The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

Source link

shows

US Federal Reserve Chair Jerome Powell attends a “Fed Listens” event in Washington, DC, on October 4, 2019.

Eric Baradat | AFP | Getty Images

A hotter-than-expected consumer price index report rattled Wall Street Wednesday, but markets are buzzing about an even more specific prices gauge contained within the data — the so-called supercore inflation reading.

Along with the overall inflation measure, economists also look at the core CPI, which excludes volatile food and energy prices, to find the true trend. The supercore gauge, which also excludes shelter and rent costs from its services reading, takes it even a step further. Fed officials say it is useful in the current climate as they see elevated housing inflation as a temporary problem and not as good a measure of underlying prices.

Supercore accelerated to a 4.8% pace year over year in March, the highest in 11 months.

Tom Fitzpatrick, managing director of global market insights at R.J. O’Brien & Associates, said if you take the readings of the last three months and annualize them, you’re looking at a supercore inflation rate of more than 8%, far from the Federal Reserve’s 2% goal.

“As we sit here today, I think they’re probably pulling their hair out,” Fitzpatrick said.

An ongoing problem

CPI increased 3.5% year over year last month, above the Dow Jones estimate that called for 3.4%. The data pressured equities and sent Treasury yields higher on Wednesday, and pushed futures market traders to extend out expectations for the central bank’s first rate cut to September from June, according to the CME Group’s FedWatch tool.

“At the end of the day, they don’t really care as long as they get to 2%, but the reality is you’re not going to get to a sustained 2% if you don’t get a key cooling in services prices, [and] at this point we’re not seeing it,” said Stephen Stanley, chief economist at Santander U.S.

Wall Street has been keenly aware of the trend coming from supercore inflation from the beginning of the year. A move higher in the metric from January’s CPI print was enough to hinder the market’s “perception the Fed was winning the battle with inflation [and] this will remain an open question for months to come,” according to BMO Capital Markets head of U.S. rates strategy Ian Lyngen.

Another problem for the Fed, Fitzpatrick says, lies in the differing macroeconomic backdrop of demand-driven inflation and robust stimulus payments that equipped consumers to beef up discretionary spending in 2021 and 2022 while also stoking record inflation levels.

Today, he added, the picture is more complicated because some of the most stubborn components of services inflation are household necessities like car and housing insurance as well as property taxes.

“They are so scared by what happened in 2021 and 2022 that we’re not starting from the same point as we have on other occasions,” Fitzpatrick added. “The problem is, if you look at all of this [together] these are not discretionary spending items, [and] it puts them between a rock and a hard place.”

Sticky inflation problem

Further complicating the backdrop is a dwindling consumer savings rate and higher borrowing costs which make the central bank more likely to keep monetary policy restrictive “until something breaks,” Fitzpatrick said.

The Fed will have a hard time bringing down inflation with more rate hikes because the current drivers are stickier and not as sensitive to tighter monetary policy, he cautioned. Fitzpatrick said the recent upward moves in inflation are more closely analogous to tax increases.

While Stanley opines that the Fed is still far removed from hiking interest rates further, doing so will remain a possibility so long as inflation remains elevated above the 2% target.

“I think by and large inflation will come down and they’ll cut rates later than we thought,” Stanley said. “The question becomes are we looking at something that’s become entrenched here? At some point, I imagine the possibility of rate hikes comes back into focus.”

Don’t miss these exclusives from CNBC PRO

Email Shows Digital Currency Group and Gemini Explored Merger Before Genesis Bankruptcy

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

Source link

Rivian‘s (RIVN 2.28%) biggest challenge right now is cash. The company’s cash burn is unsustainable while building out R2 and R3 capacity, which is why management announced reduced capital expenditures in Georgia.

But that’s not good news either because it likely doesn’t get the company to profitability. Travis Hoium digs into what we know now in the video below.

*Stock prices used were end-of-day prices of March 7, 2024. The video was published on March 7, 2024.

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. Travis Hoium is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link, they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.

Motorola shows off concept smartphone that can wrap around your wrist

Motorola’s “adapative display concept” smartphone can wrap around a user’s wrist. The phone can generative a background to match what a user is wearing.

Arjun Kharpal | CNBC

BARCELONA, Spain — Motorola thinks we may be wearing our phones on our wrist in future.

