The power of ‘I don’t know.’

Source link

Success

Decentralized social media protocol Friend.Tech captured attention last year but has noticeably faded from the radar recently.

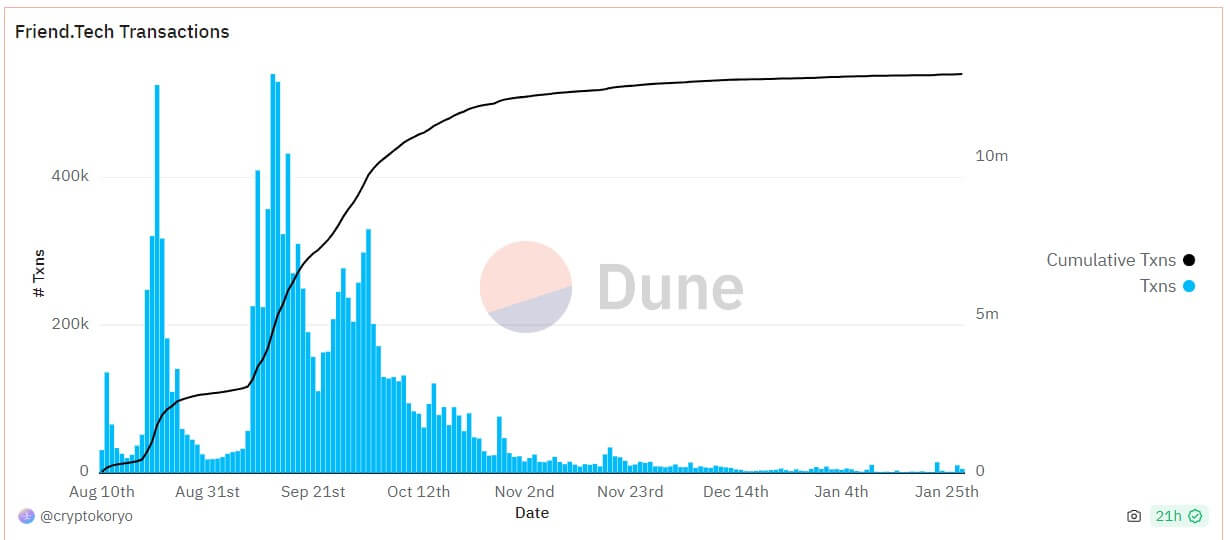

CryptoSlate, using Dune Analytics data compiled by 21.co, discovered a concerning trend – the platform’s failure to attract new users, coupled with indifference from its existing user base. On Jan. 28, the platform garnered a mere 19 new users engaged in at least one transaction, a stark contrast to its peak of over 70,000 users in September.

A separate dashboard by Cryptokoryo sheds light on the extent of the downturn. On the same date, Friend.Tech recorded only 5,544 transactions, signaling a staggering 99% decrease from its peak volume of almost 540,000.

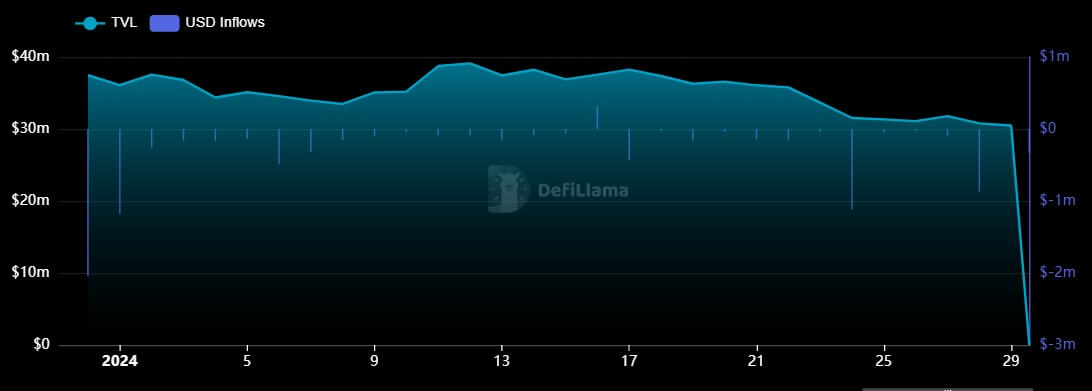

Adding to the downward spiral, DeFillama’s data reveals a consistent negative outflow throughout this month.

