The European Central Bank is expected on Thursday to leave interest rates at record highs but to imply that a cut in borrowing costs is likely by the summer

Source link

Stand

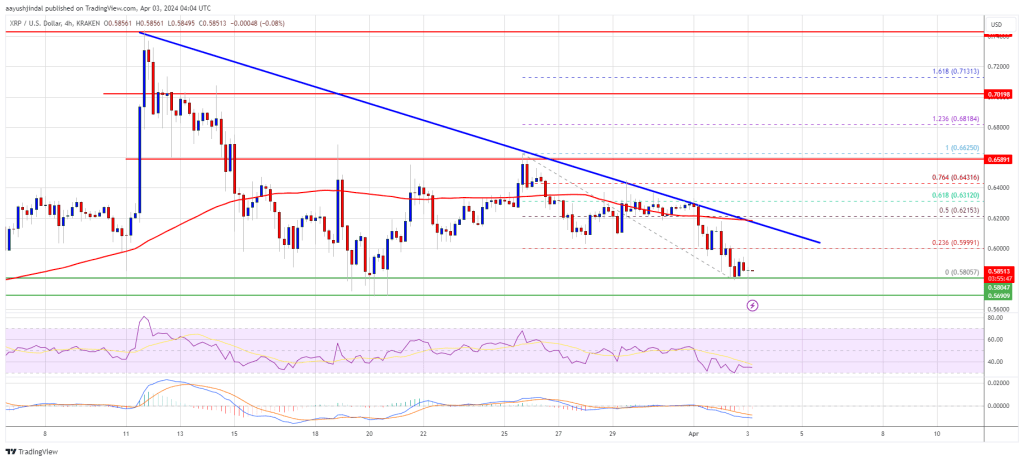

XRP price is struggling below $0.620. The price must stay above the $0.5680 support to attempt a fresh increase in the near term.

- XRP is slowly moving lower from the $0.6620 resistance zone.

- The price is now trading below $0.620 and the 100 simple moving average (4 hours).

- There is a major bearish trend line forming with resistance near $0.600 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair could gain bearish momentum if there is a close below the $0.5680 support.

XRP Price Faces Many Hurdles

In the past few sessions, XRP price saw a steady decline from well above the $0.650 level. There was a drop below the $0.620 and $0.605 support levels, like Bitcoin and Ethereum.

The price tested the $0.580 support. A low was formed near $0.5805 and the price is now consolidating losses. There is also a major bearish trend line forming with resistance near $0.600 on the 4-hour chart of the XRP/USD pair.

Ripple’s token price is now trading below $0.620 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $0.600 zone and the trend line. It is close to the 23.6% Fib retracement level of the downward wave from the $0.6625 swing high to the $0.5805 low.

The next key resistance is near $0.620. It is close to the 50% Fib retracement level of the downward wave from the $0.6625 swing high to the $0.5805 low. A close above the $0.6250 resistance zone could spark a strong increase. The next key resistance is near $0.6620.

Source: XRPUSD on TradingView.com

If the bulls remain in action above the $0.6620 resistance level, there could be a rally toward the $0.680 resistance. Any more gains might send the price toward the $0.700 resistance.

More Losses?

If XRP fails to clear the $0.600 resistance zone, it could start another decline. Initial support on the downside is near the $0.580 zone.

The next major support is at $0.5680. If there is a downside break and a close below the $0.5680 level, the price might accelerate lower. In the stated case, the price could retest the $0.5250 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.580, $0.5680, and $0.5250.

Major Resistance Levels – $0.600, $0.6250, and $0.6620.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Here’s How to Calculate Exactly How Much Spousal Social Security Benefit You Stand to Receive

For millions of older adults, Social Security is a safety net in retirement. Around 21% of adults age 50 and older have no other retirement income outside of their benefits, a 2023 survey from the Nationwide Retirement Institute found. So it’s wise to maximize your monthly checks.

Retirement benefits are the most common form of Social Security, but they’re not the only type of benefit you may qualify for. If you’re married or divorced, you could also be entitled to some form of spousal Social Security.

There are a few requirements you’ll need to meet to qualify, and the amount you receive will depend on several factors. Here’s your step-by-step guide to determining whether you’re eligible and how much you can expect to collect.

Image source: Getty Images.

Do you qualify for spousal Social Security benefits?

To qualify for spousal benefits, you must currently be married to someone who is entitled to either retirement or disability benefits. You also generally need to be at least 62 years old to begin claiming, unless you’re caring for a child who is under age 16 or disabled. In that case, you may qualify for spousal benefits at any age.

Divorce benefits have a few more requirements. For one, you can’t currently be married, and your previous marriage must have lasted for at least 10 years. If you’ve been divorced for less than two years, you’ll need to wait until your ex-spouse begins taking Social Security before you can file for divorce benefits. As with spousal benefits, you also must be at least 62 years old or caring for a qualifying child.

With both types of benefits, your payments will not affect your spouse’s or ex-spouse’s benefit in any way. If you’re divorced and your ex-spouse has remarried, taking divorce benefits also won’t affect their current spouse’s ability to claim spousal benefits.

Calculating your benefit amount

Even if you’ve never worked, you can still collect hundreds of dollars per month from Social Security. With both spousal and divorce benefits, the maximum you can collect is 50% of the amount your spouse or ex-spouse will receive at their full retirement age (FRA).

If you’ve worked enough to qualify for retirement benefits, that could affect your spousal or divorce benefit. The Social Security Administration (SSA) will pay out your retirement benefit first. Then, if your spousal or divorce benefit is higher, you’ll receive an additional amount so that your total payment equals the higher of the two amounts.

For example, say you qualify for $900 per month in retirement benefits, and your spouse is entitled to $2,000 per month at their FRA. Your maximum spousal benefit in this case, then, is $1,000 per month. The SSA will pay out your $900 first, then you’ll receive an extra $100 per month in spousal benefits so that your total payment is $1,000 per month.

