AMC Entertainment Holdings Inc. CEO Adam Aron’s compensation package increased to $25.4 million in 2023, from $23.7 million in 2022 and $18.9 million in 2021, according to a proxy statement filed with the SEC Friday.

Source link

share

Analysts eye MicroStrategy share price to Bitcoin holdings ratio closely as MSTR falls 11%

Quick Take

MicroStrategy (MSTR), the business intelligence firm renowned for its substantial Bitcoin holdings, experienced a significant share price decline of over 11% on March 28. The company’s shares are currently trading at $1,704, starkly contrasting the recently anticipated $2,000 mark reported by CryptoSlate just days earlier. Despite the recent setback, MSTR’s year-to-date performance remains impressive, with a remarkable 150% gain.

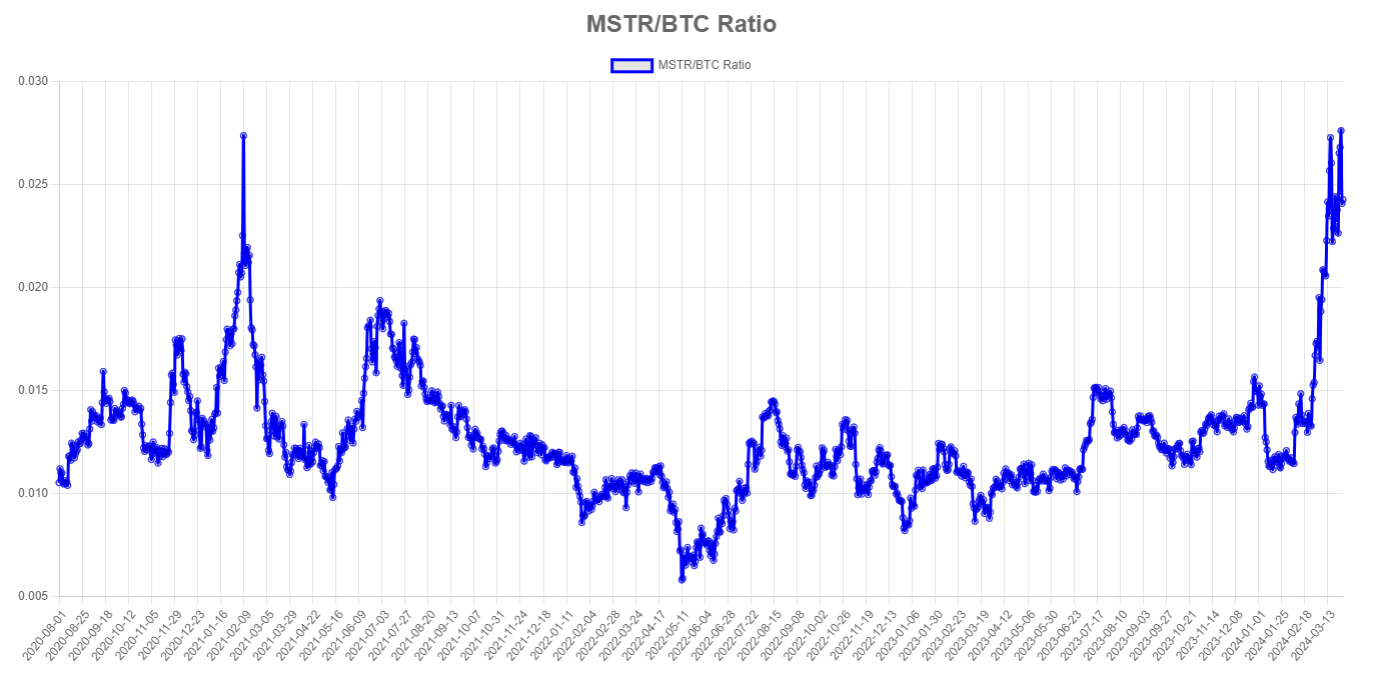

Analysts closely monitor the “MSTR/BTC Ratio,” a comparative value ratio between MicroStrategy’s stock price and the price of Bitcoin. This ratio illustrates how the company’s stock value trends in relation to Bitcoin’s market movements. Currently trading at 0.024, the ratio hit a recent high of 0.028, mirroring the levels observed in June 2021 at approximately 0.027, according to mstr-tracker.

