BofA’s Tal Liani upgraded Cisco shares, cheering the company’s opportunity to benefit from networking growth on the heels of market-share gains.

Source link

surge

Crypto Experts Predict Massive Price Surge For XRP Price, Is $20 Possible?

Crypto experts continue to be bullish on the XRP price despite the poor performance that the altcoin has exhibited in recent times. Some of these experts see the cryptocurrency’s price rising higher from its current level, with one analyst expecting XRP to rise as high as $20 in the coming bull market.

XRP Price On The Verge Of Breakout

One of the crypto experts that has shown incredibly bullish sentiment toward the XRP price is Matthew Dixon, the CEO of crypto rating platform, Evai. Dixon took to X (formerly Twitter) to share with the crypto community that the XRP trading volume had been seeing positive headwinds in recent times.

At the time, the Evai chart shared by the the crypto CEO showed that XRP had recorded an approximately 42% increase in its daily trading volume to cross $2.1 billion. Using this increase in trading volume, Dixon believes that it shows the rising interest in the altcoin.

Naturally, increased interest often translates to increased demand, which can be bullish for a cryptocurrency’s price. This was the thought shared by the Evai CEO who believed the surge in trading volume and interest meant that the XRP price was on the verge of a breakout.

However, this does not seem to be the case, at least in the short term, since the XRP price continues to trend around the same level since Dixon first made the post. It is hovering around $0.61 at the time of this writing, with a0.96% gain in the last 24 hours.

Can Price Get To $20?

Predictions for the XRP price going into the next bull market have had a wide variety, from very conservative to very ambitious. For many, though, the expectation is that the XRP price will rise very quickly as regulatory clarity from the Ripple vs SEC case is fast approaching.

Crypto analyst Armando Patoja takes the ambitious route with his own prediction, forecasting an over 3,000% price increase for XRP. According to Patoja, the predictions that put XRP’s future price at $5 severely underestimate the ability of the altcoin.

On his own, the crypto analyst believes that the XRP price has the potential to rise even further to reach between $10 to $20. Patoja posits that saying XRP will reach just $5 is like expecting Bitcoin to top out at $1,000 in 2015.

There people saying #XRP will reach $5 are significantly underestimating.

This is similar to predicting #Bitcoin would cap at $1,000 in 2015. XRP is on a trajectory akin to Bitcoin’s in 2015, with a rapidly growing network effect.$XRP prediction: $10-$20. Thoughts?

— Armando Pantoja (@_TallGuyTycoon) April 6, 2024

Despite the growing XRP community, it is no doubt that Patoja’s prediction has been received with a grain of salt. One community member responded to the post saying XRP could not possibly rise that high because major projects who were building on the XRP Ledger have been abandoning it for other chains because it is a dead chain. Due to the lack of builders, they do not believe that XRP has the steam to run that high.

XRP trading at $0.61 | Source: XRPUSDT on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Wormhole $617M Airdrop Ignites Valuation Surge To $3B, But W Price Stumbles 23%

Wormhole, a cross-chain communication protocol enabling the transfer of assets between blockchains, recently launched an airdrop campaign for its newly issued governance token, W. Early users were rewarded with 617 million W tokens, and the protocol also released a roadmap outlining its plans.

Wormhole Protocol Unveils Roadmap

According to the protocol’s roadmap, W aims to become a native multi-chain token, leveraging the advantages of both the Solana and Ethereum Virtual Machine (EVM) chains.

Initially launched as a native SPL token on Solana, W will reportedly leverage Solana’s performance, offering increased performance, scalability, low transaction costs, and fast settlement times.

After the Solana debut, W will be extended to all Wormhole-connected EVM chains using Wormhole Native Token Transfers (NTT). This framework allows W to continuously roll out across Solana, the Ethereum mainnet, and Layer 2 (L2s) without liquidity fragmentation.

The open-source NTT framework allows projects to control token behavior on each chain, including token standards, metadata, ownership/upgradability, and custom features.

Cross-Chain Governance System

Wormhole also introduces a governance system where token holders on any supported chain can create, vote on, and implement governance proposals. This approach allows maximum participation in the Decentralized Autonomous Organization (DAO) by providing a frictionless user experience for token holders distributed across multiple chains.

As announced, W holders can lock and delegate their tokens on Solana and EVM chains, allowing them to participate in governance decisions. The Wormhole DAO, composed of W token holders, will oversee the Solana, Ethereum mainnet, and EVM L2s governance system.

Wormhole, developed by Jump Crypto, a division of Jump Trading Group, has been under development for several years. Despite encountering challenges, including a significant hack in February 2022 resulting in a loss of approximately $320 million, the protocol has continued to evolve.

