As bitcoin edges closer to its peak historical value, the meme token domain is outperforming many within the crypto economy, boasting a more than 38% increase over the last day. Just four days prior, the meme coin market’s valuation stood at $34.32 billion, only to soar to $61.59 billion today. From Dogecoin to Shiba Inu: […]

As bitcoin edges closer to its peak historical value, the meme token domain is outperforming many within the crypto economy, boasting a more than 38% increase over the last day. Just four days prior, the meme coin market’s valuation stood at $34.32 billion, only to soar to $61.59 billion today. From Dogecoin to Shiba Inu: […]

Source link

Skyrocket

The stock market has been kind to growth-hunting investors recently. The tech-heavy Nasdaq Composite (NASDAQINDEX: ^IXIC) market index has gained more than 32% over the last 12 months, thanks to an improving economy making stock buyers comfortable with potentially risky ideas again.

But some excellent growth stocks didn’t punch a ticket to that freight train. This creates an imbalance between fantastic long-term business prospects and modest share prices. In turn, savvy investors get a tempting buy-in opportunity.

Let me show you why I’m especially entranced by the wide-open buying windows I see for media-streaming platform expert Roku (ROKU -0.20%) and restaurant management tools provider Toast (TOST 1.19%) right now.

Toast’s share price has drifted lower for a long time, while Roku took a steep dive last week. Either way, I think it’s high time to invest in these great growth stocks before the market comes to its senses and sends their share prices skyward again.

Roku: down 3% in 12 months

Roku looks downright spring-loaded for robust gains. Meanwhile, bearish investors seem to insist on jumping aboard this future rocket after it takes off, adding more pressure to an already low stock price in the process.

That’s cool. I don’t mind buying more shares on the cheap, kicking the big payoff down the road again.

The bears often point to bustling competition in the smart TV market, led by longtime Roku customer Walmart agreeing to acquire Roku-less TV maker Vizio for $2.3 billion. They also complain about slow revenue growth and an unprofitable hardware business. In one example, analyst firm Oppenheimer says it is staying on the sidelines with a “neutral” rating until Roku can deliver sustained growth in device sales in the “high-teens” percentage range.

But strong competition is nothing new for Roku, which holds a dominant share of global connected TV sales despite challenges from Alphabet‘s Google TV and Chromecast, Amazon‘s Fire TV, the Apple TV line, and in-house software solutions from leading TV makers Samsung and LG Electronics. If that horde of highly competent and deep-pocketed rivals can’t compete effectively with Roku, I don’t see much of a threat from Walmart’s Vizio purchase, either. And regulators are not guaranteed to approve the deal, either.

The stalled top-line growth looks poised for a rebound in the second half of 2024 and an even stronger continuation next year. Most of Roku’s revenue comes from ad sales, and that restrained market has suffered from limited ad-buying budgets since the inflation crisis started in 2021. Now that budget dollars are trickling back into the picture, more than two years’ worth of underpromoted products and services are calling out for attention. That’s why I expect a sudden swing, not a slow crawl, back to healthy digital ad sales.

And those profit-sapping hardware sales should actually be seen as a marketing expense. Keeping prices low when everyone else plays along with the inflation trend by raising their software fees and device price tags has helped Roku grow its user base dramatically in recent years.

The company reported 60 million active accounts and 19.5 billion hours of streaming activity in the fourth quarter of 2021. Two years later, Roku sported 80 million accounts and 29.1 billion streaming hours. That’s 33% more users, engaging in 49% more streaming hours. That’s how you build a huge user base that should command higher ad rates in the long term.

So I see absolutely nothing wrong with Roku’s current and future results. Profits can wait while the company gets busy building a truly great business platform for the decades ahead. This stock is an absolute steal, and you don’t want to be left empty-handed when those double-digit growth rates come along to light a fuse under Roku’s shares.

Toast: up 7% in 12 months

Here’s another underappreciated growth story.

Toast sells a cloud-based software platform that helps restaurant owners, café managers, food truck vendors, and other food service businesses run and manage their operations. From processing payments and publishing menus to tracking ingredient inventory and designing data-based marketing campaigns, the system covers many functions normally handled by software from different vendors (or notes scribbled on the breakroom’s whiteboard).

If that sounds like a winning idea to you, we’re on the same page. Many restaurant owners agree, and Toast’s services are rolling out across the country like wildfire. Fourth-quarter revenue rose 35% year over year, bottom-line losses shrank from $99 million to $36 million, and free cash flow landed at $92 million. The company sports 106,000 customer locations, a 34% jump from the year-ago quarter.