If your retirement benefit is higher than your maximum spousal or divorce benefit, you won’t qualify for this type of Social Security at all. Say, for instance, you qualified for $1,100 per month in retirement benefits in the previous example. Because that’s higher than your max spousal benefit, you’d only receive your $1,100 per month retirement benefit.

One other factor affecting your monthly benefit

To receive the full spousal or divorce benefit you qualify for, you’ll need to wait until your own FRA to begin claiming. Your FRA will depend on your birth year, but it’s age 67 for anyone born in 1960 or later.

You can file before your FRA (as early as age 62), but your benefit will be permanently reduced depending on just how early you file. Also, unlike retirement benefits, delaying claiming past your FRA won’t increase your spousal or divorce benefit. There’s no financial incentive, then, for waiting beyond your FRA to file.

This doesn’t necessarily mean you shouldn’t claim early, as there are valid reasons to consider filing before your FRA. Just be sure that you’re aware that it will result in smaller payments each month.

Spousal or divorce benefits can go a long way in retirement, sometimes increasing your payments by hundreds of dollars per month. By taking full advantage of every type of benefit you qualify for, you can set yourself up for a more comfortable retirement.

Quick Take

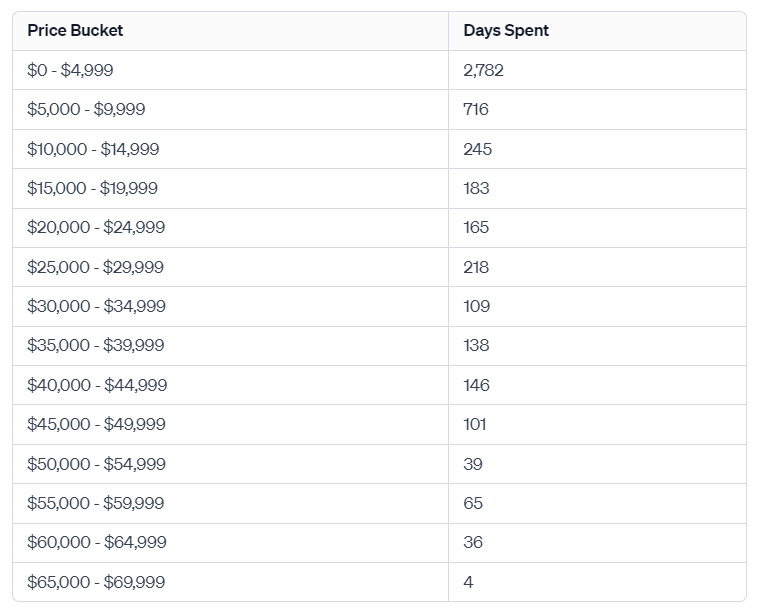

Bitcoin’s price rally from October 2023, which saw it soar from $25,000 to $49,000 in January 2024, witnessed the digital asset hitting the $40,000 mark for the first time since April 2022 on Dec. 4.

From then on, it steadily consolidated above $40,000 for 49 consecutive days. However, it lost the $40,000 support level on Jan. 22. Bitcoin’s trading price currently hovers around $42,000.

Digging deeper, the price analysis in $5,000 increments reveals a pattern. Bitcoin has been trading within the price range of $40,000 to $44,999 for 146 days. This duration has recently overtaken its previous stint in the $35,000 to $39,999 range, which spanned approximately 138 days.

When assessing price increments from $10,000 and upwards until $49,999, it becomes apparent that Bitcoin typically trades within these ranges for a period between 100 and 250 days. Thus, the current sideways price action aligns with Bitcoin’s historical trading patterns and can be considered characteristic behavior, not an anomaly.

The post Bitcoin’s steady stand: 146 days of trading between $40k and $45k appeared first on CryptoSlate.

SBF takes the stand, ‘buy Bitcoin’ searches soar and other news: Hodler’s Digest, Oct. 22-28

Top Stories This Week

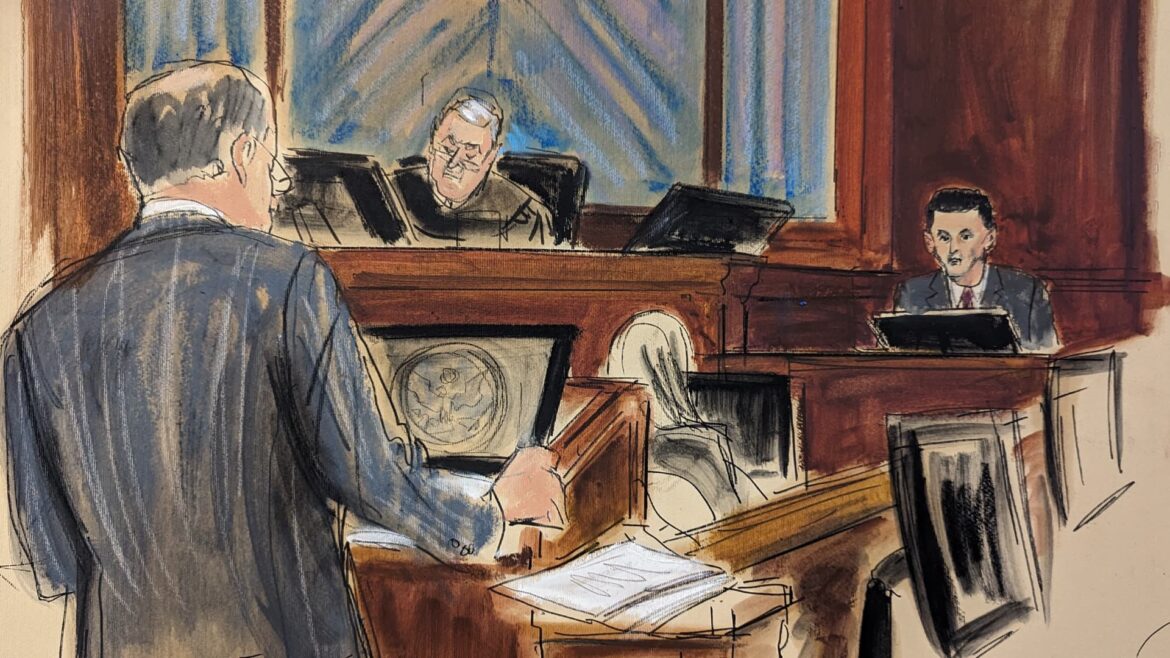

Sam Bankman-Fried takes the stand on FTX’s collapse

Sam “SBF” Bankman-Fried testified this week in his ongoing criminal trial in the Southern District of New York, denying any wrongdoing between FTX and Alameda Research while acknowledging making “big mistakes” during the companies’ explosive growth. Highlights of his testimony include denying directing his inner circle to make significant political donations in 2021, as well as claims that FTX’s terms of use covered transactions between Alameda and the crypto exchange. Additionally, Bankman-Fried testified that he requested additional hedging strategies for Alameda in 2021 and 2022, but they were never implemented. The trial is expected to conclude within the next few days.

