Customer interest seems healthy and new products could soon start to contribute financially, according to a new bull.

Source link

Start

My RMDs Start Soon So I’m Converting $700k to a Roth, But I’m Getting Conflicting Info About Having to Wait Five Years

I’m 68 and recently retired and have about $1.4 million in accounts intended for retirement ($1.2 million in a Traditional IRA and $110K in a Roth). I also am receiving about $47,000 annually in Social Security benefits. My RMDs are scheduled to start in 2027, and as a result, my financial advisor and I are considering doing some annual Roth conversions prior to 2027. It all sounds like a good plan to me, however, I am getting some conflicting information on when I will be able to make withdrawals from the Roth.

My advisor says I will have to wait the standard five years after each Roth conversion deposit before being able to make any withdrawal of those funds (the conversion amount itself and any earnings). However, I have also been told I could withdraw against the conversion amount with no waiting period since I am older than 59 ½. For example, my Roth was established in 2015 and has had a total of $60,000 in contributions and $50,000 in earnings. If I were to do a Roth conversion of $75,000 in 2024 would I then have available $135,000 for withdrawal without any penalty? My advisor says I would only have the original $60,000 available for withdrawal until the five years have passed for the conversion made in 2024. What is the proper withdrawal regulation and rules under those circumstances?

– Jeff

Hey Jeff, great question. This is unfortunately a very confusing topic that is easily jumbled up. It is not surprising that you’ve received or found conflicting information. Fortunately, once you sort through the rules and are able to keep them straight, the answer is very clear.

Because you are over 59 ½ and have had a Roth IRA for five years, you can withdraw any amount of money at any time from any Roth IRA balance you have (conversion or otherwise) without incurring a tax liability or penalty. Period.

Having said that, I am now just another guy that has given you information that conflicts with something else you’ve heard, right? Rather than leaving it at that, let’s walk through the rules and reference the specific information from the IRS. (And if you’re need financial advice or want to find a new advisor to work with, this free tool can help you connect with financial advisors who serve your area.)

What Are the 5-Year Rules?

While Roth IRAs are funded with after-tax money that can be withdrawn tax-free, there are specific rules surrounding how to take this money out of your account.

The IRS has three “five-year rules” for different types of Roth IRAs, but we’ll be discussing two of them here. The first five-year rule specifically applies to accounts that start off as Roth IRAs, while a separate five-year rule solely applies to accounts that are converted into Roth IRAs. Keep in mind that running afoul of either rule can trigger a 10% early withdrawal penalty and/or income taxes on investment earnings. You’ll obviously want to avoid these taxes and penalties as best as you can.

5-Year Rule for Roth IRAs

The first five-year rule dictates that you must wait five years after your initial contribution to a Roth IRA before you can make tax-free withdrawals of any investment earnings. However, the five-year period is retroactive to Jan. 1 of the year in which your first contributions were made.

For example, if you made your first contribution to a Roth IRA in November 2020, the five-year period officially began on Jan. 1, 2020. As a result, you could start withdrawing earnings after Jan. 1, 2025.

But waiting five years alone is only half of the equation. Withdrawals from your Roth IRA must be “qualified” in order for you to avoid taxes and penalties. Luckily, reaching age 59 ½ is the most common way to satisfy this particular requirement.

For instance, funding a Roth IRA at age 45 doesn’t mean someone can make tax- and penalty-free withdrawals from the account five years later. They’ll need to wait until age 59 ½, be disabled or meet one of the other requirements set by the IRS for qualified withdrawals. Likewise, if you open your first Roth IRA when you’re 58, the five years still need to pass before you can withdraw the earnings tax-free. Simply turning 59 ½ isn’t enough in this instance.

Failing to meet both the five-year rule and the rules governing qualified withdrawals may trigger income taxes on the earnings you withdraw, as well as a 10% tax penalty. Jeff, because you opened your Roth IRA in 2015 and you are over 59 ½ years old, you have already satisfied both rules. Plain and simple.

