Volatility is low and market signals are still flashing green.

Source link

Stay

Stay away from US stocks, expect the AI bubble to burst, and brace for a recession, elite investor Jeremy Grantham says

-

US stocks are heavily overvalued, a recession is coming, and AI is overhyped, Jeremy Grantham said.

-

Stocks would have plunged another 20% or 30% in 2023 if not for the AI craze, the investor said.

-

Grantham said he’s worried about foreign wars, especially when asset prices are at record highs.

Stocks are absurdly expensive and likely to struggle, artificial intelligence is a bubble destined to burst, and the economy will suffer a minor recession or worse, Jeremy Grantham has warned.

The cofounder and long-term strategist of fund manager GMO recommended avoiding US stocks in a recent ThinkAdvisor interview. “They’re almost ridiculously higher priced than the rest of the world,” he said.

“The stock market will have a tough year,” he continued. American companies’ profit margins are at historic highs relative to foreign rivals, creating a “double jeopardy” situation for stocks where both earnings and multiples could fall, he added.

Grantham, a market historian who rang the alarm on a multi-asset “superbubble” at the start of 2022, said it burst that year when the S&P 500 tumbled 19% and the tech-heavy Nasdaq Composite plunged 33%.

Stocks would have slumped another 20% or 30%, he said, but the sell-off was “rudely interrupted” by the AI frenzy in early 2023 that “changed the flight path of the entire stock market.”

The veteran investor said that “AI isn’t a hoax, as bitcoin basically is,” but predicted the “incredible euphoria” around it wouldn’t last. Still, he suggested it could prove to be as revolutionary as the internet over the next few decades.

Grantham also issued a grim forecast for the US economy, despite solid GDP growth of 3.3% in the fourth quarter, unemployment and annualized inflation below 4% in December, and the prospect of several cuts to interest rates this year. On the other hand, the inverted yield curve and prolonged declines in leading economic indicators point to trouble ahead.

“The economy will get weaker,” he said. “We’ll have, at least, a mild recession.”

Grantham also flagged the threat posed by conflicts in Ukraine and the Middle East, warning that wars can foster a geopolitical backdrop that’s “scary as hell and in which bad things can happen.” The backdrop is especially worrying when assets are at record highs, he added.

“What I specialize in other than bubbles are long-term, underrated negatives,” Grantham said. “And my God, there’s a rich collection of negatives right now.”

The bubble guru urged investors to be careful, and recommended they seek out undervalued assets in emerging markets like Japan, depressed sectors like natural resources, and growth areas like climate-change solutions.

It’s worth emphasizing that Grantham’s dire forecasts haven’t hit the mark in recent years. For example, he suggested in April that the S&P 500 could be cut in half to around 2,000 points in a worse-case scenario, but the benchmark stock index has surged to an all-time high of over 4,900 points since then.