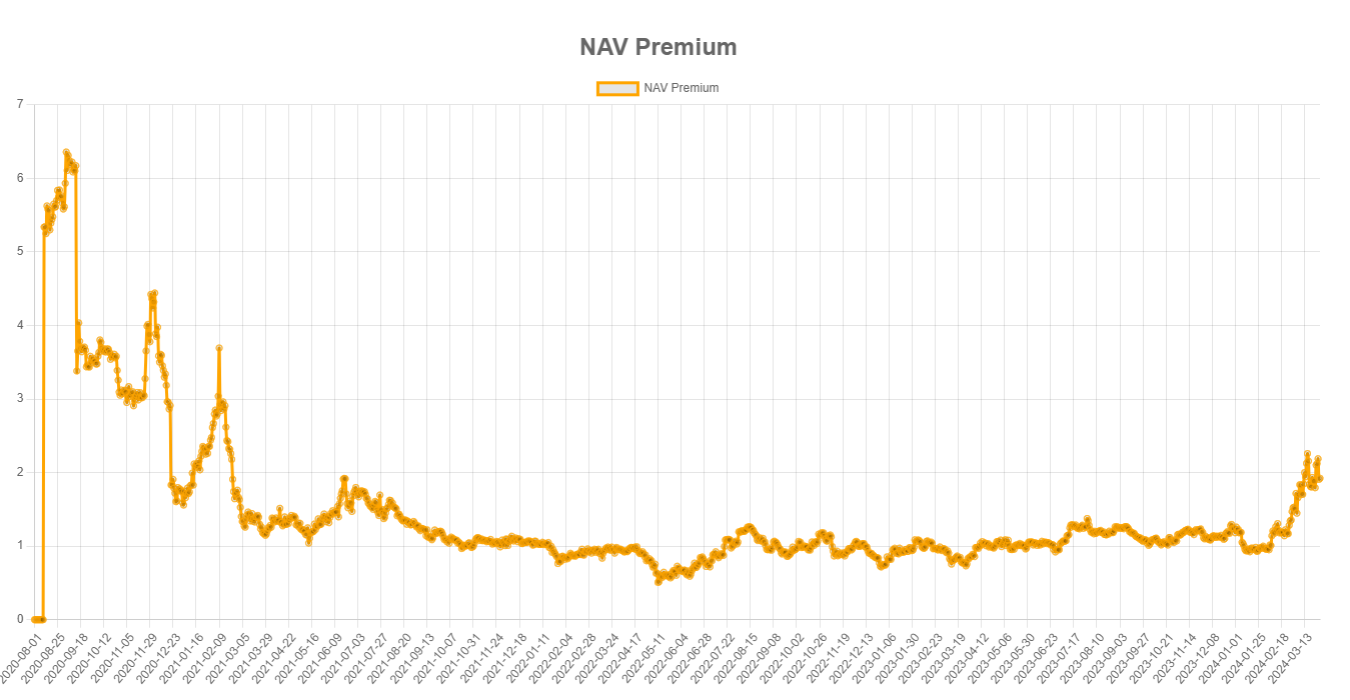

The “NAV Premium” chart, provided by mstr-tracker, which displays the premium of MicroStrategy’s stock over its proxy-NAV in Bitcoin, indicates that the market values the company’s stock at 1.92 times its Bitcoin holdings. The site has a unique methodology for defining an equivalent NAV for MicroStrategy, which considers its Bitcoin holdings, outstanding shares, share price, and market cap. Intriguingly, the current NAV figure matches the high observed in June 2021, when MSTR’s share price hovered around $500-$600, and Bitcoin traded at approximately $35,000.

The post Analysts eye MicroStrategy share price to Bitcoin holdings ratio closely as MSTR falls 11% appeared first on CryptoSlate.

Upland Introduces Token Reward System With ‘Share and Build’ Airdrop Series

Upland, a popular Web3 metaverse and crypto game, unveiled the inaugural chapter of its “Share and Build” airdrop series on Friday. This initiative is designed to reward players with tokens for their participation. Upland’s Airdrop Series Rewards Community Participation At its essence, Upland is a Web3 metaverse platform dedicated to virtual land ownership and fostering […]

Upland, a popular Web3 metaverse and crypto game, unveiled the inaugural chapter of its “Share and Build” airdrop series on Friday. This initiative is designed to reward players with tokens for their participation. Upland’s Airdrop Series Rewards Community Participation At its essence, Upland is a Web3 metaverse platform dedicated to virtual land ownership and fostering […]

Source link

Binance allows customers to custody trading collateral off exchange as market share recovers

A Binance representative confirmed in a Jan. 30 email statement sent to CryptoSlate that the platform is now allowing institutional investors to secure their trading collateral through a third-party banking partner.

