Surging Treasury yields and rising oil prices are calling the tune across markets right now.

Source link

stockmarket

What could spark the next stock-market selloff? Here’s what history tells us.

The S&P 500 has marched higher by nearly 30% over the past five months, prompting even bullish market strategists to entertain, or even welcome, the prospect of a “healthy” correction.

Most Read from MarketWatch

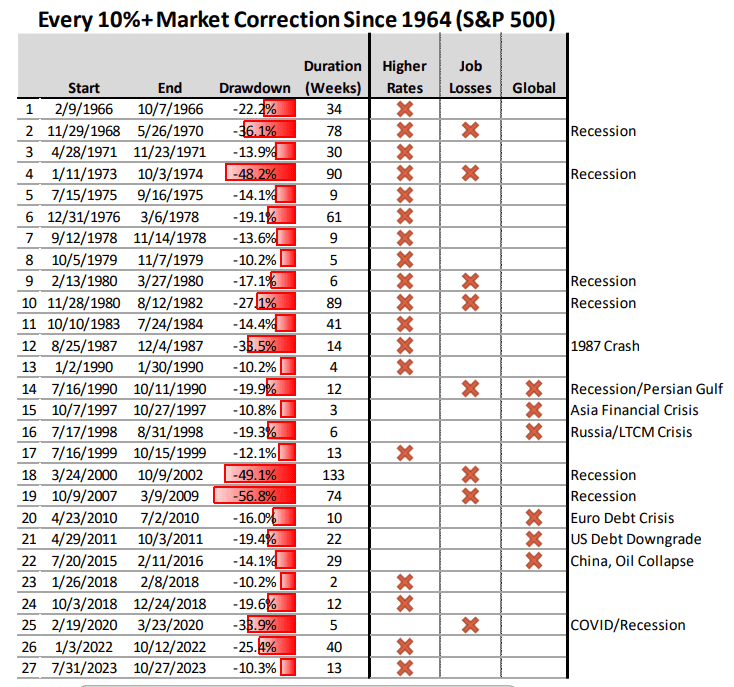

But typically market corrections don’t just happen — they need some kind of catalyst to set them in motion. To try and glean some insight into what might trigger the next double-digit pullback, a team of investment strategists led by Piper Sandler’s Michael Kantrowitz examined the 27 corrections of 10% or more for the S&P 500 that have occurred since 1964.

The team found that, without exception, each of these selloffs has been primarily driven by one of three things: rising unemployment, rising bond yields or some kind of global exogenous shock. Sometimes, it has been a combination, as was the case during the two equity-market corrections that occurred during 1980.

So, which is most likely to trigger the next 10% correction? According to Kantrowitz and his team, rising yields are the biggest threat to tranquil markets. Rising yields also caused the most recent correction, which ended on Oct. 27 with the S&P 500 down 10.3%.

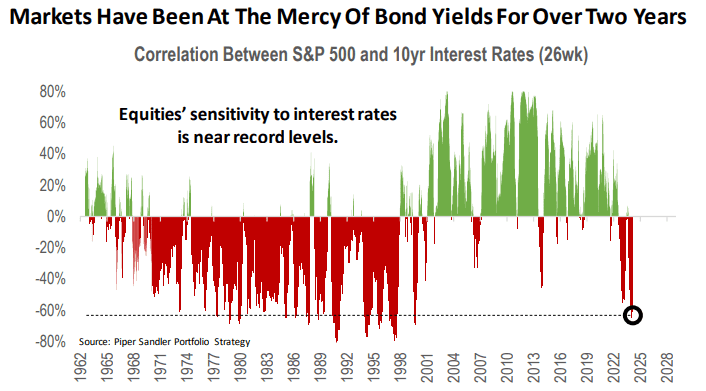

Over the past two years, equities’ sensitivity to higher yields has reached near-record levels last seen near the peak of the dot-com bubble on a rolling 26-week basis. This suggests stocks could still react negatively if long-term bond yields continue to climb, even though equities have been largely immune to the rebound in yields since the start of 2024.

“We’ve written a lot about how rate-sensitive equity markets are today. As such, the biggest risk that we see to equities in 2024 would be a rise in rates,” Kantrowitz and his team wrote.

Because of this, a modest rise in unemployment could actually help keep the rally going by guarding against higher yields. Bond yields, which move inversely to prices, often fall when the economy weakens as demand for defensive assets like bonds increases.

