The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

Source link

Surges

Solana’s stablecoin supply surges past $3 billion, USDC leads the charge

Stablecoin supply on the layer-1 blockchain network Solana has increased steadily since the beginning of the year, crossing the $3 billion mark during the past week.

Data from the blockchain analytical platform Artemis shows that the stablecoin supply on the network has increased by 55.72% in the last three months to reach $3.12 billion.

Notably, this number pales significantly against the balance on the network in 2022, when more than $6 billion worth of these assets were on the blockchain. However, it plummeted to as low as $1.4 billion during the bear market situation before embarking on the recent upward trend.

Meanwhile, stablecoin transfer volume on Solana surged by 164% to $1.4 trillion, reflecting the significant amount of activity the network has enjoyed.

USDC dominates

A breakdown of stablecoins on Solana shows Circle’s USD Coin’s (USDC) dominance, accounting for 73% of such assets on the network.

For context, Artemis data show that USDC accounted for a significant $63.69 billion of stablecoin transfer volume on April 2, overshadowing USDT’s $812.41 million. EURC completes the top three with less than $100,000 in volume.

USDC’s dominance on Solana can be directly linked to Circle’s launch of its Cross-Chain Transfer Protocol (CCTP) on the network on March 26.

Why Solana stablecoins balance is rising

Stablecoins play a crucial role as an intermediary between traditional fiat currencies and digital assets. An increasing stablecoin supply indicates heightened liquidity and is indicative of increased capital infusion.

Market observers have explained that this upsurge reflects the significant influx of capital into the network, coinciding with the frenzy surrounding memecoins and the expanding DeFi activity within the Solana ecosystem.

Over the past year, the Solana blockchain ecosystem has witnessed notable expansion despite its previous ties to Sam Bankman-Fried, the controversial founder of FTX. This growth has attracted a wave of new users and forged significant partnerships with major global financial entities, including Visa and Shopify.

The post Solana’s stablecoin supply surges past $3 billion, USDC leads the charge appeared first on CryptoSlate.

