Problems arise when couples clash over how much to budget.

Source link

spending

Disney parks are its top money maker; it’s spending to keep it that way

Visitors wearing emblematic Mickey Mouse and Minnie Mouse ears walk in front of the Sleeping Beauty-inspired castle at Disneyland Paris, Oct. 16, 2023.

Ian Langsdon | Afp | Getty Images

Three years ago, Josh D’Amaro stood in a nearly empty Disneyland.

The California theme park’s Main Street was quiet: no cheery tunes from famed barbershop quartet the Dapper Dans, no clanging railroad bell, and no wafting scent of waffle cones from the Gibson Girl Ice Cream Parlor.

It had been more than a year since the Covid pandemic had forced Disney’s domestic parks to shutter, but D’Amaro, chair of Disney’s experiences division, was confident guests would flood back in when the gates reopened.

His confidence was well founded. D’Amaro’s division is now Disney‘s best-performing segment, rebounding and offering stability in recent quarters as Disney shuffles to adapt its entertainment business to match consumer habits that changed after the pandemic.

On that quiet day in 2021, D’Amaro had been in charge of the parks, experiences and consumer products division, now just called experiences, for only a little more than a year. He took the helm when Bob Chapek was tapped as CEO in early 2020. D’Amaro spent much of those 12 months dealing with substantial operating losses from global park closures, a docked fleet of cruise ships and a plunge in hotel visits.

Revenues fell 35% in 2020, a nearly $10 billion decrease from the $26.2 billion the experiences division had tallied in the year before the pandemic. Then revenue dropped an additional 3% in 2021.

But a lot has changed in three years. D’Amaro — sitting in a conference room in Burbank, an hour north of Disneyland and just a few miles from the heart of Disney’s theme park creative engine, Walt Disney Imagineering — has much to brag about.

The experiences division posted record revenue of $32.5 billion in fiscal 2023, a 16% increase from the prior year. Operating income jumped 23% to $8.95 billion.

D’Amaro described the pandemic as “an opportunity to take a breath” and a time for his division to “think about what we wanted the future to look like.”

“So, as difficult as that situation was, we saw it as a platform, a new vantage point for us to look at the operation,” he said.

While its parks were shuttered, Disney continued construction of its Avengers Campus themed land in Disneyland and touched up old favorites such as the King Arthur Carousel. And it built new rides, and refurbished others, in the years that followed.

Avengers Campus at Disneyland in California.

Christian Thompson/Disneyland Resort

World of Frozen opened in Hong Kong Disneyland in November, and a Zootopia land opened in Shanghai Disneyland in December. The company also launched two new rides at Walt Disney World in Florida: a “Guardians of the Galaxy”-themed ride in its Epcot park in 2022, and a “Tron”-themed roller coaster in the Magic Kingdom in April 2023.

Additionally, the company has revamped attractions and themed park areas, turning the Pacific Wharf area of Disneyland’s California Adventure into San Fransokyo Square, based on the animated hit “Big Hero 6,” updating Mickey’s Toon Town at Disneyland and making major transformations at Epcot.

Those investments, coupled with new technology in mobile ordering and the ability for guests to pay to skip to the front of the line for certain rides, have kept guests coming and boosted Disney’s earnings at a time when the entertainment division is struggling to recapture its late-2010s boom.

“Sitting here now, today, you’ve seen our results; our results have been record-setting as recently as the last first-quarter earnings,” D’Amaro said. “Record revenue, record margins, record operating income. So, the recovery has been swift, it’s been strong. But more importantly, I think the future looks incredibly bright for our segment — and the company, quite frankly.”

In 2023, experiences was the best-performing part of Disney’s business, accounting for 36% of the company’s total revenue but 70% of its operating income. Meanwhile, Disney’s entertainment division, which includes its theatrical and streaming businesses, represented 45% of revenue but just 11% of operating income.

The ability to get more out of the parks in recent years was crucial for CEO Bob Iger and Disney’s board as they tried to make the company more profitable and improve share performance. On Wednesday, Disney beat back activist investor Nelson Peltz’s proxy fight, reelecting its full board.

Always innovating

The division’s strength is why Disney has pledged to invest $60 billion in experiences over the next 10 years — a key part of its strategy to keep the parks fresh and relevant in a competitive segment.

D’Amaro said about 70% of that money will go toward “new experiences” in domestic and international parks, along with cruise lines. The other 30% will go toward technology and infrastructure, including maintenance of existing attractions.

Innovation at theme parks has been a central goal since Walt Disney ran the company. Disney’s founder used to say that its theme parks would “never be finished” and would evolve to meet consumer demand and changing tastes, along with developments in technology.

Walt Disney Imagineering has long been on the cutting edge of development. Its innovations, from ride mechanics and animatronics to creature design and immersive architecture, have made Disney’s parks a standout in the industry.

Last year, guests caught a glimpse of one of these innovations — a trio of tottering bipedal robots from Star Wars called BDX droids. First spotted at California Disneyland’s Star Wars: Galaxy’s Edge, they are just one iteration of a new technology Disney Imagineering is developing to bring walking robotic characters to life.

Walt Disney Imagineering’s two-legged walking character platform in the form of BDX, a Star Wars droid.

Disney

Engineers create the mechanics for the remote-controlled droids to move and balance, and work with animators to give those movements personality. The robots were designed to have childlike curiosity, reflected through cheeky head tilts and chirping beeps, along with a special emote dubbed “tantrum,” where their eyes glow red and they emit a high-pitched squeal.

