“I would be partially unretired.”

Source link

stop

Solana co-founder Anatoly tells community to stop investing in memecoin pre-sales

Solana Labs Co-Founder Anatoly Yakovenko has seemingly taken a stand against Solana-based memecoins, calling for investors to “stop doing this” in relation to data showing the high volume of SOL being sent to memecoin pre-sale contracts.

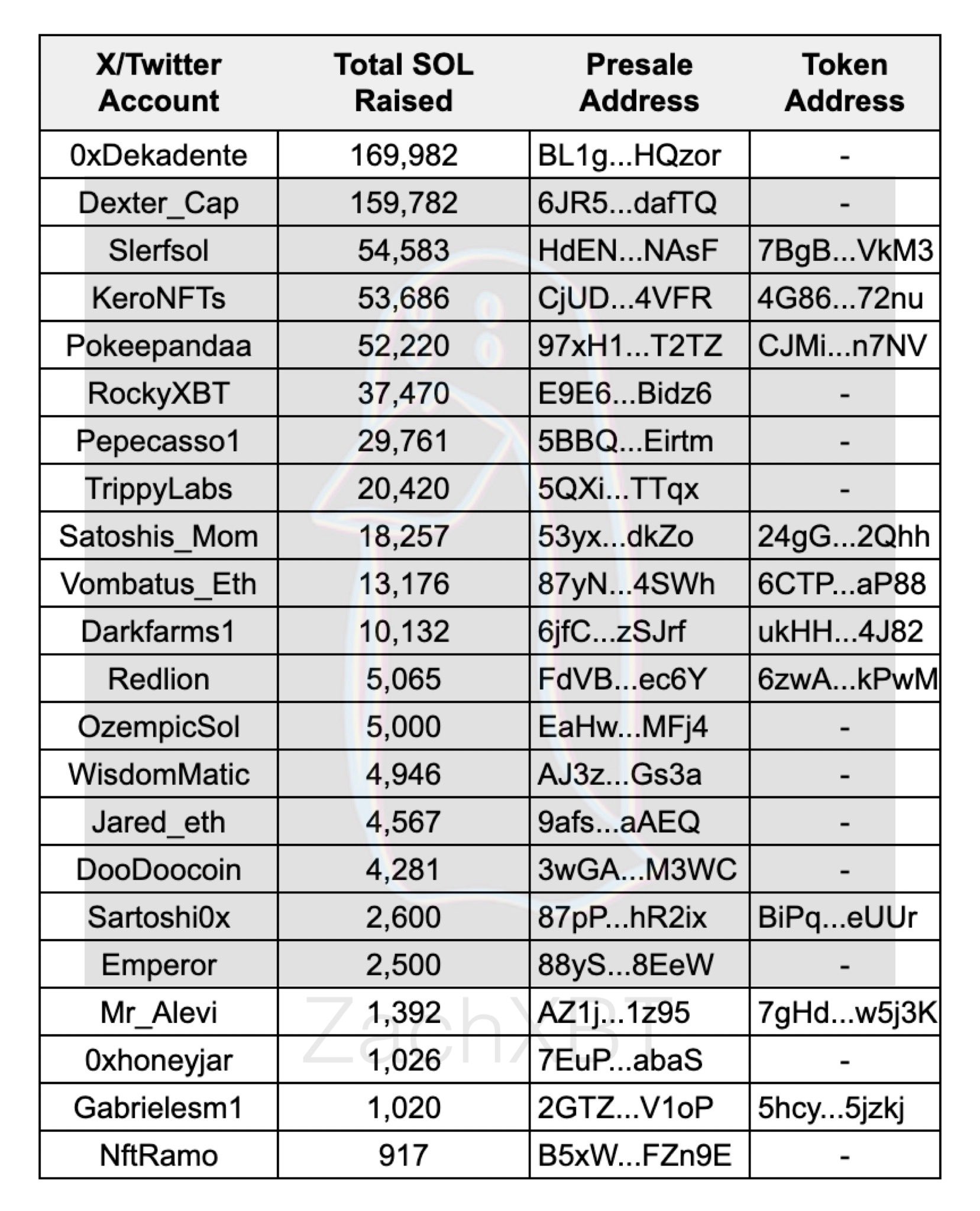

On-chain sleuth ZachXBT shared the image below detailing a list of social media accounts that had recently raised significant funding for memecoins on Solana. Top of the list 0xDekadente raised 169,982 SOL, approximately $30.5 million, while the lowest value project, NftRamo, raised roughly $165,060.