Read the original article on Business Insider

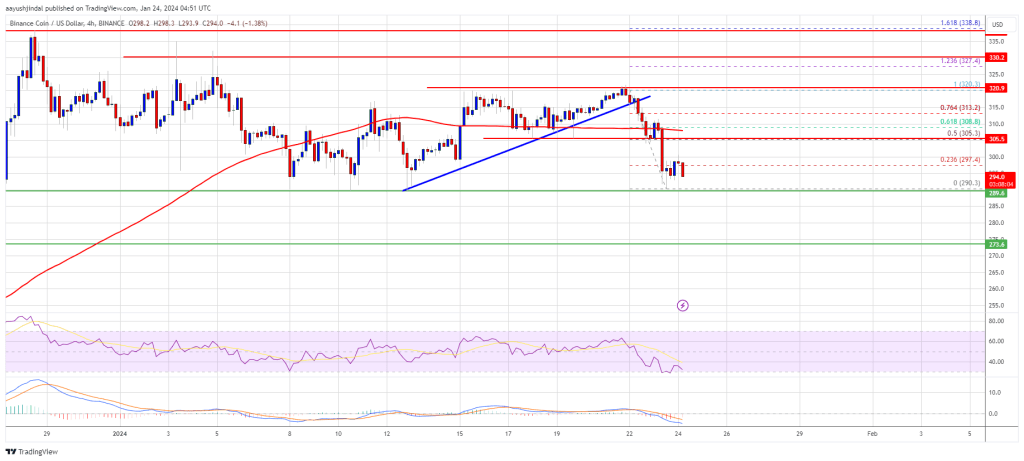

BNB Price Could See Major Drawdown If It Fails To Stay Above This Support

BNB price started a fresh decline from $320 resistance zone. The price is now retesting the $290 support and is at risk of more downsides.

- BNB price is gaining bearish momentum from the $320 resistance.

- The price is now trading below $310 and the 100 simple moving average (4 hours).

- There was a break below a key bullish trend line with support at $315 on the 4-hour chart of the BNB/USD pair (data source from Binance).

- The pair might continue to move down if it fails to stay above the $290 support.

BNB Price Takes Hit

In the past few days, BNB price made more than three attempts to clear the $320 resistance zone. However, the bears remained active and protected more gains.

As a result, there was a bearish reaction below the $315 level, like Bitcoin and Ethereum. There was a break below a key bullish trend line with support at $315 on the 4-hour chart of the BNB/USD pair. The pair even declined below the $300 level and tested the key support at $290.

A low is formed near $290.3, and the price is now struggling to correct higher. BNB price is now trading below $310 and the 100 simple moving average (4 hours). Immediate resistance is near the $298 level or the 23.6% Fib retracement level of the recent decline from the $320 swing high to the $290 low.

Source: BNBUSD on TradingView.com

The next resistance sits near the $305 level. It is close to the 50% Fib retracement level of the recent decline from the $320 swing high to the $290 low. A clear move above the $305 zone could send the price further higher. In the stated case, BNB price could test $320. A close above the $320 resistance might set the pace for a larger increase toward the $335 resistance. Any more gains might call for a test of the $350 level.

More Downsides?

If BNB fails to clear the $305 resistance, it could continue to move down. Initial support on the downside is near the $290 level.

The next major support is near the $285 level. The main support sits at $272. If there is a downside break below the $272 support, the price could drop toward the $250 support. Any more losses could initiate a larger decline toward the $220 level.

Technical Indicators

4-Hours MACD – The MACD for BNB/USD is gaining pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently below the 50 level.

Major Support Levels – $290, $285, and $272.

Major Resistance Levels – $298, $305, and $320.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Inflation to stay around 3% because of geopolitical risks, BlackRock says

Investment giant BlackRock Inc.

BLK,

is making what it calls one of its strongest strategic calls of the moment: Inflation is likely to stay closer to 3% as the world increasingly splits itself into competing blocs.

Attacks by Yemen’s Houthi militants on Red Sea vessels, followed by a U.S.-led response, are prompting a rerouting of tankers and cargo ships which is driving up shipping costs. Meanwhile, Taiwan’s Jan. 13 election of a new president whose party supports a separate identity for the island is doing little to soothe U.S.-China relations.

Read: Oil traders aren’t panicking over Middle East shipping attacks. Here’s why. and It’s less than a year until the inauguration. Here are the stock-market lessons from 134 elections in 17 countries

Geopolitical fragmentation is accelerating, in stark contrast to the era of globalization that prevailed after the Cold War, according to Wei Li, global chief investment strategist, and others at BlackRock Investment Institute. The world has jumped from one crisis to another in more recent years, starting with U.S. trade wars with China under former President Donald Trump and the COVID-19 pandemic.

A geopolitical risk indicator from New York-based BlackRock, which managed $10 trillion at the end of the fourth quarter and is the world’s largest asset manager, is rising toward levels last seen in the run-up to Russia’s invasion of Ukraine in February 2022.