Stocks sold off for three straight months between August and October last year as Treasury yields pushed higher. The nadir of the selloff occurred just a few days after the 10-year Treasury yield peaked north of 5%, a 16-year high, according to FactSet data.

Treasury yields are creeping higher once again during the first quarter. But expectations that still-robust economic growth could help boost corporate earnings have helped to shield stocks, at least so far.

The yield on the 10-year Treasury note BX:TMUBMUSD10Y has gained 39 basis points since the beginning of the year to 4.252%, while the S&P 500 SPX has risen 9.4% since the beginning of the quarter and 26.7% since Oct. 27 to close at 5,218.19 on Monday.

The Nasdaq Composite COMP is up 9.6% since the beginning of the first quarter at 16,452.69 as of Tuesday’s close, while the Dow Jones Industrial Average DJIA has gained 1,670.79 points, or 4.5%, to 39,388.56.

Most Read from MarketWatch

A month after the U.S. stock market suffered its worst consumer-price index release day in over a year, investors are worrying about a reprise when the latest inflation data arrives on Tuesday morning — data that could shake up the Federal Reserve’s monetary-policy expectations and test stocks’ 2024 bull run.

Source link

Do stock-market investors care more about Nvidia than the Fed? A big test awaits.

It might seem at times that investors care more about Jensen Huang than Federal Reserve Chair Jerome Powell.

Huang is the longtime CEO of chip maker Nvidia Corp.

NVDA,

which stole the show last week by blowing away already lofty earnings expectations and leading stocks to new rounds of all-time highs, even as nagging worries over resurgent inflation continued to percolate in the background. Huang declared that the artificial intelligence industry, of which Nvidia is a prime supplier of crucial chips, has reached a “tipping point” that will see the technology go “mainstream.”

Deep Dive: After Nvidia’s latest blowout, here are 20 AI stocks expected to rise as much as 44%

That may lead investors to wonder whether they’re wasting their energy fretting over the economic cycle and the timing of Federal Reserve interest rate cuts. Should they instead embrace a rally led by technology stocks that is started to broaden out to other sectors, enhanced by the potential for advances in artificial intelligence to bring about a generational productivity boost that will lift corporate profits and cap inflation pressures?

That’s a pretty picture, but one that is unlikely to come together so seamlessly.

“I think investors will obsess over inflation metrics again,” Michael Arone, chief investment strategist at State Street Global Advisers, told MarketWatch in a phone interview.

It so happens that the Federal Reserve’s favored inflation metric, the core reading of the personal-consumption expenditures index is due Thursday morning. The January data comes after markets were previously rattled by hotter-than-expected consumer-price index and producer-price index readings.

Investors know — and the Fed has emphasized — that one month’s data doesn’t make a trend, Arone said, but it will be important for inflation to resume a trend back down toward the central bank’s 2% target. If that begins to look in serious jeopardy, market volatility will eventually be in store.

Read: Wall Street is bracing for more strong U.S. economic and inflation data next week

Investors came into 2024 pricing in six to seven quarter percentage point rate cuts over the course of the year, beginning in March. As the data came in and the Fed pushed back on those expectations, markets now see a somewhat better-than-50% chance cuts will begin in June and that the Fed will deliver only three or four by year-end, according to the CME FedWatch tool.

Should inflation prove sticky or start to climb, investors could eventually be forced to countenance no rate cuts in 2024 or even the outside prospect that the Fed will need to hike yet again. That would be a major shock, Arone said, likely sending stocks into a correction and significantly pushing up Treasury yields.

Barring that, Arone, is upbeat, and sees prospects for the rally to continue broadening out after the past week also saw strength in sectors outside tech and consumer services. A continued rally would give investors the opportunity to build exposure to small-caps and value stocks.

Stocks extended their climb last week, with the S&P 500

SPX

and the Dow Jones Industrial Average

DJIA

reaching new highs. The tech-heavy Nasdaq Composite

COMP

briefly flirted with its first record close in more than two years on Thursday and again Friday before pulling back, but still ended the week up 1.4%.

Of course, the megacap-led tech rally isn’t a new phenomenon. Nvidia and its cohort of heavyweight AI beneficiaries led a 2023 stock-market rally that grew increasingly — and worryingly — concentrated.

The “most important event in world stock markets last year was nothing macro but the Microsoft

MSFT,

investment in ChatGPT-maker OpenAI,” argued Christopher Wood, global head of equity strategy at Jefferies, in a note last week.

