People with obesity-related heart failure and diabetes can get substantial heart-health benefits from weight-loss drug Wegovy, even if they don’t shed many pounds on the medication, according to new research.

Source link

suggests

An analyst has explained how a buy signal forming in the price of Polygon (MATIC) could lead to the asset rebounding towards these price targets.

Polygon Is Showing A TD Sequential Buy Signal Right Now

In a new post on X, analyst Ali has discussed about the a Tom Demark (TD) Sequential signal forming in the MATIC price chart. The TD Sequential here refers to an indicator in technical analysis that’s generally used for pinpointing probable locations of reversal in any given asset’s value.

This indicator has two phases to it, the first of which is known as the “setup.” In this phase, candles of the same polarity are counted up to nine, at the end of which the price may be assumed to have encountered a point of reversal.

Naturally, if the candles leading up to the completion of the setup had been red, the reversal would be towards the upside, while green candles would suggest a potential top for the asset.

Once the setup is done with, the second phase called the “countdown” begins. This phase works similarly to the setup, except for the fact that it lasts for thirteen candles instead of nine. After these thirteen candles of the same polarity are also in, the price may be considered to have attained another likely point of reversal.

Polygon has recently completed a TD Sequential phase of the former type. Below is the chart shared by Ali that shows the formation of this TD Sequential signal for the MATIC daily price.

The recent pattern forming in the 1-day price of the cryptocurrency | Source: @ali_charts on X

As displayed in the above graph, the Polygon daily price has finished a TD Sequential setup with a downtrend recently. This would suggest that the asset may be at a potential bottom at the moment.

“If MATIC stays strong above $0.87, we could see a rebound to $0.95, or better yet, $1!” says the analyst. A potential rally to the former of these targets would suggest an increase of more than 8% from the current price, while a run to the latter level would mean growth of almost 14%.

It now remains to be seen how the Polygon price will develop from here and if the TD Sequential buy signal will end up holding or not.

MATIC Price

The past few weeks have been a bad time for Polygon investors as the cryptocurrency’s price has slid down all the way from around the $1.3 level to now the $0.87 mark, corresponding to a drawdown of over 33%.

The chart below shows what the trend in MATIC’s value has looked like over the past month.

Looks like the price of the asset has plunged over the past month | Source: MATICUSD on TradingView

Amid this downward trajectory, the TD Sequential buy signal may perhaps end up being at least a glimmer of hope for the Polygon holders.

Featured image from Shutterstock.com, charts from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin euphoria phase far off, Coinbase data suggests more growth potential

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

A recent ‘Navigating Narratives’ report by K33 Research provided insights on how to trade altcoins. Interestingly, as part of their analysis, they highlighted Solana (not ETH) as the main focus and elaborated on why this was so.

Why Solana Is The Main Focus

The report, written by DeFi Analyst David Zimmerman, stated that they were focusing primarily on buying SOL if there was an opportunity to buy lower. They claim the reason for this is that “SOL has solidified its place in the market as one of the market leaders.” They also expect that SOL’s outperformance of ETH will continue in this market cycle.

Meanwhile, Zimmerman highlighted how SOL’s on-chain activity has continued to flourish and noted that the narrative of SOL being ETH’s main competitor was still intact. The Solana network has long been dubbed the “Ethereum Killer,” with the belief that the former will dethrone the latter at some point.

Indeed, Solana has gone toe-to-toe with Ethereum in recent times, momentarily surpassing it in significant metrics. Back in December, Solana ranked above Ethereum in seven-day DEX volume for the first time in history and outperformed it in NFT trading volume during that same period. More recently, Solana’s Jupiter outranked Ethereum’s Uniswap in daily trading volume.

Solana currently trading at $98.9700 on the daily chart: TradingView.com

SOL also outperformed ETH last year, with the former seeing a gain of about 1000%. Crypto analyst Santiago Santos also recently gave his opinion on Solana and Ethereum’s fight for dominance. Comparing Ethereum’s run during the ICO boom to Solana’s current run, he noted that Solana had an edge since it has “applications seeing meaningful usage and growth.”

This happens to be one of the reasons he believes that Solana will “converge on Ethereum faster than most believe.”

What Price Levels Present Buying Opportunities For SOL

Having explained why SOL was the main focus among altcoins, the Navigating Narratives report highlighted price levels they were eyeing in case in case the market gives deeper pullbacks for SOL. These levels include the $70, $50 and $30 price range.

