BofA’s Tal Liani upgraded Cisco shares, cheering the company’s opportunity to benefit from networking growth on the heels of market-share gains.

Source link

Stock

Billionaires Are Selling Nvidia Stock and Buying 2 Supercharged Artificial Intelligence (AI) Stocks Instead

Select Wall Street billionaires were selling Nvidia during the fourth quarter, while buying shares of Amazon and Palantir Technologies.

The artificial intelligence (AI) gold rush is in full swing, and Nvidia has been one of the biggest winners thus far. Its chips power the most advanced AI systems, including ChatGPT from OpenAI, and its share price rocketed 230% over the past year. But Goldman Sachs thinks software and services companies could be the biggest beneficiaries in the long run..

Several Wall Street billionaires seem to be thinking along the same lines. The hedge fund managers listed below sold down their positions in Nvidia in the fourth quarter and reinvested capital in AI stocks that fit more neatly into the software and cloud services categories.

- Israel Englander at Millennium Management sold 1.7 million shares of Nvidia, reducing his stake by 45%.

- Steven Cohen at Point72 Asset Management sold 1.1 million shares of Nvidia, reducing his stake by 66%.

Meanwhile, Englander and Cohen purchased shares of Amazon (AMZN -1.39%) and Palantir Technologies (PLTR -3.33%) during the fourth quarter, supercharged AI stocks that soared 84% and 170%, respectively, over the past year.

1. Amazon

Amazon reported fourth-quarter results that crushed Wall Street’s expectations. Sales increased 14% to $170 billion, the third straight quarter in which growth has accelerated sequentially. That was primarily due to momentum in advertising and retail, but cloud computing sales also accelerated from the previous quarter. Meanwhile, GAAP net income improved to $1.00 per diluted share, up from $0.03 per diluted share in the prior year.

Amazon is set to maintain that momentum given its strong presence in three markets. It runs the most popular e-commerce marketplace in the world as measured by monthly visitors, and the largest online marketplace in North America and Western Europe as measured by sales. Amazon is also the largest retail advertiser and the third largest ad tech company in the world. And Amazon Web Services (AWS) is the largest provider of cloud infrastructure and platform services.

That puts Amazon on a glidepath to double-digit sales growth through 2030. I say that because the online retail, digital advertising, and cloud computing markets are projected to grow at annual rates of 8%, 16%, and 14%, respectively, during that period. Indeed, with those tailwinds at its back, Wall Street expects Amazon to grow sales at 11% annually over the next five year.

However, Amazon could surprise Wall Street depending on how successfully it monetizes artificial intelligence (AI), particularly in its cloud computing business. The company has designed custom chips for AI training and inference, called Trainium and Inferentia. Those chips cannot outperform Nvidia graphics processing units (GPUs), but they are more cost effective in certain situations and could bring more business to AWS.

Additionally, Amazon Bedrock is a cloud service that lets businesses customize large language models and build generative AI applications. Likewise, Amazon Q is a conversational business assistant that leans on generative AI to search and summarize information from various internal and external data sources. The chatbot can also answer questions and automate tasks like writing blogs and social media posts. Collectively, those products could drive faster-than-expected sales growth for Amazon.

Shares currently trade at 3.4 times sales, a tolerable valuation if Wall Street’s consensus is correct and a more reasonable valuation if the company manages to grow sales faster than 11% annually. Personally, I think Amazon is a worthwhile long-term investment as its current price.

2. Palantir Technologies

Palantir reported reasonably good financial results in the fourth quarter, beating expectations on the top line and meeting expectations on the bottom line. Its customer count increased 35% to 497 and the average existing customer spent 8% more. In turn, revenue rose 20% to $608 million, reflecting 32% growth in commercial sales and 11% growth in government sales. Non-GAAP net income doubled to reach $0.08 per diluted share.

CEO Alex Karp commented on Palantir’s AI ambitions in his annual sharholder letter. “Every part of our organization is focused on the rollout of our Artificial Intelligence Platform (AIP), which has gone from prototype to product in months. And our momentum with AIP is now significantly contributing to new revenue and new customers,” he wrote. AIP brings support for large language models to Palantir’s commercial platform, Foundry.

To elaborate, Palantir builds software that helps businesses integrate and analyze data, develop and manage machine learning (ML) models, and build applications that improve decision-making. Forrester Research has recognized Palantir’s Foundry as a leading AI/ML platform. AIP enhances Foundry, such that clients can develop and utilize generative AI to improve business outcomes. For instance, one of the largest U.S. healthcare organizations is using AIP to generate shift schedules that consider employee preferences, decision costs, and demand predictions.

In other news, the U.S. Army recently selected Palantir to build its Titan ground station system, which uses AI/ML to rapidly process data received from sensors placed in terrestrial, aerial, high altitude, and extraterrestrial locations. The 24-month contract is valued at $178 million, so it will not significantly move the needle for Palantir, but it does highlight its versatility and the contract could lead to further deals with the U.S. government.