(And if you need help managing your Roth IRA, consider connecting with a financial advisor who serves your area.)

5-Year Rule for Roth Conversions

There is also a separate five-year rule for Roth conversions. If a person is under 59 ½ years old, they must wait five years before they can withdraw any money that’s converted from a traditional IRA into a Roth IRA. And unlike the first five-year rule that only needs to be satisfied once, this rule applies to each individual conversion.

Fortunately, you aren’t subject to early withdrawal penalties by virtue of your age, so this five-year rule also doesn’t apply to you. You’ll automatically avoid the 10% penalty on withdrawals from a converted Roth IRA.

However, here’s the context and rationale for this IRS rule:

Someone who’s under 59 ½ is generally subject to an additional 10% penalty on distributions from IRAs. Without this five-year rule, someone could simply convert a traditional IRA into a Roth IRA (paying the taxes on the conversion, of course) and then immediately withdraw the money from the Roth IRA, thereby sidestepping the 10% early withdrawal penalty. The five-year rule on Roth conversions closes this potential loophole.

Keep in mind that each five-year period starts on Jan. 1 of the year in which the conversion was made. (And if you need help doing a Roth conversion, consider speaking with a financial advisor who can guide you through the process.)

Bottom Line

As they say, age has its privileges. Because you are over 59 ½ and have satisfied the Roth IRA contribution rule, you no longer have to worry about taxes or penalties on any withdrawals you take from your Roth IRA.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

If you’re working with a financial advisor but you’re unhappy with the results, you can always consider finding a new professional to work with. Here are some tips for navigating this transition, including how to notify your current advisor about your decision and what you should do before breaking off the professional relationship.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column. Questions may be edited for clarity or length.

Please note that Brandon is not a participant on the SmartAsset AMP platform, and he has been compensated for this article. Questions may be edited for clarity or length.

Photo credit: ©iStock.com/Kameleon007

The post Ask an Advisor: My RMDs Start Soon So I’m Converting $700k to a Roth, But I’m Getting Conflicting Info About Having to Wait Five Years appeared first on SmartReads by SmartAsset.

It’s Time for This “Magnificent Seven” Stock to Join Its Rivals and Start Contributing to This $1.7 Trillion Payout

Last year, companies around the world paid a record $1.7 trillion in dividends to their shareholders, a 5% increase from the prior year. Leading the way were tech titans Microsoft (MSFT -2.07%) and Apple (AAPL -0.22%) at $20.7 billion and $14.9 billion, respectively.

Dividend payments are likely to set a new record this year. One catalyst is that fellow tech titan Meta Platforms (META -1.57%) initiated a dividend, which should total more than $5 billion this year. It’s now the fourth member, along with Nvidia, of the vaunted “Magnificent Seven” to join the bandwagon of dividend-paying stocks.

Among the holdouts is Alphabet (GOOG -1.50%) (GOOGL -1.34%). It’s high time for the search giant to start paying dividends. Here’s why.

It rivals its peers in producing cash

Microsoft, Apple, and Meta Platforms can afford to pay massive dividends because they generate huge cash flows. Over the past six months, Microsoft has produced $49.4 billion in operating cash flow. It returned $19.5 billion to shareholders through dividend payments ($10.6 billion) and share repurchases ($8.8 billion). Apple is also a cash flow machine. It generated $39.9 billion in cash from operating activities in its fiscal first quarter. It paid $3.8 billion in dividends and repurchased $20.1 billion in stock. Meanwhile, Meta Platforms produced $40.8 billion in net cash from operating activities last year and used $20 billion to repurchase shares.

Alphabet is just as good at generating cash as its dividend-paying Magnificent Seven peers. Last year, the search giant produced a prodigious $101.7 billion in net cash from operating activities. While the company didn’t use any of that money to pay dividends, it did return $61.5 billion to shareholders through repurchases.

