PRESS RELEASE. February 15, 2024, London, UK — In a remarkable story one Bitcasino.io player has won a huge jackpot and another big win in the space of a few weeks, earning a massive $4.5 million dollars. Bets were placed in USDT cryptocurrency, with joy found in a Max Win, followed by a Big Win […]

PRESS RELEASE. February 15, 2024, London, UK — In a remarkable story one Bitcasino.io player has won a huge jackpot and another big win in the space of a few weeks, earning a massive $4.5 million dollars. Bets were placed in USDT cryptocurrency, with joy found in a Max Win, followed by a Big Win […]

Source link

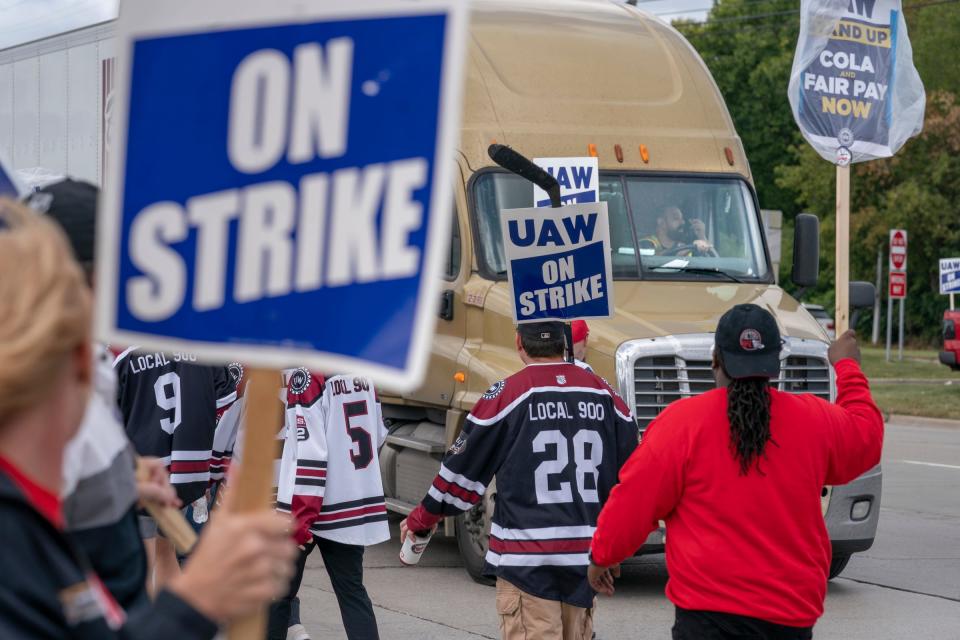

Strikes

Crypto community questions Strike’s reported denial of alleged security breach

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Auto suppliers say if UAW strikes expand to more plants, it could mean the end for many

Pat Green is nervous. He has spent the past two years trying to hire talented people to fill the two plants in Grand Rapids operated by Cascade Die Casting Group, which makes aluminum and zinc diecasting for the automotive and appliance industries.

“We’ve got a good team now and I don’t want to lose people because it was hard to find good people,” Green, who is CEO of the company, told the Detroit Free Press, part of the USA TODAY Network, on Monday.

That’s why on the fourth day of a historic United Auto Workers strike against the Detroit Three automakers, Green was intensely planning for ways to ride it out without having to lay off workers if the strike grows and stretches into weeks. He has good reason for planning. On Monday night, UAW President Shawn Fain announced a new strike deadline of this Friday at noon. If Ford Motor Co., General Motors or Stellantis have not made substantial progress toward an agreement with the UAW by that time, Fain will expand the Stand Up Strike to more plants.

‘If not now, when?’ Here’s why the UAW strike may have come at the perfect time for labor

For Green’s part, if that happens, he’ll start by ending overtime at the company and then he’ll ask for volunteers to take some time off with a reduced pay plan. It’s something he started contemplating late last week.

