The termination of the project led to a significant drop in Trekki NFT floor prices and sparked frustration among NFT holders and enthusiasts.

Senate Majority Leader Charles Schumer, D-N.Y., left, and Speaker of the House Mike Johnson, R-La., attend a Menorah lighting to celebrate the eight-day festival of Hanukkah, in the U.S. Capitol on Tuesday, December 12, 2023.

Tom Williams | Cq-roll Call, Inc. | Getty Images

Congressional lawmakers on Sunday released the details of the first six budget bills needed to keep government agencies funded before they run out of money and a partial government shutdown takes effect this coming weekend.

The 1,050-page appropriations package has funding for six major areas of government that encompass military and veterans affairs departments, agriculture, commerce, energy and water, transportation, housing, and more.

Funding for those departments was due to expire last Friday, March 1, but congressional leaders struck a deal on Wednesday to extend those deadlines by a week and avert a partial government shutdown. It was the fourth such funding extension this fiscal year, as Congress has struggled to settle on a long-term budget plan.

This partial budget deal is a step forward in the push to secure a permanent budget plan for the rest of the fiscal year, which started Oct. 1.

But these six funding bills are just half the battle.

The other six appropriations bills that keep the rest of the government funded are due to expire March 22, giving Capitol Hill just over two weeks to negotiate the other half of the government’s spending plan.

Still, leaders on both sides of the aisle are touting the first half of funding package as a win, though for different reasons.

Democrats are trumpeting the continued full funding of a special food assistance program for women, infants and children. They also secured wins on rent assistance and pay for infrastructure employees like air traffic controllers and railway inspectors.

“Throughout the negotiations, Democrats fought hard to protect against cuts to housing and nutrition programs, and keep out harmful provisions that would further restrict access to women’s health, or roll back the progress we’ve made to fight climate change,” Senate Majority Leader Chuck Schumer, D-N.Y., said in a Sunday statement.

Meanwhile, Republicans are trumpeting victories on veterans’ gun ownership and funding cuts to government agencies like the Environmental Protection Agency, the FBI and the Bureau of Alcohol, Tobacco, Firearms and Explosives.

“House Republicans secured key conservative policy victories, rejected left-wing proposals, and imposed sharp cuts to agencies and programs critical to President Biden’s agenda,” House Speaker Mike Johnson, R-La., said in a statement Sunday.

The funding package now heads to the House for a vote where it will likely face opposition from the House Freedom Caucus, a coalition of Republican hard-liners who have relentlessly opposed budget compromises over the past fiscal year.

“The clock is now ticking until government funding runs out this Friday. Between now and the end of the week, the House must quickly pass and send the Senate this bipartisan package,” Schumer said Sunday. “Once again, it will only be bipartisanship that gets us across the finish line.”

Don’t miss these stories from CNBC PRO:

Hong Kong’s Securities and Futures Commission (SFC) told unregistered Virtual Asset Trading Platforms (VATPs) within its region to submit their licensing applications by Feb. 29 or close their businesses by May 31, according to a Feb. 5 notice.

The financial regulatory authority reaffirmed this deadline for cryptocurrency trading firms while advising investors to engage with licensed platforms in the region. As outlined by the SFC, crypto traders can verify the regulatory standing of these platforms by March 1 via its “List of licensed virtual asset trading platforms” or on the “List of virtual asset trading platform applicants.”

“Investors should check the regulatory status of a VATP from time to time and in any event on 1 March 2024. This is because VATPs operating in Hong Kong which have not submitted their licence applications to the SFC by 29 February 2024 MUST close down their businesses in Hong Kong by 31 May 2024 pursuant to the transitional arrangements under the SFC’s regulatory regime for VATPs,” SFC added.

Last year, Hong Kong initiated its cryptocurrency licensing framework for virtual asset trading platforms, paving the way for licensed exchanges to provide retail trading services. Notably, the city-state has licensed two platforms, including HashKey and OSL.

Meanwhile, the regulatory authority diligently scrutinized applications from 14 crypto entities, including OKX, Bybit, and HKVAEX. The SFC emphasized that the application process does not guarantee approval, cautioning investors to exercise prudence when engaging with these platforms.

These initiatives reflect Hong Kong’s commitment to fostering a pro-crypto environment. Recently, the Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) unveiled a comprehensive regulatory framework for stablecoins. Additionally, authorities have expressed preparedness for spot Bitcoin exchange-traded fund (ETF) products, further solidifying Hong Kong’s stance in the evolving crypto landscape.

The post Hong Kong sets deadline for crypto exchange licensing applications or face shutdown appeared first on CryptoSlate.

In a 336-95 vote on Tuesday, the Republican-run House of Representatives approved a two-step measure that prevents a partial government shutdown.

The short-term funding measure now heads to the Democratic-controlled Senate, where Majority Leader Chuck Schumer of New York has promised to “get this done quickly,” given funding is set to run out after Friday.

Moderators of Reddit’s largest crypto forum were dismissed over allegations of selling off the subreddit’s native MOON token minutes before Reddit axed its crypto rewards program.

As a part of Reddit’s blockchain-based community points program, MOON tokens could previously be distributed, traded, or spent. However, Reddit admins informed moderators of the program cancellation an hour before its public announcement, leading to accusations that three moderators dumped their holdings within that hour.

While Reddit attributed the decision to end the program to scalability issues and an uncertain regulatory environment, the actions of the moderators have raised questions among users. Reddit user giddyup281 quickly asked the mods after the decision, “how many admins sold before the news?” User 2LostFlamingos wrote:

“You let everyone build up positions, list them on kraken, add liquidity using their own outside funds. And then you just lit it all on fire.”

