Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Onchain data indicates that a single custodian now manages the coinbase addresses for at least nine prominent mining pools, which collectively account for 47% of Bitcoin’s total hashrate. The analysis shows that substantial miners’ rewards from pools like F2pool, Antpool, Binance Pool, and Braiins are being funneled to this particular custodian. Onchain Data Reveals Single […]

Source link

single

Venom Blockchain Launch Triggers Huge Surge In User Adoption, Surpassing 1 Million In A Single Day

With the growing adoption of blockchain technology in various digital asset infrastructures, a team from Abu Dhabi, known for its wealth from the oil industry, has made a significant entry into the space with the launch of the Venom Blockchain.

Venom Blockchain Market Cap Soars

Venom operates as a foundational Layer 0 blockchain network, equipped with dynamic sharding and a proof of stake (PoS) consensus method. Designed to offer a scalable and efficient infrastructure, this advanced blockchain platform is tailored for the development of diverse products. It seamlessly bridges governmental applications and traditional Web3 projects through its sophisticated mesh network architecture.

The distinguishing feature of the Venom blockchain is its infrastructure, which, according to its official website, is capable of processing 100,000 transactions per second, with an average fee per transaction of just $0.0002.

As a result, the Venom Blockchain is currently attracting significant attention, as evidenced by various metrics. The Venom Blockchain currently boasts a market capitalization of over $5.2 billion and a trading volume of over $200 million, highlighting Abu Dhabi’s interest in the technology.

Over One Million Users In The First Year

The launch of Venom had a significant impact, attracting over one million users in 24 hours, demonstrating the platform’s appeal to investors and developers for building Web3 products.

In addition, the platform reportedly has over 20 projects ready to debut on the platform and several pilot stablecoin initiatives in different countries, underscoring the confidence developers have in its infrastructure.

Overall, the rise of Venom Blockchain underscores Abu Dhabi’s ability to adopt innovation beyond its traditional sectors and demonstrates the emirate’s interest in promoting the advancement of blockchain technology.

On March 27, the native token of the blockchain, VENOM, was listed on KuCoin, leading to a significant price surge of over 27% within 24 hours. Presently, the token is trading at $0.6580, reflecting a recent increase of 3.8% in the past trading hour.

In the past 24 hours, the trading volume of the VENOM token has reached $62,515,705, marking a notable increase of 193.60%, according to CoinGecko data.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The price performance of Bitcoin over the past week has been a source of concern for the majority of the crypto community. This has pretty much been the case for other cryptocurrencies in the market, with several large-cap tokens reversing their recently-accrued profits.

However, some investors are treating the recent price decline as a rare opportunity in the bull market as they continue to load their bags with assets of their choice. Specifically, the latest on-chain data shows significant buying activity amongst a certain class of investors.

25,000 BTC Flow Into Accumulation Addresses In One Day

Prominent crypto pundit Ali Martinez revealed, via a post on X, that more than 25,000 BTC (valued at approximately $1.6 billion) was moved to accumulation addresses on Friday, March 22. This figure represents the highest amount transferred to these wallets in a single day so far in 2023.

The metric of interest here is the Inflow to Accumulation Addresses on the Bitcoin blockchain. For context, a Bitcoin accumulation address refers to an address that has zero outgoing transactions and maintains a balance of at least 10 BTC.

A chart showing the inflows to Bitcoin accumulation addresses | Source: Ali_charts/X

This classification, however, excludes digital wallets linked to centralized exchanges and miners and has less than 2 non-dust incoming transfers. Also, it doesn’t include addresses that have not seen any activity in more than seven years.

The increased flow of coins into this class of wallet addresses is evidence of substantial BTC accumulation by entities who view the crypto as a long-term investment. It signals that certain big-money players are amassing Bitcoin in anticipation of potential value appreciation.

What’s more, this significant acquisition by long-term investors emphasizes the increasing adoption of Bitcoin as a store of value. Meanwhile, it might be an indicator of bullish price movement in the short term.