However, the company could easily follow Meta’s approach when it initiated its dividend earlier this year. CFO Susan Li commented on Meta’s new dividend policy on the fourth-quarter earnings conference call:

Aside from organic investments, returning capital to shareholders remains important to us. We believe our strong financial position and performance will enable us to invest in the business while also continuing to return capital to investors over time. We’ve historically done so through share repurchases, and while we expect to maintain an active share repurchase program, we are modestly evolving our approach going forward by returning a portion of capital through a regular dividend.

It’s also a financial fortress

Another reason tech titans Microsoft, Apple, and now Meta Platforms are paying dividends is that they have a lot of cash on their balance sheets.

|

Magnificent Seven Dividend Stock |

Cash, Cash Equivalents, and Short-Term Investments |

Total Debt Outstanding |

Net Cash Position |

|---|---|---|---|

|

Apple |

$172.6 billion |

$108 billion |

$64.6 billion |

|

Microsoft |

$81 billion |

$74.2 billion |

$7 billion |

|

Meta Platforms |

$65.4 billion |

$18.4 billion |

$47 billion |

Data sources: Company websites. Data as of the end of 2023.

Apple’s net cash position alone could fund its current dividend outlay for more than four years, while Meta’s would last nearly a decade.

Alphabet has an equally enormous cash position. It ended last year with $110.9 billion of cash, equivalents, and marketable securities against only $13.3 billion in debt.

Ramping its cash returns seems inevitable

Like its peers, Alphabet produces more cash than it needs to grow its business. The money it doesn’t return to shareholders through buybacks is piling up on its balance sheet. While the company might be strategically holding cash to make a sizable acquisition, that seems unlikely, since mergers and acquisitions aren’t a big part of its growth strategy. The company’s biggest deal was its $12.5 billion acquisition of Motorola Mobility in 2012. Other notable deals were relatively smaller including Nest at $3.2 billion in 2014, Fitbit at $2.1 billion in 2021, and YouTube at $1.7 billion in 2005. Between that and the increased regulatory scrutiny of acquisitions in the tech sector, Alphabet probably won’t use its cash position to make a big deal.

That leaves returning it to shareholders as the most likely outcome. On one hand, it’s hard to argue with its share repurchase program. Alphabet has reduced its outstanding shares by 10% over the past five years, second only to Apple in this group. Alphabet could buy back even more shares, which wouldn’t be a bad idea, since it has the lowest forward P/E ratio in this group at 21. However, a dividend could broaden its appeal to more investors, which could boost its valuation. Meanwhile, paying a dividend would put cash in the pockets of long-term holders, not those selling shares to Alphabet as part of the repurchases.

It’s time Alphabet initiated a dividend

Microsoft and Apple pay their investors billions of dollars in dividends each year. Meta is joining them this year. It’s time for Alphabet to get on board, too. Like its peers, it produces massive cash flows, which are piling up on its balance sheet. It really doesn’t have much use for that money, other than returning it to investors. While its buyback is doing a good job, the company can easily squeeze in a dividend to provide its investors with a little income.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Matt DiLallo has positions in Alphabet, Apple, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

How to Start Your Own Brokerage or Exchange – B2Broker CEO Arthur Azizov and CDO John Murillo

B2Broker is a premier provider of liquidity solutions, white-label platforms, CRM systems and advanced trading mechanisms. Founded in 2014, B2Broker has consistently added new features and tools to its expansive liquidity and white-label offerings. With the contribution of B2Broker’s sibling companies – B2BinPay, B2Core and B2Trader, the group delivers a comprehensive suite of B2B brokerage […]

B2Broker is a premier provider of liquidity solutions, white-label platforms, CRM systems and advanced trading mechanisms. Founded in 2014, B2Broker has consistently added new features and tools to its expansive liquidity and white-label offerings. With the contribution of B2Broker’s sibling companies – B2BinPay, B2Core and B2Trader, the group delivers a comprehensive suite of B2B brokerage […]

