PRESS RELEASE. [Singapore, Mar 22, 2024] Yala, a project that enables the seamless transfer of Bitcoin liquidity through a meta yield stablecoin, is thrilled to announce a comprehensive brand upgrade. This reflects our commitment to making Bitcoin liquidity universally accessible across blockchain ecosystems, enhancing DeFi liquidity efficiency. The upgrade includes a refreshed branding message, a […]

PRESS RELEASE. [Singapore, Mar 22, 2024] Yala, a project that enables the seamless transfer of Bitcoin liquidity through a meta yield stablecoin, is thrilled to announce a comprehensive brand upgrade. This reflects our commitment to making Bitcoin liquidity universally accessible across blockchain ecosystems, enhancing DeFi liquidity efficiency. The upgrade includes a refreshed branding message, a […]

Source link

strategic

Chainlink Labs enters into a strategic collaboration with Cointelegraph Accelerator to support Web3 startups

Cointelegraph Accelerator is excited to announce a strategic collaboration with Chainlink Labs, the primary contributing developer of the industry-standard decentralized computing platform Chainlink. This collaboration will align the Cointelegraph Accelerator and Chainlink BUILD programs, helping drive innovation and accelerate the growth of next-gen Web3 projects.

Cointelegraph Accelerator and Chainlink Labs join to empower Web3 innovation

The Cointelegraph Accelerator is a global program that supports early-stage and up-and-coming Web3 startups. As part of the collaboration with Chainlink Labs, the Cointelegraph Accelerator will provide Chainlink BUILD projects with marketing support, media strategy, social media playbooks, user acquisition guides, access to the largest industry events, and other benefits that help accelerate their growth.

On the other hand, Chainlink Labs will engage with projects under the wing of the Cointelegraph Accelerator by offering technical support, mentorship and providing access to Chainlink’s decentralized computing platform and expanding their builder communities.

The Chainlink platform can provide protocols with access to real-world data, ways to securely transfer tokens and send messages cross-chain, and leverage offchain compute.

Together, Cointelegraph Accelerator and Chainlink Labs will provide startups with technical and marketing support needed to help them find product-market fit, accelerate their growth, and securely scale their applications. According to Paul Solntsev, Head of Cointelegraph Accelerator:

“We’re excited to align the Cointelegraph Accelerator and Chainlink BUILD programs and better support projects in our ecosystem. This strategic collaboration with Chainlink Labs will help accelerate the growth of Web3 startups and drive blockchain innovation.”

About Chainlink

Chainlink is the industry-standard decentralized computing platform powering the verifiable web. Chainlink has enabled over $9 trillion in transaction value by providing financial institutions, startups, and developers worldwide with access to real-world data, offchain computation, and secure cross-chain interoperability across any blockchain.

Chainlink powers verifiable applications and high-integrity markets for banking, DeFi, global trade, gaming, and other major sectors. Learn more about Chainlink by visiting chain.link or reading the developer documentation at docs.chain.link.

About Chainlink Labs

Chainlink Labs is the primary contributing developer of Chainlink, the decentralized computing platform powering the verifiable web. Chainlink Labs is dedicated to the development and integration of Chainlink as the industry-standard platform for providing access to real-world data, offchain computation, and secure cross-chain interoperability across any blockchain.

Chainlink Labs helps power verifiable applications and high-integrity markets for banking, DeFi, global trade, gaming, and other major sectors by collaborating with some of the world’s largest financial institutions, notably Swift, DTCC, and ANZ. Chainlink Labs also works with top Web3 teams, including Aave, Compound, GMX, Maker, and Synthetix. Chainlink Labs was recently ranked in Newsweek’s 100 Most Loved Workplaces 2023 in both the United States and the United Kingdom.

Learn more about Chainlink Labs and explore open roles at chainlinklabs.com.