Anatoly quoted the above image and the phrase “stop doing this” with no other comment. Memecoin fervor recently helped drive SOL prices over $200 for the first time since the last bull market and mark a new all-time high market cap.

As of press time, 0xDekedente is attempting to airdrop tokens to pre-sale investors but is struggling due to network congestion. As a result, the account suggested launching the token before airdropping tokens to investors.

“The smolana network is extremely congested and it is impossible to airdrop at the same time as the LP in this moment… we try, but it’s impossible

So, you choose: Launch now and receive the $smole airdrop in the next few hours…

Launch the airdrop and the LP at the same time, this will take a few hours for the network to decongest… We don’t know how much exactly it will take due to the congestion, but we will do it ASAP whatever your decision.”

Currently, the online vote suggests the token will launch before the airdrop happens, meaning investors who contributed to the pre-sale will not have tokens available to sell when the token launches.

As of press time, SOL is down 15% from its local high to trade around $179. Memecoins, seen by some as exit liquidity gambling and important community innovation by others, potentially drive interest in Solana for the wrong reasons.

The memecoin demand is at least acting as a stress test for the network, showcasing the pressure points for network congestion on high demand. Memecoins are struggling to launch liquidity pools and airdrop tokens, while tokens and dApps with actual utility have little to no exposure.

The post Solana co-founder Anatoly tells community to stop investing in memecoin pre-sales appeared first on CryptoSlate.

US Senators Push SEC to Stop Approving Spot Crypto ETFs — Say Other Crypto Markets Risker Than Bitcoin

Two U.S. senators have urged U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler to refrain from approving additional crypto exchange-traded fund (ETF) applications. The lawmakers cautioned: “However vulnerable bitcoin may be to fraud and manipulation, markets for other cryptocurrencies are far more exposed to misconduct.” Lawmakers Say SEC Should Not Approve Spot Crypto ETFs […]

Two U.S. senators have urged U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler to refrain from approving additional crypto exchange-traded fund (ETF) applications. The lawmakers cautioned: “However vulnerable bitcoin may be to fraud and manipulation, markets for other cryptocurrencies are far more exposed to misconduct.” Lawmakers Say SEC Should Not Approve Spot Crypto ETFs […]

Source link

Cathie Wood became an investing hero when her exchange-traded funds (ETF) that focus on disruptive technology stocks zoomed higher early in the pandemic, outperforming the market and delivering incredible gains for shareholders.

That changed in the bear market when investors dumped growth stocks and ran toward safe stocks. But as the market has swung back firmly into bull territory, many of Ark Invest’s funds are outperforming again.

Ark has been scooping up shares of digital bank SoFi (SOFI -0.56%) stock recently, adding more to two of its ETFs. Should you follow Cathie Wood’s lead?

How SoFi stands out

SoFi is in the rather interesting position of being a bank and a fintech. It has some stability due to its large cash reserves in the form of account deposits and a well-established credit business, but there’s risk — and reward — due to its youth and innovation mindset.

It began as a cooperative for student loans, and it grew from there as management recognized the need for a full financial services center geared toward the needs of students and young professionals.

Chief Executive Officer Anthony Noto spoke with Cathie Wood and called SoFi’s sweet spot “mass, affluent high earners.” He doesn’t think their needs are being met, and SoFi is going after this unfulfilled space with a one-stop shop to provide everything they need to manage their finances easily. This is a group that is educated and earning; more than 90% of SoFi’s accounts are direct deposit. These clients are making money, and these are sticky deposits.

SoFi’s goal now is to capitalize on this lucrative market. It’s developing all sorts of initiatives to run with this ball: IPO investments and alternative investments, all with an easy-to-use interface. These are customers who have some discretionary income but need some help to build it to a level of achieving their financial ambitions. When SoFi provides that, it gains their trust and leverages its accounts to generate fees and revenue, scaling its business and becoming more profitable.

SoFi just reported its first GAAP profit

SoFi has been demonstrating growth and momentum since it became a public company, but its stock tanked in the bear market when unprofitable growth stocks at high prices fell out of favor with investors. However, SoFi has continued to report remarkable growth and sustained momentum, capturing market share and demonstrating that it has a viable business meeting its customers’ needs. There are many digital banks that have sprouted that offer easy online banking, but SoFi has shown a keen understanding of its clientele and how to expand its business.

That’s why it has a range of products in three segments: the original lending products, financial services, and technology platform. Its strategy is to get clients in its affluent target market to sign up for an account, bringing them into the company’s ecosystem where it cross-sells other services to become their preferred financial services institution.

