Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Source link

South

South Korea to Unveil Guidelines Barring the Listing of Hacked Coins

South Korean authorities are reportedly planning to release updated guidelines for virtual asset trading. These guidelines will prohibit the listing or relisting of coins that have previously been hacked. Additionally, the guidelines will require issuers of “foreign” virtual assets to release a whitepaper or a technical manual specifically for the Korean market. Guidelines for ‘Foreign’ […]

South Korean authorities are reportedly planning to release updated guidelines for virtual asset trading. These guidelines will prohibit the listing or relisting of coins that have previously been hacked. Additionally, the guidelines will require issuers of “foreign” virtual assets to release a whitepaper or a technical manual specifically for the Korean market. Guidelines for ‘Foreign’ […]

Source link

South Korea Preparing Tax System to Avoid Cryptocurrency Tax Evasion

The National Tax Service in South Korea is preparing to launch a virtual asset tax system to help analyze the information received from cryptocurrency holders to avoid cryptocurrency tax evasion. Local sources reported that the agency had contracted the services of a third-party company to help in this task, and it is scheduled to be […]

The National Tax Service in South Korea is preparing to launch a virtual asset tax system to help analyze the information received from cryptocurrency holders to avoid cryptocurrency tax evasion. Local sources reported that the agency had contracted the services of a third-party company to help in this task, and it is scheduled to be […]

Source link

Bitcoin’s Swift Climb Triggers Soaring Premium in South Korea During Worldwide Rally

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

Source link

South Africa advances financial inclusion with crypto and digital payment reforms

South Africa announced plans to weave digital payments and crypto into its financial fabric to boost the economy for marginalized groups.

The announcement was made in the country’s 2024 budget and underlines the government’s drive to build a digital economy through active collaborations between public and private sectors to enhance financial innovation.

The budget targets enhancing access to digital payments for people in townships and rural areas who predominantly handle cash. Initiatives will provide local merchants with the infrastructure needed for digital transactions, like internet connectivity and point-of-sale systems.

Starting with a pilot in Gauteng, these efforts seek to broaden the acceptance and use of digital payments among both consumers and businesses.

Regulatory Standards

South Africa intends to legitimize crypto payments and make them an intrinsic part of the local economy over the coming years, starting with a regulatory framework for the sector. The country made crypto an official financial product in 2022, akin to company shares or debt.

The Intergovernmental Fintech Working Group (IFWG) will start issuing comprehensive guidelines in 2024 that will focus on “stablecoins” and their practical applications. This effort will complete a thorough review of the stablecoin environment domestically and create regulatory recommendations that align with global standards.

In 2023, the Financial Sector Conduct Authority (FSCA) and the Financial Intelligence Centre (FIC) started to register crypto asset service providers, following changes to the FIC Act that align with FATF recommendations. The FSCA’s classification of crypto as a financial product now requires service providers to obtain a license, ensuring they meet strict operational standards.

The government is reviewing the extension of the FIC Act’s mandate, which currently requires reporting cash transactions over R49,999, to include crypto transactions. The move aims to use such data in fighting crime.

Additionally, the government intends to explore tokenization and how blockchain technology can represent assets, with the publication of policy and regulatory implications planned for December 2024.

The South African central bank has been considering the development of a central bank digital currency (CBDC) for a number of years. However, the regulator has yet to announce any significant progress in the area.

Supporting financial inclusion

The National Treasury and the Reserve Bank, together with international partners, are rolling out four pilot projects focused on digital payments to aid small and informal businesses.

These projects aim to digitize community transactions, informal worker payments, and cross-border remittances to facilitate finance for small traders engaging in cross-border commerce. Each initiative addresses specific hurdles, from cutting remittance costs to implementing digital tipping for low-income workers.

These efforts highlight South Africa’s determination to be at the forefront of financial digitalization and inclusion, using technology to strengthen its economy and uplift its people. By integrating crypto and emphasizing a solid regulatory framework, the country shows a progressive approach that ensures innovation goes hand in hand with consumer protection and financial integrity.

Montenegro deports former Terraform Labs CFO to South Korea amid fraud allegations

Montenegro has reportedly deported the former financial officer of Terraform Labs, Han Chang-Joon, back to South Korea to face criminal proceedings.

According to reports, law enforcement agencies referred to him as J.C.H. He was “handed over to the competent judicial and police authorities in South Korea today in order to conduct criminal proceedings for more criminal offenses related to financial investment fraud services.”

Daniel Shin, Terraform Labs co-founder, is facing a similar trial in Seoul for fraud, illegal fundraising, and violation of capital market laws. However, he has denied all charges and involvement in the collapse of the crypto company.

The deportation announcement closely follows Terraform Labs’ recent filing for bankruptcy protection in the United States. The company stated that this strategic move aims to safeguard its business, allowing for financial restructuring in anticipation of potential enforcement actions by the U.S. Securities and Exchange Commission (SEC.).