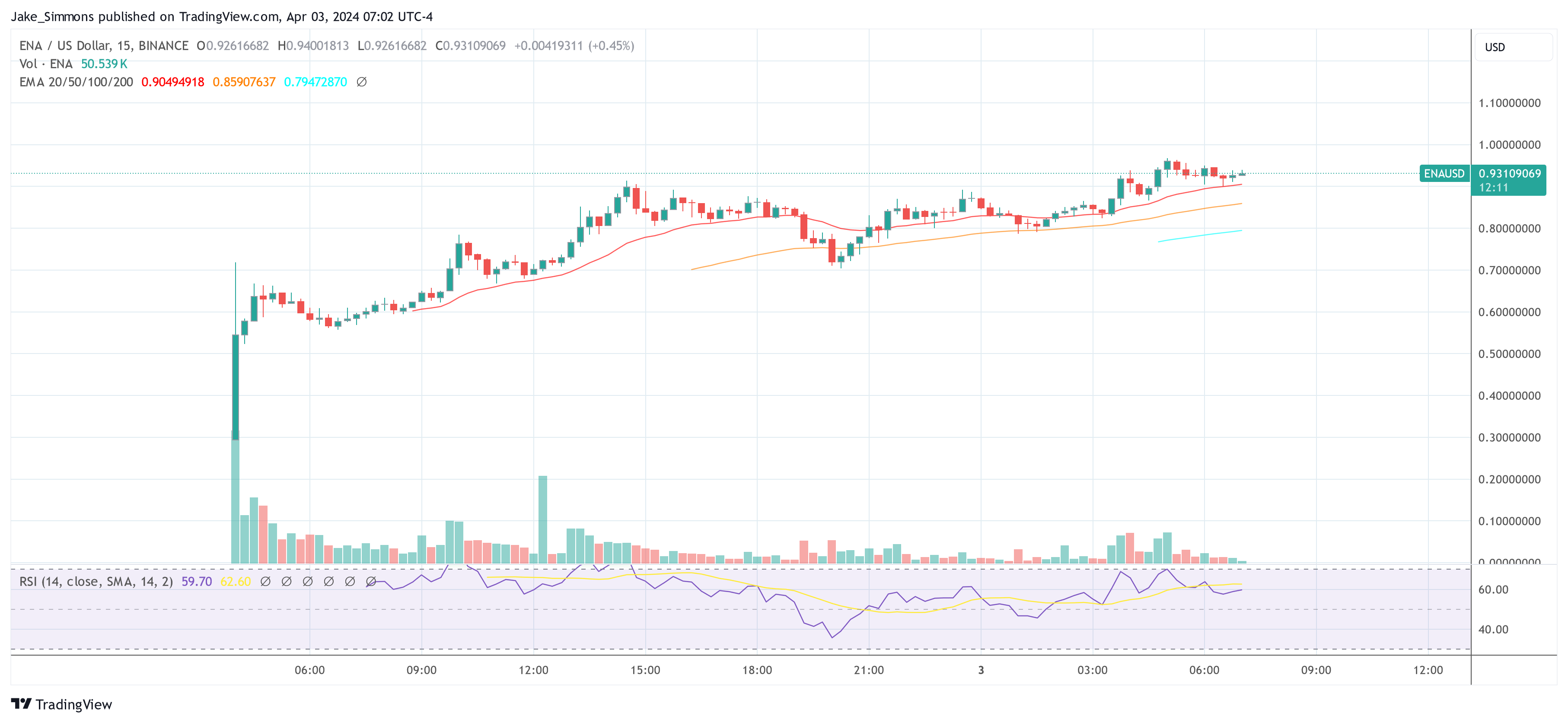

Ethena Labs’ new governance token, ENA, is witnessing a staggering 60% increase in its value, shortly after its introduction to the market. The spike in ENA’s price to approximately $0.96 has catapulted its market capitalization to nearly $1.34 billion, ranking ENA as the 80th largest cryptocurrency by market cap.

This ascent followed Ethena’s strategic distribution of 750 million ENA tokens, representing 5% of its total supply, through an airdrop to holders of its USDe token. The USDe, a synthetic dollar, is central to Ethena’s offering, leveraging a blend of ether liquid staking tokens and short Ether (ETH) perpetual futures positions to maintain a target value near $1.

The Ethena Labs airdrop went live 2 hours ago, with $450M of ENA to distribute.

The largest $ENA recipient so far has been 0xb56, who received 3.30M ENA worth $1.96M.

Track ENA on Arkham: pic.twitter.com/l6c7bqKghG

— Arkham (@ArkhamIntel) April 2, 2024

At the heart of Ethena’s value proposition is the ENA token, engineered to facilitate a digital dollar platform on the Ethereum blockchain. This platform seeks to provide a viable alternative to conventional banking mechanisms through its innovative ‘Internet Bond’. By harnessing the potential of derivative markets and staked Ethereum, the Internet Bond offers a dollar-denominated savings instrument accessible globally, independent of traditional banking infrastructure.

The total supply of ENA tokens is capped at 15 billion, with an initial issuance of 1.425 billion tokens. The distribution plan prioritizes ecosystem development (30%), core contributor rewards (30%), investor engagement (25%), and foundation support (15%), embodying a holistic approach to tokenomics. Notably, Binance’s endorsement of ENA as the 50th project on its Binance Launchpool, enabling users to farm ENA tokens by staking BNB and FDUSD, underscores the token’s appeal.

At press time, ENA traded at $0.93, up 60% in the past 24 hours.

Fantom Co-Founder Warns Of Luna-Like Collapse

Andre Cronje, co-founder of the Fantom Foundation, issued a warning on X, recalling the concerns that preceded the collapse of Terra Luna. Cronje dissected the structure of perpetual contracts (perps), a derivative product that enables traders to speculate on the price movement of an asset without holding the actual asset.