Management reiterated several times that it would report a profit in accordance with generally accepted accounting principles (GAAP) in the 2023 fourth quarter, and it came through with $48 million in net income off of $615 million in revenue. Even better, it’s anticipating another profit in the first quarter as well as a full-year profit of about $100 million.

SoFi’s price drop is an opportunity

Although Cathie Wood’s approach is often seen as the opposite of value investor Warren Buffett’s, they aren’t diametrically opposed. Wood recognizes a bargain as well as any savvy investor, and although she goes for growth and disruption, she isn’t passing up the chance to buy an incredible stock at a great price.

SoFi stock soared after its fourth-quarter report, but then it immediately plummeted, losing all of its gains. It’s now up only 9% over the past year despite its stellar performance. At the current price, it trades at a price-to-sales ratio of 3.8, which is cheap for a high-growth stock.

If you have a high tolerance for risk and love growth stocks, you might want to invest in one of Cathie Wood’s ETFs, like the flagship ARK Innovation Fund (ARKK 0.79%) or the ARK Fintech Innovation Fund (ARKF 1.23%), both of which just loaded up with SoFi stock. Or, you can follow her trades and make your own decisions.

SoFi’s drop looks like an opportunity for the forward-thinking investor, and with patience and time, you’re likely to be rewarded.

If retirement is all about money, you might not be ready to stop working

Not only is retirement readiness different for each individual, not many of us are even able to describe what that actually looks like.

Successful retirement planning requires a multi-layered exploration of our wants, needs, financial anxieties and risk tolerance, along with sensitivity to what we really mean in addition to what we actually say. There’s a close analogy to psychotherapy.

This is why it’s an exercise in futility for Wall Street firms to conduct their periodic surveys of retirement readiness. Not surprisingly, these surveys often reach widely divergent conclusions.

Wall Street nevertheless keep trying. A half-dozen such firms have reached out to me already this year, publicizing their latest surveys. One published a report on Feb. 13 announcing that the U.S. retirement crisis is worse than ever, with two-thirds of workers not saving enough for retirement — and nearly one in four without enough savings to even pay for their funeral expenses.

Meanwhile, another survey — released two weeks earlier — found that 70% of U.S. workers are confident that they have saved enough for a comfortable retirement.

The inherent weakness in these surveys is that they are trying to quantify the unquantifiable. Take, for example, the survey finding that two-thirds of workers aren’t saving enough for retirement. It reached this conclusion by measuring the size of respondents’ retirement portfolios, then comparing it to a single across-the-board dollar amount that the surveyors claimed was necessary to retire comfortably.

But there is no one-size-fits-all when it comes to a retirement portfolio. Benjamin Graham, the father of fundamental analysis, made this point in his famous book “The Intelligent Investor”: “The best way to measure your investing success is not by whether you’re beating the market, but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

How many of us can answer the question “where you want to go” with more than bromides? This isn’t to say that having a sizeable portfolio is unimportant to retirement readiness. But the relationship between money and happiness is surprisingly inscrutable. Take recent research by Matthew Killingsworth, a professor at the Wharton School, and Princeton University professors Daniel Kahnemann and Angus Deaton.

The researchers found that more money brings more happiness in large part only if you are a happy person to begin with. If you’re an unhappy person, then money helps you only to a limited extent. Even for happier people, the impact of more money is a lot less than you think: A “four-fold difference in income is… less than a third as large as the effect of a headache” on a person’s feelings of happiness on a given day.

Financial advisers can play a valuable role in helping us sort out these thorny questions, Of course there are unscrupulous advisers who take advantage of vulnerable retirees and near-retirees. The presence of such advisers only reinforces the importance of searching for an adviser carefully. Just don’t let the considerable complexity of retirement planning dissuade you from the search.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

More: These are the two biggest retirement expenses. Start planning for them now.

Also read: I have to take RMDs from multiple accounts. How can I avoid making a mistake?

3 “Magnificent Seven” Stocks Billionaires Are Selling, and the 1 They Can’t Stop Buying

Since the beginning of 2023, investors have enjoyed a true running of the bulls on Wall Street. The iconic Dow Jones Industrial Average and broad-based S&P 500 galloped to fresh highs, while the growth-driven Nasdaq Composite ended the previous week a stone’s throw from eclipsing its November 2021 record-closing high.

While I’d love to tell you that this has been a broad-driven rally, the emergence of a new bull market is the result of outsized returns from the “Magnificent Seven.”

