On Friday, Ethena Labs, the creators of the stablecoin USDE, secured $14 million in funding from key investors. Following this recent influx of funds and a previous $6.5 million investment from Maelstrom, overseen by Arthur Hayes, in July 2023, the company’s post-valuation has risen to $300 million. USDE Issuer Ethena Labs Raises $14M Ethena Labs, […]

On Friday, Ethena Labs, the creators of the stablecoin USDE, secured $14 million in funding from key investors. Following this recent influx of funds and a previous $6.5 million investment from Maelstrom, overseen by Arthur Hayes, in July 2023, the company’s post-valuation has risen to $300 million. USDE Issuer Ethena Labs Raises $14M Ethena Labs, […]

Source link

stablecoin

Surge in stablecoin supply ratio signals increased Bitcoin buying power

Quick Take

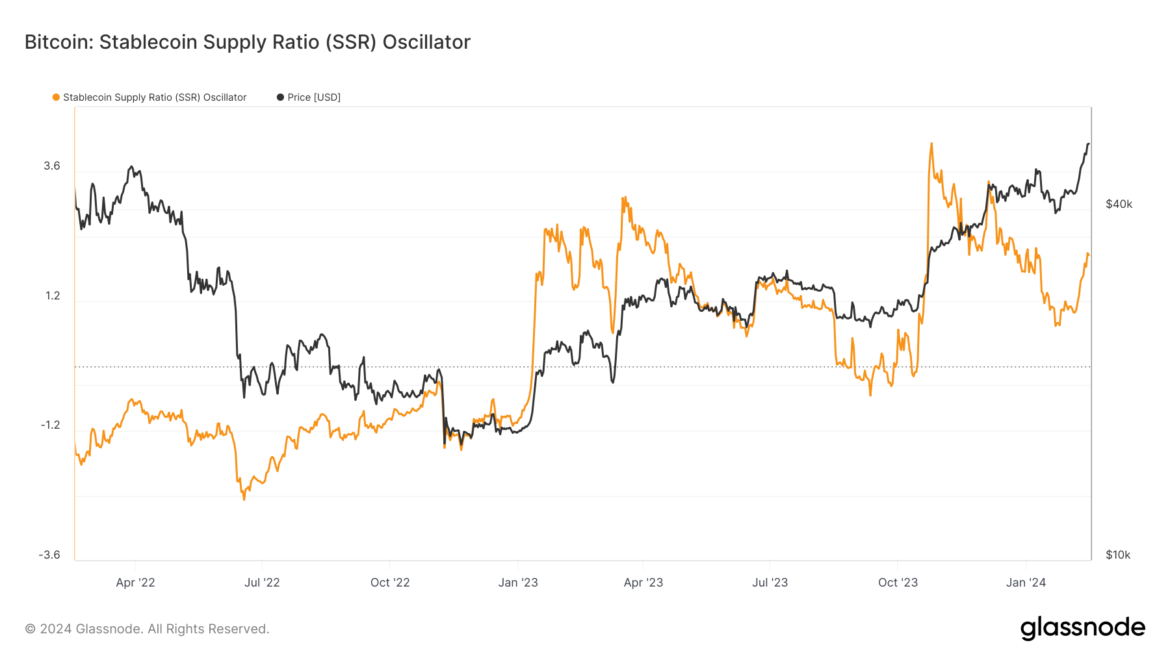

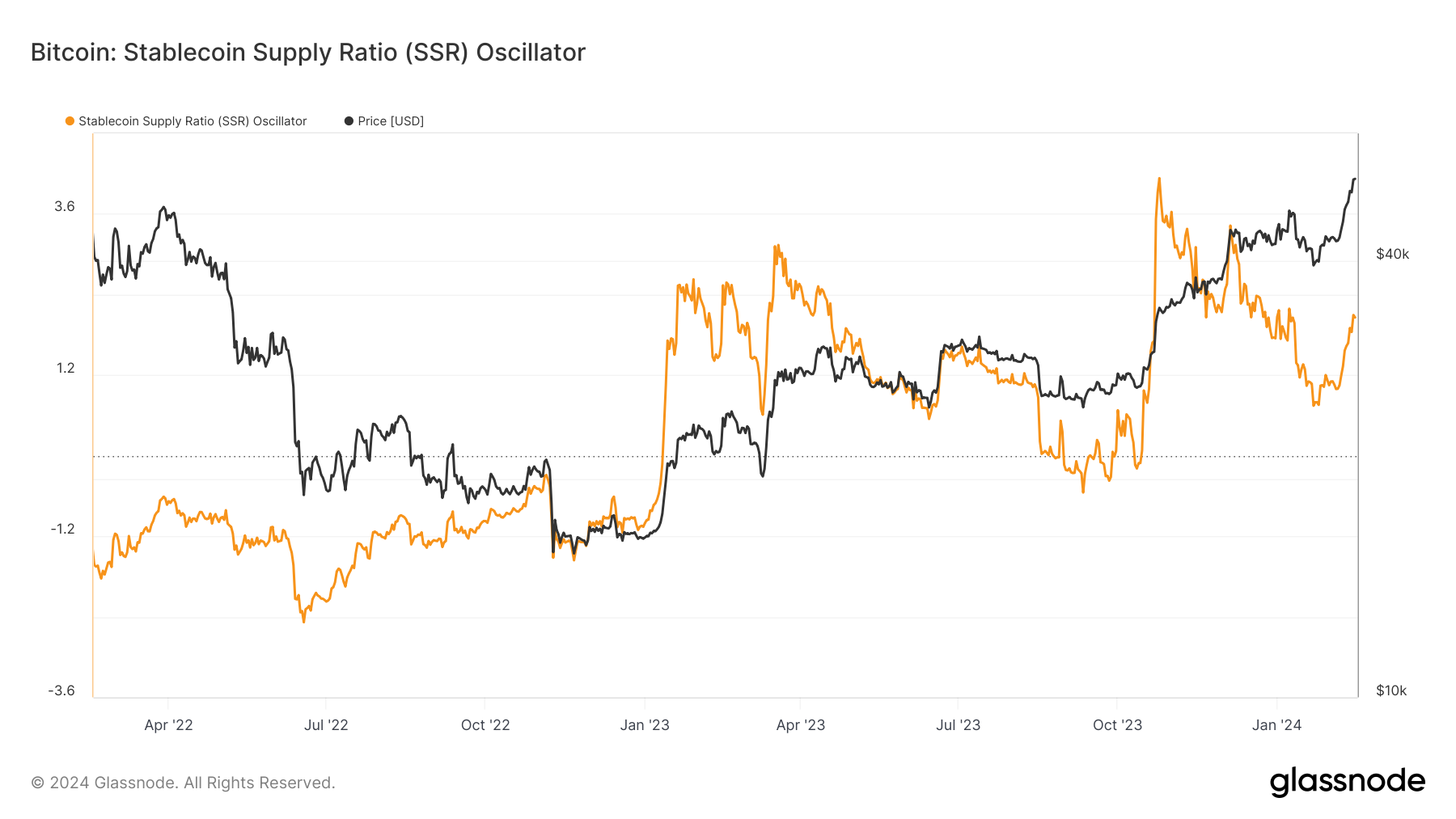

The Stablecoin Supply Ratio (SSR), a key metric that quantifies the supply forces between Bitcoin and various stablecoins, has been signaling increased “buying power” for Bitcoin in the past ten days.

Glassnode defines the SSR as the ratio of Bitcoin’s market cap to that of stablecoins denoted in Bitcoin, which serves as a proxy for the demand-supply mechanics of BTC versus USD. When the SSR dips, it implies a heightened buying power for the current stablecoin supply to purchase Bitcoin.

Three weeks ago, CryptoSlate observed a subtle upsurge in the SSR, from 0.74 to 1.04, corresponding to an increase in Bitcoin’s value to $42,000. Back then, the SSR was at 1.04, and it is now at 2.04. The upward movement started on Feb. 8 and coincided with the rise in Bitcoin price to $52,000.

This suggests that the demand for Bitcoin is driven by ETF interest and stablecoin liquidity entering the Bitcoin market.