And just like Roku, Toast uses low-priced hardware systems as a loss-leader marketing tactic. The idea is, once you try the management system, you’ll never want to leave. Just get a foot in the door. Those unprofitable credit card readers and order-taking tablets should pay off in the long run.

“We are well on our way to becoming the technology platform of choice for the entire restaurant industry,” CEO Aman Narang said on the earnings call with anaylsts. “Even in our most penetrated markets where we have over 30% market share, we are still gaining share at a healthy clip.”

Yet, Toast’s stock trades nearly 70% below the all-time high of 2021, and shares are valued at just 2.9 times sales. That would be a reasonable ratio for some of Toast’s clients, since restaurants tend to run with notoriously low margins and high growth is reserved for an elite group of newer names.

This is a software company on a high-octane growth run. Double-digit price-to-sales ratios are common in this category, even for companies with weak or nonexistent cash flows.

I’ll admit that Toast’s management has made a few unfortunate mistakes so far, such as introducing an unpopular fee for payment processing. But the company also canceled that fee quickly, showing an ability to stay flexible and listen to customer concerns.

So I understand if you’d rather watch Toast for a while to make sure the company isn’t forming a habit of problematic public relations moments. At the same time, I can’t take my eyes off the low share price and slim price-to-sales ratio — and the Toast name keeps popping up whenever I grab some takeout or take the family out to eat. Keep an eye out for Toast-branded credit card readers to see for yourself.

This growth rocket deserves better, and I highly recommend taking a chance on this innovator before the rocket ship takes off.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet, Amazon, and Roku. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Roku, Toast, and Walmart. The Motley Fool has a disclosure policy.

The market is officially back in bull territory according to all definitions. That’s exciting for investors because bull market conditions mean average stock values are growing. But it’s important to keep that word “average” in mind, because while a rising tide lifts all ships, some go higher than others, and there are always a few that sink.

Toast (TOST -2.45%) and Dutch Bros (BROS -1.17%) are two hot stocks that should soar as the market leans more favorably toward growth stocks. If you learn more about them, you’ll understand why.

1. Toast: Bringing restaurants into the digital age

Just when you thought there were no more industries to disrupt, Toast aims to turn running a restaurant into a modern, tech-based business. It offers comprehensive solutions, including hardware and software, with services like payment processing and online ordering. It customizes its packages to restaurant type and offers varied tiers.

Restaurants are signing up in droves, and Toast says it has an edge over its competition because its technology works exclusively for the restaurant industry, unlike competitors that serve many industries.

These kinds of solutions can make a restaurant work much more efficiently, and growth has been incredible. Annualized recurring revenue, which takes into account the subscription model and is what Toast uses as its top-line growth metric, increased 40% year over year in the 2023 third quarter. The company added 25,000 restaurants to its roster over the past year, bringing the total to 99,000, and it says that is a tiny fraction of its serviceable market.

Toast stock is down 24% over the past year despite its high growth and large opportunity. Investors seem disappointed in its profitability. However, it’s been improving. Gross profit improved 50% in the third quarter over last year, and net loss contracted from $98 million to $31 million.

In bull markets, investors tend to be more forgiving toward unprofitability. They focus more on opportunity and driving growth. That’s good for Toast stock and its shareholders. At the current price, Toast stock trades at a price-to-sales ratio of 2.5, which is very reasonable for a company reporting such high growth in sales. Toast stock could soar as the economy improves, and it could handle an increase in valuation.

2. Dutch Bros: A fun take on coffee

If you think Starbucks has made it impossible for other coffee chains to rise up, you’ve never had the chance to drink a Dutch Bros Annihilator. That wouldn’t be surprising, since it operates fewer than 800 stores in total — and only in 16 states. However, it has broad ambitions and is rapidly expanding. In the regions where it operates, it has forged high loyalty, indicating that it has a viable business that could grow for a long time.

Revenue increased 33% year over year in the 2023 third quarter, and it has delivered impressive growth over the past few years, including through the pandemic.