“This was the catalyst for the AI thematic to start driving market psychology and, crucially, gave the most important sector in the world’s largest stock market a new story which is secular not cyclical,” he wrote.

The rally has also prompted comparisons to the dot-com bubble of the late 1990s.

Barron’s: Echo of 1995 or 1999?

A look at how big one-day gains have contributed to the stock market’s year-to-date rally illustrates the role that tech sector strength plays.

The S&P 500 was up 6.7% for the year to date through Thursday, with just five trading days accounting for that gain, noted Nick Colas, co-founder of DataTrek Research, in a note.

That includes Thursday’s 2.1% rise, driven by Nvidia’s earnings, and four days with gains of 1% to 1.4%, including a Jan. 8 rise following an announcement of new chips by Nvidia; a Jan. 19 gain led by chip stocks following earnings guidance from Taiwan Semiconductor

TSM,

; a Feb. 1 bounce following a selloff inspired by remarks from Powell; and a Feb. 2 rally driven by Meta Platform Inc.’s

META,

20% surge.

The lesson is that the market is shrugging off the prospect of interest rates remaining higher for longer to focus on Big Tech’s earnings leverage, Colas wrote. “This is classic ‘midcycle’ market behavior. Investors can live with higher interest rates if (but only if) there is a promising development in an important sector.”

Meanwhile, the degree of that promise remains up for debate.

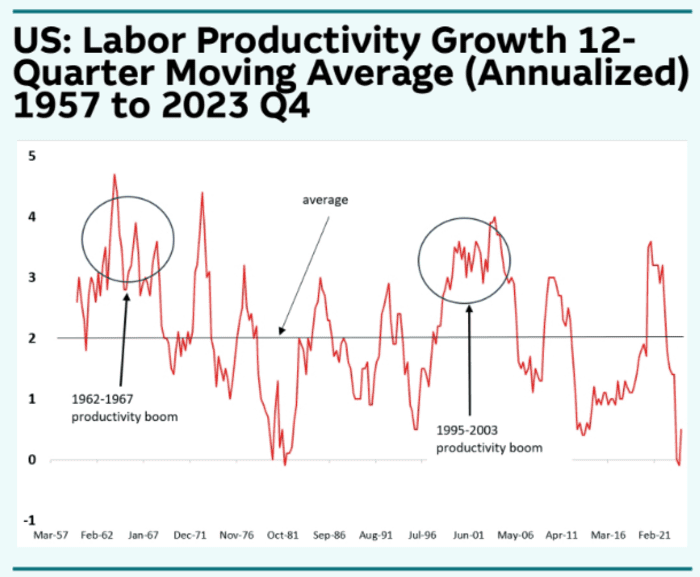

“Of course, many ‘new paradigms’ about U.S. productivity growth have been proffered by market pundits in the past 125 years. Not all of them have panned out, and there were really only two episodes (the mid-1960s and the mid-1990s) in which productivity growth in the U.S. stayed high sustainably,” said Thierry Wizman, global FX and rates strategist at Macquarie, in a note (see chart below).

Macquarie

“But what matters is not so much whether this new AI-driven paradigm

pans out; it matters whether people believe it will pan out, if it is to

change macro dynamics,” he said.

Such a change could carry a sting.

The danger is that a new growth paradigm leads the Fed to conclude that the so-called neutral rate — the level at which the official interest rate neither enhances nor sustains growth — is higher than it currently thinks, opening the door to further hikes.

Meanwhile, investors are focused on whether AI will continue to drive strong results for leading technology providers and if it will allow companies that eventually use those products to become increasingly productive and more profitable, said Jose Torres, senior economist at Interactive Brokers, in a note.

With many companies outside the tech sector offering cautious guidance, it doesn’t look like the practical aspects of AI are yet supporting aggregate profits, he said.

“Only time will tell if Nvidia CEO Jensen’s optimism is warranted,” Torres wrote, “and while bulls have been energized by his comments and Nvidia’s quarterly results, bears are praying that AI may be more fluff than substance.”