However, they noted that they weren’t expecting the $30 buy order to be filled since it would require a crash like the one that happened in March 2020. This was the period when Bitcoin lost almost half of its value in a two-day plunge. Other crypto tokens also experienced similar pain then.

Meanwhile, if SOL continues to rally, K33 Research highlighted the $115 and $140 price ranges as ideal areas for selling and taking profits.

At the time of writing, SOL is trading at around $99, up in the last 24 hours according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Here’s what the data of this historical on-chain indicator suggests regarding whether Bitcoin has become overvalued after its latest uptrend.

Bitcoin MVRV Z-Score Hasn’t Climbed Too High Yet

As the Reflexivity Research co-founder pointed out in a post on X, the BTC MVRV Z-Score readings have heated up little compared to the values observed in past bull runs.

The “Market Value to Realized Value (MVRV) ratio” is an indicator that measures the ratio between the Bitcoin market cap and the realized cap. The “realized cap” refers to a capitalization model for the cryptocurrency that assumes the “true” value of any coin in circulation is the price at which it was last transacted on the blockchain.

Since the last transaction price of any coin was likely the price at which it changed hands, one way to interpret the realized cap is that it represents the total capital the holders have invested into the asset.

Since the MVRV ratio compares the market cap (the spot price) against this model, it can tell us whether the investors are holding more value than they put in right now.

If the investors are holding more than what they bought the coin for (that is, they are in net profits), they might be tempted to sell, and thus, BTC might be likely to see a correction. Similarly, the market being in losses can suggest the cryptocurrency’s price is currently undervalued and might be due to a rebound.

Now, here is a chart that shows the trend in the Z-Score of the Bitcoin MVRV ratio over the history of the coin:

The value of the metric appears to have been going up in recent days | Source: @WClementeIII on X

The “Z-Score” is a statistical tool used to measure how far a data point is from the mean. In the graph, the analyst has marked two zones for the Bitcoin MVRV Z-Score where BTC has attained an overbought/underbought condition.

It would appear that historical bottoms in the asset’s price have formed when the metric has dipped inside the green zone. The tops haven’t been so simple, though, as they fluctuate a bit.

One common thing between all tops is that they have occurred at decently high values of the indicator. At such values, the investors make very high profits, so tops naturally become significantly probable.

The chart shows that the Bitcoin MVRV Z-Score has been climbing recently as the asset has rallied, but it’s yet to arrive at levels similar to past tops. “There will be corrections along the way, but zooming out Bitcoin is far from overvalued based on historical readings,” notes the analyst.

BTC Price

At the time of writing, Bitcoin is trading at around $43,800, up 15% in the last week.

Looks like BTC has registered a sharp uptrend over the last few days | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Glassnode.com

Luis Alvarez | Digitalvision | Getty Images

The U.S. economy inched closer to a so-called “soft landing” after a new batch of labor data, economists said.

A soft landing is a good thing. It would mean the Federal Reserve has accomplished the difficult task of taming inflation without triggering a recession.

Job openings, a barometer of employer demand for workers, fell by 617,000 to 8.7 million in October, the lowest since March 2021, the U.S. Department of Labor reported Tuesday in its monthly Job Openings and Labor Turnover Survey.

“Another key ingredient of a sustainably soft landing is falling into place,” Jason Furman, a professor at Harvard University and former chair of the White House Council of Economic Advisers during the Obama administration, wrote about job openings.

Why a soft landing is like ‘Goldilocks’ porridge’

Steaming bowl of oatmeal porridge, made with Irish oats, wheat berries and barley.

Jon Lovette | Photographer’s Choice Rf | Getty Images

On its face, a weakening labor market may sound like bad news — but that trend is by design.

The Fed started raising borrowing costs aggressively in early 2022 to tame stubbornly high inflation. By raising interest rates to their highest level since 2001, the central bank has aimed to cool the economy and the labor market.

The Fed has been walking a tightrope: bringing down inflation from four-decade highs without causing an economic downturn. The opposite — a hard landing — would mean a recession.

A soft landing is like “‘Goldilocks’ porridge’ for central bankers,” Brookings Institution economists wrote recently. In this scenario, the economy is “just right — neither too hot (inflationary) nor too cold (in a recession),” they said.

“It’s absolutely the best possible outcome,” said Julia Pollak, chief economist at ZipRecruiter. “And I think the chances [for it] get higher and higher all the time. We are very, very close.”