The company, which is owned by Chinese tech giant Lenovo, showed off a bendable smartphone during the Mobile World Congress in Barcelona, Spain, after teasing it in a video last year.

It is just a concept product so it may never be released. But Motorola is keen to show the progress of display technology to stand out in the crowded smartphone market.

During a demonstration, a Motorola representative showed how the phone could bend in various ways to wrap around a wrist or stand up on a table.

When the phone is wrapped around the wrist, the way information is displayed changes. For example, the apps appear at the top of the screen.

The representative said the phone is “contextually aware” so adapts depending on how it has been bent.

The mechanism that allows the phone to bend was desecribed by the Motorola representative as similar to the way the human spine works.

Motorola’s “adaptive display concept” was on display at Mobile World Congress in Barcelona. The smartphone can bend in various ways.

Arjun Kharpal | CNBC

Fraught with worry over high housing costs, impending student loan payments, and compounding credit card debt, millennials face financial challenges unlike other generations. Yet they’re still the generation that’s most money obsessed—and the one that wants to show it off.

While more than half of affluent millennials say they’ve been “greatly affected” by the cost-of-living crisis, 59% feel it is important to “look or appear” financially successful to others, according to a recent Wells Fargo study. This is yet another sign of “money dysmorphia” (as Intuit Credit Karma dubs it), in which people obsess over the idea of being rich so much so, that they lose sight of the actual state of their finances.

What’s even more telling is that Wells Fargo’s study actually focuses on “affluent” millennials who make at least $250,000 a year, which means it’s not just lower-income young people who feel the need to keep up with the Joneses, so to speak. More than 40% of the approximately 1,000 respondents said it’s important to have visible signs of wealth, whether it be purchasing a fancy car, clothing, or place to live. By comparison, just 21% of Gen Xers, 8% of baby boomers, and 7% of the silent generation feel the same.

“Affluent millennials are, in fact, working hard and gaining financial success,” Emily Irwin, managing director of advice and planning for Wells Fargo, tells Fortune. “Yet they’re grappling with this external image, and as a result, there’s a growing trend to present themselves with an image that isn’t reflective [of] their actual financial situation. For some, it could be even be a ‘fake it until you make it’ mentality.”

Even some of the wealthiest millennials face money dysmorphia, and more than 40% of them have to rely on credit cards or loans to fund their lifestyle—all while accumulating debt, the Wells Fargo survey shows. The national average debt among credit card holders during the fourth quarter of 2023 was $6,864, according to LendingTree. And millennials are among the consumers struggling most with unpaid balances.

“Millennials have seen the largest increase in their delinquency rates and now have rates definitely above pre-pandemic levels,” New York Federal Reserve researchers said in a November 2023 press call. “Given the strong labor market and general economy, these increases are somewhat surprising.”

Social media fuels spending anxiety among millennials

But it’s not so surprising how much millennials spend when we look at how easily and how often they’re influenced by social media—whether in the form of advertisements or subtle (or not so subtle) nudges from influencers.

“We live in a hyper-sexualized, distracted, visually curated society now all narrowly tailored into the confines of the infinite scroll,” Christopher M. Naghibi, executive vice president and chief operating officer at First Foundation Bank, tells Fortune. “Endless pictures and videos … are put in the face of the viewer, and it is simply human nature to want to be as beautiful, well-traveled, and more than anything else—rich.”

And the data shows that affluent millennials are no different. Nearly 30% said that they buy things they can’t afford in order to impress others or “fit in” with a certain lifestyle, the Wells Fargo survey found—and another third reported lying or exaggerating about their finances to keep up appearances.

“For millennials, being the first generation on the internet means that ‘keeping up with the Joneses’ isn’t just having the best of something on your block or in your neighborhood, it’s feeling pressure to match the level of consumption of a much wider net of online influencers,” Jonathan Ernest, an associate professor of economics at Case Western Reserve University, tells Fortune. “This also means that millennials may perceive more benefit from owning luxury items, as they earn the admiration of not only their peers, but also their friends, family, and followers from a larger online presence.”

But Irwin warns this “charade” isn’t sustainable.

