Either gold shares rise from here or gold prices take a dive.

Source link

Soaring

Home foreclosures are soaring nationwide – and rising fastest in these 5 states

Home foreclosures rose again in February as Americans continue to grapple with the ongoing cost-of-living crisis.

That is according to a new report published by real estate data provider ATTOM, which found that there were 32,938 properties in February with foreclosure filings, which includes default notices, scheduled auctions and bank repossessions. That marks an 8% increase from the prior year, although it is down 1% from the previous month.

“The annual uptick in U.S. foreclosure activity hints at shifting dynamics within the housing market,” said ATTOM CEO Rob Barber. “These trends could signify evolving financial landscapes for homeowners, prompting adjustments in market strategies and lending practices.”

However, the number of foreclosure completions fell in 28 states in February. Lenders repossessed 3,397 properties in February, down 14% from the previous month and 11% from the prior year. The biggest declines took place in Georgia, where completed foreclosures fell 52%, and in New York, with a decline of 41%.

401(K) ‘HARDSHIP’ WITHDRAWALS SURGE TO ANOTHER RECORD AS HIGH INFLATION STINGS

Still, foreclosures surged in other states. In South Carolina, foreclosures surged 51%, while Missouri saw a 50% jump and Pennsylvania a 46% increase. Foreclosures in Texas rose 7%, and in Indiana they climbed 0.8%.

Although foreclosures are rising, they remain well below the levels recorded during the 2008 financial crisis.

But the problem could soon get worse as high home prices, mortgage rates and property taxes bite Americans.

MORTGAGE CALCULATOR: SEE HOW MUCH HIGHER RATES COULD COST YOU

Housing affordability is the worst it has been in decades, thanks to a spike in home prices and mortgage rates. Combined, the two have helped to push the typical salary required nationwide for homeownership up to $106,500 — a stunning 61% increase from the $59,000 required just four years ago, according to Zillow.

There are several reasons to blame for the affordability crisis.

The Federal Reserve’s aggressive interest-rate hike campaign sent mortgage rates soaring above 8% for the first time in nearly two decades last year. Rates have been slow to retreat, hovering near 7% as hotter-than-expected inflation data dashed investors’ hopes for immediate rate cuts.

The average rate for a 30-year fixed loan rose to 6.74% this week, Freddie Mac reported, well above the pandemic-era lows of 3%.

Even though mortgage rates are nearly double what they were three years ago, home prices have hardly budged.

That is largely due to a lack of available homes for sale. Sellers who locked in a low mortgage rate before the pandemic began have been reluctant to sell, leaving few options for eager would-be buyers.

Original article source: Home foreclosures are soaring nationwide – and rising fastest in these 5 states

BlackRock’s IBIT Joins Elite ‘$10 Billion Club’ Amidst Soaring Demand

The demand for spot Bitcoin exchange-traded funds (ETFs) has surged since their recent approval on January 10, with BlackRock’s IBIT Bitcoin ETF leading the way. This ETF has reached impressive milestones in less than two months, attracting significant investor interest and opening doors for various market participants to invest in the largest cryptocurrency directly.

As institutional and retail investors flock to these new investment vehicles, market experts predict a bullish trend and anticipate a potential price surge.

Bitcoin ETF Frenzy

According to Bloomberg ETF expert Eric Balchunas, BlackRock’s IBIT Bitcoin ETF has quickly joined the esteemed “$10 billion club,” reaching the milestone faster than any other ETF, including Grayscale’s Bitcoin Trust (GBTC), noting that only 152 ETFs out of 3,400 have crossed the threshold.

Balchunas notes that IBIT’s ascent to this club was primarily driven by significant inflows, which accounted for 78% of its assets under management (AUM). This reflects the growing appetite for Bitcoin exposure among investors seeking diversified and regulated investment options.