Source link

‘Wolf of All Streets’ Sees Start of Major Bull Run for Bitcoin and Broader Crypto Market — Warns of a ‘Huge Bubble’

Scott Melker, also known as the “Wolf of All Streets,” believes that we are at the start of a major bull run for both bitcoin and the broader crypto market. “We will likely see a huge bubble and that coins with no fundamental value will also skyrocket before it inevitably pops,” he warned, adding that […]

Scott Melker, also known as the “Wolf of All Streets,” believes that we are at the start of a major bull run for both bitcoin and the broader crypto market. “We will likely see a huge bubble and that coins with no fundamental value will also skyrocket before it inevitably pops,” he warned, adding that […]

Source link

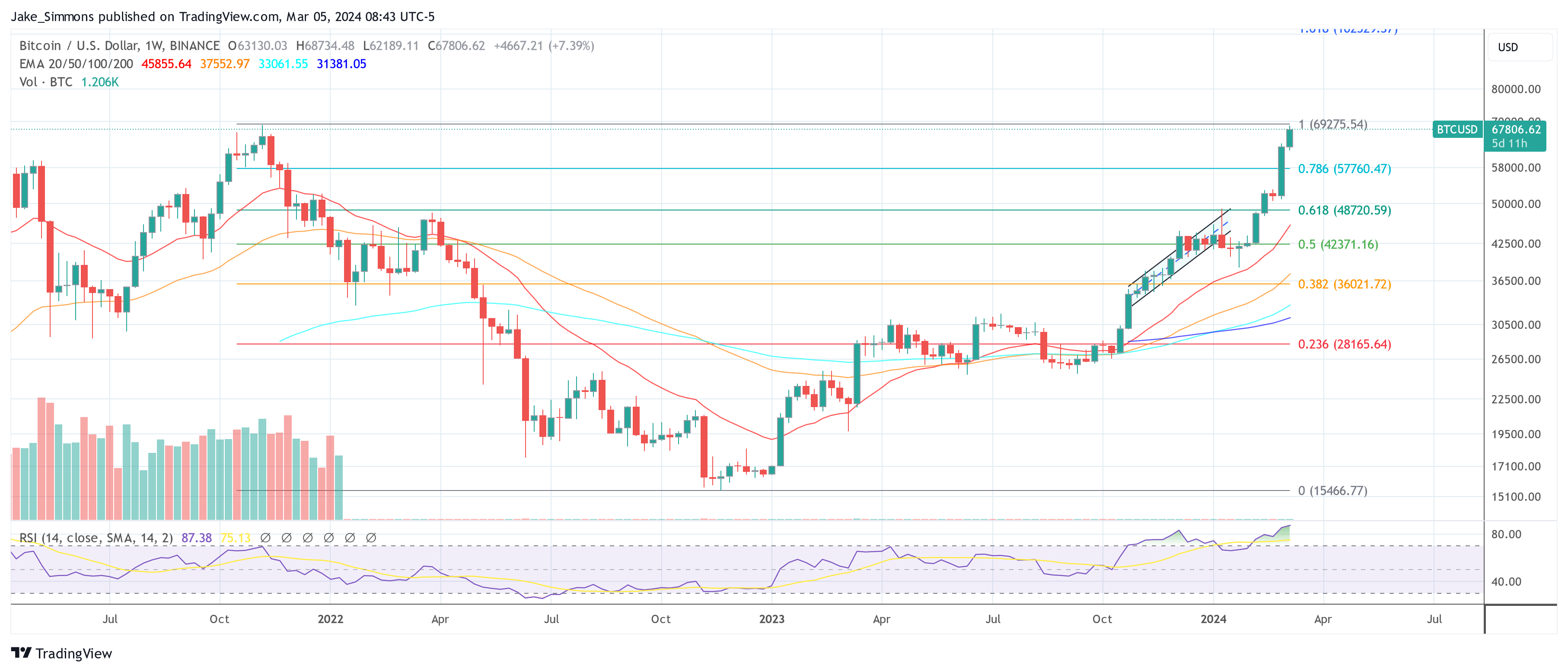

In a series of statements made on X (formerly Twitter), Marc van der Chijs, the CEO of the publicly traded Bitcoin mining firm Hut 8, shared an optimistic outlook on the future of Bitcoin, suggesting that the cryptocurrency may be on the brink of a ‘supercycle.’ “I think I have never been more bullish about Bitcoin than I am right now,” he remarked, pointing to the cryptocurrency’s recent performance and the absence of widespread hype as a prelude to what he terms a ‘supercycle.’

Understanding the concept of a ‘supercycle’ is crucial to grasping van der Chijs’ perspective. Unlike regular market cycles that see periodic rises and falls, a supercycle in the Bitcoin domain refers to an extended period of bullish growth over several years. This phase is characterized by a substantial increase in adoption, demand, and price, often leading to far-reaching economic implications.

In essence, a supercycle marks a paradigm shift where the asset’s value escalates dramatically, supported by a continuous inflow of investment and a growing consensus about its long-term viability. To come to this conclusion, Van der Chijs’ prediction hinges on several observations and trends within the Bitcoin sector.

Why A Bitcoin Supercycle Could Be Possible

First, he notes a significant shift towards Bitcoin ETFs by funds, including yesterday’s landmark announcement from Blackrock’s Strategic Income Opportunities Fund. This movement signifies a robust institutional interest that could feed a constant stream of investment into Bitcoin, setting the stage for a supercycle.