When I say Magnificent Seven, I’m referring to some of the largest, most influential businesses on Wall Street:

These are seven innovation-driven businesses that offer an abundance of competitive advantages. Examples include Alphabet’s virtual monopoly in internet search with Google; Microsoft’s continued dominance with its Windows operating system; Tesla’s position as North America’s leading electric vehicle manufacturer; Amazon’s dominant e-commerce marketplace; and Meta’s top social media assets, which attract nearly 4 billion active users each month.

While the outperformance of the Magnificent Seven isn’t lost on Wall Street, its most successful money managers have very different outlooks on these top-tier stocks, as evidenced by the latest round of 13F filings. A 13F allows investors to see what Wall Street’s brightest minds bought and sold in the latest quarter.

Based on 13Fs for the December-ended quarter, three Magnificent Seven stocks were given the heave-ho by billionaire investors, while another was aggressively purchased.

Magnificent Seven stock No. 1 billionaires are selling: Meta Platforms

The first Magnificent Seven stock that was sent to the chopping block in the fourth quarter is social media giant Meta Platforms. A half-dozen billionaire money managers lightened their respective fund’s stakes in the parent of Facebook, Instagram, and WhatsApp, including (total shares sold in parentheses):

-

Jeff Yass of Susquehanna International (3,037,082 shares)

-

Chase Coleman of Tiger Global Management (1,430,767 shares)

-

Philippe Laffont of Coatue Management (542,399 shares)

-

Steven Cohen of Point72 Asset Management (371,850 shares)

-

Israel Englander of Millennium Management (307,709 shares)

-

David Tepper of Appaloosa Management (100,000 shares)

The most logical reason for billionaires to be wary of Meta is the likelihood of a U.S. recession taking shape in 2024. Meta generates almost 98% of its revenue from advertising on its social media platforms, and it’s perfectly normal for advertisers to reduce their spending during periods of economic weakness. A recession would hurt Meta’s sales and its ad-pricing power in the short run.

The other potential concern for billionaires might be Meta’s valuation. Shares of the company have more than quintupled in value from their 2022 bear market low. Billionaires selling could represent simple profit-taking, or perhaps signal that top asset managers anticipate a short-term pullback in Meta stock.

However, the interesting thing about Meta is that it’s still historically cheap, even after its run-up. Shares of the company are valued at 12.6 times forecast cash flow in 2025, which represents a nearly 20% discount to its average price-to-cash-flow multiple over the trailing-five-year period.

Magnificent Seven stock No. 2 billionaires are selling: Alphabet

A second Magnificent Seven stock that got the boot from billionaire asset managers in the December-ended quarter is Alphabet. The parent of internet search engine Google, streaming platform YouTube, and cloud infrastructure service platform Google Cloud saw seven billionaires sell its stock, including (total shares sold in parentheses for Alphabet’s Class A shares, GOOGL):

-

Philippe Laffont of Coatue Management (3,302,342 shares)

-

Stephen Mandel of Lone Pine Capital (3,113,001 shares)

-

Chase Coleman of Tiger Global Management (1,278,300 shares)

-

Dan Loeb of Third Point (900,000 shares)

-

Ken Griffin of Citadel Advisors (806,651 shares)

-

Terry Smith of Fundsmith (571,317 shares)

-

Steven Cohen of Point72 Asset Management (236,969 shares)

Similar to Meta, the exodus among billionaires from Alphabet may have to do with concerns about the health of the U.S. economy. A few money-based metrics and predictive indicators have been blaring warnings that U.S. economic activity could weaken. Alphabet brought in about 76% of its net sales in 2023 from advertising on Google search, Google Network, and YouTube.

And just like Meta, the selling doesn’t seem to make much sense. In addition to periods of growth disproportionately outlasting recessions, Alphabet’s Google accounts for more than 91% of worldwide internet search share, as of January. In fact, you have to look back nearly nine years to find the last time a month went by where it didn’t account for at least 90% of global internet search. Alphabet’s ad-pricing power is practically unsurpassed.

Alphabet also completed its first year of operating profitability from its high-margin cloud infrastructure services segment. Google Cloud has gobbled up a 10% share of global cloud infrastructure service spending and shouldn’t have any trouble meaningfully increasing its cash flow in the years to come.