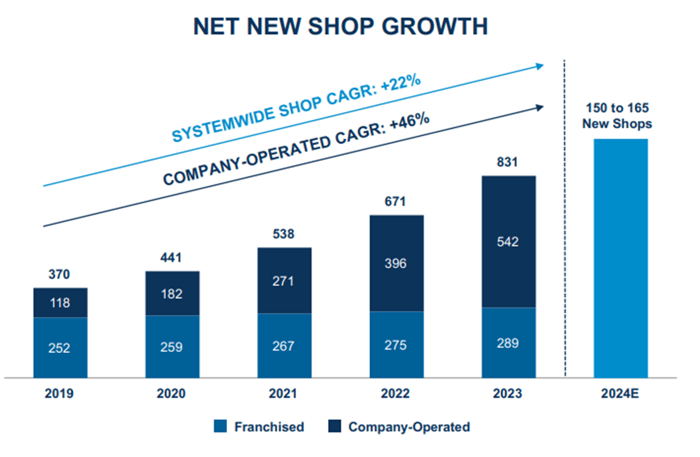

Image source: Dutch Bros.

Dutch Bros plans to open about 150 stores annually, and sees the opportunity for at least 4,000 new stores over the next eight years or so. As it moves across the country, it’s developing a strong brand presence, and as it scales, it’s growing into a formidable restaurant chain. To do this effectively, the founder-CEO is stepping down and making way for Christine Barone, a seasoned food executive, to bring the company into its next growth phase.

One problem Dutch Bros has been having is generating higher same-store sales. That’s likely due to economic headwinds, and the company also says it’s a result of a growth strategy it uses that involves opening many stores in one market to grab attention and establish itself. That leads to higher overall sales but can hurt same-store sales growth in the short run.

One place where it’s demonstrating strength is profitability. Dutch Bros has successfully raised prices to offset increased costs, and the company-operated shop contribution margin widened from 25.6% last year to 31% this year in the third quarter. It has also posted two consecutive quarters with net profits.

Dutch Bros stock trades at a price-to-sales ratio of 1.7. The company has a long growth runway, and the stock could soar in this bull market.

Semiconductor stocks outperformed the broader market by a wide margin in 2023, which is evident from the 66% gain clocked by the PHLX Semiconductor Sector index as compared to the 24% gain of the S&P 500 index as of Dec. 27.

Booming demand for artificial intelligence (AI) chips played a key role in driving the impressive surge in semiconductor stocks this year. Not surprisingly, prominent semiconductor companies such as Nvidia (NVDA) and Advanced Micro Devices (AMD -0.91%) have delivered healthy gains to shareholders in 2023.

The good part is that these semiconductor giants’ stocks could continue soaring in 2024 thanks to the emergence of a new catalyst.

The PC market is set to rebound in 2024

Sales of personal computers (PCs) have been declining every quarter since the beginning of 2022. That market experienced a sharp surge in demand in 2020 and 2021 thanks to the coronavirus pandemic, which led many consumers to buy new PCs as they shifted to doing more learning, working, and playing at home. However, that demand disappeared in 2022 and the market is estimated to have declined further in 2023.

The good news: 2024 may be the year when PC sales rise again. Market research firm IDC is predicting a 3.4% increase in PC shipments in the new year, while Canalys is forecasting a jump of 8%.

Both firms assert that the growth will be fueled by the advent of AI-enabled PCs, an aging installed base of existing computers, and the looming necessity for users to upgrade to Windows 11 as Microsoft is set to end support for Windows 10 in October 2025. What’s more, IDC is expecting the PC market to clock a compound annual growth rate of 3.1% through 2027.

A turnaround in PC sales would be great news for Nvidia and AMD as both companies supply chips for PCs and rely on this space for significant chunks of their top lines.

Nvidia and AMD would benefit

People install Nvidia’s graphics cards in PCs to power graphics-intensive tasks such as game-playing, 3D rendering, and video editing. Nvidia has a market share of more than 80% in discrete graphics cards and it’s already witnessing a nice recovery in sales of its PC graphics cards as manufacturers restock their inventories in anticipation of a recovery in demand.

In its fiscal 2024 second quarter, which ended July 30, Nvidia’s gaming revenue increased 22% year over year to $2.5 billion. This was followed by a year-over-year increase of 81% in the following quarter. Gaming accounted for nearly 16% of Nvidia’s revenue in the most recent quarter and the gaming business’s impressive momentum of late is likely to complement the AI-fueled growth of its data center business and lead to impressive growth in 2024.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

What’s more, Nvidia management said during the November conference call with analysts that “generative AI is quickly emerging as the new killer app for high-performance PCs.” The chipmaker is looking to target this market with a new platform that’s going to significantly increase the speed of AI inference workloads on PCs, which could lead to a jump in the adoption of its graphics cards.

AMD has also witnessed a sharp turnaround in its PC-focused business, which includes central processing units (CPUs) used in desktops, laptops, and workstations. The chipmaker’s revenue from this segment was up 42% year over year to $1.5 billion in the third quarter, and accounted for 26% of its top line.