The post Surge in stablecoin supply ratio signals increased Bitcoin buying power appeared first on CryptoSlate.

Tether CEO bashes JPMorgan’s ‘hypocrisy’ amid stablecoin dominance concerns

Tether CEO Paolo Ardoino slammed Wall Street giant JPMorgan’s “hypocrisy” to raise concerns about the stablecoin issuer’s dominant position in the cryptocurrency market while being the “biggest bank in the world.”

In a Feb. 2 statement sent to CryptoSlate, Ardoino stated that Tether’s market dominance has proven crucial for the emerging industry despite the negative perceptions that its competitors and banks have about it.

“Tether’s market domination may be a ‘negative’ for competitors including those in the banking industry wishing for similar success but it’s never been a negative for the markets that need us the most,” Ardoino quipped.

On Feb. 1, JPMorgan expressed apprehensions about Tether’s impact on the broader crypto market, citing concerns about its “lack of regulatory compliance and transparency.” The Wall Street giant also expressed fears of how Tether poses a risk for crypto due to its deep integration within the system

Furthermore, the bank compared Tether unfavorably to Circle, noting the latter’s greater regulatory compliance.

However, these comments were met with a stiff reaction from Ardoino who defended Tether’s resilience, citing its performance during last year’s banking crisis, and highlighted the company’s collaboration with regulators to enhance understanding of blockchain technology.

“Tether demonstrated more resilience in a black swan event than several major U.S. banks last year. As we recognize the significance of our invention, we’ve always worked closely with global regulators to educate them on the technology and provide guidance on how they must think about it,” Ardoino stated.

The Tether CEO further chimed that JPMorgan’s comments “seems hypocritical” because it is “from the biggest bank in the world.” He expressed concern about such remarks from a bank that has incurred nearly $40 billion in fines and encouraged JPMorgan to draw lessons from Tether’s success in the stablecoin sector.