Binance’s solution, described as a “banking triparty” arrangement, has been under development for the past two years and directly addresses the primary concern of counterparty risk, a significant consideration for institutional investors. This model enables investors to manage risk effectively while optimizing capital efficiency by pledging collateral in traditional assets.

While details about the specific banking partners remain undisclosed, Binance emphasized active engagement with various banking entities and institutional investors expressing interest in the arrangement.

The platform introduced the pilot scheme for this solution last November, allowing collateral held with the banking partner to be in fiat equivalents, such as Treasury Bills.

Before this development, Binance clients were limited to holding their assets on the exchange itself or through its custodial service provider, Ceffu. However, concerns arose following the U.S. Securities and Exchange Commission’s lawsuit against Binance, questioning the exchange’s crypto wallet custody practices and its relationship with Ceffu.

Binance market share recovers.

Binance market share is steadily growing to previous heights after its run-in with several financial regulators across different jurisdictions impacted its operations last year.

Last year, the platform strategically withdrew from Canada, the United Kingdom, and several European nations, including Austria, Cyprus, and the Netherlands, due to regulatory non-compliance issues.

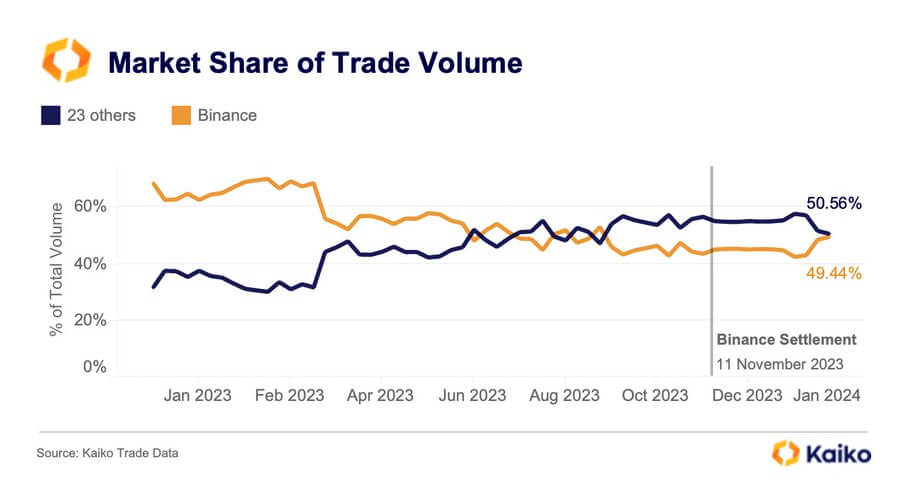

Furthermore, it faced a substantial $4.3 billion settlement with U.S. authorities, leading to a market share dip to 44.5% by the close of the same year.

However, recent findings from Kaiko Research indicate a noteworthy comeback for Binance this year.

Data reveals that Binance’s trading volume has climbed to 49.44% from its previous multi-year low, while 23 other centralized exchanges collectively account for 50.56% of trading activities.

In response to this significant turnaround, Binance CEO Richard Teng expressed his optimism with a succinct “Keep Building” post on social media platform X.

The post Binance allows customers to custody trading collateral off exchange as market share recovers appeared first on CryptoSlate.

Opinion: These stocks can be winners in AI because they all share this one quality

While the media would have investors focus on short headline-grabbing cycles such as political elections, central bank actions, and economic expansions and contractions, some investors — including our team at investment manager Alger — believe the ups and downs of such cycles are mostly noise, serving as a distraction for long-term investors.

Wealth creation is driven by innovation, which increases productivity, raises gross domestic product and ultimately boosts living standards. Innovative products and services that provide real value to businesses and consumers by making them more efficient, healthier, or happier, should find strong demand. These innovations reward investors over time, irrespective of elections and whether interest rates are rising or falling.

In its 60-year history, Alger has invested through many recessions and growth scares, as well as periods of such exuberance that capital was extremely cheap and abundant. Looking back at the ups and downs, two important lessons stand out:

- Research shows that innovation has grown through all kinds of economic volatility.

- Strong competitive advantages often translate into expanded market shares, particularly in challenging economic times.

In short, investors should consider investing in equities of innovative companies that aggressively capture market share in order to compound value no matter the macroeconomic environment.