AMD management said in an October conference call with analysts that sales of its Ryzen AI PC processors “grew significantly in the quarter as inventory levels in the PC market normalized and demand began returning to seasonal patterns.” CEO Lisa Su also added that AMD has launched more than 50 new notebook designs powered by the Ryzen AI processors, which are equipped with an on-chip AI accelerator to tackle AI workloads.

Even more exciting, AMD says that it is “working closely with Microsoft on the next generation of Windows that will take advantage of our on-chip AI Engine to enable the biggest advances in the Windows user experience in more than 20 years.” AMD seems set to ride the wave of recovery in PC sales, especially considering that it has been grabbing a bigger share of this market.

Analysts are expecting AMD’s revenue to increase 17% next year to $24 billion, but the company’s growing footprint in the AI data center chip space and a recovery in the PC market could help it deliver a stronger revenue jump. This, in turn, could send shares of AMD higher, which is why investors may want to load up on this semiconductor stock right away.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

3 Growth Stocks Expected to Skyrocket in 2024, According to Wall Street

In less than a week, Wall Street will turn the page on what’s been a stellar year for optimists. The 30-component Dow Jones Industrial Average climbed to a record high, while the growth-driven Nasdaq Composite has surged 43% year to date, as of the closing bell on Dec. 22.

Though a lot of credit for this rally goes to the “Magnificent Seven,” it was an overall strong year for growth stocks. The U.S. economy continuing to chug along, coupled with the prospect of the Federal Reserve reducing interest rates in 2024, has investors incredibly bullish on fast-paced companies as a whole.

But no two growth stocks are cut from the same cloth. Based on the consensus price targets of Wall Street analysts, three growth stocks are expected to skyrocket in 2024.

Plug Power: Implied upside of 102%

The first supercharged growth stock that Wall Street, collectively, sees rising by triple digits in the new year is hydrogen fuel-cell solutions company Plug Power (NASDAQ: PLUG). Wall Street’s consensus price target of $9.13 per share implies that Plug’s stock could gain 102% in 2024.

Plug Power optimists are counting on a continued shift to renewable energy sources by developed countries. In an effort to reduce their carbon footprints, the world’s largest economies are promoting greener transportation. The expectation is for hydrogen fuel-cell vehicles, along with green hydrogen infrastructure, to be part of that equation.

Aside from landing a green hydrogen deal in 2022 with e-commerce and logistics juggernaut Amazon, Plug’s biggest wins came in early 2021. It received an equity investment from SK Group, as well as forged a joint venture with French automaker Renault. The partnership with SK Group will focus on bringing hydrogen fuel-cell vehicles and infrastructure to Asian markets, while the joint venture with Renault will tackle Europe’s light commercial vehicle market.

Unfortunately, Plug Power’s attempts to rapidly expand its green hydrogen ecosystem are costing a pretty penny. Although the company’s sales growth is topping 50% on an annual basis, its cost of revenue is growing at an even faster pace. Through the first nine months of 2023, Plug reported a net loss of more than $726 million.

To build on this point, Plug Power made clear when it reported its third-quarter operating results that it’s going to need additional capital. A “going concern” warning was also included in the company’s financial statements, which suggests it doesn’t have adequate capital on hand to cover its liabilities over the next 12 months.

Another problem for Plug Power’s shareholders is the company’s dilutive money-raising efforts. Five years ago, Plug Power had approximately 219 million shares outstanding. As of Sept. 30, 2023, the company had more than 624 million shares outstanding. Ongoing dilution to pay for the company’s aggressive expansion efforts is doing shareholders no favor. It’s also a big reason a $9.13 price target seems unachievable in 2024.

Lexicon Pharmaceuticals: Implied upside of 293%

A second growth stock expected to skyrocket in 2024, based on the collective forecast of Wall Street analysts, is small-cap biotech company Lexicon Pharmaceuticals (NASDAQ: LXRX). Lexicon shares closed out Dec. 22 at $1.31. However, Wall Street’s consensus one-year price target suggests they’ll head to $5.15, which represents upside of 293%!

Two factors look to be fueling this incredibly optimistic price target: the launch of Inpefa and the ongoing development of LX9211.

In May, Lexicon earned its first true win when Inpefa (scientifically known as sotagliflozin) was approved by the U.S. Food and Drug Administration (FDA) as a treatment to reduce heart failure in patients with type 2 diabetes, chronic kidney disease, and other cardiovascular risk factors. Sotagliflozin was previously rejected in 2019 by the FDA as a treatment for patients with type 1 diabetes.