“It’s a vicious cycle because most people are reluctant to talk about their actual circumstances, and instead it’s the image of ‘I’m living my best life,’” Irwin says. “Now, it would be great if the trend would segue into: Share what you’ve done to be so financially responsible. How freeing it would be if everyone ‘put their cards on the table,’ and not receive judgment or embarrassment.”

Millennials aren’t letting inflation, debt, and student loans get in their way of a lavish lifestyle

Despite being a highly educated generation with staggering student loan debt, millennials look past these longer-term costs and instead choose to live in the moment, experts agree.

“Coupled with the fact that millennials as a whole may find more value in indulgences after putting in the work to become the most educated generation in American history, it’s understandable how a small splurge on a luxury item can seem an insignificant cost in the face of seemingly insurmountable student loan and housing costs,” Ernest says.

But in some cases, making expensive purchases like buying a home despite high mortgage rates could make sense for millennials because savings account yield rates have been relatively lower.

Millennials “may have rationalized that it may have made sense to stretch for a dream home versus allocating dollars to a savings account that wasn’t yielding a high interest rate,” Irwin says. “And it may make sense—assuming they’re setting aside funds for emergencies and not incurring revolving debt, like credit card debt.”

In terms of tips for fighting money dysmorphia, experts agree that thinking long-term about purchases can make a difference. Irwin says she challenges millennials to not indulge the “consumer fix” or “purchasing high” from buying something new, and others encourage millennials to take a look at long-term financial planning.

“Paying off high-interest loans, and thinking of the opportunity cost of spending a dollar today as the lost ability to earn interest on investments for tomorrow can help millennials reconsider whether that next luxury purchase is truly worth the cost,” Ernest says.

This story was originally featured on Fortune.com

Consumers are casting a wary eye at their debt, New York Fed survey shows

U.S. consumers may be growing a bit more uneasy about their debts.

That’s according to a report released Tuesday by the Federal Reserve Bank of New York, which looked at Americans’ recent spending habits and how much they plan to spend in the near future.

The survey asks individuals how they would allocate an unexpected 10% increase in their income.

An average 38% of households said they would use that surprise pay bump to pay down debt, rather than spending or saving the funds.

That’s a jump of nearly a 5 percentage points from last year and the highest share of respondents who said they would set the money aside for debt payments since 2016.

Only 16% said they would spend or donate that money — the lowest percentage since the Fed started tracking the data nine years ago.

U.S. consumers have been racking up big debt balances over the past year, with consumer credit-card debt levels hitting record highs in recent months. Widespread use of buy-now-pay-later services during the holidays added to worries that so-called phantom debt may be weighing on Americans’ wallets without being documented on their credit reports.

Total consumer credit, a measure of how much money people have borrowed, topped $5 trillion for the first time in November, a trend that Sheila Bair, former chair of the Federal Deposit Insurance Corp., called “not good.”

What else the data showed

The New York Fed report showed that household spending continued to moderate at the end of 2023.

“The survey shows a continuation of the recent declining trend in monthly household spending growth,” the report said, “even though spending growth remains well above pre-pandemic levels.”

Expectations of growth in household spending for the year ahead reached the lowest level since December 2020, the report showed.

Survey respondents said they were less likely to make a large purchase such as a home appliance, furniture or home repairs over the next four months. However, consumers indicated they were more likely to purchase a home in the next four months than they were in August.

