Around 70% to 80% of transactions in the crypto secondary market transactions occur between crypto assets and stablecoins. The South Korean government’s welcoming stance, coupled with the high popularity of crypto assets in the country, are among the reasons why the won is now the second most-used fiat currency. Decline in 2021/2 Crypto-to-Stablecoin Volumes According […]

Around 70% to 80% of transactions in the crypto secondary market transactions occur between crypto assets and stablecoins. The South Korean government’s welcoming stance, coupled with the high popularity of crypto assets in the country, are among the reasons why the won is now the second most-used fiat currency. Decline in 2021/2 Crypto-to-Stablecoin Volumes According […]

Source link

stablecoins

Over the past week, the stablecoin trueusd (TUSD) experienced a notable decrease in its supply. As of March 19, 2024, the circulation was approximately 1.1 billion TUSD, which then plummeted to just 612 million. Supply Slash Sees TUSD Fall From Top 5 Stablecoin Rankings to 8th Position Previously ranked among the top five dollar-pegged cryptocurrencies […]

Over the past week, the stablecoin trueusd (TUSD) experienced a notable decrease in its supply. As of March 19, 2024, the circulation was approximately 1.1 billion TUSD, which then plummeted to just 612 million. Supply Slash Sees TUSD Fall From Top 5 Stablecoin Rankings to 8th Position Previously ranked among the top five dollar-pegged cryptocurrencies […]

Source link

Vitalik Buterin’s ENS Address Trades $100K Worth of ETH for Stablecoins Amid Market Uptick

According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

According to blockchain analytics, the Ethereum Name Service (ENS) domain “vitalik.eth” has engaged in a transaction of $100,000 worth of ether, converting it into an equal amount of stablecoins on the Base blockchain. The address, purportedly belonging to Ethereum’s co-founder Vitalik Buterin, currently possesses 955.58 ether, estimated at $3.64 million. ‘Vitalik.eth’ Wallet Makes Strategic $100K […]

Source link

Former NFL Star Russell Okung’s Crypto Adoption Comments Ignite Bitcoin vs. Stablecoins Debate

Comments on Lightning Network adoption, made by Russell Okung, a former NFL star who is among the first to receive part of his salary in crypto, sparked a discussion that highlighted the opposing opinions of the crypto community about the usage of bitcoin and stablecoins in emerging markets. Russell Okung Ignites Discussion on Bitcoin vs. […]

Comments on Lightning Network adoption, made by Russell Okung, a former NFL star who is among the first to receive part of his salary in crypto, sparked a discussion that highlighted the opposing opinions of the crypto community about the usage of bitcoin and stablecoins in emerging markets. Russell Okung Ignites Discussion on Bitcoin vs. […]

Source link

Korean central bank governor urges CBDC development to compete with stablecoins

Bank of Korea Governor Chang-yong Rhee warned that the rise of stablecoins could pose a significant threat to the traditional roles of central bank money and impact the effectiveness of monetary policies, local media reported.

Rhee made the statement at a conference on digital money in Seoul on Dec. 15. He added that central banks must step up their efforts to issue both a retail and a wholesale form of central bank digital currency to mitigate this looming threat.

Financial stability concerns

In his keynote speech, Rhee highlighted two main issues central banks must confront.

The first major concern is the rise of stablecoins and the existential threat they pose to central bank money, while the second is the lack of a proper regulatory framework for non-depository or non-financial institutions participating in the digital financial system.

Rhee emphasized that, despite their nomenclature, stablecoins often lack intrinsic stability and could diminish the role of central bank-issued money. This, in turn, could impair the effectiveness of traditional monetary policies.

Further complicating matters is the potential involvement of global networks like Visa or Mastercard, especially for countries like South Korea. This could lead to complexities in managing capital flows and maintaining monetary policy independence, Rhee added.

To address these challenges, Gov. Rhee suggested that central banks consider introducing central bank digital currencies (CBDCs), both in retail and wholesale formats.

He highlighted South Korea’s own efforts in this domain, including a pilot project for a retail CBDC system that leverages distributed ledger technology (DLT). The programmability of such currencies, allowing for complex, conditional transactions through smart contracts, was particularly noted as a significant advantage.

Moreover, the BOK, in collaboration with financial regulators and the Bank for International Settlements, is embarking on a second CBDC pilot project to explore wholesale CBDCs.