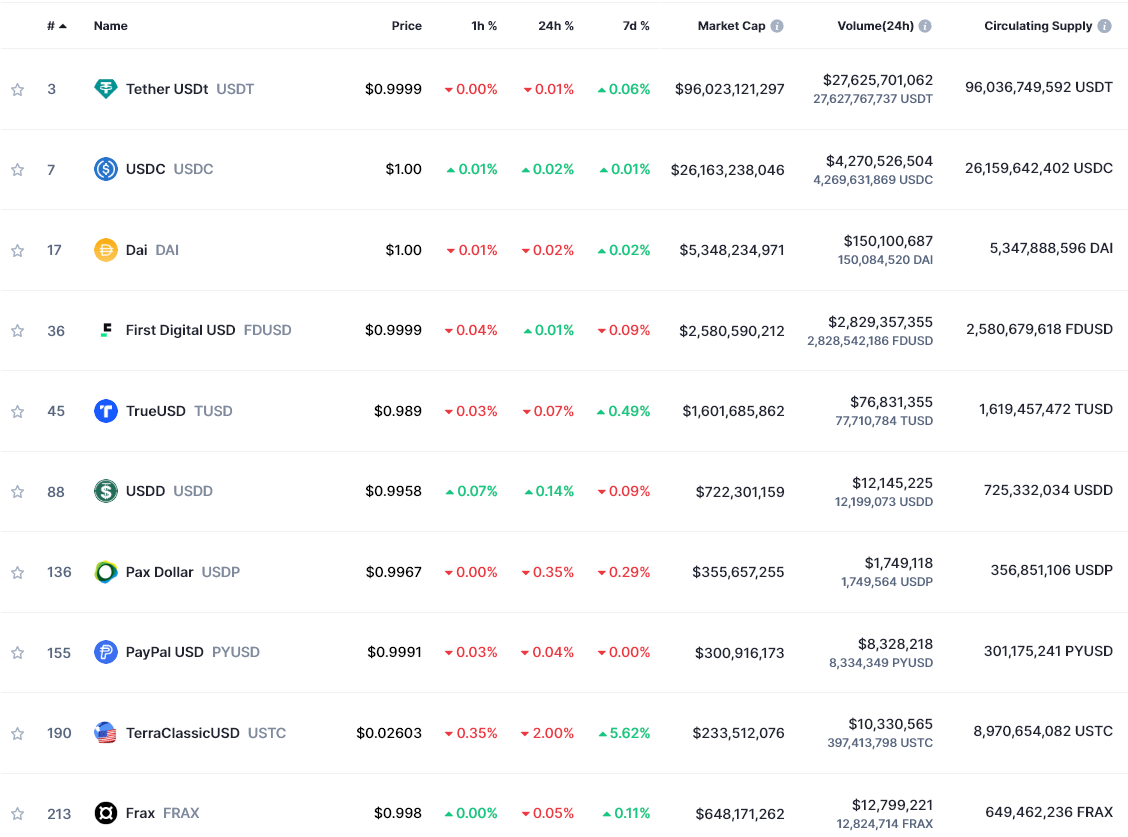

Tether’s USDT is the largest stablecoin by market capitalization and one of the most popular digital assets. The stablecoin has seen its market share rapidly expand during the past year, thanks to the regulatory issues that has impacted rivals like Circle’s USDC and Binance-backed BUSD.

Tether’s latest attestaion report showed that this dominance translated into a net profit of 10% of JPMorgan’s earnings for the last quarter of 2023.

The post Tether CEO bashes JPMorgan’s ‘hypocrisy’ amid stablecoin dominance concerns appeared first on CryptoSlate.

Abracadabra Finance’s MIM stablecoin falls from peg after $6.5M hack

Digital assets associated with the decentralized finance (DeFi) project Abracadabra Finance, including its Magic Internet Money (MIM) stablecoin, values fell after its team confirmed an exploit of the platform.

In a Jan. 30 post on social media platform X (formerly Twitter), the project’s team acknowledged an ongoing exploit involving certain Ethereum cauldrons. “Our engineering team is triaging and investigating the situation,” they added.

Data from CoinMarketCap shows that the security incident resulted in the ecosystem’s MIM stablecoin deviating from its $1 peg. The asset’s value fell to as low as $0.77 before recovering to $0.92 as of press time.

The team assured that its decentralized autonomous organization (DAO) would strive to help the stablecoin regain its peg.

“To the best of its Ability, the DAO treasury will be buying back MIM from the market to then burn.” the team stated.

Similarly, the protocol’s SPELL reward token declined 2.43% to $0.00051 as of press time, according to CryptoSlate data.

Furthermore, the security incident has rapidly dropped the total value of assets locked on the platform. Data from DeFillama shows that the protocol’s assets under management rapidly fell by around $23 million to $139 million.

However, data from Abracadabra’s website pegs the total outflow to $10.3 million and its TVL at $150 million as of press time.

Abracadabra Finance is a DeFi lending protocol allowing users to borrow its Magic Internet Money (MIM) stablecoin using different cryptocurrencies as collateral.

$6.5M hack

Blockchain security firm CertiK told CryptoSlate that the protocol was exploited for $6.5 million.

According to CertiK, the attacker was funded via the crypto-mixing tool Tornado Cash and created an attack contract that exploited a rounding error issue on the platform.

“The exploiter repeatedly called userBorrowPart() and repay() from the project’s V4 Cauldrons with early indications pointing to a rounding issue,” CertiK furthered.

Consequently, the attacker was able to siphon $6.5 million in MIM and immediately converted the stolen assets into Ethereum that were sent to two externally owned addresses,

PayPal’s entrance into the stablecoin market on Aug. 7, 2023, was welcomed by many in the industry, with Circle CEO Jeremy Allaire stating that competition from PayPal was ‘great to have.’

The news of the launch led to a modest 4% rise in the price of Bitcoin, and within days, exchanges were offering low-fee promotional opportunities for traders willing to utilize PayPal’s PYUSD. Before the end of August, Coinbase, Kraken, and HTX had listed the stablecoin, adding Venmo support just a month later.