Per the data, Friend.Tech experienced positive USD flow only on Jan. 16, with $313,000 entering the platform. However, more than $5 million flowed out on other days, significantly dropping the total value of assets locked on the platform to $30 million.

Moreover, this decline is further reflected in the fees generated by the network, plummeting from a daily average of nearly $1 million to a mere $50,000 in the last two days.

‘Biggest lowlight’

Several reasons could be blamed for Friend.Tech’s falling numbers. However, issues began when multiple users suffered sim-swap attacks due to the platform’s lax security. CryptoSlate reported that at least $20 million in the platform users’ assets were vulnerable to these attacks.

While efforts to address security concerns were made promptly, this incident reflected the platform’s challenges in keeping pace with bug fixes and implementing essential policies for its rapidly expanding user base.

The platform’s viral success also spawned copycats like Stars Arena on other blockchain networks, including Avalanche. DeFillama data shows these protocols are also struggling for adoption and use.

Teng Yan, Head of NFT Research at Delphi Digital, called Friend.Tech’s setback the “biggest lowlight” of the past year. He highlighted the project’s potential to make crypto mainstream but criticized its team’s execution.

“[Friend.tech] could have been a top consumer app bringing crypto mainstream. An on-chain reputation layer built on top of existing social graphs. Great idea but poor execution,” Yan added.

Friend. Tech’s viral growth

Friend.Tech introduced an innovative way for users to monetize their popularity in the crypto space, allowing users to buy and sell “keys.” These keys enabled buyers to send private messages to sellers.

As a result, several high-profile figures, both from the cryptocurrency world and the broader entertainment industry, used Friend.Tech to connect to their community, and the platform was driving transactions on Base, the layer2 network it was built on.

Despite this initial success, the blockchain-based social network faced a rapid decline, losing 95% of its activity within a month of launch. Yet, a revival occurred in September, with daily trading volumes nearing $10 million. At its peak, the protocol boasted a TVL exceeding 30,000 ETH ($50 million), outperforming giants like Uniswap and the Bitcoin network in fees generated.

Solana has been on a downward trend over the past week, following a surge from multi-year low levels. The token suffered when its biggest promoter, crypto exchange FTX, fell, but the ecosystem continued to thrive, leading to the high timeframe recovery.

As of this writing, Solana’s native token SOL trades at $87 with a 2% profit over the past 24 hours. Over the previous seven days, the cryptocurrency records a 12% correction.

Rising Stars In The Solana Landscape

According to a report from Coingecko, the Solana network is witnessing a resurgence fueled by its recovery in the cryptocurrency market, notable reductions in network outages, and a series of positive developments.

This rejuvenation has drawn the attention of investors and developers and led to a surge in the adoption of existing projects within its ecosystem. Specific projects stand out among these, poised to shape the future of decentralized finance (DeFi) and non-fungible tokens (NFTs) on Solana, Coingecko claims.