BlackRock Geopolitical Risk Indicator, 2018-2024

Source: BlackRock Investment Institute, with data from LSEG and Dow Jones.

“Geopolitical fragmentation, one of five mega forces or structural shifts we track, is playing out in recent events in Asia and the Middle East,” the team at BlackRock Investment Institute wrote in a note on Monday. “Fragmentation is a key reason we see persistent inflation pressures —keeping policy rates above pre-Covid levels.”

“Bottom line: We expect deeper fragmentation, heightened competition and less cooperation between major nations in 2024,” the team said. In addition, “we see the rewiring of globalization benefiting countries like Mexico and Vietnam,” which are acting as intermediate trading partners between different geopolitical blocs.

Investors and traders had entered 2024 with confidence that U.S. inflation would be heading toward 2%, and as many as seven quarter-point rate cuts from the Federal Reserve might be in store. Much of the reason for those rate-cut expectations had to do with falling oil prices last year.

Though oil prices settled at their highest level in about a month on Monday, they have been mostly rangebound. In particular, crude has failed to include a geopolitical risk premium since the start of the Israel-Hamas war in October, with U.S. benchmark WTI

CL00,

CL.1,

trading around $19 a barrel below its 2023 peak set in late September. The lack of a more meaningful jump in oil has masked the rise in shipping prices, which is resulting from the Red Sea conflict.

The BlackRock team said it sees “inflation staying closer to 3% in the new regime,” joining a growing list of financial-market participants who have been warning about the risks of persistent price gains.

That list includes James Solloway, chief market strategist and senior portfolio manager at Pennsylvania-based SEI, and Brent Schutte, chief investment officer of the Northwestern Mutual Wealth Management Co. Their concerns come at a time when one of the bond market’s most widely followed gauges of long-term inflation expectations has been nudging higher.

See also: No rate cuts in 2024? Why investors should think about the ‘unthinkable.’ and Traders give up on a March rate cut by Fed as bond-market inflation expectations move higher

An inflation rate of 2% is the level that the Fed defines as being consistent with its mandate of full employment and price stability, and a failure to achieve that on a sustainable basis would draw into question the central bank’s institutional credibility. Inflation, as measured by the annual headline rate of the consumer-price index, has remained stuck at or above 3% for seven straight months through December — suggesting that traders are off base with their current expectations for five to six quarter-point rate cuts in 2024.

On Monday, traders and investors were mostly focused on the ramping up of the fourth-quarter earnings season. All three major stock indexes

DJIA

SPX

COMP

finished higher in New York trading. Meanwhile, 2-

BX:TMUBMUSD02Y

and 10-year Treasury yields

BX:TMUBMUSD10Y

fell from their highest levels of the year, reached on Friday.

These money and investing tips help your portfolio stay open to opportunities

Don’t miss these top money and investing features:

INVESTING NEWS & TRENDS

How you can beat ARK Innovation’s longer-term return with less risk

Tech-heavy, highly concentrated ETF has significantly lagged the market on a risk-adjusted basis. Read More

accCathie Wood’s ARK Innovation ETF in ‘breakout mode’ after triggering bullish

…

‘Stay Cautious,’ Says Billionaire Leon Cooperman About the Stock Market — Here Are 2 High-Yield Dividend Stocks He’s Using for Protection

For most of this year, investor sentiment was high, and the markets were on an upward tear. But that sputtered to a halt at the end of the summer, and this fall has seen a pullback in the main indexes. We’re still up for the year-to-date, but not by as much as we were in July. At this writing, the S&P 500’s year-to-date gain is 9%, and the NASDAQ’s is 22%.

It is most accurate to say that current conditions are volatile and unsettled. Both the bulls and bears can find plenty of evidence and precedent to back up their claims. The result: confusion among investors, who just aren’t sure where to go from here.