About Cointelegraph Accelerator

Cointelegraph Accelerator ignites the growth of promising Web3 projects by developing marketing strategies, providing advertorial media coverage, organizing workshops with mentors, and arranging participation in crypto events and introductions to Cointelegraph’s network of institutional investors, exchanges and other partners. The program focuses on Decentralized Finance (DeFi), Nonfungible Tokens (NFT), GameFi, Web3 social, as well as other segments of the broader Web3 industry.

Esports leader Team Liquid joins Illuvium for strategic blockchain game beta test

Illuvium, an Ethereum (ETH)-based decentralized gaming platform, has joined forces with Team Liquid, a globally recognized esports organization, to beta-test the early access version of its game, Illuvium: Arena, according to a Dec. 1 statement shared with CryptoSlate.

The collaboration aims to introduce blockchain gaming to a broader audience by showcasing gameplay through Team Liquid’s prominent gamers like Midbeast, SnoodyBoo, and Broxah.

Over the past years, several blockchain-based games have failed to achieve mainstream success due to their perceived inferior quality. CoinGecko research showed that three out of every four web3 games launched during the past five years have failed, with more than 2000 games failing during the reporting period.

However, Team Liquid’s Co-CEO Victor Goossens expressed confidence in Illuvium: Arena‘s detailed design and competitive nature. He said the game could help shift gamers’ perception of blockchain-based games while highlighting its focus on skill and strategy.

Illuvium’s gaming ecosystem comprises three main stages: starting with Illuvium: Zero for acquiring fuel, followed by exploration in Illuvium: Overworld, and culminating in player-versus-player (PvP) matches within Illuvium: Arena using acquired assets.

The game’s high-quality graphics and strategic depth position it as a contender against popular titles like Pokémon and Teamfight Tactics. Additionally, players can earn in-game assets convertible to real-world currency, enhancing its appeal.

Beyond game testing, users can obtain exclusive Team Liquid digital collectibles, Illuvitars, from Dec. 12, which unlock rare in-game cosmetics.

Kieran Warwick, Illuvium’s CEO, emphasized the significance of delivering exceptional gaming experiences to dispel skepticism surrounding blockchain games. He sees the collaboration with Team Liquid as a milestone, demonstrating that blockchain games, including those with NFTs, offer immersive experiences comparable to traditional games.

While the primary focus of the current partnership is game testing, Illuvium hinted at potential future tournaments within Illuvium: Arena as part of their collaboration with Team Liquid.

Barrick Gold CEO Says This Is The ‘Most Strategic’ Metal Of Them All — And It’s Not Gold

Barrick Gold Corp. (NYSE:GOLD) is one of the largest producers of gold in the world. But CEO Mark Bristow recently emphasized the importance of another metal to keep an eye on.

During an interview with CNBC, Bristow said, “My view is that copper is the most strategic metal out of all the metals.”

He pointed out that batteries are a major driver for copper demand, but there’s more to the story.

“Batteries is not a long-term solution for the future of a better planet for all,” Bristow said. “What’s really important is greening our grids, and we’ve started seeing that with big cable connections around Europe. And we’ve got to take the greener energy or renewable energy to the industrial regions. And to do that you need big cables and the only way you can transport electricity is with copper.”

Bristow noted that even if all vehicles in California became battery-powered, it wouldn’t be enough to save the planet.

“The way to really protect and leave a better planet for future generations is to develop the underdeveloped economy,” he said.

And because of copper’s critical role in development, it stands as the most strategic metal.

Check out:

How To Invest In Copper

Because of its strategic significance, copper presents potential opportunities for investors.

During the interview, Bristow said that the fundamentals of copper suggest “we’re going to be in short supply very, very soon” and “everything points to a better copper price in the future.”

If you share that view and want to invest in copper, there are several ways to go about it.

You can invest in physical copper by purchasing copper bars, coins or rounds from a metals dealer. You can invest in copper futures. Or you can buy shares of copper-mining companies such as Freeport-McMoRan Inc. (NYSE:FCX), Rio Tinto plc (NYSE:RIO) and BHP Group Ltd. (NYSE:BHP). Barrick Gold also produces copper.