This mechanism operates on a system of funding rates meant to tether the perpetual price closely to the underlying asset’s spot price. However, Cronje highlighted a critical vulnerability in this system: the reliance on yield-generating assets, such as staked Ethereum (stETH), as collateral.

This approach theoretically allows for a “neutral” position, where the gains from yield should offset losses from the short position if the asset’s price drops. Yet, this equilibrium is precarious, as negative shifts in funding rates can erode the collateral, leading to liquidation.

“The mechanism – the theory here is that you can generate a ‘stable’ $1000, by buying $1000 of stETH, using this as collateral to open a $1000 stETH short, thereby achieving being ‘neutral’, while getting the benefit of the stETH yield (~3%) + whatever is paid in funding rates,” Cronje explained.

Cronje’s concerns are not unfounded. The crypto industry witnessed the dramatic implosion of Terra’s algorithmic stablecoin UST in 2021, a debacle that resulted in significant financial losses across the board. By drawing a parallel between the structural weaknesses he perceives in Ethena’s framework and the mechanisms that led to Terra’s downfall, Cronje raises a red flag about the sustainability of complex financial products that lack transparent risk mitigation strategies.

Every so often we see something new in this space. I often find myself on the mid curve for an extensive amount of time. I am comfortable here. That being said, there have been events in this industry I wish I was more curious about, there have also been events I definitely did…

— Andre Cronje (@AndreCronjeTech) April 3, 2024

Responding to Cronje’s critique, the founder of Ethena Labs Guy Young aka Leptokurtic, acknowledged the validity of the concerns raised. “These aren’t mid curve concerns at all Andre Cronje, you rightly point out risks that absolutely do exist here. Will work on a longer form response for you by end of this week with some thoughts,” Young stated on X.

Featured image from LinkedIn, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Trump Media & Technology Group (DJT) soared 14% on Wednesday in its second day of trading on the Nasdaq (^IXIC).

The parent company of Donald Trump’s social media platform Truth Social climbed 16% in its first official trading day on Tuesday. It went public after merging with special purpose acquisition vehicle Digital World Acquisition Corp. in a deal approved by shareholders last week.

DJT’s strong debut comes amid a meme stock resurgence as some trades viewed as lacking fundamentals have seen eye-popping returns.

According to an SEC filing from DWAC, Trump Media lost $49 million in the first nine months of last year and brought in $3.4 million in revenue. At current levels, its market cap now sits around $8 billion.

Other meme-friendly names like Reddit (RDDT) and GameStop (GME) have also seen massive run-ups in recent days while riskier assets like bitcoin (BTC-USD) and commodities have soared since the start of the year.

Some names are coming back down to earth. Reddit and GameStop were down about 13% and 16%, respectively, in Wednesday’s trade.

Short interest in DJT stock — bets that the stock price will fall rather than rise — is about 11% of outstanding shares, according to the latest data from S3 Partners. Average short interest in public companies sits in the 3% to 4% range.

The former president founded Truth Social after he was kicked off major social media apps like Facebook and Twitter, the platform now known as X, following the Jan. 6 Capitol riots in 2021. Trump has since been reinstated on the platforms.

Trump will maintain a roughly 60% stake in Truth Social, a stake currently worth roughly $4 billion. The merger’s completion also comes as the former president faces a $454 million fraud penalty and grapples with a campaign fundraising shortfall as he gears up for a 2024 election rematch against President Biden.

But Trump will have to wait before cashing in his shares.

According to the terms of the merger, stakeholders are subject to a six-month lockup period before selling or transferring shares. The only exception would be if the company’s board votes to make a special dispensation.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