Furthermore, the recent listing of the W token on major exchanges such as Crypto.com and the future support planned by Coinbase on April 4 further validate its progress.

W’s Debut On OpenBook

The W token debuted on the Solana-based decentralized exchange (DEX) OpenBook at $1.66, with a market capitalization of $2.98 billion and a fully diluted value of $16.5 billion.

However, the token’s market capitalization and fully diluted value have since fallen to $2.2 billion and $12.5 billion, respectively, according to updated data from CoinGecko. Trading volume for W has remarkably increased, reaching $555,937,593 in the last 24 hours, representing a staggering 25,732,359.60% surge.

Following the airdrop, some users openly shared their sell-offs of the W token on social media platforms, resulting in a 23% price drop. At the time of writing, the token is trading at $1.32.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

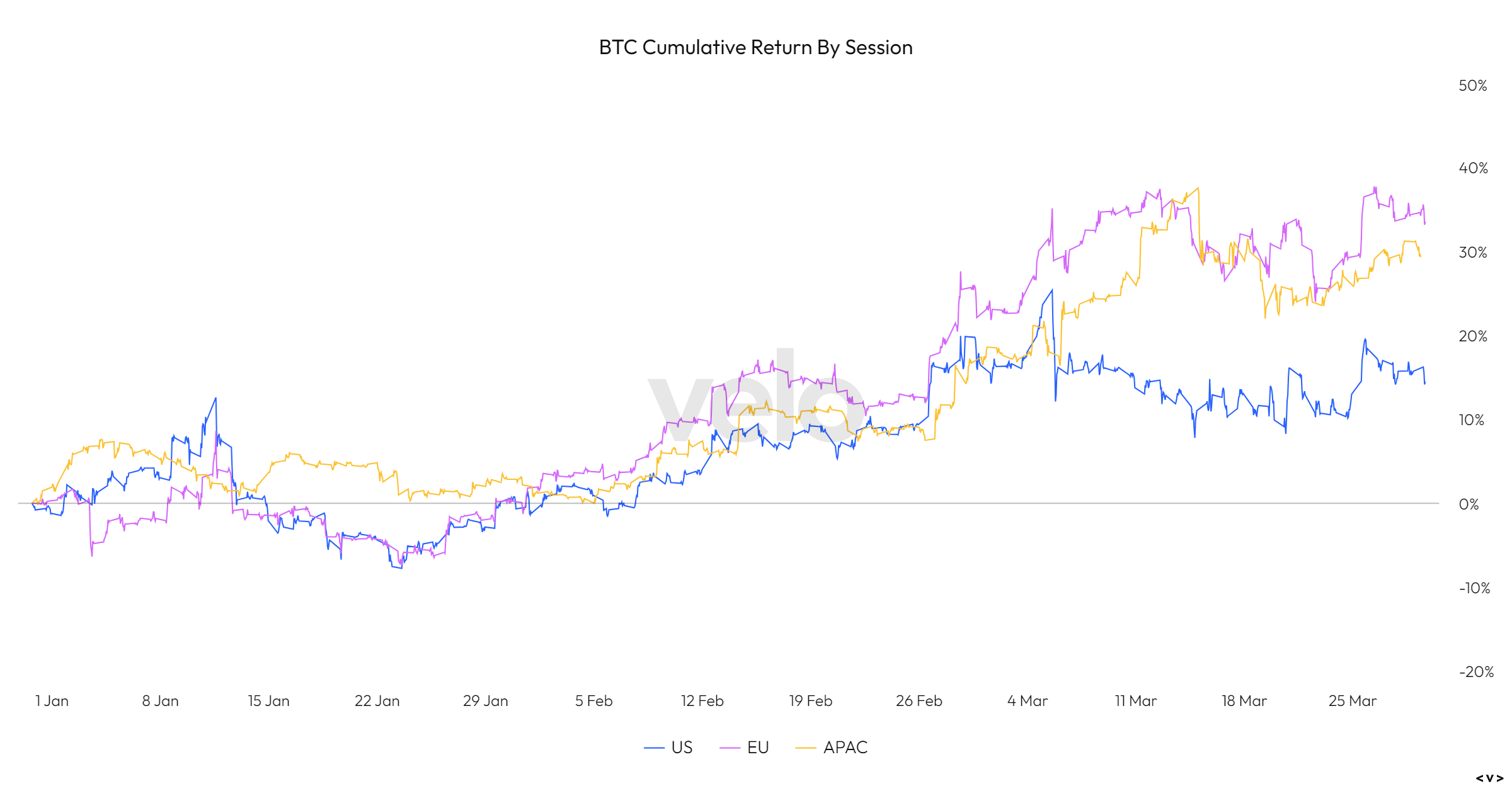

European trading hours lead global Bitcoin surge in 2024’s first quarter

Quick Take

Bitcoin has experienced a remarkable first quarter in 2024, as reported by Coinglass, with the digital asset surging by an impressive 64% over the quarter and by 13% in March alone.