Bitcoin Price Overview

As of this writing, Bitcoin is valued at $64,636, reflecting a mere 1% price increase in the past 24 hours. This price change is somewhat negligible, considering the deep retracement of the premier cryptocurrency earlier in the week.

According to data from CoinGecko, the price of BTC is down by 2.4% over the past week. Meanwhile, the market leader is currently about 13% from its record high of $73,798.

However, it has been an overall positive performance for the Bitcoin price in March, having surpassed this previous all-time high of $69,000 a little over a week ago. And, with a market cap of $1.26 trillion, BTC retains its position as the largest cryptocurrency in the sector.

The price of Bitcoin struggles to hold above $64,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Funds See Record $2.45 Billion Global Inflows in a Single Week: Coinshares

In an unprecedented surge, crypto funds around the globe registered record inflows totaling $2.45 billion last week, marking a significant uptick in investor interest. This influx has propelled the total assets under management (AUM) back to levels not seen since December 2021, signaling a strong resurgence in the crypto investment space. Record $2.45 Billion Inflows […]

In an unprecedented surge, crypto funds around the globe registered record inflows totaling $2.45 billion last week, marking a significant uptick in investor interest. This influx has propelled the total assets under management (AUM) back to levels not seen since December 2021, signaling a strong resurgence in the crypto investment space. Record $2.45 Billion Inflows […]

Source link

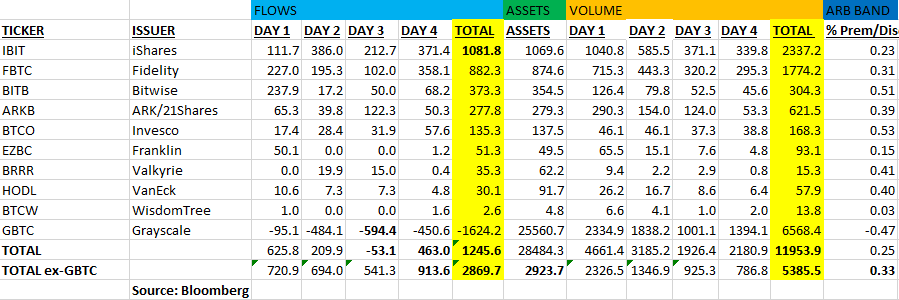

Newborn Nine Bitcoin ETFs hit record $914 million inflow in a single day

Quick Take

The fourth day of trading activity witnessed a striking upsurge in the aggregation of rolling net flows, escalating to a notable $1.2 billion, according to Eric Balchunas. This surge was primarily driven by the ‘Newborn Nine,’ a collective term for the emerging digital asset funds coined by Balchunas, which accrued a substantial $914 million, marking their most successful trading day to date. According to Balchunas, this influx surpassed the $450 million outflow from GBTC, spotlighting the significant momentum gained by the Newborn Nine.

Over the initial four-day trading period, the Newborn Nine saw an unusually high intake of $3 billion and a trading volume of $5.4 billion, painting a picture of robust market participation, according to Balchunas. Of these, IBIT surged past the $1 billion mark, while FBTC closely followed. BITB established itself in the third position. Remarkably, half of the Newborn Nine surpassed the $100 million benchmark, a testament to the strong investor interest in these budding digital asset funds, according to Balchunas.

The post Newborn Nine Bitcoin ETFs hit record $914 million inflow in a single day appeared first on CryptoSlate.

The starting point of 2024 has a positive outlook for the Maker (MKR) coin, suggesting that the year may be productive. Activity has increased, according to on-chain data, indicating a potential positive trend.

Since the start of the year, the number of active addresses on a daily basis—a crucial indicator of user engagement—has increased significantly.

Presently, there are more than 600 addresses trading MKR, which is a 4% rise from the original 590. This increase in involvement suggests that there is increasing momentum and interest in the token.