‘Buy Bitcoin’ search queries on Google surge 826% in the UK

Google searches for “buy Bitcoin” have surged worldwide amid a major crypto rally, with searches in the United Kingdom growing by more than 800% in the last week. According to research from Cryptogambling.tv, the search term “buy Bitcoin” spiked a staggering 826% in the U.K. over the course of seven days. In the United States, data from Google Trends shows that searches for “should I buy Bitcoin now?” increased by more than 250%, while more niche searches, including “can I buy Bitcoin on Fidelity?” increased by over 3,100% in the last week. Zooming out further, the search term “is it a good time to buy Bitcoin?” saw a 110% gain worldwide over the last week.

US court issues mandate for Grayscale ruling, paving way for SEC to review spot Bitcoin ETF

The United States Court of Appeals has issued a mandate following a decision requiring Grayscale Investments’ application for a spot Bitcoin exchange-traded fund (ETF) to be reviewed by the Securities and Exchange Commission (SEC). In an Oct. 23 filing, the “formal mandate” of the court took effect, paving the way for the SEC to review its decision on Grayscale’s spot Bitcoin ETF. The mandate followed the court’s initial ruling on Aug. 29 and the SEC’s failure to present an appeal by Oct. 13. To date, the SEC has yet to approve a single spot crypto ETF for listing on U.S. exchanges but has given the green light to investment vehicles linked to Bitcoin and Ether futures.

Coinbase disputes SEC’s crypto authority in final bid to toss regulator’s suit

The U.S. Securities and Exchange Commission overstepped its authority when it classified Coinbase-listed cryptocurrencies as securities, the exchange has argued in its final bid to dismiss a lawsuit by the securities regulator. In an Oct. 24 filing in a New York District Court, Coinbase chastised the SEC, claiming its definition for what qualifies as a security was too wide, and contested that the cryptocurrencies the exchange lists are not under the regulator’s purview. The SEC sued Coinbase on June 6, claiming the exchange violated U.S. securities laws by listing several tokens it considers securities and not registering with the regulator.

Gemini sues Genesis over GBTC shares used as Earn collateral, now worth $1.6B

Cryptocurrency exchange Gemini filed a lawsuit against bankrupt crypto lender Genesis on Oct. 27. At issue is the fate of 62,086,586 shares of Grayscale Bitcoin Trust. They were used as collateral to secure loans made by 232,000 Gemini users to Genesis through the Gemini Earn Program. That collateral is currently worth close to $1.6 billion. According to the suit, Gemini has received $284.3 million from foreclosing on the collateral for the benefit of Earn users, but Genesis has disputed the action, preventing Gemini from distributing the proceeds. Genesis filed for bankruptcy in January. It had suspended withdrawals in November 2022, which impacted the Gemini Earn program.

Winners and Losers

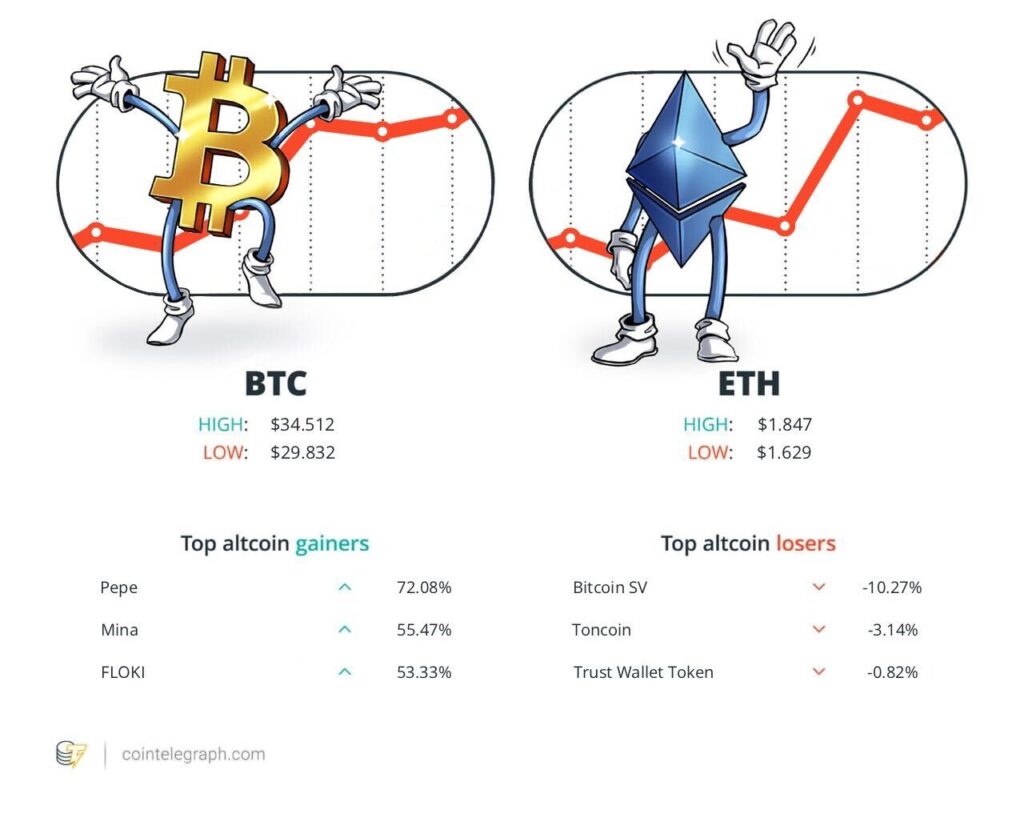

At the end of the week, Bitcoin (BTC) is at $34,143, Ether (ETH) at $1,789 and XRP at $0.54. The total market cap is at $1.26 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Pepe (PEPE) at 72.08%, Mina (MINA) at 55.47% and FLOKI (FLOKI) at 53.33%.