Many users have adopted the familiar term “rug pull” to describe Reddit’s actions. Others, however, have gone further, accusing the social media site of insider trading. The subsequent backlash has raised concerns about the integrity of the platform’s governance, with some Reddit users calling for securities fraud charges. One such comment came from user Bucksaway03, who posted:

“The trust is gone, even if you got the contract, the trust is gone… those who sold before the announcement should be reported to the SEC. Removing ones self isn’t an acceptable outcome for insider trading.”

MOON is not registered as a security. Nevertheless, the SEC could still bring enforcement actions against the moderators, according to Andy Balthazor, a litigation and dispute resolution attorney at Holland & Knight specializing in digital assets. He further explained:

“The DOJ prosecutes these actions as criminal wire fraud, which does not require proving the underlying digital assets are securities. There are several recent examples of this. The DOJ has also brought wire fraud charges in other crypto contexts, like rug pulls or ICO frauds.”

According to Reddit, the Community Points initiative was initially created to bolster communities and their contributors. However, the program reportedly ran into issues relating to scalability and regulatory concerns.

Tokens such as MOONs and BRICKs, which branched out from Reddit’s Community Points tools, gained some traction in 2023 as meme tokens. MOONs are tied to the /r/Cryptocurrency subreddit, whereas BRICKs are linked with the /r/FortniteBR. Their popularity surged particularly after their listing on Kraken in August.

The post Reddit moderators removed on suspicions of insider trading during Community Points shutdown appeared first on CryptoSlate.

Kenya’s parliamentary committee has advised Kenyan authorities to take action by shutting down Worldcoin’s virtual platforms and conducting a thorough investigation into the company.

The iris biometric cryptocurrency project Worldcoin has recently come under the scanner as the parliamentary committee of the government in Kenya is now investigating the project. The committee has asked regulators to shut down the project’s operations in the country.

As per the report released last week on September 30 by Kenya’s parliament, Worldcoin has started collecting the personal data of Kenya’s residents. this was in complete disregard of an ‘order to stop’ issued earlier in May 2023. The committee has advised Kenyan authorities to take action by shutting down Worldcoin’s virtual platforms and conducting a thorough investigation into the company for possible criminal charges.

The report noted:

“The registration of Kenyans by Worldcoin online App is still going on despite the pendency of a court order and other administrative directions halting the same in entirety.”

The report raised privacy concerns for Kenyan residents but acknowledged the challenge of determining the number of “orbs” in the country – the devices Worldcoin uses for iris scans. The committee’s suggestions encompass the government’s potential adoption of a comprehensive framework for digital assets and virtual asset service providers in Kenya, as well as the revision of existing regulations to address cybercrimes and tax reporting obligations.

The Kenyan lawmakers further added:

“The unregulated adoption and use of cryptocurrency as an attempt to fully decentralize the global monetary systems, poses threat to statehood.”

Sam Altman’s Worldcoin project, which aimed to differentiate genuine users from bots through retinal scans for identity verification, garnered millions of sign-ups by July. Nevertheless, the project has come under the scrutiny of global regulators who allege that it is bypassing regulations and standards related to data protection and user privacy.

Officials in Germany, Argentina, France, and the United Kingdom have expressed concerns about Worldcoin or initiated investigations into its operations. In August, Argentina’s Agency for Access to Public Information (AAIP) announced that they were looking into the storage, collection, as well as use of user data at Worldcoin.

The AAIP noted that the project gained significant attention in recent weeks for its practice of scanning the faces and irises of numerous individuals in exchange for financial compensation at various locations in Buenos Aires City and the provinces of Buenos Aires, Córdoba, Mendoza, and Río Negro.

Despite these warnings, Worldcoin has continued to see record daily sign-ups in Argentina, as per the report earlier this month.

next

Blockchain News, Cryptocurrency News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

You have successfully joined our subscriber list.

U.S. Navy photo courtesy of General Dynamics Electric Boat

Text size

A government shutdown is looming—but that’s no reason to avoid defense contractor

General Dynamics

.

Any politics-induced weakness would just make the stock even more attractive.

General Dynamics (ticker: GD) is as sturdy and dependable as any of the big U.S. prime contractors, alongside

Boeing

(BA),

Lockheed Martin

(LMT), and

Northrop Grumman (NOC)

.

The company is locked into long-term contracts to produce some of the U.S. military’s most iconic assets, such as the M1 Abrams main battle tank and next-generation nuclear submarines, and it has a growth kicker in its Gulfstream business-jet segment.

| Key Data | |

|---|---|

| Recent Price | $221.00 |

| YTD Change | -10.9% |

| Market Value | $60.3 B |

| 2024E P/E | 14.8 |

| Dividend Yield | 2.4% |

E=estimate

Source: Bloomberg

The stock, down 11% in 2023, hasn’t been acting like one of the steadiest growers in the market. That makes little sense. Defense spending by the U.S. and its allies shows no signs of slowing in a more geopolitically volatile world, and rebuilding stocks of munitions and equipment after large transfers to Ukraine will juice industry sales in the coming years. Gulfstream is preparing to launch a new jet, which adds to the potential upside, and the stock remains cheap relative to its own history and its peers. It also has a history of dividend increases and share buybacks.

“Unfortunately, in today’s climate, it makes sense to be long a defense contractor, and with General Dynamics, there’s the added bonus of the Gulfstream inflection coming up,” says Boyar Research President Jonathan Boyar.

General Dynamics’ defense business is strong and getting stronger. The company had a record committed backlog—orders for products and services—of $91 billion at the end of the second quarter, while its total estimated contract value was $129 billion, representing three years of revenue.

