Costco saw a 9.4% sales boost the five weeks through April 7, driven by a surge in e-commerce activity. .

Source link

Sharp

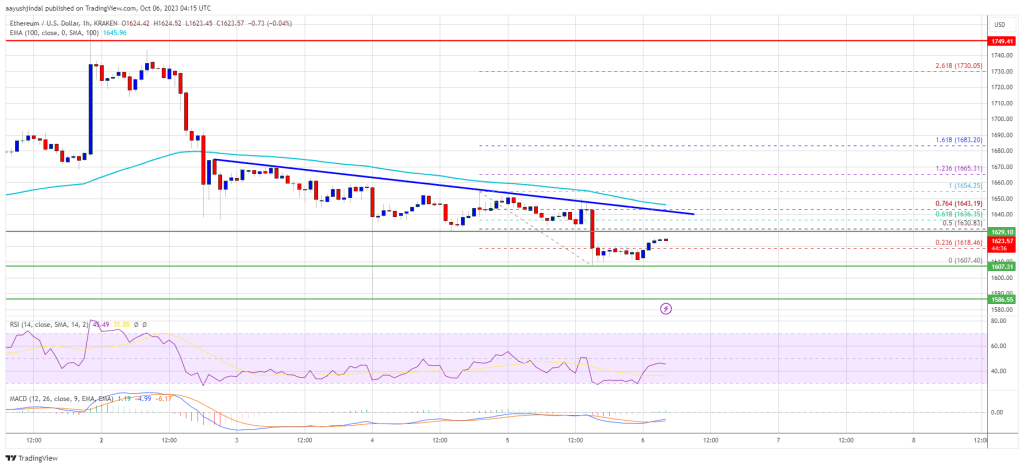

Ethereum Price At Risk of Sharp Decline Unless ETH Clears This Heavy Resistance

Ethereum price is slowly moving lower toward the $1,585 support against the US dollar. ETH must clear the $1,650 resistance to start a recovery wave.

- Ethereum is struggling to stay above the $1,600 support zone.

- The price is trading below $1,650 and the 100-hourly Simple Moving Average.

- There is a major bearish trend line forming with resistance near $1,645 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,650 and $1,665 resistance levels.

Ethereum Price Grinds Lower

Ethereum attempted a recovery wave from the $1,630 zone. ETH climbed above the $1,650 resistance level but upsides were limited, like Bitcoin.

The price struggled to gain pace for a move above the $1,665 resistance level. A high was formed near $1,654 and the price reacted to the downside. It declined below the $1,620 support and even traded close to the $1,600 level. A low is formed near $1,607 and the price is now consolidating losses.

Ethereum is now trading below $1,650 and the 100-hourly Simple Moving Average. There is also a major bearish trend line forming with resistance near $1,645 on the hourly chart of ETH/USD.

On the upside, the price might face resistance near the $1,630 level. It is close to the 50% Fib retracement level of the recent decline from the $1,654 swing high to the $1,607 low. The next major resistance is $1,650, the trend line, and the 100-hourly Simple Moving Average.

The trend line is close to the 76.4% Fib retracement level of the recent decline from the $1,654 swing high to the $1,607 low. A close above the $1,650 resistance might send the price toward the key resistance at $1,665.

Source: ETHUSD on TradingView.com

To start a steady increase, Ether must settle above the $1,650 and $1,665 levels. The next key resistance might be $1,720. Any more gains might open the doors for a move toward $1,750.

More Losses in ETH?

If Ethereum fails to clear the $1,650 resistance, it could continue to move down. Initial support on the downside is near the $1,610 level. The next key support is $1,600.

The first major support is now near $1,585. A downside break below the $1,585 support might start another strong decline. In the stated case, the price could decline toward the $1,540 level. Any more losses may perhaps send Ether toward the $1,500 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $1,585