Leon Cooperman, the billionaire investor and hedge manager who got his start at Goldman Sachs and now runs Omega Advisors, takes a more moderate stance. Urging caution for investors, Cooperman has stated his belief that the S&P 500 is overvalued now, and will likely face a downturn in the near future.

“I don’t think we’re in a bubble; I think we’re in a rolling correction,” Cooperman has said, and he’s added that it will “take a long time for us to work out the problems.” The S&P hit its last peak, near 4,800, in January of last year, and Cooperman thinks it will take a long while before it can climb back to that level.

So, a cautious mind set is required and that will lead us to dividend stocks. These are the stocks that will ensure a steady income no matter the day-to-day market swings and protect the portfolio against any incoming volatility.

Turning to Cooperman for more inspiration, we took a closer look at two high-yield dividend stocks in which the billionaire investor has placed his trust. Here are the details.

Don’t miss

Energy Transfer

First up, Energy Transfer is a major player in the North American midstream sector, the vital segment of the energy industry that connects oil and natural gas producers with their end customers. Midstream companies operate networks of pipelines, transport assets, storage facilities, and terminal facilities, moving hydrocarbons and refined products to where they are needed. Energy Transfer has operations in 41 states, plus international offices in Panama City, Panama, and Beijing, China.

The company’s core operations include the transport, storage, and terminalling of crude oil, natural gas, natural gas liquids, and refined hydrocarbon products. Energy Transfer’s two largest areas of operation are centered in Texas, Oklahoma, and Louisiana, and in the Great Lakes-Mid Atlantic regions. ET’s network includes gathering facilities, fractionation facilities, pipelines, processing plants, and import/export terminals.

Energy Transfer is a dominant player in the midstream sector, boasting a market cap of $43 billion, and this past summer, the company completed a move that will expand its market share and footprint. In August, Energy Transfer and Crestwood announced an acquisition agreement; ET will fully acquire Crestwood and its assets. The transaction, which will be conducted wholly in stock, is valued at nearly $7.1 billion and is expected to close in early November.

Also in early November, Energy Transfer will release its 3Q23 financial results. Looking back at the Q2 results, we find that the company had a top line of $18.3 billion, a result that was down 29% year-over-year and missed the forecast by over $2 billion. The midstream company’s bottom-line EPS, at 25 cents per diluted share, missed the estimates by 7 cents. For Q3, the Street is expecting ET to show $20.4 billion in revenue and 25 cents per share in earnings.

One recent metric that bodes well for return-minded investors comes from the company’s dividend. ET, on October 20, announced a modest increase in the common share dividend payment, from 31 cents to 31.25 cents. The new payment will go out on November 20; at the new rate, the dividend annualizes to $1.25 per common share and yields 9%.

As for Leon Cooperman, he remains long and strong here. The billionaire investor holds an impressive 11,912,500 shares in ET, which are worth $163 million at current prices.

For Stifel analyst Selman Akyol, Energy Transfer is a company with high return potential going forward in a favorable commodity market environment. He writes of the stock, “Over the last several years ET has focused on reducing debt while finishing a campaign of large capital investments. With the upturn in the commodity environment and production on the rise across the US, Energy Transfer is poised to generate significant free cash flow. We believe investors will be well served by owning ET as demand for US energy increases around the globe… The set up for 2024 looks great for ET.”

The 5-star analyst goes on to give ET stock a Buy rating, with an $18 price target that suggests it will gain 30% in the year ahead. Add in the dividend yield, and the total return potential hits 31%. (To watch Akyol’s track record, click here)

Overall, ET shares maintain a Strong Buy consensus rating from the Street, based on 9 recent reviews that include 8 Buys and 1 Hold. The stock is selling for $13.69 and its $16.78 average price target implies an upside of ~23% on the one-year horizon. (See ET stock forecast)

Arbor Realty Trust

From energy, we’ll switch to another segment that is well known for perennial dividend champs: real estate investment trusts. The REITs are companies that acquire, own, lease out, and manage real properties – residential, commercial, industrial, and more – as well as invest in mortgages and mortgage-backed securities. They attract shareholders with strong profit-sharing policies, including high dividend yields.