This surge marks the seventh consecutive month of gains for Bitcoin. The introduction of spot Bitcoin ETFs in the United States has played a significant role, attracting over $12 billion in net inflows.

Furthermore, analysis of session data from Velo Data indicates that European trading hours have surpassed both the US and Asia in performance year-to-date. European sessions have seen a 34% increase compared to 30% for Asia and 14% for the US.

Notably, there was a significant spike on March 25, coinciding with the announcement by the London Stock Exchange (LSE) of the launch dates for Bitcoin and Ethereum Exchange Traded Notes (ETNs).

Looking ahead, a number of anticipated bullish events, such as the Bitcoin halving, the launches of LSE ETNs, and the potential introduction of Hong Kong ETFs, are expected to provide further impetus to Bitcoin’s momentum.

The post European trading hours lead global Bitcoin surge in 2024’s first quarter appeared first on CryptoSlate.

Venom Blockchain Launch Triggers Huge Surge In User Adoption, Surpassing 1 Million In A Single Day

With the growing adoption of blockchain technology in various digital asset infrastructures, a team from Abu Dhabi, known for its wealth from the oil industry, has made a significant entry into the space with the launch of the Venom Blockchain.

Venom Blockchain Market Cap Soars

Venom operates as a foundational Layer 0 blockchain network, equipped with dynamic sharding and a proof of stake (PoS) consensus method. Designed to offer a scalable and efficient infrastructure, this advanced blockchain platform is tailored for the development of diverse products. It seamlessly bridges governmental applications and traditional Web3 projects through its sophisticated mesh network architecture.

The distinguishing feature of the Venom blockchain is its infrastructure, which, according to its official website, is capable of processing 100,000 transactions per second, with an average fee per transaction of just $0.0002.

As a result, the Venom Blockchain is currently attracting significant attention, as evidenced by various metrics. The Venom Blockchain currently boasts a market capitalization of over $5.2 billion and a trading volume of over $200 million, highlighting Abu Dhabi’s interest in the technology.

Over One Million Users In The First Year

The launch of Venom had a significant impact, attracting over one million users in 24 hours, demonstrating the platform’s appeal to investors and developers for building Web3 products.

In addition, the platform reportedly has over 20 projects ready to debut on the platform and several pilot stablecoin initiatives in different countries, underscoring the confidence developers have in its infrastructure.

Overall, the rise of Venom Blockchain underscores Abu Dhabi’s ability to adopt innovation beyond its traditional sectors and demonstrates the emirate’s interest in promoting the advancement of blockchain technology.

On March 27, the native token of the blockchain, VENOM, was listed on KuCoin, leading to a significant price surge of over 27% within 24 hours. Presently, the token is trading at $0.6580, reflecting a recent increase of 3.8% in the past trading hour.

In the past 24 hours, the trading volume of the VENOM token has reached $62,515,705, marking a notable increase of 193.60%, according to CoinGecko data.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

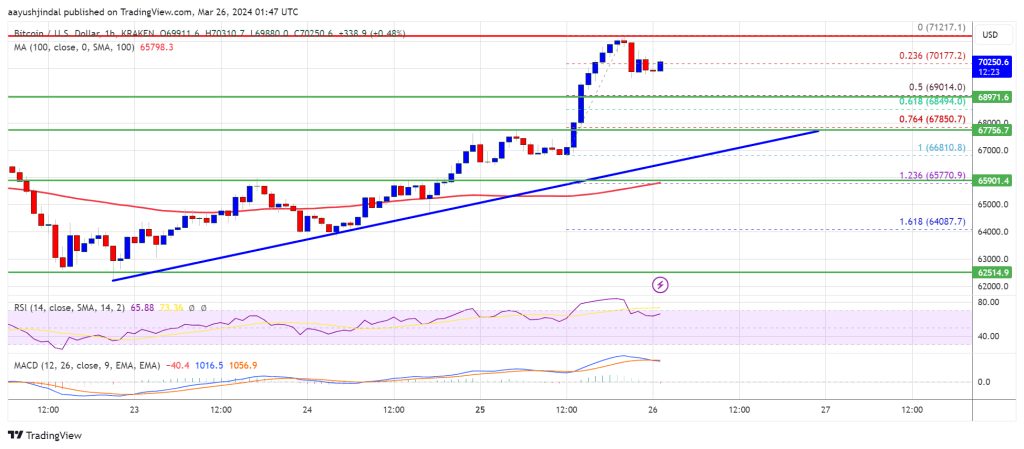

Bitcoin price is rising and now trading above $70,000 resistance zone. BTC could continue to rise toward the $73,000 and $75,000 levels in the near term.