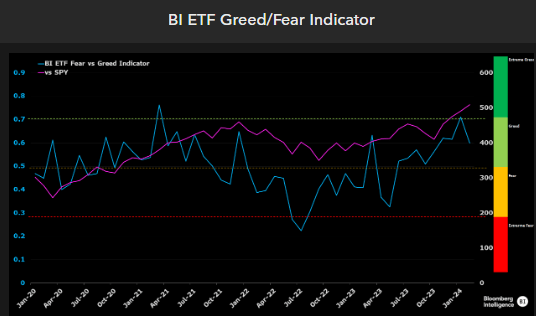

In particular, the current trajectory of the ETF market paints a picture of resilience and bullish sentiment in the market. Equity ETF flows, and leveraged trading levels are positive indicators, although they have not yet reached the euphoria seen in 2021, Balchunas notes.

However, Bloomberg’s new BI ETF Greed/Fear Indicator, which incorporates various inputs, highlights the optimistic outlook shared by ETF investors, as seen in the chart below.

On this matter, crypto analyst “On-Chain College” went to social media X (formerly Twitter) to emphasize the significant demand for Bitcoin as evidenced by its rapid departure from exchanges.

In its analysis, On-Chain College highlights that Bitcoin ETFs buy approximately ten times the daily amount of BTC mined. At the same time, the upcoming halving event will further reduce the mining supply. The analyst predicts when demand will exceed available supply, leading to potential upward price pressure.

Highest Monthly Close Since 2021

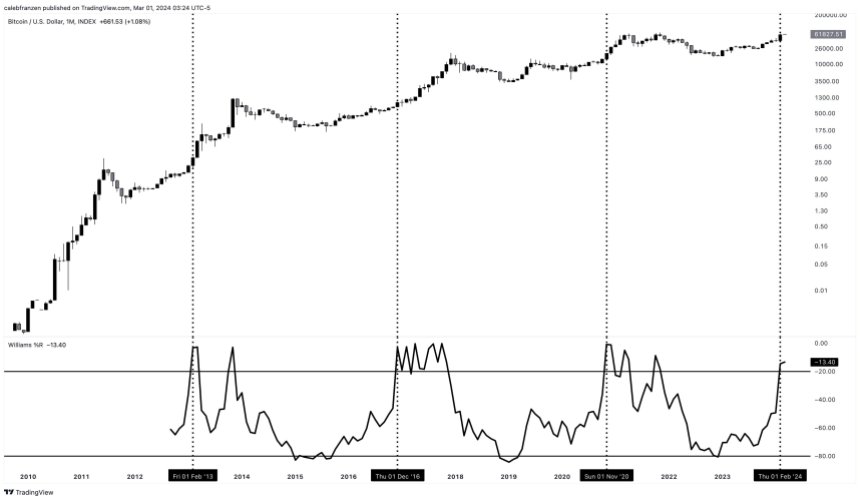

Bitcoin’s recent market performance has caught the attention of wealth manager Caleb Franzen, who highlights the significance of the highest monthly close since October 2021.

Franzen further emphasizes the bullish momentum by pointing out that the 36-month Williams%R Oscillator has closed above the overbought level for only the fourth time in history. Historical data reveals impressive returns following such signals, indicating the potential for substantial gains in the coming months.

Additionally, Franzen notes the changing dynamics of the market, with increased institutional participation and the ease of retail onboarding through ETFs.

Franzen presents a compelling case for the bullish nature of overbought signals, urging market participants to view them as momentum indicators rather than signals to fade. Previous instances of overbought signals have resulted in significant Bitcoin price appreciation:

- February 2013: +3,900% in 9 months

- December 2016: +1,900% in 12 months

- November 2020: +260% in 12 months

While acknowledging diminishing returns in each cycle, Franzen highlights the unprecedented level of institutional participation and the ease of retail access through ETFs.

Even if Bitcoin were to match the +260% gain from the November 2020 signal, it would reach a price of $180,000, surpassing Franzen’s minimum cycle target of $175,000.

Ultimately, Franzen notes that bull markets are typically characterized by a rising ETHBTC ratio and a falling BTC.D (Bitcoin dominance). While these characteristics have yet to manifest fully, Franzen suggests that a multi-quarter rally in the broader cryptocurrency market may be on the horizon.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin’s Swift Climb Triggers Soaring Premium in South Korea During Worldwide Rally

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

Source link

Synopsys’s stock is another chip and AI play that’s soaring after earnings report

Shares of Synopsys Inc. rocketed into record territory as the semiconductor-design-software company beat quarterly profit expectations and raised its full-year outlook, while touting its “turbocharged” artificial-intelligence platform, Synopsys.ai.

