According to the latest data, bitcoin has been trading above the $67,000 mark, with average network transaction fees experiencing a 288% increase from $3 to $11.64 since Feb. 25, 2024. Meanwhile, BTC has consistently stayed over the $60,000 level for eight straight days, elevating the daily value of one petahash per second (PH/s) of mining […]

According to the latest data, bitcoin has been trading above the $67,000 mark, with average network transaction fees experiencing a 288% increase from $3 to $11.64 since Feb. 25, 2024. Meanwhile, BTC has consistently stayed over the $60,000 level for eight straight days, elevating the daily value of one petahash per second (PH/s) of mining […]

Source link

Soars

Donald Trump’s Crypto Portfolio Soars to $7.5 Million, Fueled by TRUMP Coin’s Ascension and Ethereum Gains

After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

Source link

CrowdStrike’s stock soars as earnings impress in face of cybersecurity jitters

CrowdStrike Holdings Inc. shares were exploding 16% higher in Tuesday’s extended session after the cybersecurity company delivered an upbeat forecast on top of its better-than-expected quarterly results.

For the fiscal first quarter, CrowdStrike

CRWD,

models $902.2 million to $905.8 million in total revenue, along with 89 cents to 90 cents in adjusted earnings per share. Analysts tracked by FactSet were looking for $900 million and 82 cents, respectively.

Looking to the full fiscal year, CrowdStrike’s management is anticipating about $3.925 billion to $3.989 billion in revenue, as well as $3.77 to $3.97 in adjusted EPS. The revenue forecast beat the $3.938 billion consensus view at the midpoint. The earnings outlook came in ahead of the FactSet consensus, which was for $3.76.

The upbeat stock movement for CrowdStrike in the extended session comes after shares dropped about 5% in Tuesday’s regular session. In general, there have been some jitters among cybersecurity investors after Palo Alto Networks Inc.

PANW,

delivered a downbeat outlook in mid-February and Zscaler Inc.’s

ZS,

results last week were met with a negative stock reaction.

CrowdStrike logged fourth-quarter net income of $53.7 million, or 22 cents a share, whereas it recorded a net loss of $47.5 million, or 20 cents a share, in the year-earlier period.

On an adjusted basis, CrowdStrike’s earnings per share roughly doubled to 95 cents from 47 cents, while analysts tracked by FactSet had been modeling 82 cents.

Revenue increased to $845.3 million from $637.4 million, whereas analysts were looking for $839.1 million.

CrowdStrike’s ending annual recurring revenue grew 34% from a year earlier, the company said. Net new ARR growth accelerated to 27%.

“Our achievements in fiscal 2024 represent another high-water mark for CrowdStrike and we remain relentlessly focused on profitably scaling the business to $10 billion ARR and beyond,” Chief Financial Officer Burt Podbere said in a release.

The company also announced plans to acquire Flow Security in a deal that it says will enhance its cloud-data protection.

CrowdStrike is “expanding our cloud leadership by protecting data in all states as it flows through the cloud, and … redefining the future of data protection by securing data from code, to application, to device and cloud,” its chief executive, George Kurtz, said in a release.

Bitcoin Cash Soars 40% in 24 Hours as Market Eyes Upcoming Halving and Adaptive Block Size Upgrade

On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

Source link

Open interest, the total number of outstanding derivative contracts that have not been settled, is an important metric for gauging market health and sentiment. An increase in open interest means new money entering the market, showing heightened trading activity and interest in Bitcoin. Conversely, a decline suggests closing positions, potentially indicating a change in market sentiment or a consolidation phase. Monitoring these trends is important for understanding the liquidity, volatility, and future price expectations in the market.

In a bullish market, an increase in open interest often correlates with rising prices, suggesting that new money is betting on further price appreciation. This scenario typically reflects a strong market sentiment and investor confidence in Bitcoin’s upward trajectory. On the other hand, in a bearish context, growing open interest might indicate that investors are hedging against expected price declines, revealing a more cautious or negative market outlook.

