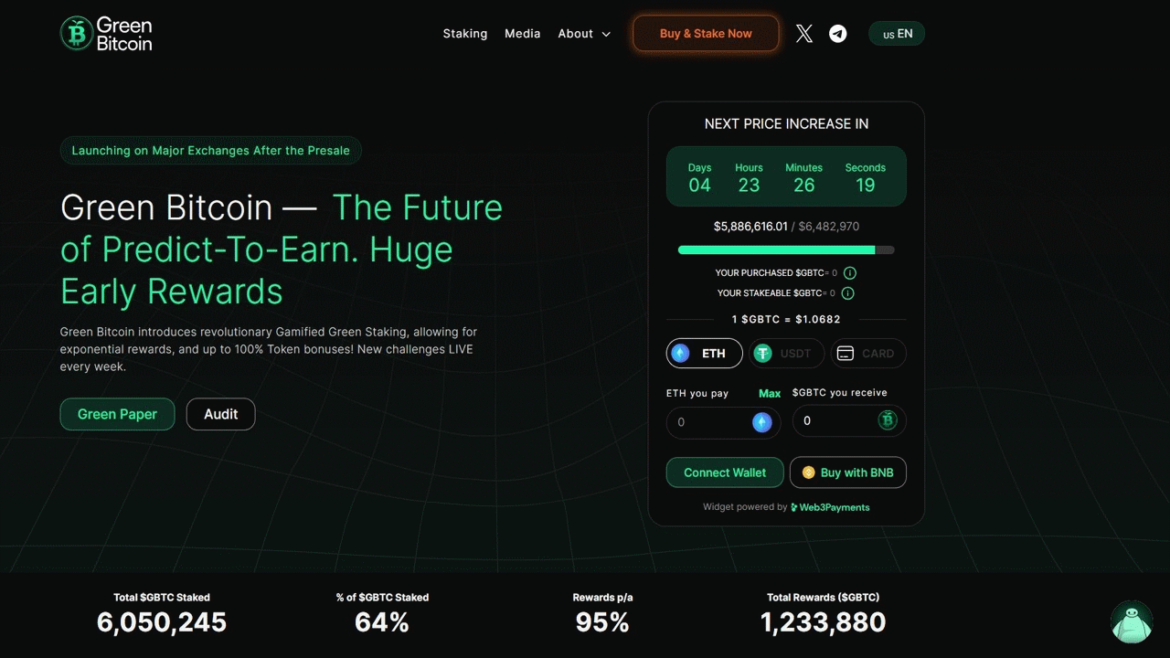

PRESS RELEASE. A new project called Green Bitcoin (GBTC) saw a sudden burst of popularity around the time when the original Bitcoin (BTC) saw its massive price surge. While Bitcoin skyrocketed to an all-time high, Green Bitcoin — currently still in presale — managed to raise $6 million in only two weeks. Green Bitcoin’s presale […]

PRESS RELEASE. A new project called Green Bitcoin (GBTC) saw a sudden burst of popularity around the time when the original Bitcoin (BTC) saw its massive price surge. While Bitcoin skyrocketed to an all-time high, Green Bitcoin — currently still in presale — managed to raise $6 million in only two weeks. Green Bitcoin’s presale […]

Source link

staking

The Ethereum network is witnessing a surge in validator exits, which hit a record high of over 16,000 validators in the exit queue on Jan. 5, on-chain data showed.

The rise in exits has caused the wait time for unstaking to spike to an average of 5.6 days. Around 15,140 validators are still in the queue as of press time.

The surge was primarily driven by withdrawal requests from defunct CeFi lender Celsius Network and staking provider Figment, which collectively make up roughly 75% of total withdrawals in the queue.

550k ETH

Celsius, which is currently undergoing a restructuring process after declaring bankruptcy last year, has initiated a large-scale withdrawal from Ethereum staking.