Magnificent Seven stock No. 3 billionaires are selling: Nvidia

The third Magnificent Seven stock that had billionaires willingly pressing the sell button during the fourth quarter is the infrastructure backbone of the artificial intelligence (AI) movement, Nvidia. All told, eight billionaires were sellers of the hottest megacap stock on Wall Street, including (total shares sold in parentheses):

-

Israel Englander of Millennium Management (1,689,322 shares)

-

Jeff Yass of Susquehanna International (1,170,611 shares)

-

Steven Cohen of Point72 Asset Management (1,088,821 shares)

-

David Tepper of Appaloosa Management (235,000 shares)

-

Philippe Laffont of Coatue Management (218,839 shares)

-

Chase Coleman of Tiger Global Management (142,900 shares)

-

David Siegel and John Overdeck of Two Sigma Investments (30,663 shares)

One of the prime reasons billionaire investors may have rushed for the exit is growing graphics processing unit (GPU) competition. Not only is Nvidia going to fend off increasing competition from external competitors like Advanced Micro Devices and Intel, but many of Nvidia’s top customers are developing their own AI chips, including Microsoft and Meta Platforms.

There’s also a real possibility that Nvidia could cannibalize its own gross margin as it expands its production of A100 and H100 AI-GPU chips. A modest increase in cost of revenue compared to an 86% jump in sales through the first nine months of fiscal 2024 (Nvidia’s fiscal year ended in late January) pretty clearly demonstrates how powerful Nvidia’s pricing power has been. Once this GPU scarcity wanes, its gross margin is liable to decline.

Lastly, every next-big-trend over the past three decades has worked its way through an early-stage bubble. History suggests that investors will overestimate the uptake of AI, just as they have with every previous next-big-thing trend for 30 years.

The Magnificent Seven stock billionaire money managers can’t stop buying: Amazon

There was, however, one Magnificent Seven stock that didn’t have billionaires abandoning ship. During the December-ended quarter, eight billionaires gobbled up shares of e-commerce company Amazon, including (total shares purchased in parentheses):

-

Ken Griffin of Citadel Advisors (4,321,477 shares)

-

Jim Simons of Renaissance Technologies (4,296,466 shares)

-

Chase Coleman of Tiger Global Management (947,440 shares)

-

Ken Fisher of Fisher Asset Management (888,369 shares)

-

David Siegel and John Overdeck of Two Sigma Investments (726,854 shares)

-

Steven Cohen of Point72 Asset Management (462,179 shares)

-

Israel Englander of Millennium Management (85,532 shares)

The lure of Amazon for billionaires is that its business isn’t as reliant on e-commerce as you might think. Although e-commerce accounts for a sizable percentage of Amazon’s sales, online retail sales are low margin. If the U.S. economy were to stumble and online retail sales tapered off, it won’t have much impact on Amazon’s cash flow.

By comparison, the company generates the lion’s share of its operating income from its cloud infrastructure services platform Amazon Web Services (AWS). AWS was responsible for close to a third of global cloud infrastructure service spending in the third quarter of 2023. As long as AWS continues to grow by a double-digit percentage, Amazon’s cash flow can motor substantially higher.

Despite a huge rally in its share price, Amazon remains inexpensive, relative to its cash flow. The reason I’m using cash flow, as opposed to the traditional price-to-earnings ratio, is because Amazon reinvests most of its operating cash flow back into its business. After ending every year of the 2010s at a multiple of between 23 and 37 times its cash flow, Amazon shares can be picked up right now for a little over 12 times forecast cash flow in 2025.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, Intel, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short February 2024 $47 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 “Magnificent Seven” Stocks Billionaires Are Selling, and the 1 They Can’t Stop Buying was originally published by The Motley Fool

Amazon’s Ring will stop letting police request doorbell video footage

A Ring Stick Up Cam is pictured at the Amazon Headquarters in Seattle following a launch event on Sept. 20, 2018.

Stephen Brashear | Getty Images

Amazon‘s Ring will no longer allow police to request users’ doorbell video footage in its neighborhood watch app.

In a blog post on Wednesday, Ring said this week it plans to discontinue its “Request for Assistance” tool, which allowed law enforcement to submit requests for users’ footage in their communities through a publicly accessible post in its Neighbors app.

“Public safety agencies like fire and police departments can still use the Neighbors app to share helpful safety tips, updates, and community events,” Eric Kuhn, head of Neighbors, wrote in the post. “They will no longer be able to use the RFA tool to request and receive video in the app.”

Ring in 2021 made police requests for user footage public in its Neighbors app. Previously, law enforcement could message users privately to request clips from their smart doorbell cameras.