The top three altcoin losers of the week are Bitcoin SV (BSV) at -10.27%, Toncoin (TON) -3.14% and Trust Wallet Token (TWT) at -0.82%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Read also

Features

Andy Warhol would have loved (or possibly hated) NFTs

Features

‘Account abstraction’ supercharges Ethereum wallets: Dummies guide

Most Memorable Quotations

“The witness [Sam Bankman-Fried] has an interesting way of responding to questions.”

Lewis Kaplan, senior judge of the U.S. District Court for the Southern District of New York

“When it comes to illicit finance, crypto is not the enemy – bad actors are.”

“I should say, I am not a lawyer, I am just trying to answer based on my recollection. […] At the time [at] FTX, certain customers thought accounts would be sent to Alameda.”

Sam Bankman-Fried, former CEO of FTX

“Without prejudging any one asset, the vast majority of crypto assets likely meet the investment contract test, making them subject to the securities laws.”

Gary Gensler, chair of U.S. Securities and Exchange Commission

“I do not believe there has been a single serious conversation regarding a settlement between Ripple […] and the SEC. The SEC is pissed and embarrassed and wants $770M worth of flesh.”

John Deaton, attorney

“He [Sam Bankman-Fried] thought he was going to take that money, and […] he would out-trade the market and put the money back and end up as a half-a-trillionaire, but it never works like that.”

Anthony Scaramucci, founder of SkyBridge Capital

Prediction of the Week

Bitcoin beats S&P 500 in October as $40K BTC price predictions flow in

The largest cryptocurrency avoided significant volatility as the weekly and monthly closes — a key moment for the October uptrend — drew ever nearer.

“I think Bitcoin will hang around this range for some time,” popular pseudonymous trader Daan Crypto Trades told X subscribers in one of several posts on Oct. 27. “Roughly $33-35K is what I’m looking at as a range. Eyes on potential sweeps of any of these levels for a quick trade,” he wrote.

FUD of the Week

UK passes bill to enable authorities to seize Bitcoin used for crime

Scammers create Blockworks clone site to drain crypto wallets

Phishing scammers have cloned the websites of crypto media outlet Blockworks and Ethereum blockchain scanner Etherscan to trick unsuspecting readers into connecting their wallets to a crypto drainer. A fake Blockworks site displayed a fake “BREAKING” news report of a supposed multimillion-dollar “approvals exploit” on the decentralized exchange Uniswap and encouraged users to visit a fake Etherscan website to rescind approvals. The fake Uniswap news article was posted on Reddit across several popular subreddits.

Kraken to suspend trading for USDT, DAI, WBTC, WETH and WAXL in Canada

Kraken will suspend all transactions related to Tether, Dai, Wrapped Bitcoin, Wrapped Ether and Wrapped Axelar in Canada in November and December. The suspensions may not surprise many Canadian cryptocurrency users, as they come on the heels of several other notable exchanges taking similar actions throughout 2023. OKX ceased operations in Canada in June after Binance announced its intention to do so in May.

5,050 Bitcoin for $5 in 2009: Helsinki’s claim to crypto fame

Australia’s $145M exchange scandal, Bitget claims 4th, China lifts NFT ban: Asia Express

Australian police bust $145 million money laundering scam, Bitget gains market share in Q3, China unblocks NFTs, and more.

How blockchain games fared in Q3, Upland token on ETH: Web 3 Gamer

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.

Sam Bankman-Fried takes the stand with jury present in second day of testimony

Sam Bankman-Fried, the co-founder and former CEO of FTX, continued to provide testimony in his criminal case on Oct. 27, in which he described how FTX and its sister firm, Alameda Research, began as small but ambitious operations that eventually collapsed.

Bankman-Fried testified that he launched Alameda because of the growing popularity of cryptocurrency even though he knew “basically nothing” about it, saying:

“Crypto was getting public. In 2017, I’d seen two people talking excitedly and it was probably about crypto … crypto seemed like a place with a big demand for an arbitrage provider.”

He told the court that Alameda operated out of a small Airbnb in North Berkeley, California, in order to keep a low profile. When asked to explain the firm’s name, he said that he wanted to “stay under the radar” and “didn’t want to call it Sam’s crypto trading firm.”

Jury returns to hear testimony

Up to this point, Bankman-Fried had been made to give his testimony in the absence of the jury at the request of government prosecutors.

As jurors returned to hear the remainder of his testimony, Bankman-Fried stated that Alameda Research continued to serve as a market maker for FTX as the latter firm went live. He explained that risk could spill between companies, stating:

“We increased the number of servers for the risk engine. But we learned that if there was an erroneous liquidation of Alameda, or any other large account … it would be catastrophic for FTX.”

Bankman-Fried said that he eventually told FTX co-founder Gary Wang to take measures to stop possible liquidations of that type. He said that he now knows that those measures consisted of allowing account balances to go negative, as described in Wang’s testimony.

Bankman-Fried added that Alameda’s line of credit “grew over time to billions” of dollars. He testified that he had discussed Alameda with Wang and FTX’s former director of engineering, Nishad Singh, and said that they decided to increase the line of credit.

He once again downplayed his awareness of the full financial situation, stating:

“At the time I wasn’t entirely sure what was [happening]. I thought the funds were being held in a bank account or sent to FTX in stablecoins. If Alameda was keeping it, I figured it would be reflected as a negative number on FTX.”

Bankman-Fried briefly touched on a number of other operational matters, including his use of the Signal messaging app, FTX’s terms of service, and FTX’s FTT token.