Innovation is resilient

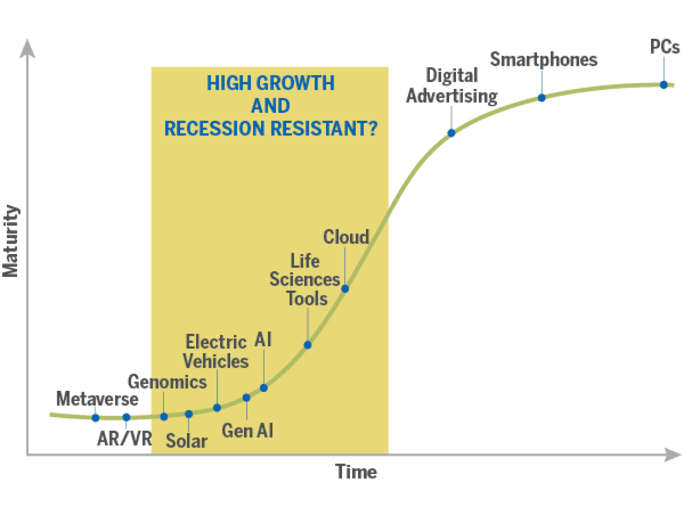

Productivity-enhancing technologies have a history of growing through both good and bad economic times. For example, personal computer use increased through the recession of the early 1990s while digital advertising and smartphones grew through the Global Financial Crisis. These technologies grew through adversity because they were early in their adoption cycle.

Today, these particular industries are mature and more cyclical, as shown in the chart below. However, the chart also shows newer technologies, such as artificial intelligence (AI), that are just coming up the so-called “S” curve. As a result, these newer technologies are more likely to garner an increasing share of business or consumer spending and as such, grow through various economic environments.

Source: Alger

Artificial intelligence

Bill Gates has said that artificial intelligence “is every bit as important as the PC, as the internet.” AI is a mega-theme that will impact business and investing for years to come. Through routine field research, Alger recently spoke with a multi-billion-dollar cloud service consultant who shared that technology solutions, such as AI, may end up feeling like “need-to-haves” because of the vital business importance of digital transformation and the belief that companies will use these tools to reduce costs.

The adoption of this technology will persist irrespective of the pace of economic growth. Finding beneficiaries of this trend can generate strong returns for investors. Below are some potentially attractive investments in the AI space.

We refer to the companies that provide the infrastructure for AI services as “enablers.” Some of the most important components of the AI infrastructure are semiconductors. These chips provide the industry with the processing power that is seeing soaring demand.

Consider that one of the main determinants for the intelligence of generative AI programs, like ChatGPT, is the amount of training that they undergo. That training is doubling roughly every four months, much faster than the two years that Moore’s Law has accurately forecasted the number of transistors will be crammed onto computer chips. This difference in speed is so massive that a six-inch plant growing at Moore’s Law would be 16-feet tall in a decade, while if it grew at the speed of AI, it would reach the moon.

Some of the leading chip providers to the AI industry with innovative technologies include Nvidia

NVDA,

Marvell Technology

MRVL,

and Advanced Micro Devices

AMD,

The immense computational demands of AI require the development of groundbreaking chip and server architectures, which together drive greater power consumption per server cabinet within the giant data centers that house the brains of these systems, leading to higher electricity consumption. According to Schneider Electric

SU,

AI power usage will increase more than 30% annually, resulting in a cumulative increase of four times the current usage over the next five years, as measured in gigawatts.

However, higher power densities in AI tasks lead to excessive heat generation, posing cooling challenges for data centers. Today, companies like Vertiv Holdings

VRT,

not only solve this overheating challenge but potentially improve cost and energy efficiency.

As data centers expand to meet the growing demand for AI, lack of transmission and distribution of power could prove to be a key issue. This may necessitate grid modernization, potentially benefiting power management and electrical services companies that work with utilities and commercial customers. Companies like Eaton

ETN,

a diversified global power management company, are working hard to meet growing electricity demand and in the process may generate attractive returns for shareholders.

Driven by data

“If AI is a rocket ship, data is the fuel. ”

In today’s economy, data is the new oil — a very important raw material for digital transformation. To automate and make software work for us, we need our data digitized and organized. Artificial intelligence is particularly dependent on good data. If AI is a rocket ship, data is the fuel. Unstructured data such as text messages, emails, social media, webpages and business documents all need to be accessible by software programs like generative AI.