Arbor Realty works in the commercial REIT segment, focusing on funding the development and building of multifamily residential projects. That is, the company provides commercial mortgages for developers and builders working on apartment complexes. Arbor is involved in multiple commercial property funding operations, and in addition to private loan funding also works with both Fannie Mae and Freddie Mac.

As of June 30 this year, the end of 2Q23, Arbor’s fee-based loan servicing portfolio totaled $29.45 billion, with the bulk of that – slightly more than $20 billion – serviced through Fannie Mae. Arbor’s loan and investment portfolio had an unpaid principal balance of $13.49 billion and had an average current interest pay rate of 8.76%.

This portfolio activity generated a net interest income for Arbor of $108.5 million in Q2, up 15% year-over-year and $9.7 million better than had been expected. The company’s bottom line, a non-GAAP distributable earnings per diluted share, came to 57 cents, beating the forecast by 12 cents. Arbor will report its Q3 results on October 27, and the Street is looking for 47 cents per share in distributable earnings and $98.35 million in revenues.

The company last paid its common share dividend on August 31 at 43 cents per common share. This was up a penny from the previous quarter and was fully covered by the distributable earnings. The dividend’s annualized rate of $1.72 gives a forward yield of 12.5%.

Cooperman also has a big position here. He currently owns 3,454,694 shares of ABR, which command a market value of ~$45 million.

ABR also gets the support of Raymond James’ 5-star analyst, Stephen Laws, who likes Arbor for both its dividend and its clear ability to cover that dividend.

“Our distributable earnings estimates are increasing, as the benefits of wider portfolio spreads and lower expenses more than offset the impact of more conservative portfolio growth assumptions. Our Outperform rating reflects the attractive portfolio characteristics (floating rate, primarily multifamily), business diversification, high earnings visibility provided by the agency segment, and strong dividend coverage,” Laws opined.

Laws uses this stance to support his Outperform (i.e. Buy) rating on the shares, and his $17 price target implies that ABR will gain ~31% in the coming year. Combined with the dividend yield, that return can reach ~43%. (To watch Laws’ track record, click here)

The rest of the Street is less confident, however; based on 1 Buy and Hold, each, plus 2 additional Sells, the stock has a Hold consensus rating. Yet, the $15.75 average target price suggests an upside of ~21% in the next 12 months. (See ABR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Hong Kong Officials Warn Investors to Stay Away from Retail Stablecoins since They Are Unregulated

The Hong Kong Monetary Authority (HKMA) recently completed a public consultation on stablecoins regulations.

As the city of Hong Kong prepares for mainstream adoption of digital assets through a regulated manner, the officials are grappling with cases of crypto-related scams. In a bid to ensure maximum protection of investors’ funds, Hong Kong’s Secretary for Financial Services and Treasury Christian Hui has noted that trading of retail stablecoins is not yet allowed. With the regulations of stablecoins in Hong Kong expected to take place late next year, Hui cautioned investors to tread cautiously with the retail stablecoins.

This comes after a local crypto exchange dubbed JPEX dipped investors millions of dollars and charged customers up to $1000 to facilitate withdrawals. Notably, JPEX duped investors of getting up to 30 percent in APY through stablecoins staking. Since the exchange advertised its services to novice traders through taxis, experienced investors were hardly touched as it was a direct scam that drained more than $180 million.

Another scam exchange causing thousands of victims losing their savings. 😔

JPEX is a small crypto exchange in Hong Kong that’s been offering nearly 30% APY on stablecoin staking.