There is no official definition for a soft landing. According to conventional wisdom, it has only been achieved once — in 1994-95 — in the history of 11 Fed monetary-policy-tightening cycles dating to 1965, the American Economic Association wrote.

How the labor market fits in

Why the job market is already ‘back into balance’

The latest labor data added to encouraging news about a likely soft landing, economists said.

A big pullback in job openings didn’t coincide with weakness elsewhere. Quits and hires held steady around their respective pre-pandemic levels. Layoffs remain low and are about 17% below their pre-pandemic baseline, suggesting employers want to hold on to workers, Pollak said.

Despite the large monthly decline, job openings are still 25% above their February 2020 level, she added.

It’s absolutely the best possible outcome. And I think the chances [for it] get higher and higher all the time.

Julia Pollak

chief economist at ZipRecruiter

The ratio of job openings to unemployed workers fell to 1.3 in October, down from a pandemic-era high of 2.0 and near the pre-pandemic level of 1.2.

“This [JOLTS] report should bring abundant holiday cheer as the probability of a soft landing continues to rise,” Nick Bunker, director of economic research at the Indeed Hiring Lab, wrote Tuesday.

“The current state of the labor market suggests no further recalibration is necessary to bring [it] back into balance,” he added. “It’s already there.”

In short: The labor market has cooled while layoffs haven’t spiked and workers still enjoy relatively good job security and prospects, economists said.

“It’s still a favorable labor market,” Pollak said.

However, workers have lost leverage relative to 2021 and 2022. Big pay increases aren’t as prevalent, nor are signing bonuses. While there remain ample job opportunities, they are harder to get, Pollak said. Outside of industries such as health care, in which there’s an acute labor shortage, the opportunities “aren’t quite as attractive,” she added.

Don’t miss these stories from CNBC PRO:

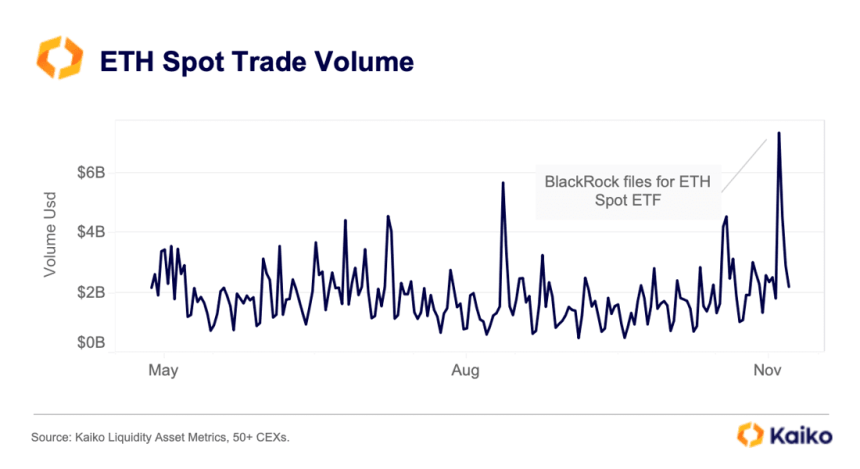

Ethereum (ETH), the second-largest cryptocurrency, has seen a significant price increase over the past month. The recent bullish rush in the crypto market, coupled with BlackRock’s involvement, has pushed ETH to its year-to-date high of $2,139.

Ethereum Outshines Bitcoin And Altcoins

According to market data provider Kaiko, ETH has outperformed BTC and many altcoins in recent weeks, signaling a shift in market dynamics.

Kaiko’s report highlights how ETH struggled to gain momentum over the past year, despite successful upgrades such as The Merge in April.

However, the sentiment around ETH changed dramatically when BlackRock filed for a spot ETH exchange-traded fund (ETF), leading to a reversal in the ETH to Bitcoin (BTC) ratio.

The impact on the market was substantial, with ETH prices surging above $2,000 for the first time since April. Additionally, daily spot trade volumes reached $7 billion, the highest level since the collapse of FTX.

The ETH ETF narrative provided further impetus to the ongoing rally, amplified by improved global risk sentiment and declining US Treasury yields.

The dominance of altcoin + ETH volume relative to BTC has risen to 60%, marking its highest level in over a year. During bull rallies, altcoin volume typically increases relative to BTC.