FTX goes to the Bahamas

Earlier in his testimony, Bankman-Fried said that FTX and Alameda had moved to Hong Kong for the region’s “better regulatory environment.” However, both companies soon left due to COVID-19 quarantines and domestic disputes with China.

Bankman-Fried said that FTX instead moved to the Bahamas, which had “suitable” regulations. The firm’s employees moved into an apartment for ten, he said.

He also described his break-up with former Alameda Research CEO Caroline Ellison, stating that “she wanted more than I could give … it wasn’t the first time with me.” Ellison described a significantly more strained relationship in her own testimony, stating that Bankman-Fried had blamed and yelled at her for the company’s issues.

SBF describes company spending

Bankman-Fried described his marketing activities, including the purchase of Miami-Dade Arena and investments in emerging projects such as Solana. He further detailed his investments in the VC firm K5 for its “promising incubations” and “celebrity contacts.”

He also described his decision to invest in political candidates and groups, stating:

“I was interested in pandemic prevention. So I thought policy was important, [as well as] Congress and the Executive Branch. Some [donations] were by FTX for cryptocurrency lobbying … some, not most … [for] a U.S. regulatory structure.”

Bankman-Fried admitted that those donations came from loans from Alameda Research. He said that FTX executives Nishad Singh and Ryan Salame made donations as well. In his own testimony, Singh said that his name was merely associated with some donations but nevertheless pleaded guilty to campaign financing charges in his plea deal.

Bankman-Fried was still on the witness stand at the time of writing. His defense’s ultimate argument is still unclear. CryptoSlate’s coverage of the case will continue.

Sam Bankman-Fried defense team fails to land a blow as he takes stand

Courtroom sketch showing Sam Bankman Fried questioned by his attorney Mark Cohen. Judge Lewis Kaplan on the bench

Artist: Elizabeth Williams

Sam Bankman-Fried took the stand in a New York courtroom on Thursday, as he and his defense team auditioned their best legal material for U.S. District Judge Lewis Kaplan.

The former crypto billionaire had originally been scheduled to testify before the jury, but the judge sent jurors home early to consider whether some aspects of Bankman-Fried’s planned testimony, related to legal advice he got while running FTX, would be admissible in court.

In a sort of mini-hearing within the trial, defense attorney Mark Cohen guided Bankman-Fried through a series of questions designed to showcase the defense’s strongest arguments of his innocence, including suggesting that he relied on FTX’s former chief regulatory officer and in-house attorney, Dan Friedberg, to guide some actions that the government claims are illegal.

Bankman-Fried faces seven criminal counts, including wire fraud, securities fraud and money laundering, that could land him in prison for more than 100 years if he is convicted at his trial in Manhattan federal court. Bankman-Fried, the son of two Stanford legal scholars, has pleaded not guilty in the case.

“Before the trial, I was convinced that SBF was headed to near-certain conviction on serious felony counts, and it was apparent to me that his defense team had not come up with anything that could derail that result,” said Renato Mariotti, a former prosecutor in the U.S. Justice Department’s Securities & Commodities Fraud Section and now a trial partner in Chicago with Bryan Cave Leighton Paisner.

“Nothing that has occurred during the trial has changed my view. The evidence of his guilt appears to be overwhelming,” added Mariotti.

In the last four weeks of trial, multiple members of the C-suite at crypto exchange FTX, and its sister hedge fund Alameda Research, have all singled out Bankman-Fried as the mastermind behind the scenes. Several of these witnesses have themselves pleaded guilty to multiple charges, including Bankman-Fried’s ex-girlfriend Caroline Ellison, who faces a maximum sentence of 110 years for crimes committed while she was the CEO of Alameda.

Prosecutors have also entered evidence to corroborate witness accounts, including encrypted Signal messages and other internal documents that appear to show Bankman-Fried orchestrating the spending of FTX customer money.

The defense’s case — which is comprised of Bankman-Fried’s upcoming testimony along with that of two witnesses who both wrapped in just over an hour on Thursday morning — hinges on whether the jury believes the defendant when he takes the stand.

“He has always been convinced that he’s the smartest guy in the room and that he can talk his way out of any problem,” continued Mariotti.

“But the biggest problem with SBF’s testimony will be SBF himself. Given that the core issue will be intent to defraud, SBF should be portraying himself as clueless, inattentive, and in over his head. But for years he had portrayed himself as a visionary genius, and I don’t expect that to change on the stand,” he said.

Defense struggles to land a blow

Judge Kaplan previously ruled that Bankman-Fried’s lawyers could not make a so-called advice of counsel argument in their opening remarks since it might risk prejudicing the jury. On Thursday, Kaplan sent the jury home early to reconsider in a closed-door session whether to allow this line of testimony.

Under questioning led by Cohen, Bankman-Fried appeared to place much of the criminal blame on FTX’s chief regulatory officer, Friedberg, as well as outside counsel Fenwick & West, which advised the crypto exchange. Bankman-Fried spoke about Friedberg’s active involvement in everything from the company-wide auto deletion policy on messaging apps like Signal, to the creation of Alameda’s North Dimension bank account, where billions of dollars worth of FTX customer money was funneled.

The former FTX chief also said that the hundreds of millions of dollars in personal loans to himself and other founders of the platform were structured through promissory notes drafted by his in-house legal team and discussed in concert with his general counsel and Friedberg. Having the blessing of his legal counsel was something that SBF said he “took comfort in.”

While taking the stand offers Bankman-Fried the opportunity to tell his side of the story to jurors, it also opens the door for federal prosecutors to go for the jugular in cross-examination. Following damning testimony from Bankman-Fried’s closest ex-confidantes and top deputies, defense attorneys for the FTX founder have failed to flip the narrative in cross-examining key witnesses or to undermine the most troubling allegations regarding their client.

Indeed, Bankman-Fried’s practice run on Thursday was tough to watch. While he came across as direct and credible in his direct examination, the grilling by prosecutors was aggressive and effective. At multiple points, the judge appeared exasperated by Bankman-Fried’s responses, once saying that the defendant had an “interesting way of answering questions.”