Inpefa is unique in that it’s the first-approved SGLT1/SGLT2 inhibitor. Whereas a handful of SGLT2 inhibitors, which block glucose absorption in the kidneys, have found their way onto pharmacy shelves, a dual inhibitor (SGLT1 blocks glucose absorption in the intestines) hadn’t been approved until now. Although peak sales estimates vary, Inpefa is expected to ramp from around $4 million in sales in 2023 to potentially north of $500 million annually by 2028.

The other source of excitement is the late-stage development of LX9211, an AAK1 inhibitor that’s attempting to become the first non-opioid therapy for diabetic peripheral neuropathic pain in more than two decades. On Nov. 30, Lexicon enrolled its first patient in the phase 2b study that could expand the company’s product portfolio beyond Inpefa.

Similar to Plug Power, the biggest risk for Lexicon shareholders looks to be the prospect of dilution. Although Lexicon raised $143.7 million in gross proceeds by selling stock in June, operating losses are liable to continue as the company ramps up its marketing and branding efforts.

While I’m not convinced Lexicon has a shot at hitting $5 per share in 2024, a triple-digit percentage gain on the heels of Inpefa’s launch does seem doable in the new year.

Cassava Sciences: Implied upside of 316%

The third growth stock expected to skyrocket in 2024, according to Wall Street, is clinical-stage biotech company Cassava Sciences (NASDAQ: SAVA). Though shares ended the previous week at $23.94, Wall Street’s consensus price target for the company chimes in at a cool $99.50. For those of you keeping score at home, this represents upside potential of 316% in the new year.

Cassava Sciences first put itself on the map in 2021 when it released an interim analysis of its open-label phase 2b study involving simufilam for patients with Alzheimer’s disease. The first 50 people dosed with simufilam demonstrated mean improvements in cognition scores, as measured by the Alzheimer’s Disease Assessment Scale, at the six-, nine-, and 12-month mark. Considering how few drugs have been successful improving the quality of life for Alzheimer’s patients, optimists flocked to Cassava.

The company is currently in the midst of a randomized, 1900-patient, phase 3 trial with simufilam that’s expected to yield top-line 52-week results toward the end of 2024, with top-line 76-week results announced by mid-2025. With $142.4 million in cash and cash equivalents available as of Sept. 30, it would appear that Cassava has enough capital, and access to capital, to see this extensive trial through to completion.

On the other hand, Cassava Sciences has faced serious allegations that its trials are flawed. In particular, an investigative report by the City University of New York (CUNY) found that an associate professor at CUNY’s school of medicine may have deliberately falsified scientific findings in 14 out of 31 allegations. Though Cassava Sciences management team has repeatedly blamed short-sellers for pushing its stock lower, any validity to these allegations would be highly detrimental to the company and its only developed experimental therapy.

To add fuel to the fire, investors have witnessed a number of success stories when it comes to treating Alzheimer’s in phase 2 clinical trials only to see these same companies fall flat in expanded phase 3 studies. Historically, few late-stage indications have a poorer success rate than Alzheimer’s.

While it’d be great to see Alzheimer’s drugs succeed, it’s far more realistic to expect Cassava Sciences to fall well short of Wall Street’s lofty price target.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

3 Growth Stocks Expected to Skyrocket in 2024, According to Wall Street was originally published by The Motley Fool

1 Artificial Intelligence (AI) Stock That Could Skyrocket in 2024 if the Fed Cuts Rates

The Federal Reserve influences more areas of your life than you think. It’s not only the body that determines the prime rate that can skew what mortgage or auto loan rates you get, but it also affects investors’ risk appetites for stocks versus guaranteed income assets, like bonds.

However, one stock is at the crossroads of both trends, as Upstart (UPST 0.14%) is an aggressive investment pick and a company operating within the lending industry. The past year has been bumpy for Upstart, but it could skyrocket if the Fed cuts rates in 2024.

Upstart’s model is more accurate than a traditional FICO score

Upstart’s program, powered by artificial intelligence (AI), helps lenders assess creditworthiness using alternative methods like work experience, education history, and other items not typically accounted for by the industry-standard FICO score.

Upstart’s proprietary model can assess risk better than the FICO model by painting a more complete picture of a loan applicant. This allows lenders to approve the same number of loans yet see 53% fewer defaults.