The project focuses on integrating a wholesale CBDC with tokenized bank deposits. It aims to explore the issuance of tokenized e-money by banks and non-bank financial institutions fully backed by wholesale CBDCs.

Echoing sentiments

The views of the Bank of Korea align with the sentiments of other major global central banks and financial institutions. For instance, the U.S. Federal Reserve has highlighted the volatility risks associated with stablecoins, especially those collateralized by other cryptocurrencies.

The Fed’s analysis points out the potential for market runs and the amplification of financial instability due to these digital assets. Similarly, the BIS has raised concerns about using stablecoins in cross-border payments.

According to a report by the BIS Committee on Payments and Market Infrastructures, stablecoins could challenge monetary sovereignty and financial stability, and impact seigniorage income. The report also suggests that the benefits of stablecoins could only be realized under stringent design and regulatory frameworks.

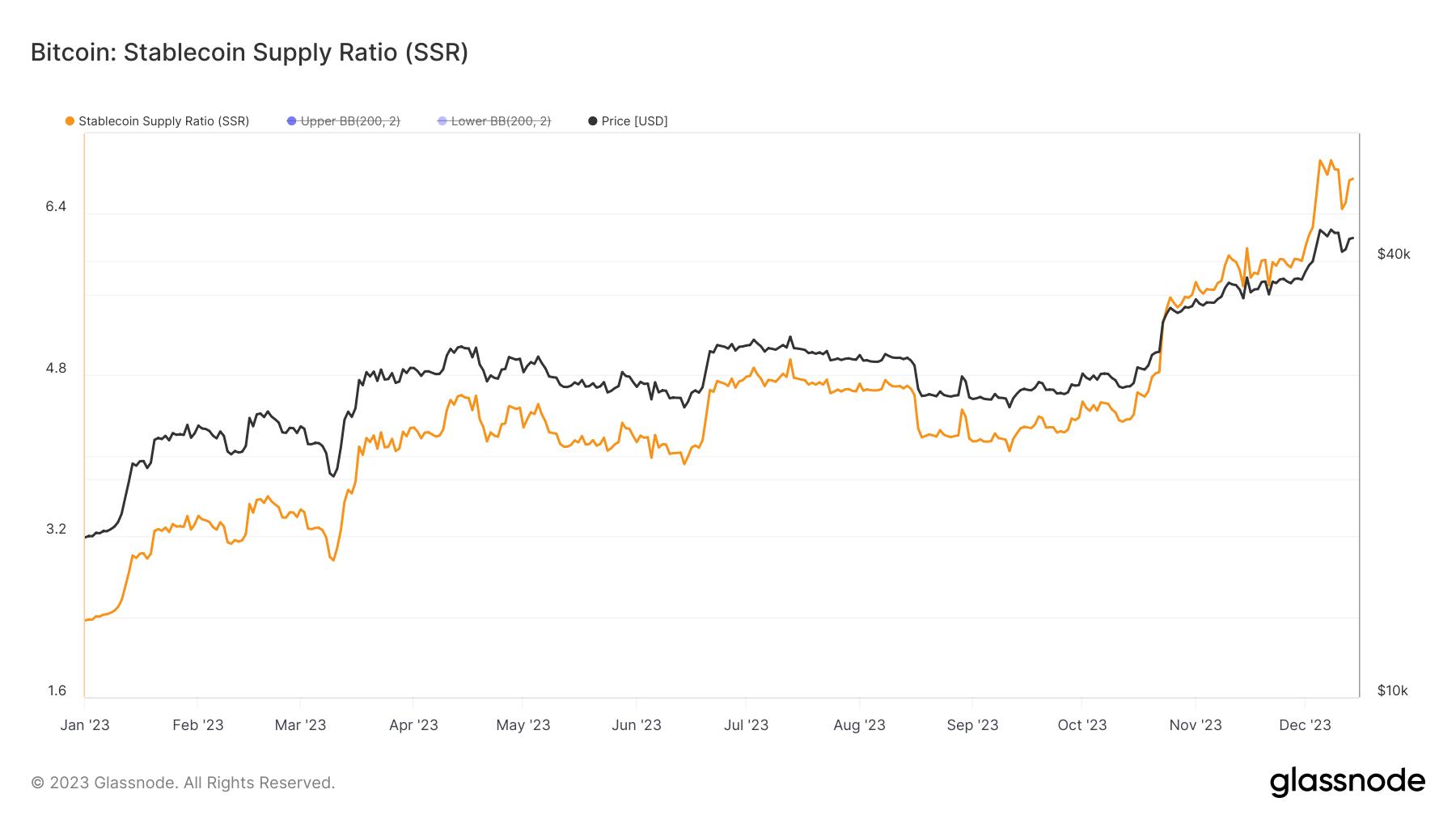

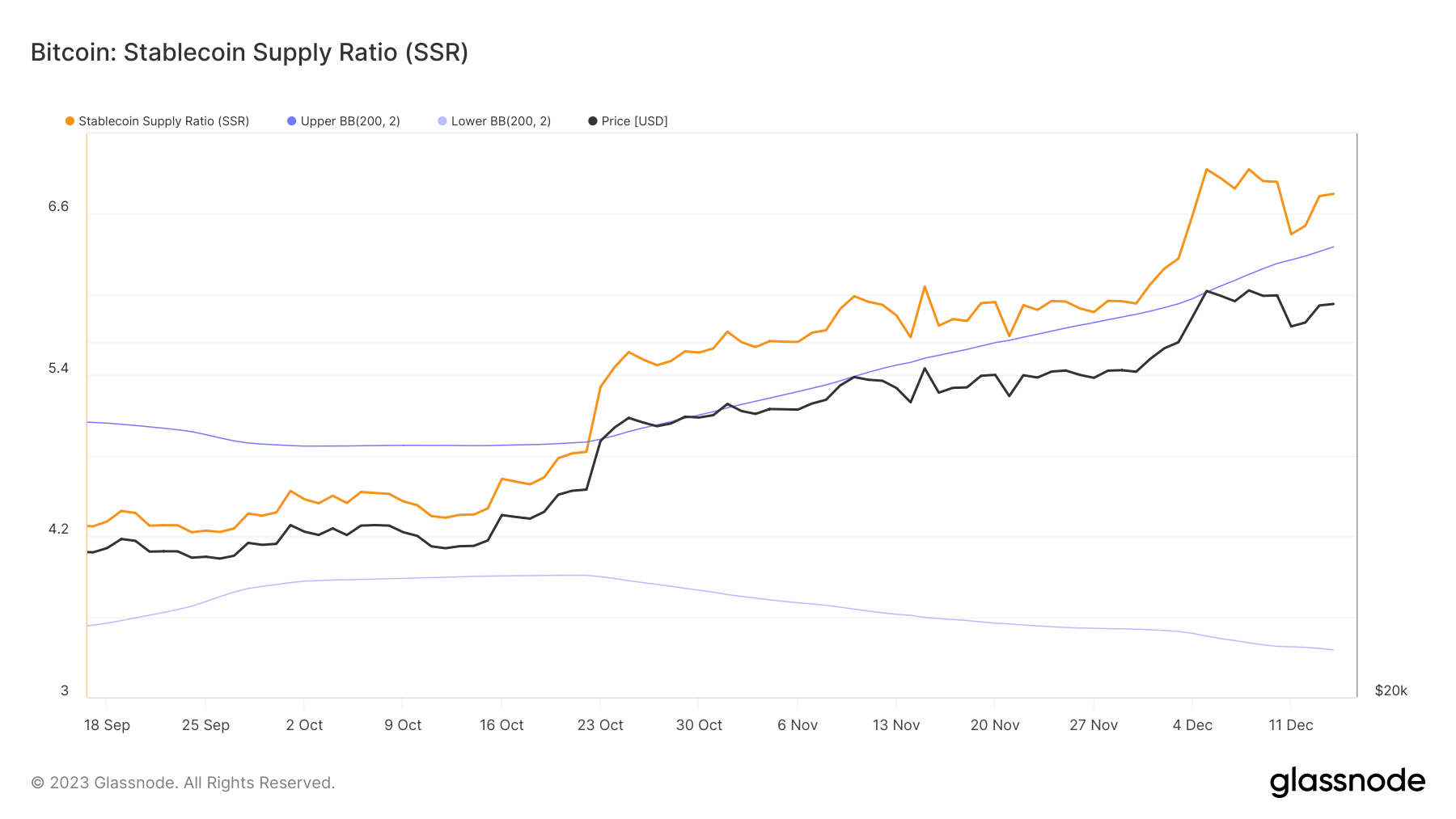

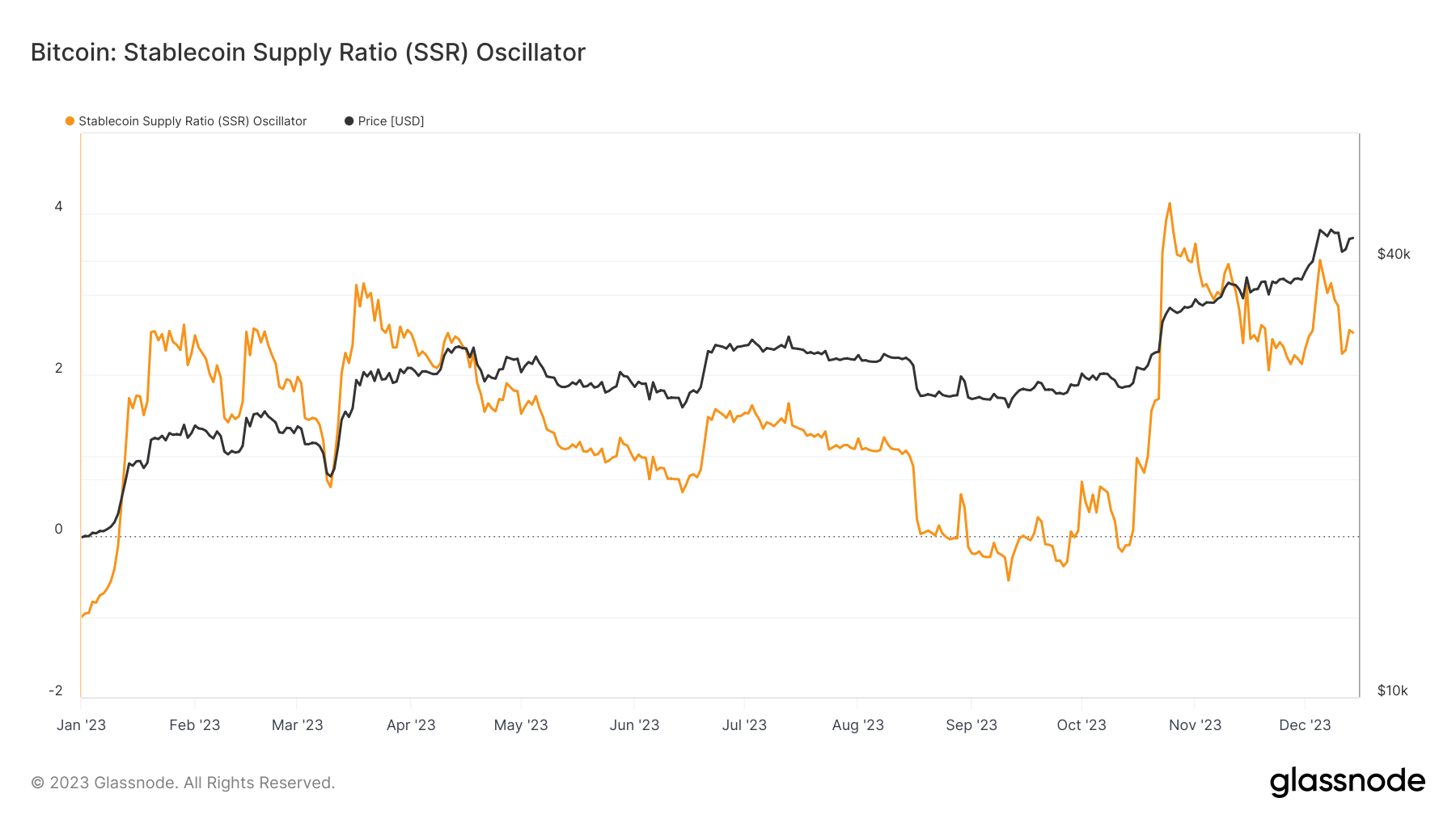

This year, the Stablecoin Supply Ratio (SSR) has shown significant trends, offering deep insights into Bitcoin’s market behavior. The SSR, calculated by dividing Bitcoin’s market cap by the market cap of major stablecoins, is a barometer for the relative financial strength and purchasing power of stablecoins against Bitcoin.

