Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

Based on current metrics, the Bitcoin blockchain is set to undergo another difficulty adjustment before the halving, with an anticipated increase of 1.2% to 2.16% around April 11, 2024. Following this adjustment, there will be 1,344 blocks remaining until the reward is halved. Estimated Increase in Difficulty Precedes Halving In April, bitcoin (BTC) miners face […]

Source link

stage

Uncomfortable Conversations About Privacy and Security Take the Stage in Amsterdam

PRESS RELEASE. Privacy is dead in crypto, people that know, know. People who don’t know, should know. That’s why CryptoCanal’s ETHDam Conference will gather people from all sides of the blockchain spectrum to discuss the future of privacy and security. “As a privacy and security-focused conference, we encourage panels on the harder discussion topics,” explains […]

PRESS RELEASE. Privacy is dead in crypto, people that know, know. People who don’t know, should know. That’s why CryptoCanal’s ETHDam Conference will gather people from all sides of the blockchain spectrum to discuss the future of privacy and security. “As a privacy and security-focused conference, we encourage panels on the harder discussion topics,” explains […]

Source link

An analyst has explained that the latest cooldown in the Ethereum futures market could suggest there is potential for a price rise to resume for ETH.

Ethereum Funding Rates Have Seen A Decline Recently

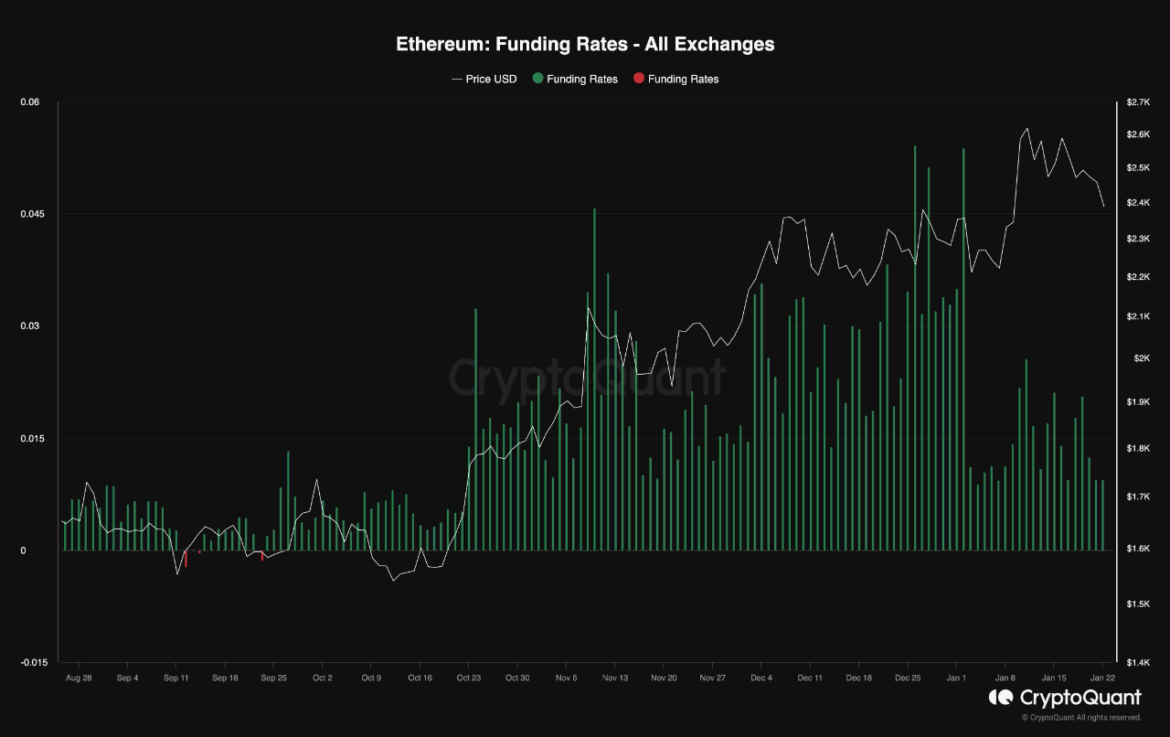

An analyst in a CryptoQuant Quicktake post explained that the ETH funding rates have seen a cooldown from their previously overheated levels. The “funding rate” refers to the periodic fees that futures contract holders on derivative platforms currently exchange with each other.

When the value of this metric is positive, it means that the long contract holders are paying a premium to the shorts to hold onto their positions. Such a trend implies that most traders share a bullish sentiment right now.