The UAW’s strike started at 11:59 p.m. Thursday when nearly 13,000 UAW workers across the three Detroit automakers walked out of three plants as part of the first wave of shutdowns until a new labor agreement is reached. Those plants are Ford Michigan Assembly Plant (Final Assembly and Paint only) in Wayne, Stellantis Toledo Assembly Complex in Ohio and GM’s Wentzville Assembly in Missouri.

If the union and the automakers can’t reach a tentative agreement, at some point the UAW has said it plans to strike more plants across the three companies. A broader and prolonged strike would mean parts suppliers couldn’t keep production going if the vehicle assembly plants that use their parts are idled. No one is sure of just how long suppliers could hold out.

See the picket lines: UAW launches a strike, targeting three Detroit automakers

“We’re in better shape than most, but if others in the supply chain go down, we’ve got another crisis on our hands just like the chips crisis,” Green said, referring to a recent shortage of semiconductor chips that crippled the industry. “If this stretches out to five or six weeks, there’s going to be real problems in the supply chain. And I could be wrong; it could be shorter than that.”

The first fallout

The Biden administration has been preparing to offer emergency economic aid to auto suppliers to mitigate any long-term damage caused by a prolonged strike, according to published reports.

But the strike has already had some impact. A component maker in Michigan, CIE Newcor, warned it may have to lay off 293 people.

German-based supplier ZF said that it has already had to lay off some workers at various sites, including in Michigan, said Tony Sapienza, ZF North America, Inc.’s head of communications. ZF supplies components for all the vehicles made at the three plants targeted so far in the strike, including the hybrid transmission to the Jeep Wrangler 4xe hybrid made at the Toledo facility.

Sapienza declined to say which of ZF’s facilities have been affected or how many people ZF has laid off. ZF, which has North American offices in Northville, employs 11,000 people at five manufacturing sites and four technology centers in Michigan.

“The impact was immediate; we’ve had to slow production in a couple of areas,” Sapienza told the Free Press. “If the strike were to broaden or last anything longer than one or two weeks, that would be a crisis for the supply chain. I’d be really concerned with tier 2 and tier 3 and their ability to stay solvent.”

Sapienza said a bigger and prolonged strike “would hurt” his company, but because of its size, it would be OK.

But “every plant that goes offline creates additional stress in the supply chain, and we really hope our customers and the UAW are taking this into consideration,” Sapienza said.

U.S. Steel said Monday it is temporarily idling furnace B at the Granite City steel plant in Illinois as a “risk mitigation” in response to the UAW strike. The company said it is evaluating how many of its 1,450 employees there will be affected.

Keeping an eye on Unifor, too

All of this news comes as the UAW’s counterpart in Canada, Unifor, is negotiating a new contract with Detroit automakers as well. Its current contract was slated to expire at 11:59 p.m. Monday. But in the early hours Tuesday morning, Unifor said it would keep talking with Ford, after the automaker made a “substantive offer” on a new labor contract as the former deal expired. Unifor is extending negotiations for a 24-hour period.

Unlike the UAW, Unifor is following tradition and has selected a target company — Ford — to negotiate a deal with first. It would use that agreement as a template for contracts with the other two. In the U.S., the UAW is negotiating with all three automakers separately, but simultaneously.

Around 4 p.m. Monday, Unifor National President Lana Payne said there was still no tentative agreement with Ford.

“While we remain at the table the likelihood of a strike increases with each passing hour,” Payne said, adding that the union has advised more than 5,600 members at Ford facilities in Canada to prepare for all scenarios, including a strike.

After Ford’s eleventh-hour “substantive offer,” Unifor said it would negotiate through the night, but members should continue to maintain strike readiness.

If Unifor does not get a tentative agreement and strikes in solidarity with the UAW, that will be a double whammy for parts suppliers.

“These are not normal times,” Sapienza said. “We’re coming off of three years of stress on the supply chain and so we’re already in a fragile state. We’re keeping an eye on Unifor, for sure. … There’s only so much more stress the system can take.”

Layoffs could go into the thousands

The state of the supply chain is delicate. That’s because it has had to recover from the COVID-19 pandemic, which shut down the industry for eight weeks, then suppliers faced a massive shortage of semiconductor chips used in a variety of car parts. Since early last year, many suppliers have struggled to hire and retain workers.