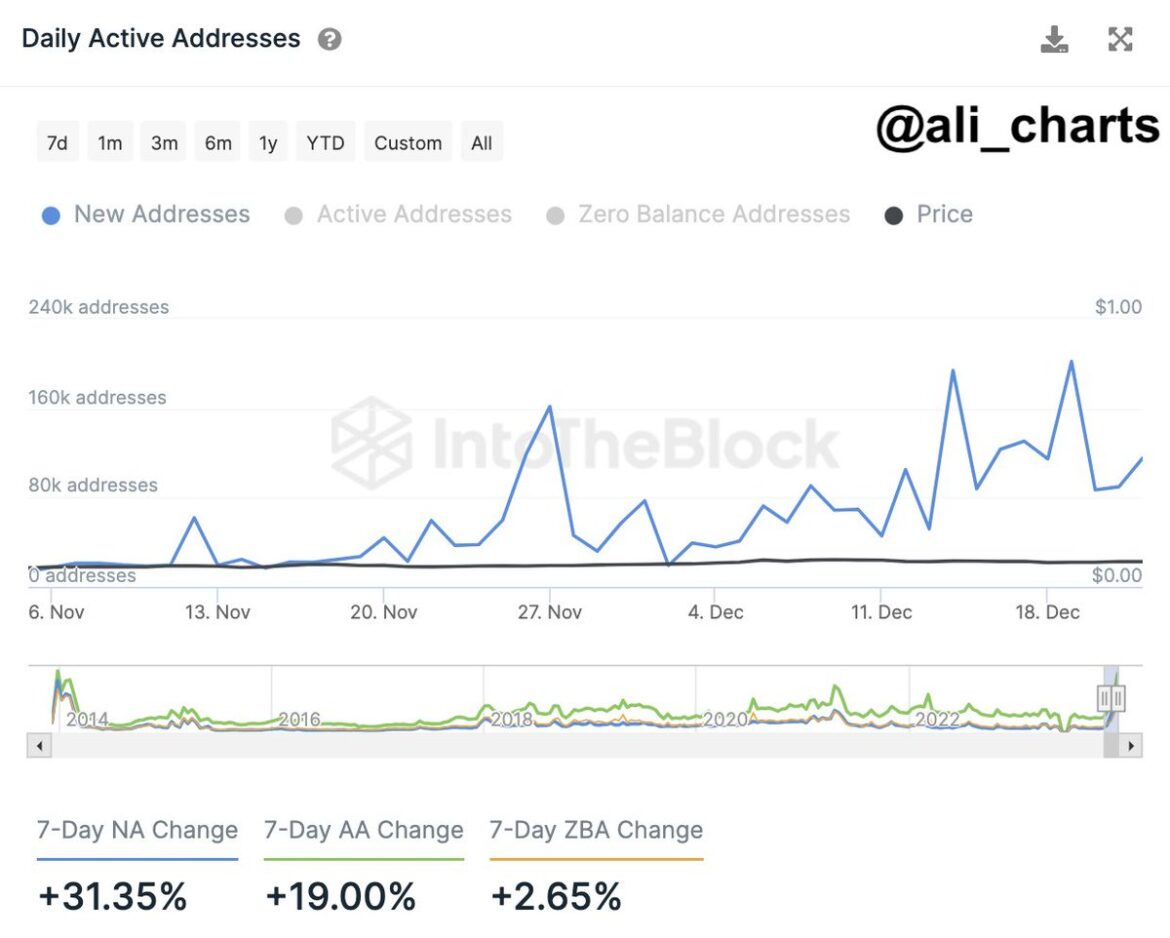

On-chain data suggests the Dogecoin adoption has been picking up recently as a large number of new addresses are popping up on the network.

Dogecoin Is Observing A High Number Of Daily New Addresses Currently

In a new post on X, analyst Ali talked about how the Dogecoin network activity has been looking like recently in terms of new address creation. A “new address” is one that has taken part in some kind of transaction activity for the first time.

Some of the new addresses that pop up on the network every day belong to the existing users, who may be creating additional addresses for privacy purposes or simply moving to a different wallet.

The rest of the new addresses, though, are being created by fresh investors entering into the market, so the daily total value of the new addresses can provide hints about how the adoption of the meme coin is coming along.