“The first quarter marked an excellent start to the year with strong execution across the company as AI continues to drive our customers’ investments in silicon and systems that position them for future growth,” Chief Executive Sassine Ghazi said.

The stock

SNPS,

blasted 10.4% higher in midday trading, toward its biggest one-day gain in four years and its first close above $600 since the company went public 32 years ago.

It was the fifth-best performer among S&P 500 index

SPX

components on Thursday. The biggest gainer was the stock of AI-chip leader Nvidia Corp.

NVDA,

which also reported results late Wednesday.

Synopsys’s fiscal first-quarter report comes about a month after it announced an agreement to buy design-software company Ansys Inc.

ANSS,

in a deal valued at $35 billion, riding the AI trend.

Synopsys reported net income for its fiscal first quarter, which ended Jan. 31, of $449.1 million, or $2.89 a share, up from $271.5 million, or $1.75 a share, in the same period a year ago.

Excluding nonrecurring items, such as stock-based compensation costs and gains on the sale of investments, adjusted earnings per share of $3.56 beat the FactSet consensus of $3.43.

Revenue grew 21.1% to $1.649 billion, just above the FactSet consensus of $1.645 billion, as total products revenue rose 20.8% to $1.35 billion and maintenance and service revenue increased 22.5% to $297 million.

Gross margin improved to 80% from 79.1%.

For the full fiscal year through October, the company maintained its revenue guidance of $6.57 billion to $6.63 billion but raised its adjusted EPS outlook to $13.47-$13.55 from $13.33-$13.41.

KeyBanc Capital analyst Jason Celino reiterated his overweight rating on Synopsys’s stock and his $675 price target following the earnings report.

“[W]e come away positive and continue to view [Synopsys] as a core decade-long growth holding, and view the upcoming investors day on March 20 as the next potential catalyst,” Celino wrote.

On the post-earnings conference call with analysts, CEO Ghazi said that across industries, “a paradigm shift is under way” as companies race to deliver in an era of “pervasive intelligence” in which AI and smart technologies are omnipresent and interconnected.

“To capitalize on this shift, the technology industry is … converging on a Silicon-to-Systems approach to innovation,” Ghazi said, according to an AlphaSense transcript. “As the company at the heart of Silicon and Systems, Synopsys was made for this moment.”

Regarding the design-automation business, Ghazi boasted about “strong design win activity” and about winning several “full-flow displacements” at chip and networking companies.

“A key differentiator in these competitive wins was the breadth and leadership of our [electronic-design-automation] platform, from digital-to-analog and from architecture to sign-off, all turbocharged with the industry’s leading full-flow AI platform, Synopsys.ai,” Ghazi said.

Synopsys’s stock has run up 69% over the past 12 months, while the VanEck Semiconductor exchange-traded fund

SMH

has gone up 78.9% and the S&P 500 has advanced 26.8%.

Layer1 blockchain network Sui is ending the month as one of the best-performing digital assets, according to CryptoSlate’s top gainers list.

According to the list, SUI gained around 75% during the past 30 days to post a new all-time high of $1.64 on Jan. 30, surpassing its previous high of $1.43. However, its value has declined 3.5% to $1.58 as of press time.

This price performance reflects the overall improvements the network has enjoyed since the beginning of the year, allowing it to outperform major cryptocurrencies like Bitcoin and Ethereum during the reporting period.

Sui DeFi metrics improve.