- Bitcoin price remained in a positive zone above the $66,500 level.

- The price is trading above $70,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $67,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $71,200 resistance zone.

Bitcoin Price Restarts Increase

Bitcoin price remained stable above the $65,000 resistance zone. BTC climbed higher above the $67,500 and $68,000 resistance levels. The bulls even pumped the price above the $68,800 and $70,000 resistance levels.

A new weekly high was formed near $71,217 and the price is now consolidating gains. It is trading near the 23.6% Fib retracement level of the upward move from the $66,810 swing low to the $71,217 high. Bitcoin is also trading above $70,000 and the 100 hourly Simple moving average.

There is also a connecting bullish trend line forming with support at $67,500 on the hourly chart of the BTC/USD pair. The trend line is close to the 76.4% Fib retracement level of the upward move from the $66,810 swing low to the $71,217 high.

Source: BTCUSD on TradingView.com

Immediate resistance is near the $70,500 level. The first major resistance could be $71,200. If there is a clear move above the $71,200 resistance zone, the price could continue to gain strength. In the stated case, the price could even clear the $73,500 resistance zone in the near term. The next key resistance sits at $75,000.

Another Drop In BTC?

If Bitcoin fails to rise above the $71,200 resistance zone, it could start another decline. Immediate support on the downside is near the $70,000 level.

The first major support is $69,000. The next support sits at $67,800 and the trend line. If there is a close below $67,800, the price could start a drop toward the $66,800 level. Any more losses might send the price toward the $65,500 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 60 level.

Major Support Levels – $69,000, followed by $67,800.

Major Resistance Levels – $70,500, $71,200, and $73,500.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Market Cap Hints at Potential Price Surge After Retesting 2021 Highs

A crypto analyst on X is confident that Bitcoin has bottomed and is poised for major gains in the sessions ahead. Interestingly, the bullish outlook hinges on the Bitcoin market cap retesting all-time highs at press time.

Will BTC Rally? Market Dynamics Changing

So far, the Bitcoin price is around 2021 highs in USD terms but recently broke all-time highs, peaking at around $73,800. This fluctuation is also reflected in its market cap. It currently stands at $1.25 trillion, down 5% in the past 24 hours.

Notably, it is at the same price level as in 2021, when Bitcoin prices peaked, recording new all-time highs.

While optimism abounds and the trader expects more sharp price expansions in the days ahead, it is not immediately clear whether the coin will rip higher, aligning with this forecast. Bitcoin is volatile and has remained so despite changing market dynamics.

At the same time, unlike in the past, Bitcoin prices are driven not only by retail forces but by institutions. These institutions are regulated by the United States Securities and Exchange Commission (SEC), which also approved the spot Bitcoin exchange-traded fund (ETF).

This Bitcoin derivative product has been the primary driving force in the past ten weeks. This is from looking at how prices have evolved since its approval in mid-January 2024.

However, since BlackRock and Fidelity are regulated by the United States SEC, unlike retailers, they cannot act as they wish. Considering the millions and billions of dollars at play, their comments or assessments on the coin, now and in the future, can greatly impact sentiment.

Sentiment Is Dented, BTC Facing Headwinds

Sentiment has been dented when writing. Even with the United States Federal Reserve (Fed) ‘s decision to hold rates at 5.5%, the highest in 2023, lifting prices, there has been no solid follow-through in price action. The coin remains steady below $70,000.

Whether prices will rally over the weekend remains to be seen. However, for now, there are some headwinds to consider.

First, there has been a slowdown in inflows to spot BTC ETFs. At the same time, outflows from the Grayscale Bitcoin Trust (GBTC) have increased. Second, after rallying sharply from October 2023, a cool-off before halving might see the coin trend lower.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Solana has recently become one of the trendiest cryptocurrencies in the space, capturing the interest of both crypto investors and enthusiasts in the space. The popular cryptocurrency has witnessed a significant surge in network activity, surpassing even that of Ethereum, the world’s second-largest cryptocurrency.