Traders that fueled stock-market rally are now nearly tapped out, Goldman says

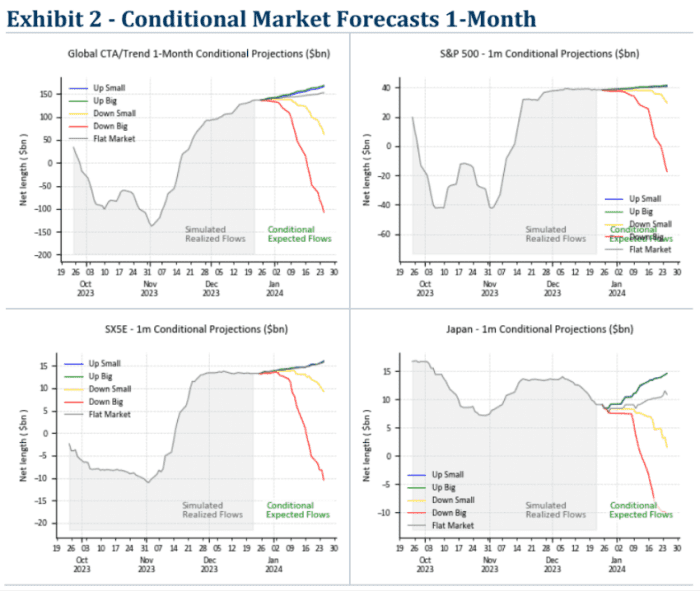

After helping to push U.S. stocks’ higher in November and December, trend-following trading firms known as CTAs are nearly tapped out, according to a report published by a Goldman Sachs Group trading desk.

That could limit further upside for the market, although the analysts cautioned that CTAs’ positioning may not be indicative of what other market participants are doing.

According to a report reviewed by MarketWatch on Wednesday, Goldman’s models suggest that CTAs — or commodity trading advisers — are already nearly max long when it comes to their exposure to the S&P 500, which they typically trade by buying or shorting futures contracts tied to the index.

Numbers from the Goldman trading desk that typically services CTAs show that this class of traders is carrying about $40 billion in long exposure to the S&P 500, and nearly $150 billion in exposure to global equities.

This would suggest that even if global stocks continue to power higher, CTAs’ ability to keep chasing the tape may have reached its limit.

GOLDMAN SACHS

CTAs certainly have a lot of influence across equity, fixed-income and commodity markets.

That said, Goldman’s numbers represent only a partial view of what’s happening in the space, and there are plenty of other types of traders aside from CTAs who can help push markets higher or lower.

See: November’s stock-market rally gets a boost from trend-following funds and company share buybacks

The S&P 500

SPX

gained 0.1% on Wednesday, closing at around 4,781, just a few points shy of its record closing high from Jan. 3, 2022, according to FactSet data. The large-cap index has gained nearly 25% since the beginning of 2023. The Dow Jones Industrial Average

DJIA

rose by around 111 points, or 0.3%, to notch its sixth record close of the year.

Check out: The latest threat to U.S. stocks: computerized trend-following funds are cutting their exposure to the market

A broadening stock-market rally just led to this ‘fairly uncommon’ occurrence

U.S. stocks recently broadened their rally, with a majority of the S&P 500’s sectors closing at 52-week peaks at the same time, according to Bespoke Investment Group.

“Yesterday, six of the eleven S&P 500 sectors traded at 52-week highs,” Bespoke said in a note emailed Wednesday. ”That is the highest share of sectors simultaneously hitting 52-week highs since May 2021.”

It’s “fairly uncommon” for the majority of the index’s sectors to reach such peaks at the same time based on data going back to 1990, the note shows.

BESPOKE INVESTMENT GROUP NOTE EMAILED DEC. 20, 2023

The stock market’s stronger breadth in the past several weeks stands in contrast to much of 2023, which saw “narrow leadership” driving the S&P 500’s gains, according to the note. The index has surged around 23% this year, led by the information-technology, communication-services and consumer-discretionary sectors, FactSet data show, at last check.

A group of megacap stocks that span across those three sectors, known as the Magnificent Seven or Big Tech, have propelled the S&P 500’s rise in 2023 with massive gains.

For example, Nvidia Corp.

NVDA,

has skyrocketed around 232% so far this year while Facebook parent Meta Platforms Inc.

META,

has soared around 191% and Tesla Inc.

TSLA,

has surged around 103%, according to FactSet data, at last check.

Meanwhile, Google parent Alphabet Inc.

GOOGL,

was among the S&P 500’s top-performing stocks in Wednesday afternoon trading, with a gain of around 1.8%, FactSet data show, at last check.

The S&P 500

SPX

was down 1.2% Wednesday afternoon, after finishing Tuesday just 0.6% below its record close reached in early January 2022.