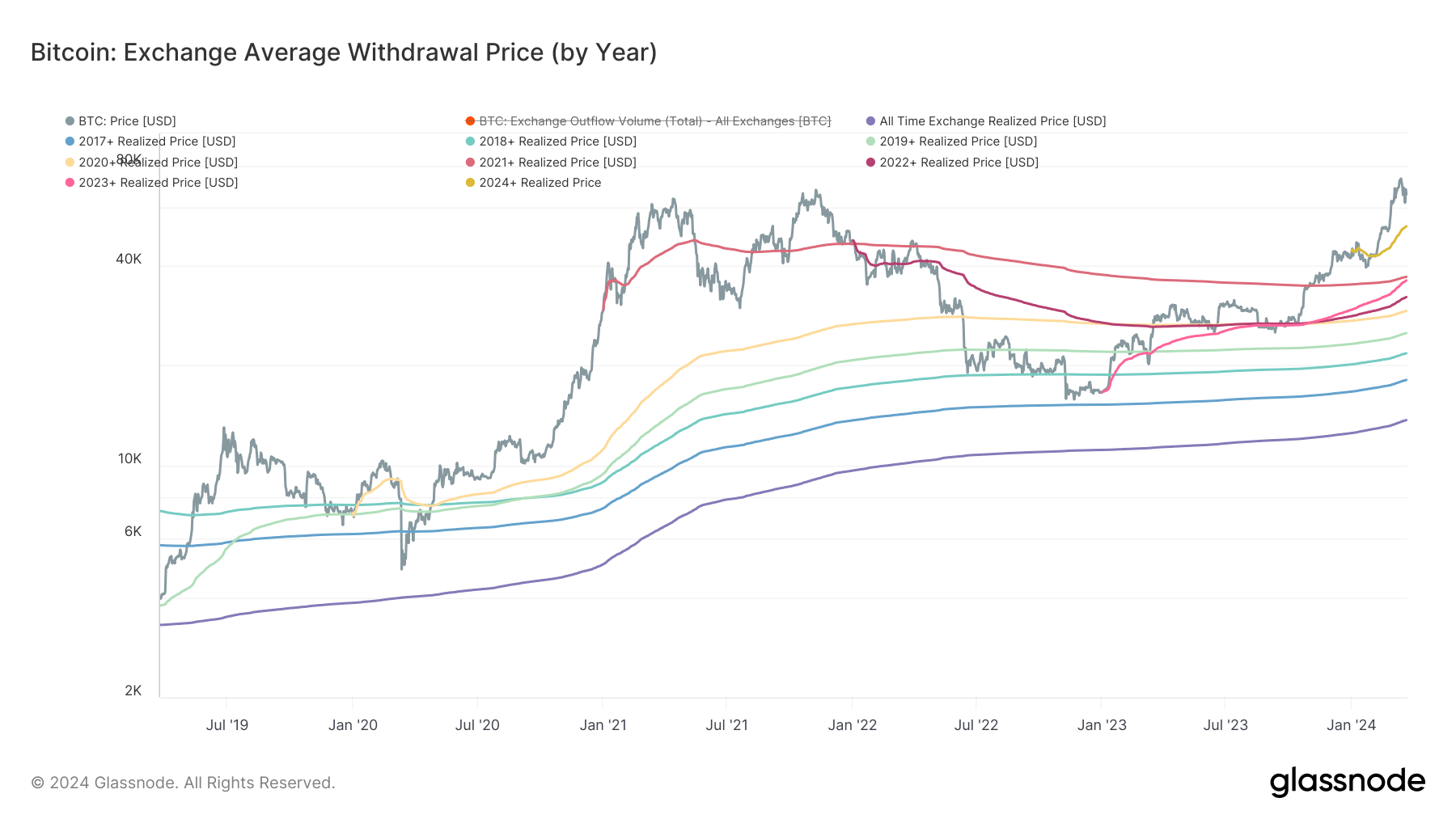

Recent Bitcoin buyers show unyielding optimism, pushing cost basis upward despite price surges

Quick Take

Utilizing data from Glassnode to estimate a market-wide cost basis reveals intriguing trends in the average price at which coins are withdrawn from exchanges. The information, segregated into cohorts, uncovers an upward trajectory on a cost basis, indicating a trend of purchasing Bitcoin at incrementally higher prices.

Most notably, the 2024 cohorts experienced a significant upswing, seeing an average profit margin of about $10,500, which translates to an approximately 20% gain from their initial cost basis ($52,478), according to data from Glassnode.