Investors also can use exchange-traded funds (ETFs) to gain exposure to the metal. For instance, the United States Copper Index Fund (NYSE:CPER) is designed to be a convenient way for investors to access the returns of a portfolio of copper futures contracts.

Gold Is Not Forgotten

While highlighting copper’s value, Bristow also touched upon gold, noting that it has always been a “go-to asset.”

“Right now we have a situation in the world where there’s a question mark over whether the dollar will stand up as a reserve currency into the future,” he said.

Fitch Ratings recently downgraded the United States’ long-term foreign-currency issuer default rating from its highest AAA rating to AA+. The credit rating agency pointed to “expected fiscal deterioration over the next three years,” a “high and growing general government debt burden” and an “erosion of governance” as reasons behind the decision.

After Fitch’s downgrade, the price of gold rose about 0.6% on the news but has since pared those gains.

Bristow acknowledged that gold has been under pressure “because of the yields with the increase in interest rates on the back of inflation.” He also pointed out that the yellow metal is “one currency politicians can’t print.”

Gold has served as a store of value for thousands of years. Unlike fiat money, which can be produced in unlimited quantities by central banks, precious metals have an inherent scarcity, making them a valuable hedge against inflation.

While gold doesn’t offer a yield, new companies have innovated ways for investors to earn passive income from inflation-resistant assets. Here’s how to invest as little as $100 in a rental property while staying completely hands-off.

Read next:

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article Barrick Gold CEO Says This Is The ‘Most Strategic’ Metal Of Them All — And It’s Not Gold originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jason Lowrey’s book on the strategic significance of Bitcoin removed from circulation and MIT library for unknown reasons

Jason Lowrey, the author of Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, has withdrawn his book from public access, prompting speculation among readers and academics alike. The work, which was presented as a thesis to the System Design and Management Program at MIT in February 2023, has additionally been removed from the MIT library’s inventory.

Lowrey did not disclose reasons for this action other than to say that he was directed to remove the text from circulation. He wrote on Twitter: “For those asking what’s been going on w/me, I was ordered to take SOFTWAR down & asked to stop talking about the subject publicly. Can’t talk details but things are good & I’m working hard behind the scenes. Appreciate the kind words.”

Proof-of-work in national security

Softwar examines Bitcoin’s proof-of-work technology in the context of national security, proposing an innovative theoretical framework for considering Bitcoin’s potential strategic influence as an electro-cyber security instrument instead of viewing it strictly as a financial technology. The book posits Bitcoin as a potentially transformative tool for national security and power projection within the digital realm.

Critical reviews commended Lowrey’s fresh viewpoint, which suggested that the landscape of modern warfare is evolving towards non-physical, non-kinetic forms. Under this framework, Lowrey proposes that Bitcoin, through its proof-of-work consensus mechanism, could provide a formidable mechanism for power projection within the cyber realm, thus bolstering cybersecurity. Lowrey’s analysis emphasized Bitcoin’s potential not only as a financial technology but also as a security asset capable of protecting sensitive data and deterring cyberattacks by implementing physical costs on assailants.

The thesis, supervised by Joan Rubin, Executive Director of the System Design & Management Program, stressed the potential of Bitcoin’s proof-of-work technologies to function as a novel type of electro-cyber power projection tool. This groundbreaking idea, which he dubbed “softwar,” was considered to hold transformative potential for national strategic security in the 21st century.

The abrupt and unexplained removal of “Softwar” from the public sphere has created a cloud of unanswered queries. Lowrey’s cryptic tweet has further intensified the enigma. His innovative approach to Bitcoin and cybersecurity had begun to resonate, and his work’s disappearance from the public eye has left a palpable gap in the ongoing discussion.

At press time, Softwar had been removed from Amazon, Google shopping listings, Thriftbooks, and other major booksellers, as well as from the MIT Press site. It is still available for online viewing through the Air University library system.