One company that helps businesses store and organize their unstructured data in a database management system is MongoDB

MDB,

Gartner estimates the data management market may grow 17% annually from 2023 to 2027, making this an attractive investment area.

Prepare for all possibilities

Alger believes investors should aim to position portfolios for a range of economic outcomes by investing in companies that will gain market share within the economy. Companies that enable AI such as chip makers, power management companies and database providers may be good examples of companies that are providing innovative products and services to customers around the world. They can grow through good and bad economic environments, allowing investors to ignore the noise and focus on long-term wealth creation.

Brad Neuman is Alger’s director of market strategy . As of Oct. 31, 2023 (Alger’s most recent reporting date), the firm had positions in MongoDB, Nvidia, Marvell, Advanced Micro Devices, Schneider Electric, Vertiv and Eaton.

More: Intel’s new AI chips for the PC will be widely used, but may not be the most useful

Plus: Whether it amounts to an actual recession is uncertain, but the U.S. is headed for a soft patch, economists say

Opinion: These Big Tech stocks look to grab the biggest AI market share in 2024

It’s hard to imagine that the chip and technology sector could repeat the stunning year it had in 2023, but financial and technology analyst groups both are nearly universal in agreement that 2024 will be just that.

Fueled by the need for more computing horsepower than ever before, including the rise of AI, chip companies will likely see 2024 as another strong year, with nuances between the levels of success.

Let’s start with a look at some of the critical players in the data center and IT infrastructure markets. This segment fueled the AI appetite in 2023, driving valuations higher and consuming essentially every chip that these players could produce. I see no reason not to have another 20%-50% increase in silicon and infrastructure opportunities, a way for nearly all players to benefit to some degree.

Nvidia

NVDA,

is obviously the leader in the clubhouse, benefiting with a more than 200% increase in stock price over the past year thanks to its dominance in the data center for its GPUs, powering the most intense and complicated workloads to train the AI models revolutionize computing. Though other companies were playing catch up in 2023 and will continue to do so in 2024, I expect the rise of competing chip options from Advanced Micro Devices

AMD,

and in-house developed silicon from the likes of Microsoft

MSFT,

Alphabet

GOOGL,

and Amazon.com

AMZN,

to start to make some inroads.

Nvidia’s data center segment revenue will grow along with the larger market expansion, but it seems inevitable that its market share will trickle backwards a bit as competition heats up. The company is hoping to offset that with new product and service offerings; if Nvidia can truly be more than just a chip supplier to the market, and instead offer “AI factories” as CEO Jensen Huang has dubbed them, or other AI and compute microservices, it could see the same or better revenue growth in 2024.

The primary competitor for Nvidia is going to be AMD and its MI300 family of GPUs announced late in 2023. CEO Lisa Su has been dripping with confidence about this new chip and making some bold statements on expected revenue, with customers like Microsoft buying in early. As a true second supplier for high-performance, high-memory bandwidth chips capable of handling the most demanding AI workloads, AMD should see significant upside on that alone. But AMD also will continue to see improvements in its market share in the data center CPU space, with the EPYC line of processors needling away at the dominant Intel Xeon family.

Intel

INTC,

has the cloudiest but potentially most interesting 2024 ahead of it in the data center segment. Last December the company launched its next-generation Xeon processor, codenamed Emerald Rapids, and teased Gaudi 3, a dedicated AI processor that uses a unique architecture compared to the GPUs from Nvidia and AMD. Gaudi 2 is selling now, though visibility into how successful it has been in 2023 or what the pipeline of customers in 2024 looks like isn’t well known. This custom AI architecture offers unique power and performance benefits for some specific workloads based on testing I have seen, but it needs to convince large scale AI customers that this is a long-term solution. Intel will see some gains simply because of the limitation of Nvidia’s own GPU inventory, but CEO Pat Gelsinger has much larger ambitions than just Nvidia’s leftovers.

Finally for the data center space, it’s worth mentioning the cloud service providers and the expected growth there. Microsoft Azure, Google Cloud, and Amazon AWS are the three biggest players that could see significant increases in compute utilization by AI companies large and small, offering both off-the-shelf solutions from AMD, Nvidia, and Intel, but also with their own custom chips in a fully verticalized solution stack. All three of these companies, along with Meta Platforms

META,

and others, have verbally committed to these custom silicon and software development roadmaps, but it isn’t clear what kind of percentage of their own cloud service offerings will really utilize them over the next 12 months.