Going forward, the data analytics market is forecasted to grow at 27% annually through 2030. While I doubt Palantir will match that pace given its past performance and small customer base, the tailwind still has positive implications for the company. Wall Street expects Palantir to grow sales at 21% annually over the next five years.

In that context, its current valuation of 23.5 time sales looks expensive, especially when the three-year average is 17.8 times sales. Also noteworthy, Palantir currently carries a consensus sell rating among Wall Street analysts, and the stock bears a median price target of $20.50 per share, which implies 10% downside from its current price of $22.80 per share. I would steer clear of Palantir until the stock trade at a more reasonable valuation.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, and Palantir Technologies. The Motley Fool has positions in and recommends Amazon, Goldman Sachs Group, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

Billionaire Dan Loeb Sold Amazon and Microsoft but Bought This “Magnificent Seven” Stock

Dan Loeb is known as a mover and a shaker in the investing world. He founded the New York-based hedge fund Third Point in 1995. It now has roughly $11.5 billion in assets under management. Loeb’s net worth stands at $3.3 billion, according to Forbes.

The activist investor did some moving and shaking in his hedge fund’s portfolio in the fourth quarter of 2023. Loeb reduced his stakes in Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT). However, the billionaire investor bought another “Magnificent Seven” stock.

Taking profits

Loeb sold 210,000 shares of Microsoft in Q4. While this reduced Third Point’s stake in the tech giant by over 9.4%, Microsoft remains the second-largest holding in the hedge fund’s portfolio.

The billionaire investor has owned Microsoft off and on since 2006. He most recently initiated a new position in the fourth quarter of 2022, just in time to ride the generative AI wave started by OpenAI’s launch of ChatGPT. Microsoft was a major beneficiary of this wave thanks to its partnership with OpenAI.

Third Point first owned Amazon in late 2019 and held the stock through the second quarter of 2022. Loeb didn’t stay on the sidelines long with the e-commerce and cloud services leader. He initiated a new position in Amazon in the second quarter of 2023. Although he reduced Third Point’s stake in the stock by nearly 10.3% in Q4 2023, Amazon still ranks as the hedge fund’s third-largest holding.

Why did Loeb trim his positions in Amazon and Microsoft? The most likely reason is he wanted to take some profits. Both stocks delivered impressive gains last year.

A bigger bet on Meta

Although Loeb cooled somewhat on two Magnificent Seven stocks, he placed a bigger bet on Meta Platforms (NASDAQ: META). The hedge fund manager increased Third Point’s stake in Meta by nearly 5.5% in Q4 2023. The $410.6 million value of the position made Meta the sixth-largest holding for Third Point at the end of 2023.

Loeb’s history with Meta goes back to the second quarter of 2016 when he first bought the stock. He owned shares of the social media company for a little over two years before exiting the position. The activist investor again bought Meta stock in the second quarter of 2020 and maintained a position through 2021 Q4. Loeb went back to the well in the third quarter of 2023 with another new stake in Meta.

Like Amazon and Microsoft, Meta enjoyed a generative AI tailwind last year. However, I suspect that wasn’t Loeb’s primary reason for adding to his position in the stock. Instead, my hunch is that Loeb liked Meta’s moves to increase its profitability.

Those efforts are paying off. Meta’s earnings more than tripled year over year in 2023 Q4. Full-year profits jumped 69%.

Did Loeb make the right moves?

In one sense, Loeb went one for three with these Magnificent Seven transactions. Loeb’s decision to increase Third Point’s stake in Meta is already paying off. Meta stock has skyrocketed over 45% since the end of 2023. However, Amazon and Microsoft are also up by double-digit percentages year to date. Loeb could have made more money by holding his shares in both companies.

However, trimming the positions in Amazon and Microsoft could still have been the right call for Loeb. Both stocks make up significant percentages of Third Point’s portfolio. You can’t blame any investor for wanting to ensure their holdings aren’t overly concentrated in a handful of stocks.

Over the long term, I think that Loeb — and other investors — will be well served by owning all three of these stocks. Amazon’s and Microsoft’s cloud businesses should continue to grow robustly thanks largely to AI. I like Meta’s focus on business messaging and smart glasses with embedded AI assistants. I predict Amazon, Microsoft, and Meta will remain magnificent for a long time to come.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