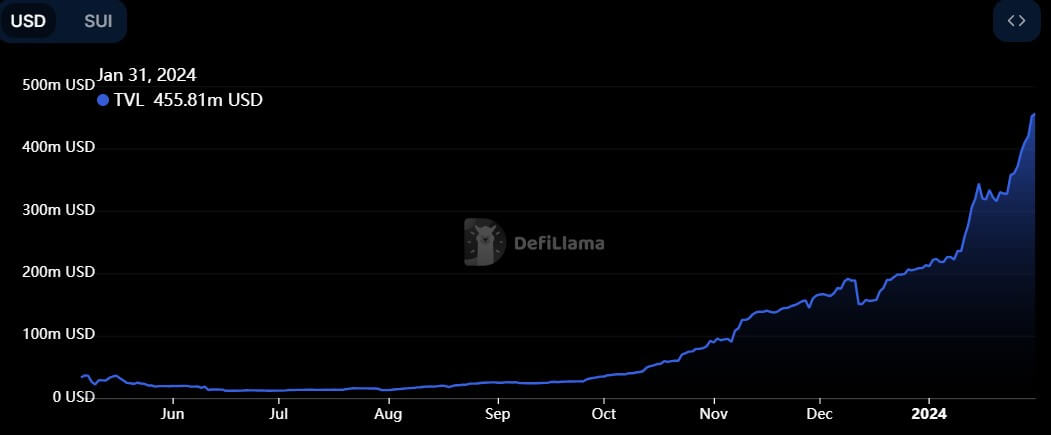

The improved price follows Sui’s brief entrance into the top 10 decentralized finance (DeFi) projects in terms of the total value of assets locked (TVL).

According to a Jan. 30 statement shared with CryptoSlate, SUI’s TVL surged past the $430 million milestone less than a year after its mainnet launch. The rapid increase in Sui’s TVL is attributed to various protocols and applications leveraging its strength, including liquid staking platforms, decentralized exchanges, and lending protocols like Scallop Lend, Navi Protocol, and Cetus.

Greg Siourounis, Managing Director of the Sui Foundation, said:

“What we are seeing in these numbers is developers on Sui [are] building products that people are using to address real-world challenges. That dynamic will form the basis of a sustainable decentralized network that lasts well into the future.”

The TVL has now risen to $444m as of press time, but it now sits as the eleventh largest DeFi blockchain network, per DeFiLlama data.

In addition to the TVL growth, the network’s on-chain activities have exploded, with weekly DeFi volume rising 1,200% since October 2023.

Despite these achievements, the protocol is poised for further development with co-founder Adeniyi Abiodun revealing that the network aims to introduce internet-less transactions before the end of the year.

Notably, Abiodun’s disclosure aligns with a similar prediction made by Mysten Lab’s co-founder, Kostas Chalkias, who stated:

“I predict that Sui will support internet-less transactions in the next 12 months.”

Shiba Inu Team’s Record 9.35 Billion SHIB Burn Sends Burn Rate Soaring

The Shiba Inu burn rate is not slowing down, especially now that the SHIB team has officially joined the effort. This participation from the Shiba Inu team has led to some of the largest daily SHIB burns that have been recorded since the burn initiative started. And now, once again, the team has carried out another massive burn that sent the burn rate surging.

Shiba Inu Team Burns 9.35 Billion Tokens

In the latest iteration of the Shiba Inu team burn, a total of 9.35 billion SHIB have now been sent to the burn address. At the time of the transaction, the 9.35 billion SHIB was worth a total of $92,953.36. This makes it the largest burn that the team has carried out since it began burning tokens.

The token burn which took place on January 9 triggered a substantial surge in the daily SHIB burn rate. According to data from the Shiba Inu burn tracking website Shibburn, the team’s burn caused the burn rate to spike by 28,659% in the 24-hour period. This spike represents the highest spike in the burn rate in 2024 so far, suggesting a bullish start to the year for the token.

However, the burn rate has since taken a nosedive as the burn figures fell short of expectations between Wednesday and Thursday. Shibburn data shows a 99.94% decline in the burn rate at the time of writing, with only a little over 5.3 million SHIB tokens burned in the last day.

There have also been only four burn transactions carried out in the 24-hour period at the time of writing, following the same trend from the last few days.

SHIB price above $0.00001 | Source: SHIBUSD on Tradingview.com

SHIB Burn Gains Steam

Despite the decline in the burn rate in the last day, the community is still looking at more significant burns as time goes on. One of the developments that guarantee these burns is the fact that Shiba Inu burns are now being automated directly through the Shibarium network.

The burn automation was revealed by the Shiba Inu team which revealed that there will be a two-pronged approach to this process. The first, which is how the team has been burning tokens, is manually sending tokens from the deployer wallet to the burn address.