Interestingly, the 2021 cohort managed to significantly reduce their cost basis from $47,000 to a more conservative $36,971, as highlighted by recent CryptoSlate data analysis. Despite the reduction, the cost basis for all cohorts has risen in recent months, showing an unwavering dedication to buying Bitcoin regardless of increasing prices.

| Year | Price |

|---|---|

| All-time | $13,689 |

| 2017+ | $18,082 |

| 2018+ | $21,758 |

| 2019+ | $25,018 |

| 2020+ | $29,173 |

| 2021+ | $36,971 |

| 2022+ | $32,139 |

| 2023+ | $36,058 |

| 2024+ | $52,478 |

Source: Glassnode

The 2023 cohort, exhibiting the most bullish behavior, showcased a dramatic rise in cost basis from roughly $26,500 in October 2023 to a present figure of $36,058, suggesting a potential to surpass the 2021 cohort.

The post Recent Bitcoin buyers show unyielding optimism, pushing cost basis upward despite price surges appeared first on CryptoSlate.

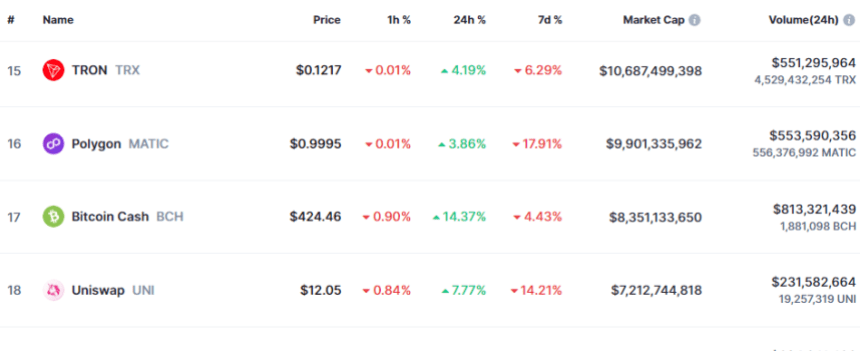

Bitcoin Cash (BCH) has registered a sharp 15% rally in the past 24 hours after plans of a futures listing on Coinbase have surfaced for the asset.

Coinbase Plans To Launch Bitcoin Cash Futures Product On 1 April

As an X user has pointed out, the cryptocurrency exchange Coinbase appears to have filed certifications with the Commodity Futures Trading Commission (CFTC) to list futures products for three coins on its platform: Bitcoin Cash (BCH), Dogecoin (DOGE), and Litecoin (LTC).

Coinbase Derivatives LLC quietly filed certifications with CFTC to list US regulated futures for Dogecoin, Litecoin and Bitcoin Cash.

They filed them on March 7 and surprisingly nobody seemed to notice.

Futures are set to start trading on April 1 if there are no objections from… pic.twitter.com/DYbWjuS6G2

— Summers (@SummersThings) March 20, 2024

As per the CFTC filing, all of these products were certified on March 7, and they are set to go live on trading on the first of the month.

The BCH, LTC, and DOGE futures contracts were all certified earlier in the month | Source: CFTC

Interestingly, all three of these digital assets happen to be based on the original cryptocurrency: Bitcoin. Bloomberg analyst James Seyffart has hinted that this may be why Coinbase has chosen them.

This is interesting… wonder if the SEC objects to these being classified ‘commodities futures’ vs ‘securities futures’. These all forked from Bitcoin so “these are securities” claims would be hard to make after spot #Bitcoin ETF approvals. Might be why Coinbase chose them🤔

— James Seyffart (@JSeyff) March 20, 2024

Unlike LTC and DOGE, which are based initially on BTC’s code, BCH is a direct fork of the cryptocurrency made to fulfill BTC’s original purpose as a fast and cheap form of currency that may be used for regular purposes (hence the name).