The largest share of that backlog is in the company’s marine systems segment, which builds and maintains submarines and surface ships for the U.S. Navy and its allies. Those are long-term contracts and expensive products that rank among the U.S.’s top defense-spending priorities. The Navy’s Columbia-class nuclear-powered ballistic missile submarines alone are a 15-year long program worth more than $110 billion to General Dynamics and its partners.

“Shipbuilding is one of the safest parts of the U.S. defense budget,” says Matthew Akers, an aerospace and defense analyst at Wells Fargo Securities. “China is building its fleet very rapidly, and a large number of ships are reaching the end of their useful lives over the next decade.”

Back on dry land, General Dynamics produces the M1 Abrams tank and the Stryker armored fighting vehicle, and it’s a finalist to build a replacement for the M2 Bradley, versions of which have been in service since 1981. Recent growth has been accelerated by demand from European nations building up their ground forces and buying artillery shells and missiles, and segment revenue was up 15.5% year over year in the most recent quarter, versus 10.5% at the company overall.

Rounding out General Dynamic’s portfolio is an IT segment responsible for around 30% of revenue, which competes against the likes of

Leidos Holdings

(LDOS) and

Booz Allen Hamilton

(BAH) to design and operate computer systems for the Defense Department and other government agencies. It’s a stable but slower-growing segment with tighter profit margins.

This weekly email offers a full list of stories and other features in this week’s magazine. Saturday mornings ET.

Unlike most other defense leaders, investors also get a cyclical kicker in the form of Gulfstream, which competes with manufacturers like

Bombardier

(BBD.B.Canada) and

Dassault Aviation

(AM.France). Gulfstream has an estimated 50% share of long-range, large-cabin jets, the fastest-growing segment of the market, and its offerings are only getting stronger: Management expects the Federal Aviation Administration to complete the much-delayed certification of the G700 jet in the fourth quarter, and FAA certification of the even longer-range G800 should follow in 2024.

G700 certification and an improved aerospace supply chain should allow Gulfstream to reach around 140 deliveries for the year, heavily weighted to the fourth quarter. That momentum will continue in 2024. Gulfstream could deliver 170 aircraft next year, according to some analysts, while the consensus calls for higher sales and expanded profit margins to boost the unit’s operating income by 30%.

“The market for business aircraft should see several years of positive fundamentals due to aging fleets globally and continued post-Covid commercial air travel difficulties,” says Bill Whelan, a portfolio manager at Clough Capital Partners. “You can see that in Gulfstream’s strong backlog.”

Analysts expect General Dynamics’ earnings per share to rise 18% in 2024, to $14.93, and for free cash flow to hit a record $4.2 billion, up 12%. Yet at a recent $221, its stock isn’t getting the credit it deserves. Shares trade for 14.8 times 2024 expected earnings, a discount to their historical average. Lockheed goes for a similar 14.5 times next year’s expected earnings, but analysts forecast growth of only 4%. Northrop trades for a premium 17.5 times on expected 2024 earnings growth of less than 10%.

General Dynamics has boosted its dividend payment for 26 years straight, with its annual payout increasing by an average of 9% a year for the past decade, to $5.28, for a current yield of 2.4%. Over the same period, the company has reduced its shares outstanding by nearly 25% with repurchases.

Wall Street’s average price target for General Dynamics is $265, or about 17.5 times 2024 estimated earnings—an upside of about 20%. That’s a premium multiple to its recent history and some peers, reflecting the company’s higher expected growth in coming years.

A government shutdown may bring some near-term turbulence. If shares take another dip, investors should take the opportunity to buy. “Historically [selloffs around government shutdowns] are a pretty good chance to get in,” Akers says.

General Dynamics stock remains a solid choice for both calm and stormy seas.

Write to Nicholas Jasinski at nicholas.jasinski@barrons.com

Bitcoin (BTC) starts the last week of September with a retest of $26,000 as a stubborn range persists.

An unimpressive weekly close sets the tone for the culmination of a traditionally lackluster month for BTC price action.

Having shaken off a hectic week of macroeconomic events, Bitcoin has plenty more to weather before September is over. United States gross domestic product figures for Q2 will come on Sept. 28, with Personal Consumption Expenditures (PCE) data following the day after.

The highlight, however, will likely come in the form of a speech from Jerome Powell, chair of the Federal Reserve, a week after it opted to hold U.S. interest rates at current elevated levels.

Inflation remains a major talking point into Q4, and Bitcoin still lacks direction as week after week goes by without a clear upward or downward trend emerging.

Will this week be different? The countdown to the monthly close is on.

BTC price performance, while steady over the weekend, deteriorated after the Sep. 24 weekly close.

BTC/USD took a trip to $26,000, data from Cointelegraph Markets Pro and TradingView shows, with this level still managing to hold as support at the time of writing prior to the week’s first Wall Street open.

Eyeing the state of play on exchanges, commentators noted liquidations occurring for long and short BTC positions.

Both sides almost liquidated.

Nice long squeeze. Bulls trapped. pic.twitter.com/us8Cxno5PZ

— IT Tech (@IT_Tech_PL) September 24, 2023

Bitcoin is still near two-week lows, bolstering arguments from already cautious analysts over what might come next.