The defendant’s demeanor flipped 180 degrees when U.S. assistant attorney Danielle Sassoon began her questioning. He swiveled back and forth in his chair, nervously shook a piece of paper he held in his hands, repeatedly grabbed for his water bottle before responding, and skirted a lot of questions by saying he couldn’t recall what had happened.

Judge Kaplan interjected at one point, telling the defendant to “listen to the question and answer the question directly.”

On Friday morning, we’ll get a ruling from the judge on what’s admissible from the defense’s wish list of topics – as well as Bankman-Fried’s debut before the jury from the stand.

“Given that he appears headed for defeat, taking the stand can be a ‘Hail Mary’ of sorts,” said Mariotti.

“SBF will be hamstrung by his many prior statements, which could be used to impeach him. It will be difficult for SBF to weave his testimony around those prior statements.”

This week’s testimony is just the latest example of the defense team’s struggle to land a blow in the criminal fraud case.

Prosecutors spent four weeks of the trial walking former leaders of FTX and Alameda Research through specific actions taken by their boss that resulted in clients losing billions of dollars late last year.

In trying to poke holes in witness accounts, Bankman-Fried’s lawyers have repeatedly jumped around, unable to maintain a consistent timeline or coherent argument, while also opening the door for witnesses to offer additional testimony in furtherance of what they’d previously told the jury.

The scattershot approach is potentially troubling for Bankman-Fried, who’s counting on his defense attorneys to keep him out of prison in what could be a life sentence if convicted. The central claim the defense has been unable to knock down is that Bankman-Fried knowingly used billions of dollars in FTX customer funds to pay for his lavish lifestyle, to make political donations and, most dramatically, to cover a gaping hole in Alameda’s books following the cratering of cryptocurrency prices last year.

Cohen, a co-founder of the New York law firm Cohen & Gresser, is being joined at trial by Christian Everdell, a member of the firm’s white collar defense team. Cohen, a graduate of the University of Michigan Law School, started his firm 21 years ago and previously served as an assistant U.S. attorney for the Eastern District of New York. Everdell started at Cohen & Gresser in 2017 after almost a decade working as a prosecutor for the Southern District of New York.

— CNBC’s Dawn Giel contributed to this report.

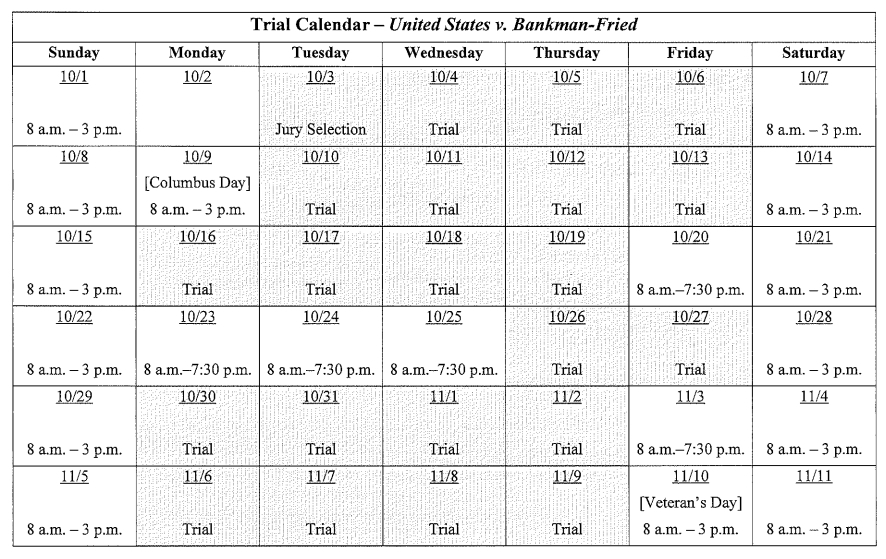

Former FTX CEO Sam “SBF” Bankman-Fried will spend at least 21 days in court as part of his criminal trial, which will begin in earnest on Oct. 4 and last until Nov. 9, according to a newly released trial calendar posted to the public court docket.

The burgeoning trial calendar, released on Sept. 28, begins on Oct. 3 with jury selection. The first official date of the Bankman-Fried trial is Oct. 4, where they will begin discussing seven fraud charges laid against him.

There are two substantive charges where the prosecution must convince a jury that Bankman-Fried committed the crime. Five other “conspiracy” charges involve the prosecution convincing a jury that Bankman-Fried planned to commit the crimes.

There are 15 full trial days in October and another six in November. The court will not be in session between Oct. 20 and Oct. 25 and on weekends. Public holidays also fall on Oct. 9 and Nov. 10, and there is also no trial slated for Nov. 3.

The former FTX CEO has been serving pre-trial detention at the Metropolitan Detention Center since Aug. 11. Through his attorneys, Bankman-Fried has filed numerous motions for temporary release to prepare for his upcoming trial.

His latest attempt was knocked back again on Sept. 28 by United States District Judge Lewis Kaplan, suggesting Bankman-Fried might be a flight risk, given his young age and a “very long sentence” if convicted.

“If things begin to look bleak… maybe the time would come when he would seek to flee.”

However, Kaplan said that he was sympathetic to the defense’s concerns and has granted Bankman-Fried permission to arrive at court at 7 am local time on most trial days to speak with his lawyers before testimony begins.

Related: Sam Bankman-Fried’s temporary release request denied as trial date looms

During the hearing on Sept. 28, assistant U.S. attorney Danielle Kudla said the Department of Justice estimated the case could last four to five weeks.