Furthermore, the balance between call and put options within the open interest provides deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many investors expecting price rises, whereas a majority of puts can indicate bearish expectations.

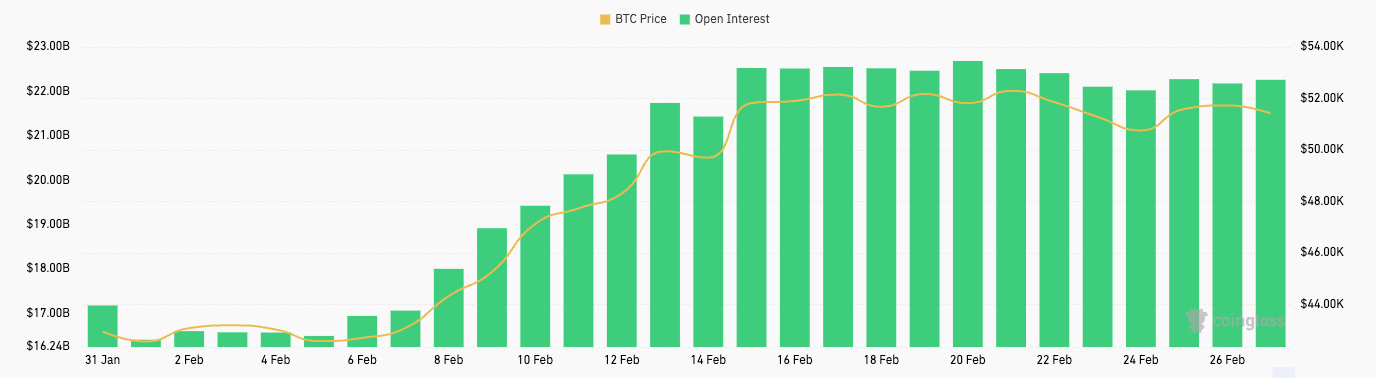

February saw a significant increase in open interest for Bitcoin futures and options.

From Feb. 1 to Feb. 20, Bitcoin futures open interest grew from $16.41 billion to $22.69 billion. This substantial rise suggests that traders were increasingly entering into futures contracts, anticipating higher volatility or making directional bets on Bitcoin’s price. Interestingly, this period aligns with a notable increase in Bitcoin’s price, from $42,560 to $52,303, suggesting a bullish sentiment among futures traders. The slight decrease in open interest by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s price to $51,716, could indicate some traders taking profits or closing positions in anticipation of a consolidation phase or to reduce exposure ahead of potential volatility.