“This will be a constant flow of new money into the ETFs. […] The flows into the ETF are getting bigger, not smaller,” van der Chijs remarked. With financial advisors poised to recommend Bitcoin ETFs to clients following a regulatory settling period, van der Chijs sees a torrent of new capital on the horizon. This anticipation is not unfounded, considering the groundbreaking success of the Bitcoin ETF launch, which he cites as “the most successful ETF launch ever.”

Corporate strategies around Bitcoin also play a pivotal role in van der Chijs’ supercycle theory. He points to Microstrategy’s aggressive leverage-based Bitcoin purchases as a harbinger of a trend where companies increasingly view Bitcoin not just as an investment, but as a fundamental aspect of their financial strategy. This shift, according to van der Chijs, could prompt other CEOs to follow suit, further accelerating Bitcoin’s ascendancy.

Moreover, a critical mass of financial advisors is on the brink of recommending Bitcoin ETFs to clients, pending the expiration of regulatory and due diligence waiting periods. This opens the gates for substantial new investments from a segment traditionally cautious about direct cryptocurrency investments. “They can’t sell the ETF during the first 90 working days (internal regulations mostly because of DD), although they are fast tracking it for this ETF,” van der Chijs stated.

FOMO And A Self-Fulfilling Prophecy

The speculation around unidentified large-scale Bitcoin acquisitions adds another layer to the supercycle narrative. Van der Chijs alludes to the intrigue surrounding a wallet that has been steadily accumulating Bitcoin, hinting at the involvement of a billionaire possibly akin to Jeff Bezos. “Since November 2023 a wallet has been adding on average about 100 BTC per day, the wallet now contains over 50,000 BTC,” he states, pointing to the potential for influential figures to catalyze broader market movements.

Another argument is potential purchases by nation-states. Although nation-state involvement in Bitcoin has been minimal, with El Salvador being a notable example, any increase in such activities could trigger a domino effect. The participation of nation-states in the Bitcoin market could significantly elevate Bitcoin’s status as a sovereign asset class.

Next, the retail sector remains largely on the sidelines in the current cycle, but van der Chijs anticipates a surge in retail interest following new all-time highs and increased media coverage. This could initiate a FOMO cycle, drawing more investment from traditional asset classes into Bitcoin.