Joe Petrillo, director of business development and advanced engineering at Meridian Lightweight Technologies in Plymouth, said the company is a global supplier of lightweight cast metal parts to many automakers including the Detroit Three. So the strike is a concern because of the interconnection of the supply chain from the tier 1 suppliers — those that supply parts directly to the carmakers — down to the smaller tier 2 and tier 3 suppliers, those who supply components to the tier 1 group.

“We are monitoring the events and checking in with our suppliers and customers,” Petrillo said. “In our view, an escalation of events that leads to a prolonged strike that possibly idles all the Detroit Three (manufacturing) plants, may prove to be the last Jenga block on a supply base that has been stressed to the max, having to overcome COVID shutdowns, ‘stop-and-go production’ due to chip and part shortages, while still trying to work its way through a constrained manufacturing labor market.”

Glenn Stevens, executive director of MICHauto, the group that advocates for the statewide automotive industry, said he has been talking to suppliers for a couple months and they have all been preparing for a strike scenario for some time.

“Some much more proactively than others, but nobody was flying blind anticipating that there might not be a work stoppage,” Stevens said.

There are about 1,000 supplier facilities in Michigan, he said, noting that 96 of the top 100 suppliers to the North American auto market either have their headquarters or a facility in Michigan. So if the strike expands to other automaker plants and lasts into weeks, the job layoffs could reach into tens of thousands.

“You have the direct employment and you have the multiplier affect of each of the automotive jobs and that is between six to 10 people for every one automaker job, so it’s substantial,” Stevens said. “This is the largest industry in our economy. It has an economic contribution of over $300 billion annually to the state of Michigan.

The potential impact

The larger suppliers are likely more protected than the smaller ones from strike fallout, said Laurie Harbour, CEO of Harbour Results, Inc. That’s because they often have other customers from other industries to keep business going. They can move people around and change up schedules to avoid massive layoffs.

“I talked to several companies last Friday and most said little to no impact yet,” Harbour said. “Any one program, which is what you’re looking at with the (automakers), is not going to create massive layoffs but come tomorrow or the next day if (UAW’s Fain) closes more plants and we get to a significant product like the (Ford) F-150 pickup, then you’re going to see more layoffs.”

Because the sales volume of the F-150 is so important, if the union were to strike the plants that build Ford’s big seller, “you’ll see thousands of layoffs because you have so many supplier plants and sub-suppliers,” Harbour said.

“The fact that it’s happening in this spotty fashion is actually better for the supplier community,” Harbour said. “But every day or week that goes by you could see more and more layoffs.”

Big auto suppliers react

At giant tier 1 auto supplier Magna International, leaders are closely monitoring the situation, said Dave Niemiec, Magna spokesman. The company has about 12,450 employees in Michigan. Niemiec said it is premature to comment on any specific impact the strike may have on its operations.

“However, we have focused considerable attention on contingency planning to proactively address any temporary business disruptions to our operations,” Niemiec said. “If that time comes, we are prepared in terms of temporarily scaling back production on affected programs as efficiently as possible, while being equally prepared to ramp up quickly when ready. In the meantime, we remain hopeful that the parties will be able to reach amicable agreements and the disruption and potential impact will be minimal.”

When asked of any impact from the strike on Lear, spokesman Brian Corbett said, “At this time, we’re not commenting on the UAW strike.”

‘We have to take action’

Harbour said most suppliers she’s talked to are prepared or at least forming plans if the strike grows that include considering how to effectively keep producing, make scheduling changes to their shifts and have layoff strategies in place, even offering supplemental pay up to 70% of workers’ salaries if they are laid off.

“Those are the ones who are financially strong and don’t want to lose their people,” Harbour said. “It’s a daily challenge and you’ll evaluate everything every day: What is my forecast? What can I deliver to my customer? And run a little bit of inventory so that when the spigot comes back on, I have parts and ready to go.”

At Cascade Die Casting Group, Green said the company makes parts for the Detroit Three’s SUVs and pickups. For example, it makes parts for the Jeep Grand Cherokee that Stellantis builds at the Mack Avenue Assembly Plant in Detroit. If the UAW strikes that plant or any of the plants that make the Detroit Three’s heavy duty pickups, Green has to be ready.

