maker CNGR Advanced Material announced in September it was teaming up with Moroccan private investment fund Al Mada to build a US$2 billion industrial base.

Sino-German electric vehicle battery maker Gotion High-Tech also plans to build a US$6 billion factory in Morocco to produce electric car batteries and energy storage systems.

Youshan, the subsidiary of China’s biggest cobalt refiner Huayou, is partnering with South Korea’s LG Chem to build a lithium iron phosphate (LFP) cathode materials plant in Morocco for the US market.

Among the first companies to break ground in the Tangier Science and Technology City was Qingdao Sentury Tyre Company, which has pumped nearly US$300 million into building a factory there. It recently signed a 20 hectare (49.4 acre) land purchase contract for the site, Li said.

By setting up a factory, the Chinese tyre company is looking to meet growing demand from vehicle manufacturers while taking advantage of Morocco’s prime geographic positioning for easy distribution to Europe.

Morocco is already a major vehicle manufacturing hub for European giants Stellantis and Renault, producing about a million units per year.

They are based in Kenitra, about 200km south of Tangier and 40km north of Moroccan capital Rabat, where the Atlantic Free Zone plays host to a large number of major vehicle and parts makers.

Rabat is now positioning itself as an EV manufacturing hub – and Chinese companies are at the centre of the ambitious plans.

Abdelmonim Amachraa, a Moroccan specialist on sustainability and global value chains, said as a key market for EVs, Europe is a strategic destination for Chinese companies looking to quickly supply their customers.

He said China’s expansion of global value chains in countries like Morocco can help Beijing get closer to European carmakers and the European market, reducing transport distances and electric vehicle production costs.

The strategic partnership between China and Morocco therefore represents the second stage of the African automotive ecosystem, he added.

“Morocco has successfully connected Africa to Europe through its dynamic automotive sector. France and Germany are excellent partners, and American companies also have a significant presence. Now, the question is whether Morocco can serve as a pivot between Asian value chains and Europe while strengthening China’s leadership in the electric vehicle sector,” he said.

Dr John Calabrese, a senior fellow at the Middle East Institute, said the Pan-Euro-Mediterranean (PEM) agreement gives Morocco the ability to export into the European Union on a tariff-free basis.

“And Morocco also has a free-trade agreement with the United States,” Calabrese said.

Last year Morocco announced the discovery of large deposits of lithium in the area bordering Mauritania and is also home to the world’s largest phosphate reserves. This makes it a “natural” candidate for the construction of LFP battery plants, Calabrese said.

“Moroccan scientist Rachid Yazami and his team have apparently developed a way to substantially reduce EV battery charging time,” Calabrese said. “It looks as though Asian EV producers recognise that Morocco is the ‘complete EV package’ for penetrating the European and American markets – and are competing with each other for a piece of the action.”

Zakia Subhan, head of Middle East and Africa Forecasting, and David Leah, a senior analyst at Powertrain Forecast, both part of LMC Automotive, said Morocco’s free-trade agreement with both the EU and the US puts Chinese companies in a more favourable position to benefit from subsidies under the US Inflation Reduction Act, as well as policies in relation to the EU’s Critical Raw Materials Act.

Renault vehicles lined up at the Tangier-Med container port. Photo: AFP alt=Renault vehicles lined up at the Tangier-Med container port. Photo: AFP>

The analysts said Morocco’s two industrial platforms, Tangier and Kenitra, have been granted free zone status – a total exemption from corporate tax for companies operating in these zones for five years, followed by a cap of 8.75 per cent for the next 20 years.

It makes the African nation an attractive option, given that transit time from Morocco to Spain is just a day or two, while labour costs are around a quarter of those in Spain and slightly lower than in eastern Europe.

Morocco is also part of the African Continental Free Trade Area, a massive zone bringing together the 55 countries of the African Union and eight regional economic communities. This means anything companies produce in Morocco can easily be exported within Africa, said Lauren Johnston, associate professor at the University of Sydney’s China Studies Centre.

“Morocco is also uber close to the EU market and moreover it has good ties with the US and UK. So perhaps it can even reach those markets. It is a geographic middle kingdom,” Johnston said.

The country also has a solid pre-existing auto sector and it already produces car parts, she added.

“So perhaps they [Chinese companies] can build from there.”

It is an example of the more general global trend towards nearshoring. Francois Conradie, the lead political economist at Oxford Economics Africa, said multinational industrial firms with long supply chains are planning to shorten and diversify them, and move production closer to the end client.

In North Africa, Morocco and Egypt have been big beneficiaries of this, he said, as firms establish production facilities near the European market.

“EV manufacturers, especially Chinese ones, are pivoting to lithium iron phosphate batteries, and phosphates are abundant in Morocco,” Conradie said.

Michel Jacinto, senior associate of light vehicle sales forecasts for Morocco, Algeria, Egypt and Iran at S&P Global Mobility, said Europe could become a major market for batteries made in Morocco as the EU announced the end of internal combustion engines for new vehicle registrations after 2035.

Plus, he said, increasingly the EU will pay closer attention to the amount of carbon dioxide emissions across a battery’s entire life cycle, starting with the extraction of raw materials and including assembling, transport and recycling.

“So having batteries made in Morocco, close to the OEM’s [original equipment manufacturer’s] plants, will be an advantage – versus batteries that could come from Japan, South Korea or China,” Jacinto said.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2023 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2023. South China Morning Post Publishers Ltd. All rights reserved.