Police can still obtain Ring video footage using a search warrant or subpoena. In response to a 2022 letter from Sen. Ed Markey, D-Mass., questioning its police partnerships, the company disclosed that Ring may provide footage directly to law enforcement “in cases involving imminent danger of death or serious physical injury to any person.”

Amazon acquired Ring in 2015 for a reported $1 billion. The home security company is primarily known for its connected doorbell devices, which allow users to record activity in front of their homes, though it has expanded to include a portfolio of products ranging from camera-equipped floodlights to flying security camera drones.

Ring has long sparked controversy about privacy due to its controversial partnerships with hundreds of police departments across the U.S. Privacy advocates have expressed concern that the program, and Ring’s accompanying Neighbors app, have heightened the risk of racial profiling and turned residents into informants, with few guardrails around how law enforcement can use the material.

Jamie Siminoff, Ring’s former CEO, couched the features as a public safety tool that would help communities. “My goal would be to have every law enforcement agency on the police portal,” Siminoff told CBS in 2019. Siminoff stepped down last year and was replaced by Elizabeth Hamren, a former executive at Microsoft and Discord.

Kuhn wrote in the post Wednesday that Ring is introducing updates to the Neighbors app, including “Ring Moments, a new post category that expands the content allowed on the Neighbors app beyond just crime and safety,” and a “Best of Ring” tool that will feature a rotating selection of top videos.

WATCH: Amazon’s smart home dominance and how it could grow with iRobot acquisition

Don’t miss these stories from CNBC PRO:

The donors have spoken.

Apparently, it was the revolt of the university’s rich, powerful donors that helped seal the fate of Harvard University President Claudine Gay, who resigned this week. The board had spent months trying to defend her. First, it was against accusations that she wasn’t taking a strong enough stand against antisemitism on campus in the wake of the Oct. 7 Hamas attack on Israel. Then it was against accusations of plagiarism — or “duplicative language without appropriate attribution,” which is how the university described more than 40 alleged instances.

Harvard, naturally, declined to comment.

But Robert Reich, a former Harvard professor and former U.S. Cabinet member, is among many making the point forcefully that the donors pushed Gay out.

He may be right or not, but nobody is denying that donors have put enormous pressure on Harvard ever since this crisis erupted in early October. Many, reportedly, have been keeping their wallets closed — and warned that they would keep doing so until the crisis was gone.

Hedge-fund billionaire Bill Ackman, one donor, has been especially vocal and just published a long critique of how the university has lost its way.

I suspect many MarketWatch readers may have had their fill of this topic already. I wouldn’t blame them. But there are two things that bother me about this.

First, why is anyone giving money to Harvard anyway?

And, second, why does Harvard give two figs what donors say?

Harvard, in case anyone didn’t know, is richer than Croesus. It is by far the richest university in the United States, or the world. Its endowment is now up to $53 billion — which means that just parking the money in index funds should be enough to generate a good $5 billion a year or more. That’s before charging any student a penny for admission.

That’s equivalent to 85% of the university’s entire operating expenses, according to the annual report, which says they came to $5.9 billion a year.

This endowment is obscene. It is four times the size of the one at Columbia University, and five times that at Cornell University. It’s 20 or 30 times the size of the endowment at almost any college outside the Ivy League.

Who on Earth is still giving this institution a nickel? And why?

Pretty much any educational establishment you can name would be a better recipient of your charitable dollars. Last year — again, from the annual report — donors gave Harvard another $1.4 billion in gifts. The year before, they also gave $1.4 billion.

To put this in context, that’s bigger than the entire endowment at, say, Brandeis University, or Colgate University, or Vassar College. One year’s gifts!

It’s twice the (alleged) net worth of the British royal family.

I’m trying to think of a single private institution that needs your money less than Harvard. You want to do some good with your $1 million or $100 million? Don’t give it to the richest institution in the world. Give it to someone who needs it. There are colleges and schools and educational charities out there crying out for nickels.

(Harvard won’t say how much it’s lost in donations since this entire crisis blew up. Apparently, we’ll have to wait until the next annual report.)

But if the donors have baffled me, the alleged behavior of the Harvard board is also confusing.

Of all the possible reasons for Claudine Gay to resign — don’t email me; I’m not getting into it — surely the worst would be that donors wanted it.

What is the point of having a $53 billion endowment if you can’t tell hedge-fund managers to go jump in the Charles River? How much more do you need?

Harvard won’t comment. Fair enough. The university also points out that Gay resigned, and was not fired. As so often in these cases, it’s never entirely clear whether someone jumped, was pushed, or jumped before they were pushed.