The post Jason Lowrey’s book on the strategic significance of Bitcoin removed from circulation and MIT library for unknown reasons appeared first on CryptoSlate.

Ant Group’s IPO was halted in 2020 after the Chinese government intervened, citing rising concerns about the company’s growth and potential systemic threats to the financial industry.

Chinese fintech giant Ant Group, backed by billionaire Jack Ma, has made headlines with its plan to undergo a strategic restructuring and cut ties with non-core operations. This bold move is intended to streamline its business strategy and prepare it for a renewed attempt toward a possible Initial Public Offering (IPO) in Hong Kong.

Ant Group Renewing Focus on Core Business Ahead of IPO

Anonymous sources familiar with the matter told Bloomberg that the restructuring will create a separate entity for obtaining a financial holding license in China, excluding blockchain, database management services, and international business from this entity.

This entity will be streamlined to include core operations that align with China’s financial regulatory requirements. Ant Group aims to demonstrate its commitment to responsible growth and compliance, which is critical for obtaining regulatory approval.

Ant’s current foreign business comprises Alipay+, a transaction network that supports cross-border payments among several digital wallets in a variety of nations. Additionally, the company operates WorldFirst, for small firms doing cross-border commerce, and ANEXT Bank, a Singapore-based digital wholesale bank launched in 2022.

If the restructuring is successfully completed and Ant Group secures a financial holding company license in China, it can prepare for an IPO in Hong Kong. While the prospect of an IPO in Hong Kong is exciting, there are still many uncertainties. It is worth mentioning that Ant Group’s intentions have not been finalized and may change.

Navigating Regulatory Challenges

The journey of Ant Group toward its IPO has been marked by challenges and regulatory hurdles. Ant Group’s IPO was halted in 2020 after the Chinese government intervened, citing rising concerns about the company’s growth and potential systemic threats to the financial industry.

Amid the regulatory crackdown on Ant Group, the proposed restructuring plan seems to be a beacon of relief. The plan not only aims to streamline the company’s core financial operations but also offers shareholders stakes in entities left out of the main operation at a nominal price.

The report highlighted that Ant Group has, ahead of the IPO plans, received approval from shareholders to initiate a share buyback program. This program allows the corporation to repurchase up to 7.6% of its shares for an estimated $79 billion. Shareholders have until early August to decide whether to participate in the share buyback program.

Alibaba Group Holding Ltd (HKG: 9988), which owns a third of Ant Group, has decided to stay out of the buyback process. The corporation has stated its intention to keep its current share in Ant Group, highlighting the significance of its collaboration with the fintech giant.

On the other hand, some Chinese state-owned firms that previously participated in Ant Group’s funding rounds are reportedly planning to take part in the share buyback. This move signals a show of confidence in Ant Group’s long-term prospects despite the regulatory challenges it has faced.

next

Business News, IPO News, Market News, News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

LeBron James of the Los Angeles Lakers at a game against the LA Clippers at ESPN Wide World Of Sports Complex on July 30, 2020 in Lake Buena Vista, Florida.

Mike Ehrmann | Getty Images

As Disney considers a strategic partner for ESPN, Chief Executive Officer Bob Iger and ESPN head Jimmy Pitaro have held early talks about bringing professional sports leagues on as minority investors, including the National Football League, National Basketball Association and Major League Baseball, according to people familiar with the matter.

ESPN has held preliminary discussions with the NFL, NBA and MLB about a variety of new partnerships and investment structures, the people said. In a statement, an NBA spokesperson said, “We have a longstanding relationship with Disney and look forward to continuing the discussions around the future of our partnership.”

Spokespeople for ESPN, the NFL and MLB declined to comment.

Talks with the NFL have occurred in conjunction with the league’s own desire for a company to take a stake in its media assets, including the NFL Network, NFL.com and RedZone, said the people, who asked not to be named because the talks have been private.