Last, van der Chijs mentions the concept of a self-fulfilling prophecy: As Bitcoin continues to rise without significant dips due to constant new money inflow, more people and institutions will entertain the concept of a supercycle. This, in turn, could lead to increased capital allocation to Bitcoin, making the supercycle more likely.

Macroeconomic Implications Of A Supercycle

Van der Chijs’ theory also touches on the potential macroeconomic implications of a Bitcoin supercycle, predicting a significant shift in wealth and power structures. The redistribution of wealth could see Bitcoin at the center of a new economic order, with traditional asset classes potentially losing ground.

In conclusion, Marc van der Chijs outlines a compelling case for a forthcoming Bitcoin supercycle, supported by a confluence of institutional, corporate, speculative, and retail trends. He acknowledged the speculative nature of his prediction, “Right now I think there is a chance of maybe 10% that this will happen and that chance is (very slowly) going up.”

However, the implications could be massive. “[I]t will change the existing world order. It will suck money out of the stock and bond markets, out of gold and other commodities, and even out of real estate (global housing prices could collapse). This will lead to BTC prices that we can’t even imagine today, potentially millions of dollars per BTC.”

At press time, BTC traded at $67,806.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

A young woman in her early 20s riding a chopper cycle.

Karan Kapoor | The Image Bank | Getty Images

Having a strong budget can help you build financial wellness.

“A budget is a picture of what your money is doing,” Tiffany Aliche, also known as The Budgetnista, told CNBC during a Women & Wealth livestream.

“It’s the foundation where you build your financial house. You have to understand what your money is doing,” said Aliche, a personal financial educator and author of “Get Good with Money.”

More from Women and Wealth:

Here’s a look at more coverage in CNBC’s Women & Wealth special report, where we explore ways women can increase income, save and make the most of opportunities.

By examining what you spend and setting a budget, you may find the cash to build other financial safeguards, such as an emergency savings fund and retirement contributions.

“You’re supposed to give each dollar a job,” said Sophia Bera Daigle, a certified financial planner and the founder of Gen Y Planning in Austin, Texas.

It might also be good to think of your budgets from an annual perspective. Taking on a new, big expense like a car or house, or even experiencing the occasional emergency, can affect your monthly spending, said Daigle, who’s also a CNBC Financial Advisor member.

Three steps to start a budget

1. Make a list of expenses: The first thing to do is write a list of all the things you spend money on within a given month, said Aliche. “That’s step one.” Consider expenses that are fixed, such as your rent or car payment, and those that are variable, such as groceries and utilities. It can also help to list out expenses you don’t pay every month, such as annual memberships or quarterly taxes.

2. Check your records: Next, see how those estimates match up to what you actually spend. Pull up your recent debit and credit card statements, and add up how much money you spent in a recent month.

3. Figure out how your spending matches with your income: Once you know how much you spend on a monthly basis, find the difference from how much you earn. Aliche calls this “the tears and tissues” step because many people realize they are overspending.

A lot of people hold onto the financial mistakes they made in their life, said Aliche. Don’t let the “tears and tissues” budgeting step derail you.

“Shame shields solutions,” she said.

To progress, lean on your community for emotional support and accountability. Figure out how to adjust your spending to bring your budget in line and give you room to meet your goals.

Also, “understand that money is a team sport,” said Aliche. You need a “board of directors” to help you reach your goals, such as an accountability partner, an accountant and a financial advisor.

SIGN UP: Join the free virtual CNBC’s Women & Wealth event on March 5 at 1 p.m. ET, where we’ll bring together top financial experts to help you build a better playbook, offer practical strategies to increase income, identify profitable investment opportunities and save for the future to set yourself up for a stronger 2024 and beyond.

Do Kwon’s lawyers told a US court on Feb. 26 that the Terraform Labs co-founder will be unable to attend the initial hearings of the SEC trial.