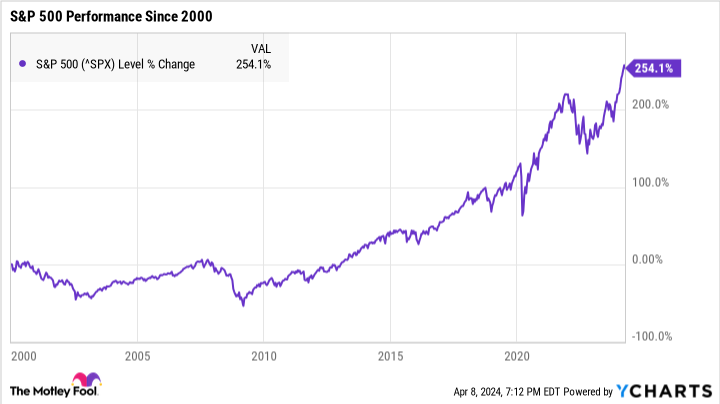

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Amazon, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Dan Loeb Sold Amazon and Microsoft but Bought This “Magnificent Seven” Stock was originally published by The Motley Fool

Could This Be The Mystery Stock Billionaire Warren Buffett Has Been Adding to Berkshire Hathaway’s Portfolio?

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is a legend in the investing world. Since taking over the failing textile business in 1965, Buffett has given investors nearly 20% returns annually. Put differently, a $100 investment in the company back then would be worth nearly $4.4 million today.

Berkshire’s long track record of success has drawn much attention, which is why investors eagerly track the company’s investment portfolio like a hawk. However, because of the popularity of Berkshire’s investments, the conglomerate occasionally requests confidential treatment when building an equity position so it doesn’t tip off the markets until it’s finished buying.

In the last two quarters of last year, Berkshire Hathway accumulated an estimated $5.3 billion stock position, with investors speculating about what it could be. One company on my short list has earned high praise from Buffett and his longtime partner Charlie Munger and has other connections to Berkshire.

Berkshire bought around $5 billion in one company’s stock last year

In the second quarter, Berkshire reported $23.5 billion in investments in “banks, insurance, and finance.” This amount increased to $27.1 billion by the end of the year, or a $3.6 billion increase. Berkshire also eliminated equity positions in Globe Life and Markel, so the investment is around $5.3 billion.

Another thing we know is that if Berkshire’s ownership stake exceeded 5% of shares outstanding, it would be required to report this to the Securities and Exchange Commission. With this in mind, Berkshire likely invested in a company with a large market capitalization of $100 billion or more, significantly narrowing down the list of potential candidates.

Progressive has earned high praise for Berkshire Hathway’s leaders

One company that could fit the Berkshire Hathaway criteria is Progressive (NYSE: PGR), the second-largest automotive insurer in the U.S. behind State Farm. GEICO, wholly owned by Berkshire Hathaway, rounds out the top three.

When it comes to the automotive insurance industry, Buffett sees it as a two-horse race between Progressive and GEICO. He has said:

I have always thought for a very long time [that] Progressive has been very well run. They have an appetite for growth. Sometimes they copy us. Sometimes we copy them. And I think that will be true five years from now, ten years for now.

Buffett’s right-hand man, the late Charlie Munger, also praised Progressive, saying, “In the nature of things, every once in a while, somebody is a little better at something than we are.”

Progressive’s underwriting advantage

Thanks to its stellar underwriting ability, Progressive has gotten Buffett’s and Munger’s attention over the years. The company has committed to underwriting profitable insurance policies since 1971, when it went public. At the time, it was common to think that insurers should break even on their policies and make their actual returns from their investment portfolios.

CEO Peter Lewis bucked the trend then and prioritized achieving a combined ratio of 96, meaning the company would earn $4 of profit for every $100 in premiums written. This goal has been core to Progressive’s disciplined underwriting and is a big reason for the stock’s long-term outperformance.