The NBA and Disney have broached many potential structures around a renewal of media rights, the people said. Disney and Warner Bros. Discovery have exclusive negotiating rights with the NBA until next year.

Iger said last week in an interview with CNBC’s David Faber that Disney is looking for a strategic partner for ESPN as it prepares to transition the sports network to streaming. He didn’t elaborate on what exactly that meant beyond saying a partner could bring additional value with distribution or content. He acknowledged selling a stake in the business was possible.

Disney owns 80% of ESPN. Hearst owns the other 20%.

“Our position in sports is very unique and we want to stay in that business,” Iger said to Faber. “We’re going to be open minded about looking for strategic partners that could either help us with distribution or content. I’m not going to get too detailed about it, but we’re bullish about sports as a media property.”

Theoretically, a jointly owned subscription streaming service among multiple leagues could eventually give consumers new packages of games and other innovative ways to take in content.

The move would be a logical one for Disney as it tries to move past the traditional cable subscriber model and underscores how badly the company wants to find a solution for the sports network as its linear subscribers decline. Still, ESPN ratings have climbed in recent years on major sporting events. There’s no better partner for sports content than the leagues, themselves.

Superficially, it may make less sense for the NBA, NFL and MLB which sign lucrative media rights deals with many media partners that fuel team revenue and player salaries with a range of media companies.

Professional sports leagues could face conflicts of interest if they take a minority stake in ESPN. Owning a stake in ESPN may irritate Disney’s competitors, such as Comcast‘s NBCUniversal, Fox, Amazon, Paramount Global and Apple, who help make the leagues billions of dollars by participating in bidding wars for sports rights. Taking an ownership stake in ESPN could give leagues the incentive to boost the value of that entity rather than striking deals with competitors.

There would also be hurdles for Disney. ESPN also employs hundreds of journalists that cover the major sports leagues. Selling an ownership stake to the leagues could cloud the perception of objectivity for ESPN’s reporting apparatus.

Still, the leagues are already business partners with ESPN. It’s possible ESPN could put measures in place to ensure reporters can continue to cover the leagues while minimizing conflicts, but it adds another layer of complexity to any deal.

A streaming-first ESPN

ESPN is trying to forge a new path as a digital-first, streaming entity. Disney realizes ESPN won’t be able to make money like it previously has in a traditional TV model.

Selling a minority stake in ESPN to the leagues could mitigate future rights payments, allowing Disney to better compete with the big balance sheets of Apple, Google and Amazon. It would also guarantee ESPN a steady flow of premium content from the leagues.

Until last quarter, Disney’s bundle of linear TV networks still had revenue growth because affiliate fee increases to pay-TV providers — largely driven by ESPN — made up for the millions of Americans who cancel cable each year. That trend finally ended last quarter, according to people familiar with the matter. Accelerating cancellations have now overwhelmed fee increases, and linear TV revenue outside of advertising has begun to decline.

“A lot has been said about renting [sports right] versus owning,” Iger said last week in his CNBC interview. “If you can rent it and continue to be profitable from renting, which we have been and we believe we will continue to be, then there’s value in staying in it. We have great relationships with Major League Baseball, and the National Hockey League, and various college conferences, and of course the NFL and the NBA. It’s not just about the live sports coverage of those leagues, those teams, it’s also about all of the shoulder programming it throws off on ESPN and what you can do with it in a streaming world.”

ESPN would like to morph itself into a streaming hub for all live sports. Management would like to launch a feature allowing ESPN.com or the ESPN app to funnel users to games no matter where they stream, CNBC reported earlier this year.

While striking a deal with professional sports leagues wouldn’t be easy, Disney appears to be pushing the envelope on its thinking to prepare for a streaming-dominated world that includes its full portfolio of sports rights.

“If [a partner] comes to the table with value, whether it’s content value, distribution value, whether it’s capital, whether it just helps derisk the business — that wouldn’t be the primary driver — but if they come to the table with value that enables ESPN to make a transition to a direct-to-consumer offering, we’re going to be very open minded about that,” Iger said.