What next for Do Kwon

Meanwhile, the latest update on the fate of Do Kwon, the founder of Terraform Labs, remains elusive, with no new information provided by Montenegrin authorities.

CryptoSlate reported that Kwon and Han were apprehended in Montenegro for attempting to travel to Dubai using forged Costa Rican passports. Subsequently, the Montenegrin authorities charged them with forgery and the use of false passports, leading to their incarceration.

Kwon is facing fraud charges in both the United States and South Korea. The charges are linked to the collapse of the algorithmic TerraUSD stablecoin, which resulted in approximately $40 billion in losses for investors and triggered broader setbacks in the global crypto market.

Montenegro’s court has signaled Kwon’s extradition to either the U.S. or South Korea, pending a decision by the country’s minister of justice. Recent developments, however, indicate a potential journey to the U.S. Kwon has requested a trial delay until mid-March, suggesting an intention to participate in the proceedings on American soil.

Montenegro court clears path for Do Kwon’s extradition to US or South Korea

Terraform Labs founder Do Kwon faces possible extradition to either the United States or South Korea, as confirmed by an update on a court website in Montenegro on Nov. 24.

The High Court of Podgorica stated that the necessary legal conditions for Kwon’s extradition to either country had been satisfied. This pertains to his alleged involvement in the collapse of the algorithmic stablecoin UST, leading to criminal proceedings in both nations.

Kwon, currently serving a four-month prison sentence in Montenegro due to traveling with forged documents, awaits a decision from Montenegro’s Minister of Justice regarding his extradition after completing this term. Kwon’s attempt to appeal his conviction earlier this month was rejected as the court determined that his case was “correctly and completely determined.”

Initially, Kwon expressed consent for extradition to South Korea. However, the court couldn’t grant this request as the decision relied on international law. The U.S. authorities’ establishment of the legal basis for extradition influenced the court’s decision on the destination.

Meanwhile, Daniel Shin, the co-founder of Terraform Labs, is currently facing trial in Seoul for fraud, illegal fundraising, and violating capital market laws.

However, he has denied all charges and involvement in the collapse of the crypto company. Shin’s legal representatives argued that Kwon’s “unreasonable” managerial decisions led to Terra’s collapse, emphasizing that Shin severed ties with Kwon at least two years before the company’s failure.

The post Montenegro court clears path for Do Kwon’s extradition to US or South Korea appeared first on CryptoSlate.