The lawyers did not request an adjournment and said the trial could begin as scheduled on March 25 without Kwon’s presence, according to court filings.

Unforeseen complications

Kwon’s lawyer, David Patton, said that Kwon, currently in Montenegro, may not be extradited by the end of March due to unforeseen complications in the legal process. He added that these have derailed earlier expectations of a quick extradition.

Patton said the delay is primarily caused by “unanticipated mistakes” made by the Montenegrin court in charge of Kwon’s extradition case.

The filing includes a declaration from Kwon’s Montenegrin defense attorney, Goran Rodic, which highlights several issues with the high court’s extradition ruling.

Rodic criticized the Feb. 21 decision, claiming it was based on incorrect information regarding the timing of extradition requests by the US and South Korea. He also raised concerns over several procedural errors during the legal process.

Legal saga continues

Kwon was arrested by Montenegro in March 2023 for using falsified travel documents and has remained there since. The arrest came amid ongoing investigations following the collapse of Terra in May 2022, with Kwon’s whereabouts previously unknown.

Montenegro found him guilty of possessing forged documents and sentenced him to four months in prison. His extradition case has been ongoing in tandem.

The legal battle over his extradition involves both South Korea and the US. The two countries filed extradition requests with Montenegro following Kwon’s arrest.

The SEC’s lawsuit against Kwon and Terraform, filed in February 2023, and subsequent criminal charges by the US Attorney’s Office have placed Kwon at the center of allegations involving billions in crypto asset securities fraud.

In December 2023, Judge Jed Rakoff granted summary judgment in favor of the SEC, with the trial scheduled for late March 25.

Meanwhile, South Korea wants him extradited to face trial in his home country. Some of his former associates, including Terra co-founder Daniel Shin, have already faced trial over fraud charges.

Grant Cardone Says The ‘Dumbest, Most Selfish Thing A Person Could Do’ Is Start A New Business — You’re Going To Be The Slave And The Master — For Nothing’ — Here’s What He Says To Do Instead

Renowned real estate mogul Grant Cardone sparked controversy with his recent comments on entrepreneurship and business investments. On Feb. 5, Cardone posted a video on Instagram where he expressed strong opinions about the pitfalls of starting a new business.

“I wouldn’t go start a business today. Dumbest, most selfish thing a person could do,” Cardone said, emphasizing the challenges and unrealistic expectations new entrepreneurs face. “You can’t work for somebody else. How are you going to work for yourself? You don’t even know what you’re doing. You can’t even pay rent.”

He also mocked the idea of aspiring to be your own boss thinking you can make all the rules and have the freedom to call the shots.

“You’re going to be the slave and the master — for nothing,” he said.

Cardone, known for his candid and often polarizing advice, elaborated on what constitutes a successful business.

“A good business is a business that cash flows. A good business is a business that scales. … A good business is a business I could walk away from, it’s not dependent upon my ability, my talent, my skill or my body or my time,” he said, highlighting the importance of scalability and independence from the owner’s direct involvement. He pointed to real estate and banking as exemplary sectors where such business models thrive.

“Real estate is a great business,” he said.

For people seeking entry into real estate investment without the complexities of direct ownership, options such as purchasing shares in publicly traded real estate investment trusts (REITs) or engaging with crowdfunding platforms present viable alternatives. These methods allow investors to own a portion of physical properties — from rental units to commercial spaces — providing a pathway to generate income with significantly reduced responsibilities related to property management.

In addition to criticizing the startup culture, Cardone advised against the common entrepreneurial aspiration of starting from scratch. He suggested an alternative route to business ownership: buying an existing business.

According to Cardone, the U.S. market is saturated with small businesses, the majority of which are struggling or not profitable.

“There are 32 million. … And these small businesses in America, with 64% of them breaking even or losing money because it’s being incorrectly run,” Cardone said, advocating for the acquisition of businesses that already have customers, cash flow and operational systems in place.