Seven of the index’s 11 sectors are up so far in 2023, with only consumer staples, energy, utilities and healthcare seeing losses year to date, FactSet data show, at last check.

“Historically, a majority of S&P 500 sectors hitting new 52-week highs on the same day has been followed by weaker-than-average returns in the near term but returns in line with the historical norms over the longer term,” said Bespoke.

G7 ETFs rise in global stock-market rally as S&P 500 approaches all-time high

Stocks in the group of wealthy democracies known as the G7 are up in 2023, with exchange-traded funds tracking those regions climbing last week amid a broader recent rally in equities globally.

Funds targeting the group of seven democracies — represented in the U.S. by the SPDR S&P 500 ETF Trust

SPY

and also including the iShares MSCI Canada ETF

EWC,

iShares MSCI Germany ETF

EWG,

iShares MSCI Italy ETF

EWI,

iShares MSCI Japan ETF

EWJ,

iShares MSCI France ETF

EWQ

and iShares MSCI United Kingdom ETF

EWU

— have all posted gains in the year to date.

The S&P 500 index, a widely followed benchmark for U.S. stocks, is trading near its all-time high, seen about two years ago.

“Looking at the charts of all seven ETFs representing the G7, they’re all right at or near 52-week highs,” Bespoke Investment Group said in a note Monday. “One key difference between the U.S. and the rest of the world, though, is that while other countries are still testing or [are] only marginally higher than their summer highs, the U.S. handily took that level out over a week ago as it has been a leader.”

BESPOKE INVESTMENT GROUP NOTE EMAILED DEC. 18, 2023

As seen in the chart above, the U.S. ETF is one of four with a gain surpassing 20% year to date, according to Bespoke, which added: “Only Italy’s 27.8% topped the S&P 500.”

U.S. stocks surged in November and have continued their rally in December. The S&P 500 finished Friday just 1.6% from its record high of 4,796.56, reached Jan. 3, 2022, after rallying for seven straight weeks, according to Dow Jones Market Data.

The S&P 500

SPX

was trading 0.6% higher on Monday afternoon at around 4,746, while the Dow Jones Industrial Average

DJIA

was edging up 0.1% after scoring a fresh record close on Friday, according to FactSet data, at last check.

Read: Dow posts third straight record close, S&P 500 scores longest weekly win streak in six years

The SPDR S&P 500 ETF Trust has this year seen gains of more than 25% on a total return basis as of Monday afternoon.

Global stocks rise as China struggles

The global equities market has broadly rallied this year, including in emerging markets. That’s despite losses in China, an authoritarian government with the world’s second-largest economy.

Shares of the iShares MSCI ACWI ETF

ACWI,

which tracks stocks globally in developed and emerging markets, have jumped around 19.6% this year as of Monday afternoon, according to FactSet data, at last check. The iShares MSCI Emerging Markets ETF

EEM

has trailed with 5.4% gains in 2023, dragged down by China.

The iShares MSCI China ETF

MCHI

has seen its shares plunge this year around 14%, while the iShares MSCI Emerging Markets ex China ETF

EMXC,

which excludes the country, has risen almost 15% year to date, according to FactSet data, at last check.

Meanwhile, shares of the Freedom 100 Emerging Markets ETF

FRDM,

which excludes autocracies such as China, has soared more than 17% this year, including a rally of more than 14% so far this quarter, according to FactSet data, at last check.

‘Stock-market correction is over’ after broad surge amid ‘epic’ market rallies

The S&P 500’s big jump amid last week’s “epic rallies” for stocks and bonds was driven in part by interest-rate-sensitive sectors that broadened the breadth of the index’s gains, putting it on course for a rally into year-end, according to Yardeni Research.

“All 11 sectors gained ground last week, many enjoying their best week in nearly a year,” said Yardeni analysts led by the firm’s president and chief investment strategist Ed Yardeni, in a note Monday. “We think the stock market’s correction is over and that the S&P 500 is back on track to end the year at 4,600.”

U.S. stocks finished higher Monday, with the S&P 500 index

edging up to about 4,366 after last week scoring its biggest weekly percentage gain since November 2022. After a group of seven so-called Big Tech stocks has fueled the S&P 500’s rally so far in 2023, investors are keeping an eye out for any signs of the market gauge’s breadth broadening as it rises.

