As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

As of April 15, 2024, bitcoin presents a mixed landscape of consolidation and subtle recovery hints, reflecting a crucial moment for potential bullish or bearish trends. Bitcoin Despite the current market indecisiveness indicated by the 1-hour chart, the 4-hour and daily charts suggest underlying movements that could influence future price actions. The 1-hour chart displays […]

Source link

Suggest

Ethereum Price Key Indicators Suggest A Strengthening Case For Surge To $3,800

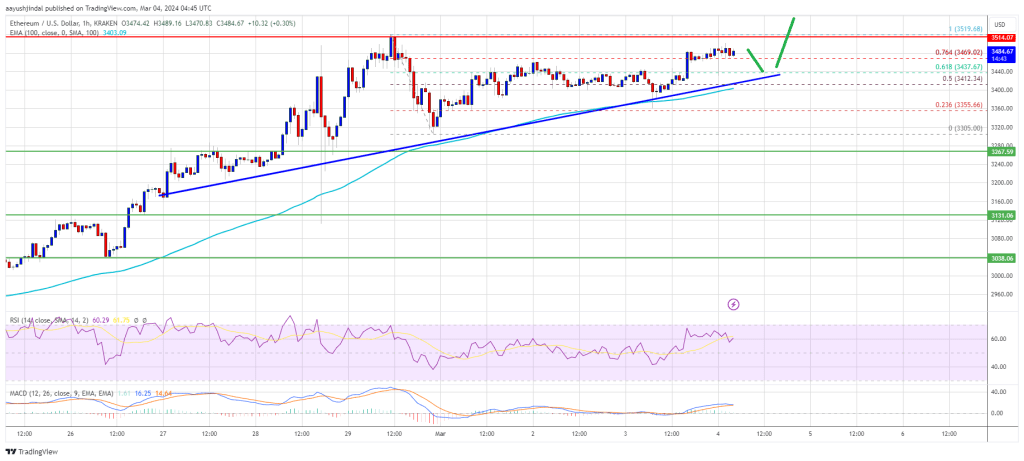

Ethereum price is consolidating gains above $3,400. ETH is showing positive signs and might soon aim for a move above the $3,500 resistance zone.

- Ethereum is holding gains and consolidating below the $3,500 resistance zone.

- The price is trading above $3,400 and the 100-hourly Simple Moving Average.

- There is a key bullish trend line forming with support at $3,420 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair seems to be setting up for a move toward the $3,650 and $3,800 levels.

Ethereum Price Remains Supported

Ethereum price formed a base above the $3,350 level and started another increase, like Bitcoin. ETH broke the $3,400 level to set the pace for more upsides.

There was a clear move above the 50% Fib retracement level of the downside correction from the $3,519 swing high to the $3,305 low. The bulls are now active above the $3,420 level. There is also a key bullish trend line forming with support at $3,420 on the hourly chart of ETH/USD.

Ethereum is now trading above $3,450 and the 100-hourly Simple Moving Average. It is showing positive signs above the 76.4% Fib retracement level of the downside correction from the $3,519 swing high to the $3,305 low.

Immediate resistance on the upside is near the $3,500 level. The first major resistance is near the $3,520 level. The next major resistance is near $3,550, above which the price might gain bullish momentum. The next stop for the bulls could be near the $3,650 level.

Source: ETHUSD on TradingView.com

If there is a move above the $3,650 resistance, Ether could even rally toward the $3,720 resistance. Any more gains might call for a test of $3,800.

Are Dips Supported In ETH?

If Ethereum fails to clear the $3,520 resistance, it could start a downside correction. Initial support on the downside is near the $3,420 level and the trend line.

The first major support is near the $3,400 zone or the 100 hourly SMA. The next key support could be the $3,350 zone. A clear move below the $3,350 support might send the price toward $3,320. Any more losses might send the price toward the $3,150 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $3,400

Major Resistance Level – $3,520

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ethereum ETFs Approval Date Set For May 23, Forecasts Suggest ETH Could Reach $4,000

The Securities and Exchange Commission (SEC) is poised to follow a similar approach to approving spot Bitcoin (BTC) exchange-traded funds (ETFs) for spot Ethereum ETFs, with the expectation that approval will be granted on the initial final deadline of May 23, as per Standard Chartered Bank analysis.

Ethereum ETFs Face Delays, Approval Remains Likely

According to a report by The Block, Geoffrey Kendrick, head of forex and digital asset research at Standard Chartered Bank, stated that they expect pending applications for spot Ethereum ETFs to be approved on May 23, which is considered the equivalent date to January 10 for Bitcoin ETFs.

Furthermore, Kendrick predicts that if Ethereum prices follow a similar trajectory to Bitcoin leading up to ETF approval, Ethereum could trade as high as $4,000 by the specified date.

Kendrick further supports the approval of spot Ethereum ETFs based on the SEC’s classification of ether as a non-security in its legal actions against crypto companies.

