Shares of teen-centric discount retailer Five Below Inc. sank on Wednesday after the company forecast full-year profit and sales that fell short of Wall Street’s expectations.

Source link

sinks

MicroStrategy’s stock sinks after plan to offer convertible debt to buy bitcoin

Shares of MicroStrategy Inc. slumped Tuesday, as the business-analytics software company and bitcoin play’s plan to offer convertible debt gave investors a reason to take a breather following the stock’s recent sprint to a 24-year high.

Also weighing on MicroStrategy’s stock

MSTR,

bitcoin dropped 1.5%, after rallying into record territory earlier in the session. That followed a 34% run-up in bitcoin

BTCUSD,

over the previous six sessions.

MicroStrategy said late Monday that the $600 million in senior notes due 2030 it plans to offer can be converted into shares of common stock, cash or a combination of both.

The notes will be part of a private offering, in which only people believed to be “qualified institutional buyers” can participate.

“MicroStrategy intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes,” the company stated.

The stock sank 10.5% in morning trading, after closing Monday at the highest price since March 17, 2000. That puts the stock in danger of suffering its biggest one-day selloff since it tumbled 19.6% on Nov. 9, 2022.

The pullback comes after the stock rocketed 94.1% amid a six-day win streak, which was the longest win streak in four months and the biggest six-day gain in three years.

Read: MicroStrategy stock rises 24% — tops $1,300 for first time in 24 years as bitcoin soars.

MicroStrategy’s market capitalization ballooned by about $11 billion over the past six days, to $22.6 billion at Monday’s close.

The company said in its annual report filed in February that as of Dec. 31, it had $2.21 billion in debt.

S&P Global Ratings rates MicroStrategy’s credit at CCC+, which is seven-notches deep into speculative grade, or “junk,” territory.

The company said the interest rate, conversion price and other items related to the latest debt offering will be determined when it prices, which is still unknown.

MicroStrategy’s stock has hiked up 89%, while bitcoin has climbed 59.5%, the SPDR S&P Software & Services ETF

XSW

has slipped 0.9% and the S&P 500 index

SPX

has gained 6.6%.

GALA, the native token of Gala Games, is under immense selling pressure as of early September 2023. Trackers show that the token is down 72% from 2023 peaks when it soared to $0.062 in late January 2023. From there, the token has been edging lower, sinking to $0.017 at spot rates, unwinding over 95% of gains posted in early 2023. To illustrate, GALA is cents away from retesting all-time lows registered in late 2022 at around $0.016.

GALA Plunging

The drawdown could be pinned to the unfavorable market-wide bear market conditions that have seen top coins, including Bitcoin and Ethereum, surge before dumping, dragging altcoins even lower. The slowdown across Bitcoin has been mirrored in GALA as the token edges lower, reversing gains posted on August 29.

On this day, Bitcoin rose after a US Court of Appeal ruled in favor of Grayscale, the issuer of GBTC. Even though the court didn’t direct the Securities and Exchange Commission (SEC) to convert GBTC trust to an exchange-traded fund (ETF), the judge didn’t provide clear reasons why they denied Grayscale’s request. BTC prices rallied as odds of the US approving a spot Bitcoin ETF rose, lifting altcoins, including GALA. However, bears have successfully peeled back losses, as the daily chart shows.

CEO Versus Co-Founder

Beyond market factors, GALA may plunge to all-time lows primarily because of internal wrangles that could heap more pressure on the token that’s already struggling against unrelenting bears. Court documents show that CEO Eric Schiermeyer and co-founder Wright Thurston filed lawsuits against each other.

Filings show that Schiermeyer blames the co-founder for illegally obtaining and selling $130 million of GALA. The CEO also claims the co-founder stole node licenses for operating nodes within the Gala game ecosystem. He also cites Thurston’s history of founding companies that often in bankruptcy. The CEO wants the co-founder replaced as director.

The co-founder and his investment vehicle, True North Investments, accuse the CEO of wasting millions of dollars in company assets and engaging in fraudulent practices that harmed the company. The co-founder claims the CEO misused millions, including $600 million of assets, and lending millions of dollars from Gala Games to himself. They also alleged that the CEO created entities in Switzerland and Dubai that, in reality, should belong to Gala Games. The co-founder wants to kick out the CEO, who has held the office since 2021.