The second approach, which is the most significant, will see an automated SHIB burn system from Shibarium put in place in January. This automated burn mechanism has sparked excitement in the SHIB community as some expect as much as 9.25 trillion tokens to be burned monthly.

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Trump is now complaining that soaring stocks are ‘making rich people richer’ after bragging about the market’s gains while president

-

Donald Trump complained the stock market was enriching the wealthy after touting it while president.

-

President Biden marked this year’s stock rally by poking fun at Trump’s warnings of a crash.

-

Many Americans don’t personally own stocks, and the ultra rich benefit more from market gains.

Donald Trump views a booming stock market as a glorious achievement when he’s in office, but a symbol of mounting wealth inequality when he’s not.

“The stock market is making rich people richer,” the former US president who’s running for reelection next year said during a Nevada rally this week, according to Reuters. Trump frequently crowed about advances in stocks during his presidency but has changed his tune during President Biden’s time in office.

The major stock indices tumbled in 2022 but have rallied strongly this year. The benchmark S&P 500 is up 24% to a near-record level, the tech-heavy Nasdaq has surged 43%, and the Dow Jones Industrial Average has climbed 13% to an all-time high as well.

Biden celebrated the strong performance by posting a campaign ad on X last week. It started with a clip of Trump warning in 2020 that “if Biden wins, you’re gonna have a stock-market collapse the likes of which you’ve never had.” The video then cut to Biden smiling as cable news commentators hailed the stunning rally.

“Good one, Donald,” Biden wrote.

It’s worth noting that many Americans don’t personally own stocks, meaning they only benefit indirectly from market gains, for example if they boost their retirement accounts. Trump certainly isn’t wrong to say that rising stocks enrich the wealthy, either.

The world’s 10 richest people have gained an estimated $470 billion in cumulative net worth this year, lifting their combined fortunes to nearly $1.5 trillion, per the Bloomberg Billionaires Index. Their wealth has soared in large part because they own large stakes in public companies that have seen their stock prices soar this year.

For example, Warren Buffett’s shares of his company, Berkshire Hathaway, make up over 98% of the investor’s $119 billion net worth. Berkshire’s shares have climbed 15% this year, making Buffett $12 billion richer on paper despite his gifting of $5.5 billion of stock to philanthropic causes.

It’s not surprising to see Trump try to disparage the stock market when Biden is actively pointing to it as evidence of his successful presidency. It may not be a surprise either to see Trump return to his previous stance on stocks if he’s reelected.

Read the original article on Business Insider

Crypto Silver Lining: Market Dips Are Stepping Stones To Soaring Heights

Crypto Rand, a renowned crypto trader, has shared insights on the current market corrections, emphasizing the necessity of these corrections for sustainable market ‘growth.’

The trader, who disseminates his views on X, stresses that despite the evident pullbacks, the crypto market’s macrostructure remains “intact.”

This perspective comes at a time when most crypto assets, including Bitcoin, have experienced significant price drops over the past couple of days.

Navigating Resistance Levels: The Path To Growth

Crypto Rand’s leveraged the price action index of various cryptocurrencies, such as Cosmos (ATOM), Chainlink (LINK), NEAR Protocol (NEAR), Algorand (ALGO), and MultiversX (EGLD), among others to highlight his point.

Rand identifies multiple resistance levels in these assets’ trajectories, suggesting these as potential points for market turnaround. These resistance levels are categorized as major or minor, depending on the frequency and intensity of price actions historically observed at these points.

Despite the temporary pullbacks that these resistance levels might introduce, Crypto Rand views them as necessary pauses that allow the market to gather strength for future upward movements.

This perspective is particularly relevant in light of Bitcoin’s recent price behavior. The flagship cryptocurrency has seen a notable dip from its recent high of $44,000, currently trading just below $42,000.

This downward trend has echoed across the crypto market, impacting other major assets like Ethereum including altcoins Rand mentioned like Chainlink, and Algorand.

Over the past 7 days, BTC and ETH have experienced declines of 4.4% and 2%, respectively. Meanwhile, Chainlink has seen a 6.9% drop during the same period, and Algorand has fallen by 4.1% in just the past 24 hours.