Additionally, the fact that Ethereum is listed as a regulated futures contract on the Chicago Mercantile Exchange (CME) adds weight to the expectation of approval.

Following the same line, Scott Johnsson, a financial lawyer, offered insights into the potential roadmap for Ethereum ETFs. Johnsson emphasized that while long-term approval for spot Ethereum ETFs is highly likely, there may be short-term delays due to ongoing regulatory actions involving Coinbase/Binance securities exchanges.

Shorter Path For ETH ETF Approvals?

Johnsson highlighted the regulatory path from a plain spot digital asset to a spot ETF offering, using Bitcoin as an example. Johnsson noted that the process for Bitcoin took seven years, involving multiple steps and disapprovals along the way.

However, Johnsson noted that the timeline for Ethereum is compressing, with applications open for both futures ETFs and spot ETFs. He suggested certain prerequisites that Johnsson believes may no longer be necessary for spot approval, such as Step 3, which requires the SEC to issue a formal 19b-4 approval for the futures ETF.

Johnsson highlighted two key factors to understand the SEC’s current approach to future approvals, including Ethereum. Firstly, he discussed the threshold question in the context of the Grayscale ruling, which focused on correlation analysis.

Secondly, Johnsson emphasized the SEC’s view, as bounded by the recent BTC approval order, which considers correlation with the CME, a lengthy sample period, intra-day trading data, and consistency throughout the sample period.

While the specific threshold for sufficiency remains unknown, the correlation analysis for Bitcoin is within an acceptable range. Therefore, it is expected that Ethereum will likely meet this threshold in the foreseeable future, Johnsson suggests.

Once the required level of correlation is achieved, Johnsson believes that approval for spot Ethereum ETFs is likely to follow shortly after that, with May being the expected month of approval.

Overall, industry analysts and experts suggest that the SEC’s approval of spot Ethereum ETFs is a matter of time, barring any major legal shifts.

ETH is currently trading at $2,370, up more than 2% in the past 24 hours and more than 7% in the past seven days, following Bitcoin’s lead.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In the past month, the Bitcoin price has experienced a significant decline after reaching a 22-month high of $49,000. Currently, the largest cryptocurrency has fallen below the crucial $40,000 mark, raising concerns about the prospects of the ongoing bull run and the overall bullish market structure.

However, there are indications that the bottom of the current downtrend may be near, potentially setting the stage for a potential price reversal.

Bitcoin Price To Avoid Plummeting To Low $30,000s

Market analyst Marco Johanning sheds light on the situation, offering insights into the Bitcoin price movement. Johanning suggests that it won’t be long until Bitcoin reclaims the $41,500 level or potentially rises from a lower level if a specific scenario unfolds.

According to Johanning, Bitcoin will finally encounter significant liquidity on the downside. Notably, the price has touched around below $39,000 multiple times, indicating the presence of substantial liquidity at these lows.

Moreover, Johanning addresses the skepticism surrounding the price of around $37,800, arguing against widespread expectations of a drop into the low $30,000 range.

Johanning emphasizes that the primary liquidity lies below $40,000 and is not in the low $30,000 range. Traders profited from the low $30,000 range have likely adjusted their stop orders to protect their gains, creating a layer of support below the recent equal lows.

As the price starts hitting these stop orders, automatic selling occurs, further down the price until it encounters significant buy pressure. The analyst points out a daily order block at $37,700 and high timeframe (HTF) support at $38,5000, indicating the potential for notable buy pressure in these price regions.

Johanning also highlights the likelihood of filling Chicago Mercantile Exchange (CME) gaps and Imbalances, with the next imbalance anticipated below $33,000.

Short Squeeze Rally Imminent?

According to Johanning, the prevailing sentiment reveals many bears waiting to short a market dump. Johanning predicts that a short squeeze could occur once the price reverses, leading to a rapid price increase.

In terms of Fibonacci retracement levels, Johanning suggests that since the Bitcoin price has already lost the $40,200 level, it could potentially fall to the 0.5% Fibonacci level, which coincides with those above the $37,800 level.

Johanning speculates that the price may briefly touch $37,800 before closing above the HTF support level of $38,500, setting the stage for a potential upward movement.

The recent downtrend in Bitcoin’s price has raised concerns about continuing the bull run. However, market analyst Marco Johanning presents several key arguments supporting the possibility of a price reversal.

With Bitcoin’s current price at $38,900, there is a possibility of increased buying pressure in this region. The support wall at $38,5000 has demonstrated resilience thus far, and its performance will be closely observed.