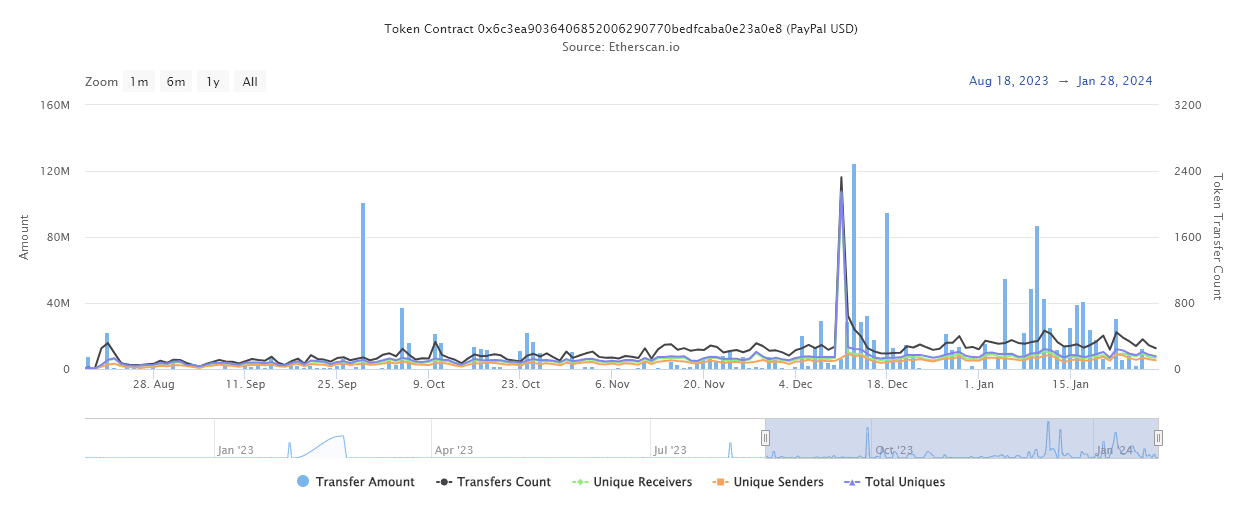

Five months after its launch, PYUSD has now claimed the number eight position by market cap in the global stablecoin charts, having captured the $300 million mark around Jan. 22. However, PYUSD drops to eleventh overall when ordered by volume, with just $10 million in 24-hour trade volume. This puts it only slightly ahead of UST Classic, which, with a price 98% off its originally intended $1 peg, traded just $500,000 less over the past day.

Still, PayPal’s PYUSD climb to $300 million in value locked in five months is impressive. In addition to an increase in market cap, the token has seen steady on-chain activity, with a modest 200 – 400 transactions per day.

However, PYUSD has yet to break into the DeFi landscape in any meaningful way, as the below table and diagram highlight. The majority of the PYUSD liquidity sits on centralized exchanges, with Crypto.com being the largest single holder of the token at $113 million, just over one-third of the total market cap.

The visualization below depicts the transactions between major entities exclusively for PYUSD. Entities with more substantial PYUSD holdings are shown larger than those with smaller amounts. The entities with no logos on the far right are unknown wallets holding above $30,000. The logos in the top right depict business entity tokens, likely treasury holdings.

Interestingly, there are several connections between PYUSD issuer Paxos, Uniswap, and Curve. Yet, these entities do not then link into the major exchanges, suggesting the DeFi and CEX ecosystems for PYUSD are wholly separate.

While PayPal was subpoenaed by the SEC when PYUSD had half the current market cap, it was reported to have complied with requests, and little has been heard on the matter since. The announcement of the filing marked the local low for PayPal’s stock price also, with it rallying 24% since November.

Further, PayPal Ventures has recently started using the PYUSD stablecoin as a mechanism for strategic investments, using it for a stake in the institutional crypto platform Mesh. Amman Bhasin, Partner at PayPal Ventures, commented,

“As the world of financial services undergoes rapid transformation, we believe that user ownership and portability of assets will become a critical building block of product innovation, with crypto serving as the first beachhead where this is possible.”

Thus, while PYUSD still has some way to go to catch behemoths such as Circle and Tether, the debutant and web2 disruptor is certainly in the process of cementing its position in the industry.