Moreover, since the beginning of the year, there has been an over 5% increase in the establishment of new addresses only for MKR trading. This inflow of new players gives the ecosystem more room to flourish and more liquidity.

MKR Daily Active Addresses. Source: Santiment

2024 is off to a good start for MakerDAO, the driving force behind the DAI stablecoin in the decentralized finance (DeFi) space.

Analysts are upbeat, projecting steady returns and even calling it a safe pick given the volatile state of the cryptocurrency market. Still, let’s examine this more closely before jumping on the MKR bandwagon.

One of MakerDAO’s strongest points is its mature ecosystem. A key component of DeFi lending and borrowing is the MKR token, which controls the DAI stablecoin.

MKR market cap currently at $1.6 billion. Chart: TradingView.com

This mutually advantageous association has bestowed MakerDAO with considerable sway and a foothold in the market. However, to attribute its future exclusively to the Bitcoin ETF decision, as some contend, offers an inadequate perspective.

Although the crypto markets could benefit from an authorized Bitcoin ETF, it’s important to understand how complex and interwoven the sector is.

Regulations, the general use of DeFi, and even rivals’ actions impact MakerDAO’s trajectory. Ignoring these things could result in unrealistic expectations.

According to Coinglass data, there has been a notable spike in liquidations as a result of Maker’s hike from a minimum of $1,826 to a maximum of $1,928.

Source: Coinglass

The sudden surge in MKR’s value has forced the liquidation of more than $500,000 worth of short bets, defying the sellers’ gloomy projections.

There could be both good and negative effects on Maker’s pricing if the number of profitable addresses rises. Some 74% of addresses, or 69,400 addresses, are in profit, which is a two-year high, according to IntoTheBlock data.

This increase could lift buying pressure for the cryptocurrency as hopeful Maker holders may want to stockpile more tokens in expectation of future price improvements.

As the Maker market witnesses a surge with over 600 addresses completing MKR trades in a single day, the momentum appears robust and promising. This heightened activity signifies growing interest and participation in the MKR ecosystem.

Featured image from Freepik

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The divorce rate in the United States is slowing down, but there are still plenty of single people out there. And in addition to finding a partner, these singles are likely looking for good jobs, affordable housing and buzzing nightlife.

With “cuffing season” in mind, Zumper evaluated close to 100 U.S. cities to determine which afford singles the best opportunities and lifestyle:

- Percentage of single population

- One-bedroom median rent price

- Dating satisfaction

- Entertainment and restaurant per capita

- Cost of living

- Non-family median income

- Unemployment rate

No. 1 U.S. city for singles: Atlanta

Atlanta, Georgia, topped the list as the best city for singles.

According to the report, over 57% of Atlanta’s population is single and the city ranked in the top five in the entertainment and restaurant categories.

Atlanta is the best U.S. city for singles, according to Zumper.

Sean Pavone | Istock | Getty Images

The median non-family income of $71,069 is higher than the national average of $70,784, according to the U.S. Census Bureau.

Atlanta is a city full of life and dominates in sectors like transportation and film and television production. It is also home to the Hartsfield–Jackson Atlanta International Airport, considered to be the world’s busiest airport.

Top 10 U.S. cities for singles

- Atlanta, GA

- St. Louis, MO

- Minneapolis, MN

- Boston, Mass.

- Madison, Wis.

- Washington, D.C.

- Orlando, Fla.

- Salt Lake City, UT

- Richmond, VA

- Pittsburgh, PA

St. Louis is the second-best city for singles.

St. Louis is the second-best city for singles in the U.S.

Art Wager | E+ | Getty Images

The city offers an average rent of $864 a month and a low cost of living, according to Zumper. St. Louis has, on average, rents that are 62.1% lower than in New York, according to Numbeo.

It is also 29.4% less expensive than New York.

Because of St. Louis’ low cost of living and central U.S. location, the city is a hub for many large companies like Anheuser-Busch and Emerson Electric.