This surge in demand has also led to rising leverage, as reflected in the recovery of ETH open interest to early August levels. Notably, BTC open interest has declined over the past month due to liquidations on Binance, resulting in the Chicago Mercantile Exchange (CME) outpacing Binance as the largest BTC futures market.

Furthermore, ETH funding rates, a gauge of sentiment and bullish demand, have reached their highest levels in over a year, indicating a significant shift in sentiment. In November, both BTC and ETH 30-day volatility rose to 40% and 50% respectively, following a multi-year low of around 15% during the summer months.

Crypto Expert Predicts ETH Breakout

Renowned crypto expert Michael Van de Poppe believes that ETH is on the cusp of a significant breakthrough. According to Van de Poppe, if Ethereum manages to surpass the crucial $2,150 resistance level, it could signify the end of the bear market.

Drawing a parallel with Bitcoin’s critical $30,000 barrier, Van de Poppe suggests that breaching this level could pave the way for a substantial rally, potentially propelling Ethereum towards the price range of $3,100 to $3,600.

However, Ethereum has yet to touch the $2,150 resistance line, as it faces a pre-existing obstacle in the form of its yearly high of $2,139. This pivotal level has halted the cryptocurrency’s bullish momentum, acting as a formidable resistance.

As a result, Ethereum has been consolidating within a narrow range between $2,050 and $2,100 for the past three days.

The forthcoming days will reveal whether Ethereum can overcome its immediate resistance levels and establish a consolidated position above them. Alternatively, it may face a fate similar to Bitcoin, which failed to surpass the $31,000 level for over seven months before reaching its current trading price of $36,000.

Featured image from Shutterstock, chart from TradingView.com

JPMorgan analysts have cast a skeptical eye over the recent crypto rally, indicating it may be built on sand rather than solid ground. Their latest report conveys a guarded stance, suggesting that the market’s exuberance may be outpacing the underlying fundamentals.

As the market’s enthusiasm swells, fueled by pivotal developments such as the US Securities and Exchange Commission’s (SEC) potential green light of the spot Bitcoin exchange-traded fund (ETF), these financial experts are urging caution, advocating a closer examination of the elements at play.

A Closer Look At ETF Approval And Regulatory Battles

Within the crypto sphere, JPMorgan analysts disclosed that two significant events have captured investor interest and driven prices upward.

These events include anticipating a US-approved spot Bitcoin ETF, which has ignited hopes of new capital inflows. At the same time, recent legal tussles involving the SEC have raised expectations for a more permissive regulatory environment.

However, the JPMorgan team, led by analyst Nikolaos Panigirtzoglou, presents a contrarian view, deconstructing these drivers and their probable impact on the market. They argue that an ETF approval would usher in fresh capital, which might be misleading.

The analysts propose that rather than attracting new investment; the approval could redirect existing funds from current Bitcoin investment products into the new ETFs. The JPMorgan team noted:

First, instead of fresh capital entering the crypto industry to be invested in the newly-approved ETFs, we see as a more likely scenario existing capital shifting from existing bitcoin products such as the Grayscale bitcoin trust, bitcoin futures ETFs and publicly listed bitcoin mining companies, into the newly-approved spot bitcoin ETFs.

This shift, they assert, would not necessarily expand the market’s capital base. JPMorgan’s team points to the tepid response to similar products in Canada and Europe as evidence, suggesting that a US spot Bitcoin ETF might encounter the same lukewarm reception.

Legal victories against the SEC in high-profile cases like Ripple and Grayscale are also interpreted as potential precursors to a regulatory softening. Yet, the analysts remain unconvinced, citing the lingering aftereffects of the FTX scandal and the inherent risks of an under-regulated market.

They further disclosed that these factors will likely keep the regulatory tightening trend intact, with little room for significant easing.

Bitcoin Halving: A Pre-Priced Crypto Event?

The report delves into the much-discussed Bitcoin halving, which traditionally stokes bullish forecasts. However, JPMorgan’s analysts believe the market has already factored in the halving’s supply-squeeze implications. They noted:

This argument seems unconvincing as the Bitcoin halving event and its effect are predictable and in our opinion are well factored into Bitcoin price.

They calculate that based on current data, the production cost of Bitcoin post-halving should double, particularly from the current $ $21,000 to $43,000.

Their analysis concludes with a sobering outlook, anticipating a potential “buy the rumor, sell the fact” scenario post-ETF approval. Such a dynamic could see prices climb on anticipation and plummet once the event materializes, a pattern familiar to seasoned market observers.