The filling made by Coinbase on Bitcoin Cash reads:

The market position of Bitcoin Cash reflects its role as an alternative to Bitcoin that prioritizes transaction efficiency. While it has not matched Bitcoin in terms of market capitalization or price, Bitcoin Cash has established itself as a significant player in the cryptocurrency space, with a dedicated user base and ecosystem.

BCH Has Enjoyed A 14% Surge During The Last 24 Hours

The cryptocurrency sector has been up in the past day, but two coins in particular have stood out among the top 20 assets by market cap: Bitcoin Cash and Dogecoin.

Both of these have managed more than 14% returns in this period, notably outperforming their peers. Bitcoin itself has only been able to put together a rally of about 6%.

Given that the Coinbase filling has been making the rounds in this window, it would appear likely that it was at least partially responsible for the extraordinary surges of these coins.

Even though Litecoin is also planned to see its futures contract launch on the same day as the other two, its price performance has been more or less in line with the rest of the market with its profits sitting at just 4%.

Following the sharp rally, Bitcoin Cash has now arrived at the $424 level. The chart below shows how the cryptocurrency’s trajectory has looked in the last few days.

Looks like price of the asset has shot up over the past day | Source: BCHUSD on TradingView

Regarding the market cap, Bitcoin Cash is currently the 17th largest asset. While there is some distance to Polygon (MATIC) in 16th place, LTC may be able to catch it if it can keep up this rally.

The BCH market cap seems to be $8.3 billion at the moment | Source: CoinMarketCap

Featured image from Shutterstock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Shiba Inu (SHIB), the self-proclaimed “Dogecoin Killer,” has the crypto world buzzing once again. This meme coin, forever linked to the adorable Shiba Inu dog breed, has witnessed a meteoric rise in both price and burn rate, igniting a passionate fire within its devoted “Shiba Army” community.

But beneath the current frenzy lies a crucial question: can Shiba Inu transform itself from a playful pup into a respected player in the ever-evolving cryptocurrency game?

Shiba Inu Burns Bright: Can It Melt The Ice Of Skepticism?

The recent surge stems from a staggering 22,432% increase in the burn rate over a 24-hour period, according to Shibburn, a platform dedicated to tracking SHIB transactions. This translates to a colossal 14 billion SHIB tokens being sent to a “dead wallet,” effectively removing them from circulation.

Proponents hail this decrease in supply as a catalyst for long-term price appreciation, echoing the basic economic principle of scarcity driving demand.

Source: Shibburn

However, seasoned crypto veterans remain cautious. The dramatic rise is based on data from a limited timeframe (one week, one day), and the cryptocurrency market is infamous for its hair-trigger volatility.

This rapid price increase could very well be a bubble on the verge of bursting, leading to a sharp correction. Additionally, the “meme coin” label itself carries a certain stigma. Meme coins, often lighthearted parodies, tend to be more speculative and prone to wild price swings compared to established cryptocurrencies with underlying utility.

SHIB market cap currently at $20 billion. Chart: TradingView.com

Shiba Army Marches On

Despite the skepticism, the Shiba Inu community, affectionately known as the “Shiba Army,” pulsates with unwavering enthusiasm. They’ve been instrumental in the burning initiative, actively contributing to the surge.

Furthermore, recent hints from Kusama, the lead developer of Leash (another token within the Shiba Inu ecosystem), regarding a potential token burn have further stoked the flames of community spirit. This dedicated fanbase is a powerful force, capable of influencing market sentiment and potentially propelling the price upwards.

A Look Beyond The Hype

The future of Shiba Inu remains shrouded in uncertainty. The short-term outlook appears bullish, with some analysts predicting a surge towards $0.0001. However, long-term sustainability hinges on several crucial factors.

The success of Shibarium, the upcoming layer-2 blockchain specifically designed for SHIB, will be a major determining factor. Furthermore, developing real-world use cases that extend beyond mere speculation is essential for Shiba Inu to shed its meme coin label and establish itself as a serious contender in the ever-evolving cryptocurrency landscape.