For example, an applicant may have a FICO score of 700 or higher yet have an E- Upstart grade (Upstart uses a letter-grade system to convey a consumer’s chances of defaulting, with an E- being the lowest possible score). A lender using the traditional FICO model would give this borrower the best rate and assume little risk, while the Upstart model would flag them and either reject them or increase the rate to compensate for the increased risk.

Upstart has seen a 12.9% default rate for these individuals. Compared to the inverse of this example (FICO score below 639 and an A+ Upstart grade) default rate of 5.6%, it shows that Upstart’s model works much better than the FICO score.

So, why are lenders still using FICO if Upstart is so much better? Upstart’s current product offering is centered around personal and auto loans, so switching half of a lending system over to use Upstart’s model is cumbersome. However, Upstart has seen multiple customer wins in personal lending, showing its product is starting to catch on.

Unfortunately for Upstart, the high rates set by the Fed have caused personal loan rates to skyrocket, so consumers aren’t as apt to borrow. Furthermore, many cars were purchased and financed at incredibly low rates from 2020 to 2021, and those loans are still working their way through the system. But 2024 may be the year these rates come down.

Will the Fed cut rates in 2024?

The CME FedWatch Tool gives investors the odds of what the Fed will do in its next meeting. Although it expects rates to stay steady in the next two Fed meetings, it gives a 44% chance of a rate cut in March 2024. Fast forward to December 2024, and it expects rates to be in these ranges:

| Target Rate Set in December 2024 | Probability |

|---|---|

| 3.50%-3.75% | 4.40% |

| 3.75%-4.00% | 17.20% |

| 4.00%-4.25% | 29.40% |

| 4.25%-4.50% | 27.50% |

| 4.50%-4.75% | 15.20% |

| 4.75%-5.00% | 5.00% |

Note: Probabilities do not add up to 100% due to the omission of rates with less than 1% probability of happening. Data source: CME Group.

Keep in mind that the current rate is set between 5.25% and 5.5%, so there is a high likelihood we’ll see rate cuts of some kind next year (the tool gives it a 0.1% chance the rates will remain the same for the next year). That’s fantastic news for Upstart, as substantial cuts could bring potential borrowers out of the woodwork.

If these cuts happen, Upstart’s stock probably will rise because its business will ramp up from today’s depressed levels. Upstart originated about 114,000 loans in Q3, down from more than 188,000 in 2022 and 362,000 in 2021. Interest rates were much lower in these periods, which allowed Upstart to thrive on volume. Without the low rates, Upstart’s revenue plummeted.

Data source: YCharts.

A reversal of the Fed’s trend will drastically help Upstart and may well make it into one of the hottest stocks on Wall Street. So, if you’re confident that the Fed will cut rates next year, Upstart may be a fantastic stock pick for 2024.

Trump NFTs sales volume skyrocket by 3,700% following mug shot release

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Memecoin madness has arrived on Coinbase’s Ethereum layer-2 scaling solution Base, bringing with it everything from remarkable shitcoin surges to classic token rug pulls.

On July 30, memecoin traders were snapping up a suite of questionable tokens on Base, with one Brian Armstrong-themed memecoin dubbed “BALD” experiencing a 289,000% gain within the first 14 hours of trading.

This is despite the Bald token not having an official website or any discernable purpose, creator or utility.

According to data from blockchain analytics service Lookonchain, a small number of investors managed to score a 100,000% return on a relatively small initial investment.

Four separate wallet addresses swapped 0.5 Ether (ETH) — worth roughly $950 at the time — into BALD within the first four minutes of trading. Eight hours later, the wallet addresses swapped their BALD into ETH for a total of 554 ETH, which is worth more than $1 million at current prices.

These 4 addresses spent 0.534 $ETH($1K) to buy 50M $BALD (50% of the total supply) within 4 mins of $BALD starting trading.

Then sold 37M $BALD for 554 $ETH($1.04M).

Earned $1M with $1K in 1 day! pic.twitter.com/gXIDRjbhic

— Lookonchain (@lookonchain) July 30, 2023

Another memecoin featuring the ticker BASED has also gone on an incredible rally, surging well over 1,000,000% in the last 20 hours.

At current, BASED commands a whopping $1.39 billion fully-diluted market cap, making it more valuable — at least on paper — than mainstay blockchain networks Aave (AAVE) and Optimism (OP).

Rug pulls and memecoin gambling

However, as many investment professionals have stated in the past, memecoins are notorious for their massive swings in price and any investment in them should be treated as gambling adjacent.

The sudden influx of hundreds of new, un-backed tokens also brings with it the potential danger of scams, rug pulls and severe financial losses.