His stance on “don’t start a business — buy a business” reflects a pragmatic approach to entrepreneurship, focusing on existing opportunities rather than the creation of new ventures. Cardone’s advice resonates with investors and entrepreneurs looking for sustainable business models in a competitive and often unpredictable market.

Regardless of people’s opinions about Cardone, he has demonstrated an ability to generate wealth. He was working as a car salesman when he ventured into his first investment: a single-family home in Houston. This foray into property investment taught him a lesson about the risks of relying on one tenant after he experienced a sudden halt in cash flow when his tenant left after seven months.

Learning from this experience, Cardone decided he would not rely on a single tenant for his income. Five years later, he shifted his focus and invested in a multifamily complex in San Diego. The move marked the beginning of a new strategy for Cardone, where he used the income from his first two properties to finance a third purchase.

Continuing with this strategy, Cardone gradually expanded his real estate portfolio. By 2012, his efforts had paid off significantly, with his company being recognized for conducting some of the largest private-party real estate transactions in Florida, particularly in the multifamily property category.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Grant Cardone Says The ‘Dumbest, Most Selfish Thing A Person Could Do’ Is Start A New Business — You’re Going To Be The Slave And The Master — For Nothing’ — Here’s What He Says To Do Instead originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

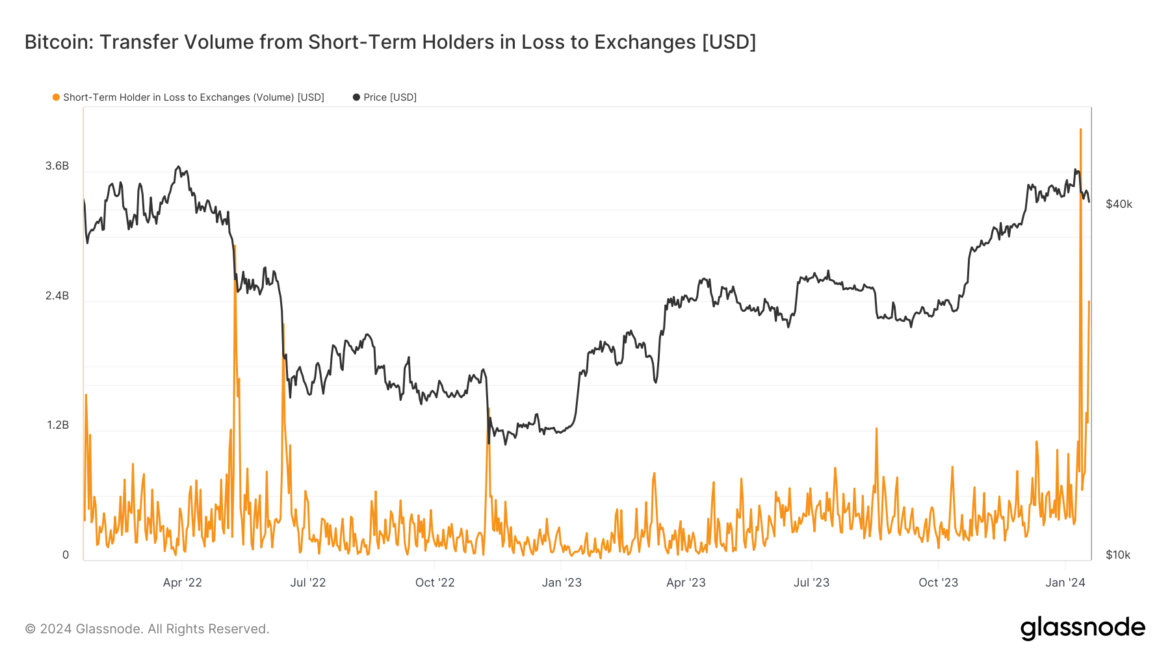

Long-term Bitcoin holders start to cash in as short-term investors face losses

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.