The average Saint Louis home value is $170,019, according to Zillow. That, paired with the low cost of living and affordable rent, makes it an ideal place for a single person looking to live comfortably.

Rounding out the top three is Minneapolis, Minnesota.

According to the report, over 55% of the population in Minneapolis is single. It got an “A” grade in the category of dating opportunities thanks to its ample entertainment options and thriving restaurant scene.

Minneapolis is the No. 3 best city for singles.

Saibal | Moment | Getty Images

The city has one of the lowest unemployment rates in the country and the Minneapolis-St. Paul metro area is richer by median household income than New York City, Chicago, and Los Angeles, according to The Atlantic.

Not including rent, Minneapolis is also 20.9% less expensive than New York. The Zumper report states the median rent for a one-bedroom apartment is $1,289.

With a low unemployment rate paired with lower rents than other major cities like New York or Los Angeles, Minneapolis has enough economic stability to make it an ideal place for anyone looking to set down some roots.

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC’s free Warren Buffett Guide to Investing, which distills the billionaire’s No. 1 best piece of advice for regular investors, do’s and don’ts, and three key investing principles into a clear and simple guidebook.

There’s a good chance there are singles in your area. Nearly half of adults in the U.S. are currently single.

The 117.6 million unmarried, divorced or widowed Americans older than 18 account for 46% of the population, according to U.S. Census Bureau data.

That number has been growing slowly but steadily since the 1960s. As more adults are finding themselves single or remaining unmarried for longer, many are feeling crushed by the total weight of living expenses, which have also continued to grow in recent years.

“The majority of my friends who are single and living alone are stressed about the cost of living,” Kaishon Holloway, a single man living in New York City, tells CNBC.

While it can play a significant factor for people trying to find a relationship, paying for dates isn’t the reason single people may struggle financially. On top of being solely responsible for living costs that couples can split, single people are excluded from several financial benefits reserved for married couples.

Here’s what the “singles tax” looks like in the U.S.

The cost of living alone

Dollar for dollar, it is cheaper to be in a one-person household. After all, there’s only one mouth to feed, one person using household essentials and the home only needs to have enough space for one body.

But when you add it all up, maintaining a single-person household doesn’t cost exactly half of a two-person household. That’s why it’s called the singles tax — it costs more to be on your own than it would for you to share costs with a partner.

Kaishon Holloway says he and his single friends are stressed about the cost of living.

Juhohn Lee and Mark Licea | CNBC

Take South Carolina, for example, which falls around the middle of all states in terms of cost of living, according to the Missouri Economic Research and Information Center.

Here’s the cost of a year’s worth of typical expenses before taxes, including necessities such as food, housing, medical care, transportation and more, in South Carolina, according to estimates from the Massachusetts Institute of Technology:

- Single-person household: $29,880 a year

- Two-person household: $47,483 a year

The two-person household could split costs down the middle and each contribute about $23,742 per year, whereas someone living on their own would need to cover that much plus an additional $6,138.

The biggest factor is housing. Single people often have to choose between getting a roommate or covering the entire cost of a house or apartment on their own.

In expensive cities such as New York, renting a studio apartment costs an average of $3,550 a month, according to Zumper data from October 2023. That means someone living alone would pay $42,600 a year in rent, whereas a couple splitting the same rent down the middle would pay just $21,300 each.

The financial benefits of marriage are ‘written into the laws of the land’

Even if individuals earn a high income and keep their living costs low, “financial advantages for married couples are written right into the laws of the land,” Bella DePaulo, author of “Singled Out,” tells CNBC.

In some cases, married couples have advantages that simply don’t exist for single individuals, such as with income taxes.

“It used to be that the tax brackets were structured in such a way that if two people were earning money and then they combine their incomes, they would pay more taxes after they were married,” Monique Morrissey, senior economist at the Economic Policy Institute, tells CNBC.