Always be ready for more shakeouts, but remember, these corrections are needed for healthy growth.

The Mid Caps for example got rejected on the main resistance, but overall macrostructure remains in tact.

⚡️ INDEXED: $ATOM, $LINK, $NEAR, $ALGO, $EGLD and more. pic.twitter.com/YKUhwyRM9C

— Crypto Rand (@crypto_rand) December 13, 2023

The Broader Perspective On Crypto Market Corrections

The sentiment that market corrections are a healthy and necessary aspect of growth is not exclusive to Crypto Rand. William Clemente, the co-founder of Reflexivity Research, echoes this viewpoint.

Clemente posits that the current market retraction, which could potentially bring Bitcoin’s price closer to $40,000, should “not be a cause for alarm.”

Clemente argues that this process is crucial for eliminating weaker market participants and reducing excess leverage, ultimately establishing a firmer foundation for future upward trends.

Clemente further articulates that the inherent volatility of Bitcoin should be perceived as “a feature, not a bug”. It is worth noting that this stance reinforces the notion that the crypto market is still evolving and that such fluctuations are part and parcel of its journey towards maturity.

BTC just ~doubled in 2 months with no pull backs, a correction is not that surprising.

Corrections shake out “weak hands” and leverage, allowing for a stronger foundation for eventual moves higher.

Bitcoin’s volatility is a feature, not a bug.

— Will (@WClementeIII) December 11, 2023

Featured image from iStock, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Saudi Arabia may make surprise oil cuts, sending prices soaring and the futures market into backwardation, says a 30-year energy expert

-

Oil prices fell on Thursday after OPEC delayed its meeting from November 26 to November 30.

-

It’s set to take place virtually, suggesting members have made an agreement, says Anas Alhajji.

-

There could be additional cutbacks not anticipated by the markets, he added.

As the US Thanksgiving holiday puts the stock market at a standstill, oil prices are still on the move.

West Texas Intermediate (WTI), a benchmark for oil prices, has been in free fall since Wednesday after OPEC members delayed a meeting from November 26 to the 30th that was set to determine crude oil supply output for 2024.

It’s good news if you’re at the pump but bad if you’re a trader who had bet on prices going up. US crude traded at around $76.01 on Thursday, down by about 2.4% from the previous day.

A surplus in supply has dragged down the price of a barrel by almost 19% since September. As a result, traders anticipated an announcement that OPEC and its allies, known as OPEC+, would agree to production cuts to keep the commodity’s price steady. The expectation caused markets to react prematurely, leading to a rally over the weekend before reversing.

Traders weren’t wrong — they were just too early, according to 30-year energy expert Anas Alhajji, who believes that we should be bracing for a potential surprise announcement from Saudi Arabia.

Alhajji, a managing partner at the research and advisory firm Energy Outlook Advisors, says the initial impression from the meeting’s delay is that OPEC+ has issues agreeing on production quotes with countries like Nigeria and Angola, pushing to increase their output. But with no official post from the organization about the reason for the delay, this is all speculation, he noted.

However, since the November 30 meeting is virtual, it suggests that the members have already agreed on their quotas, and the meeting will be a short formality, he said. It also coincides with the COP28 climate summit in Dubai, which many ministers will be attending, he added.

There are three levels at which production can be pulled back: through OPEC+, an extension of the existing voluntary cuts, and new voluntary cuts.

Markets should expect production cutbacks from OPEC+, and on the voluntary level from Saudi Arabia and its allies extending into January or the first quarter of 2024, Alhajji noted. This is because demand seasonally declines in the first quarter. But, what he anticipates could happen is an announcement about additional voluntary cuts from Saudi Arabia.

“Why all of this?” Alhajji said. “Because we believe that the only way the Saudis can be in the driver’s seat in the oil market without anyone else with them is if we are in backwardation, where today’s prices are way higher than the following month’s prices.”

Right now, it’s the opposite, he said. The futures market is in contango, which means futures contracts are higher than current prices. This incentivizes investors and companies to store oil, causing inventories to rise. If Saudi Arabia does implement additional cuts, then this will flip the futures curve into backwardation, he noted.

Read the original article on Business Insider