On the other hand, the under zero indicates that a bearish sentiment is currently dominant in the futures market, as the short traders are overwhelming the longs.

Now, here is a chart that shows the trend in the Ethereum funding rates over the last few months:

The value of the metric seems to have been low in recent days | Source: CryptoQuant

As displayed in the above graph, the Ethereum funding rates have been mostly positive during the last few months, implying that traders on the futures side of the market have mostly been bullish about the asset.

The few times that the metric did dip into the negative inside this period didn’t turn out to be anything major, as the indicator only attained low red values and rebounded back inside the green territory without too much wait.

The chart shows that during some phases of this lasting period of bullish sentiment, the metric attained particularly high values. “However, it’s crucial to note that elevated values in funding rates raise concerns about a potential overheated state in the perpetual markets, signaling the possibility of an impending long-squeeze event,” notes the quant.

A “squeeze” is an event in which a sharp swing in the price triggers a large number of liquidations, which in turn feed into this price move, elongating it and causing further liquidations.

When such a cascade of liquidations affects the long side of the market (that is, the price move in question is a rapid drawdown), the event is known as a “long squeeze.”

Generally, the side of the futures market most heavily dominated by traders is likelier to fall prey to a squeeze. Thus, when the funding rates are highly positive, a long squeeze can be more probable.

Recently, though, as Ethereum has gone through its latest correction, so have the funding rates. Although they are still positive, their magnitude may no longer be associated with an overheated market, and the risk of a long squeeze would have thus fallen.

“Consequently, there exists the potential for the price to resume its upward trajectory following the completion of the ongoing correction stage,” explains the analyst.

ETH Price

Ethereum has declined by around 5% during the past week as its price has now fallen under $2,400.

Looks like the price of the coin has been sliding off recently | Source: ETHUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Stock market fails to stage a ‘Santa Claus rally’ in rough start to 2024

Santa Claus was pretty much a no-show on Wall Street.

As defined by the Stock Trader’s Almanac, the “Santa Claus rally” refers to the S&P 500’s tendency to rise during the last five trading days of a calendar year and the first two trading sessions of the new year.

Since 1950, the Santa rally has boosted the S&P 500 by an average of 1.3% over the seven trading-day range. The benchmark large-cap index

SPX

closed higher 78% of the Santa Claus trading window in the past 75 years, and gained during that time for the past seven years, according to Dow Jones Market Data.

That compares with an average return of 0.2% for the S&P 500 during any seven trading-day range since 1950. The index also closed higher 58% of any seven-day trading window over the same period, according to Dow Jones Market Data.

But this time around, the Santa rally period, which ran from Dec. 22 through Wednesday, Jan. 3, saw the S&P 500 fall 0.9%. That was the worst performance for a Santa-rally period since 2015-2016, snapping a streak of seven positive Santa stretches, according to Dow Jones Market Data.

The Nasdaq Composite

COMP

also dropped over that time span, down 2.5% since Dec. 22 to book its third consecutive negative Santa rally period, while the Dow Jones Industrial Average

DJIA

eked out a modest gain of less than 0.1% over the same period, according to Dow Jones Market Data.

A failure to rally in that stretch is seen by some market analysts as a signal for more rough sledding ahead.

“Years when there was no ‘Santa Claus rally’ tended to precede bear markets or times when stocks hit significantly lower prices later in the year,” wrote Jeff Hirsch, editor of the Stock Trader’s Almanac & Almanac Investor Newsletter.

U.S. stocks finished lower on Wednesday as most megacap technology stocks fell for a second session to start the new year. Investors appeared to reassess the year-end rally which helped the Nasdaq Composite surge 43% in 2023, while digesting the monetary-policy path in 2024 following the release of the minutes from the Federal Reserve’s last policy meeting.

The S&P 500 was down 0.8%, to end at 4,704 on Wednesday, while the Dow industrials also dropped 0.8%, at 37,430, and the Nasdaq tumbled 1.2%, to finish at 14,592, according to FactSet data.

Biden’s Israel support leaves him as isolated as Russia on world stage: Bremmer

The Biden administration’s steadfast support of Israel in its war against Hamas in Gaza has cost him tremendous political capital internationally, according to Ian Bremmer, the CEO and founder of the Eurasia Group.

Washington’s stated unconditional backing of Israel — politically, financially, and militarily — has been a longstanding pillar of its Middle East foreign policy.