Featured image from Canva, chart from TradingView

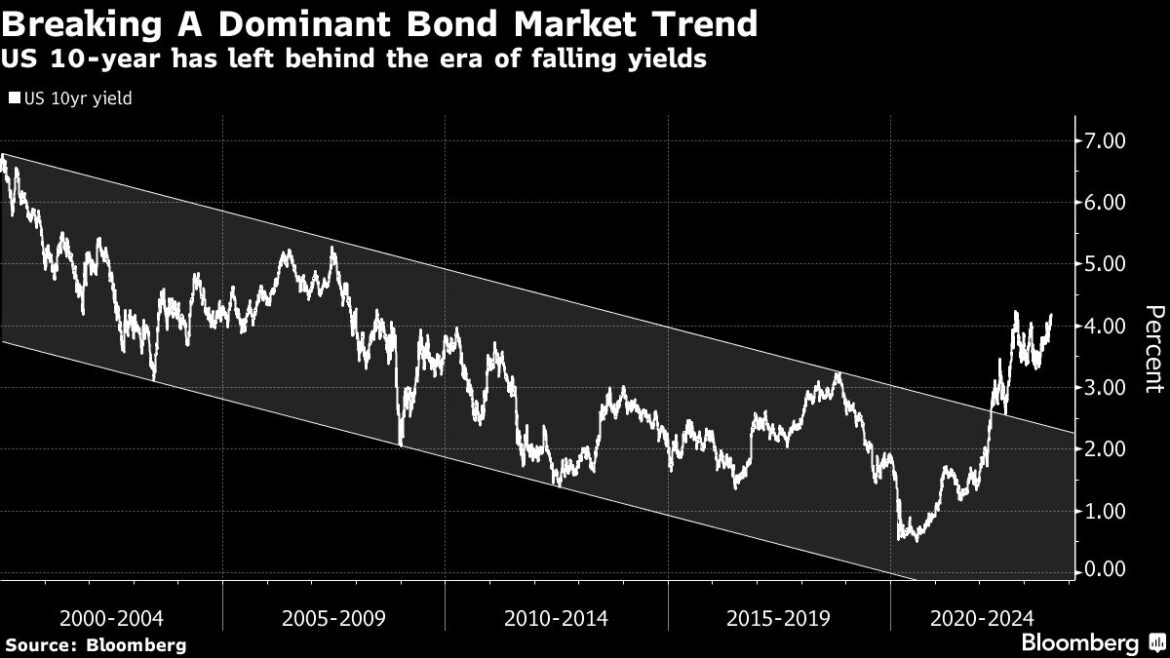

(Bloomberg) — All around the world, bond traders are finally coming to the realization that the rock-bottom yields of recent history might be gone for good.

Most Read from Bloomberg

The surprisingly resilient US economy, ballooning debt and deficits, and escalating concerns that the Federal Reserve will hold interest rates high are driving yields on the longest-dated Treasuries back to the highest levels in over a decade.

That’s prompted a rethink of what “normal” in the Treasury market will look like. At Bank of America Corp., strategists are warning investors to brace for the return of the “5% world” that prevailed before the global financial crisis ushered in a long era of near-zero US rates. And BlackRock Inc. and Pacific Investment Management Co. say inflation could remain stubbornly above the Fed’s target, leaving room for long-term yields to push even higher.

“There is a remarkable repricing higher in longer-term rates,” said Jean Boivin, a former Bank of Canada official who now heads the BlackRock Investment Institute.

“The market is coming more to the view that there is going to be long-term inflation pressures despite recent progress,” he said. “Macro uncertainty is going to remain the story for the next few years, and that requires greater compensation to own long-dated bonds.”

It’s a sharp break for markets that last year started positioning for a recession that would push the Fed to ease monetary policy, raising hopes for a sharp rebound from a brutal 2022 that sent Treasuries to the deepest losses since at least the early 1970s.

While higher rates will soften the blow by boosting bondholders’ interest payments, they also threaten to weigh on everything from consumer spending and home sales to the prices of high-flying tech stocks. What’s more, they will increase the US government’s financing costs, worsening the deficits that are already forcing it to borrow some $1 trillion this quarter to cover the gap.

Read More: Yardeni, Economist Who Cried ‘Bond Vigilantes,’ Spots Them Again

The recent selloff has hit long bonds the hardest and wiped out the broader Treasury market’s gains this year, putting it on pace for the third straight annual loss. It has also pulled down stock prices, which rallied strongly until this month on expectations about the Fed’s path.

It’s possible the latest turn will prove off base, and some Wall Street forecasters are still calling for an economic contraction that would put downward pressure on consumer prices.

Moreover, inflation expectations have remained moored this year as the pace slowed sharply from last year’s highs, a sign the market is anticipating it will eventually draw back near the Fed’s 2% target. The personal consumption expenditures index, the Fed’s preferred measure of inflation, rose at a 3% pace in June. That’s down from as much as 7% a year earlier.

What Bloomberg’s Strategists Say…

“The short-term real neutral rate that underpins the US economy will reach 2.5% by the end of this year, according to researchers at the New York Fed. Given that average PCE inflation hit 3.7% in the second quarter, the Fed may be forced to tighten its policy benchmark to at least 6%.”

– Ven Ram, macro strategist, Markets Live

Click here for full report

But many now expect a soft landing that would leave inflation the dominant risk. That was underscored this week by the release of the Federal Open Market Committee’s meeting minutes from July, when officials expressed concern that more rate hikes may still be needed. They also indicated the Fed may keep paring its bond holdings even when they decide to ease rates to make policy less restrictive, threatening to keep another drag on the bond market.

That helped push Treasury yields up this week, with those on benchmark 10-year notes climbing as high as 4.33%. That’s just shy of the October peak, which was the highest since 2007. Thirty-year yields hit 4.42%, a 12-year high. Yields pared the jump on Friday.