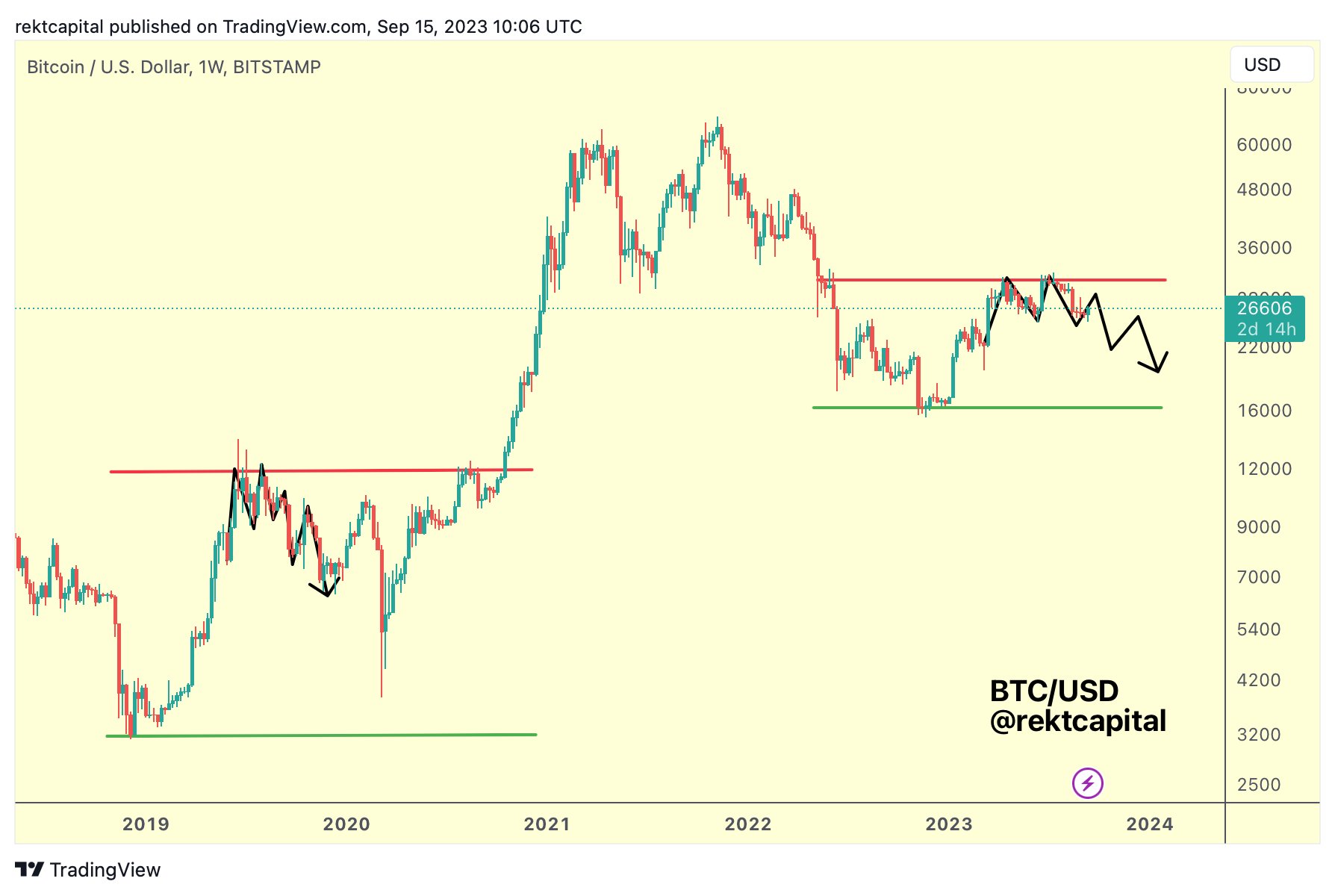

Popular trader and analyst Rekt Capital continued to track what he suggested could be a repeat of previous BTC price behavior. 2023, he argued at the weekend, might end up looking just like 2019 — its counterpart from the last cycle.

“Bitcoin could follow the same bearish fractal from 2019 to drop lower in this Macro Range,” he suggested alongside a comparative chart.

In a subsequent debate on X, Rekt Capital put the potential fractal downside target at near $20,000.

Keith Alan, co-founder of monitoring resource Material Indicators, meanwhile spied a so-called “death cross” on weekly timeframes.

Here, the falling 21-week simple moving average (SMA) has crossed under its rising 200-week counterpart — a phenomenon that highlights the comparative weakness of recent price action.

Uploading a chart showing a downside warning from Material Indicators’ proprietary price tools, Alan added that this would be invalidated should BTC/USD reclaim $26,500.

A #DeathCross + a new Trend Precognition ⬇️ Signal on the #btc Weekly Chart (Pump > $26.5 to invalidate).

Any questions? pic.twitter.com/aBa64Be56D

— Keith Alan (@KAProductions) September 25, 2023

A more optimistic take came from trader and analyst Credible Crypto, who believed a rebalancing of market composition would result in a return to $27,000.

“We had clear, visible and confirmed accumulation occurring in the green square,” he commented on a chart, building on analysis from the weekend.

“This latest push down looks to be manipulation to the downside (red square) prior to expansion to the upside. 27k incoming imo.”