If the support wall fails to hold, the market will observe how the $37,800 price level performs and whether it aligns with the analyst’s thesis.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

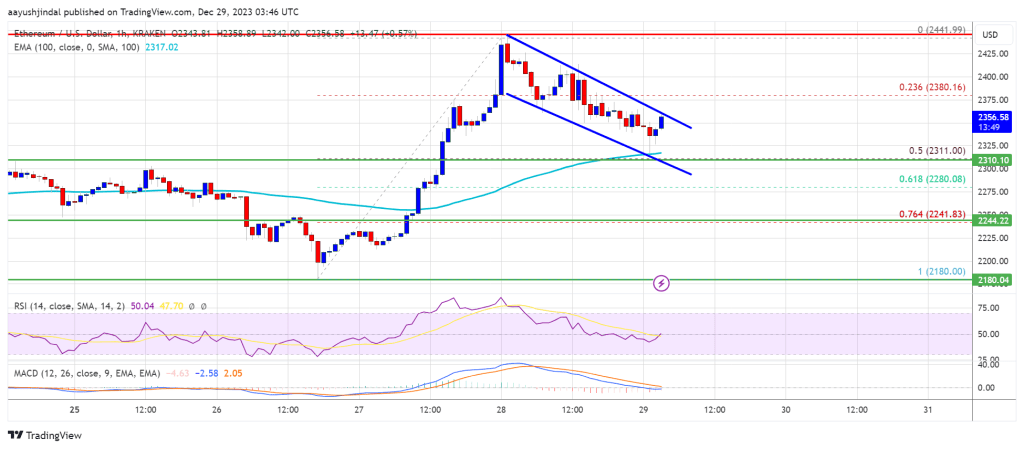

Ethereum Price Retreats From Highs But Technicals Suggest Upside Continuation

Ethereum price is correcting gains from the $2,440 zone. ETH is correcting gains, but the bulls might remain active near the $2,300 and $2,240 support levels.

- Ethereum is correcting gains and trading below the $2,400 level.

- The price is trading above $2,320 and the 100-hourly Simple Moving Average.

- There is a bullish flag forming with resistance near $2,360 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if there is a close above the $2,400 level.

Ethereum Price Remains Supported

Ethereum price climbed higher above the $2,320 resistance zone. ETH even broke the $2,400 level before the bears appeared. A high was formed near $2,441 before the price started a downside correction, like Bitcoin.

There was a move below the $2,400 and $2,380 levels. The price declined and tested the 50% Fib retracement level of the upward wave from the $2,180 swing low to the $2,441 high. The bulls seem to be active near the $2,320 support zone.

Ethereum is now trading above $2,320 and the 100-hourly Simple Moving Average. On the upside, the price is facing resistance near the $2,360 level. There is also a bullish flag forming with resistance near $2,360 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

The first major resistance is now near $2,400. A close above the $2,400 resistance could send the price toward $2,440. The next key resistance is near $2,500. A clear move above the $2,500 zone could start another increase. The next resistance sits at $2,620, above which Ethereum might rally and test the $2,750 zone.

More Losses in ETH?

If Ethereum fails to clear the $2,400 resistance, it could continue to move down. Initial support on the downside is near the $2,320 level and the 100 hourly SMA.

The first key support could be the $2,240 zone or the 76.4% Fib retracement level of the upward wave from the $2,180 swing low to the $2,441 high. A downside break and a close below $2,240 might start another major decline. In the stated case, Ether could test the $2,165 support. Any more losses might send the price toward the $2,120 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now near the 50 level.

Major Support Level – $2,320

Major Resistance Level – $2,400

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Seeking up to 11% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

The headwinds are piling up on our economic horizon, just a few blurs of cloud right now, at the edge of the horizon – and we just don’t know what’s coming next. The headwinds include factors we all know about: persistent inflation, the Fed’s higher interest rates and tighter monetary policy, the tighter business and consumer credit environment, and the fast-rising government debt which at $33.57 trillion already measures 103% of the total GDP. We’ve been reading about these headwinds for several years now; what we don’t know is if, or when, they will coalesce into a storm.

In the words of Jamie Dimon, the CEO of JPMorgan, “This may be the most dangerous time the world has seen in decades. While we hope for the best, we prepare the Firm for a broad range of outcomes so we can consistently deliver for clients no matter the environment.”

The bottom line is that investors need to take defensive postures with their portfolio additions. And that will naturally lead investors toward high-yield dividend stocks. These income-generating equities offer some degree of protection against both inflation and share depreciation by providing a steady income stream.

Against this backdrop, some top-rated analysts have given the thumbs-up to two dividend stocks yielding up to 11%. Opening up the TipRanks database, we examined the details behind these two to find out what else makes them compelling buys.

Blackstone Secured Lending (BXSL)

First up is Blackstone Secured Lending, a business development company, or BDC, operating under the larger cover of the Blackstone asset management firm. BXSL operates in the financial services sector, providing capital and credit services to private companies in the US market and across a wide range of sectors including veterinary care, the insurance industry, and cable communications distributors. The top sectors represented in BXSL’s portfolio are software and healthcare.

By the numbers, BXSL’s portfolio holds $9.3 billion in investments, at fair value. These are composed mainly of first lien senior secured loans, 98.4% of the total, and 98.7% of the total is made in floating rate instruments. BXSL has current investments in 180 companies, as of the end of 2Q23.