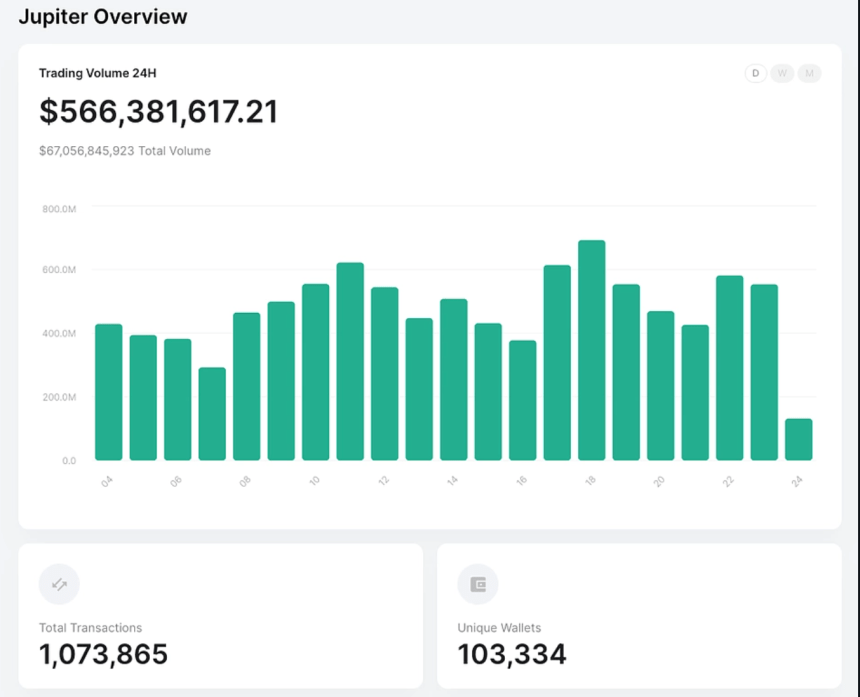

Decentralized exchanges (DEXs) such as Jupiter, Orca, and Drift are at the forefront of Solana’s innovation. Jupiter is “transforming” the landscape with its limit-order decentralized swap services, offering a DEX aggregator to ensure users get the optimal price offers.

The chart below shows that its daily trading volume, involving around 90,000 unique wallets, has reached an average of $400 million.

Orca, another DEX, has a concentrated liquidity feature, Whirlpools, which enhances returns for liquidity providers and reduces slippage for traders. With a total value of approximately $185 million, Orca’s community-driven governance model is another selling point to attract new users in the coming months.

Drift is a decentralized perpetual trading platform, allowing traders to engage with up to 20x leverage. It integrates a series of features, including a money market for decentralized lending, offering additional passive income opportunities through staking and market maker rewards.

Furthermore, Solend, Marginfi, and Kamino are making strides on the lending front. Solend, a prominent money market, enables users to lend and borrow crypto assets, with over $165 million locked in its smart contracts.

Marginfi, boasting over $345 million in tokens locked, enhances the lending experience with advanced risk management technologies.

Kamino, another lending platform, manages over $242 million in assets. It offers liquidity through CLMM-based lending vaults, allowing users to deploy tokens in yield-bearing programs.

Emerging Projects: Helium And Render Network

In addition to these platforms, the report identified projects that could benefit from the surge of interest in Solana over the long run.

These include Marinade Finance and Jito. Marinade Finance, with over $1 billion in assets, offers maximized returns through liquid staking and immediate unstaking options. Jito, enhancing staking yields via MEV rewards, boasts about 6.7 million SOL staked across its platform.

In the world of NFTs, collections like Mad Lads and Tensorians are gaining popularity. Mad Lads, a unique collection of 10,000 artworks, reached a new all-time high in floor price, reflecting the increasing interest in Solana-based NFTs.

According to the report, Helium and Render Network are two emerging projects within the Solana ecosystem worth watching. Helium, a decentralized connectivity service provider, utilizes Solana’s blockchain to remit and administer its internet services. Its multi-token system incentivizes hotspot owners and fosters the expansion of decentralized internet facilities.

Render Network, expanding to Solana in 2023, offers GPU rendering services for creators. By renting out excess GPU power, artists can produce high-resolution graphics with the Render token (RNDR) as the network’s remittance token.

The Solana ecosystem, marked by innovation and rapid growth, solidifies its position in the smart contract blockchain space. Its diverse projects, from DEXs and lending protocols to staking solutions and NFT collections, showcase the network’s dynamic and burgeoning landscape. With the SOL token climbing the ranks, Solana’s ecosystem is poised for continued expansion and success in the years ahead.