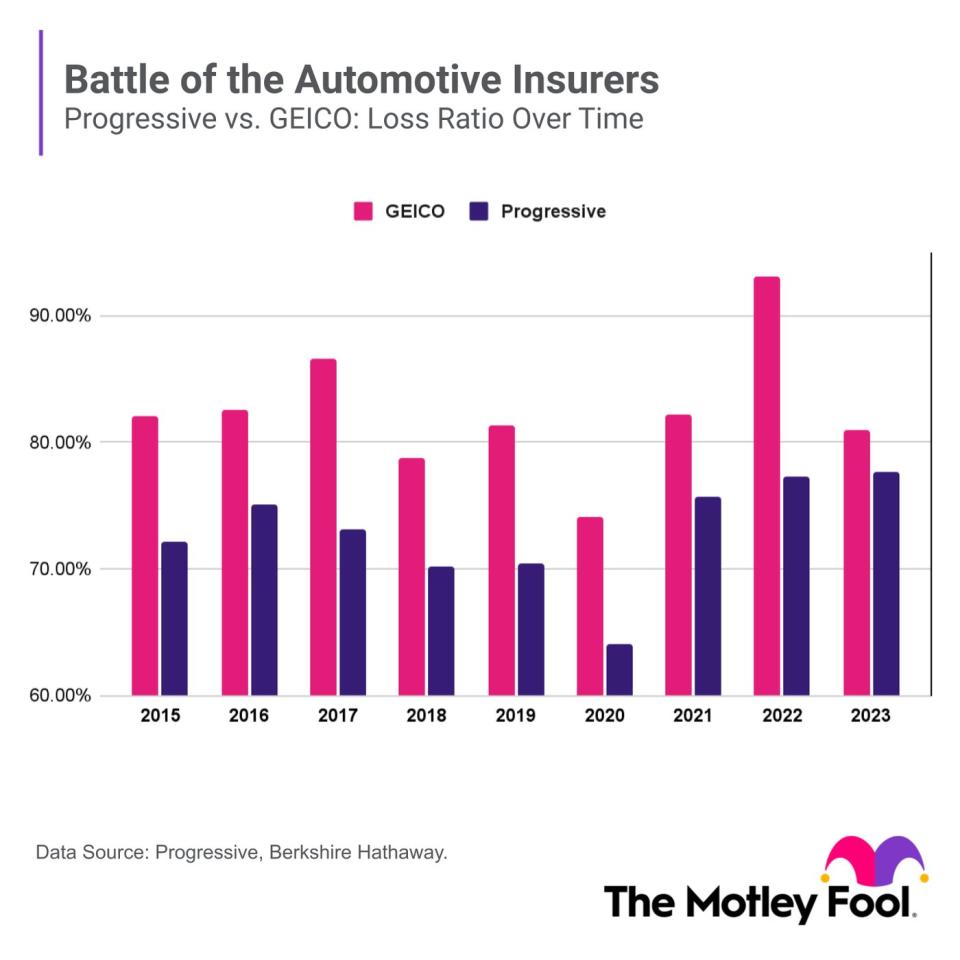

One way to assess Progressive’s stellar performance is to examine its loss ratio. This is one component of the combined ratio and the ratio of losses to premiums earned. Over the last nine years, Progressive’s loss ratio has averaged 73%, an excellent number in the highly competitive auto insurance industry. GEICO, also a solid underwriter, averaged 82% over that period.

Berkshire’s other connection to Progressive

Progressive could also be a candidate for Berkshire Hathaway because of Todd Combs’s connection to the insurer. Combs works alongside Ted Weschler to help manage Berkshire’s investment portfolio with Buffett. Combs worked at Progressive as a pricing analyst in the late ’90s and is quite familiar with the company.

During an interview on the “Art of Investing” podcast, Combs recounted talking to Buffett in 2010 before being offered a job at Berkshire Hathaway. Buffett asked Combs his opinion on Progressive vs. GEICO, and Combs told him that GEICO excelled at marketing and branding, but Progressive’s focus on data would drive its long-term success. Combs was right about Progressive’s data advantage — the stock has crushed it over the past few decades.

A quality company for long-term investors

Berkshire Hathaway has long had its eye on Progressive as a competitor, and the conglomerate may have seen an excellent opportunity to scoop up the insurer at the end of last year. Progressive continued its profitable underwriting streak, maintaining an annual combined ratio below 96 for the 23rd consecutive year. The stock has climbed 28% since the start of the year.

We won’t know if Berkshire is buying Progressive until its 13-F filing for the first quarter is made available in mid-May, assuming it’s not marked as confidential again. Regardless, Progressive has been an excellent stock for long-term investors. Even if Berkshire isn’t buying it, it can make a solid addition to your portfolio today.

Should you invest $1,000 in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends Berkshire Hathaway and Markel Group. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

Could This Be The Mystery Stock Billionaire Warren Buffett Has Been Adding to Berkshire Hathaway’s Portfolio? was originally published by The Motley Fool

Both companies benefit from the AI semiconductor boom, but one of them looks like a better investment right now.

Shares of Nvidia (NVDA -2.68%) and Arm Holdings (ARM -3.66%) have been in fine form on the stock market in 2024 with impressive gains of 75% and 66%, respectively, so far, and artificial intelligence (AI) has played a key role in this solid surge.

While Nvidia’s fiscal 2024 fourth-quarter results, which were released in February, established the company’s dominance in the fast-growing market for AI chips, Arm also joined the AI bandwagon following its latest quarterly results. However, if you are looking to buy an AI stock right now and need to choose between Nvidia and Arm Holdings, which one should you buy?

Let’s find out.

The case for Nvidia

Nvidia’s eye-popping stock market surge can be justified by the company’s terrific share of the AI chip market, which has led to a sharp acceleration in the company’s revenue and earnings growth in recent quarters. The graphics specialist ended fiscal 2024 with $60.9 billion in revenue, an increase of 126% over the prior year.

Additionally, Nvidia’s non-GAAP (adjusted) earnings shot up 288% in fiscal 2024 to $12.96 per share, driven by a jump of 14.6 percentage points in the company’s gross margin. That’s not surprising as the chipmaker has been enjoying immense pricing power in the AI chip market. Its flagship H100 AI processor reportedly carries a hefty margin of 1,000%, according to financial services and investment banking provider Raymond James.