That was the last reported quarter, and in it, BXSL realized some $290 million in total investment income. This was up 55% year-over-year and beat the forecast by $14.5 million. At the bottom line, BXSL reported a net investment income of $1.06 per share, a result that was 3 cents per share ahead of the estimates. The NII exceeded the company’s regular dividend payment – marking the 17th quarter in a row that BXSL has achieved full coverage of the common share dividend.

BXSL has recently increased its common share regular dividend by 10% to 77 cents, which is scheduled to be paid out this coming October 26. At an annualized rate of $3.08, this dividend offers a robust yield of 11.5%, surpassing the average dividend yield of S&P-listed companies by more than 5x.

Truist analyst Mark Hughes has been impressed by BXSL’s high quality portfolio and its ability to maintain its dividend. The 5-star analyst writes of the stock, “The high quality of Blackstone Secured Lending’s portfolio is underscored by its low proportion of PIK income and high dividend coverage. This positions the company to both grow net asset value (NAV) on a consistent basis and to maintain a stable and attractive dividend yield; historically this has been the formula for BDCs to trade at a premium to NAV… Blackstone Secured Lending shares are compelling on a price-to-NAV basis, we believe, particularly when evaluated in the context of the company’s return on equity and the quality of its investment portfolio…”

Looking ahead, Hughes rates BXSL shares a Buy, and his price target, now set at $29, implies the stock will gain 8.3% in the year ahead. The total return will approach ~20% when the dividend is added to the upside. (To watch Hughes’ track record, click here)

Overall, the 9 recent analyst reviews on this stock include 6 Buys over 3 Holds, for a Moderate Buy consensus rating. (See BXSL stock forecast)

Equitrans Midstream (ETRN)

Next up on our ‘dividend list’ is Equitrans, a midstream company in the oil and gas sector. Midstream firms hold a vital link in the energy chain, moving hydrocarbon products from production regions and wellheads to the refineries, terminal points, and storage farms where retailers can pick it up for sale to the end users. Equitrans focuses its operations in the Appalachian region, specifically the area where Pennsylvania, Ohio, and West Virginia come together. This is one of America’s richest natural gas production regions and forms the core of this company’s extensive midstream network.

Equitrans’ transport assets mainly move natural gas and natural gas products out of the Appalachian Basin; the company describes its network as holding a strategic position capable of ‘debottlenecking’ the Basin. In particular, the company’s Mountain Valley Pipeline (MVP) and MVP Southgate projects promise the growth needed to improve the key link between natural gas sources and the major US demand markets.

At bottom, this means the company is routinely capable of generating profits and cash. Yet, in its last financial report, for Q2, the company’s total revenue came to $318.5 million, down 3% from the prior-year quarter and missing the forecast by almost $7.9 million. But – the company’s bottom line was sound, at 9 cents per share by non-GAAP measures, a result that beat the forecast by 4 cents per share.

This company has a dividend history going back to 2019, and the dividend has been held stable since 2020. That current stable payment is 15 cents per common share, or 60 cents annually, and the dividend yield is 6.3%.

Writing on this stock from Goldman Sachs, industry expert John Mackay likes Equitrans’ extensive footprint and notes that its assets are attractive to investors and M&A firms alike.

“Given ETRN’s strategic gathering and transmission footprint in the Appalachian Basin, relative EV size, and cash flow clarity from an MVP resolution, we see ETRN as a potential M&A target. ETRN’s assets are highly strategic in our view in the core of the SW Marcellus and Utica with interconnections into all major interstate pipelines in the region – and are supported by long term MVCs with IG counterparties… With an EV size of ~$[12]b, we believe the relative size appears manageable for larger midstream players,” Mackay opined.

Going forward, these comments back up the Goldman Sachs analyst’s Buy rating, which comes with an $11.50 price target, suggesting a gain of almost 21% on the one-year horizon. That return can reach 27% with the dividend added in. (To watch Mackay’s track record, click here)

Overall, Equitrans boasts a Strong Buy rating from the analyst consensus, and it is unanimous – based on 3 recent positive share reviews. (See Equitrans stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Bitcoin has observed a pullback in the past day, but these factors may imply that the cryptocurrency’s rally can continue.

These Factors Could Suggest A Bullish Outcome For Bitcoin

A couple of days back, Bitcoin had started observing some sharp upward momentum, and by yesterday, the cryptocurrency had managed to breach the $28,500 level. In the past day, however, the asset has registered a decline, falling below the $27,500 mark.

While it’s uncertain whether the rally is over or not, some signs can be optimistic for the investors. As explained by the on-chain analytics firm Santiment, two positive developments have occurred related to Tether (USDT), the largest stablecoin in the cryptocurrency sector.

The first indicator of relevance here is the “USDT supply on exchanges,” which measures the percentage of the total circulating supply of the stablecoin in the wallets of all centralized exchanges.