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Build My Burgers founder Aly Lalani always knew that a typical desk job wasn’t for him. He wanted something more challenging and unpredictable.

The 38-year-old has worked in the restaurant industry for the last 16 years, spending most of that time employed by other people — until 2021, when he opened Build My Burgers in Orlando, Florida. The burger joint uses an open design concept to entice customers — roughly 400 per day, Lalani says — who watch their meals being made up close, a more personal experience than a typical fast food chain.

That first year, Build My Burgers brought in $584,000 in revenue, according to documents reviewed by CNBC Make It. Last year, that number increased to $739,000, enabling Lalani to pay himself an $84,000 salary.

Very little went according to plan along the way. Between Lalani’s first inklings of his big idea in 2018 and the restaurant’s launch, he lost his father, penny-pinched during the Covid-19 pandemic, prepared for a new baby and pushed the big opening from April 2020 to January 2021.

Here’s how Lalani launched his restaurant, and what’s driving its success so far, he says.

‘We are big foodies’

When you ask the Pakistan-born entrepreneur why he chose to open a burger restaurant, his answer is pretty simple. “We love burgers,” he says. “My wife and I, we are big foodies.”

Initially, Lalani wanted to become a franchisee, owning and running an outpost of an extant restaurant chain. Building a brand from scratch would be too time-consuming — but there was a problem.

“The franchises we were looking into that had a name, they were not affordable,” he says. He and his wife Zahra got “very close” to signing a deal with a particular burger chain, but it didn’t work out, so “we just decided that we’re going to go ahead and open our own brand and bring it to life in Orlando.”

Aly and Zahra Lalani at the Build My Burgers restaurant in Orlando, Florida.

Andrea Desky

In 2018, the two got to work. They designed the restaurant’s logo and interior — from the wall art to the orange and black color scheme — to give off the appearance that it was already a successful chain, Lalani says.

Lalani signed the lease for his storefront in 2019, and construction started immediately, he says. He was on track to open its doors the following year.

Living off a single salary

When Covid hit, Lalani and his family made a tough decision: All three of them — including their new baby — would live off the salary from Zahra’s 9-to-5 job. Lalani kept working on the restaurant full-time, despite not knowing when it could open.

“I was just staying at home, living off my wife’s paycheck and just trying to pay all the bills that we could to stay afloat,” he says.

The challenge intensified when his startup budget of $200,000 doubled to $400,000, with construction fees costing more than he’d expected. Lalani used $60,000 in personal savings, took on $218,000 in credit card debt and unsecured loans, and got $22,000 from Build My Burgers’ landlord to help renovate the building. The landlord spent an additional $100,000 on other renovations, Lalani notes.

Only $60,000 of the credit card debt remains, says Lalani.

All the while, Lalani grieved his father, who died in December 2019. As the responsibilities piled up, he used memories of his father and his own excitement of becoming a dad to keep himself going.

“[It] pushed me to do more,” he says, adding: “It was really difficult. But, one thing about me is I’m very motivated. I’m very positive. I had a vision. I had a goal. I wanted to do everything it takes to make sure it comes to life.”

Growing into the local community

Build My Burgers never had a grand opening. Lalani simply turned on the “open” sign in the front window.

The restaurant features special deals for its local community, from free and discounted meals for college students or police officers to free drinks for delivery drivers. “We want to make sure that we’re taking care of the people that are taking care of us,” Lalani says, noting that it helps build a loyal customer base.

Aly Lalani serving an order at Build My Burgers.

Andrea Desky

In 2022, Zahra became a co-owner and joined Build My Burgers part-time, handling the restaurant’s marketing and accounting. Lalani still works 50 hours per week on tasks like restaurant operations and social media, he says.

He’s also still thinking about restaurant franchises — specifically, turning Build My Burgers into one. His goals are ambitious. First: He’s set a minimum investment price of $235,000, he says, roughly his original budget for trying to buy into someone else’s franchise.