Contact Jamie L. LaReau: jlareau@freepress.com. Follow her on X, formerly Twitter: @jlareauan.

This article originally appeared on Detroit Free Press: UAW strikes: Auto suppliers warn of closures if more plants involved

US SEC Strikes against Ceffu Wallet as Binance-Affiliate in Motion against BAM

The US SEC has reaffirmed its claims of undeniable ties between wallet provider Ceffu and Binance in its recent motion against BAM, the parent company of Binance.US.

In its recent motion against BAM, the parent company of Binance.US, the US Securities and Exchange Commission (SEC) has reaffirmed that wallet provider Ceffu has undeniable ties to Binance. These allegations contradict Binance’s prior assertions in court documents.

This redacted filing reiterates the SEC’s position that Binance’s plea for a protective order to shield itself from the SEC’s investigation holds no merit. As a result, the securities regulator has strongly urged the court to reject this request.

Binance had originally submitted this request to the US District Court for the District of Columbia on August 14, characterizing the SEC’s investigation as a “fishing expedition.” In this latest filing, the SEC characterizes Binance’s response to its lawsuit from June as “a labyrinthine maze of distortions.”

In a memorandum filed in the court last week on September 14, the SEC officials raised concerns regarding the Ceffu wallet. The SEC said that Ceffu “appears to have control of Customer Assets”. The Ceffu wallet is basically the rebranded version of the Binance wallet.

In its filing on Monday, September 18, the US SEC responded to Binance’s alleged resistance to the SEC investigation. The securities regulator noted:

“The limited inspection the SEC has been able to conduct so far demonstrates the urgent need for an inspection. [redacted] The Court should order the inspection the SEC seeks as set forth in its Motion to Compel.”

SEC’s Allegations against BAM

The SEC’s filing on September 18th delineated BAM’s claim that Binance is merely a third-party vendor, providing wallet software services analogous to BAM’s internet service provider. Consequently, according to BAM, it doesn’t have knowledge of Binance’s operational intricacies. Countering this, the US SEC noted:

“Far from being a mere innocuous service provider, however, Binance and BAM are under the common ownership of another Defendant in this action, an individual who views himself outside the jurisdiction of any court.”

The SEC is additionally pursuing depositions from former Binance.US CEO Brian Shroder and Chief Financial Officer Jasmine Lee. Binance.US has argued that their testimony would cause disruptions to BAM’s business. Schroder’s departure, along with substantial layoffs, was reported on September 13.

Binance’s efforts to curtail the SEC’s investigative activities triggered a series of reciprocal court filings. A hearing scheduled for the afternoon of September 18, Washington D.C. time, is expected to resolve this issue.

next

Binance News, Blockchain News, Cryptocurrency News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

You have successfully joined our subscriber list.

Robinhood strikes deal with U.S. Marshal Service to buy back shares seized from Sam Bankman-Fried

Robinhood‘s proposed deal to repurchase shares seized from Sam Bankman-Fried by the U.S. Marshal Service (USMS) has been approved by a federal court in the Southern District of New York.

As a result, Robinhood will be allowed to buy back shares seized from Bankman-Fried’s Emergent Fidelity Technologies for $605.7 million, according to a statement released by the company.

After FTX and Emergent filed for bankruptcy protection last year, the U.S. government took custody of Bankman-Fried’s Robinhood shares. In February, Robinhood announced its plan to repurchase the stake.

Cash, stocks, and crypto

According to the agreement, Robinhood will buy back 55.3 million shares at $10.96 each, utilizing corporate cash from its balance sheet, which featured over $6 billion in cash and investments as of its latest quarterly report.

Bankman-Fried, who previously held a 7.6% stake in Robinhood, had expressed no intentions of gaining control over the trading platform. He had voiced enthusiasm about Robinhood’s business prospects, hinting at potential partnerships with the platform. However, the sudden bankruptcy of FTX led to the seizure and dissolution of his fortune, which was once estimated to be around $26 billion.