The move, aimed at reallocating assets to satisfy creditors’ demands, involves the withdrawal of more than 200,000 ETH, valued at approximately $450 million.

The situation is exacerbated by the involvement of Figment, another major staking provider, which is linked to 54% (350,000 ETH) of the total withdrawals in the queue.

Together, the two entities want to withdraw approximately 550,000 staked Ethereum — roughly 1.7% of the 29 million ETH staked across all platforms.

Entries drying up

Amid these substantial exits, the entry queue for new Ethereum validators remains notably low, hovering near zero. This is a stark contrast to the swelling numbers in the exit queue.

The Ethereum network operates with a churn limit, which restricts the number of validators that can enter or exit the network per day to 2,925, based on 13 validators per epoch.

The surge in exit requests has also impacted the staking yield for Ethereum validators. As of press time, the staking rewards reference rate is about 3.4%, down more than 50% from the nearly 8% yield recorded in May 2023.

This significant shift in validator dynamics poses potential challenges to the Ethereum network’s stability, given the crucial role of validators in securing and processing transactions.

Meanwhile, the extended wait time for unstaking, now at an average of 5.6 days, has raised concerns about the network’s ability to handle large-scale exits.

Chainlink Staking Program Exceeds Expectations, Drives LINK Price Up By 12%

In a significant development for the blockchain data-oracle project, Chainlink (LINK) has witnessed a significant response to its enhanced crypto-staking program, amassing over $632 million worth of its LINK tokens within a remarkably short period.

The company announced a recent press release highlighting the “overwhelming demand” during the early-access period, which filled the staking limit in just six hours.

Chainlink Unveils Staking v0.2

Chainlink, recognized as the industry-standard decentralized computing platform, unveiled Chainlink Staking v0.2, the latest upgrade to the protocol’s native staking mechanism.

The Early Access phase has commenced, inviting eligible participants to stake up to 15,000 LINK tokens. This phase will last four days before transitioning into the General Access phase, enabling investors to stake up to 15,000 LINK tokens as long as the staking pool remains unfilled.

Per the announcement, the upgrade introduces an expanded pool size of 45,000,000 LINK tokens, equivalent to 8% of the current circulating supply. This enlargement aims to enhance the accessibility of Chainlink Staking, enabling a more diverse audience of LINK token holders to participate.

Staking forms an integral part of Chainlink Economics 2.0, which brings an additional layer of cryptoeconomic security to the Chainlink Network. Specifically, Chainlink Staking empowers ecosystem participants, including node operators and community members, to support the performance of Oracle services by staking LINK tokens and earning rewards for contributing to network security.

While v0.1 served as the initial phase of the Staking program, v0.2 has been restructured into a fully modular, extensible, and upgradable Staking platform. Building upon the lessons learned from the previous release, the v0.2 beta version focuses on several key objectives.

Chainlink is introducing several new features to enhance its staking program. These include a new unbinding mechanism that provides more flexibility for Community and Node Operator Stakers.

Additionally, security guarantees for Oracle services are being reinforced by slashing node operator stakes. A modular architecture is being adopted to support future improvements and additions, and a dynamic rewards mechanism is being introduced to seamlessly accommodate new external sources of rewards in the future, such as user fees.

Following the conclusion of the Early Access phase on December 11, 2023, the v0.2 staking pool will transition to General Access. At this stage, anyone will have the opportunity to stake up to 15,000 LINK tokens.

LINK Surges To New Yearly High

Given Chainlink’s successful upgrade, LINK, the native token of the decentralized computing platform, experienced a significant surge of 12%, reaching a price as high as $17.305.

This price level has not been seen since April 2022, signifying a new yearly high for the cryptocurrency. However, LINK has retraced slightly and is currently trading at $16.774.

Crypto analyst Ali Martinez has highlighted a critical support zone for Chainlink. Martinez noted that over 17,000 addresses purchased 47 million LINK tokens from $14.4 to $14.8.