And let’s be clear that Gay resigned after a confluence of several things: the events on campus after the Hamas attack on Israel, her appearance before Congress last month, and accusations of plagiarism that broke a few weeks ago. It’s impossible to know exactly how much of a role pressure from donors played in relation to everything else.

But I see hedge-fund billionaire Bill Ackman is now demanding that the entire board should quit.

You know what? The best reason for them to quit en masse would be if it turned out they were kowtowing to donors — including hedge-fund managers.

Stop Trying to Maximize Your Monthly Social Security Check. Maximize This Instead.

Getting the most from Social Security is important for a lot of people. More than four out of five non-retirees expect Social Security to be a meaningful source of income in retirement, according to an annual Gallup poll.

But maximizing the size of your monthly check shouldn’t be the ultimate goal for people’s retirement plans.

Image source: Getty Images.

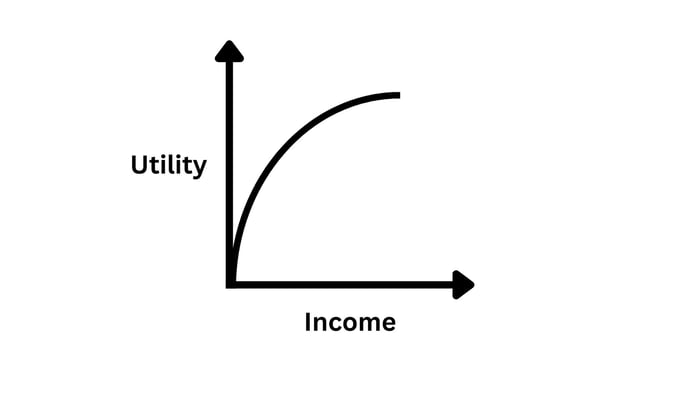

When it comes to retirement planning, individuals need to consider the impact their Social Security will actually have on their wellbeing. In economics, this concept is known as utility, or how much happiness is gained from additional money that you receive.

Here are a couple of simple examples. If someone doesn’t have enough money to take care of your basic physiological needs for shelter and food, for example, the utility of additional money you get could be extremely high. Just a small amount could mean the difference between paying the rent and facing homelessness.

By contrast, for those who have millions of dollars set aside for retirement, getting an extra dollar or two each month doesn’t really make that big a difference in their lives. In economic terms, the utility of each additional $1 is lower for wealthier people.

The graphic below shows the amount of utility an example individual derives from income. (The graph for every individual will be different, but it generally follows a similar curve.) As you can see, the first few dollars have a huge impact, but there are diminishing returns to increasing income.

Image source: Author.

If you consider how much utility your Social Security benefit can provide, you may not end up with the largest possible monthly check. You will, however, maximize how much you can enjoy your retirement.

How maximizing utility can impact when you claim Social Security

In order to maximize utility, retirees need to consider where they fall on the curve above. Someone who believes they fall closer to the left side of the curve will get a lot more utility from their Social Security check than someone who considers themselves further to the right side of the curve.

Consider someone who has to have a career-ending surgery at age 60. They didn’t get a chance to save as much as they had planned for retirement, plus they had to start withdrawing their retirement savings sooner than expected. When they get to age 62 and become eligible for Social Security, they may see a huge benefit to claiming early.

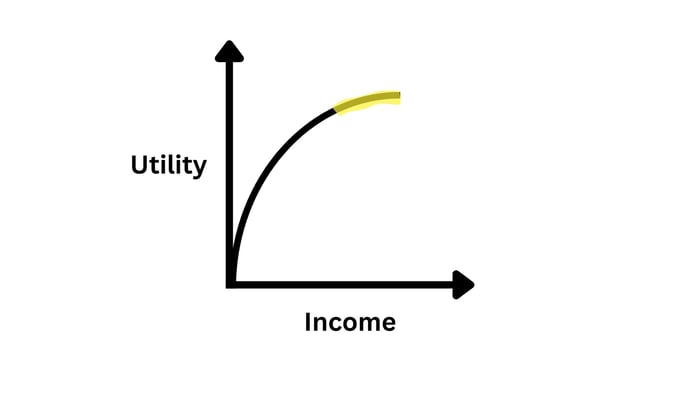

Adding Social Security to their retirement savings budget could move them along the highlighted area of the graph below.

Image source: Author.

As you can see, they move much higher on the graph by taking Social Security early. Their quality of life will improve immensely, even if it means they’ll receive less in absolute dollar terms than they would if they waited.