The FTX founder sought to retain ownership of Robinhood shares worth $450 million. He vehemently disputed the bankrupt exchange’s “legal claims” over the assets, insisting that he and Gary Wang were the primary holders of the shares, not Alameda Research or any other entities implicated in the FTX bankruptcy.

Robinhood has demonstrated robust strength within the crypto market, underlined by its substantial holdings in Bitcoin (BTC) and Ethereum (ETH). According to reports by Arkham Intelligence, Robinhood holds the fifth-largest wallet on Ethereum, amounting to $2.54 billion in ETH and more than 100 ERC-20 tokens collectively valued at over $177 million.

The trading app company also owns the third-largest Bitcoin wallet globally, holding about $3 billion worth of BTC.

What’s at stake for workers and their rights amid ‘summer of strikes’

Writers Guild of America and Screen Actors Guild members and supporters on a picket line outside Paramount Studios in Los Angeles on July 17, 2023.

Bloomberg | Bloomberg | Getty Images

The recent wave of worker strikes have ushered in a new era: the “summer of strikes,” also known as hot strike summer.

Employees at UPS, Amazon, Starbucks and entertainment companies across Hollywood have walked off the job or threatened to do so over the last few months in an effort to pressure their bosses to improve conditions and pay them more.

More than 200 strikes have occurred across the U.S. so far in 2023, involving more than 320,000 workers, compared with 116 strikes and 27,000 workers over the same period in 2021, according to data by the Cornell ILR School Labor Action Tracker.

“Workers have more bargaining power given the strength of the economy,” said Harry Katz, a professor at Cornell University.

More from Personal Finance:

5 U.S. metro areas with the highest single-family rents

Many feel trapped in their homes by their mortgages

How to apply for Biden’s new SAVE student loan plan

Employees who withhold their labor can face a number of consequences, including losing their job and health insurance, experts said. As a result, they should learn their protections.

“Strikes are a powerful tool for exercising power, but because our labor law is so weak it comes with great risk for workers,” said Sharon Block, a professor at Harvard Law School and the executive director of the Center for Labor and a Just Economy.

Here’s what to know.

Workers typically have the right to strike

The National Labor Relations Act of 1935 codified the right to strike into law. As a result, all workers covered by the NLRA have the right to participate in lawful strikes, Block said.

What is a lawful strike?

The National Labor Relations Board defines two classes of lawful strikers: those protesting unfair labor practices at their workplace and those who are fighting its economic conditions.

“If workers are standing together in a strike for better wages and working conditions, they should feel confident that their strike is protected,” Block said.

That includes workers who are not in unions, she added, “as long as they act collectively.”

That last part is important.

“Strikes have to be ‘collective action’ to be protected,” said Kenneth Dau-Schmidt, a law professor at Indiana University Bloomington. “Generally that means you have to do it as a group.”

Two people can constitute a group, he said, but “the larger, the better.”

Even then, there are exceptions.

Those in the private sector covered by the Railway Labor Act, which includes most railway and airline employees, are subject to that law rather than the NLRA.

“Workers covered by the Railway Labor Act are also allowed to strike, but there are many more obstacles and procedures for them to get through before they can strike,” Dau-Schmidt said.

“The RLA system is set up to facilitate mediation and presidential or congressional intervention before a strike, so big railway strikes are rare,” he added.

Most government employees are prohibited from striking in the U.S. Only a handful of states — about eight — have passed their own laws permitting certain public sector workers to strike.

Meanwhile, Dau-Schmidt said: “No state allows police or firefighters to strike.”

Strikers can be replaced in many cases

Under the NLRA, workers can’t be fired or discriminated against for participating in a strike.

However, economic strikers can be permanently replaced if their employer hires someone else to do their job, Dau-Schmidt said: “Permanent replacement looks a lot like firing from the employees’ perspective.”

Strikers must be offered a position vacated by their replacement before anyone else is hired, though, Block said.

UPS reached a tentative agreement to renew a five-year labor contract with the Teamsters ahead of a July 31, 2023 deadline, averting a costly strike.