TrueUSD (TUSD) stablecoin experienced wild volatility the past day as it fell below the $1 peg amid its declining supply.

Data from CryptoSlate shows that the stablecoin fell to as low as $0.984 during the reporting period and has yet to regain its peg as of press time. Chainlink’s TUSD data also confirms this downtrend, with the Justin Sun-linked stablecoin exchanging hands for $0.98535493.

Trading activity analyzed on various platforms shows that the stablecoin holders have been dumping their assets.

For context, Binance data shows that about 60% of the cash flow around TUSD has gone to the asset’s sales. TUSD saw sell orders exceeding $450 million against around $296 million in buy orders. This leaves a deficit of around $155 million.

Observers have suggested the absence of TUSD mining in Binance’s latest launch pool contributed to the sales. Adam Cochran, the managing partner at Cinneamhain Ventures, praised the crypto exchange for not supporting the embattled asset in its latest pool.

TUSD’s Curve pool further shows it is heavily imbalanced as of press time, with crypto traders showing preferences for Tether’s USDT, Circle’s USD Coin (USDC), and DAI.

The TUSD Curve dashboard shows that the stablecoin accounts for nearly 88% of the pool’s $70,396 reserve, while USDT made up roughly 8%. The other stablecoins in the pool make up the 5% balance.

Similarly, Whale Alert also flagged the burning of 54 million TUSD tokens during the past day. Stablecoins are burned when users convert their holdings into fiat.

The stablecoin is also facing concerns over its collateral attestations report. Members of the crypto community highlighted a pause in the real-time attestation of TUSD on Jan. 10. The screenshot shared showed that the balance ripcord is usually triggered when there is an “actual imbalance of liabilities and corresponding assets.”

However, the attestation has become functional, with the stablecoin collateral at 101% on the website as of press time.

Meanwhile, the drama surrounding the stablecoin has severely impacted its supply, falling under $2 billion, its lowest level since June 2023. TUSD had seen a dramatic uptick in 2023, climbing to a peak of $3.5 billion in September from $840 million at the start of the year.

UN Flags Increased USDT Stablecoin Use in Money Laundering across Asia

Despite the increasing involvement of the USDT stablecoin in criminal activities, the UN has reported that law enforcement authorities have successfully dismantled various money laundering organizations responsible for transferring illegal funds using USDT.

The United Nations (UN) has warned that Tether’s USDT stablecoin has become the preferred cryptocurrency for money laundering schemes and other illicit activities in Asia.

The Financial Times reported Monday, citing a report published by the UN’s Office of Drug and Crime Unit, that nefarious actors in Southeast Asia are using the digital assets to engage in fraudulent activities, including the infamous romance scam known as pig butchering.

Rising Criminal Activities Involving Tether

The UN’s Office of Drug and Crime Unit uncovered that in recent years, the Asian region has been significantly entangled in highly sophisticated, high-speed money laundering and other criminal activities involving Tether’s USDT.

The UN’s report cited an example of a money laundering syndicate that operates in both Myanmar, and Cambodia, displaying a sign on the street advertising USDT and offering to exchange “black” tokens for cash.

These crimes also extend to online gambling platforms operating illegally in the region. According to the Financial Times report, these platforms have become a preferred choice for crypto-related money launderers, especially those using USDT, representing the world’s largest stablecoin.

Jeremy Douglas, an executive at the UN, said that the emergence of cryptocurrencies and new technologies has successfully created an alternative banking system for bad actors.

“Organized crime has effectively created a parallel banking system using new technologies, and the proliferation of loosely or entirely unregulated online casinos together with crypto has supercharged the region’s criminal ecosystem,” said Douglas.

Tether Froze $225 Million in USDT

Despite the increasing involvement of the USDT stablecoin in criminal activities, the UN has reported that law enforcement authorities have successfully dismantled various money laundering organizations responsible for transferring illegal funds using USDT.

In a notable incident last year, Singaporean authorities busted an illegal organization in August, recovering $737 million in cash and crypto.

During the same period, Tether, in collaboration with US authorities and the crypto exchange OKX, froze USDT tokens valued at $225 million. Coinspeaker reported the funds were traced back to a syndicate engaged in unlawful activities related to “pig butchering” and human trafficking in Southeast Asia.