This accumulation by many addresses suggests strong buying interest in this price range, potentially acting as a support level for the token.

While the support zone may hold and trigger a rebound in the price of LINK, Martinez cautions that investors should remain vigilant. Any signs of weakness, such as a breach of the support zone or negative market sentiment, could prompt investors to sell their LINK holdings to avoid losses.

It remains to be seen whether LINK can maintain its position above these critical levels and whether the broader cryptocurrency market will enter an accumulation phase or experience a retracement after the significant upward movement witnessed in recent weeks.

Such a retracement could potentially impact LINK’s price and lead to a test of the support above levels. On the other hand, the token faces immediate resistance at $17.483, $18.069, and $18.910. These represent the final hurdles to overcome before LINK reaches the $20 milestone.

Featured image from Shutterstock, chart from TradingView.com

Mantle introduces mETH liquid staking protocol, expanding its Ethereum-based DeFi ecosystem

Mantle, the DAO-led web3 ecosystem, today unveiled its Mantle Liquid Staking Protocol (LSP) as a key addition to the Mantle Ecosystem, offering users a novel way to engage with Ethereum’s proof-of-stake (PoS) validator network, according to a statement shared with CryptoSlate.

The Mantle LSP is a permissionless and non-custodial Ethereum (ETH) liquid staking protocol, functioning on Ethereum L1 and governed by Mantle. It stands as the second core product of the Mantle Ecosystem, following the Mantle Network L2. Mantle posits that the introduction of Mantle Staked Ether (mETH), a value-accumulating receipt token, is a pivotal step in their protocol.

Mantle detailed that the genesis of Mantle LSP began with a proposal in a Mantle forum on July 14, 2023. Following the acceptance of the Mantle Governance Proposal MIP-25, the staking of Mantle Treasury ETH was sanctioned, leading to the phased deployment of Mantle LSP. This process culminated in the protocol’s full operational launch on Dec. 4, transitioning it into a Permissionless Mode.

Mantle LSP distinguishes itself by offering instant and sustainable rewards. Users staking ETH receive mETH, a token embodying their staked value and accumulated rewards, while also unlocking additional yield opportunities within the Mantle Ecosystem. Mantle states that the ETH to mETH exchange rate is deterministically calculated, thus mitigating the impact of stake size on slippage. Furthermore, mETH is available for trade on various exchanges, with its pricing governed by market dynamics.

Mantle emphasizes that their protocol underscores a commitment to user experience, security, and yield optimization. Mantle states its LSP features a streamlined architecture, focusing on the ETH to mETH conversion process on L1, and avoids complexities associated with other PoS tokens and chains. The protocol’s design incorporates robust risk management strategies, including non-custodial core smart contracts and off-chain services that impose strict risk limits. Additionally, Mantle LSP’s security framework involves dividing responsibilities among various roles, ensuring the safeguarding of staked ETH within smart contract addresses.

With the launch of Mantle LSP, Mantle intends to enhance its DeFi offerings by exploring the adoption of mETH across various applications within its ecosystem and beyond. This expansion aims to bolster the utility and efficiency of mETH, contributing significantly to Mantle’s growth in the DeFi space.

The broader Mantle ecosystem, anchored in Ethereum technology, now includes the Mantle Network, an Ethereum layer 2 (L2) solution, Mantle Governance, a decentralized autonomous organization (DAO), and Mantle Treasury, one of the largest on-chain treasuries. The ecosystem is facilitated by the Mantle token (MNT), which serves as a product and governance token.

By deploying the LINK staking v0.2, Chainlink shows its commitment to blockchain initiatives that drive user engagement.

Chainlink has announced a new version of its LINK token staking, whose pool it claims is made up of 45 million LINK tokens. As of publication, the pool is worth approximately $650 million.

According to the X announcement, Chainlink intends to roll out 40.875 million LINK tokens to its community while its node operators take up the remaining tokens in the pool.