When Israel suffered a brutal terrorist attack on Oct. 7 by the Palestinian militant group Hamas that killed some 1,200 people and took more than 240 hostages, Biden flew to the country in a show of solidarity, pledging billions of dollars in military support. The U.S. already provides Israel some $3.1 billion annually in military aid, making it the largest recipient of American foreign aid in the world.

But in the ensuing days and weeks, the enormous and disproportionate scale of Palestinian deaths in Gaza caused by Israeli airstrikes and ground offensive operations raised anger in many parts of the world at both Israel and Biden, particularly in the Global South. Protests in major cities, including across Europe and the U.S., in support of Palestinians and demanding a cease-fire have made global headlines.

During multiple United Nations General Assembly votes calling for cease-fires, Israel and the U.S. were often the only countries or among a very small minority voting “against.”

“Biden is probably as isolated on the global stage, given how close he is to Israel, closest ally of the United States on this issue, as the Russians were when they first invaded Ukraine, which is a shocking thing to say,” Bremmer, the high-profile geopolitical commentator, told CNBC Tuesday. “But it shows just how challenging this war continuing is going to be for U.S. foreign policy.”

A picture taken from southern Israel near the border with the Gaza Strip on December 6, 2023, shows smoke billowing during Israeli bombardment in Gaza amid continuing battles between Israel and the militant group Hamas.

Jack Guez | Afp | Getty Images

Internationally, numerous leaders and human rights organizations have condemned the U.S. for its continued support of Israel. Biden and other members of his administration including Vice President Kamala Harris and Secretary of State Antony Blinken have said that “far too many” Palestinians have died, and that the way Israel defends itself “matters.” They have helped broker hostage-for-prisoner swaps during a fragile week-long truce and urged the allowance of more aid into Gaza.

But the administration officials hold to the position that Israel “has the right to defend itself,” which critics see as continuing to give Israel carte blanche in its military operations.

A former Egyptian foreign affairs minister, Nabil Fahmy, said last month that the U.S. is “losing a tremendous amount of credibility in the Arab world.”

The “U.S. needs to take a serious look at its role. If it wants to support a stable world order based on rule of law, it has to demand everybody respect international law, whether friend or foe,” Fahmy, who served as minister between 2013 and 2014, told CNBC in an interview.

Since Oct. 7, more than 16,200 people have been killed in Gaza, including more than 10,000 women and children, according to Hamas-run health authorities there. Israel declared a siege of the already blockaded territory shortly after the Hamas attacks, cutting off all water, food and fuel to Gaza. Weeks later, the first aid trucks were able to enter the Strip, but the provisions that have made it in so far are woefully inadequate, according to the United Nations.

U.S. President Joe Biden is welcomed by Israeli Prime Minster Benjamin Netanyahu, as he visits Israel amid the ongoing conflict between Israel and Hamas, in Tel Aviv, Israel, October 18, 2023.

Evelyn Hockstein | Reuters

The situation is also a problem for Biden domestically, Bremmer said.

“At home in the United States this is kind of a no-win situation for Biden, because he’s got a majority of Democrats that increasingly are aligned with the Palestinian position, while the Republicans are saying he’s too soft on Israel. And so, I mean, he just really wants this war to be over. He really wants it out of the headlines. And of course, that’s exactly what’s not happening right now.”

“In fact, the war on the ground in Gaza is now expanding,” Bremmer added. “The impact on Palestinian civilians is increasing, and the proxy war in the region, particularly the Houthis in Yemen, a proxy for Iran are engaging in their most significant attacks on commercial waterway traffic and on U.S. military vessels in the last 24 hours that we’ve seen since the war started. So this is really a problem from the perspective of the U.S. and this isn’t going to get better anytime soon.”

People use the lights on their telephones to search for victims amid the rubble of a smouldering building, following an Israeli strike in Rafah in the southern Gaza Strip on December 6, 2023.

Mahmud Hams | AFP | Getty Images

The White House did not immediately reply to a CNBC request for comment, but spokesperson previously told CNBC that “Israel has the right to defend itself in compliance with international law, including international humanitarian law, especially as Hamas terrorists have said that what happened on October 7th ‘will happen again and again and again’ until Israel is annihilated.”

The northern half of Gaza has been decimated, with Israeli forces now moving their ground offensive into the southern half of the enclave, after 1.1 million residents of the north evacuated south on the Israeli military’s orders. Palestinians in Gaza say they have “nowhere to go” to escape the bombings, and the World Health Organization warns that Gaza’s health system has collapsed and disease is spreading among the population.