WATCH: Disney CEO Bob Iger talks to CNBC’s David Faber about ESPN and its future

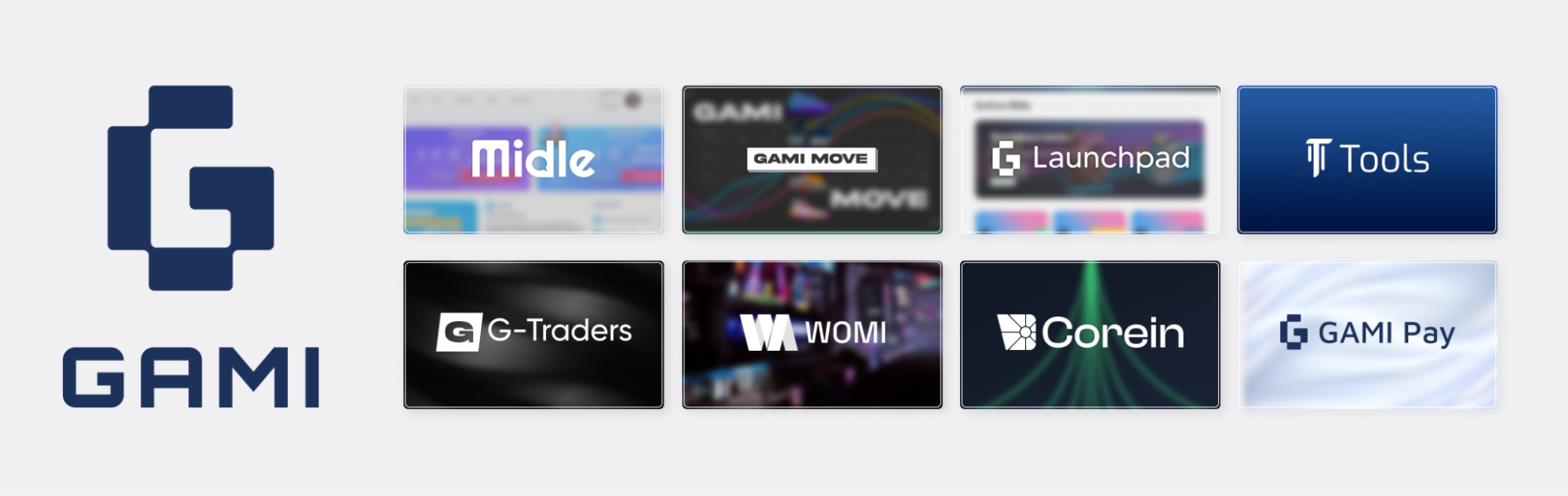

Cointelegraph Accelerator welcomes Web3 venture builder GAMI as a strategic partner

Cointelegraph Accelerator, the startup booster leveraging Cointelegraph’s media capabilities, has announced GAMI — a Web3 Venture Builder — as its new strategic partner.

The blockchain and crypto ecosystems are expanding into a much broader universe with the rise of Web3. With decentralization as a core value, Web3 brings more utility and use cases for blockchain-based technologies in a user-centric environment. Although initiated by decentralized finance (DeFi), Web3 offers a much broader spectrum of digital interactions and experiences, including nonfungible tokens (NFTs), loyalty programs, action-to-earn and gaming.

Cointelegraph Accelerator’s newest strategic partner GAMI works as Venture Builder with many products focused on DeFi and Web3, including the data-based marketing platform Midle, the move-to-earn app GAMI Move and the blockchain-based crowdfunding platform GAMI Launchpad. Together with several other projects in the pipeline, they form the GAMI World ecosystem, which uses GAMI as its native utility token. Launched in October 2021, the GAMI token offers various utilities on all platforms in the GAMI World ecosystem. GAMI has more than 40,000 users, including token holders and project participants. Last year, GAMI announced its partnership with the major Turkish soccer team Galatasaray SK.