Guests who visit Galaxy’s Edge in the next three months may stumble across this trio as part of Disney’s “Season of the Force.” They add to the regular roaming character meet-and-greets with the likes of Rey, Chewbacca, Kylo Ren and stormtroopers.

Disney hopes hands-on innovations such as the robots will keep guests coming.

“Those moments where there’s a spark, there’s an emotion that’s on full display, where a guest is interacting with an attraction or a cast member or a character, it’s very real and genuine,” said D’Amaro.

That emotion was on display at the South by Southwest conference in March 2023, when Disney debuted a new iteration of its “stuntronics” robot, this time in the form of Judy Hopps from “Zootopia.” This technology had previously been used to create the Spider-Man leap stunt at Avengers Campus. During the 2023 presentation, Imagineers showed the audience how the Judy Hopps robot could balance on roller blades and perform somersaults.

The biggest audience reaction came at the end of the presentation, when an Imagineer lifted the bot to sit on his shoulders and it realistically moved its legs to fit around his neck, as a child would. The simple motion — programmed just for the presentation, Imagineers told CNBC — captured something intrinsic to the human experience.

D’Amaro said those moments show why it’s important for Disney animators to be part of the development process: As the Imagineers craft new technologies, the artists can help bring them to life.

It shows in Disney’s rebrand of Splash Mountain. In both the California and Florida parks, the company is refurbishing the ride into Tiana’s Bayou Adventure, which will feature dozens of animatronic characters from “The Princess and the Frog.”

A preview of Walt Disney Imagineering’s audio-animatronics for the upcoming refresh of Splash Mountain, Tiana’s Bayou Adventure.

Disney

Imagineers have developed all-electronic audio-animatronics for the ride for characters such as Lewis, the trumpet-playing alligator from the film. Disney revolutionized animatronics decades ago with its hydraulic, or liquid-fueled, and pneumatic, or air-fueled, systems, but the electronic animatronics for Tiana’s Bayou allow for more refined and precise movement, making them appear more realistic. Similar animatronics can be seen in the rides Smuggler’s Run and Rise of the Resistance, in Galaxy’s Edge.

Interior pieces of some of the animatronics were crafted using 3-D printing, resulting in a lighter-weight material.

Telling stories in the parks

Disney’s ambitions to grow its experiences unit hinge in part on making its attractions feel more real.

“They continue to push the envelope of storytelling and creativity,” D’Amaro said of the Imagineering team.

He cited the recently shuttered Star Wars Galactic Starcruiser, a hotel and immersive experience that took guests on a two-day “voyage” in space. It was a 48-hour interactive story that allowed fans to physically play in the Star Wars universe.

Guests arrive aboard the Chandrila Star Line’s Halcyon at Star Wars Galactic Starcruiser.

Disney

“This is something that had never been done before,” D’Amaro said. “It was difficult to even explain to the public, and I think it was incredibly brave for us to move into this space. … And this, to me, says Imagineering is still at its best today.”

High ticket prices deterred the average parkgoer, and the Galactic Starcruiser shuttered in September. Still, D’Amaro said the experiment was a learning opportunity for the company.

“Those learnings are being employed on the next experiences, which we haven’t even announced yet,” he said.

Storytelling is at the heart of everything across Disney’s experiences division.

This extends to Disney’s cruise line and hotels, as well as its video game business. The company has a fleet of five cruise ships, and plans to add three more by fiscal 2026.

The Disney Wish, which made its maiden voyage in 2022, was the first addition to the fleet in a decade and bet big on its powerhouse franchises to entice travelers to the high seas.

There’s a “Frozen” sing-along dinner and a Marvel dining experience, as well as a Star Wars-inspired Hyperspace Lounge. The ship also has the first ever Disney water ride attraction on board, the AquaMouse.

Disney’s “Frozen”-themed dinner show on the cruise ship Wish.

Disney | Matt Stroshane

“This is something I think that’s really important, the idea of the Disney difference,” D’Amaro said. “That this company works together as one is more powerful now than I think it ever has been — whether it’s [entertainment co-chair] Alan Bergman in the studios creating a new property that we can then take to Disney experiences and bring it to life and extend that story in brand new ways, or franchises that are birthed out of the theme parks.”

Disney’s ‘blue sky’

Disney’s experiences division has immediate expansion plans — even before the bulk of the planned $60 billion investment kicks in.

Next to open for Disney is Fantasy Springs, an eighth port at the Tokyo DisneySea park. The land will be home to three new areas — inspired by the films “Frozen,” “Tangled” and “Peter Pan” — as well as the new Tokyo DisneySea Fantasy Springs Hotel.

Concept and design work is also underway for the Tropical Americas area at Disney’s Animal Kingdom in Florida. There have been no official updates on the previously announced third ride at Avengers Campus in the California Adventure area at Disneyland.

The company is developing what it’s dubbed “blue sky” ideas for its parks — projects that are still in early development and may ultimately not see the light of day.

Disney has teased that an area based on “Coco” or “Encanto” or both could be underway in the Magic Kingdom. There were also talks about opening an area of the Magic Kingdom that would be overrun by Disney villains.

During the company’s investor meeting this week, Iger even teased the possibility of an “Avatar” land at Disneyland in California.

“We have thousands of acres of land still to develop,” Iger said during the Morgan Stanley Conference in March. “We could actually build seven new full lands if we wanted to around the world, including the ability to increase the size of Disneyland in California, which everybody thinks is kind of landlocked, by 50%.”

Price points for these projects will vary, if they do come to fruition. The recent additions of the two Star Wars: Galaxy’s Edge lands in Disneyland and Disney World are estimated to have cost $1 billion each.