Bloomberg | Bloomberg | Getty Images

“Strikers just have to make an unconditional offer to return and wait for an opening,” she said.

If workers were on strike due to unfair labor practices, they may have a right to reinstatement, but that process, Dau-Schmidt said, “can often take a long time and people often move on to other jobs.”

And employees “can never be sure their strike will be found to be an unfair labor practice strike,” he cautioned.

Pay and health insurance is ‘a real problem’

Workers who go on strike generally lose their wages, Dau-Schmidt said. “If you don’t work, you don’t get paid.”

Yet if the strike was over unfair labor practices, which was caused by violations of the law by their employer, they may qualify for back pay, he added.

Strikes have to be ‘collective action’ to be protected. Generally that means you have to do it as a group.

Kenneth Dau-Schmidt

law professor at Indiana University Bloomington

Economic strikers typically also get their other workplace benefits, including health insurance, nixed.

“Health insurance is a real problem,” Dau-Schmidt said. “Employers can suspend or end coverage.”

But, he said, “sometimes employers won’t kick employees off of the health insurance right away because it escalates the conflict and almost ensures an unhappy ending.”

Some states offer unemployment benefits to strikers

There is no federal law guaranteeing workers on strike jobless benefits, said Michele Evermore, a senior fellow at The Century Foundation.

But two states — New York and New Jersey — provide some unemployment coverage to strikers.

There is also a bill working its way through the Massachusetts Legislature that would offer unemployment benefits to those who have been on strike over a labor dispute for 30 days or more.

“States have the right to decide that they do not want to see striking workers and their families go hungry while they are fighting for a fair work contract,” Evermore said.

Striking Writers Guild of America (WGA) members walk the picket line in front of Netflix offices as SAG-AFTRA union announced it had agreed to a ‘last-minute request’ by the Alliance of Motion Picture and Television Producers for federal mediation, but it refused to again extend its existing labor contract past the 11:59 p.m. Wednesday negotiating deadline, in Los Angeles, California, July 12, 2023.

Mike Blake | Reuters

Traditional TV is dying. Ad revenue is soft. Streaming isn’t profitable. And Hollywood is practically shut down as the actors and writers unions settle in for what is shaping up to be a long and bitter work stoppage.

All of this turmoil will be on investors’ minds as the media industry kicks off its earnings season this week, with Netflix up first on Wednesday.

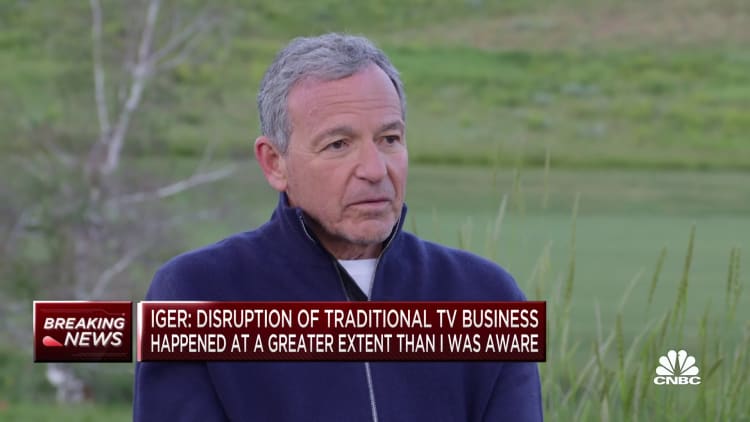

Netflix, with a new advertising model and push to stop password sharing, looks the best positioned compared with legacy media giants. Last week, for instance, Disney CEO Bob Iger extended his contract through 2026, telling the market he needed more time at the Mouse House to address the challenges before him. At the top of the list is contending with Disney’s TV networks, as that part of the business appears to be in a worse state than Iger had imagined. “They may not be core to Disney,” he said.

“I think Bob Iger’s comments were a warning about the quarter. I think they are very worrying for the sector,” said analyst Michael Nathanson of SVB MoffettNathanson following Iger’s interview with CNBC’s David Faber on Thursday.