Founded by a team of senior executives coming from the capital markets and the startup landscape and with over 20 years of experience, GAMI aims to build its Web3 ecosystem with a wide range of decentralized apps (DApps) and DeFi services. GAMI currently has three active platforms. The GAMI World ecosystem will continue to expand with other products in the near futured.

As the first platform of the GAMI World ecosystem, Gami Launchpad includes the latest initial DEX offers (IDO) and initial NFT offers (INO) to track and participate in new projects.

The GAMI World ecosystem consists of many web3 and blockchain applications. GAMI, the native utility token of the ecosystem, provides various utilities to users on these platforms. Source: Gami

GAMI Move, the ecosystem’s second platform, is a move-to-earn App where users who own GAMI Move NFTs can earn GAMI tokens by walking through the GAMI Move Mobile App.

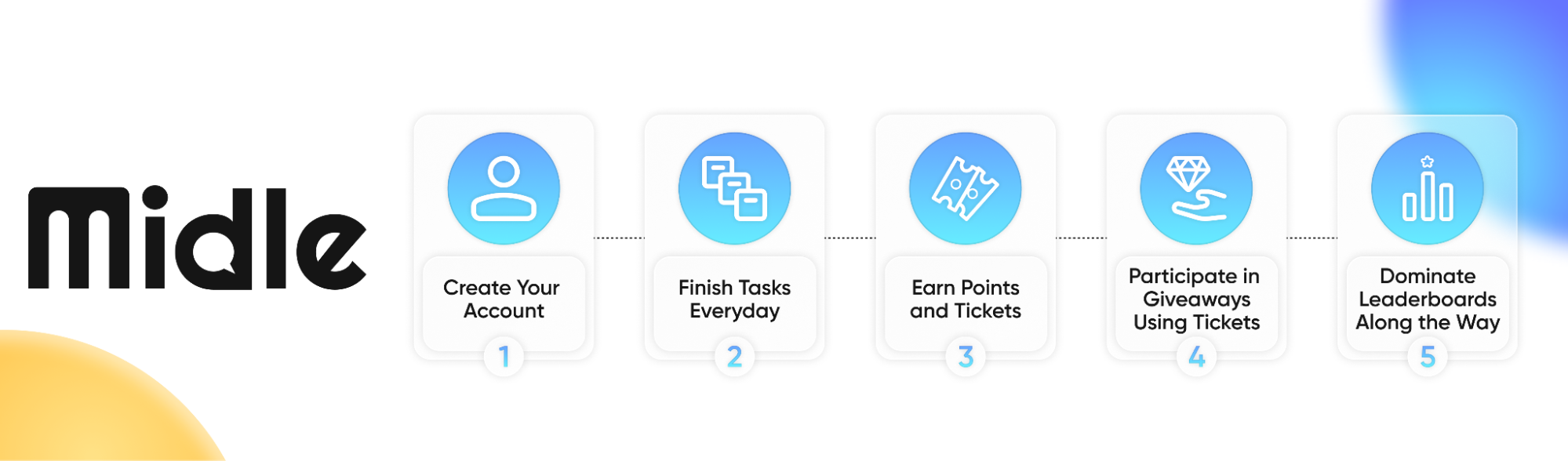

To push Web3 adoption even further, GAMI also launched Midle.io, a Web3-based marketing tool that brings together projects, influencers, DeFi and crypto communities, and users. Midle.io users can collect points by completing tasks and earn rewards according to their progress. The goal of the platform is to create a sustainable and effective crypto marketing method and to strengthen the loyalty between users and projects.

How does Midle.io work? Source: Midle.io

The Cointelegraph Accelerator program empowers promising Web3 projects and startups by helping them tap into Cointelegraph’s global audience and established leadership in the media landscape. The program selected Gami as its strategic partner to help the latter build an ecosystem of services with a growing community. Together with Cointelegraph Accelerator, GAMI aims to become a unicorn, with a focus on scaling its product suite globally.