Solana Outpaces Ethereum Network Activity

On March 16, Solana experienced a major increase in its overall network activity, pushing its capacity to its limits amidst the growing demands. The network had surged past Ethereum’s total trading volume and exceeded its daily trading volume by more than $1.1 billion, according to data by DefilLama.

Specifically, Solana’s 24-hour trading volume had recorded almost $3 billion, surging past Ethereum’s daily volume of $2.04 billion. During the surge, the network witnessed an unprecedented amount of trading activities, which resulted in failed transactions and a surge in ping times.

As highlighted by Solana Validator, the cryptocurrency network’s ping time on March 18, had jumped to a staggering 46 seconds, causing about a 30% to 40% failed transactions. The validator’s report also revealed a steady and rapid increase in Solanan’s transaction count, recording over 276 million transactions at the time of writing, with about 2,107 transactions per second.

This rise in Solana’s network activity has been attributed to the surge in interest in Solana-based meme coins. On Thursday, March 14, degens eagerly sought after a new meme coin called Book of Meme (BOME), which had experienced an unprecedented bullish spike that triggered its market capitalization to rise from almost zero to a staggering $1.45 billion.

During these periods, the price of Solana also rallied alongside, witnessing an unexpected price surge that propelled it by more than 30% in the past week. The cryptocurrency has been on a steady momentum since the beginning of the year, displaying slight price corrections before continuing on its upward trajectory.

SOL Price Rides The Bullish Wave

Amidst Solana’s burgeoning popularity and rising transaction volumes, the cryptocurrency saw a price increase to more than $200, reflecting a daily surge of approximately 8.9%, at the time of writing. The cryptocurrency’s market capitalization is also up by 11.10%, recording over $89 billion and steadily closing towards the $100 billion mark.

Due to its overwhelming network activities and growing popularity, Solana has successfully gained the position of the 4th largest cryptocurrency by market capitalization, overtaking BNB Chain (BNB) by more than four billion, according to CoinMarketCap.

Moreover, the cryptocurrency has reached peak levels globally in terms of Google search interest, hitting a new all-time high. This surge has been attributed to the increasing interest and demand for the popular digital asset.

SOL price crosses $200 | Source: SOLUSD on Tradingview.com

Featured image from LinkedIn, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

XRP Records Massive 80% Surge In Trading Volume, Can Price Reach A New ATH?

XRP continues to show strength despite largely underperforming during the ongoing bull market. Interestingly, the crypto witnessed a surge in activity last week, with trading volume surging in tandem. Particularly, the trading volume saw an increase of over 80% recently.

However, the boost in activity and trading volume has not necessarily translated into continuous price growth, as XRP is currently on a 13% percent correction from the $0.74 price level on Monday.

XRP Trading Volume Surges, But Will Price Follow?

XRP witnessed a surge earlier in the week which saw it breaking out of a 6-year-long symmetrical triangle, prompting analysts to anticipate a continued price surge.

During this period, the crypto witnessed a surge in trading volume from whales in particular, with large bouts of XRP leaving crypto exchanges.

This bullish sentiment allowed XRP to cross over $0.74 for the first time in eight months, albeit for a short moment. This surge in price was short-lived, as XRP fell as low as $0.6 in the days after.

However, a recent 80% surge in on-chain activity and trading volume has led to the price of XRP increasing by 4.45% in the past 24 hours and 2.2% in a seven-day timeframe.

Volume spikes of this magnitude often occur before a price rally, therefore, this massive spike in volume has the XRP community speculating that a strong price rally could be on the horizon.

Total crypto market cap currently at $2.5 trillion. Chart: TradingView

Current Price Action: Can XRP Reach A New All-Time High?

At the time of writing, XRP is trading at $0.6398. The crypto’s journey to a new all-time high is definitely not going to be an easy one, as it is now down by 83% from its current all-time high of $3.84.

However, current market dynamics and various predictions from many crypto analysts indicate that the crypto might go on a surge of great magnitude in the near future.

One of these is a prediction from analyst Jaydee, who noted that XRP’s recent breakout from the six-year trendline mentioned earlier could lead to a surge to $3 from the current price level.

The major resistance level to watch is $0.74. XRP tested this level a few days ago but failed to close above it. If bullish momentum continues and volume stays strong, XRP could break through $0.74 decisively in the new week. If it does, the next resistance levels are at $0.82 and $1.5.

One of the few factors that could contribute to a strong price increase is regulatory clarity regarding XRP’s status, which could boost confidence from institutional investors.

Notably, XRP’s non-security status seems to be gaining ground. The European Corporate Governance Institute (ECGI) recently published a research paper acknowledging this non-security status.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.