Second: He wants to expand to 51 franchise locations across the U.S. in the next five years, and hire enough quality staff for each location to keep Build My Burgers from overextending itself.

“It just amazes me how food makes people so happy,” says Lalani. “And it feels great because it all started as a dream.”

Update: This story has been corrected to reflect that Build My Burgers’ startup budget doubled due to construction fees. It also reflects that the restaurant’s landlord spent $100,000 and gave Lalani $22,000 for building renovations, according to Lalani.

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Want to land your dream job in 2024? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay. Get started today and save 50% with discount code EARLYBIRD.

Hershey’s bitter ending to 2023 shows innovation will be key to success in 2024, says analyst

Hershey (HSY) investors are hoping for a sweeter 2024.

The candy giant is ending the year on a sour note after shares hit a new two-year low this week, down 21% compared to a year ago.

The chocolate maker was singing a different tune earlier this year, as its shares hit an all-time high in May. Its stock is down 34% since then, as fears over commodity inflation, pricing power, volume decline, and fierce competition continue to grow.

Overall, the Consumer Staples Select Sector (XLP) index is down roughly 5% over the past year, compared to the S&P 500’s (^GSPC) 25% gain.

Following a meeting with Hershey executives, JP Morgan analyst Ken Goldman said the tone of the company was not confidence-inspiring.

“We emerged incrementally more cautious about Q4 2023 and next year … and we are starting to think that consensus’ estimate for a flattish gross margin next year is highly optimistic,” Goldman wrote in a note to clients.

Hershey reiterated its 2023 full-year outlook last quarter. It expects net sales growth of roughly 8%, earnings per share growth of 13%-15%, and adjusted earnings per share growth of 11%-12%.

Higher prices for two much-needed ingredients — sugar and cocoa — aren’t helping its outlook.

Sugar prices have been on a roller coaster, even though they’re coming down. Sugar futures (SB=F) are up nearly 4% compared to a year ago, after jumping 40% year over year in early November.

“There has been volatility, especially with the weather patterns,” Andraia Torsiello, Mintec US sugar analyst, told Yahoo Finance over the phone, adding that “supply availability has improved year over year.”

Supply outlook is looking brighter in Brazil. India, another major producer, is recovering as well after the government “instructed mills to focus on sugar production rather than ethanol,” as unfavorable weather conditions resulted in poor crops this year.

And in the US, the sugar beet harvest hit a record high in 2023.

Cocoa prices could offset that savings as a warmer weather pattern, known as El Niño, drifts over Asia. Cocoa futures (CC=F) are up roughly 65% compared to last year.

Goldman wrote Hershey said in its meeting that “the amount of cocoa inflation has been extraordinary.”

Irregular weather patterns have limited cocoa exports from India, as it focuses on domestic consumption, and Thailand’s supply will be short as well, David Branch of Wells Fargo told Yahoo Finance over the phone.

Branch expects the El Niño pattern to last through Q1 of 2024 and maybe the second half of 2024.

While Hershey CEO Michele Buck said in a call with investors that the company has “pricing and productivity” that can help offset the rising costs, the company’s comments to Goldman gave the analyst pause.

Statements like “we’ve gone to the pricing lever quite a bit over the last few years,” and “pricing remains a key part [of our longer-term strategy] but we also are sensitive to the consumer” did not alleviate concerns Hershey doesn’t have the pricing power to make up for higher input costs.

Innovation can help boost traffic

Chocolates being a recession-proof category is “no longer the case,” Goldman wrote in his note to clients.

In October, Hershey posted a 1% decrease in volume, while prices jumped 11.1% in North America confectionary.

As consumers have been battling headwinds all year with high interest rates, the return of student loan payments, and sticky inflation, they’re starting to pull back on small delights.

“Confections has definitely seen a little bit of softness recently,” Dan Sadler, IRI principal of client insights, told Yahoo Finance. While consumers are not necessarily forgoing all sweets, they are opting for smaller sizes and more affordable brands.