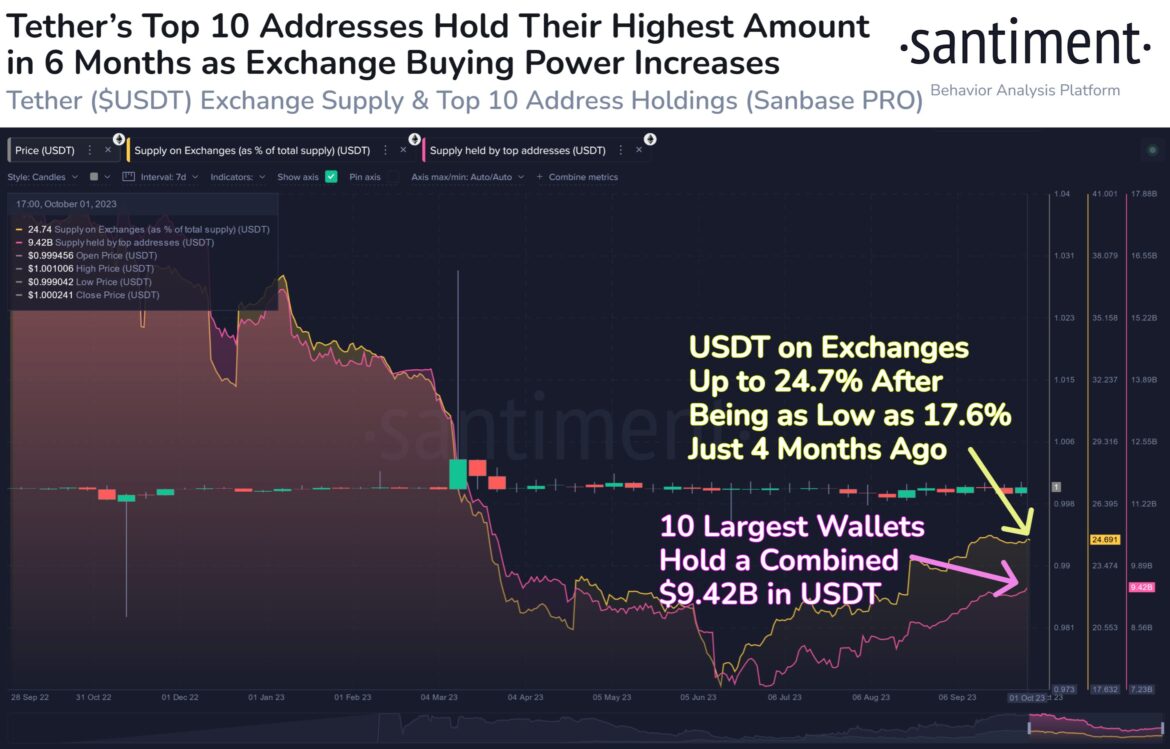

Here is a chart that shows the trend in this Tether metric over the past year:

It looks like the value of the indicator has been heading up in recent weeks | Source: Santiment on X

Usually, investors store their capital in the form of a stablecoin like USDT whenever they want to avoid the volatility associated with the other assets in the sector. Such investors generally plan to go back into the volatile side of the market eventually, though, as they would have instead gone for fiat if they didn’t.

Once these holders feel the time is right to dive into Bitcoin and other coins, they trade their stables for their desired cryptocurrencies. Naturally, such a shift provides a bullish boost to whatever assets they buy using their stablecoins.

Investors generally use exchanges for conversions like these, so the current supply on these platforms can be considered potential dry powder ready to be deployed into BTC and others.

The graph shows that the Tether supply on exchanges had plunged to a low of 17.6% a few months back, implying that the available buying pressure from the stablecoin had run out.

Interestingly, this low in June had occurred in the leadup to a sharp Bitcoin rally, implying that the plunge in the exchange reserve of the stablecoin was, in fact, because of it being converted into the asset, thus providing the fuel for the surge. However, the rally back then couldn’t be sustained, as BTC eventually faced a struggle.

In the months since this low, USDT reserves have slowly built back up on exchanges, as 24.7% of the stablecoin’s supply is now sitting on these platforms. Unlike that previous rally, it would appear that this latest surge has a store of potential buying power available that may be deployed at any time.

In the chart, Santiment has also attached the data for another metric: the combined supply of the ten largest Tether whales. It would appear that these humongous investors have also increased their holdings during this period, implying that they also carry significant dry powder now.

It now remains to be seen whether this stored-up USDT will be converted into the cryptocurrency to provide support to the surge in the coming days or not.

BTC Price

At the time of writing, Bitcoin is trading at around $27,400, up 5% in the last week.

BTC has observed some pullback in the past 24 hours | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.net

Even with the Cardano network hitting seeing good metrics over the last month, the ADA price has remained rather stale in its performance. However, this trend might soon change for the digital asset as multiple developments have emerged that could fast-track its recovery.

Cardano Whales Go To Market

It is no secret that Cardano whales have often doubled down on their positions even at times when the digital asset has suffered from the bear trends. This has not changed, especially with the most recent dip in the ADA price, which sent the whales into a buying frenzy instead of dumping their holdings.