That’s where the $60 billion investment comes in.

Disney likely won’t spend it all soon.

“We actually have a fairly good idea in the near term of what’s being built, but we’re purposefully not going to allocate it all,” Iger said at a media event Tuesday, according to the Los Angeles Times. “Because who knows? In five years we can end up with a giant hit movie — think ‘Frozen’ — that we may want to mine essentially as an attraction, or a hotel or restaurant in our parks. So you want to maintain some flexibility.”

But Iger won’t be head of the company in five years, if all goes according to plan. The CEO, who returned to the post in 2022, is set to step down at the end of 2026. Disney’s board is in the process of succession planning.

D’Amaro is on the short list.

His track record helming Disney experiences is part of a 26-year career with the Walt Disney Company, in which D’Amaro has held posts as chief financial officer for consumer products and global licensing and chief commercial officer for Walt Disney World Resort.

For now, however, D’Amaro said he is concentrating on his current post. He called it a “blessing” to have Iger back as CEO.

“I’m focused on Disney experiences,” he said when asked about potential succession plans. “And I’m focused on driving innovation and storytelling forward and paying tribute to our fans and continuing to grow this business.”

U.S. President Joe Biden and Vice President Kamala Harris meet with (L-R) Senate Minority Leader Mitch McConnell (R-KY), House Speaker Mike Johnson (R-LA), Senate Majority Leader Chuck Schumer (D-NY), House Minority Leader Hakeem Jeffries (D-NY), on February 27, 2024 at the White House in Washington, DC.

Roberto Schmidt | Getty Images

President Joe Biden on Saturday signed Congress’ $1.2 trillion spending package, finalizing the remaining batch of bills in a long-awaited budget to keep the government funded until Oct. 1.

Almost halfway into the fiscal year, the president’s signature ends a months-long saga of Congress struggling to secure a permanent budget resolution and instead passing stopgap measures, nearly averting government shutdowns.

“The bipartisan funding bill I just signed keeps the government open, invests in the American people, and strengthens our economy and national security,” Biden said in a Saturday statement. “This agreement represents a compromise, which means neither side got everything it wanted.”

The weekend budget deal slid in just under the wire before the Friday midnight funding deadline, as has been typical this fiscal year with eleventh-hour disagreements derailing near-complete deals.

The Senate passed the budget in a 74-24 vote at roughly 2 a.m. ET Saturday morning, technically two hours after the deadline due to last-minute disagreements. However, the White House said that it would not begin official shutdown operations since a deal had ultimately been secured and only procedural actions remained.

The House passed its own vote Friday morning after a week of scrambling to reconcile a lingering sticking point: funding for the Department of Homeland Security, which the White House took issue with last weekend. The White House’s qualms delayed the negotiation process further, just as lawmakers were preparing to release the legislative text of the budget proposal.

This trillion-dollar tranche of six appropriation bills will fund agencies related to defense, financial services, homeland security, health and human services and more. Congress approved $459 billion for the first six appropriations bills earlier in March, which related to agencies that were less partisan and easier to negotiate.

With the government finally funded for the rest of the fiscal year, House Speaker Mike Johnson, R-La., has cleared his plate of at least one looming issue.

But in so doing, he may have created another.

Hours before the House passed the spending package Friday morning, hardline House Republicans held a press conference to lambast the bill. Moments after the House narrowly passed the bill, far-right Georgia Republican Rep. Marjorie Taylor Greene filed a motion to oust Johnson.

If ousting a House speaker for budget disagreements feels like a familiar story, that’s because it is.

In October, after former Speaker Kevin McCarthy struck a deal with Democrats to avert a government shutdown, the House voted to remove him, making him the first Speaker in history to be removed from that position. Johnson has been trying to appease the hardline Republican wing of the House, called the Freedom Caucus, to avoid meeting a similar fate.

Opinion: We’re spending more on leisure and travel. These 11 stocks will soak it up.

Leisure stocks are likely to outperform this year as emboldened consumers kick back and relax. Here’s more on three economic trends supporting this trend and 11 stocks to consider, according to five money managers I check in with on this theme.

1. Consumer sentiment is surging. The University of Michigan consumer sentiment index added almost 10 points to 79 in January. Sentiment rose on improved outlooks for inflation and income. Consumer sentiment has surged 29% since November. That’s the biggest two-month increase since 1991.

2. Jobs are plentiful: Nonfarm payroll employment increased by 353,000 in January, and the count for the prior two months was revised upwards. Average hourly earnings rose by 4.5% over the prior year. The January jobs increase is even more impressive because payroll numbers typically shrink that month due to post-holiday layoffs, says Bank of America. The data confirm there is no recession on the horizon. Plentiful jobs and wage hikes make consumers more confident about leisure spending.

3. We’re in the midst of a productivity boom: Productivity growth was a robust 3.2% in the fourth quarter of 2023, following 4.9% and 3.5% gains in the prior two quarters. For perspective, growth has rarely come in above 4% over the past 20 years. Productivity growth supports pay hikes, and it reduces pressure on companies to raise prices. Both improve spending power. The boom also boosts economic growth. GDP growth is driven by a combination of labor force and productivity growth — both of which we have right now.

Here are 11 leisure stocks that will benefit from these trends:

Travel

When people feel more confident about their budgets, they hit the road. And there is still pent-up demand for travel post-Covid, says George Young, a portfolio manager with Villere & Co. in New Orleans. This is one reason his portfolio owns casino and hotel company Caesars Entertainment

CZR,

The stock may also benefit from continued efforts to reduce its high debt levels.