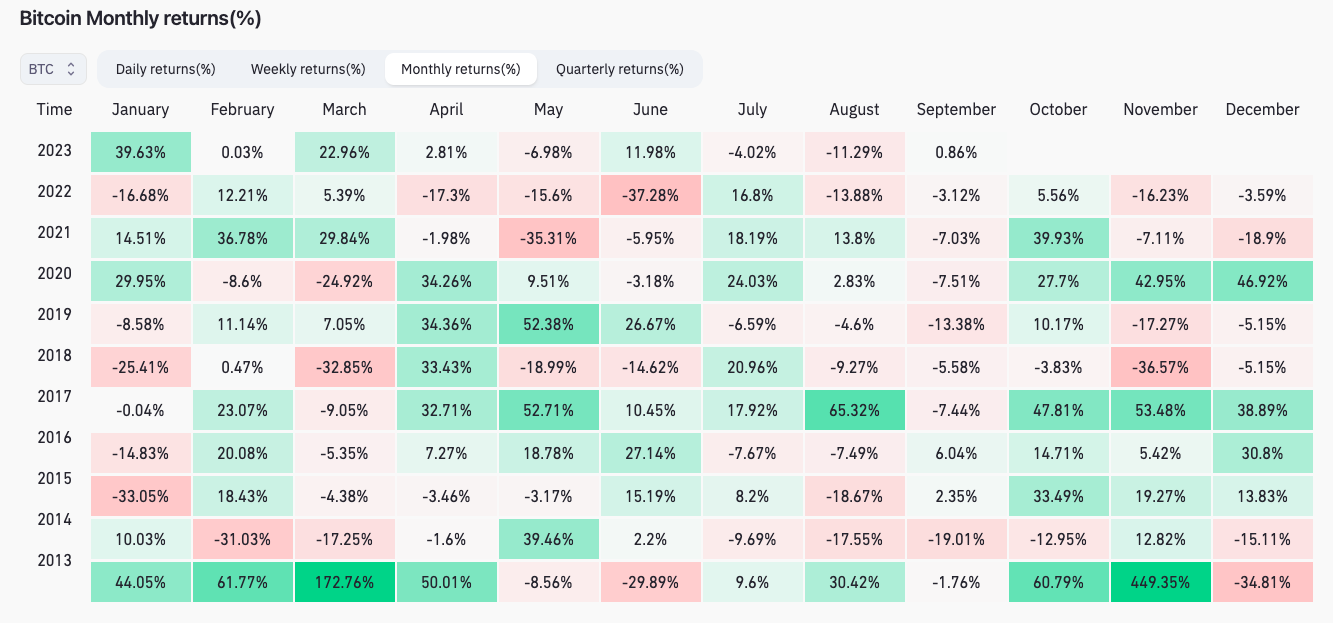

Despite the overnight weakness, Bitcoin remains in the black for September overall — a rare feat by historical standards.

The latest live data from monitoring resource CoinGlass puts BTC/USD up 0.8% month-to-date.

While this seems modest compared to the volatility generally seen with the pair, September usually forms a bearish prelude to a more substantial upside traditionally seen in October.

2023 is thus still on track to be Bitcoin’s strongest September performance for seven years.

October, which is informally known as “Uptober” among hodlers thanks to coinciding with BTC and broader crypto gains, is already a talking point.

Michaël van de Poppe, founder and CEO of trading firm Eight, suggested the start of next month could provide the fuel for the total crypto market cap to break above the 200-week exponential moving average (EMA).

“Total market capitalization for Crypto fights the resistance here of the 200-Week EMA,” he told X subscribers late last week.

“I think it’s just a matter of time until we flip above it. Probably 1-2 weeks if Ethereum ETF Futures could be approved and Uptober begins.”

Bitcoin’s 200-week EMA continues to act as support and currently sits at $25,700.

If last week’s macroeconomic events were not enough to induce significant volatility across Bitcoin and crypto markets, perhaps the month-end selection will have the desired effect.

Revised U.S. Q2 GDP precedes comments from Fed Chair Powell, as well as five other speakers, including Governor Lisa Cook, later on Sept. 28. Markets, as ever, will be closely watching the language used — especially by Powell — to determine how future economic policy might play out.

PCE data will come a day later; this is known to be one of the Fed’s preferred gauges for measuring inflation trends.

“Very busy week just as volatility has returned,” financial commentary resource The Kobeissi Letter summarized in an X outlook.

The return of volatility is fantastic news for traders.

More Fed uncertainty is back and we are ready for it.

We’re publishing our trades for the week shortly.

In 2022, our calls made 86%.

Subscribe to access our analysis and see what we’re trading:https://t.co/SJRZ4FrNBc