Earlier in the week, ADA fell as low as $0.2422, which is the second-lowest that the price has been this month but this did not deter believers in the coin. Instead, Cardano whales increased their activity, suggesting that they were scrambling to buy the digital asset at what is believed to be a low price.

Whales increase activity following dip | Source: IntoTheBlock

Data from IntoTheBlock showed that these whales moved over $3 billion worth of ADA on Monday alone. While this doesn’t exactly serve as evidence for buying, the time frame in which this happened is what points toward accumulation.

The whales began to move these tokens not long after the price dip. Additionally, since then, the digital asset has been showing strength with the ADA price recovering and eventually beating the resistance at $0.245.

This continued show of strength on the part of the altcoin suggests that the whales had been buying the token rather than selling it. In this case, they expect the ADA price to continue to rise, and choose to add to their positions.

ADA Price Could Be Poised For A Rally

Another interesting development on the Cardano network that could boost the ADA price is the rise in its active users. IntoTheBlock’s data showed a prominent jump in the daily active users that brought it up to over 42,500 addresses. This translates to a more than 60% increase from the prior figures.

Related Reading: Ethereum Open Interest Barrels Past $5.2 Billion, Is It Time To Buy?

Now, the daily active addresses have begun to correct downward with the DeFi tracking website DeFiLlama showing a total of 31,846 active users in the past 24 hours. Nevertheless, this remains significant, surpassing the likes of Avalanche at 29,042 daily active users.

This surge in active addresses suggests rising interest in the Cardano network. Given that ADA is the token that powers the entire ecosystem, a rise in activity means more demand for the token as users need it to carry out transactions.

The ADA price has also been trading in a tight range for some time. So a bounce from there would see the token’s price retest the $0.26 resistance in no time.

Seeking up to 10% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

Dividend stocks are the multi-purpose tool of the markets. They offer investors a two-pronged path towards profitable returns, including a measure of defense against tough market conditions along with a steady source of passive income. It’s an attractive combination.

The best dividend stocks will give an inflation-beating income based on the dividend alone, backing it up with a long-term history of reliable payments. It’s a win-win situation for investors: when the stock goes up, you’ll make money, but when it goes down, you can still make money.

The Street’s analysts are not shy about recommending high-yield dividend payers, and we’ve found two among their recent calls with dividend yields reaching up to 10%. That’s a solid return right there, but these equities also feature ‘Strong Buy’ ratings from the analysts – so let’s dip into the data from TipRanks and find out just what makes them such compelling portfolio additions.

Sunoco LP (SUN)

First up is Sunoco, one of America’s great brand names. The company has a long history in the energy industry, mainly as a producer and provider of motor fuels. Sunoco’s product lines include multiple formulations of gasoline, diesel fuels, and jet fuels, all offered in both branded and unbranded labels. The company manages a distribution network comprised of gas stations, convenience stores, independent dealers, and commercial distributors, with more than 10,000 locations across 40 states.

Sunoco’s fuel retail operations are backed up by the usual ‘value added’ products in the gas stations and convenience stores, including snacks and beverages, and the company also provides fuel dispenser equipment for gas stations and fleet customers.

In an important nod to the expanding ‘green’ economy, Sunoco has been developing reclamation solutions for transmix fuels – that is, gasoline, diesel, and jet fuels that mixed in the transport pipeline, rendering them unusable. The company collects these mixed fuels for processing into usable products, reducing both fuel waste and damage from environmental pollution.

With all that said, Sunoco’s latest quarterly update was something of a mixed bag. The company reported $5.75 billion at the top line in 2Q23, a total that was down 26% year-over-year, although the figure beat expectations by $28 million. The bottom line, while profitable, was not as upbeat; the 78-cent EPS figure came in 47 cents per share under the forecast.

For dividend investors, a key metric to note is the distributable cash flow, which was reported at $175 million for Q2, a favorable comparison to the $159 million from the prior-year second quarter. This supported a Q2 dividend declaration of 84.2 cents per common share, or $3.36 annualized. At the annualized rate and current share valuations, the dividend is yielding 7.1%, more than double the average dividend found among S&P 500 companies, and almost double the 3.7% annualized inflation reported for August.

For Justin Jenkins, 5-star analyst from Raymond James, Sunoco is notable for its ability to remain profitable and to generate cash, both features that will support a continued high-yield dividend. He writes of the company, “We remain constructive on Sunoco given strong execution, confidence in the continuation of increased profitability, and the upside potential from medium-term business optimization and M&A opportunities. These efforts, along with capital/cost discipline, have allowed for considerable free cash flow generation, positioning the balance sheet with solid flexibility, which will be utilized to further grow the business (organically and inorganically). While the macro backdrop is still ‘throwing curve balls,’ we see a stable-to-positive volume trend in 2023 supported by elevated fuel margins. This is complemented by a healthy slate of attractive bolt-on acquisitions and organic projects that generate long-term value, while further M&A could add to upside.”

Jenkins goes on to rate SUN shares as Outperform (a Buy), with a $53 price target that indicates room for 12% upside in the next 12 months. (To watch Jenkins’ track record, click here.)