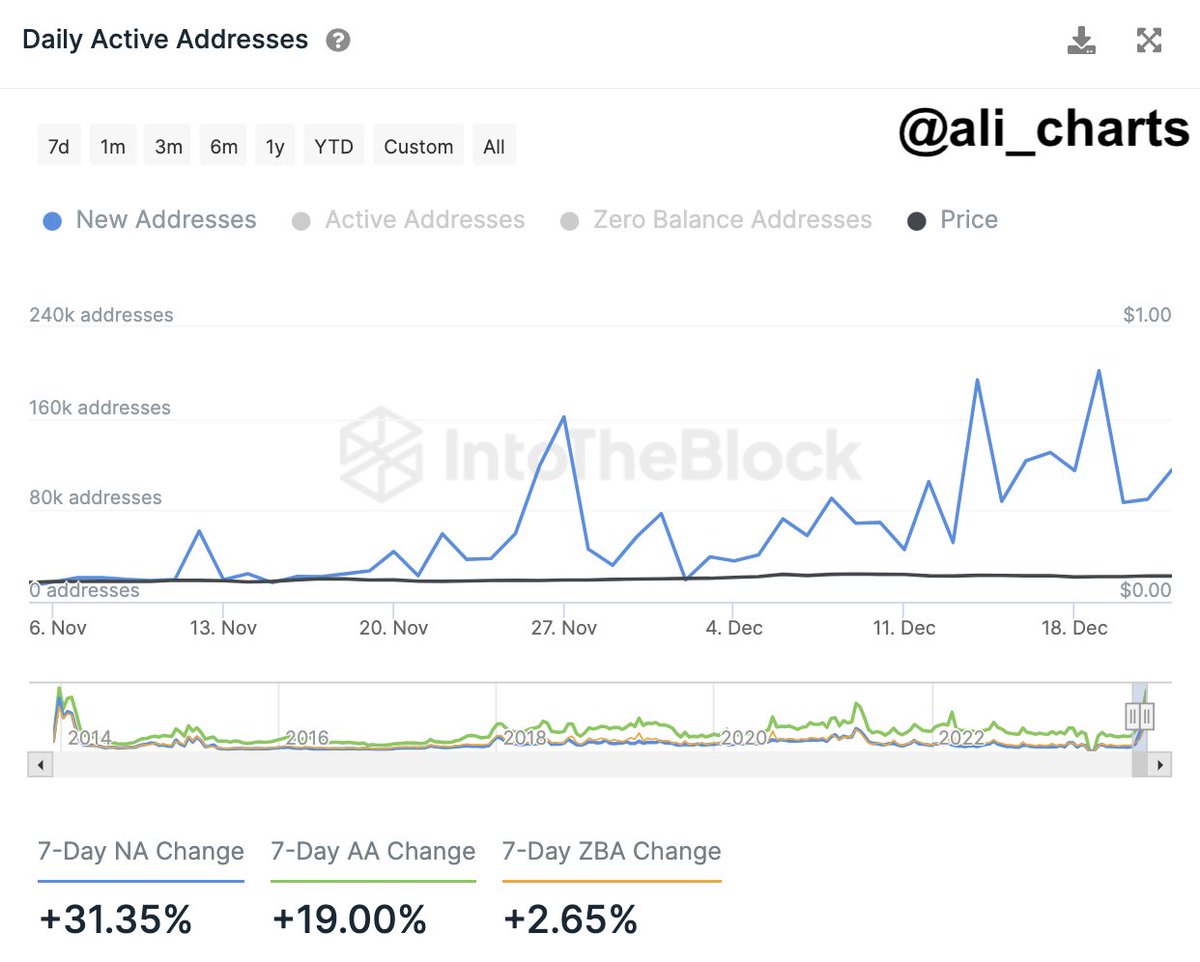

The below chart shows the trend in this metric for Dogecoin over the last couple of months:

The value of the metric appears to have seen some overall uptrend in the last few weeks | Source: @ali_charts on X

As displayed in the above graph, the daily number of new Dogecoin addresses started spiking last month and has since been consistently setting new highs as the metric continues in an overall upward trajectory. This would suggest that the network has been receiving a consistently high influx of new investors recently.

Adoption is always a constructive sign for any cryptocurrency, as fresh hands can help build a solid foundation that future uplifts in the price can sustainably grow off. Thus, it’s crucial for assets to continue to look attractive to new users, something that Dogecoin appears to have been doing fine recently.

Any positive effects on the price that come through adoption, though, generally only appear in the long term. Rather, depending on the nature of the adoption, it can in fact impart a negative influence on the cryptocurrency in the short-term.