Presently, LINK staking has known restrictions that only allow community members to stake between 1 to 15,000 LINK. The same restrictions also extend to node operators, but they may only stake 1,000 to 75,000 LINK.

v0.1 Stakers Will Get Priority Access to v0.2, Chainlink Says

Meanwhile, Chainlink has assured its users of plans to ensure a seamless transition. To this end, it has told users who already staked on version 0.1 that they are eligible for priority migration. This means that they can transfer their version 0.1 stake and LINK prizes to version 0.2 without any hassles.

According to the timeline issued by Chainlink, priority migration will begin for those who are eligible on November 28, 2023, at 12 pm ET. The migration will last for nine days after which, v0.1 stakeholders may no longer have assured access to move parts of, or their complete investments and rewards, per Chainlink.

The Early Access period will follow the Priority Migration. As the name implies, the period would give eligible users a 4-day head-start to buy and hold LINK tokens before the General Access to Chainlink Staking Pool is opened on December 11 at 12 pm ET.

By this time, all interested users may begin to stake LINK, at least, up until the Chainlink Staking v0.2 Pool is full. This means that, as long as the v0.2 pool is not yet full, users may decide to stretch their wallets even to their maximum limits as earlier mentioned.

Aiming at Proper Decentralization and Community Involvement

Chainlink continues to prove itself as a force to reckon with in the world of decentralized finance (DeFi). By deploying the LINK staking v0.2, especially with such a large pool size, it shows its commitment to blockchain initiatives that drive user engagement. Interestingly, Chainlink is demonstrating this in a way that actively involves both the community members and node operators, albeit in a balanced manner.

These efforts, which show a high level of inclusivity for both present and coming community members, will go a long way to strengthen Chainlink network security and improve the overall health of the ecosystem.

For now, the cryptocurrency community is waiting in eager anticipation for when LINK staking v0.2 will go live. However, Chainlink may have just established its dominance in DeFi among its counterparts.

next

Altcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Vitalik Buterin Discusses Certain Changes to Ethereum Staking, What’s Coming Next?

Ethereum co-founder Vitalik Buterin also raised concern regarding the concentration of Ethereum’s liquid staking providers.

In his recent blog post, Ethereum co-founder Vitalik Buterin shared his opinion on adding some protocols to the Ethereum blockchain code. He also touched upon the most important part which is the concentration of liquid staking service providers.

Vitalik Buterin discussed several Ethereum protocols, including the account abstraction protocol ERC-4337, ZK-EVMs, private mempools, code precompiles, and liquid staking. He expressed stronger support for “enshrining” some of these protocols, such as ERC-4337, in Ethereum’s code, while he had reservations about others like private mempools. However, he acknowledged that each protocol presents a complex tradeoff that will continue to evolve over time.

Buterin also raised concerns about the concentration of Ethereum’s liquid staking providers. Notably, Lido currently controls over 32% of staked ether, albeit across different validators. Buterin highlighted that both Lido and Rocket Pool, two major providers, carry different risks and have some safety measures in place, though these might not be sufficient.

Rather than relying solely on “moralistic pressure” to promote a more diverse set of staking providers, Buterin contemplated potential protocol changes aimed at further decentralizing liquid staking. These changes could involve adjusting RocketPool’s approach or granting additional governance powers to a randomly selected committee of small stakers.

ETH Price Gains Before Ethereum Futures Launch

In the last 24 hours, the Ethereum (ETH) price has gained more than 3.5% shooting all the way to the $1,750 level. The price move comes ahead of the launch of Ethereum futures ETFs and $1,750 serves as a key resistance level for Ethereum.

Ethereum faces major resistance at $1,800, and a successful breakthrough could pave the way for further gains toward $1,850 and $1,920, potentially even reaching $2,000. On the downside, if Ethereum fails to surpass the $1,750 resistance, it may initiate a corrective move.