The 5 recent analyst reviews on SUN include 4 Buys against 1 Hold, for a Strong Buy consensus rating. Going by the $51 average price target, the stock has a one-year upside potential of 7.5%; add in the dividend, and the total return potential here approaches 15%. (See Sunoco’s stock forecast.)

Ares Capital Corporation (ARCC)

The next stock on our list is Ares Capital Corporation, a BDC, or business development company. These firms are specialty lenders, providing credit and financing services for small- and mid-market businesses that won’t necessarily qualify for services from the traditional commercial banks. ARCC’s combination of capital funding, credit services, and provision of financial instruments is essential for its client base, and fills a vital niche in the American small business landscape.

Since going public in 2004, ARCC has invested over $21 billion in 475 companies, and generated a shareholder return of 12%. The company boasts a market cap exceeding $10.7 billion, making it the largest publicly traded BDC in the US markets. The portfolio behind this performance is both diverse and well-balanced, with a healthy composition of assets. Of the total, 22% is in software and services, 11.3% is in healthcare services, and 8.7% is in commercial and professional services. Other sectors represented in the portfolio include power generation, insurance, and consumer durables. Just under 42% of the portfolio is in first lien senior secured loans, and another 18.1% is in second lien senior secured loans.

For investors, results are what matter most. Ares reported 2Q23 total investment income of $634 million, up from $479 million in 2Q22 – for a y/y gain of 32% and beating the forecast by $11 million. At the company’s bottom line, Ares posted earnings of 58 cents per share, 1 cent ahead of the estimates and well above the 46 cents per share from 2Q22. The company boasted $411 million in cash and liquid assets as of June 30, 35% better than it had at the end of 2022.

A profitable business and solid cash holdings support the company’s Q3 dividend, which was declared on July 25 for a September 29 payout. The dividend, of 48 cents per common share, annualizes to $1.92 and yields 10%. The company has a dividend history stretching back to 2004, with regular quarterly payments interspersed with variable special distributions.

KBW analyst Ryan Lynch notes Ares’s history of generating returns and surviving the ups and downs of credit cycles. He says of the stock, “ARCC has a great underwriting and credit quality track record, and has generated some of the best economic returns in the sector, and has a best-in-class credit platform. ARCC has one of the longest track records and has operated through multiple credit cycles with very good results. ARCC’s dominant platform and broad, long-standing relationship with sponsors will help ARCC continue to capture a significant market share of the growing direct lending market. ARCC has the best liability structure which is low-cost, diverse, long-dated, and flexible with multiple investment grade ratings which have funded and will continue to help fund their portfolio growth.”

Looking forward, Lynch gives ARCC an Outperform (Buy) rating, linked with a $21 price target. This suggests an 8.5% upside potential on the one-year time horizon. (To watch Lynch’s track record, click here.)

The Strong Buy consensus rating on ARCC is based on 10 analyst reviews, including 9 Buys and 1 Hold. The shares are currently trading for $19.33 and their average price target, at $20.75, implies a 12-month gain of 7%. With the dividend in the mix, investors can realize a 17% return on ARCC. (See Ares Capital’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Seeking at Least 8% Dividend Yield? Analysts Suggest 2 Stocks to Buy

Since hitting bottom last October, the S&P 500 has bounced back strongly – in fact, it’s up approximately 25% from that trough. A rally of that magnitude meets the definition of a bull market, and some economists are saying we’re experiencing just that.

A word of caution, however, comes from investment firm Wells Fargo. In a recent warning to investors, investment strategy analyst Austin Pickle notes that a recession is likely in the near future, and says, “With stock valuations full, we believe prices are unlikely to sustain recent highs as the economy rolls over.”

Pickle goes on to list three factors that are likely to push markets down in 2H23 or 1H24. First, the analyst notes that the Fed is still locked into raising interest rates. Even though the rate of inflation is falling, the Fed is almost certain to implement another 0.25% bump this month, putting rates at their highest level since 2007. Second, the economy hasn’t yet fallen into a recession. Historically, stocks tend to bottom after a recession hits – and after the Fed starts cutting rates in response. And finally, the current rally isn’t healthy. It’s been driven mainly by a small group of megacap tech stocks, a base too narrow to support a large rally.

It’s a mindset that naturally turns us toward dividend stocks. These are the traditional defensive investment plays, offering steady payouts to shareholders that guarantee an income stream whether markets go up or down.

Against this backdrop, some Wall Street analysts have given the thumbs-up to two dividend stocks yielding no less than 8%. Opening up the TipRanks database, we examined the details behind these two to find out what else makes them compelling buys.

OneMain Holdings (OMF)

We’ll start in the financial services sector with OneMain. This online banking and finance firm focuses on consumer services in the subprime banking and loan market. OneMain offers a wide range of financial services, especially personal loans and insurance products, to a consumer customer base that sometimes lacks access to the traditional banking system. OneMain uses a careful vetting system to screen its customers and boasts that its screening process has kept defaults at an acceptable rate. In addition to its online presence, OneMain also reaches out to customers through a network of physical locations, with approximately 1,400 branches across 44 states.