This year, a marked increase in SSR has been observed, with the ratio climbing from 2.36 on Jan. 1 to 6.74 by Dec. 14. This rise indicates a growing market cap of Bitcoin relative to stablecoins, hinting at shifts in market liquidity and investor preference.

To fully understand these trends, it’s crucial to examine the SSR in relation to Bollinger Bands. Bollinger Bands are a set of trend lines plotted two standard deviations (positively and negatively) away from a simple moving average (SMA) of a particular asset or metric. They help identify the degree of volatility in the market. When the SSR crossed the upper Bollinger Band at 4.90 on Oct. 23 and remained above it, it signaled an unusual market condition: Bitcoin’s market cap grew significantly compared to stablecoins, indicating a potential shift in investor behavior or market sentiment.

A record high SSR of 6.93 on Dec. 8 further underscores this trend, though the subsequent slight decrease following Bitcoin’s price dip from $44,200 to $41,200 shows that as Bitcoin’s price fluctuates, the relative strength and impact of stablecoins on the market adjust accordingly, influencing the SSR.

The Stablecoin Oscillator, a derivative of the SSR, tracks how the 200-day SMA of the SSR moves within its Bollinger Bands, providing a more nuanced view of market trends. Between Dec. 8 and Dec. 14, the oscillator fell from 3.13 to 2.52 as Bitcoin’s price dropped and partially recovered. This shows a balancing act between Bitcoin’s direct market performance and the comparative value and utility of stablecoins. As Bitcoin’s price changes, it influences the SSR, which in turn affects the oscillator, highlighting the continuous and complex relationship between these two crucial aspects of the cryptocurrency market.

The year-to-date (YTD) high for the oscillator was marked on Oct. 25, reaching 4.13, contrasting with a YTD low of -1 at the beginning of the year. The oscillator’s YTD high and low points reflect the market’s changing sentiment and the evolving role of stablecoins in relation to Bitcoin.

An increasing SSR, especially alongside a rising Bitcoin price, points to a diversified investment landscape. Bitcoin’s market cap growth outpacing that of stablecoins could be driven by various factors, including direct fiat investments, conversions from stablecoins to Bitcoin, and speculative trading where stablecoins are retained as a hedge while Bitcoin is actively traded.

The post Bitcoin outpaces stablecoins in market cap growth appeared first on CryptoSlate.