SBF, who pleaded not guilty to seven counts of fraud and conspiracy following the collapse of FTX, faces a statutory maximum of 110 years in prison.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

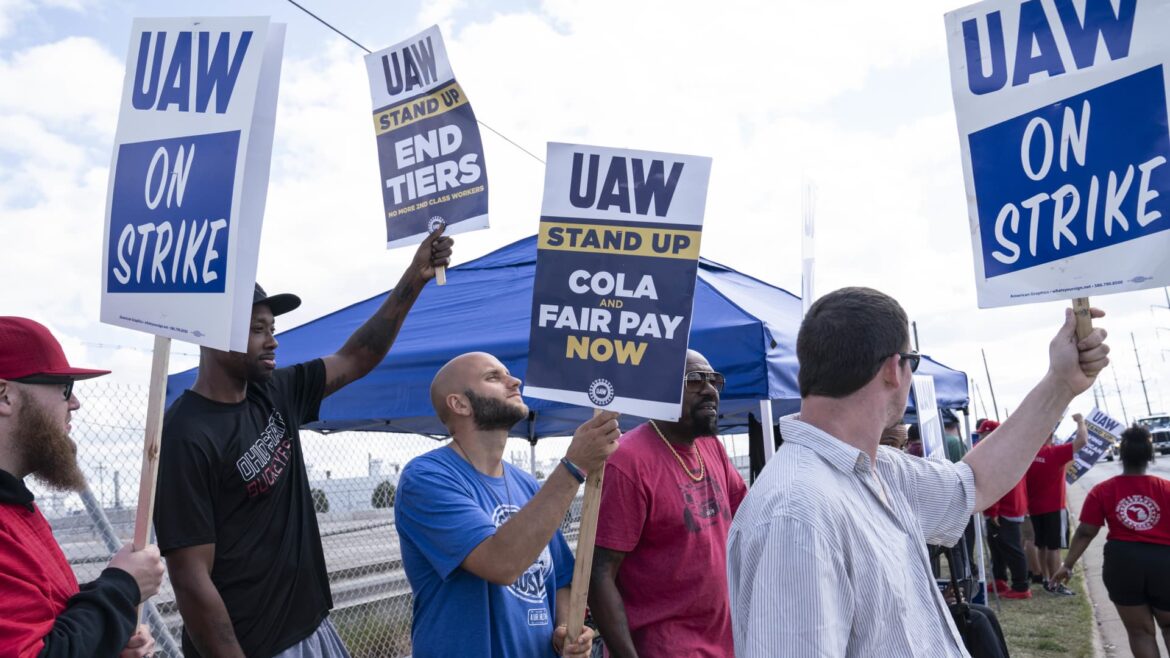

(L-R) Supporter Ryan Sullivan, and United Auto Workers members Chris Sanders-Stone, Casey Miner, Kennedy R. Barbee Sr. and Stephen Brown picket outside the Jeep Plant on September 18, 2023 in Toledo, Ohio.

Sarah Rice | Getty Images

DETROIT — With a deadline for expanded strikes by the United Auto Workers against the Detroit automakers closing in, the “serious progress” called for by the union seems all too elusive.

The UAW and General Motors, Ford Motor and Stellantis are all holding their ground on demands, and it appears likely the union will strike additional plants at some, if not all, of the automakers at noon Friday — as it’s warned.

While talks are ongoing, there has been little reported movement in proposals since the strikes were initiated on Sept. 15 at assembly plants in Michigan, Ohio and Missouri. Sources familiar with the talks describe a “big” gap in demands and the parties being “far apart.”

Headline economic issues and benefits such as hourly pay, retirement benefits, cost-of-living adjustments, wage progression and work-life balance remain central to the discussions. All issues play into one another and can change based on demand priorities.

Each automaker has its own unique issues, but overall the companies want to avoid fixed costs and what they’ve called “uncompetitive practices” such as traditional pensions. The union, in contrast, is attempting to regain benefits lost during past talks and secure significant increases to pay and other benefits, while retaining platinum health care for members.

In the end, it comes down to money, and how much a deal will cost the companies. Wall Street is currently expecting record costs to come from a settlement, though still below the $6 billion to $8 billion in demands the union would like, according to Wells Fargo.

Here’s a general overview of where the union and companies stand on key issues.

Wages

Union leaders have been highly transparent during collective bargaining this year with the automakers. However, they’ve largely been quiet on any potential for compromise around a demand of 40% wage increases over four and a half years.

Media reports indicate the union has adjusted that demand to the mid-30% range. UAW President Shawn Fain last week said the union has not made an offer below 30%.

The automakers have countered with wage increases of around 20% over the length of the contract — what would still be a record — to a top wage of more than $39 per hour for a majority of workers.

Sources familiar with the talks say if the companies do increase hourly wages beyond that 20% level, they’re likely to lower other benefits or reduce jobs in the future to try to make up the difference.

A Ford source said the company’s current proposals would offer entry-level employees starting salaries of about $60,000, potentially increasing to $100,000 or more during the life of the deal. That includes base pay, expected overtime, profit-sharing and other cash bonuses.

Under GM’s latest proposal, President Mark Reuss said about 85% of current represented employees would earn a base wage of about $82,000 a year. That’s compared with the average median household income of $51,821 in nine areas where GM has major assembly plants, he said.

Tiers/’In-progression’/Temps

Wage tiers — putting autoworkers into distinct pay ranges or classifications — is a tricky, moving target.

The companies and union have defined tiers differently during past negotiations as well as during the talks this year. Tiers can signify the following scenarios: workers doing the same job for different pay and benefits; similar but different job responsibilities; or differences between workers at assembly and components plants, depending on the talks.

The UAW has called broadly for “equal pay for equal work.” It’s a cornerstone of the group’s platform, while automakers have historically argued for pay to be based on seniority, job classification and responsibilities.

So-called tiers were established in 2007 as a concession by the union to allow lower wages and benefits for workers hired after the contracts were ratified that year — what became known as a second tier. The starting pay of these workers was roughly half that of the incumbent workers, and they would not be eligible for the same active health-care benefits, pensions or retiree health-care coverage.

The union has won some similar benefits back for newer workers compared to veteran, or “legacy” ones, but there remains different classifications of workers and pay tiers that amount to “in-progression” wages, in which a worker earns more the longer they’re employed.

For this year, the automakers have largely proposed cutting an existing eight-year pay progression in half and eliminating some pay discrepancies between workers who do similar jobs such as parts and components.

The union would like to eliminate the in-progression pay structure entirely and have workers across the contract earning the same wage (after a 90-day adjustment period) including temporary, or supplemental, workers.