On November 16, Tether, the stablecoin issuer, addressed letters to the US Senate Committee on Banking, Housing, and Urban Affairs and the US House Financial Services Committee, expressing its dedication to combating illicit activities within the digital assets space.

In these letters, Tether disclosed its proactive measures, including implementing a reactor tool obtained from Chainalysis, a blockchain data analytics company. This tool provides reports on all transactions conducted in Tether’s secondary markets.

Additionally, Tether said it established a dedicated Compliance Department equipped with an anti-money laundering (AML) and know-your-customer (KYC) program. The tool aims to assist the company in analyzing blockchain transactions, identifying wallets associated with problematic activities, and preventing funding for terrorist groups.

Up to this point, the stablecoin issuer has frozen more than 1,260 addresses linked to illicit activities, with a combined value surpassing $875 million, according to data from Dune Analytics.

next

Altcoin News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Circle Internet Financial confidentially filed for an initial public offering (IPO) in the US.

Circle, a leading financial technology company and the issuer of the popular USDC stablecoin, has taken a significant stride towards becoming a publicly traded entity by confidentially submitting its draft registration statement for an Initial Public Offering (IPO). This move signals the company’s ambition to bring innovative blockchain-based financial services to a broader audience and capitalize on the growing interest in digital assets.

According to the confidential draft S-1 document with the US Securities and Exchange Commission (SEC), the stablecoin issuer is yet to determine the number of shares to be made available to the public and the price range for these offerings. The company stated that the IPO will occur once the SEC concludes its review, contingent on market and other factors.

Circle Is Eager to go Public

Interestingly, this is not the company’s first attempt at being publicly listed. The stablecoin issuer attempted a Special Purpose Acquisition Company (SPAC) deal with Concord Acquisition back in 2022. The $4.5 billion deal later fell through last December when the firm failed to complete the regulator’s qualification on time.

Notably, Circle has been at the forefront of revolutionizing finance through blockchain technology. The company’s platform facilitates the seamless transfer and management of digital assets, bridging traditional finance and the emerging world of Decentralized Finance (DeFi). By submitting a draft registration statement for an IPO, Circle is poised to bring its vision to a wider audience and raise significant capital to fuel its continued growth.

Meanwhile, investors and enthusiasts alike will keenly watch the developments surrounding Circle’s IPO journey. The company’s commitment to transparency, security, and innovation has garnered significant attention in the fintech space. An IPO would not only provide Circle with additional capital but also serve as a testament to the maturation and acceptance of blockchain-based financial services on a global scale.

Circle Stablecoin Expansion Journey Rages On

Interestingly, Circle has been strengthening its presence in Asia, and other countries. The company’s co-founder and CEO Jeremy Allaire has been considering issuing stablecoins in Japan after visiting the country in June 2023.

Likewise, the company was recently registered and regulated in Singapore as a money transfer company that can use digital currencies and transfer money across borders. It is also working on getting authorization in Europe as a digital asset provider.

Based in Boston, Circle has garnered support from prominent players in the financial services sector, such as BlackRock Inc (NYSE: BLK), Goldman Sachs Group Inc (NYSE: GS), and Fidelity Management, among others. Also, Circle (USDC) is available on several blockchains including Ethereum (ETH), Polygon, Stellar Network, and Solana, among many others.

If successful, Circle will rank as the second native crypto firm to go public following the debut of Coinbase Global Inc (NASDAQ: COIN) in the second quarter of 2021.

next

Business News, IPO News, News

You have successfully joined our subscriber list.

Arthur Hayes believes big banks will make stablecoin issuers like Tether obsolete

Big banks are poised to enter and potentially dominate the stablecoin market, overshadowing current leaders like Tether, according to former BitMEX co-founder Arthur Hayes.

In a recent interview with Unchained’s Laura Shin, Hayes said that centralized stablecoins have found a lucrative niche due to the reluctance of traditional banks to engage in similar activities.

However, he foresees a possible disruption, as banks might eventually enter the market with their own digital currencies. Hayes predicted that once banks recognize the profit potential in this domain, they will quickly move to dominate it, leveraging their existing infrastructure and customer trust.