Initial support lies around the $1,710 level, with a more critical support at $1,680. Additionally, the 76.4% Fibonacci retracement level from the recent rally, positioned near $1,685, offers support. A breach below $1,685 might test the $1,650 support, potentially triggering a bearish trend towards the $1,600 level.

As per the schedule and plans, the Ethereum futures ETF from Bitwise is likely to go live later today, October 2. As of a September 27 note, there are 15 Ether futures ETFs from nine different issuers awaiting approval. These issuers include well-known names like VanEck, ProShares, Grayscale, Volatility Shares, Bitwise, Direxion, and Roundhill.

The analysts assessing the situation have assigned a 90% likelihood of Ether futures ETFs launching in October. Among these offerings, Valkyrie’s Bitcoin futures product, with Bitcoin trading at approximately $28,308, is expected to be the first to include exposure to Ether starting on October 3.

next

Blockchain News, Cryptocurrency News, Ethereum News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

You have successfully joined our subscriber list.

ELI5:50 – Web3 liquid staking versus traditional bank savings explained

As the decentralization of finance continues to steer the course of modern financial systems, the interplay between traditional bank savings and web-based liquid staking is something most may not fully comprehend.

Let’s break the topic down using the ‘Explain Like I’m 5’ (ELI5) concept.

ELI5: Liquid Staking in Web3

Imagine you’re at an arcade. You play several games, win tickets, and instead of immediately cashing them in for a prize, you lend them to the arcade owner. The owner gives you virtual tokens, which you can use at any time for a prize, while the owner uses the actual tickets to attract more players. This is how liquid staking works in the web3 world. You lend your cryptocurrency tokens to a network, and in return, you get “staked tokens” you can trade or use anytime.

ELI50: Liquid Staking in Web3

Liquid staking in web3 is a process that allows cryptocurrency holders to participate in network security and decision-making while maintaining the liquidity of their assets. Users delegate their tokens to a network’s validator node, receiving newly minted staking tokens representing the original stake and claimable rewards. These derivative tokens can be freely traded, providing liquidity to the staker.

ELI5: Traditional Bank Savings

Think of traditional bank savings like a piggy bank, but instead of home, you keep it at a trusted friend’s house (the bank). The friend makes your money work by lending it to others and pays you a small part of what he earns via interest.

ELI50: Traditional Bank Savings

A traditional bank savings account is a deposit account held at a financial institution that provides principal security and a modest interest rate. Banks use the funds from these accounts to lend to borrowers and charge a higher interest rate, the difference of which becomes their revenue. Account holders receive a portion of this interest while enjoying the safety of their deposit.

Comparison Between Liquid Staking and Traditional Bank Savings

Both liquid staking and traditional bank savings share the core principle of generating income from idle funds. However, the differences between these two methods become evident when we delve deeper into their functional dynamics, potential returns, and inherent risks.

Liquid staking, a byproduct of blockchain technology, provides an appealing level of transparency and potential for high yields fueled by the often volatile yet rewarding cryptocurrency markets. Meanwhile, traditional savings accounts offer relatively lower but more predictable returns, safeguarded by insurance up to certain limits.

Banks are intermediaries in the traditional banking ecosystem, utilizing deposits from savings accounts to fund loans. The interest garnered from these loans exceeds what is paid on the savings, and this disparity, known as the net interest margin, forms a significant portion of a bank’s income.

In contrast, DeFi protocols incentivize stakers through unique reward mechanisms. Part of the transaction fees and rewards from freshly minted tokens are distributed among stakers, creating an environment ripe for high-yield potential. However, this lucrative opportunity is balanced by high risk, primarily from market volatility and possible vulnerabilities within smart contracts.

Liquid staking, especially in the evolving web3 domain, and traditional bank savings each provide platforms for passive income generation. However, they cater to different risk profiles and yield expectations.