Matt Wittmer and Abby Roach at Allspring Global Investments favor Hilton Worldwide Holdings

HLT,

as a play on leisure travel spending. It’s also one of the major builders of hotels at a time when there’s a shortage of rooms. Hilton accounts for one in five rooms under construction, more than any other chain, Roach says. Meanwhile, independent operators continue to convert to the Hilton brand because it boosts business.

Next, consider airlines like Ryanair Holdings

RYAAY,

in Europe. The continent is in an economic slump, which hurts air travel. But it actually helps Ryanair. Since it has lower costs and a stronger balance sheet than competitors, Ryanair takes market share from struggling competitors in downturns, says Andrew Brown at Baillie Gifford, who specializes in finding companies that find ways to win throughout the economic cycle. The airline is still profitable even during this slump, and it is using profits to buy more landing slots at airports. The European economy may provide a tailwind this year as the central bank there eased monetary conditions, predicts Ed Yardeni, of Yardeni Research.

Also, consider two behind-the-scenes names in travel. Brown at Baillie Gifford singles out Amadeus IT Group

AMADY,

which provides software that runs booking systems for airlines and hotels, and in-house media systems at hospitality chains. Young, at Villere & Co., owns Euronet Worldwide

EEFT,

which has more than 50,000 ATMs in Europe, the Middle East, Asia and the U.S. That makes it a travel play.

Computer and mobile games

Consumers are spending less on games, but targeting their dollars on the most popular titles. This favors the large gaming software companies with the big hits, namely Take-Two Interactive Software

TTWO,

and Electronic Arts

EA,

says Alec Boccanfuso of Gabelli Funds.

Both will soon release updates of their biggest hits. Take-Two’s Grand Theft Auto VI will likely come out in 2025. But it’s not too early to position in the stock ahead of that release. Grand Theft Auto has not been refreshed since 2013 so there is probably a lot of pent-up demand for a new version. Take-Two also has a big position in mobile games, because of its purchase of Zynga. Electronic Arts should release an updated version of its Sports College Football series later this year. Now that college players are allowed to earn income from the use of their images it’ll feature popular college stars, another draw.

The great outdoors

Like a lot of retail chains that sell gear used in outdoor activities like camping, fishing and hunting ran big sales last year to blow out excess inventory. They got that job done, and now they’re ordering inventory again. “We are finally starting to see restocking,” says Boccanfuso at Gabelli Funds. “Retailers and manufacturers say the second half of this year will be better.” That would support growth at outdoor supply manufacturers.

Boccanfuso favors Vista Outdoor

VSTO,

which is selling its ammunition business to focus on products used in hiking, camping, cycling, golfing and fishing. It owns some of the biggest brands including Bell, Fox Racing and Giro in helmets, CamelBak in hydration packs, Bushnell and Foresight Sports in golfing, and Simms in fishing products. Another favorite is Johnson Outdoors

JOUT,

which makes fishing products like sonar, GPS systems and trolling motors. Among the retailers selling outdoor supplies, Boccanfuso singles out Sportsmans Warehouse Holdings

SPWH,

Though the pandemic-era outdoor activity craze died down, interest in the space remains above pre-pandemic levels. So, demand for outdoor products remains elevated.

Pool supplies

For many people, leisure means nothing more than lounging around the backyard pool. As consumers spend more time poolside, it will help Pool

POOL,

a wholesaler of pool maintenance products. This company also benefits from two trends, says Wittmer, at Allspring Global Investments. A lot of people put in pools during the pandemic. And there’s an ongoing migration to the Southeast, where people put in pools because of the warmer weather.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned CZR. Brush has suggested CZR and POOL in his stock newsletter, Brush Up on Stocks. Follow him on X @mbrushstocks.

More: George Soros’ fund bets on U.S. leisure travel, with fresh stakes in JetBlue, Spirit, Sun Country

Also read: The ‘cardboard-box’ recession is over. An out-of-the-box economic recovery is coming.

Jamie Dimon believes U.S. debt is the ‘most predictable crisis’ in history—and experts say it could cost Americans their homes, spending power and national security

In the late 19th century Alexander Hamilton wrote “national debt, if it is not excessive, will be to us a national blessing.” A nice idea in theory, but America’s governments since then haven’t quite stuck to the plan.

Instead, the U.S. economy is resting atop a public debt exceeding $34 trillion, with its debt-to-GDP ratio sitting at around 120%. Perhaps not the blessing the Founding Fathers had once envisioned.

Now, alarm bells are beginning to ring with increasing frequency and volume.

Jamie Dimon says Washington is facing a global market “rebellion” because of the tab it is racking up, while Bank of America CEO Brian Moynihan believes it’s time to stop admiring the problem and instead do something about it.

Elsewhere The Black Swan author Nassim Taleb says the economy is in a “death spiral”, while Fed chairman Jerome Powell says it’s past time to have an “adult conversation” about fiscal responsibility.

And despite the issue being the “most predictable crisis we’ve ever had” according to former Speaker of the House Paul Ryan—a summary Dimon agrees with—it’s an item that isn’t yet top of the political agenda.

It’s also worth noting this isn’t the job of one party or the other to fix—this debt has been accumulated courtesy of spending by both Republicans and Democrats.

The list of presidents who added the most debt by percentage begins with FDR (Dem.), followed by Woodrow Wilson (Dem.) and Ronald Reagan (Rep.).

Whoever’s shoulders it falls on to address, it’s clear the public now wants action.

Last year Pew Research found that ‘reducing government debt’ was a key concern for 57% of the 5,152 people surveyed—up from 45% just a year prior.