What’s more, customers have been willing to pay the high prices of Nvidia’s AI processors as they don’t want to be left behind in the race to develop AI applications. Meta Platforms, for instance, is going to spend more money on procuring Nvidia’s H100 processor in 2024. It is also worth noting that major cloud computing providers have already set their sights on deploying Nvidia’s next-generation AI GPUs based on the Blackwell architecture.

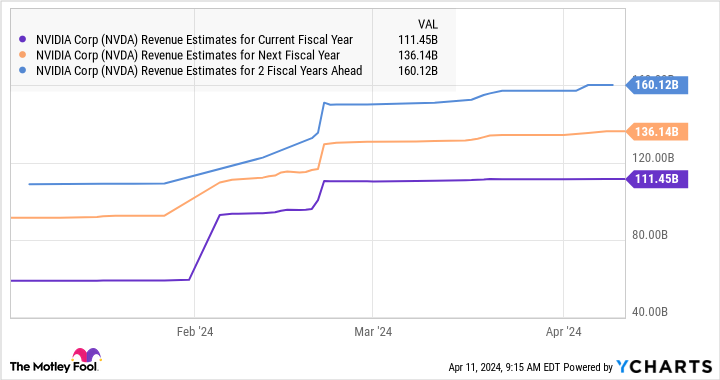

All this indicates why Nvidia is anticipating that the demand for its upcoming AI processors will continue to be higher than supply, even though the company has been taking steps to boost its production capacity. The healthy demand for Nvidia’s AI chips explains why analysts have significantly upgraded their revenue growth expectations from the company for the current fiscal year and beyond.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

Even better, analysts estimate that Nvidia’s robust share of the AI chip market is likely to translate into healthy long-term growth, with its data center revenue alone jumping to $280 billion by 2027. As such, Nvidia could continue to be a top growth stock thanks to the fact that it currently controls more than 90% of the lucrative AI chip market, which is expected to generate more than $300 billion in annual revenue by the end of the decade.

The case for Arm Holdings

Like Nvidia, Arm Holdings is also a play on the AI chip market. However, unlike Nvidia, the company isn’t involved in manufacturing chips. Instead, Arm licenses its intellectual property (IP), software tools, and architecture to chipmakers so that they can develop and manufacture different types of processors such as central processing units (CPUs), neural processing units (NPUs), and graphics processing units (GPUs).

The demand for all these types of chips is increasing thanks to the growing adoption of AI servers, personal computers (PCs), and smartphones. Not surprisingly, the number of companies looking to develop AI chips with the help of Arm’s IP has also increased. Arm reported that 27 companies are using its total access license at the end of the third quarter of fiscal 2024, up from 18 at the end of fiscal 2023.

The company credits the new licensing agreements to the growing demand for “high-performance CPUs etc. to embedded AI into every end device.” The new licenses explain why Arm’s revenue pipeline saw a significant improvement. Its remaining performance obligations (RPO), which refers to the total value of a company’s unfulfilled contracts, shot up to $2.4 billion in fiscal Q3, up 38% from the year-ago period.

There is a solid chance that Arm will be able to sustain this newly found momentum in the long run as well. That’s because the company’s architecture powers more than 50% of the chips that have a processor inside them. Also, the adoption of the company’s AI-specific Armv9 architecture, which commands double the royalty compared to the previous generation’s architecture, is increasing at a nice pace.

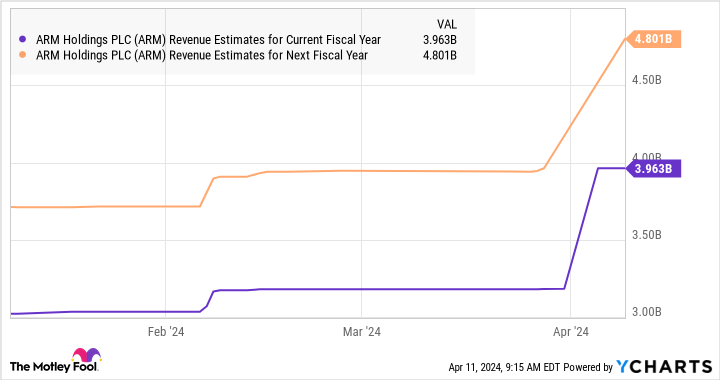

In all, it is easy to see why analysts raised their revenue growth projections from Arm as well.

ARM Revenue Estimates for Current Fiscal Year data by YCharts

Also, analysts forecast the company’s earnings to increase at an annual rate of just over 44% over the next five years, which is higher than the 38% annual earnings growth expected from Nvidia.