Another risk spot for cloud providers is the need for data security and privacy for enterprises rolling out AI applications and solutions where it might make more sense to have on-premises data centers handling some of the AI training and inference workloads, a possible win for Dell Technologies

DELL,

and HPE

HPE,

to fill that gap.

The client space for chip companies might be more interesting than even the data center segment, despite growing at a much lower clip. The impact of the AI PC, and client computing increases in general, is more likely to create dramatic winners and losers over the next 12 months, with either incumbent leaders squashing the competition or with that same competition taking noticeable market share.

Microsoft’s potential game-changer

A unique opportunity here lies with Microsoft. The AI PC push, which is still ill-defined and more of a marketing term than anything consumers can understand or depend on, provides Microsoft a chance to redefine what personal computing is across devices, operating systems, content management, generative AI tools, and more.

Much like the smartphone revolution changed how we think about accessing and creating data, how we integrate with AI will be the next big shift. This could bring a renaissance of the PC, taking back mindshare from the smartphone as the preeminent device for getting things done and organizing our massive collections of data and information. And what better way to try to fight back against Apple

AAPL,

and the Mac than with a capability Apple has yet to really engage with? The window might be small, but it’s definitely there.

The three big names around the “AI PC” have been Intel, AMD, and Qualcomm

QCOM,

to this point. Intel launched its Meteor Lake chips, now called Intel Core Ultra, in December of last year, promising to bring AI compute acceleration to a whole generation of laptops in 2024. By integrating a dedicate NPU (neural processing unit) on the chip itself, like you can integrate a graphics engine on the chip, Intel is pushing for a balance of performance and battery life. Intel Core Ultra gives Intel the chance to scale up the AI PC space, shipping millions and millions of processors to market this year, and it hopes to capitalize on this by creating thought leadership (Intel = AI on your PC) and probably pushing up prices of these chips to its customers to drive revenue.

AMD has had a dedicated AI accelerator in a small segment of its laptop chips since the middle of last year, but sales and market saturation are unknown. In December it announced the next two generations of its Ryzen laptop chips coming in 2024 with improvements in AI performance for both, hoping to take more of this chip market from Intel. For AMD, it can continue to displace Intel with OEMs and as long as it has a competitive and reliable AI PC strategy, can draft off of any marketing Intel and Microsoft push.

Qualcomm is also in this race, with its Snapdragon X-series of chips coming in the middle of 2024, announced last October. These processors are based on the Arm architecture, rather than x86, and include a much more powerful NPU for AI processing than either Intel or AMD options. This is all upside for Qualcomm, part of its strategy of moving from a communications company to a compute company, and I expect we’ll see some significant wins with key system partners announced in the next few months. Qualcomm is also the only chip company in the client space that appears to be heavily investing in brand marketing, hoping it can capitalize on the stagnation of its chip competitors, tying Qualcomm and Snapdragon to the biggest advancements in AI computing for consumers.

Not frequently brought up in the conversation of the AI PC, Nvidia has an interesting position that it has plans to emphasize in 2024. It’s GPUs, the same ones used in the data center AI segment but with less memory, are a great place for high performance, high throughput AI processing on a PC. For high end content creators, game developers, video and 3D animators, the power of a discrete GPU for AI work on a local machine dwarfs that of any integrated NPU from Intel, AMD, or Qualcomm. The highest end GeForce products have 800+ TOPS (tera-operations per second) compared to just 10 TOPS for the NPU on the Intel Core Ultra. This comes at the cost of power, and battery life if we are looking at Nvidia GPUs in a laptop, but for many AI workloads you just want pure performance. Not to mention Nvidia’s software stack is second to none, and developers of nearly all AI applications have been using Nvidia GPUs from day one, giving them another potential advantage to capitalize on.

3 unknowns

There are three big questions that I will be tracking through 2024 that will have impact on the above predictions and analysis, and just generally set the tone for what 2025 might look like.

- Where will the majority of AI processing take place? In the cloud, at the edge, or on a consumer’s local device? This will determine the balance, to some degree, of how much the data center segment or client segment chip battles affect the companies mentioned in this story.

- How prevalent will the custom silicon options from Microsoft, Alphabet, Amazon, Meta, and others become relative to the traditional silicon providers of Intel, AMD, and Nvidia? These are expensive investments that require billions of dollars and thousands of engineers, both hardware and software, to do right. Will the advantages of the verticalization, or for performance and power efficiency, provide enough gain to offset the momentum of traditional chip company products?