But do individuals—who currently have a sum of more than $100,000 dangling over their heads when debt is divided by capita—need to be so concerned about the issue?

How will it impact their purse strings, their living costs, and their savings plans?

How big is the threat?

It depends on who you ask.

If it’s the Peter G. Peterson Foundation you’re talking to, the issue is pretty sizable.

The New York-based nonpartisan organization dedicates itself to increasing public awareness around fiscal challenges, with the increasing government debt being one of its top concerns.

The group believes debt could lead to reduced public spending, private investors losing faith in America’s economy, a shrinking window of prosperity for U.S. families thanks to worsening housing and jobs markets, and a threat to national security.

Laura Veldkamp, a professor of finance at Columbia University, has a less catastrophic view.

She encourages the public to use real-world comparisons to understand the context around the headline-grabbing figures.

Professor Veldkamp explained to Fortune: “If the US were a household, we might measure its debt by the debt-to-income ratio. The debt is about 1.3 times the national income (GDP).

“The payment each year for federal debt interest is around 4% of the debt. This means the U.S. government needs to pay about 5.2% of GDP in interest expenses.

“Federal tax income is around 18% of GDP. So, the debt payments are less than one-third of the income. If this were a household or firm, we wouldn’t call that highly indebted.”

The far more difficult issue is whether or not this debt is being accumulated responsibly, and will result in a positive return in the future.

This is where JPMorgan boss Dimon gets concerned: in a slowing economy, can the government expect to see an uptick in output to offset the investment?

“Instead of focusing on the level of debt, we should be asking: What is the return on the investment?” Professor Veldkamp added. “If the government is issuing debt to invest in high-return projects, then debt is good. If it is not, then the debt will be tough to pay off because of low future productivity.”

And in The Deficit Myth, Stephanie Kelton, professor of economics at Stony Brook University, points out that public debt in the past has made economies more equitable and prosperous, but that scary words like “deficit” quell societies into not pushing fiscal support far enough for it to truly pay off on a large scale.

While Professor Kelton’s belief is a far cry from the doomsday opinions of some, she doesn’t advocate for limitless spending without cause or future societal payoff either, as investing in areas of the economy that are already working well merely results in inflation.

Could the housing market be impacted?

Housing, construction, cars and any other interest-rate sensitive sectors will be “disproportionately” impacted by an attempt to rebalance public debt, William G. Gale of the Brookings Institute told Fortune.

“Higher government debt will tend to raise interest rates,” the author of Fiscal Therapy: Curing America’s Addiction to Debt and Investing in the Future said.

“If government creates debt, it has to be financed somehow—taxes or money creation. If debt gets out of hand, money creation historically has been the (false) solution as it is easier to issue money than raise taxes but often more disastrous in the long term.”

Any rise in interest rates will shock younger generations coming up the housing ladder over the next few decades.

While many economists point out the controversial Fed rate hikes of the 2020s are merely normalizing the rates of many eras before, homeowners and prospective buyers have grown accustomed to a Federal base rate of effectively less than 1%.

Beyond having negative psychological impacts, rising rates is also bad news for the already unattainable market.

According to the latest National Realtors’ Association index, the median family income is $99,432 while the median amount needed to qualify to buy a home is $105,504.

Will public debt impact America’s national security?

This is a long-held fear from experts in the field.

More than a decade ago when national debt sat at a measly $19 trillion, America’s former joint chiefs of staff chairman Admiral Michael Mullen said debt was the top threat to national security.

Fourteen years on, former Speaker Ryan told the Bipartisan Policy Centre in January that before long the government will be spending more on servicing its debt than it is on investing in the Pentagon.

Dimon added: “This is about the security of the world. We need a stronger military, we need a stronger America. We need it now. So I put this as a risky thing for all of us.”

Couldn’t the government just keep spending?

If the government’s racked up this level of debt and the economy is still surviving—after all, inflation is down, jobs are steady, consumers are in ‘decent shape’—some might question why politicians can’t keep spending seemingly without confidence.

There are a couple of issues with that.

The first is well known: the government has a self-imposed debt ceiling which it cannot spend above, and it needs congressional approval to raise or extend it.

This is a fairly regular occurrence—it’s happened 78 separate times since 1960—however, negotiations reached the eleventh-hour last summer when Republicans pushed hard for promises from President Biden’s government to reign in spending.

When the issue comes around again just after the 2024 election, a deal may be more difficult.

The other issue is that, at some point, investors may no longer want to buy government debt if they fear the government won’t be able to pay it back.

That’s a primary concern for Joao Gomes, senior vice dean of research and Professor of finance at the University of Pennsylvania’s Wharton School.

“The most important thing about debt to me that people to keep in mind is you need somebody to buy it,” Gomes told Fortune. “We used to be able to count on China, Japanese investors, the Fed to [buy the debt.] All those players are slowly going away and are actually now selling.”

America’s ability to pay its debts is a concern for the nations around the world that own a $7.6 trillion chunk of the funds.

The nations most exposed are Japan, which owned $1.1 trillion as of November 2023, China ($782 billion), the U.K. ($716 billion), Luxembourg ($371 billion), and Canada ($321 billion).

“If at some moment these folks that have so far been happy to buy government debt from major economies decide that ‘You know what, I’m not too sure if this is a good investment anymore, I’m going to ask for a higher interest rate to be persuaded to hold this’ then we could have a real accident on our hands,” Gomes said.

He added: “The moment the government in any country realizes that it cannot sell $1.7 trillion in [annual] debt anymore, you will have to impose major cuts on some programs. That opens a Pandora’s box of social unrest that I don’t think anybody wants to think about.”