One source familiar with the talks said there’s a “philosophical difference” between the sides. Ford, which utilizes the fewest temporary workers, has agreed to move all current temps with 90 days of work to full-time employees.

COLA/Profit-sharing

The UAW suspended cost-of-living adjustments in 2009, as the companies attempted to cut costs. COLA helps employees maintain the value of their compensation against inflation.

The union now wants to reinstate COLA, especially following a period of decades-high inflation. But the automakers, in general, have proposed either lump-sum payments or suggested utilizing calculations based on inflation levels that the union argues wouldn’t be sufficient to offset increased costs.

Automakers have further argued that profit-sharing payments that have traditionally been based on North American profits of the companies have assisted in offsetting inflation.

The companies are attempting to change or lower profit-sharing payments to offset other increased costs, while the union would like an enhanced formula.

The UAW previously outlined a calculation of providing $2 for every $1 million spent on share buybacks and increases to normal dividends.

32-hour workweek

The union has proposed better work-life balance, including a potential 32-hour workweek for the pay of 40 hours. It has argued that salaried workers are allowed remote or hybrid work, giving them more time at home with their families.

A shorter workweek has been a non-starter for the automakers, which have countered with additional vacation time, added holiday pay such as for Juneteenth and two-week paternal leave, in some cases.

Product

For the UAW, product commitments equal jobs, meaning more members for the union.

UAW leaders are specifically concerned with vehicle production commitments at Stellantis, which has proposed closing, selling or consolidating 18 facilities. The locations included its North American headquarters, 10 parts and distribution centers and three manufacturing components facilities (two of which have already been fully or partially decommissioned).

A source familiar with the talks said GM has committed product to all of its facilities, following three closures four years ago.

Retirement benefits and savings

The UAW has demanded a “significant” increase in pay for retired workers. The union last week said the companies had rejected all such increases. However, GM CEO Mary Barra said the automaker included in its offer a lump-sum cash payment of $500 for retirees.

A Ford source said the company’s current offer includes a health-care retirement bonus program with lump sums of either $50,000 or $35,000, upon retirement, based on seniority, for newer workers.

Automakers also have pushed back on returning to traditional pensions in lieu of 401(k) plans.

A proposal last week by Ford included a 6.4% contribution from the company and $1 per hour for every hour worked, with a previous cap removed, according to a company source.

GM also offered an unconditional 6.4% company 401(k) contribution for employees who are not eligible for pensions.

Coinbase Launches ‘Stand with Crypto’ Campaign to Advocate for Clear Cryptocurrency Legislation in US

The “Stand with Crypto” campaign will have a strategic focus on nine specific states in the United States: New Hampshire, Nevada, Ohio, Pennsylvania, Arizona, California, Georgia, Illinois, and Wisconsin.

The Coinbase “Stand with Crypto” campaign is dedicated to advocating for favorable cryptocurrency legislation in the United States. This initiative follows extensive research by Coinbase, revealing that a majority of Americans believe the financial system requires significant reforms. Among the respondents, 51% contend that the current financial system is unjust, primarily favoring powerful interests over ordinary citizens. The research also indicates that only a small fraction (14%) are optimistic about the future of the existing financial system.

The “Stand with Crypto” campaign will have a strategic focus on nine specific states in the United States: New Hampshire, Nevada, Ohio, Pennsylvania, Arizona, California, Georgia, Illinois, and Wisconsin. Notably, particular attention will be given to the four the “swing states” where voters are less likely to support anti-crypto presidential candidates.

While some elected members of Congress advocate for cryptocurrency regulation and innovation in the financial sector, others prefer maintaining the status quo. Coinbase aims to raise awareness and voice its support for cryptocurrency through this campaign, aligning with the desire for change among many Americans.

“It’s time to challenge the status quo by updating the system,” wrote the company.

Coinbase’s decision to embark on this campaign is substantiated by data from a 2022 fall poll, which revealed that over half (55%) of voters in some targeted states expressed a disinclination to vote for candidates opposing cryptocurrency and Web3. Additionally, during the polling, 13% to 19% of respondents in these states claimed to own cryptocurrencies.

For instance, in Nevada, Ohio, and Pennsylvania, over 40% of cryptocurrency owners use blockchain technology for cross-border money transfers to support individuals’ food, housing, and healthcare expenses. They prefer this method due to its cost-effectiveness and speed compared to traditional bank wire transfers.

Unregulated Crypto Landscape in the US Is a Competitive Disadvantage

The absence of clear regulations poses challenges for cryptocurrency exchanges and businesses in the United States. Even well-established crypto exchanges have faced legal issues and allegations due to the lack of regulatory clarity. Furthermore, many countries are already implementing regulatory frameworks to position themselves strategically in the innovative crypto-driven financial system. Failure to act promptly could result in the United States missing out on attracting innovative companies, creating jobs, and generating additional revenue from the cryptocurrency industry. Coinbase said:

“Crypto needs clear, sensible legislation. The current “enforcement only” approach puts jobs, innovation, and global leadership at risk.”

Some Coinbase’s Strategy for the ‘Stand with Crypto’ Campaign

The “Stand with Crypto” campaign, initiated by Coinbase, is a 14-month-long effort with various programs. It includes “Stand with Crypto Day” in Washington D.C. on September 27, dedicated to promoting cryptocurrency innovation and policy. The campaign also encourages crypto supporters to engage with their Congress Representatives to advocate for favorable and transparent crypto regulations in their respective states.

Coinbase’s approach to achieving its campaign goals involves community rallies, transitioning from social media to phone calls for advocacy aimed at congressional members and influential figures, hosting in-person events, and showcasing how clear cryptocurrency regulations can benefit the financial system and the United States as a whole.

next

Blockchain News, Cryptocurrency News, News

Temitope is a writer with more than four years of experience writing across various niches. He has a special interest in the fintech and blockchain spaces and enjoy writing articles in those areas. He holds bachelor’s and master’s degrees in linguistics. When not writing, he trades forex and plays video games.

You have successfully joined our subscriber list.