Bitcoin’s computing power has reached a new peak, ascending to 618 exahash per second (EH/s) as shown by the seven-day simple moving average. Currently, 56 entities are contributing at least 916.26 megahash per second (MH/s) to the network, with the mining pool Foundry USA at the forefront, delivering 204.41 EH/s. Bitcoin Edges Closer to Zettahash […]

Bitcoin’s computing power has reached a new peak, ascending to 618 exahash per second (EH/s) as shown by the seven-day simple moving average. Currently, 56 entities are contributing at least 916.26 megahash per second (MH/s) to the network, with the mining pool Foundry USA at the forefront, delivering 204.41 EH/s. Bitcoin Edges Closer to Zettahash […]

Source link

SMA

Bitcoin Price Consolidates Losses, Why 100 SMA Is The Key To Recovery

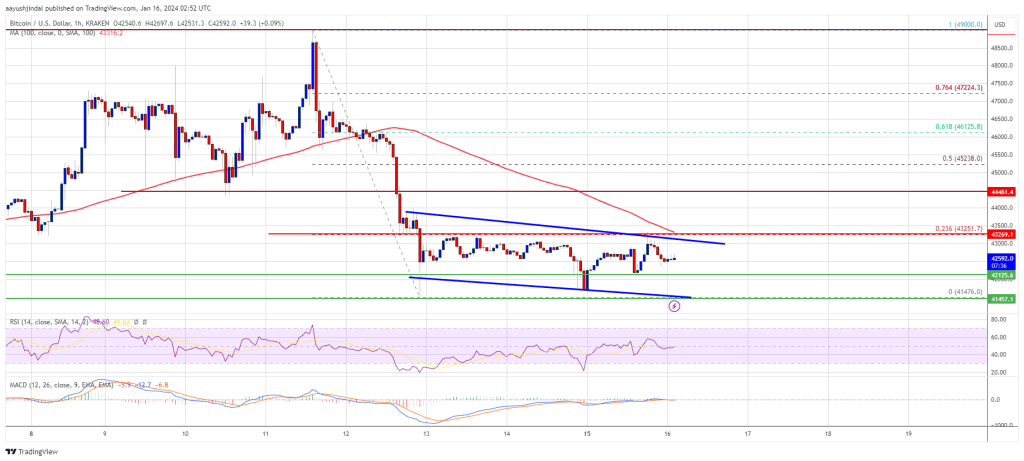

Bitcoin price is struggling below the $43,500 resistance zone. BTC could start another decline if it stays below the 100 hourly SMA.

- Bitcoin price started a major decline from the $49,000 resistance zone.

- The price is trading below $43,250 and the 100 hourly Simple moving average.

- There is a key declining channel forming with resistance near $43,050 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh decline if it stays below the $43,250 resistance zone.

Bitcoin Price Turns Red

Bitcoin price started a major decline from the $49,000 resistance zone. BTC traded below the $46,500 and $45,000 support levels to enter a short-term bearish zone.

The bears even pushed the price below the $42,500 support zone before the bulls appeared. A low was formed near $41,476 and the price is now consolidating losses. It recovered a few points above the $42,000 level. The price tested the 23.6% Fib retracement level of the key drop from the $49,000 swing high to the $41,476 low.

Bitcoin is now trading below $43,250 and the 100 hourly Simple moving average. There is also a key declining channel forming with resistance near $43,050 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $43,000 level and the channel zone. The first major resistance is $43,250 or the 100 hourly Simple moving average. A clear move above the $43,250 resistance could send the price toward the $44,450 resistance.

Source: BTCUSD on TradingView.com

The next resistance is now forming near the $45,250 level. It is near the 50% Fib retracement level of the key drop from the $49,000 swing high to the $41,476 low. A close above the $45,250 level could start a strong increase and send the price higher. The next major resistance sits at $47,000.

More Losses In BTC?

If Bitcoin fails to rise above the $43,250 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $42,120 level.

The next major support is $41,500. If there is a close below $41,500, the price could gain bearish momentum. In the stated case, the price could drop toward the $40,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $42,120, followed by $41,500.

Major Resistance Levels – $43,050, $43,250, and $44,450.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

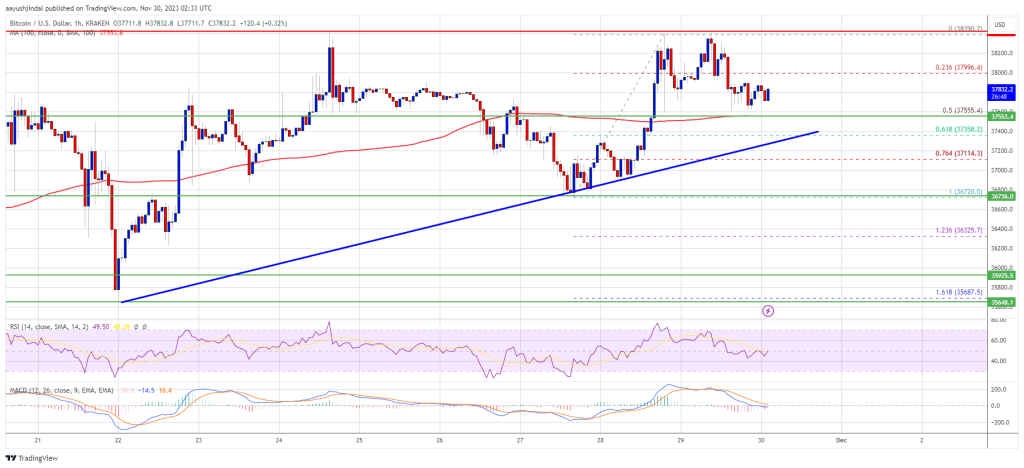

Bitcoin price failed again to clear the $38,500 resistance zone. BTC is consolidating above the 100 hourly SMA and might attempt another increase.

- Bitcoin is still facing heavy resistance near the $38,500 zone.

- The price is trading above $37,400 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support near $37,350 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could make another attempt to clear the $38,500 resistance unless it breaks below $37,350.

Bitcoin Price Holds Support

Bitcoin price remained well-bid above the $37,500 support zone. BTC climbed higher above the $38,000 level and made another attempt to clear the $38,400 resistance zone.

However, the bulls failed to gain strength and the price peaked near $38,400. It is again correcting gains and trading below the 23.6% Fib retracement level of the upward move from the $36,721 swing low to the $38,390 high.

Bitcoin is now trading above $37,400 and the 100 hourly Simple moving average. There is also a key bullish trend line forming with support near $37,350 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $38,200 level. The first major resistance is forming near $38,400. The main resistance is still near the $38,500 level. A close above the $38,500 resistance might start a fresh rally.

Source: BTCUSD on TradingView.com

The next key resistance could be near $39,200, above which BTC could climb toward the $39,500 level. Any more gains might send BTC toward the $40,000 resistance.

More Losses In BTC?

If Bitcoin fails to rise above the $38,400 resistance zone, it could start another decline. Immediate support on the downside is near the $37,550 level or the 50% Fib retracement level of the upward move from the $36,721 swing low to the $38,390 high.

The next major support is near $37,350 and the trend line. If there is a move below $37,350, there is a risk of more downsides. In the stated case, the price could decline toward the $36,720 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $37,550, followed by $37,350.

Major Resistance Levels – $38,400, $38,500, and $39,200.