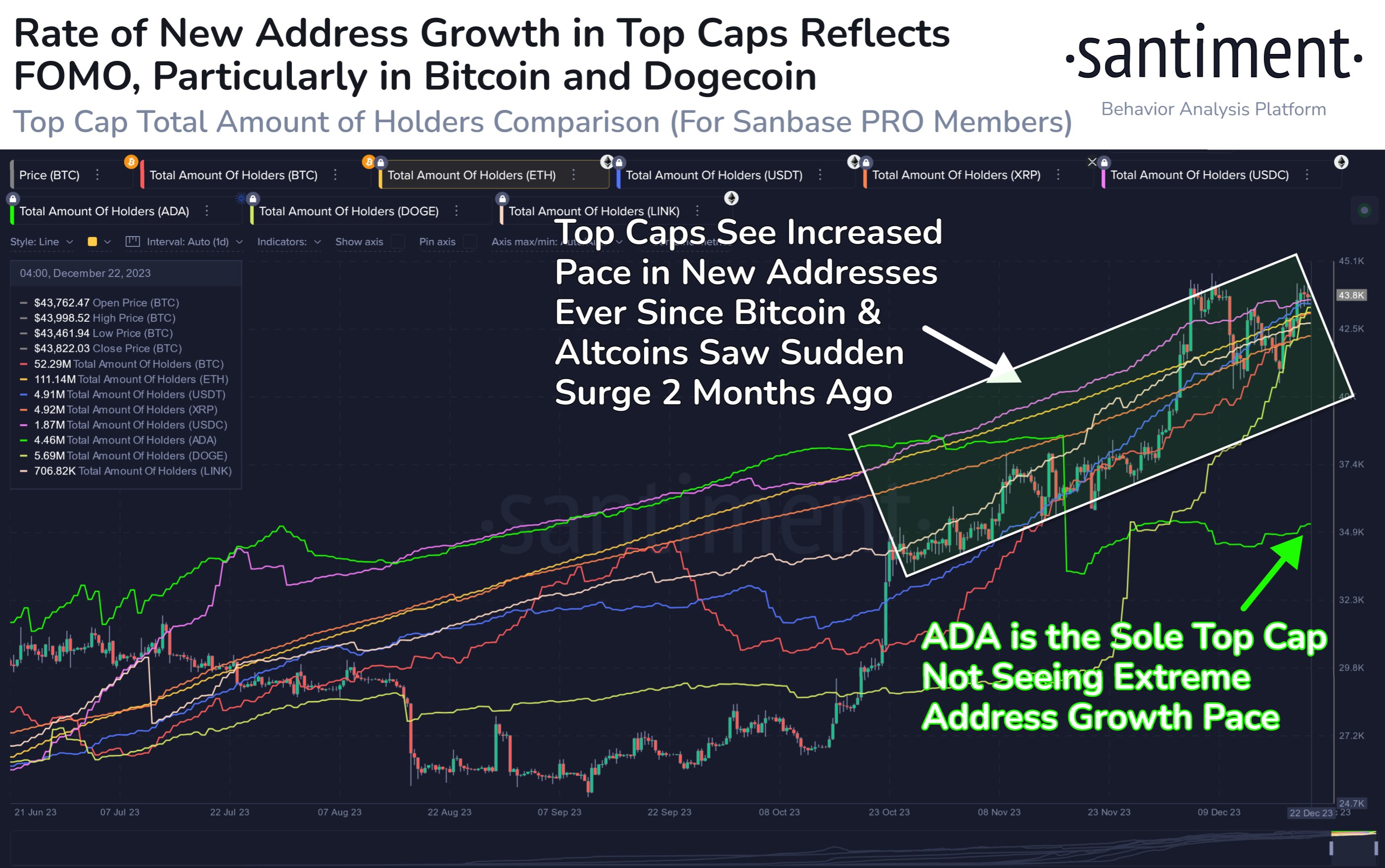

This happens when too many new users join the blockchain in a short amount of time, only buying into the asset due to FOMO. Recently, the on-chain analytics firm Santiment also discussed this fast pace of address creation on the Dogecoin network, noting that Bitcoin (BTC) is also displaying a similar trend.

The trend in the addresses of the top assets in the sector | Source: Santiment on X

“Though network growth is a great sign long-term, this rapid rate of new wallets is a FOMO sign to be slightly cautious of,” explained the analytics firm in the post.

From the chart, it’s visible that Cardano (ADA) is the only asset among the top cryptocurrencies by market cap that’s not displaying any sort of address growth at all.

DOGE Price

Since the rally Dogecoin observed during the starting third of the month, the asset has gone rather stale, as its price has continued to move sideways around the $0.093 level during the last two weeks.

DOGE hasn't enjoyed any upwards momentum in recent days | Source: DOGEUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.net, IntoTheBlock.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.