Although the soft advertising market has been weighing on the industry for some quarters now, the recent introduction of a cheaper, ad-supported option for services like Netflix and Disney+ will likely be one bright spot as one of the few areas of growth and concentration this quarter, Nathanson said.

Iger has talked at length in recent investor calls and Thursday’s interview about how advertising is part of the plan to bring Disney+ to profitability. Others, including Netflix, have echoed the same sentiment.

Netflix is scheduled to report earnings after the close Wednesday. Wall Street will be keen to hear more details about the rollout of its password sharing crackdown in the U.S. and state of its newly launched ad-supported option. The company’s stock is up nearly 50% this year, after a correction in 2022 that followed its first subscriber loss in a decade

Investor focus will also be on legacy media companies like Paramount Global, Comcast and Warner Bros. Discovery, which each have significant portfolios of pay-TV networks, following Iger’s comments that traditional TV “may not be core” to the company and all options, including a sale, were on the table. These companies and Disney will report earnings in the weeks ahead.

Strike woes

Scene from “Squid Game” by Netflix

Source: Netflix

Just a week ahead of the earnings kickoff, members of The Screen Actors Guild – American Federation of Television and Radio Artists joined the more than 11,000 already striking film and television writers on the picket line.

The strike – a result of the failed negotiations with the Alliance of Motion Picture and Television Producers – brings the industry to an immediate halt. It’s the first dual strike of this kind since 1960.

The labor fight blew up just as the industry has moved away from streaming growth at all costs. Media companies saw a boost in subscribers – and stock prices – earlier in the Covid pandemic, investing billions in new content. But growth has since stagnated, resulting in budget cuts and layoffs.

“The strike happening suggests this is a sector in tremendous turmoil,” said Mark Boidman, head of media and entertainment investment banking at Solomon Partners. He noted shareholders, particularly hedge funds and institutional investors, have been “very frustrated” with media companies.

Iger told CNBC last week the stoppage couldn’t occur at a worse time, noting “disruptive forces on this business and all the challenges that we’re facing,” on top of the industry still recovering from the pandemic.

These are the first strikes of their kind during the streaming era. The last writers strike occurred in 2007 and 2008, which went on for about 14 weeks and gave rise to unscripted, reality TV. Hollywood writers have already been on strike since early May of this year.

Depending on the longevity of the strike, fresh film and TV content could dry up and leave streaming platforms and TV networks – other than library content, live sports and news – bare.

For Netflix, the strikes may have a lesser effect, at least in the near term, Insider Intelligence analyst Ross Benes said. Content made outside the U.S. isn’t affected by the strike — an area where Netflix has heavily invested.

“Netflix is poised to do better than most because they produce shows so well in advance. And if push comes to shove, they can rely on international shows, of which they have so many,” said Benes. “Netflix is the antagonist in the eyes of strikes because of how it changed the economics of what writers get paid.”

Traditional TV doom

The decline of pay-TV subscribers, which has ramped up in recent quarters, should continue to accelerate as consumers increasingly shift toward streaming.

Yet, despite the rampant decline, many networks remain cash cows, and they also supply content to other parts of the business — particularly streaming.

For pay-TV distributors, hiking the price of cable bundles has been a method of staying profitable. But, according to a recent report from MoffettNathanson, “the quantity of subscribers is falling far too fast for pricing to continue to offset.”

Iger, who began his career in network TV, told CNBC last week that while he already had a “very pessimistic” view of traditional TV before his return in November, he has since found it’s even worse than he expected. The executive said Disney is assessing its network portfolio, which includes broadcaster ABC and cable channels like FX, indicating a sale could be on the table.

Paramount is currently considering a sale of a majority stake in its cable-TV network BET. In recent years Comcast’s NBCUniversal has shuttered networks like NBC Sports and combined sports programming on other channels like USA Network.

“The networks are a dwindling business, and Wall Street doesn’t like dwindling businesses,” said Nathanson. “But for some companies, there’s no way around it.”

Making matters worse, the weak advertising market has been a source of pain, particularly for traditional TV. It weighed on the earnings of Paramount and Warner Bros. Discovery in recent quarters, each of which have big portfolios of cable networks.