One developer reportedly made off with an undisclosed sum of ETH deposited by eager investors, promising to return it after they had multiplied their funds.

OMG some presale on Base just rugged and dev sent a whole ass apology letter pic.twitter.com/rcmMcP7F7i

— punished echo (@OHEXE_ECHO) July 30, 2023

“You will get your ETH back. I just need to multiply it,” the developer wrote upon deleting their Telegram account.

Meanwhile, others have warned that the memecoin surge is likely already over.

Pseudonymous professional trader “Horse” informed his 180,000 followers that FOMO buying into tokens such as BALD at this late stage would most likely be a bad idea.

You are not early to $BALD if you are not already up.

The market is leap frogging from one thing to the next right now.

Don’t be someone’s exit liquidity on this fine Sunday.

— HORSE (@TheFlowHorse) July 30, 2023

Related: UFO hearing: Crypto degens spare no time crafting 50 alien shitcoins

Coinbase launched the Base network for developers on July 13; as such, trading on Base remains relatively technical.

Interacting with tokens on the Base network requires investors to send their ETH to a Coinbase developer contract address and then swap that ETH into the token of their choice on a specialized decentralized exchange such as LeetSwap.

Notably, Base users are unable to bridge their tokens off the network. Once ETH is deposited on the network, it cannot be transferred back to another usable chain like Ethereum until Base developers introduce a token bridge.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How smart people invest in dumb memecoins — 3-point plan for success

Cava Group (CAVA 2.14%) is one of the big stories of 2023. It’s one of the few companies that have decided to go public amidst a bear market and tumultuous economy, but the timing was right, and the initial public offering (IPO) took place just as some indications showed the end of the bear market.

The stock exploded onto the market, ending its first day with a closing price of nearly $43, or almost double the IPO price of $22. Now, a month later, it’s up another 18%. That’s a lot of movement for a short amount of time.

Many are comparing Cava to fast-casual king Chipotle Mexican Grill (CMG -2.08%), which has been an incredible stock to own over time. Is it time for it to move over for the new kid restaurant on the block? Let’s see which of these two stocks has better odds today.

The case for Cava: new and fresh

The main investing thesis for Cava stock is that it’s just getting started. If you’d invested in Chipotle when it was just starting out, you’d be 4,500% richer today. That kind of potential is very compelling. Cava is demonstrating momentum, and that’s catching investors’ eyes, especially when there are so few IPOs in today’s market.

Cava is a similar idea to Chipotle, the original fast-casual cuisine: fresh, healthy food at a moderate price point. Chipotle does it with Mexican food, while Cava does it with Mediterranean food. Cava operates 263 locations and expects to open another 34 to 44 this year. It also owns Zoe’s Kitchen. Management sees the opportunity to have 1,000 restaurants by 2032, and it plans to expand into new markets in the U.S.

One thing that stands out is Cava’s comparable sales (comps), which have routinely been in the low double digits. That’s growth coming from existing restaurants, and it demonstrates customer engagement and loyalty.

The restaurant-level profit margin is 20%, which is solid unit economics. That doesn’t take into account overall company expenses, but it’s a viable model that should lead to company profits as Cava opens new restaurants and scales. That will be one of the most important things to watch over the next few years as Cava grows: Does opening new restaurants bog it down in increased expenses, or can Cava do that efficiently and become profitable?

If the business continues to progress with strong revenue growth and reaches profitability, owning Cava stock could lead to incredible gains.

The case for Chipotle: old, and still fresh

It’s easy to argue that Cava is new and has a long growth runway, but don’t count out companies that have already achieved success. In terms of a growth runway, while Cava sees an opportunity to about quadruple its store count over the next nine years, Chipotle sees an opportunity to double its store count at the same time, for a total of 7,000 stores. And this is a company that has already demonstrated that it can scale profitably.

As established as it is, it’s also still increasing comps in the double digits, along with net profits. Total revenue increased 17% in the 2023 first quarter over last year, with comps up 11%. It has very strong unit economics, with a restaurant-level operating margin of 25.6% in the first quarter.

Investors love Chipotle, and for good reason. The formula works, and it’s likely to keep going.

It’s a different landscape today

Cava stock debuted at a high price and it’s already richly valued, trading at a price-to-sales ratio of around 10. It’s hard to call Cava a bargain, but if it continues to demonstrate strong growth and becomes profitable, it could be a multi-bagger over time.

However, it’s still an unproven model, as well as it’s been doing. Scaling up is challenging, and many restaurant stocks that were supposed to be the next Chipotle didn’t make it. There are only a handful of truly great restaurant stocks that have achieved phenomenal returns over time.