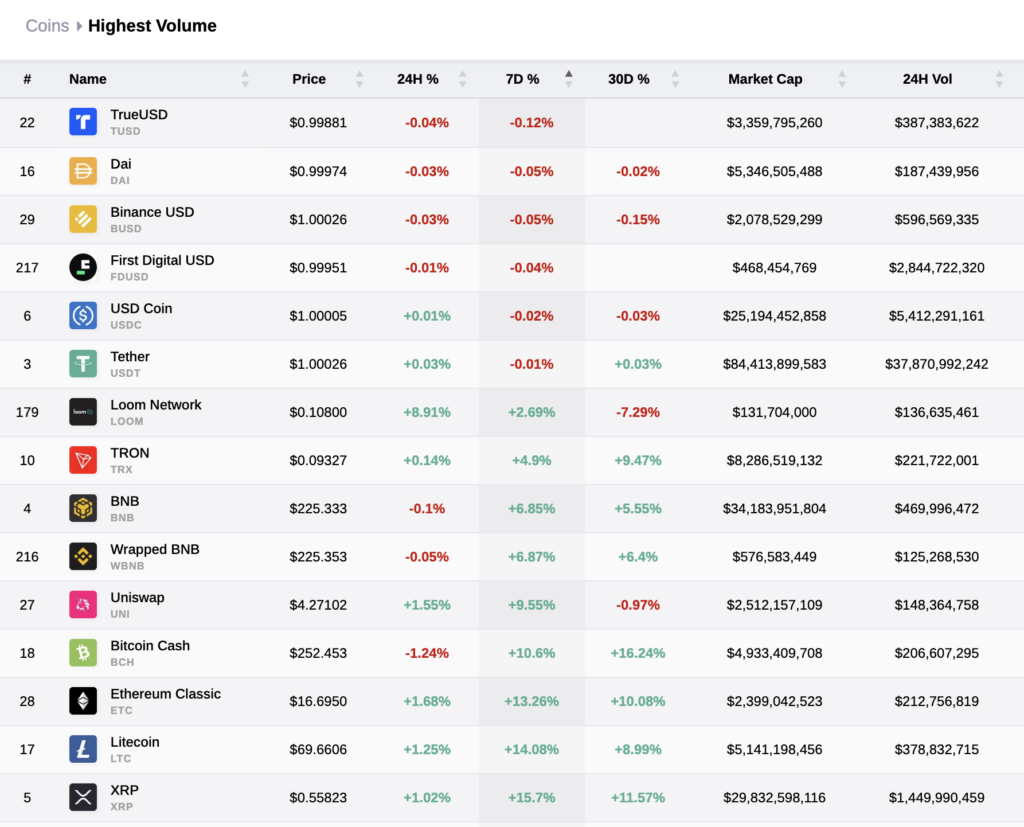

In a week where every high-volume digital asset is up, stablecoins lead losses with a mere 0.12% decline

In a bullish indicator for the broader cryptocurrency market, six stablecoins have technically led industry losses over the past 7 days, with the largest decline at 0.12%, underscoring the overall strength of the market.

The market remains robust, with stablecoins’ high trade volumes highlighting their fundamental role in the crypto ecosystem, holding their peg within a range of 0.15%. After the stablecoins, the next asset on the list is Loom Network (LOOM), which recorded a 2.69% gain in the past week.

Only assets with trading volumes above $125 million were included in the table to analyze the movements of assets with high liquidity. Tether recorded the highest trading volume of the past 24 hours at $37,870,992,242, while the lowest volume within the data set was Wrapped BNB at $125,268,530.

According to CryptoSlate data, TrueUSD (TUSD), Dai (DAI), Binance USD (BUSD), First Digital USD (FDUSD), USD Coin (USDC), and Tether (USDT) secured the top 6 spots in terms of 7-day losses when viewing the highest traded tokens of the past week. This comes when the market displays a bullish sentiment, marked by a marked uptick in Bitcoin (BTC) and Ethereum (ETH).

Over the past week, TrueUSD posted a 0.12% decline, while Dai experienced a 0.05% dip. Similarly, Binance USD, First Digital USD, and USD Coin saw a 0.05%, 0.04%, and 0.02% decrease, respectively. Tether, currently leading the pack in terms of trading volume, saw a minute 0.01% decline.

The importance of stablecoins in the digital asset economy cannot be overstated. Their stability pegged to traditional fiat currencies, makes them the preferred choice for traders seeking to mitigate volatility risks inherent in the cryptocurrency market. These digital assets provide an efficient medium of exchange, a robust unit of account, and a practical store of value, contributing to their high trading volumes.

Meanwhile, Bitcoin and Ethereum, the second and third leading digital assets by volume, posted robust gains over the same period. Bitcoin rose by 20.07%, currently trading at $34,214, while Ethereum saw an increase of 17.67%, with its price climbing to $1,826.95 as of press time.

While the gains in the leading digital assets suggest a bullish market, the decrease in stablecoin values over the past week indicates a shift in investor sentiment. As stablecoins’ volume surges, traders use these digital assets as a launchpad, getting ready to venture into more volatile cryptocurrencies amid an optimistic market outlook.

Yet, these market movements should be seen in their broader context. Undoubtedly, the crypto market remains volatile and subject to rapid change. However, the high trading volume of stablecoins and the recent upswing in Bitcoin and Ethereum offer a promising glimpse into the present market dynamics.

As we continue to monitor these trends, it’s worth noting that such nuances in market behavior highlight the intricate dynamics of the crypto industry. When stablecoins

Hong Kong Officials Warn Investors to Stay Away from Retail Stablecoins since They Are Unregulated

The Hong Kong Monetary Authority (HKMA) recently completed a public consultation on stablecoins regulations.

As the city of Hong Kong prepares for mainstream adoption of digital assets through a regulated manner, the officials are grappling with cases of crypto-related scams. In a bid to ensure maximum protection of investors’ funds, Hong Kong’s Secretary for Financial Services and Treasury Christian Hui has noted that trading of retail stablecoins is not yet allowed. With the regulations of stablecoins in Hong Kong expected to take place late next year, Hui cautioned investors to tread cautiously with the retail stablecoins.