- This is kind of a wild one, but will Intel remain a combined integrated device manufacturer, or will it eventually split into a manufacturing company (making the chips) and a product company (designing chips)? We continue to see signs of Intel moving away from non-core businesses like Mobileye, its FPGA group, and now even its AI software business. A change here opens opportunities for other chip companies to expand their supplier options and gives the Intel products the chance to engage with new partnerships.

Ryan Shrout is the President of Signal65 and founder at Shrout Research. Follow him on X @ryanshrout. Shrout has provided consulting services for AMD, Qualcomm, Intel, Arm Holdings, Micron Technology, Nvidia and others. Shrout holds shares of Intel.

More: Apple stock looks expensive vs. the rest of the ‘Magnificent Seven’

Also read: Nvidia’s stock breaks new ground after healthcare partnerships and ahead of CES

Saudi Arabia may wage oil ‘market share war’ against the US, reversing output cuts and unleashing a flood of supply, energy expert says

-

Saudi Arabia may wage a “market share war” against the US and flood oil markets with supply, energy expert Paul Sankey said.

-

That would mark a reversal from Riyadh’s strategy of curbing production to boost oil prices.

-

“You’ve got to attack the guy that’s making the marginal decision to drill or not — and that guy is Mr. Permian Basin.”

Saudi Arabia is struggling to boost oil prices with production cuts and may soon make a dramatic reversal aimed at the US, according to energy expert Paul Sankey.

In an interview with Business Insider, he said Saudi Arabia may pivot to ramping up production to flush the market with a flood of supply in the first half of 2024. And that’s not to target emerging producers like Guyana or Brazil.

“You’ve got to attack the guy that’s making the marginal decision to drill or not — and that guy is Mr. Permian Basin,” Sankey said, referring to the US shale epicenter.

He later added, “I think to be specific, it’s a market share war.”

Saudi Arabia is currently producing about 2.5 million barrels a day below maximum capacity. If the country follows through with additional supplies that sink crude prices, the goal would be to essentially “bankrupt” the US industry by making it unprofitable to drill oil, Sankey explained. It’s a tactic Riyadh used in 2014 and 2020 to regain control over oil prices.

And right now, the set-up is similar to both earlier episodes, the market veteran said. There’s a lack of support from the rest of OPEC as countries like the UAE keep producing more oil while Iran is eating into Saudi’s share of Chinese crude oil imports. And then there’s weakening demand, like what happened during Covid.

“In all three instances you’ve had the biggest problem, arguably, which is that the US is just making highs and new highs and even further highs in terms of its own production,” Sankey said.

US crude production has exploded this year and recently hit a record high of 13.2 million barrels a day, according to the Energy Information Administration.

Meanwhile, global energy markets have become skeptical that OPEC+ is serious about its latest pledges to curb production. After the cartel’s meeting last week, when members vowed to extend cuts, oil prices fell.

Its weakening hold over oil markets was on display again this week. On Monday, the Saudi energy minister told Bloomberg TV that production cuts could go past the first quarter. On Tuesday, the Kremlin also talked tough. But oil prices dropped further.

Sankey declined to comment on whether he has heard about plans to increase production from Saudi officials. But the time to act may come soon.

“I think what will happen is they’ll wait through winter to see what’s going on and maintain, as they’ve said, into Q1, their cuts,” he said. “And then if things start to weaken from there, they’re going to have to decide what they’re going to do.”

Read the original article on Business Insider

Private sector should share wealth with taxpayers: Mariana Mazzucato

A form of universal basic income called “citizens’ share” could redistribute wealth proportionate to how value is created, according to economist Mariana Mazzucato, a professor at University College London.

Mazzucato spoke with CNBC about how the public, private and third sector can work together to co-create value and share both risks and rewards.

“The whole notion of stakeholder value should have become a real kind of call to arms of how do we create value differently,” Mazzucato said. “We need to bring communities, workers, public and private institutions together to create value in a more collective, better way.”

“The reason the moon landing worked is actually it managed to catalyze so much activity,” she said. “So many homework problems had to be solved along the way. We got camera phones, foil, blankets, baby formula, software. This created commercialization. It created growth, it created profits. But profits for a purpose.”

Mazzucato said success in the private sector often begins with significant contributions from the public, and wealth distribution should reflect those contributions.