On the financial side, OneMain reported its 1Q23 results at the end of April, showing some mixed results. The top line revenue came to $1.03 billion; this was in-line with expectations, flat year-over-year, and just missed the forecast, coming in $2.6 million below expectations. The company’s bottom line earnings showed a split. The non-GAAP measure came in at $1.46 per share, missing by 19 cents, while the GAAP EPS of $1.48 was 5 cents better than the estimates.

OneMain had $18.5 billion in outstanding debt balances at the end of Q1, along with $544 million in cash and liquid assets. Of that cash total, $177 million was not available for general corporate uses. The company has $385 million set aside as provision for finance receivable losses. While this sum is lower than equivalent provisions in the last three quarters, it is significantly higher than the $238 million set aside for this purpose at the end of 1Q22.

Turning to the dividend, we find that OneMain declared its last payment on April 25 of this year, for $1 per share. The dividend annualizes to $4, and gives a strong yield of 8.6%.

This consumer credit company has caught the attention of JMP’s 5-star analyst David Scharf, who sees the overall risk/reward here as favorable. Scharf notes that OneMain is outperforming its competition on customer applications, and maintaining discipline on expenses.

“We continue to be encouraged by the improving credit profile that has emerged since the mid-2022 tightening; the increased application volumes and share gains resulting from weakened competition; the maintenance of expense discipline; elevated capital generation; and the improving funding profile. We continue to believe that the company’s 2023 guidance is somewhat conservative, both in terms of loan loss reserves and portfolio growth, and we already saw the target for receivables growth raised to the high end of the range after just one quarter,” Scharf opined.

“When the positive attributes noted above are combined with a discounted current year P/E below 6x and a dividend yield above 10%, we see a very compelling risk/reward trade-off for shares of OMF,” the analyst summed up.

Looking ahead, Scharf gives OneMain stock an Outperform (i.e. Buy) rating, and his $55 price target implies a one-year upside potential of 18%. Based on the current dividend yield and the expected price appreciation, the stock has ~27% potential total return profile. (To watch Scharf’s track record, click here)

Overall, OneMain gets a Strong Buy rating from the Street, based on 12 recent analyst reviews that include 9 Buys and 3 Holds. (See OMF stock forecast)

Global Medical REIT (GMRE)

The next stock on our list is a real estate investment trust, a REIT. These are perennial dividend champs, and Global Medical puts an interesting twist on the REIT model: the company focuses on medical facilities and properties. The company boasts a heavy footprint, including 188 owned buildings, with 4.9 million leasable square feet, and 274 tenants. Global Medical’s real estate assets are valued at approximately $1.5 billion, and the company collects an annualized base rent of $114.9 million.

The firm has seen its revenues increase over the past several quarters, while earnings per share are sliding down. This can be seen in the company’s last quarterly financial release, from 1Q23. GMRE reported a top line of $36.2 million, up more than 13% from the year-ago quarter but sliding in just under the forecast by $340,000. The company’s bottom line, a net income of $700,000 attributable to common shareholders, gave an EPS of 1 cent per share. This was in-line the forecast, but was down sharply from the 4-cent EPS reported in 1Q22.

Dividend-minded investors should watch the company’s funds from operations, or FFO, as this metric reflects available cash. Global Medical reported an FFO of $15.1 million, or 22 cents per share for Q1, and an adjusted FFO, or AFFO, of $16 million, translating to 23 cents per share. The company had $4.6 million in cash and cash equivalents on hand as of March 31 this year, compared to $4.02 million at the end of 2022.

On June 9, the company declared its common stock dividend payment for 21 cents per share, and paid it out on July 11. The dividend annualizes to 84 cents, and yields a robust 8.6%. The company has been paying out the 21-cent dividend for the last 6 quarters, and has been paying out a slowly increasing dividend since 2016.

Covering this stock for Stifel, 5-star analyst Stephen Manaker sees plenty of potential for investors to grab onto. He writes, “We rate GMRE Buy, believing the stock represents an attractive value, despite limited near-term growth and above-average leverage. We still view the REIT as a long-term growth story, buying assets in secondary markets, markets that larger institutional investors typically avoid. While the tenants might not have an investment grade rating, GMRE’s focus on the profitability of a tenant in a specific location (among other underwriting criteria) has proven to be successful.

“The REIT should be able to sell some of these assets with proven tenants, allowing for the recycling of capital into higher yielding investments. This could help the REIT grow earnings without necessarily increasing the size of the balance sheet or accessing expensive capital,” the analyst added.

Alongside his Buy rating, Manaker gives GMRE shares a price target of $11, implying a 13% upside in the next 12 months. (To watch Manaker’s track record, click here)

Overall, GMRE gets a Moderate Buy rating from the analyst consensus, based on 7 recent reviews. These break down to 4 Buys and 3 Holds. (See GMRE stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.