“The plunge in the bond yield boosted the valuation multiples of technology stocks as well as the more traditional interest-rate sensitive ones,” the Yardeni analysts said of last week’s rally.

Real estate was the S&P 500’s best-performing sector last week, ripping 8.5% higher, while financials and consumer discretionary had the next biggest gains, the firm’s note shows.

How S&P 500 sectors stacked up last week

| S&P 500 sector | %Performance |

| Real estate | 8.5 |

| Financials | 7.4 |

| Consumer discretionary | 7.2 |

| Information technology | 6.8 |

| Communication services | 6.5 |

| Industrials | 5.3 |

| Utilities | 5.2 |

| Materials | 5.1 |

| Healthcare | 3.5 |

| Consumer staples | 3.2 |

| Energy | 2.3 |

| Source: Yardeni Research note |

Read: Home-builder ETFs surged, exceeding the Dow’s big gains

The U.S. stock market’s broad jump last week led the S&P 500

,

Dow Jones Industrial Average

and Nasdaq Composite

to a strong start to November, after the indexes slumped in the previous three consecutive months.

“From August through October, investors were spooked by the jump in the 10-year U.S. Treasury bond yield from 3.96% on July 31 to 5.00% a week ago,” the Yardeni analysts said.

U.S. stock prices broadly climbed last week as Treasury bond yields fell, with the rate on the 10-year Treasury note seeing its biggest weekly decline since March to finish Friday at 4.557% based on 3 p.m. Eastern Time levels, according to Dow Jones Market Data.

Last week’s “epic” bond-market rally carried the 10-year Treasury note yield “down to a more comfortable distance from 5.00%,” the Yardeni analysts wrote. They said the move was “fueled by modestly bullish economic news that seems to have triggered a massive short-covering rally by the bears and a buying panic by the bulls.”

The 10-year Treasury yield

rose Monday to 4.662%, according to Dow Jones Market Data. Bond yields and prices move in opposite directions.

Meanwhile, “the stock market seems to be following the classic seasonal year-end script of weakness in September and October setting the stage for a Santa Claus rally,” the Yardeni analysts said.

See: Dow scores best week since October 2022 as stocks rise after soft jobs report

The S&P 500 rallied 5.9% last week, with its real estate

,

financials

,

consumer-discretionary

,

tech

and communication-services

sectors all beating the broader index over the same period.

Big Tech in 2023

Meanwhile, the S&P 500’s best-performing sectors so far in 2023 are communication services, tech and consumer discretionary, each with huge double-digit gains.

Big Tech stocks, which include seven giant companies that fall across all three of those sectors, have a heavy weighting in the S&P 500 index.

Chip maker Nvidia Corp.

NVDA

has by far the biggest gains among Big Tech stocks in 2023. Shares of the tech company, with a market valuation of more than $1 trillion, have skyrocketed 213% so far this year through Monday, according to FactSet data.

The next biggest 2023 stock gains in the Big Tech group are from Facebook parent Meta Platforms Inc.,

META

which has soared about 162%, followed by Tesla Inc.

TSLA,

whose shares have surged 78%, and then Amazon.com Inc.’s

AMZN

jump of around 66%, according to FactSet.

But real estate and financials, the S&P 500’s top two sectors in last week’s rally, remain down so far in 2023, with each sector falling Monday. By contrast, the S&P 500 has risen 13.7% this year.

U.S. stock-market seasonality suggests a potential rally in the fourth quarter. Why this time might be different.

The stock-market seasonality trend has played out almost perfectly in the third quarter of 2023, with both August and September living up to their reputation as brutal months for U.S. stocks. But that seasonal weakness may set up a stock-market rally in the final quarter of the year, said longtime market strategists.

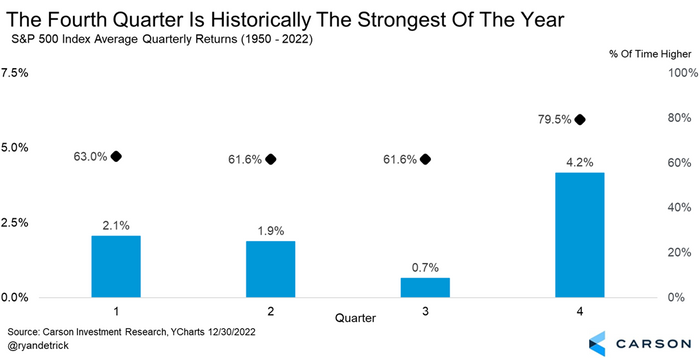

Historically, the fourth quarter has been the best quarter for the U.S. stock market, with the large-cap S&P 500 index

SPX

up nearly 80% dating back to 1950 and gaining more than 4% on average, twice as much as the next best quarter, said Ryan Detrick, chief market strategist at Carson Group (see chart below).