“Everything in my phone and your phone that makes it smart and not stupid was not only publicly financed — internet, GPS, touch screen, Siri all came out of the taxpayer — but also was risk-taking investment,” she said.

“For every investment in the internet there were lots of failures. For every investment in GPS, there were lots of failures,” she said. “So any venture capitalist would tell you that’s normal. They’ll say for every success, you need to basically bear with seven, eight, nine failures. In the case of medicines, why do the prices of medicines not reflect that contribution from the public? Why is it then that the taxpayer pays once, twice, three different times?”

“So this isn’t about socialism, this is about proper capitalism. If you’ve invested in something, surely you want access to it,” said Mazzucato, who is also author of “The Big Con: How the Consulting Industry Weakens our Businesses, Infantilizes our Governments and Warps our Economies.”

Mazzucato also said artificial intelligence should be calibrated in a way that encourages inclusive and sustainable growth.

“How can we make sure these algorithms take into account issues that we know we care about?” she said. “What kind of planet do we want to be living on? What kind of growth do we care about? Is it just growth for growth’s sake?”

Watch the video above to see the full interview.

CME overtakes Binance to grab largest share of Bitcoin futures open interest

Binance’s dominance of Bitcoin (BTC) futures open interest has been toppled by traditional derivatives marketplace heavyweight Chicago Mercantile Exchange (CME), following Bitcoin’s first move past the $37,000 mark in over 18 months.

A number of analysts highlighted the “flippening” of Binance by CME, with the latter overtaking the global cryptocurrency exchange for the largest share of Bitcoin futures open interest.

Wow, the real flippening that no one is talking about:

CME just flipped Binance for the largest share of Bitcoin futures open interest.

Bittersweet — there will soon be more suits than hoodies here.

(h/t @VidiellaLaura) pic.twitter.com/SIPRLMlFcy

— Will (@WClementeIII) November 9, 2023

Open interest is a concept commonly used in futures and options markets to measure the total number of outstanding contracts. The metric represents the total number of contracts held by traders at any given point in time. The difference between the number of contracts held by buyers (longs) and the number of contracts held by sellers (shorts) determines open interest.

Bloomberg Intelligence exchange-traded fund (ETF) research analyst James Seyffart followed up an initial X (formerly Twitter) post from Will Clemente, questioning whether CME’s growing amount of Bitcoin futures open interest would appease the United States Securities and Exchange Commission’s historical concerns over the depth of Bitcoin markets and the potential for market manipulation.

Okay this is interesting… Does this constitute ‘market of significant size’ now? haha https://t.co/eQb7QXvO3H

— James Seyffart (@JSeyff) November 9, 2023

This has long been a point of contention, which has led to the SEC holding back from approving several spot Bitcoin ETF applications over the past few years. The regulator previously told the likes of BlackRock and Fidelity that their filings were “inadequate” due to the omission of declarations relating to the markets in which the Bitcoin ETFs will derive their value.

Related: Bitcoin puzzles traders as BTC price targets $40K despite declining volume

In July 2023, the Chicago Board Options Exchange (CBOE) refiled a submission for Bitcoin spot ETFs following feedback from the SEC. Fidelity intends to launch its Bitcoin ETF product on CBOE, while BlackRock, the world’s largest asset manager, grabbed headlines for its proposed Bitcoin ETF, which is set to be offered on Nasdaq.

CBOE’s amended filing with the SEC highlighted its efforts to take additional steps to ensure its ability to detect, investigate, and deter fraud and market manipulation of shares in the proposed Wise Origin Bitcoin Trust.

“The Exchange is expecting to enter into a surveillance-sharing agreement with Coinbase, an operator of a United States-based spot trading platform for Bitcoin that represents a substantial portion of US-based and USD denominated Bitcoin trading.”

CBOE’s filing adds that the agreement with Coinbase is expected to carry the “hallmarks of a surveillance-sharing agreement.” This will give CBOE supplemental access to Bitcoin trading data on Coinbase.

The stock exchange also added that Kaiko Research data indicated that Coinbase represented roughly 50% of the U.S. dollar-to-Bitcoin daily trading volume in May 2023. This is pertinent, given the SEC’s misgivings over the depth of BTC markets to back ETF products.

A surveillance-sharing agreement is intended to ensure that exchanges and regulators are able to detect whether a market actor is manipulating the value of stocks or shares.

Magazine: US gov’t messed up my $250K Bitcoin price prediction: Tim Draper, Hall of Flame