Echoing similar sentiments, financial commentator Peter Schiff has cast doubt on the longevity of Bitcoin’s price surges driven by ETF speculations.

Schiff warns that post-approval, Bitcoin might face a shortage of positive triggers, potentially culminating in a market sell-off as the ‘buy the rumor, sell the news’ phenomenon unfolds.

How many times can #Bitcoin rally on the same ETF rumor? Once a U.S. Bitcoin EFT is approved, or $GBTC is able to convert into an ETF, there will be no more “good” news for Bitcoin to rally on. After years of buying the rumor, everyone will finally be able to sell the news.

— Peter Schiff (@PeterSchiff) October 16, 2023

Meanwhile, Bitcoin has seen quite a significant move in the past few hours. The asset has now marked a new high for 2023, surging above $37,000, up by nearly 10% in the past day.

Featured image from Unsplash, Chart from TardingView

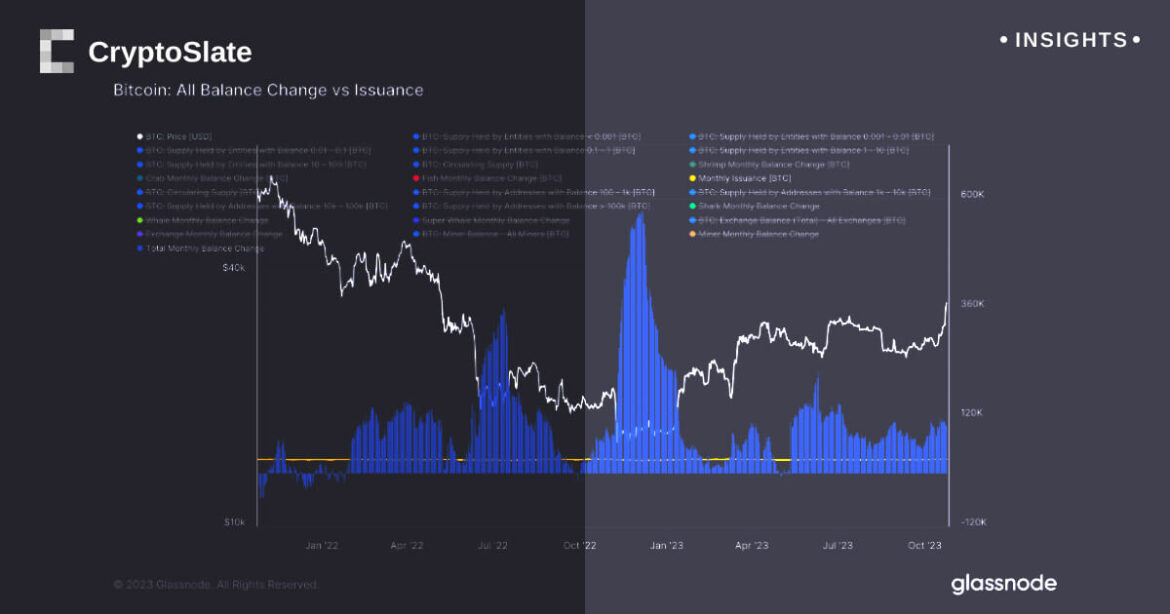

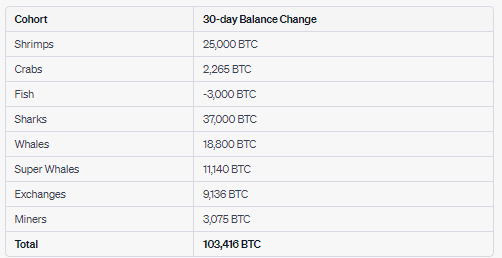