Israel says it is not intentionally targeting civilians and that it gives warnings before it attacks certain areas. Its goals are to eliminate Hamas and its military capabilities and to ensure the return of all the hostages captured by the group during its October attack.

South Korean crypto trading volumes soar with altcoins taking center stage

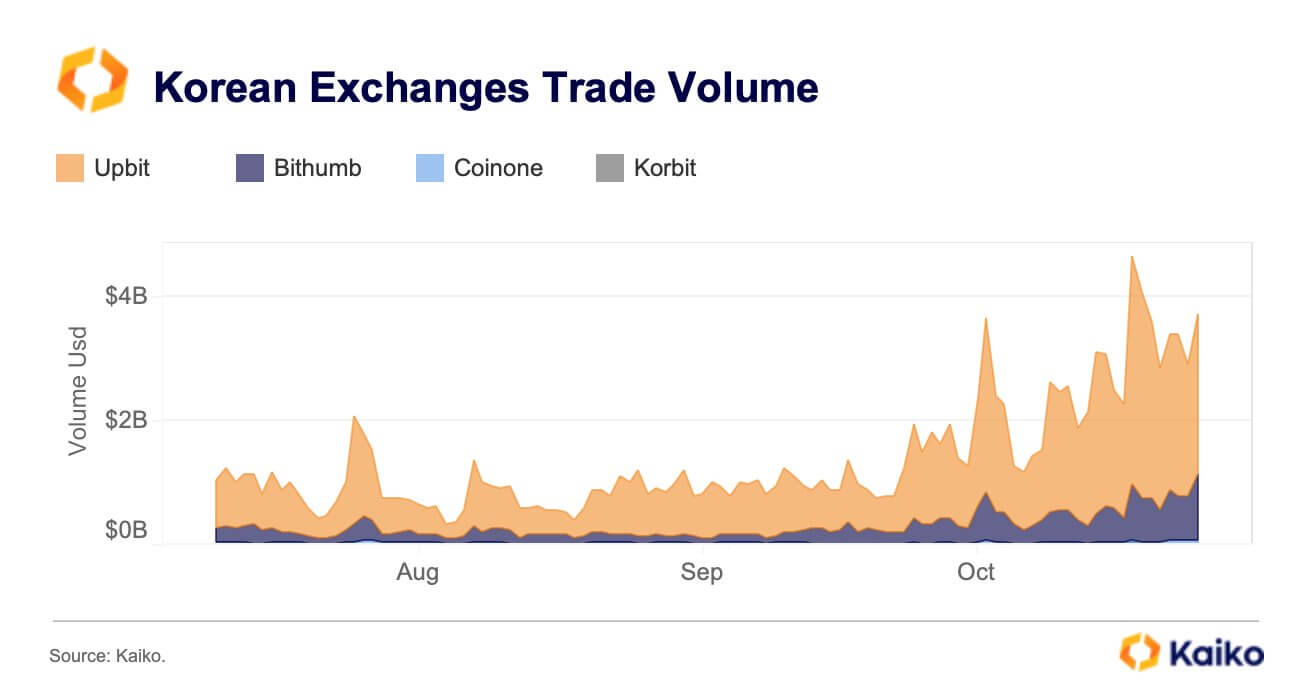

Daily trading volumes on South Korean exchanges have hit their highest point since August last year, with altcoins dominating the transactions, according to data from blockchain analytical firm Kaiko.

Trading activities on major South Korean platforms, including Upbit, Bithumb, Coinone, and Korbit, surged to an average of more than $4 billion towards the end of October and the beginning of November before dropping to more than $3 billion.

Data from CCData, as reported by Bloomberg, also corroborates these upward trading activities on South Korean exchanges. According to the report, crypto trading platforms in the Asian country saw their market shares rise to around 13% from the 5.2% recorded in January.

Around this period, the crypto market saw flagship digital assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) rally to new yearly highs driven by the market optimism surrounding the possible approval of a spot exchange-traded fund (ETF) in the United States.

However, South Korean crypto traders heavily trade altcoins, according to CryptoQuant analysts.