This story was originally featured on Fortune.com

Mark Zuckerberg indicates Meta is spending billions on Nvidia AI chips

Meta founder and CEO Mark Zuckerberg speaks during the Meta Connect event at Meta headquarters in Menlo Park, California, on Sept. 27, 2023.

Josh Edelson | AFP | Getty Images

Meta is spending billions of dollars on Nvidia’s popular computer chips, which are at the heart of artificial intelligence research and projects.

In an Instagram Reels post on Thursday, Zuckerberg said the company’s “future roadmap” for AI requires it to build a “massive compute infrastructure.” By the end of 2024, Zuckerberg said that infrastructure will include 350,000 H100 graphics cards from Nvidia.

Zuckerberg didn’t say how many of the graphics processing units (GPUs) the company has already purchased, but the H100 didn’t hit the market until late 2022, and that was in limited supply. Analysts at Raymond James estimate Nvidia is selling the H100 for $25,000 to $30,000, and on eBay they can cost over $40,000. If Meta were paying at the low end of the price range, that would amount to close to $9 billion in expenditures.

Additionally, Zuckerberg said Meta’s compute infrastructure will contain “almost 600k H100 equivalents of compute if you include other GPUs.” In December, tech companies like Meta, OpenAI and Microsoft said they would use the new Instinct MI300X AI computer chips from AMD.

Meta needs these heavy-duty computer chips as it pursues research in artificial general intelligence (AGI), which Zuckerberg said is a “long term vision” for the company. OpenAI and Google’s DeepMind unit are also researching AGI, a futuristic form of AI that’s comparable to human-level intelligence.

Meta’s chief scientist Yann LeCun stressed the importance of GPUs during a media event in San Francisco last month.

″[If] you think AGI is in, the more GPUs you have to buy,” LeCun said at the time. Regarding Nvidia CEO Jensen Huang, LeCun said “There is an AI war, and he’s supplying the weapons.”

In Meta’s third-quarter earnings report, the company said that total expenses for 2024 will be in the range of $94 billion to $99 billion, driven in part by computing expansion.

“In terms of investment priorities, AI will be our biggest investment area in 2024, both in engineering and computer resources,” Zuckerberg said on the call with analysts.

Zuckerberg said on Thursday that Meta plans to “open source responsibly” its yet-to-be developed “general intelligence,” an approach the company is also taking with its Llama family of large language models.

Meta is currently training Llama 3 and is also making its Fundamental AI Research team (FAIR) and GenAI research team work more closely together, Zuckerberg said.

Shortly after Zuckerberg’s post, LeCun said in a post on X, that “To accelerate progress, FAIR is now a sister organization of GenAI, the AI product division.”

— CNBC’s Kif Leswing contributed to this report

WATCH: The AI dark horse: Why Apple could win the next evolution of the AI arms race

Delving into the unique financial ecosystem of Bitcoin involves unpacking the concept of Unspent Transaction Outputs (UTXOs), a distinct characteristic that sets Bitcoin transactions apart from traditional financial transactions and offers a unique lens through which to analyze market behavior and investor sentiment.

Unlike traditional financial transactions where balances are tracked, Bitcoin uses a system of UTXOs, which represent the unspent value from Bitcoin transactions. A UTXO is the amount of digital currency remaining after a cryptocurrency transaction is executed. This output waits to be used as an input in a future transaction.