Existential threat for stablecoin issuers

Hayes observed that despite Tether’s success in establishing itself as a leading fiat-collateralized stablecoin, the fundamental business model it employs is one that traditional banks could easily adopt and potentially excel in.

Hayes said that centralized stablecoins like Tether have thrived due to a gap left by traditional banking systems.

Tether, for instance, generates significant profits by exploiting interest rate differentials between dollar deposits and U.S. treasury bills, a business model that banks have refused to engage in due to political or regulatory constraints.

According to Hayes:

“[Stablecoin issuers] don’t have any defensible business because they use banks to custody their funds, which allows them to trade debt instruments.”

However, Hayes predicts a shift where major banks could launch their digital currencies, potentially rendering services like Tether obsolete.

He said that once banks are given the green light to engage with the digital assets sector, they have the necessary comprehensive financial networks and regulatory compliance frameworks to hit the ground running.

He speculated that if banks like JP Morgan Chase were to launch their own stablecoin, they could easily leverage their established reputations and global reach to quickly gain a significant market share, thereby impacting the dominance of current providers such as Tether.

Bitcoin and AI

The conversation also touched on the role of Bitcoin (BTC) as the preferred currency for AI. Hayes argued that money, at its core, is a form of energy transformation.

In his view, Bitcoin, being a direct product of energy expenditure (through mining), represents the purest form of monetary energy. This makes it uniquely suited for AI systems, which prioritize efficient energy management and operate in a purely computational realm.

Hayes further elaborated that AI systems, in their quest for efficiency and autonomy, would naturally gravitate towards a currency that embodies these principles. Bitcoin, with its decentralized, energy-based foundation, fits this criterion perfectly.

Hong Kong lawmaker raises concerns over proposed stablecoin regulations

Earlier today, Hong Kong’s financial regulators—the Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA)—released a joint statement about a new regulatory framework for stablecoins, a type of cryptocurrency designed to minimize the volatility of the price, typically tied to a reserve asset like the U.S. dollar.

However, Hong Kong Legislative Council member Johnny Ng has expressed concerns about this regulatory proposal in a Dec. 27 post on social media platform X (formerly Twitter).

Stablecoin regulation

Under the regulatory proposal, Hong Kong wants to oversee the activities of fiat-referenced stablecoins (FRS) and mandates issuers of these assets to obtain local licensing to operate.

The license will necessitate stablecoin issuers to back their assets fully, maintaining high-quality and highly liquid reserves with minimal risks. Furthermore, these reserves must remain separate from the issuers’ other assets.

“The licensee would also need to comply with relevant governance, risk management and AML/CFT measures. We also intend to put in place necessary guardrails for entities other than the stablecoin issuers who would like to offer or distribute stablecoins. In particular, only stablecoins issued by licensed issuers could be offered to retail investors,” the regulators stated.

Additionally, the proposal mandates that these firms establish a local presence within Hong Kong. This local entity should include a Chief Executive, senior management team, and key personnel based in the country.

The proposal invites public feedback and contributions until February 29, 2024, and follows a prior discussion paper regarding stablecoins published by the HKMA in 2022.

Meanwhile, these regulatory efforts further indicate Hong Kong’s pro-crypto regulations designed to position it as a crypto hub. Last week, CryptoSlate reported that Hong Kong’s Securities and Futures Commission (SFC) and HKMA revealed their readiness to accept applications for spot crypto exchange-traded funds (ETFs).

Concerns

In his statement on X, Ng emphasized the importance of regulators acknowledging the presence of major global stablecoins like Tether (USDT), USD Coin (USDC), etc., already in circulation, potentially failing to seek licensing.

According to him, if these international stablecoin companies do not apply for licenses in Hong Kong, the regulatory authorities should explore how such coins could be traded on licensed exchanges.

He noted that a failure to address this could disrupt crypto transactions and reduce trading volumes, leading to unintended repercussions in the market.

Additionally, Ng highlighted concerns about the policy’s ambiguity regarding stablecoin applications and potential transaction fees.