SOURCE: CARSON INVESTMENT RESEARCH

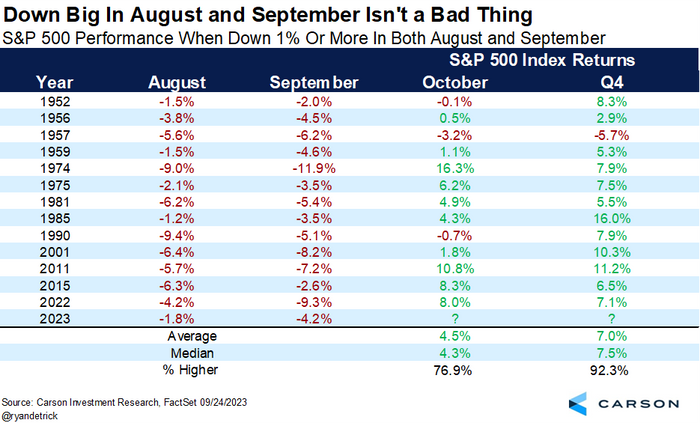

October is known as a month for extreme volatility, with some of the legendary U.S. stock-market crashes — the Panic of 1907, the Wall Street Crash of 1929 and the Black Monday in 1987 — all occurring in October. However, it is still in general a “pretty decent month,” especially when stocks fall more than 1% in the previous two months, Detrick wrote in a Thursday note.

See: Why stocks are likely to be especially volatile this October

On Friday, the S&P 500 and the Nasdaq Composite

COMP

recorded their worst month since December and their worst performing quarter so far in 2023. All three major indexes suffered their second consecutive month of losses, according to Dow Jones Market Data.

The latest surge in Treasury yields

BX:TMUBMUSD10Y

and the U.S. dollar

DXY

at a 10-month high against a basket of major currencies conspired with seasonal weakness to knock the market down in September. While bullish trends in the dollar and yields have been underway for months, the Federal Reserve’s interest-rate decision and Chair Jerome Powell’s press conference last week accelerated the rally in rates and the greenback.

In the meanwhile, U.S. energy prices

CL00,

CL.1,

hovered above $90 a barrel in September as investors weighed tightening supplies after Saudi Arabia and Russia extended their voluntary cuts in oil production through the end of 2023, deepening investors’ concerns that reducing inflation to 2% is hard, and more interest-rate hikes might be needed.

As a result, the S&P 500 ended the month with a loss of 4.9%, while the Dow Jones Industrial Average

DJIA

fell 3.5% and the Nasdaq Composite dropped 5.8% in September. In August, the S&P 500 was off 1.8%, while the Dow industrials fell 2.4% and the Nasdaq declined 2.2% for the month, according to FactSet data.

Ryan Belanger, founder and managing principal at Claro Advisors, said the fourth quarter of 2023, despite strong seasonal tailwinds, could be weaker than the historical average as market fundamentals are pointing to a recession.

“Bond yields are at multi-decade high, while the Fed is still considering raising interest rates — it’s going to be challenging for investors to allocate significant capital to the stock market to drive those returns,” Belanger told MarketWatch by phone on Friday.

See: September’s U.S. stock-market rout left just 1 winner as defensive sectors failed to provide shelter

While many investors expect seasonal weakness to continue, Detrick of Carson Group does not count out a stock-market rally in the fourth quarter just yet.

For the last three times when stocks were off 1% in the previous two months, October bounced back with an impressive gain of 10.8%, 8.3%, and 8.0%, respectively, said Detrick.

“Turning to the fourth quarter, it has been up 12 out of 13 times and up more than 7.0% on average [since 1950],” he said. “In other words, when we see the seasonal August and September weakness, it is also normal to see a strong end-of-year rally.” (See chart below)

SOURCE: CARSON INVESTMENT RESEARCH, FACTSET

Moreover, when the S&P 500 is up between 10-20% for the year heading into the normally strong fourth quarter, Detrick said he expects “an even better fourth quarter,” up more than 5% on average. The S&P 500 has advanced over 12% so far in 2023, according to FactSet data.