Advertising pricing growth, which has long offset audience declines, is a key source of concern, according to MoffettNathanson’s recent report. The firm noted that this could be the first nonrecessionary year that advertising upfronts don’t produce increases in TV pricing, especially as ad-supported streaming hits the market and zaps up inventory.

Streamers’ introduction of cheaper, ad-supported tiers will be a hot topic once again this quarter, especially after Netflix and Disney+ announced their platforms late last year.

“The soft advertising market affects everyone, but I don’t think Netflix is as affected as the TV companies or other established advertising streamers,” said Benes. He noted while Netflix is the most established streamer, its ad tier is new and has plenty of room for growth.

Advertising is now considered an important mechanism in platforms’ broader efforts to reach profitability.

“It’s not a coincidence that Netflix suddenly became judicious about freeloaders while pushing a cheaper tier that has advertising,” said Benes, referring to Netflix’s crackdown on password sharing. “That’s pretty common in the industry. Hulu’s ad plan gets more revenue per user than the plan without advertising.”

Are more mergers coming?

Although the Federal Trade Commission appealed the ruling, bankers took it as a win for deal-making during a slow period for megadeals.

“This was a nice win for bankers to go into board rooms and say we’re not in an environment where really attractive M&A is going to be shot down by regulators. It’s encouraging,” said Solomon Partners’ Boidman.

As media giants struggle and shareholders grow frustrated, the judge’s ruling could fuel more deals as “a lot of these CEOs are on the defensive,” Boidman added.

Regulatory roadblocks have been prevalent beyond the Microsoft deal. A federal judge shut down book publisher Penguin Random House’s proposed purchase of Paramount’s Simon & Schuster last year. Broadcast station owner Tegna scrapped its sale to Standard General this year due to regulatory pushback.

“The fact that we are so focused on the Activision-Microsoft deal is indicative of a reality that deal-making is going to be an enormous tool going forward to solidify market position and jump your company inorganically in ways you couldn’t do yourself,” said Jason Anderson, CEO of Quire, a boutique investment bank.

These CEOs won’t just do a deal to do a deal. From this point forward, it will take a higher bar to consolidate.

Peter Liguori

former Tribune Media CEO

Anderson noted bankers are always thinking about regulatory pushback, however, and it shouldn’t necessarily be the reason deals don’t come together.

Warner Bros. and Discovery merged in 2022, ballooning the combined company’s portfolio of cable networks and bringing together its streaming platforms. Recently, the company relaunched its flagship service as Max, merging content from Discovery+ and HBO Max. Amazon bought MGM the same year.

Other megadeals occurred before that, too. Comcast acquired U.K. broadcaster Sky in 2018. The next year, Disney paid $71 billion for Fox Corp.’s entertainment assets – which gave Disney “The Simpsons” and a controlling stake in Hulu, but makes up a small portion of its TV properties.

“The Simpsons”: Homer and Marge

Getty / FOX

“The Street and prognosticators forget that Comcast and Sky, Disney and Fox, Warner and Discovery —happened just a few years ago. But the industry talks as if these deals happened in BC not AD times,” said Peter Liguori, former CEO of Tribune Media who’s a board member at TV measurement firm VideoAmp.

Consolidation is likely to continue once companies are finished working through these past mergers and get past lingering effects of the pandemic, such as increased spending to gain subscribers, he said. “These CEOs won’t just do a deal to do a deal. From this point forward, it will take a higher bar to consolidate.”

Still, with the rise of streaming and its lack of profitability and bleeding of pay-TV customers, more consolidation could be on the way, no matter what.

Whether M&A helps push these companies forward, however, is another question.

“My kneejerk reaction to the Activision-Microsoft ruling was there’s going to be more M&A if the FTC is going to be defanged,” Nathanson said. “But truth be told, Netflix built its business with licensing content and not having to buy an asset. I’m not really sure the big transactions to buy studios have worked out.”

– CNBC’s Alex Sherman contributed to this article.

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC. NBCUniversal is a member of the Alliance of Motion Picture and Television Producers. Comcast is a co-owner of Hulu.