— The Kobeissi Letter (@KobeissiLetter) September 24, 2023

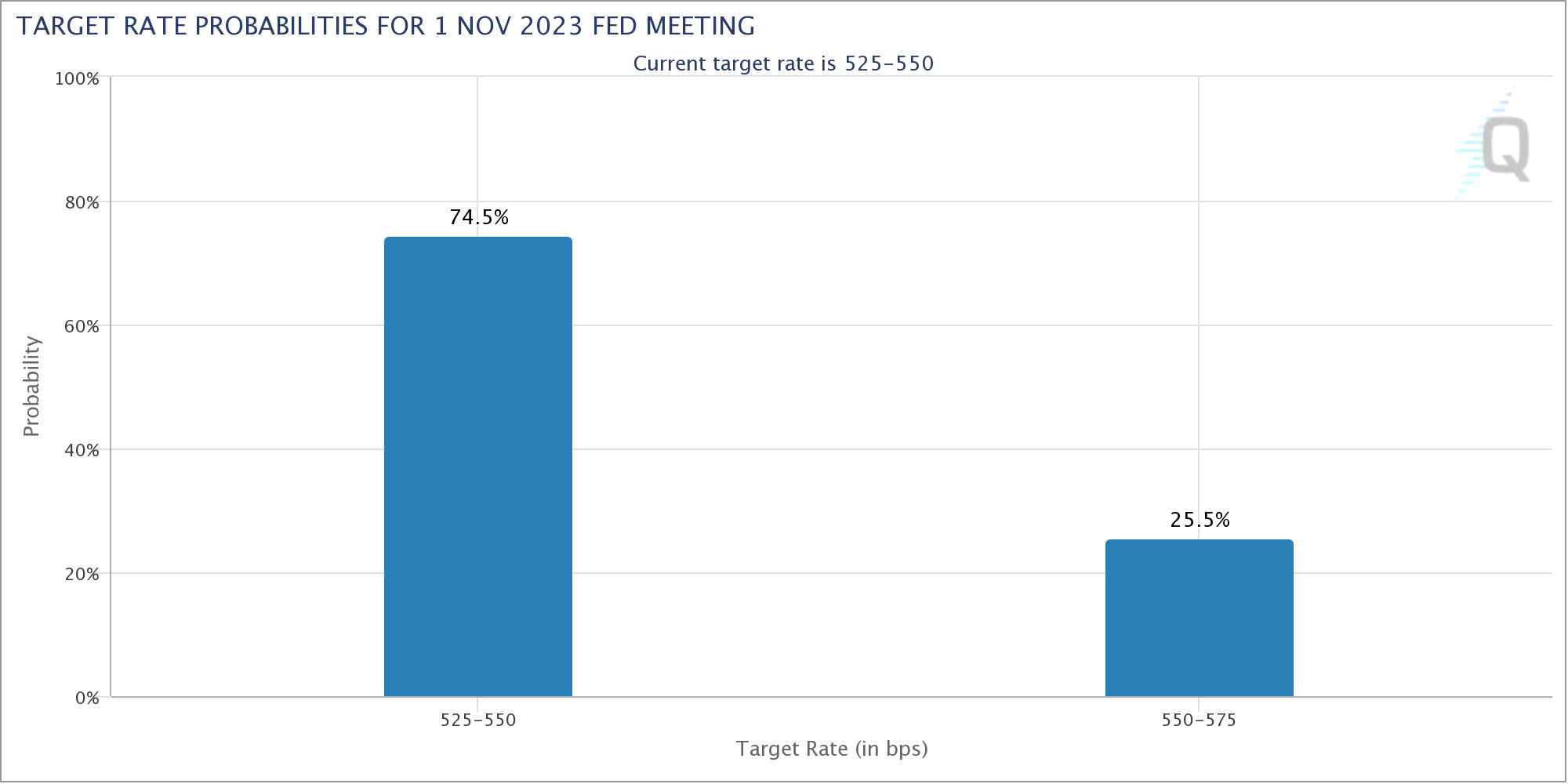

Prior to the data and Fed speakers, markets are pricing in a 75% chance that interest rates stay anchored at present levels at the next decision meeting in November, per data from CME Group’s FedWatch Tool.

Waiting in the wings before that, meanwhile, is the threat of a fresh U.S. government shutdown over budget wrangling. Politicians have until Oct. 2 to avert one, notes pro-Bitcoin commercial litigator Joe Carlasare.

Major October Catalysts (Part 2)

Predictive markets now anticipate a 70% of a Government Shutdown on October 2.

Millions of federal workers face delayed paychecks when the government shuts down, including many of the roughly 2 million military personnel and more than 2 million… pic.twitter.com/XTrt0g06t2