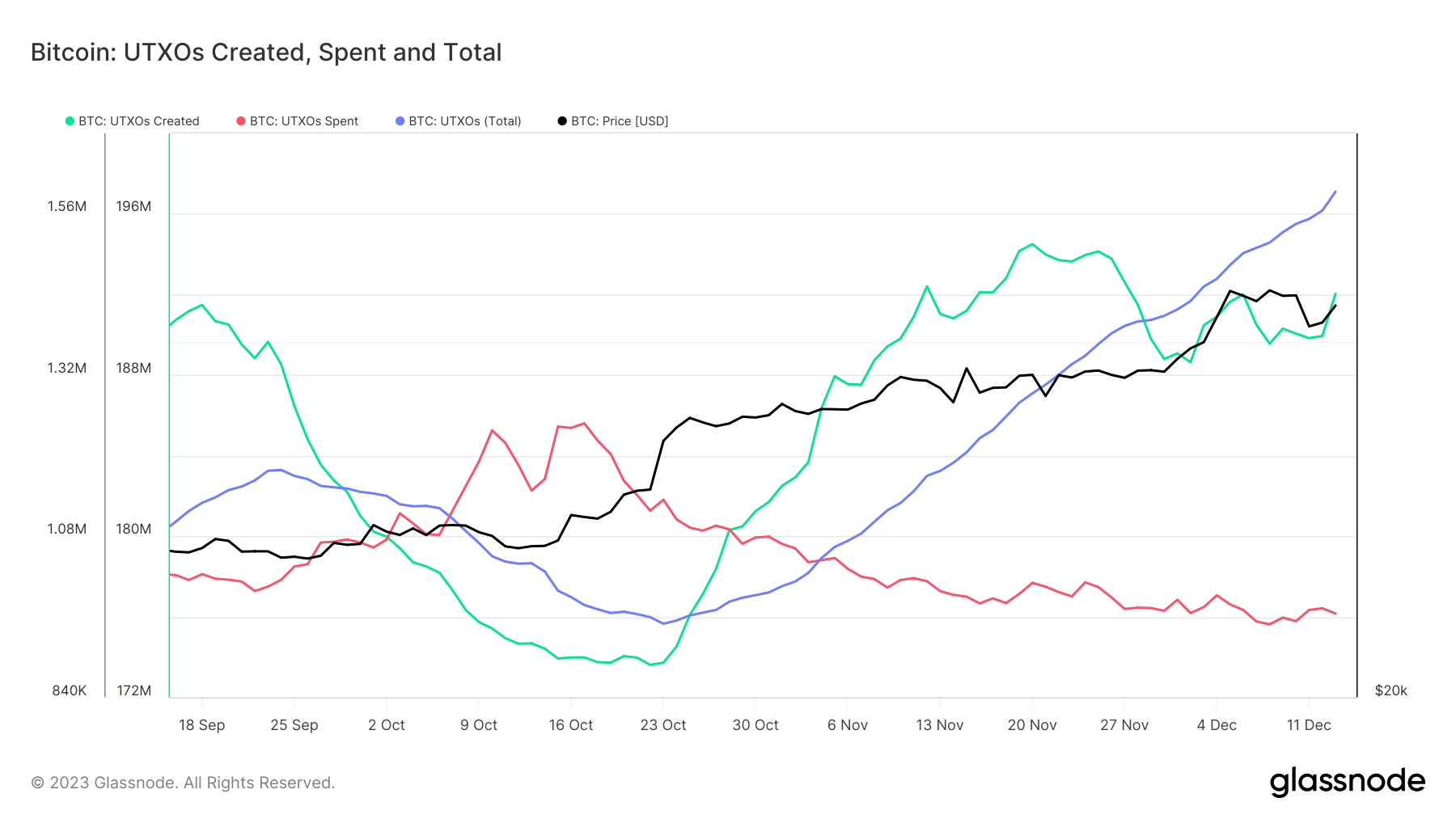

Bitcoin’s surge past the $40,000 mark has led to a notable trend in UTXOs. Since Oct. 28, the creation of UTXOs has consistently outpaced their spending. A ‘created UTXO’ refers to the output of a new transaction that hasn’t been spent, while a ‘spent UTXO’ is an input used in a transaction and is thus no longer available. The distinction between these two types of UTXOs reveals insights into how Bitcoin is used and stored.

This indicates a growing trend of Bitcoin accumulation, as new UTXOs represent new Bitcoin holdings that have not yet been spent. In contrast, spent UTXOs indicate Bitcoins that have been transferred or used in transactions. This distinction between created and spent UTXOs is pivotal in understanding market sentiment and behavior.