When Chipotle went public, it had about double Cava’s store count, and it had been profitable for three years. Perhaps coincidentally, its stock also closed the first day at $42, so there many parallels here. A few weeks after its IPO, shares were trading at a price-to-sales ratio of 2.3, and a price-to-earnings ratio of 47. That highlights how some percentage of Cava’s growth is already priced into a somewhat inflated valuation for Cava stock at current levels.

To me, this contest boils down to investor risk tolerance level. If you see the potential with Cava stock, have a long-enough time horizon, and enjoy a higher risk level, you might be interested in Cava stock. If you’re an investor that appreciates a proven model and believes in a winners-keep-winning approach, you can feel comfortable that your money is likely to increase over time with an investment in Chipotle stock.

Which one is more likely to skyrocket? In the short term, at least, probably Cava. But it’s also a riskier play, and long-term, you should buy the stock that fits your tolerance level.

Wall Street Thinks These 3 Warren Buffett Stocks Could Skyrocket the Most

Warren Buffett looks ahead a lot more than he looks back. That’s what every investor should do.

The Oracle of Omaha had several big winners in Berkshire Hathaway‘s (BRK.A 0.35%) (BRK.B -0.16%) portfolio during the first half of 2023. But those aren’t the stocks that will necessarily be his best stocks looking ahead. Wall Street thinks these Buffett stocks could skyrocket the most over the next 12 months.

1. Liberty SiriusXM Group

Wall Street is more bullish about Liberty SiriusXM Group (LSXMA 2.44%) than any other Buffett stock. The consensus 12-month price target for the media stock reflects an upside potential of more than 39%.

Not every analyst is gung-ho about Liberty, but most are. Of the eight analysts recently surveyed by financial technology expert Refinitiv, six rate the stock as either a buy or a strong buy. The remaining two analysts recommend holding the stock.

Why is Wall Street generally optimistic about Liberty? For one thing, there’s the low valuation. Shares currently trade at a forward earnings multiple of less than 11.

The company’s future also looks brighter. SiriusXM, of which Liberty owns nearly 83%, raised its full-year adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) and free cash flow guidance in April. Liberty is also on schedule to split off its Atlanta Braves operation and create a new Liberty Live Group tracking stock this month.

2. Bank of America

Most bank stocks have been hit hard in the wake of the failures of several U.S. banks earlier this year. Bank of America (BAC 0.88%) is no exception. Shares of the big bank have tumbled around 12% year to date.

But analysts expect a rebound. The average 12-month price target is nearly 23% higher than BofA’s current share price.

Buffett appears to remain optimistic about Bank of America as well. He added to Berkshire’s stake in the company during the first quarter of 2023.

Wall Street and Buffett don’t always see eye to eye, but they agree about Bank of America. I suspect that’s due primarily to two factors. First, the stock is attractively valued, with shares trading at only 8.3 times forward earnings. Second, BofA continues to deliver solid revenue and profit growth and maintains a strong balance sheet.

3. Citigroup

You can add another bank stock to the list of Buffett’s favorite stocks these days. He also scooped up more shares of Citigroup (C 0.79%) in the first quarter.

Unlike Bank of America, Citigroup’s share price is in positive territory so far in 2023. It’s still down from the high set earlier this year, however.

Wall Street is almost as bullish about Citigroup as it is about BofA. The consensus 12-month price target reflects an upside potential of almost 23%.

Citigroup is even cheaper than Bank of America, with the stock trading at around 7.4 times forward earnings. Its revenue and earnings continued to climb in the first quarter, like BofA. Citi’s balance sheet also remains in good shape.

Is Wall Street right?

I’m not entirely convinced that these three stocks will be Buffett’s biggest winners over the next 12 months. My view is that at least a couple of factors could cause Wall Street to be wrong.

First, it’s possible that the U.S. will enter into a recession either later this year or in the first half of 2024. If this happens, other stocks in Berkshire’s portfolio that are viewed as safe havens will likely outperform Liberty SiriusXM, Bank of America, and Citigroup.

Second, the effects of the banking crisis could linger longer than expected. I don’t think Bank of America or Citigroup is at risk. But even the strongest banks could feel the downward pull if more issues are uncovered within the industry.

Ultimately, though, valuations matter. Even if Liberty SiriusXM, Bank of America, and Citigroup don’t deliver the biggest gains for Buffett over the next 12 months, I think they should all make him plenty of money over the long run.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Keith Speights has positions in Bank of America and Berkshire Hathaway. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.