— Joe Carlasare (@JoeCarlasare) September 24, 2023

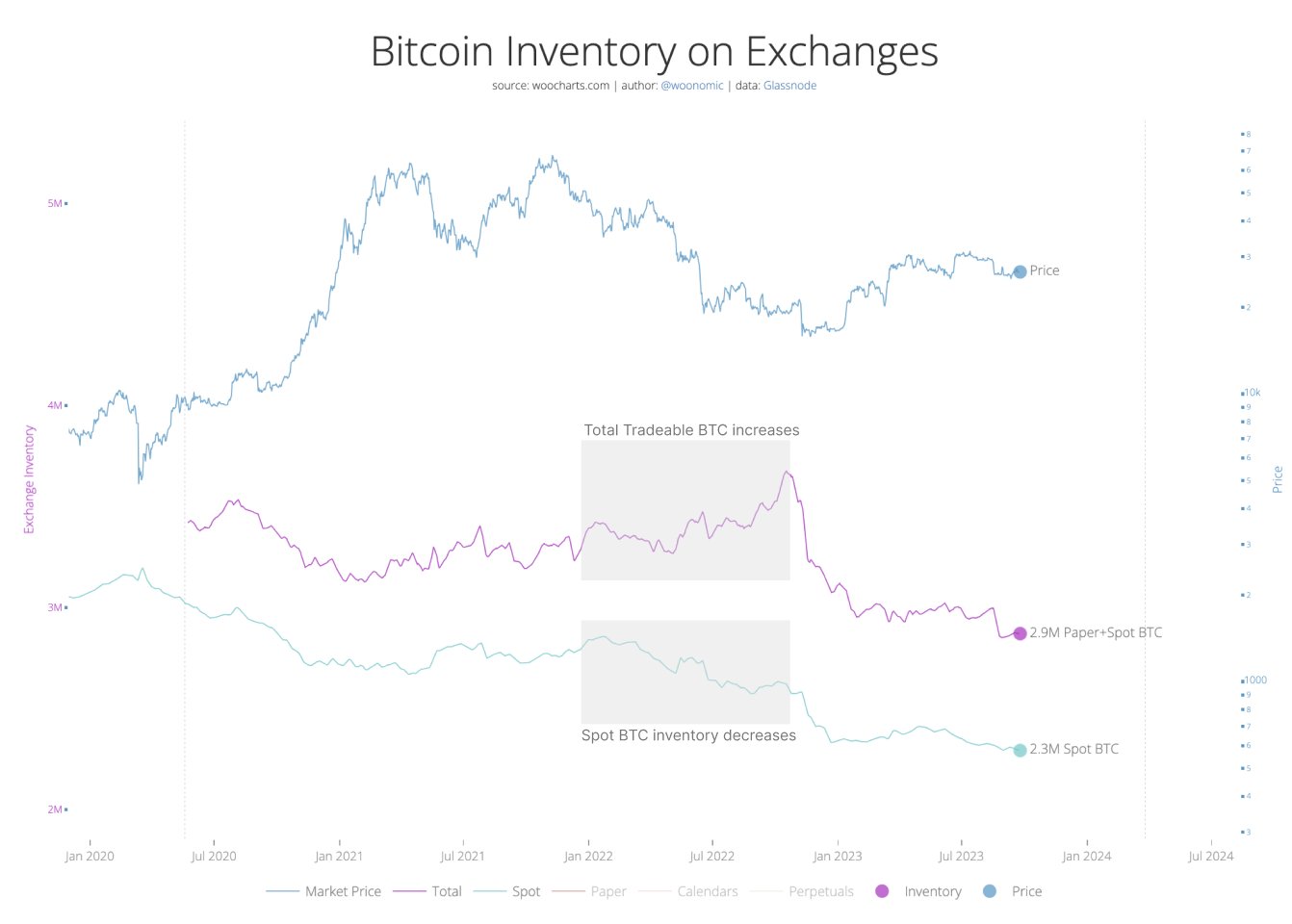

Bitcoin available to buy on exchanges may be near its lowest levels since 2018, but this is no cause for celebration or even bullishness, one longtime analyst argues.

For Willy Woo, creator of the statistics platform Woobull, the “synthetic” nature of exchanges’ BTC balances means that their multi-year decline does not represent the BTC supply becoming more illiquid or scarce.

“Will buying up the inventory of BTC on exchanges moon the price? NO! This is a fallacy,” he told X subscribers in a thread at the weekend.

“This happened all through the 2022 bear. There’s no supply shock because synthetic BTC via futures markets added to inventory. The market made a bottom when futures markets relented.”

Woo argued that approving a Bitcoin spot price exchange-traded fund in the U.S. would go some way to “rectify” the problem.

Futures, he added, were the elephant in the room that skewed his perspective of the market at the start of 2022 before BTC/USD hit two-year lows of $15,600 in November.

“I saw the market bullish in early 2022 by reading on-chain (spot) flows as bullish, all the while the leviathan of futures impact was saying the opposite,” he admitted.

Regardless of near-term BTC price performance, some remain universally bullish when it comes to the overall health of Bitcoin this year.

Related: Bitcoin short-term holders ‘panic’ amid nearly 100% unrealized loss

Among them is the popular trader and analyst known as Moustache, who now believes that current levels could represent the last chance to “buy the dip” on BTC in 2023.

Uploading a chart comparing the status quo to that of 2020, Moustache additionally noted “fascinating” similarities in Bitcoin’s relative strength index (RSI).

#Bitcoin 2020 vs. #Bitcoin 2023

Isn’t it fascinating?