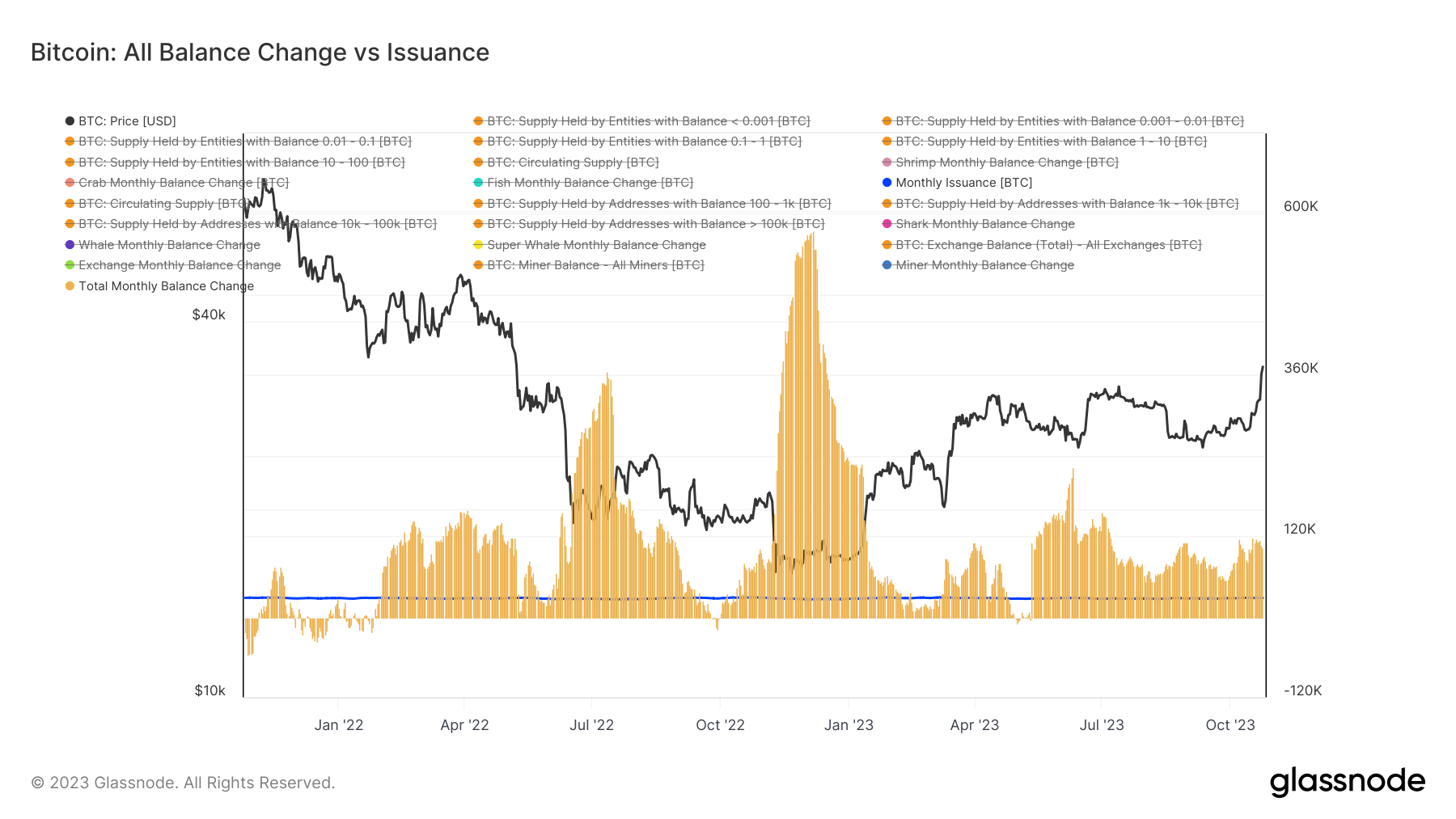

Bitcoin supply absorption by various cohorts suggests impending halving event not fully priced in

Quick Take

A deep dive into Bitcoin’s issuance reveals a fascinating trend as the next Bitcoin halving event approaches.

The current monthly issuance of Bitcoin stands at 27,000 BTC, calculated from 900 Bitcoin mined each day over 30 days. An analysis of various cohorts, along with exchanges and miners, unveils a significant absorption of this supply.

Indeed, the balance of the 27,000 BTC is being consumed overwhelmingly. The past month’s data shows ‘Shrimps’ accumulating 25,000 BTC and ‘Crabs’ by 2,265 BTC,

‘Fish’ decreased by 3,000 BTC, ‘Sharks’ by 37,000 BTC, ‘Whales’ by 18,800 BTC, and ‘Super Whales’ by 11,140 BTC.

Meanwhile, exchanges saw a balance decrease of 9,136 BTC, seen as a bullish sign, and miners increased their balance by 3,075 BTC. In total, these cohorts absorbed roughly 103,000 BTC.