Fee Generation in Web3 and Traditional Finance

In the banking sector, fees are often associated with account maintenance and transaction costs. These fees can eat into the overall returns from a savings account. On the other hand, in the realm of staking, fees usually arise from transaction costs on the blockchain, and sometimes, a percentage is taken by the staking pool operator as a commission for services rendered.

As decentralization continues redefining the financial landscape, an in-depth understanding and adoption of these novel financial concepts and models, including staking, becomes invaluable. Therefore, it’s imperative for potential investors to meticulously analyze their risk appetite, desired returns, and the dynamics of each method before deciding where to park their idle funds.

The team behind the Sui network and its native SUI token has denied allegations that they unlocked SUI staking rewards and “dumped” them on cryptocurrency exchange Binance .

The Sui Foundation knocked back the claim in a five-part Twitter thread on June 27, stating that none of the locked or non-circulating tokens, including SUI staking rewards, had been sold:

“Sui Foundation has not sold staking rewards or any other tokens from locked and non-circulating staked SUI on Binance or otherwise.”

“All insider token allocations remain subject to and compliant with their lock ups and other restrictions on transfer,” the foundation added.

The purpose of this communication is to share information regarding the tokenomics of the Sui Network including the SUI token supply and certain distributions of SUI tokens. Here’s what you need to know:

— Sui Foundation (@SuiFoundation) June 27, 2023

Sui is a decentralized proof-of-stake blockchain. Users can stake their Sui tokens to participate in its proof-of-stake mechanism in exchange for more SUI. No minimum staking period is required.

Sui’s recent denial was in response to claims by pseudonymous crypto commentator DeFiSquared in a June 27 Twitter thread, where they accused the Sui Foundation of “dumping rewards from *locked* and *non-circulating* staked SUI” on Binance.

Exclusive new research on SUI:

Intentionally misrepresented emissions and proof the team themselves are dumping rewards from *locked* and *non-circulating* staked SUI onto Binance. (1/12) pic.twitter.com/jYRyeTFY56

— DeFi^2 (@DefiSquared) June 27, 2023

While Sui said the specific transactions were subject to a “contractual lockup,” DeFi Squared said the SUI tokens could be unlocked “without restriction.”

The DeFi-focused pundit claimed that Sui Foundation’s wallet address “0x341f” transferred 3.125 million of the total 27 million SUI in staking rewards to three separate addresses, which were then transferred to Binance.

The specific transaction referenced was a payment subject to a contractual lockup.https://t.co/ViYxQoJMos

— Sui Foundation (@SuiFoundation) June 27, 2023

DeFi Squared claimed this process occurred many times before “most of it” ended up on Binance:

“While the amounts are split many times, most of it ends up at Binance eventually. This could either be to obfuscate the selling, or perhaps because it is being split between different team members. But regardless, most of it is reaching Binance in the end.”

Related: Over $204M was lost in Q2 DeFi hacks and scams: Report

The commentator said their “curiosity was piqued” in May by SUI’s “seemingly endless sell pressure” while failing to publish an emissions chart separate from Binance’s launchpad, which supposedly wasn’t legitimate. Notably, they claimed the foundation is inflating the supply of the SUI token by roughly 20% month-on-month for non-foundation token holders:

“This is higher than the inflation rate of the hyperinflating Venezuelan Bolivar in 2022.”

Sui’s blockchain is designed to offer users high transaction throughput at low fees, according to Mysten Labs, the creators of the Sui Foundation.

The SUI token currently has a market cap of $427.7 million, from a circulating supply of about 604 million tokens, according to CoinMarketCap. SUI is trading for $0.70 at the time of publication, down 2.4% in the past 24 hours.

The Sui Foundation said it will publish a “detailed projection” of the token release schedule soon.

The next unlock of 61 million tokens ($43 million) is scheduled for June 3, according to tokenomics dashboard Token Unlocks.

Magazine: Web3 Gamer: District 9 director’s shooter, Decentraland red-light district battle