Perhaps the last “buy the dip” opportunity in 2023. pic.twitter.com/1S88g4Nc4x

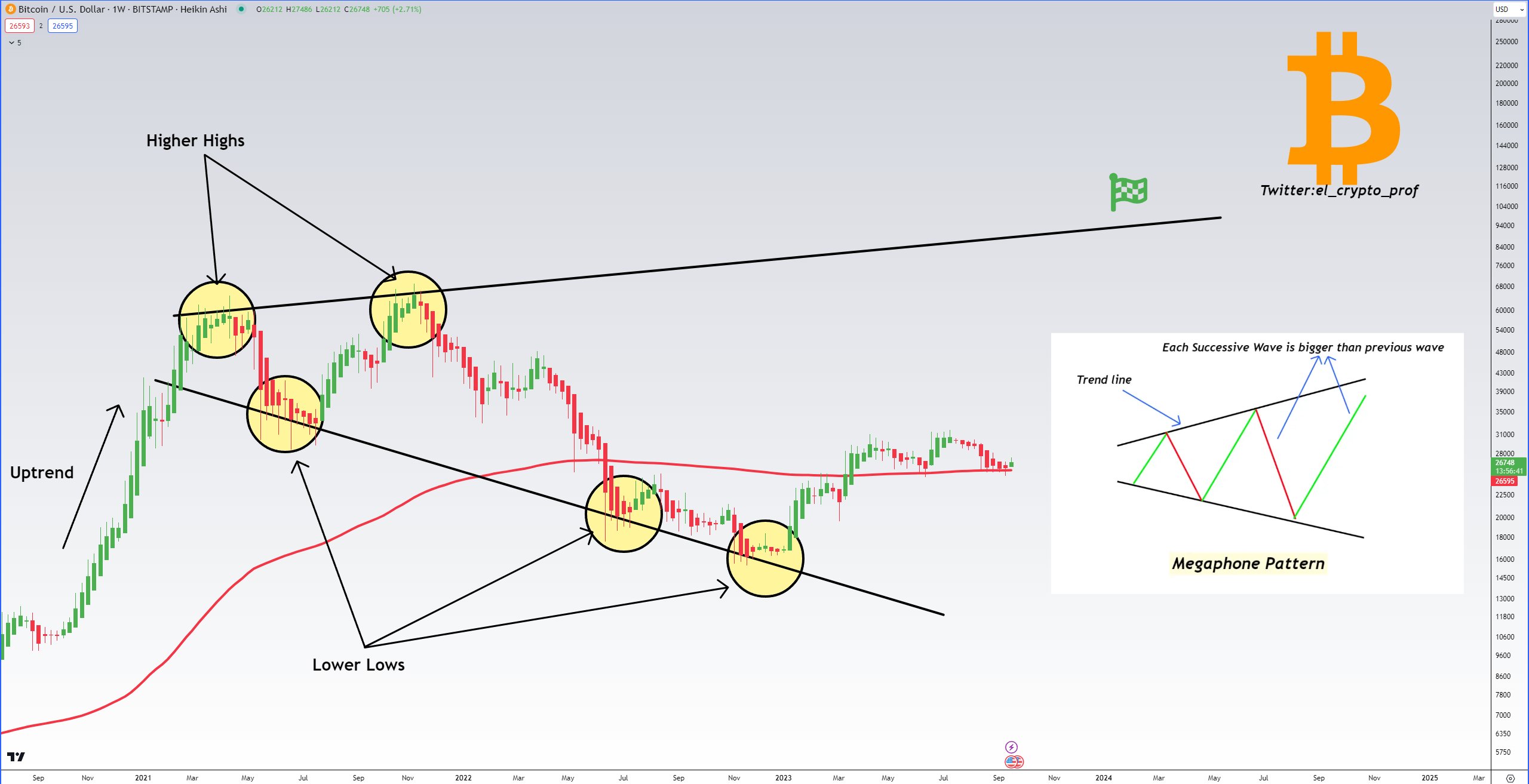

— ⓗ (@el_crypto_prof) September 22, 2023

He subsequently gave significance on the 200-week EMA holding as support.

“95% wait for lower prices that won’t happen.,” he wrote in part of the accompanying commentary, with another chart placing BTC/USD in an expanding “megaphone” structure.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

On the latest episode of Macro Markets, analyst Marcel Pechman examines the current state of the American economy. He references a headline from Barron’s that highlights the disparity between people’s perception of the economy and the objective data.

Pechman delves into the concept of excess savings, agreeing with Barron’s that a significant portion of the United States population lacks sufficient savings for retirement, potentially necessitating longer working years. He notes that household wealth in the U.S. has reached new heights, primarily due to surges in equities and real estate assets.

Shifting his focus, Pechman discusses rising concerns among U.S. consumers about increasing prices, particularly the cost of filling up their vehicles with gasoline. He connects this to the recent surge in U.S. crude futures, influenced by Saudi Arabia’s decision to extend output curbs.

Pechman foresees challenges for President Joe Biden, especially in managing inflation and the impact of Federal Reserve interest rate hikes on real estate and the S&P 500. He then addresses the implications for Bitcoin (BTC), suggesting that if inflation outpaces income growth, it could exert downward pressure on the cryptocurrency.

Moving on to the U.S. budget issue, Pechman explores the possibility of a government shutdown due to disagreements in Congress. In a critical analysis, Pechman questions the use of disaster funds to cover war expenses, drawing attention to the Biden administration’s priorities. He emphasizes the potential consequences and legality of such maneuvers.

Pechman concludes by suggesting that a U.S. government shutdown could trigger a bull run in Bitcoin and advises keeping an eye on this potential trigger for a cryptocurrency rally in early October.

Check out the latest episode of Macro Markets, available exclusively on the Cointelegraph Markets & Research YouTube channel.

SpiritSwap, a decentralized exchange (DEX) on Fantom, will no longer be shutting down its operations in September after it received a takeover offer from Power, another Fantom-based DeFi protocol. The proposed shutdown was a result of cross-chain protocol Multichain’s collapse, which had a significant impact on the Fantom ecosystem.

On August 9, SpiritSwap announced on Discord that it is “winding down” operations and is looking for a team to take over the project after its treasury was drained in the Multichain exploit. The protocol initially planned to shut down by September 1, 2023, but it appears that won’t be happening anymore after Power’s intervention.

This would come as a relief to several SpiritSwap community members, especially those who have the native token SPIRIT locked on the protocol. According to the protocol’s website, there are currently over 410 million SPIRIT tokens locked.

On August 16, the SpiritSwap community approved the proposal to hand the keys of the protocol to Power, a non-fungible token platform on Fantom. Power has now proposed to deposit 200,000 USDC into the SpiritSwap treasury.

Related Reading: Stellar Breaks Free: Unleashes New Open-Source Disbursement Platform

The team behind the NFT platform stated in the proposal that the deployment of these funds into the treasury is the first phase of ensuring that SpiritSwap survives. Meanwhile, Power claims to hold more than $1 million in liquid assets across multiple chains “ready to mobilize for use”.

In the proposal, the Power team clarified that it has also been developing its own decentralized exchange, PowerSwap. Then, it laid out plans to integrate some designs of the new DEX into SpiritSwap.

It is worth mentioning that Power was also impacted by the Multichain exploit. Fortunately, the protocol’s treasury assets were not bridged to Multichain, leading to relatively small losses.

The Fantom ecosystem was the biggest victim in the Multichain exploit in July, which resulted in a total loss of over $126 million. The attack seemed to have specifically targeted the protocol’s Fantom bridge, causing a drain of more than $120 million worth of assets.

As inferred earlier, the ripple effect of the Multichain hack spread across various projects on the Fantom blockchain. As a result, the total value locked (TVL) on the network has been on a steady decline.

Fantom has seen its TVL drop by more than 61% since July 6 – the day of the Multichain exploit. As of this writing, the total value locked on the network stands at about $86.2 million, according to data from DefiLlama.

FTMUSDT continues downward trend on the daily timeframe | Source: FTMUSDT chart on TradingView

Featured image from iStock, chart from TradingView