South Korean crypto trading volumes soar with altcoins taking center stage

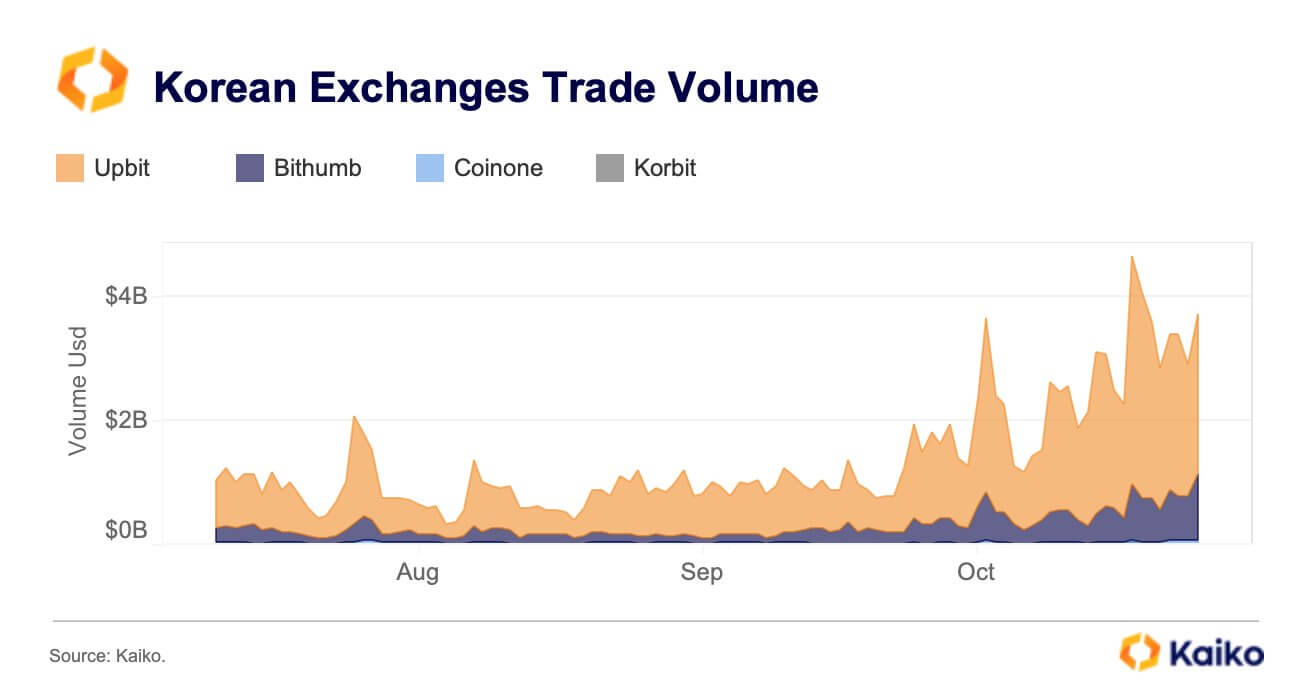

Daily trading volumes on South Korean exchanges have hit their highest point since August last year, with altcoins dominating the transactions, according to data from blockchain analytical firm Kaiko.

Trading activities on major South Korean platforms, including Upbit, Bithumb, Coinone, and Korbit, surged to an average of more than $4 billion towards the end of October and the beginning of November before dropping to more than $3 billion.

Data from CCData, as reported by Bloomberg, also corroborates these upward trading activities on South Korean exchanges. According to the report, crypto trading platforms in the Asian country saw their market shares rise to around 13% from the 5.2% recorded in January.

Around this period, the crypto market saw flagship digital assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) rally to new yearly highs driven by the market optimism surrounding the possible approval of a spot exchange-traded fund (ETF) in the United States.

However, South Korean crypto traders heavily trade altcoins, according to CryptoQuant analysts.

Upbit dominates

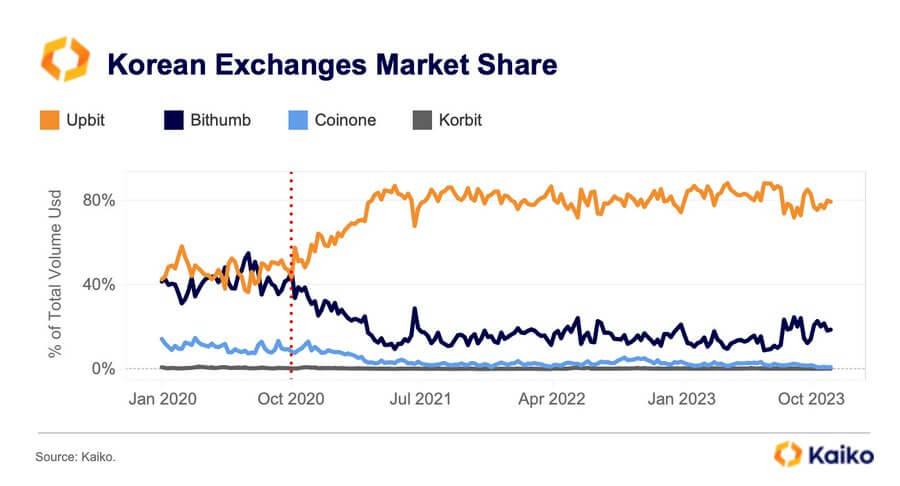

Meanwhile, the Kaiko data restates Upbit’s South Korean crypto market dominance, as the exchange accounts for most trading activities.

Kaiko noted that Upbit’s market dominance had soared to as high as 90% in May last year before slightly declining to around 80% in October 2023. Altcoins account for 88% of all trading activities on Upbit.

On the other hand, its rival, Bithumb, controls around 20% of the market. During the past year, the crypto exchange’s leadership has faced various challenges, with its majority shareholder, Kang Jong-hyun, being arrested for allegedly embezzling roughly $50 million.

This has resulted in its latest efforts to rebuild public trust by planning an Initial Public Offering (IPO) for 2025 and removing transaction fees.

SEOUL (Reuters) – South Korea’s stock market watchdog said on Sunday it found two Hong Kong-based investment banks had engaged in naked short-selling, which would likely result in record fines.

The two unnamed investment banks made naked short-selling transactions of a total 40 billion won ($29.58 million) and 16 billion won, respectively, the Financial Supervisory Service (FSS) said in a statement.

Naked short selling of stocks – in which an investor short sells shares without first borrowing them or determining they can be borrowed – is banned by the Capital Markets Act in South Korea.

The violations by the global banks were over long periods, for nine months through May 2022 and five months through December 2021, respectively, and expected to result in record amounts of fines, the FSS said.

The FSS said such violations, which came against authorities’ efforts to provide a more favourable environment for foreign investors, should be prevented from recurring and that it would also look into practices at other similar investment banks.

($1 = 1,352.2100 won)

(Reporting by Jihoon Lee; Editing by Muralikumar Anantharaman)

South Korea’s Upbit experiences severe disruption due to fake APT tokens

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.