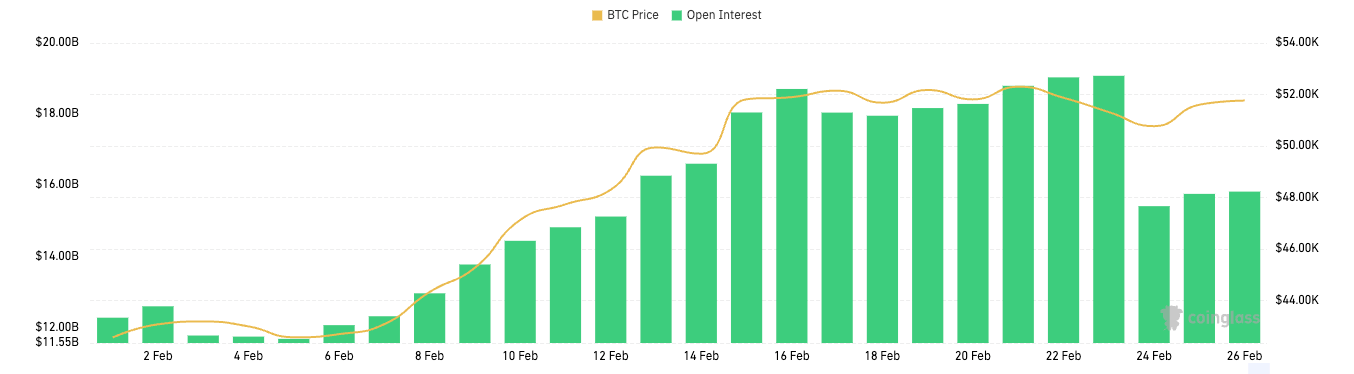

Similarly, Bitcoin options open interest saw a dramatic increase from $12.27 billion at the beginning of February to a peak of $19.08 billion by Feb.23 before dialing back to $15.82 billion towards the month’s end. Options provide the holder the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin at a specified price, offering more complex strategies for traders to express bullish or bearish views or to hedge existing positions. The initial spike in options open interest reflects a robust engagement from investors, leveraging options for directional bets on Bitcoin’s price and protective measures against potential downturns.

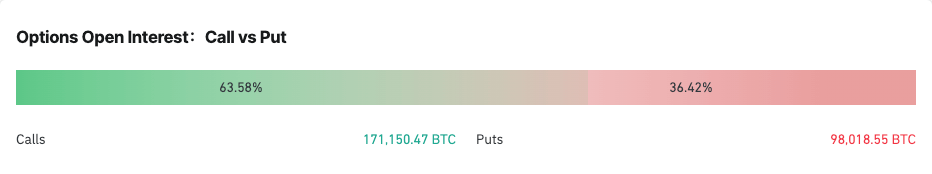

The ratio between calls and puts for Bitcoin options provides a deeper insight into market sentiment and potential expectations for Bitcoin’s price direction. The distribution between calls and puts is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising prices and puts on falling prices.

As of Feb. 26, the open interest in Bitcoin options was skewed towards calls, comprising 63.76% of the total, compared to 36.24% for puts. This distribution reinforces the bullish sentiment observed through the increase in options open interest earlier in the month. A predominance of calls in the open interest suggests that a significant portion of market participants were expecting Bitcoin’s price to continue rising or were utilizing calls to hedge against other positions.

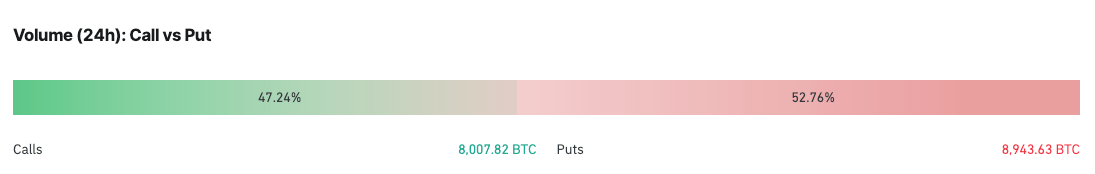

However, the 24-hour volume tells a slightly different story, with calls accounting for 47.24% and puts for 52.76%. Compared to the overall open interest, this shift towards puts in the daily trading volume might indicate a short-term increase in caution among traders. It suggests that within the last 24 hours, there was a noticeable pick-up in defensive strategies or bearish bets.

The immediate implication for Bitcoin’s price is a potential increase in volatility. The bullish sentiment, as evidenced by the growing open interest and high proportion of calls, supports a continued positive outlook among many market participants. However, the recent uptick in puts volume may signal upcoming price fluctuations as traders adjust their positions in anticipation of or in response to new information or market trends.

Considering these, the market appears to be at a crossroads, with a strong bullish sentiment tempered by short-term caution. This scenario often precedes periods of heightened volatility as conflicting expectations play out through trading activities.

Vials move along a conveyor at the Novo Nordisk A/S production facilities in Hillerod, Denmark, on Monday, June 12, 2023. The success of Novo’s bestsellers Ozempic and Wegovy, drugs that help people lose significant amounts of weight, has created something of a gold rush in the pharma industry with about 40 companies developing products that will intensify competition.