Broader economic shifts are also driving speculation that the low rates — and inflation — of the post-crisis period were an anomaly. Among them: demographics that may push up wages as aging workers retire; a shift away from globalization; and drives to combat global warning by shifting away from fossil fuels.

“If inflation is going to be sticky and high, I don’t want to own long-term bonds,” said Kathryn Kaminski, chief research strategist and portfolio manager at AlphaSimplex Group.

“People are going to need more term premium to own long-term bonds,” she said, referring to the higher payments investors normally demand for the risk of parting with their money for longer.

Even with the recent rise in yields, though, no such premium has returned. In fact, it remains negative as long-term rates hold below short-term ones — an inversion of the yield curve that’s usually seen as a harbinger of a recession. But that gap has started to narrow, cutting a New York Fed measure of the term premium to around minus 0.56% from nearly minus 1% in mid-July.

That upward pressure has also been exacerbated by US federal spending, which is creating a flood of new debt sales to plug the deficit even as the economy remains at — or near — full employment. At the same time, the Bank of Japan’s decision to finally allow 10-year yields there to push higher will likely cut Japanese demand for US Treasuries.

BlackRock’s Boivin says there’s major shift underway at the world’s central banks. For years, he said, they kept interest rates well below the rate that’s considered neutral to spur their economies and ward off the risk of deflation.

“This has been flipped now,” he said. “So even if the long-term neutral rate is not changed, central banks will hold policy above that neutral rate to stave off inflationary pressure.”

(Updates to add Yardeni tout.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Shares of AT&T Inc. were falling again Monday after a Citi Research analyst weighed in with a more cautious view in light of recent reporting on legacy use of lead-sheathed cables within the telecommunications industry.

Citi’s Michael Rollins cut his rating on AT&T’s stock

T,

to neutral from buy Monday, writing that it was among names that could see an “overhang” following The Wall Street Journal’s recent reporting on risks related to industry’s historical use of lead-sheathed cabling as Wall Street works to understand potential financial implications.

He also downgraded shares of Frontier Communications Parent Inc.

FYBR,

and Telephone & Data Systems Inc.

TDS,

to neutral from buy, and he already had a neutral rating on Verizon Communications Inc.’s stock

VZ,

“First, copper network deployed with possible lead sheathing could be a significant percentage of the legacy network deployed nationally with varying exposures for each firm,” Rollins wrote. He said he was “unable to specifically quantify financial risks (if anything material)” for wireline telecommunications companies stemming from these issues, though “the timing to receive more information could take at least a couple months and full resolution could take years.”

AT&T’s stock was off 3.8% in Monday morning action, to a recent $13.95, and on track to close at its lowest level since March 24, 1993, according to Dow Jones Market Data. The stock is on pace to spend a ninth-straight session without a daily gain, factoring in one day of flat performance last week alongside a string of daily losses.

“We still expect the company to display forward progress on cash flow generation and setting the stage to reduce net debt leverage over the next two years before considering any potential liabilities, if anything material, associated with lead sheathed cables,” Rollins wrote, though he called out “uncertainty from the industry’s use of lead-sheathed cabling” as a key reason for the downgrade.

See also: AT&T sees ‘incredibly healthy’ wireless market, even as several factors will ding growth this quarter

Frontier shares were down 8.2%, while TDS shares were off 5.0%. Verizon’s stock was down 1.6% and on pace for its eighth consecutive losing session.

USTelecom, a trade association that counts AT&T and Verizon as members, said in a statement that the telecommunications industry “has a long tradition of closely following science and evidence as it relates to public health, environmental protection, and worker safety issues,” while “safe work practices within the industry have proven effective in reducing potential lead exposures to workers.”

There are “many considerations” that go into deciding whether to remove legacy cables, “including those regarding the safety of workers who must handle the cables, potential impacts on the environment, the age and composition of the cables, their geographic location, and customer needs as well as the needs of the business and infrastructure demands,” the spokesperson continued.

The trade group said in a prior statement that it had “not seen, nor have regulators identified, evidence that legacy lead-sheathed telecom cables are a leading cause of lead exposure or the cause of a public health issue.”

Representatives from Frontier and TDS couldn’t immediately be reached for comment.

Rollins noted in his report that “Verizon and AT&T indicated their expectation as that the exposure should be small,” though he said that “for Verizon, we learned the term ‘small’ could be as much as 20% of its copper network infrastructure.”

Don’t miss: Verizon CEO says the wireless market isn’t such a bad business after all

He joined JPMorgan’s Philip Cusick, who downgraded AT&T’s stock Friday and mentioned potential lead-cable liabilities as a concern.

SVB MoffettNathanson analyst Craig Moffett weighed in on the issue as well Monday, calling out heavy uncertainty.

“The unsatisfying, but honest, answer is that at this point we have nothing but unknowns to work with and no real way to quantify the companies’ exposures,” he wrote. “Lead risk is clearly not a good thing, but we don’t know how bad it will ultimately be. It would be disingenuous to try putting firm numbers around it.”