They also have a exchange token $JPEX with $200 billion fully diluted value, advertising on Hong… pic.twitter.com/vns0QnMOpn

— Leon.sol (@leon_only1) September 14, 2023

Hong Kong and Digital Assets

The Hong Kong market has attracted both retail and institutional investors from the region seeking to get demo crypto exposure. Chinese banks have been reported to invest in the Web3 ecosystem through Hong Kong-based firms in a bid to play catch up with their Singapore counterparts. Moreover, the crypto asset industry has outperformed most traditional investment instruments including the bond and stock markets.

The Hong Kong Monetary Authority (HKMA) recently completed a public consultation on stablecoins regulations. As a result, the HKMA intends to issue a clear stablecoins regulatory framework before the end of 2024 to enable seamless adoption. The Hong Kong authorities intend to tap into the high demand for digital assets by most fintech startups within the region in a bid to boost its local economy.

The move by the Hong Kong authorities has caught most Western countries by surprise as a crackdown on digital assets-related firms continues in the United States following the collapse of FTX. As more crypto-related companies move away from the United States due to a lack of clear regulations, Hong Kong is opening its arms wide to all investors who are ready to comply with its crypto-related terms

Stablecoins Market Outlook

The stablecoins market has grown significantly in the past few years to a $123 billion valuation with an average 24-hour trading volume of approximately $24.5 billion. Tether (USDT), Circle (USDC), and TrueUSD (TUSD) are the top retail stablecoins that have stood the test of time, more so the bear market.

With more institutional investors entering the stablecoins industry, as shown by PayPal Holdings Inc (NASDAQ: PYPL) and its new product, PYUSD.

next

Blockchain News, Cryptocurrency News, News

Let’s talk crypto, Metaverse, NFTs, CeDeFi, and Stocks, and focus on multi-chain as the future of blockchain technology.

Let us all WIN!

You have successfully joined our subscriber list.

They thought the work-from-home revolution that took place during the Covid lockdowns would come to an end when the crisis was over.

They were wrong.

An astonishing 28% of American workdays are now spent working from home, quadruple the rate from before the pandemic, a startling new report reveals. And that figure rises above 40% in the most crowded city areas like parts of New York, adds the study, published by the authoritative National Bureau of Economic Research.

Just 59% of workers are now going into the office or workplace five days a week, while most of the rest only go in part time, the report says. The 3-day week, where workers go in Tuesdays through Thursdays but work Mondays and Fridays at home, is emerging as the new normal.

And CEOs say they expect the amount of their staff who work from home will rise, not fall, over the next five years.

The paper, entitled “The Evolution of Work From Home,” was written by economists Jose Maria Barrero from the Instituto Tecnologico Autonomo de Mexico, Nicholas Bloom of Stanford University, and Steve Davis of Stanford’s Hoover Institution.

The findings are great news for workers who have big houses, live in nice neighborhoods with strong social bonds, and who have, or had, long commutes into their offices.

They are also good news for companies that want to keep down wages, because the shift to remote work makes it easier to shift more jobs to lower-wage workers in lower cost-of-living areas.

But the findings are less good for other groups.

Working from home raises the risks of isolation for residents of single-person households. Those account foe 29% of all U.S. households, and while some of those will be elderly many others will be of working age.

It is also less good for people who earn less and have smaller homes, with less space for generous home offices and possibly less amiable surroundings.

And the findings will raise a host of economic fears and challenges. Big U.S. cities have seen a collapse of small businesses and a sharp rise in crime since the pandemic, as a core of higher-wage office workers stopped coming in.

Big city downtowns are no longer ghost towns, as they were 2 or 3 years ago, but many are still struggling. In cities with 1.5 million or more workers, foot traffic by late last year had recovered to only 60% of its prepandemic levels, recent research has found.

With a depleted office class, cities could potentially face the kind of death spiral seen in the 60s and 70s, when crime rates spiraled. It took until the late 1990s before they started to recover.

Many economists also fear a wave of real estate bankruptcies from newly-deserted office buildings — a subject only of interest to their owners and creditors, unless or until it starts to affect the rest of the economy.