Bloomberg | Bloomberg | Getty Images

Shares of Denmark’s Zealand Pharma rocketed higher, after the company posted strong results from a trial of a liver disease treatment that has been touted as a potential competitor in the booming weight loss drug market.

The Phase 2 trial of the survodutide drug showed 83% of adults saw positive results for a form of liver inflammation caused by excess fat cells known as “MASH,” the company said in an announcement Monday.

The drug has “demonstrated efficacy” in people with obesity and is currently undergoing five Phase 3 trials in a clinical program for people who are overweight or obese. It has received a fast-track designation from the U.S. Food and Drug Administration.

More CNBC health coverage

Analysts latched onto the drug’s possible efficacity in obesity research after the latest test results, which indicated the safety of the top dosage used in that trial.

Shares of Zealand Pharma provisionally closed 35% higher on Monday, amid enthusiasm for the company’s potential in the highly lucrative obesity market that propelled fellow Danish drugmaker Novo Nordisk to become Europe’s most valuable firm on its development of Ozempic and Wegovy.

Several other companies, including Eli Lilly, Roche and AstraZeneca, also seek to compete in the sector.

“Top-line results demonstrated an improvement in MASH, at all doses explored in the trial. Treatment with survodutide did not show unexpected safety or tolerability issues, including at the higher dose of 6.0 mg,” Michael Novod, head of bank Nordea’s health-care equity research team, said in a Monday note, hailing the latest Zealand Pharma results as an “unequivocal win for survodutide.”

“Importantly, the [Phase 2] MASH trial also tells us that the 6mg dose is safe, which is the top dose used in the ongoing [Phase 3] obesity trial too,” he added.

Analysts at Jefferies assessed that Zealand Pharma’s “position as a key player in next wave of obesity therapeutics is underappreciated,” noting the significance of the German co-inventor Boehringer Ingelheim’s announcement that the drug will advance as “quickly as possible” with treatment on liver diseases and related conditions.

Pharmaceutical firm Boehringer Ingelheim is funding and running clinical development of survodutide.

Coinbase Global Inc. shares jumped 14% in the extended session Thursday after the crypto-trading platform swung to a quarterly profit and reported revenue well above Wall Street expectations, saying it benefited from “risk on” activity in the markets.

Coinbase

COIN,

earned $273 million, or $1.04 a share, in the fourth quarter, versus a loss of $557 million, or $2.46 a share, in the year-ago quarter.

Sales rose to $954 million from $629 million a year ago.

Analysts polled by FactSet expected Coinbase to report earnings of 2 cents a share on sales of $826 million.

In a letter to shareholders, Coinbase executives said that they saw “a sharp increase in crypto asset volatility,” akin to early 2023, and in crypto asset prices.

That was mostly thanks to around approvals for a bitcoin spot ETF and “broad expectations around improving macroeconomic conditions in 2024, which contributed broadly in the capital markets to ‘risk on’ activity,” it said.

“Coinbase is a fundamentally stronger company today than a year ago, and we are in a strong financial position to capitalize on the opportunities ahead,” the company said in the letter.

Coinbase said it continued to fight for “clarity” in the U.S. markets in relation to crypto, and that it is supporting the crypto-focused Fairshake

Super PAC and affiliates “with the goal of electing pro-crypto candidates in the 2024 election and by supporting Stand With Crypto’s efforts to engage 1 million crypto advocates and help drive pro-crypto policies.”

Coinbase is one of the main supporters of Fairshake, and the PAC recently came out in opposition to Democratic Rep. Katie Porter, who is running in the California Senate primary, scheduled for early next month.

The company guided for first-quarter subscription and services revenue between $410 million and $480 million, and that it has generated about $320 million of transaction revenue through Tuesday.

Expenses with technology and development as well as general and administrative expenses in the first quarter are seen increasing to $600 million and $650 million, Coinbase said.

Shares of Coinbase ended the regular trading day up 3.3%. The stock has skyrocketed 140% in the past 12 months, compared with an advance of about 21% for the S&P 500 index

SPX

in the same period. So far this year, however, the shares are down about 5%, contrasting with gains of more than 5% for the broader index.