Upbit dominates

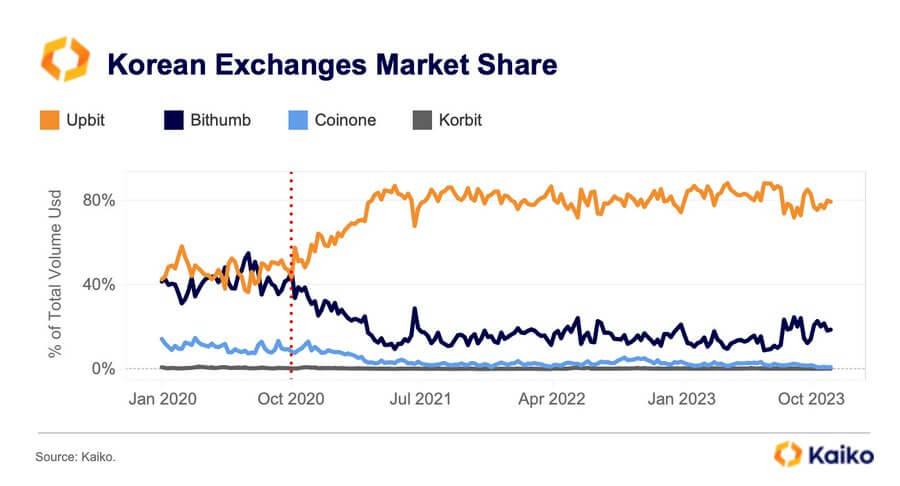

Meanwhile, the Kaiko data restates Upbit’s South Korean crypto market dominance, as the exchange accounts for most trading activities.

Kaiko noted that Upbit’s market dominance had soared to as high as 90% in May last year before slightly declining to around 80% in October 2023. Altcoins account for 88% of all trading activities on Upbit.

On the other hand, its rival, Bithumb, controls around 20% of the market. During the past year, the crypto exchange’s leadership has faced various challenges, with its majority shareholder, Kang Jong-hyun, being arrested for allegedly embezzling roughly $50 million.

This has resulted in its latest efforts to rebuild public trust by planning an Initial Public Offering (IPO) for 2025 and removing transaction fees.

Bitcoin’s shaky stage mirrors FTX collapse as short-term holders cut losses

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

UK Launches £1 Billion FinTech Growth Fund to Support Growth Stage Companies

Such companies as Barclays plc, National Westminster Bank (NatWest), Mastercard Incorporated (NYSE: MA), London Stock Exchange Group, and Peel Hunt have backed FinTech Growth Fund.

UK FinTech Growth Partners LLP has announced the launch of the FinTech Growth Fund – an investment fund aimed at supporting companies at the early stages of their business until they can go public. The move aims to back UK’s image as a fintech hub as well as allow the country to compete with Silicon Valley.

Basically, FinTech Growth Fund will provide four to eight investments per year, with investments between £10 million and £100 million, as well as offer strategic support to its portfolio companies to help them bring their corporate ambitions to life. The fund is set to make the first investments as soon as the fourth quarter of this year.

Such companies as Barclays plc, National Westminster Bank (NatWest), Mastercard Incorporated (NYSE: MA), London Stock Exchange Group, and Peel Hunt have backed FinTech Growth Fund.

Lord Dominic Johnson CBE, Minister of State, Department for Business and Trade, commented:

“UK Fintech remains one of this country’s crown jewels, casting a shining light to global investors that attracted $12.5 billion of inward investment in 2022. Second only to the US and larger than the next 13 European markets combined, UK Fintech can still reach new heights with new UK-based growth funds. I welcome the launch of the Fintech Growth Fund and wish them well in their fundraising.”

The leading team of the fund has also been formed. Its board of partners includes experts in the industry, such as Angel Issa – former Global Head of Corporate Development & Strategic Investments at Nomura, Joe Parkin – former Managing Director – Head of Banks, Digital Channels and UK Inorganic at BlackRock, Kaushalya Somasundaram – Former Executive Director and UK Head of Payments, Partnerships & Industry Relations at Square; and Phil Vidler – CEO of FinTech Alliance.

UK’s FinTech Climate

Earlier, Britain was facing criticism saying that the UK government put barriers to fintech entrepreneurs and forced them to consider listings overseas, especially after the country’s exit from the European Union, which undermined the UK’s status as a global financial centre.

In response to scepticism, the London Stock Exchange has undergone a number of reforms to encourage fintech firms to float in the UK rather than in the US. Besides, the government created initiatives to promote innovation and growth, such as the Fintech Delivery Panel and the Fintech Sector Strategy. As a result, the UK is now the leading fintech hub in Europe.

Fintech is one of the UK’s strongest startup sectors, with more than 1,500 high-growth fintech companies currently active, 20 fintech unicorns (around half of the UK’s billion-dollar startups), and more venture capital investment than any other industry. The sector is home to many of the world’s largest fintech companies and is comprised of more than 1,600 firms. This number is projected to double by 2030.

next

Business News, FinTech News, News, Startups

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.