The verdict

Both Arm Holdings and Nvidia benefit from the proliferation of AI chips. However, investors looking to choose one of these two AI stocks now would be better off investing in Nvidia.

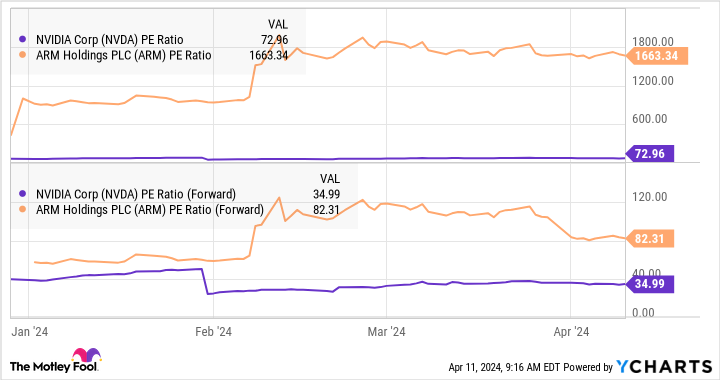

That’s because Nvidia stock is significantly cheaper than Arm Holdings right now from a valuation perspective. Nvidia’s sales multiple of 36 is lower than Arm’s reading of 44. A similar story unfolds if we look at their trailing and forward earnings multiples.

NVDA PE Ratio data by YCharts

Moreover, Nvidia is growing at a much faster pace than Arm, as the latter’s revenue is expected to increase 19% this year. Arm, therefore, is expensive if you consider the potential growth that it is expected to deliver, making Nvidia the better AI stock to buy right now as it is not only delivering stronger growth but also has a much cheaper valuation.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.

1 Unstoppable Stock That Could Join Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta in the $1 Trillion Club

The speed with which artificial intelligence (AI) caught on last year took many investors by surprise, and it sparked a changing of the guard among the ranks of the world’s most valuable companies. Apple was finally dethroned by Microsoft, which now tops the list as the only company that currently has a market cap of more than $3 trillion. Nvidia, fueled by its industry-leading AI processors, has tripled over the past year to take the No. 3 spot, behind Apple with $2.6 trillion. Alphabet, Amazon, and Meta Platforms are all major players in the AI revolution and also members of this auspicious fraternity.

With a market cap of just $53 billion (as of this writing), it might seem like hyperbole to suggest that Super Micro Computer (NASDAQ: SMCI), also called Supermicro, could make a run at the $1 trillion club. However, the accelerating demand for AI-centric servers and the company’s decades of expertise suggest that Supermicro is a dark horse candidate in the race.

Servers of the stars

While Supermicro has been creating customized server solutions for more than 30 years, the company was working in relative obscurity until the accelerating adoption of AI kicked off. It turns out that Supermicro has amassed quite a pedigree out of the glare of the spotlight.

Supermicro has built its reputation by providing highly customizable, energy-efficient, liquid-cooled rack-scale servers designed to handle the rigors of AI and hyperscale data centers. The company has developed strong working relationships and works hand-in-hand with all the top AI chipmakers to ensure its rack-scale servers are top performers while also providing energy efficiency and the lowest total cost of ownership in the industry. It boasts partnerships with Nvidia, Advanced Micro Devices, and Intel, among others.

This is a winning strategy that has its AI-centric servers flying off the shelves. For its fiscal 2024 second quarter (ended Dec. 31), Supermicro’s revenue surged 103% year over year to $3.7 billion, while its earnings per share (EPS) of $5.10 jumped 85%. Management is forecasting its triple-digit growth will continue, raising its full-year guidance to $14.5 billion, which would represent growth of 104%.

Management reports that Supermicro grew five times faster than the industry average over the preceding 12 months, suggesting the company is stealing market share from its rivals. Analysts at Northland agree, suggesting the company has increased its market share to 11%, leaving “plenty of room for future share gains.”

The path to $1 trillion

Supermicro is in an enviable position among AI server makers. The company is small enough to be nimble and has a long history of providing customized server solutions to enterprises. Furthermore, the strong and enduring relationships Supermicro has forged with chipmakers give it the inside track and an abundant supply of the processors used for AI. Despite those advantages and the clear opportunity, a lot will have to go right for Supermicro to join the ranks of the trillionaires.

According to Wall Street, Supermicro is poised to generate revenue of $14.7 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 3.6. Assuming its P/S remains constant, Supermicro would have to grow its revenue to about $275 billion annually to support a $1 trillion market cap. To be clear, the company is currently ramping up production to support annual sales of $25 billion, so revenue of that magnitude is still a ways off.

If the company were able to keep up its triple-digit, year-over-year growth, Supermicro could reach the $1 trillion market cap threshold by 2031. That said, it’s unlikely the company will keep up its current rate of parabolic growth. If we cut its revenue growth rate assumption to 50%, Supermicro could potentially reach a $1 trillion market cap by 2035.