Crypto Fear and Greed Index Touches ‘Extreme Greed’ as Bitcoin Soars, Echoing 2021’s Highs

Bitcoin’s ascent beyond the $51,000 mark has propelled the Crypto Fear and Greed Index (CFGI) into the “greed” territory, registering a notable 74 out of 100. Just a day earlier, the CFGI soared to an impressive peak of 79, denoting “extreme greed” and marking its highest point since 2021. Crypto Fear and Greed Index Score […]

Bitcoin’s ascent beyond the $51,000 mark has propelled the Crypto Fear and Greed Index (CFGI) into the “greed” territory, registering a notable 74 out of 100. Just a day earlier, the CFGI soared to an impressive peak of 79, denoting “extreme greed” and marking its highest point since 2021. Crypto Fear and Greed Index Score […]

Source link

Bitcoin’s Price Soars Past $48K, Nears $1 Trillion Market Cap Amidst Bullish Momentum

On Saturday, Feb. 10, 2024, bitcoin’s price soared beyond the $48K mark, reaching heights unseen since prior to Dec. 28, 2021. On Sunday, the leading digital currency maintained its robust momentum, consistently staying above the newly established price level. Over the last 24 hours, the crypto asset’s value has risen by over 2.6%, and it […]

On Saturday, Feb. 10, 2024, bitcoin’s price soared beyond the $48K mark, reaching heights unseen since prior to Dec. 28, 2021. On Sunday, the leading digital currency maintained its robust momentum, consistently staying above the newly established price level. Over the last 24 hours, the crypto asset’s value has risen by over 2.6%, and it […]

Source link

Cardano is currently riding on the back of a modest 3.76% gain in the past seven days with the cryptocurrency on its way to the $0.55 level which will define its short-term price trajectory. On-chain data shows that the bulls are working hard in the background to push the crypto toward this price point, as evidenced by the buy orders piling up.

Particularly, Cardano has experienced a surge in buy orders, tipping the bid-ask volume imbalance in the direction of the bulls. With so many buyers and so few sellers, the price of ADA has only one way to go.

At the same time, activity on the Cardano blockchain is exploding but the question remains whether this interest and optimism will continue to drive ADA prices up or whether the rally will run out of steam as some traders take profits.

Buy Orders Tip By 678% In The Way Of The Bulls

On-chain data show that Cardano bulls are currently out in full force, driving a huge imbalance in buy and sell orders that’s currently sending the bid volume outpacing ask volume by 678%. This strong imbalance tells the current bullish sentiment among Cardano investors.

The dynamic nature of the battle between buyers and sells means the imbalance can change at any time. If the spread narrows, it could signal that the rally is losing steam and a reversal may be on the horizon.

Cardano currently trading at $0.54 on the daily chart: TradingView.com

However, Cardano seems to be holding on, as indicated by this week’s price action. Presently trading at $0.5361, Cardano has shown incredible resilience to continue trading above the $0.50 price level throughout the week.

Price Targets For Cardano (ADA)

ADA is still down in a monthly timeframe, but many crypto analysts are hopeful on the crypto’s future price trajectory. The first step in establishing a very bullish run is a break over the psychological price resistance at $0.55 which it has tested in the past 24 hours. Failure to break over this resistance would either mean a continued range trading between $0.55 and $0.50 or a bearish breakout below $0.50.

According to crypto analyst Ali Martinez, ADA might continue consolidating until April before going on a sustained breakout past its current all-time high to reach $8 by January 2025.

For Cardano to maintain this momentum, it is necessary for the cryptocurrency to continue demonstrating robust market fundamentals and meaningful advances within its ecosystem. Despite facing multiple criticisms,

Cardano remains one of the most actively developed blockchains, with a vibrant open-source community. According to founder Charles Hoskinson, Cardano’s main hurdle is not technological but human in the aspect of decentralized on-chain governance.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.