Major Resistance Level – $1,665

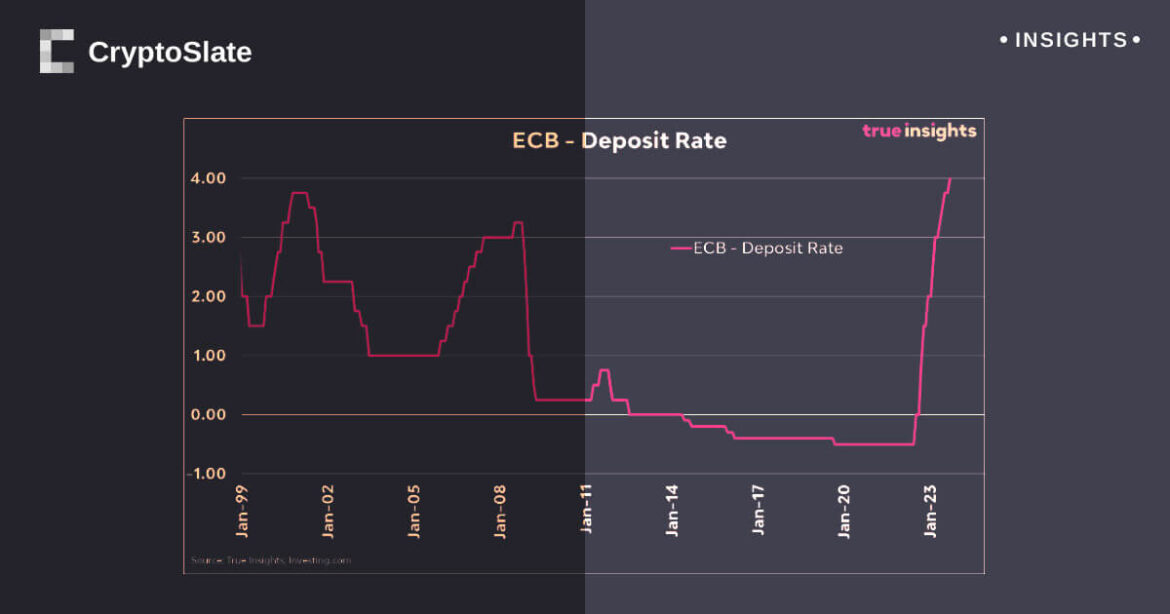

ECB rate hike catapults EUR/USD into sharp decline: a tale of forex sensitivity

Quick Take

The European Central Bank (ECB) has initiated a rate hike of 25 basis points, causing the ECB rates to now stand at 4%. This move, aimed at tightening monetary policy, has had a significant impact on foreign exchange markets, particularly influencing the EUR/USD pair.

The pair experienced a sharp decline, dropping to just below 1.07 post-announcement. This suggests the market’s sensitivity to the ECB’s monetary policy decisions, reflecting the influential role of central banks on currency valuations.

The immediate reaction of the EUR/USD pair underscores the close connection between interest rates and Forex movements. As higher interest rates typically strengthen the local currency, the downturn may indicate investors’ response to the potential economic implications of the rate hike. This action, while seen as a measure to curb inflation, may also reflect the ECB’s confidence in the region’s economic stability.

The post ECB rate hike catapults EUR/USD into sharp decline: a tale of forex sensitivity appeared first on CryptoSlate.

As per the UK Office for National Statistics, the UK unemployment rate was estimated at 4.0% for the second quarter of this year, which is 0.2% higher than the previous quarter.

The job market in the UK is suffering a sharp decline. The experts believe the crisis has been caused not only by the general economic recession but also by a shortage of talent on the market. According to the report by the Broadbean Technology firm, a fall in the number of open positions is accompanied by a 30% decline in the number of applicants. The shortage of staff is extremely sharp in engineering, science, architecture, hospitality and catering, as well as health services.

Alex Fourlis, Managing Director at Broadbean Technology, explained:

“Although the market is slowing down, the skills crisis is far from over. The UK simply doesn’t have enough of the highly trained and highly skilled professionals it needs to fill the demand. It’s imperative that employers stay focused on the skills agenda and continue to invest in talent attraction and development if they are to grow their competitive standing.”

He further added:

“The lack of candidates isn’t going to be solved overnight and is already a big issue for firms. Those that can get in front of the right people quickly, and via the right channels, will be the ones in a prime position to win the war for talent.”

As per the UK Office for National Statistics, the UK unemployment rate was estimated at 4.0% for the second quarter of this year, which is 0.2% higher than the previous quarter. Reed Recruitment has reported a 24.40% fall in the number of advertised positions over the past three months in comparison to the previous year. Notably, the number of available jobs is below the pre-pandemic era.

UK Crypto Companies Posting New Job Offers

Meanwhile, crypto companies located in the UK are publishing new job offers and actively looking for employees.

For example, the Gemini exchange is looking for a Compliance Associate at its UK office. Coinbase Inc (NASDAQ: COIN) is hiring the Head of Mobile Business Development and International Policy Manager.

Further, Ripple is seeking Employment and Litigation Counsel to provide strategic legal advice and counseling globally on a broad range of employment law matters. The company is also in need of an Executive Assistant based in London. Recently, it won a court ruling in the US against the Securities and Exchange Commission (SEC).

Following the victory, the company applied for registration as a crypto asset firm with the UK’s Financial Conduct Authority and for a payment institution license in Ireland. Now, Ripple is definitely planning to expand its footprint in the UK. Over the past 18 months, Ripple has increased its UK and European employees count by about 75%, with over 100 of its approximately 900 global employees based in its offices in London, Dublin, and Reykjavik, Iceland.

Crypto trading company Robinhood Markets Inc (NASDAQ: HOOD) is also moving forward with plans to launch in the United Kingdom. As we have reported, the company has appointed former Barclays director Jordan Sinclair as its UK arm’s CEO. Among the jobs posted by Robinhood on LinkedIn are a senior risk and compliance associate, a compliance officer, and an operations lead, all based in London.

next

Business News, Cryptocurrency news, News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.