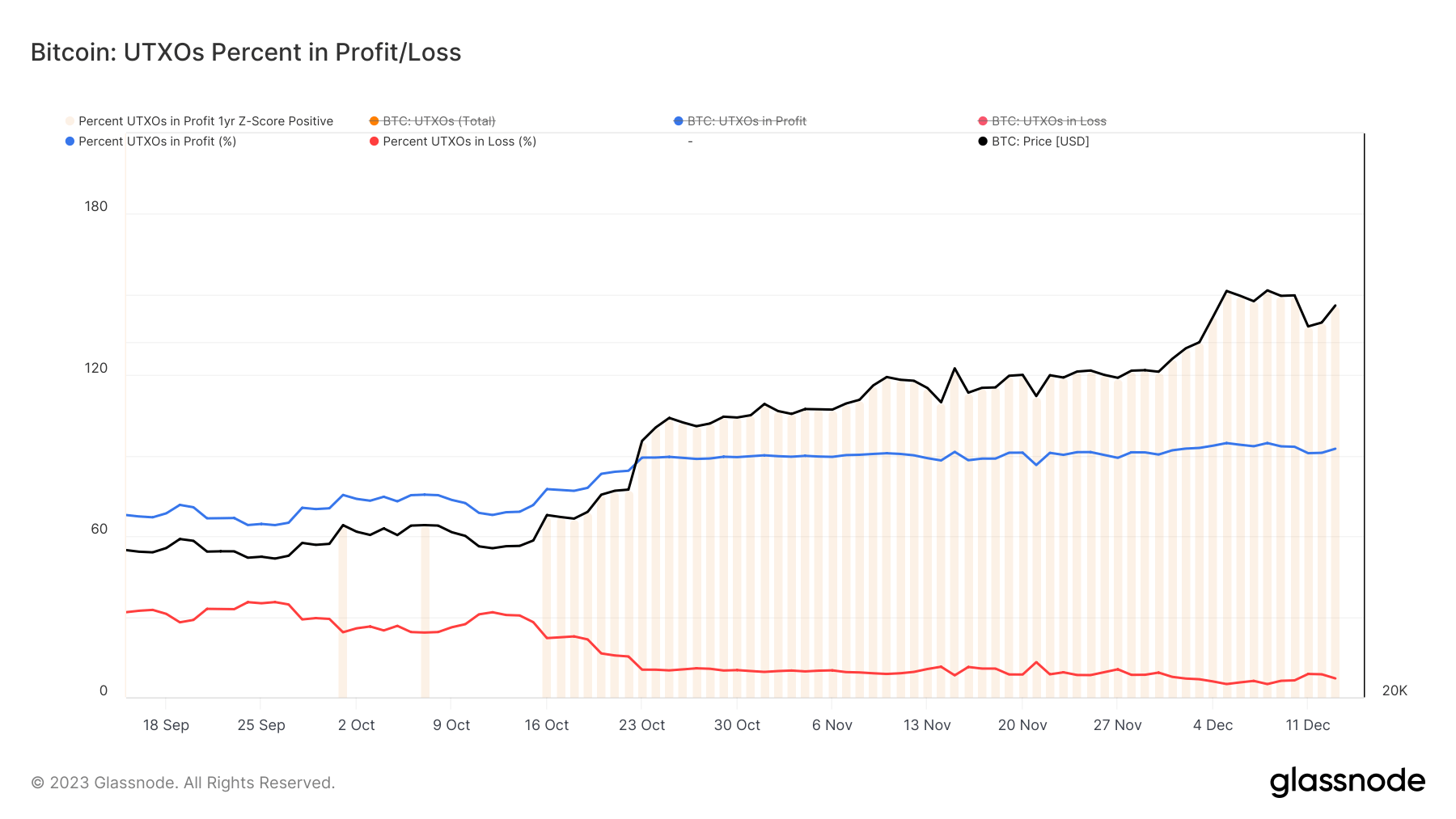

Between Oct. 28 and Dec.14, 2023, the daily average of created UTXOs was approximately 1.43 million, significantly higher than the 984,000 UTXOs spent on average per day. This resulted in a net increase in UTXOs, averaging around 442,000 daily. Despite some variability in the daily figures, as indicated by the standard deviation for UTXO creation and spending, the overall trend remained consistent. This trend signifies not only an increase in network activity but also a potential expansion in Bitcoin ownership, as indicated by the growing total count of UTXOs.

Concurrently, the percentage of Bitcoin UTXOs in profit rose from 88% to 92% during the same period. A UTXO is considered ‘in profit’ if the current market price of Bitcoin exceeds the price at which the Bitcoin in that UTXO was last transacted. This increase suggests that if these UTXOs were to be transacted or sold at the current market price, a profit would be realized, indicating a bullish sentiment in the market.

The observed patterns suggest a holding behavior among investors, possibly due to expectations of further price appreciation. This behavior is a hallmark of bullish market conditions, where the anticipation of future gains discourages selling or spending. The combination of a growing number of UTXOs and an increase in profitable ones might signify the entry of new investors or the augmented holdings of existing ones.

Another factor influencing this trend could be the significant rise in Bitcoin Inscriptions. Between Oct.28 and Dec. 14, 11.4 million new Inscriptions were created. While not every Inscription results in a new UTXO, the notable increase likely impacted the number of UTXOs created.

The trend of UTXOs created outpacing those spent has multiple implications for the market. Primarily, it suggests a preference for holding Bitcoin, indicating a positive market sentiment. This trend, coupled with the rise in profitable UTXOs, which signifies the potential earnings if these were to be sold at current market prices, reinforces the notion of Bitcoin as a promising investment, potentially attracting more investors and leading to more stability in the Bitcoin ecosystem.

This trend, influenced by both investor behavior and technological factors like Inscriptions, points to a period of accumulation and optimism among Bitcoin investors, which is mirrored in the strong support Bitcoin seems to have created above $40,000.

The post Bitcoin owners hold tight as new UTXOs outstrip spending appeared first on CryptoSlate.

Black Friday shoppers leave the Nike store as other shoppers wait in line to shop as retailers compete to attract shoppers and try to maintain margins on Black Friday, one of the busiest shopping days of the year, at Woodbury Common Premium Outlets in Central Valley, New York, U.S. November 24, 2023.

Vincent Alban | Reuters

Consumer spending has remained remarkably resilient in the face of some stiff economic headwinds.

Nearly all Americans, 96%, are concerned about the current state of the economy, according to a recent report by Intuit Credit Karma.

Still, more than a quarter are “doom spending,” or spending money despite economic and geopolitical concerns, the report found.

Even as inflation and high interest rates have squeezed budgets, a record 200 million shoppers turned out between Black Friday and Cyber Monday, according to the National Retail Federation. This season, holiday spending is expected to reach record levels, totaling up to $966.6 billion, the NRF projects.

More from Personal Finance:

Can money buy happiness? 60% of adults say yes

The ‘radically different’ wage growth forecast in 2024

Cooling job market no reason for panic yet, economists say

“Much like doom scrolling, we’re seeing people mindlessly shop to soothe concerns about the economy and foreign affairs, which could take a toll on their financial wellbeing,” said Courtney Alev, Credit Karma’s consumer financial advocate.

Even as credit card debt tops $1 trillion, Gen Z and millennials are particularly susceptible to this mindset, other reports show.

Rather than cut expenses, 73% of Gen Zers say they would rather live in the moment, a recent Prosperity Index study by Intuit found.

High inflation has made it particularly hard for those just starting out. More than half, or 53%, of Gen Zers said the increased cost of living is a barrier to their financial success, according to a separate survey from Bank of America.

“Younger adults feel discouraged,” said Ted Rossman, senior industry analyst at Bankrate.

However, “one thing that young adults have working for them is the advantage of time,” he added. “Every dollar you set aside will compound.” Gen Z workers are the biggest cohort of nonsavers, Bankrate also found.

At the very least, strike a balance, Rossman advised. Automate a portion of your income toward savings and build some fun into the budget, he said. “At least then you are not paying 20% credit card interest.”

Don’t miss these stories from CNBC PRO:

Nordstrom warns of ‘softening’ consumer spending, but notes fewer price cuts

Upscale clothing retailer Nordstrom Inc. on Tuesday warned of “softening” consumer spending ahead of the holidays. But after more than a year of rushing to clear shelves of piles of unwanted clothing, executives there became the latest to say they haven’t needed to cut prices as much.

Chief Executive Erik Nordstrom said on the company’s earnings call that store inventories — or its reserves of shirts, pants and shoes still sitting in stockrooms — were down 9% during the third quarter. Those thinner stockpiles, he said, “required…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In