This comes after a local crypto exchange dubbed JPEX dipped investors millions of dollars and charged customers up to $1000 to facilitate withdrawals. Notably, JPEX duped investors of getting up to 30 percent in APY through stablecoins staking. Since the exchange advertised its services to novice traders through taxis, experienced investors were hardly touched as it was a direct scam that drained more than $180 million.

Another scam exchange causing thousands of victims losing their savings. 😔

JPEX is a small crypto exchange in Hong Kong that’s been offering nearly 30% APY on stablecoin staking.

They also have a exchange token $JPEX with $200 billion fully diluted value, advertising on Hong… pic.twitter.com/vns0QnMOpn

— Leon.sol (@leon_only1) September 14, 2023

Hong Kong and Digital Assets

The Hong Kong market has attracted both retail and institutional investors from the region seeking to get demo crypto exposure. Chinese banks have been reported to invest in the Web3 ecosystem through Hong Kong-based firms in a bid to play catch up with their Singapore counterparts. Moreover, the crypto asset industry has outperformed most traditional investment instruments including the bond and stock markets.

The Hong Kong Monetary Authority (HKMA) recently completed a public consultation on stablecoins regulations. As a result, the HKMA intends to issue a clear stablecoins regulatory framework before the end of 2024 to enable seamless adoption. The Hong Kong authorities intend to tap into the high demand for digital assets by most fintech startups within the region in a bid to boost its local economy.

The move by the Hong Kong authorities has caught most Western countries by surprise as a crackdown on digital assets-related firms continues in the United States following the collapse of FTX. As more crypto-related companies move away from the United States due to a lack of clear regulations, Hong Kong is opening its arms wide to all investors who are ready to comply with its crypto-related terms

Stablecoins Market Outlook

The stablecoins market has grown significantly in the past few years to a $123 billion valuation with an average 24-hour trading volume of approximately $24.5 billion. Tether (USDT), Circle (USDC), and TrueUSD (TUSD) are the top retail stablecoins that have stood the test of time, more so the bear market.

With more institutional investors entering the stablecoins industry, as shown by PayPal Holdings Inc (NASDAQ: PYPL) and its new product, PYUSD.

next

Blockchain News, Cryptocurrency News, News

Let’s talk crypto, Metaverse, NFTs, CeDeFi, and Stocks, and focus on multi-chain as the future of blockchain technology.

Let us all WIN!

You have successfully joined our subscriber list.

Circle weighs in on SEC vs. Binance case, argues stablecoins are not securities

Circle, the company behind the USD Coin (USDC) stablecoin, has weighed in on the United States Securities and Exchange Commission (SEC) case against crypto exchange Binance, arguing that stablecoins are not securities.

In a court filing, Circle argued that assets pegged to the U.S. dollar, such as Binance USD (BUSD) or USDC, are not securities because those who purchase the assets are not expecting any profit from acquiring them. According to Circle, payment stablecoins do not have the “features of an investment contract” on their own.

On June 5, the SEC sued Binance for several alleged legal violations. The regulator pressed a total of 13 charges against the crypto exchange. Charges include the sale of BNB (BNB) tokens and BUSD tokens being unregistered security sales. The SEC also claims that Binance failed to register as a broker-dealer clearing agency and that it operated illegally in the United States.

On Sept. 22, Binance and its CEO Changpeng Zhao asked the court to dismiss the SEC lawsuit. Binance and Zhao claimed the SEC had overstepped its authority in the lawsuit against them. In a petition, Binance and Zhao’s lawyers highlighted their belief that the SEC failed to introduce clear guidelines for the sector ahead of its lawsuit of the exchange and imposed its authority over the industry retroactively.

Related: Crypto lawyer about SEC: ‘Problematic to imply all NFTs are securities’

Apart from cryptocurrencies and exchanges, the SEC has also claimed nonfungible tokens (NFTs) are securities. On Aug. 28, the SEC filed a charge against entertainment company Impact Theory for the sales of its NFT collection. The SEC said that the NFTs are unregistered securities.

Apart from Impact Theory, on Sept. 13, the SEC charged the firm behind the Stoner Cats NFT collection. According to the SEC, the firm facilitated the sales of unregistered securities for offering the NFTs to the public.

Magazine: Binance.US scores against SEC, Mt. Gox delay repayments, and other news: Hodler’s Digest