She’s alluding to what’s known commonly as the marriage tax penalty or bonus.

Prior to the Tax Cuts and Jobs Act of 2017, married couples were more likely to face what’s known as a “marriage tax penalty,” which is when a couple combined their incomes and entered a higher tax bracket. The penalty was mostly eliminated under the 2017 reform except for some states and among ultra-high-income earners.

The “marriage tax bonus” occurs when couples pay less in income taxes when they file jointly than they would have as individuals.

It became easier for married couples — aside from those in the highest tax bracket — to get a tax bonus after the Tax Cuts and Jobs Act, according to the Tax Policy Center. That’s because the change made the married filing jointly income brackets exactly double the individual filer income brackets, aside from the 35% tax bracket.

A different kind of financial freedom

It’s not all bad news for singles.

“The financial freedom that comes from being single is really awesome because I get to spend all my money on me and my favorite person is me, so that’s really great,” Holloway says. “I get to really invest in myself and that’s really nice.”

“My favorite person is me,” Holloway says.

Juhohn Lee and Mark Licea | CNBC

That being said, you may want to pay extra attention to your finances as a single person, since you don’t have the financial safety net of a partner’s income. Your parents, friends or other family members may be able to help you out, but for the most part, you’re on your own.

“It’s even more important for you to budget, to understand how much money you’re making, how much money you’re spending, where is your money going,” says Kamila Elliott, a certified financial planner at Collective Wealth Partners.

Since housing is such a huge cost, the most effective money-saving advice might be to get a roommate or downsize as much as possible.

Outside of that, Elliott recommends looking for other ways you can cut costs by using your community.

She uses toilet paper as an example. It’s usually cheaper when bought in bulk, but a single person in a small space may not want or need to have that much on hand. “If you buy 30 [rolls] and you share them with three friends, you have that cost savings that you can share amongst each other,” she says.

“Think about yourself integrating into a community and identifying ways to help minimize some of your day to day expenses.”

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC’s free Warren Buffett Guide to Investing, which distills the billionaire’s No. 1 best piece of advice for regular investors, do’s and don’ts and three key investing principles into a clear and simple guidebook.

The price of Stacks (STX) experienced a sustained rebound, driven by a prevailing sentiment of positivity within the cryptocurrency sector. STX had a significant increase, reaching a peak of $0.680, which represents the highest value observed since July 14th.

Stacks is a layer-1 blockchain solution aiming to enable smart contracts and decentralized applications on the Bitcoin network without altering its core features, like security and stability.

It operates through the Stacks token (STX), which powers smart contract execution, transaction processing, and asset registration on the Stacks 2.0 blockchain. This enhances Bitcoin’s capabilities without requiring a fork or changes to its original blockchain.

Stacks (STX) Racks Up 26% Gain

At the time of writing, STX was trading at $0.640, up 1.5% in the last 24 hours, and registering a solid 26% increase in the last seven days, data from crypto market tracker Coingecko shows.

STX price action today. Source: Coingecko

The surge in STX is attributed to the prevailing optimism among investors on the potential acceptance of a spot Bitcoin ETF by the US Securities and Exchange Commission.

In a recent statement, Gary Gensler affirmed that the agency is currently engaged in an ongoing examination of the various proposals for exchange-traded funds (ETFs).

It is widely anticipated by analysts that the commission is likely to provide approval to proposals put up by established ETF companies such as Blackrock, Invesco, Infidelity and Franklin Templeton.

STXUSD trading at $0.636 on the weekend chart on TradingView.com

This expectation is influenced by their considerable knowledge and experience in the exchange-traded fund (ETF) sector. Given its previous setbacks in lawsuits against Grayscale and Ripple Labs, the SEC also hopes to head off any prospective legal challenges.

Meanwhile, Peter Schiff tweeted this week that the price of bitcoin might rise ahead of the ETF approval, only to fall afterward. Buying rumors and then selling them as news is a common practice.