Now, consider someone who had a long and fulfilling career. They dutifully saved for retirement, and they’ve actually been talking to their financial advisor about estate planning and leaving money to their kids and favorite charitable organizations. They have all the money they need, and they can even go on vacations and visit their grandchildren whenever they fancy.

Claiming Social Security could move them along the following highlighted portion of the graph.

Image source: Author.

The same increase in income as the first person resulted in a much smaller increase in utility. Of course, more money is always better, but it’s going to take a lot more money than they could receive from Social Security for them to move significantly higher on the graph.

In this case, it probably makes the most sense for the person to delay Social Security as long as possible. Getting more later could give this person more money to leave to heirs or donate to charity. In the grand scheme of this person’s life, though, their Social Security decision isn’t going to make a big difference in how they live in retirement.

How to maximize utility for yourself

You’ll likely fall somewhere in between these two extremes. Only you can determine how much a monthly Social Security check will impact your life and the circumstances in which it makes sense to forego the maximum possible Social Security check you could receive.

The good news is if you decide to claim your benefits early, you have an opportunity to reverse your decision if you realize you haven’t optimized for utility. Importantly, you can only do this once per lifetime, you have to act relatively quickly, and you’ll have to pay back what you received.

If you file to withdraw your application within 12 months of your initial benefits approval and pay back what you received, you can go back to how things were. Your benefit will continue to increase each month you delay your claim.

While you may want to maximize the amount you receive every month, you shouldn’t sacrifice what could be a quality retirement in your 60s for the chance of living moderately better in your 70s.

Shares of Peloton Interactive (PTON -1.12%) hit a new all-time low on Friday. One analyst believes that the stock can head even lower in the near term.

Arpine Kocharyan at UBS is slashing her price target from $8 to $4 this week. She is sticking to her sell rating, a market call that has been particularly astute when it comes to the beleaguered connected fitness pioneer. The stock has shed nearly half of its value in 2023, down a brutal 97% from the all-time peak it reached in early 2021.

A lot has gone wrong at Peloton after the initial pandemic surge for its stock and its products. Things aren’t getting better, according to Kocharyan. After a positive trend in visits to the Peloton website in May and June, the data that she’s seeing shows traffic taking a negative turn in July and August.

Working up a sweat

The analyst cutting her price target in half on Monday doesn’t translate into a sharp drop from current levels. Falling to $4 would be just a 10% decline from the fresh lows it hit on Friday. However, Peloton didn’t exactly spark any confidence in its turnaround when it announced problematic financial results late last month.

Revenue, members, and app subscribers continue to go in the wrong direction. All three metrics clocked in with year-over-year and quarter-over-quarter declines for the fiscal Q4 that Peloton announced this summer. Losses continue. Churn rates are still high.

Image source: Peloton.

Revenue slumped a modest 5% in last month’s report, marginally better than expected. However, the top-line performance is a result of a 10% increase in subscription revenue and a 25% drop in sales of its connected fitness products. If folks aren’t making four-figure investments in new Peloton gear, it’s hard to get excited about its growth prospects given a thin pipeline of fresh walkers, runners, and bikers on its high-end equipment.

The thorny challenge for Peloton is winning its reputation back. It’s hard for a premium brand to recover its momentum once its appeal is squandered. Peloton has been on the wrong end of headlines and Hollywood storylines. Check out Peloton’s recall page and there is information about four different products with repair or replacement instructions.

There have been rare accidents with Peloton treadmills that have proven tragic for young children and pets. Earlier this month, the family of a New York man initiated a lawsuit against the connected fitness specialist over a freak accident that ended his life. A Peloton workout has factored into the scripted passing of a TV show character at least twice. Horrific accidents happen with all products, but it’s a particularly bad look for Peloton. When your market positioning is that your platform helps enhance the quality of life, you don’t want the rare mishaps amplified or turned into fodder for Hollywood writers.

Peloton is not in a good place. It’s not a coincidence that it stopped reporting its subscriber engagement metrics earlier this year. The reopening of the economy after folks were sheltering in place early in the COVID-19 crisis was great for gym stocks, but it also marked the peak for Peloton.

This workout doesn’t have to end all sweaty and messy. Peloton is a prime buyout candidate, and maybe its fortune could change under new ownership taking a fresh approach to the premium fitness brand. However, investors have been saying this all the way down over the last two years. Peloton is still tired, and like one of its stationary bikes, there’s a lot of effort going nowhere right now.

Rick Munarriz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Peloton Interactive. The Motley Fool has a disclosure policy.