There’s reason to believe strong demand for AI-centric servers will continue. BofA analyst Ruplu Bhattacharya suggests the data center market will grow at a compound annual growth rate (CAGR) of 50% over the next three years, and Supermicro’s revenue could grow even faster.

Nvidia CEO Jensen Huang is equally bullish, suggesting that the installed base of data centers will double to $2 trillion over the coming four to five years.

If Supermicro captures even a small part of that vast opportunity, the company will soon join the $1 trillion club.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Super Micro Computer. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Bank of America, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Unstoppable Stock That Could Join Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta in the $1 Trillion Club was originally published by The Motley Fool

At first glance, Coinbase Global (NASDAQ: COIN) looks like a terrible investment right now.

The stock price has more than tripled in 52 weeks. The cryptocurrency exchange operator’s shares trade at the lofty valuation of 103 times free cash flows and 950 times earnings. I mean, it’s enough to make even seasoned growth investors reach for the smelling salt.

Many investors won’t look any further. Happy to skip this seemingly overvalued crypto stock, they move on to the next idea.

And that could be a big mistake. Coinbase is going through the usual four-year cycle of boom and bust in the crypto space, and the rising bottom-line profits barely clicked above the breakeven line so far.

Let me show you two reasons you should consider making Coinbase your next stock investment.

1. Coinbase runs a sophisticated business

Sure, Coinbase’s stock looks expensive at the moment. The crypto market is waking up from another cold, hard winter, and the whole industry is soaring. Bitcoin (CRYPTO: BTC) is up 138% over the last year, while Ethereum (CRYPTO: ETH) gained 85%. Low-priced altcoins are jumping even higher, led by Solana (CRYPTO: SOL), posting a 730% one-year gain. Coinbase saw a 270% return over the same period, and for good reason.

The company doesn’t build value by holding Bitcoin coins or Ethereum tokens. Its digital currency holdings are minimal and only used to facilitate its customers’ crypto trades as smoothly as possible. Coinbase doesn’t even record changing values in digital assets as a revenue item but as a part of its operating costs.

Instead, it makes money from transaction fees, interest and blockchain rewards, and subscription-style services. You know, pretty much like any ordinary bank, just based on a different set of financial assets. The company’s financial health is more closely related to basic interest in cryptocurrencies than to the price of any specific digital currency.

2. This crypto cycle is not like the others

Coinbase has been around since the early days of crypto. Founded in 2012, with only three cryptocurrencies on the market and one Bitcoin worth less than $7, the exchange has experienced three of Bitcoin’s halving cycles. The fourth one is coming up next week, cutting the rewards for mining Bitcoin in half again. Each halving so far has fueled a dramatic run-up in Bitcoin prices, giving the crypto industry another turn in the spotlight and inspiring larger transaction volumes across different digital coin types.

So, that scenario is about to play out again, but things are different this time. And it’s all about exchange-traded funds (ETFs) tied to Bitcoin’s spot price.

Spot Bitcoin ETFs give investors a radically different way to invest in this newfangled asset class. Instead of opening a new account with Coinbase or some other crypto exchange, learning a different set of trading rules and processes, and taking direct ownership of digital currencies, you can now make Bitcoin trades pretty much like you’d buy or sell an ordinary stock. The Securities and Exchange Commission (SEC) approved 11 applications for this brand-new ETF type in January, and they already manage more than $53 billion of Bitcoin assets.

The expected arrival of spot Bitcoin ETFs inspired an early start to the fourth halving surge. As noted earlier, many cryptocurrencies and related stocks have soared over the last year thanks to halving expectations, ETF plans, and a calmer economic inflation trend. On top of this robust launching pad, Coinbase will record higher trading volumes thanks to the new ETFs.

But wait a minute — why would that be a good thing? Aren’t these ETFs taking away potential crypto-trading volume from the Coinbase system?

Thanks for asking. As it turns out, most ETFs are using a third-party custodian service to execute Bitcoin trades and hold the crypto assets in a secure digital wallet. And nine of the 11 ETFs rely on Coinbase.

“We’re earning revenue, not just on custody, but also on trading and financing,” Coinbase CEO Brian Armstrong said on an earnings call in February, four weeks after the ETF approvals. “Every institution is now starting to hold crypto, the asset class will be a standard part of every diversified portfolio. The financial system is officially adopting crypto. This is really good, and Coinbase is the most trusted partner here.”

So, Coinbase found a new revenue stream while giving the whole crypto market a helpful push. That’s a win-win.

Coinbase is growing into its rich valuation

Coinbase’s valuation shrinks dramatically if you look forward to the incoming market surge. The stock trades at 12 times the average next-year revenue estimate and 108 times earnings projections. And in the last five quarterly reports, the company has exceeded the consensus revenue target by an average of 11% — and earnings have more than doubled the average Wall Street projections.