How many times can #Bitcoin rally on the same ETF rumor? Once a U.S. Bitcoin EFT is approved, or $GBTC is able to convert into an ETF, there will be no more “good” news for Bitcoin to rally on. After years of buying the rumor, everyone will finally be able to sell the news.

— Peter Schiff (@PeterSchiff) October 16, 2023

Analysts’ Outlook For STX

A significant number of cryptocurrency traders utilizing platform X exhibit a favorable perspective towards STX.

DaanCrypto expresses a positive outlook regarding the possibility of a substantial increase in the STX price, contingent upon its ability to surpass the resistance level of $0.52.

$STX Not looking bad on the higher timeframe. Had this huge run up early in the year and has since come down to test the high timeframe support area.

Needs to break above $0.52 to break out of this consolidation.

Below $0.44 is the danger zone. pic.twitter.com/tGI6AeZZWN

— Daan Crypto Trades (@DaanCrypto) October 14, 2023

Nevertheless, the author cautions that a negative trajectory might potentially emerge in the event that the price descends below the threshold of $0.42.

Crypto Tony holds a positive outlook for the cryptocurrency, but his approach differs from the previous trader. He emphasizes a bullish ascending triangle pattern for the altcoin instead of placing the same emphasis on horizontal long-term levels.

Break above 0.53c would be a trigger for a long position legends. Love the structure we are forming so far pic.twitter.com/Gd4xBYptGi

— Crypto Tony (@CryptoTony__) October 8, 2023

This indicates his expectation for potential upward price movement, as ascending triangles are typically seen as bullish patterns with the potential for a breakout to higher price levels. This analysis showcases the diversity of trading strategies and technical indicators in the cryptocurrency market.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Cute Wallpapers

AI can be used in ‘every single process’ of JPMorgan’s operations, says CEO

JPMorgan CEO Jamie Dimon says artificial intelligence (AI) could be applied to “every single process” of his firm’s operations and may replace humans in certain roles.

In an Oct. 2 interview with Bloomberg, Dimon said he expects to see “all different types of models” and tools and technology for AI in the future. “It’s a living, breathing thing,” he said, adding:

“But the way to think about for us is every single process, so errors, trading, hedging, research, every app, every database, you can be applying AI.”

“So it might be as a co-pilot, it might be to replace humans … AI is doing all the equity hedging for us for the most part. It’s idea generation, it’s large language models,” he said, adding more generally, it could also impact customer service.

“AI is real”

JPMorgan CEO Jamie Dimon says artificial intelligence will be part of “every single process,” adding it’s already “doing all the equity hedging for us” pic.twitter.com/J9YD4slOpv

— Bloomberg (@business) October 2, 2023

“We already have thousands of people doing it,” said the JPMorgan CEO about AI research, including some of the “top scientists around the world.”

Asked whether he expects AI will replace some jobs, Dimon said “of course,” but stressed that technology has always done so.

“People need to take a deep breath. Technology has always replaced jobs,” he explained.

“Your children will live to 100 and not have cancer because of technology and literally they’ll probably be working three days a week. So technology’s done unbelievable things for mankind.”

However, Dimon acknowledged there are also negatives to emerging technologies.

When it comes to AI, Dimon says he’s particularly concerned about “AI being used by bad people to do bad things” — particularly in cyberspace — but is hopeful that legal guardrails will curtail such conduct over time.

Related: AI tech boom: Is the artificial intelligence market already saturated?

Dimon concluded that AI will add “huge value” to the workforce, and if the firm replaces its employees with AI, he hopes they will be able to redeploy displaced workers in more suitable work environments.

“We expect to be able to get them a job somewhere local in a different branch or a different function, if we can do that, and we’ll be doing that with any dislocation that takes place as a result of AI.”

Magazine: AI Eye: Real uses for AI in crypto, Google’s GPT-4 rival, AI edge for bad employees