Meanwhile remote work may leave younger workers stranded, without the networking, learning and mentoring that previous generations got from working full time in an office with older and more experienced employees.

Research so far suggests that working from home has been better for productivity, including research and collaboration, than many had feared. But it is far too early to draw any conclusions about the long-term impacts, on businesses, the economy, or society at large,

Intriguingly the trend to remote work has not been matched in the economically advanced countries of Asia, such as Japan, South Korea and Taiwan. The authors argue that this may be because those countries went through less draconian long-term lockdowns in the West.

In a curious datum, a recent (2022) study of car companies’ job postings for engineering positions found that 0% of Tesla’s

TSLA,

jobs offered work from home option while Honda

HMC,

offered 45%. (General Motors was in the middle at 23%, while Ford was 8%). We will find out in due course which one of them got it right.

Bybit’s approach is grounded in cooperation and compliance, seeking to create a harmonious relationship with UK regulators and authorities.

Bybit, a prominent crypto exchange remains steadfast in its commitment to stay in the United Kingdom with CEO Ben Zhou reiterating that “leaving the UK is not part of our current strategy”.

The New Regulatory Landscape in the UK

Crypto has been the subject of intense scrutiny by regulatory authorities around the world. The UK is no exception, and its Financial Conduct Authority (FCA) has been actively working to establish a regulatory framework for the crypto industry. One notable change on the horizon is the overhaul of rules governing financial promotions, which will take effect from October 8.

The FCA’s financial promotions rules will encompass crypto companies, potentially impacting their ability to reach local customers. To promote transparency and protect consumers, these rules necessitate that any company engaging with UK clients must be registered or authorized by the FCA.

The FCA’s new rules include a ban on crypto derivatives and Exchange-Traded Notes (ETNs) for retail consumers. These derivatives and ETNs are known for their high volatility and risk, and the FCA believes that banning them will protect retail investors from potentially catastrophic losses.

The enforcement of these rules has already influenced some companies, including Luno and American payments giant PayPal Holdings Inc (NASDAQ: PYPL) which extended its crypto trading services to the country a few years back to suspend specific crypto operations in the UK. The challenge lies in aligning their operations with the new regulations without compromising their service quality or withdrawing from the market altogether.

While this move is seen as a positive step towards reducing the risk of consumer harm, it has also raised concerns within the industry about the potential impact on crypto businesses.

Bybit Exchange’s Ongoing Commitment to Stay in the UK

Bybit’s initial comment about potentially withdrawing from the UK stirred discussions, but CEO Ben Zhou has since clarified the exchange’s stance. The exchange is determined to navigate these regulatory changes while staying operational in the country.

Zhou emphasized the exchange’s proactive engagement with regulators, underlining its efforts to identify the best path forward within the regulatory framework. Zhou stated, “There are still several avenues available for crypto exchanges to achieve compliance with UK regulators in the future, and we are actively exploring all options for this market.”

Bybit’s approach is grounded in cooperation and compliance, seeking to create a harmonious relationship with UK regulators and authorities. Such collaborations can help ensure the exchange’s full compliance with the evolving regulatory landscape.

These partnerships and consultations are strategic moves designed to align Bybit’s operations with local expectations and regulatory requirements.

By actively engaging with local businesses and assessing potential collaborations, Bybit aims to secure its position in the UK market and provide UK customers with a compliant and trustworthy platform for their cryptocurrency needs.

next

Blockchain News, Cryptocurrency News, News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

Rocket Lab Stock Has a Long Way to Go — Should Investors Stay Along for the Ride?

The Best Argument for Claiming Social Security at Age 62

My Top Dividend King to Buy and Hold for the Next 10 Years, and It Isn’t Even Close

Starbucks, Pinterest, and AMD Drop Some News on Investors

2 Stocks Warren Buffett Is Buying Hand Over Fist and 1 Top Holding He’s Selling