Past performance is no guarantee of future results, but Coinbase has a proven history of leaving analyst estimates behind — and the company has a unique set of growth-driving balls in the air right now. Keep this up throughout the 12-to-18-month span of the halving cycle’s bullish action, and the current stock price quickly starts to look cheap.

That’s why you should consider picking up a few Coinbase shares now. They will not stay this deceptively cheap forever.

Should you invest $1,000 in Coinbase Global right now?

Before you buy stock in Coinbase Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coinbase Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Anders Bylund has positions in Bitcoin, Coinbase Global, Ethereum, and Solana. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, Ethereum, and Solana. The Motley Fool has a disclosure policy.

2 Reasons to Buy Coinbase Stock Like There’s No Tomorrow was originally published by The Motley Fool

This Is Hands-Down the Simplest Way to Earn $1 Million or More in the Stock Market

With a few simple steps, you could be on your way to millionaire status.

Investing in the stock market is a tried-and-true way to generate long-term wealth, and while reaching $1 million may seem like a lofty goal, it’s not as difficult as it might appear.

You don’t have to be a stock market expert to earn $1 million or more, but you will need the right investing strategy. There’s no single correct way to invest, and the best approach for you will depend on your preferences and risk tolerance.

That said, there’s a simple and straightforward strategy to maximize your long-term earnings while minimizing risk. Whether you’re new to the stock market or just want a no-fuss way to build wealth, this step-by-step process can take you from $0 to $1 million or more.

Image source: Getty Images.

1. Get started investing right now

The more time you give your money to grow, the less you’ll need to invest each month to reach $1 million. Thanks to compound growth, your investments will accumulate exponentially faster over time. Getting started as soon as possible, then, is key to maximizing your earnings.

Even if you can’t afford to invest much right now, every year counts. For example, say you’re earning a modest 9% average annual return on your investments — which is just under the market’s historic average. Here’s approximately how much you’d need to invest each month to reach $1 million, depending on how many years you have to save:

| Number of Years | Amount Invested per Month | Total Portfolio Value |

|---|---|---|

| 20 | $1,700 | $1.044 million |

| 25 | $1,000 | $1.016 million |

| 30 | $625 | $1.022 million |

| 35 | $400 | $1.035 million |

| 40 | $250 | $1.014 million |

Data source: Author’s calculations via investor.gov.

It’s never too early to start investing, and the sooner you begin, the easier it will be to build a substantial amount of wealth. You can always invest more later if you can swing it, but you won’t get this precious time back.

2. Don’t worry about timing the market

The stock market will always be volatile to a degree, and it can be nerve-wracking trying to determine the best time to buy. Many people are understandably worried about investing right before prices drop, and it can be tempting to hold off on buying until the perfect moment.

However, there’s never going to be a perfect time to invest in the stock market, and the longer you wait to invest, the harder it will be to catch up later. While it may seem counterintuitive, it’s often safer to simply invest consistently no matter what the market is doing.

This approach is called dollar-cost averaging, and it involves investing a set amount at regular intervals throughout the year. Sometimes you’ll end up buying when prices are at their peaks, and other times you’ll snag investments at steep discounts. Over time, those highs and lows should average out.

Dollar-cost averaging can help take the guesswork out of when to buy, making it easier to invest consistently. Again, time is your most valuable resource when building wealth, so consistency is key to reaching $1 million or more.

3. Choose long-term investments

All investments are subject to short-term volatility, but stocks from healthy companies with solid underlying fundamentals have the best chance of recovering from downturns and earning positive long-term returns.

These types of stocks won’t see explosive growth overnight, but they are more likely to earn consistent returns over time. This makes them much safer than short-term investments promising to make a quick buck.

If you’d prefer a more low-maintenance investment, a broad-market index fund or ETF may be your best bet. The S&P 500 index fund, for example, tracks the S&P 500 index and includes stocks from all 500 companies within the index itself. This can help create an instantly diversified portfolio with next to no effort, limiting your risk while still setting you up for positive long-term returns.

If you’re willing to put in more effort for the chance to earn above-average returns, investing in individual stocks may be a better fit. This approach requires more research, as you’ll need to study each stock you’re interested in buying as well as keep up with industry trends going forward. But with the right portfolio, you could earn far higher-than-average returns over time.

Building a million-dollar portfolio isn’t necessarily easy, but it’s simpler than it might seem. By getting started early, investing consistently, and keeping a long-term outlook, you’ll be on your way to becoming a stock market millionaire.

Fool.com contributor Parkev Tatevosian forecasts where Alibaba‘s (NYSE: BABA) stock could be by the end of the year.

*Stock prices used were the afternoon prices of April 10, 2024. The video was published on April 12, 2024.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $555,209!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

My Alibaba Stock Price Prediction for 2024 was originally published by The Motley Fool