Other consumer staple companies to keep an eye on: JM Smucker (SJM), General Mills (GIS), Kraft Heinz (KHC), Kellanova (K), and WK Kellogg (KLG), among others.

General Mills CEO Jeff Harmening said consumers are seeking value, bringing into question whether these companies can raise prices like they once did — especially as the popularity of private labels grows.

“While many factors have evolved in line with our expectations, we are seeing consumers continue to display stronger-than-anticipated value-seeking behaviors across our key markets,” Harmening said on a call with investors.

Innovation, though, will be a key differentiator in bringing in new customers. Sadler said companies are finally able to move past woes of the pandemic like supply chain issues and shortages and focus on creating new offerings.

Oreo maker Mondelez (MDLZ) has done innovation right, per Morningstar director Erin Lash. The company opened a $50 million R&D center this year to help further develop its lines of Oreo cookies, Ritz crackers, and Sour Patch Kids candies. It’s also offering more options in chocolates, such as Toblerone Truffles and Tiny Toblerone.

“I would attribute the ability or the track record [of the stock performance] to consumer-valued innovation,” said Lash.

Having geographical diversification is a plus as well, Consumer Edge research analyst Connor Rattigan told Yahoo Finance over the phone.

“[Mondelez is] exposed to all sorts of emerging markets, Asia, Latin America … that can drive volume growth,” Rattigan said.

Rattigan also likes JM Smucker’s $5.6 billion acquisition of Hostess, as it can drive product creation and new sales. The iconic cake snacks’ dominance in convenience stores could help get Smucker’s Uncrustables in more locations, and cross-collaboration could result in new offerings — say, jelly-filled Twinkies.

—

Brooke DiPalma is a senior reporter for Yahoo Finance. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

When it comes to the ultra rich, you might think there’s some unknown secret to attaining such success. But there isn’t, according to billionaire Charlie Munger, who died last week at age 99.

“I don’t know the secret,” Munger told CNBC’s Becky Quick in an interview last month, initially meant to air on his 100th birthday in January. His method for getting ahead — in life and at work — was pretty cut and dry, he added.

“I avoided the standard ways of failing, because my game in life was always to avoid all standard ways of failing,” said Munger. “You teach me the wrong way to play poker and I will avoid it. You teach me the wrong way to do something else, I will avoid it. And, of course, I’ve avoided a lot, because I’m so cautious.”

Munger spent his life “avoiding traps,” like living in the same modest home for 70 years, refusing to follow his rich friends who built mega-mansions, he said. “In practically every case, [fancy houses] make the person less happy, not happier,” he said.

His general sense of cautiousness was well-documented, from his personal disdain for the “gambling” nature of cryptocurrency to his generally conservative spending decisions.

In terms of cryptocurrency: “Sometimes I call it ‘crypto crappo.’ Sometimes I call it ‘crypto s—.’ It’s just ridiculous that anybody would buy this stuff,” Munger told CNBC in February, adding: “It’s totally absolutely crazy, stupid gambling.”

As far as his spending decisions, his penchant for practicality went beyond his investment portfolio.

Once, when Warren Buffett — Munger’s longtime business partner at Berkshire Hathaway — needed to replace a company jet, he wrote to shareholders to justify the $6.7 million price tag. Munger found the purchase to be spendthrift, Buffett recalled in the letter.

“His idea of traveling in style is an air-conditioned bus, a luxury he steps up to only when bargain fares are in effect,” wrote Buffett.

Indeed, avoiding obvious risks, frivolity and “crazy” situations were instrumental to Munger’s financial success and longevity, he told CNBC last month.

“Avoid crazy at all costs. Crazy is way more common than you think,” said Munger. “It’s easy to slip into crazy. Just avoid it, avoid it, avoid it.”

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC’s free Warren Buffett Guide to Investing, which distills the billionaire’s No. 1 best piece of advice for regular investors, do’s and don’ts, and three key investing principles into a clear and simple guidebook.