With the impending halving event, the monthly Bitcoin supply will drop to 13,500 BTC. Assuming constant demand, this reduction in supply could trigger a bullish turn in the market—an event that may not yet be fully priced in.

The post Bitcoin supply absorption by various cohorts suggests impending halving event not fully priced in appeared first on CryptoSlate.

Bitcoin pioneer Hal Finney can’t be Satoshi Nakamoto, new analysis suggests

Bitcoin pioneer Hal Finney was competing in a 10-mile race when Satoshi Nakamoto was responding to emails and transacting on Bitcoin, newly surfaced evidence has revealed.

For years, it has been speculated that the late Hal Finney, a computer scientist, created Bitcoin (BTC). He was the first person besides Satoshi to download and run Bitcoin’s software and was the first recipient of Bitcoin. Finney, however, denied the theory until his passing in 2014.

Jameson Lopp, a self-proclaimed cypherpunk and co-founder of Bitcoin custody firm Casa, doesn’t believe the speculation either. In an Oct. 21 blog post, Lopp shared new evidence that casts further doubt on the theory.

Racing to send an email

Lopp’s key evidence revolves around a 10-mile race in Santa Barbara, California, on Saturday, April 18, 2009.

According to the race data, Finney competed in the “Santa Barbara Running Company Chardonnay 10 Miler & 5K,” starting at 8:00 am Pacific Standard Time and finishing the race 78 minutes later.

The race, however, coincides with timestamped emails between Satoshi and one of the first Bitcoin developers, Mike Hearn.

Hal Finney was a legendary Cypherpunk, but he was not Satoshi.

Today I present my research to support that claim.https://t.co/gZVQv3QW0B— Jameson Lopp (@lopp) October 21, 2023

“It turns out that early Bitcoin developer Mike Hearn was emailing back and forth with Satoshi during this time,” explained Lopp, referring to archived emails that Hearn had released publicly in the past.

“What can we determine from all of this? Satoshi sent the email to Mike at 9:16 AM Pacific time – 2 minutes before Hal crossed the finish line.”

“For the hour and 18 minutes that Hal was running, we can be quite sure that he was not interacting with a computer,” Lopp added.

The Bitcoin transaction

Meanwhile, Lopp highlighted on-chain data to further support his claim.

Hearn’s emails show that Nakamoto sent Hearn 32.5 BTC in one transaction.

Lopp pointed to this transaction that took place on block 11,408, which was mined at 8:55 am PST — 55 minutes into Finney’s race.

Nakamoto confirmed this transaction — in addition to another one involving 50 BTC — in the 6:16 pm email, which Lopp iterates took place while Finney was still running.

Health issues

Meanwhile, analysis has also highlighted that Satoshi was working on code and posting on various forums during a time when Hal Finney’s battle with Amyotrophic Lateral Sclerosis (ALS) had already affected his ability to use a keyboard.

Lopp cited an Aug. 22, 2010 post from Hal Finney’s wife, Fran Finney, who said the couple attended the 2010 Singularity Summit in San Francisco on Aug. 14–15 and that Finney’s hard-fought battle with ALS slowed his typing from a “rapid-fire” 120 words per minute to a “sluggish finger peck.”

Bitcoin is better off with Satoshi’s identity remaining unknown. A human can be criticized and politically attacked. A myth will withstand the test of time.

— Jameson Lopp (@lopp) August 12, 2023

During that same time, Nakamoto performed four code check-ins and wrote 17 posts on various forums between Aug. 14–15, 2010, said Lopp.

Lopp also noted several differences in Finney’s Reusable Proofs of Work code compared with the original Bitcoin client code.

Related: Bitcoin pioneer Hal Finney talks ZK-proofs in 25-year-old unearthed footage

However, Lopp also acknowledged there could be objections to the so-called evidence.

Hearn published the emails in 2017 — seven years ex-post facto — and that it was around a time when other Bitcoiners lost trust in him over disagreements on how to scale Bitcoin.

Finney could have also scripted the emails and transactions in advance, or there could have been more than one Satoshi Nakamoto, Lopp said.

However, Lopp argues that Bitcoin’s creation came from a single developer:

“In all my time researching Satoshi, I’ve yet to come across any evidence suggesting it was a group. If it was a group, then they all operated on the same sleep schedule, consistent across code commits, emails, and forum posts.”

Hal Finney unfortunately passed away in August 2014 as a result of complications with ALS.

Magazine: Big Questions: Did the NSA create Bitcoin?