Featured image from Nguyen Duc Khoi/Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin surges to prices last seen two years ago in painful crash days after ATH

Bitcoin (BTC) surged 6% on Feb. 26 to a new two-year high of $54,910 after US markets began trading, an indication of rising interest in the flagship crypto from retail and institutional investors.

Bitcoin was trading at roughly $54,650 as of press time, up 5.6% on a daily basis, with a market cap of $1.07 trillion, according to CryptoSlate data.

Start of winter

The last time Bitcoin was trading at these levels was in December 2021 — 21 days after it hit a new all-time high of $69,044 on Nov. 10, 2021.

On Dec. 3, 2021, Bitcoin was trading around $54,365 after giving up significant gains over the past three weeks following its rally to a new all-time high amid profit-taking and shifting market conditions.

However, the drawdown had only just begun, as the flagship crypto saw a severe dip over the next 24 hours that took Bitcoin to a painful low of $42,000 before recovering some of the almost $15,000 in losses before the day closed.

By the end of Dec. 4, 2021, Bitcoin was trading at $49,191, down 8.6% over a single day.

ETF performance, halving hype

Spot Bitcoin ETFs have continued their strong performance over February and experienced a significant spike in volume on Feb. 26 to set a new record of $2.4 billion in daily volume.

According to data shared by Bloomberg ETF analyst Eric Balchunas, BlackRock’s spot Bitcoin ETF IBIT posted a record trading volume of $1.3 billion as of press time, which brings it to the top 0.3% of all ETFs and the top 25 of all stocks for the day.

Meanwhile, spot Bitcoin ETF inflows for the past week stood at $583 million. The total is made up of more than $1 billion in inflows, which are offset by $436 million of Grayscale’s GBTC outflows.

Notably, GBTC outflows have slowed down significantly over the past couple of weeks, with the ETF recording only $44.2 million in outflows on Feb. 23.

Bitcoin Market Data

At the time of press 8:47 am UTC on Feb. 27, 2024, Bitcoin is ranked #1 by market cap and the price is up 10% over the past 24 hours. Bitcoin has a market capitalization of $1.11 trillion with a 24-hour trading volume of $48.69 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 8:47 am UTC on Feb. 27, 2024, the total crypto market is valued at at $2.13 trillion with a 24-hour volume of $111.16 billion. Bitcoin dominance is currently at 51.96%. Learn more about the crypto market ›

Filecoin (FIL) has been among the top gainers during the current market rally. Throughout February, FIL has shown a formidable performance fueled by the bullish momentum and its partnership with a major blockchain.

This performance has analysts and important crypto actors predicting a potential bullish run around the corner for the decentralized storage network’s native token.

Should Filecoin Investors Get Ready For A Bull Run?

Pseudonym analyst and trader Crypto Breakout highlighted that FIL broke through a crucial resistance in the 3-day timeframe, signaling that the “bulls return with force.” The chart shared by the analyst illustrates a downtrend pattern in FIL’s price since 2022.

Two years ago, as the chart below shows, the token traded at $11 before facing a pullback that shredded about 70% of the token’s value in the following months. By February 2023, the token recovered and broke through the $9 resistance level before repeating a similar downtrend.

FIL's downtrend pattern since 2022. Source: Crypto Breakout on CoinMarketCap

Since 2023, the price has remained well below this level, only breaking through the $8 support zone once at the very beginning of 2024. Throughout January, FIL’s price had a turbulent performance, falling around 40%.

The price has picked up the crypto market uptrend, and, as the analyst highlights, it has been gaining positive momentum. The 3-day time frame shows that FIL has been following an upward trend that led to the token breaking through the crucial $8 support zone this Friday.

As the post suggests, this break out of the downtrend could signal FIL’s “beginning of an epic bullish rally” and that investors should “get ready for exciting moves ahead.”

Renowned crypto analyst Ali Martinez made a similar prediction. Earlier this week, Martinez highlighted Filecoin moving within a parallel channel on the 3-day chart. He suggested a successful breakthrough from the $8.50 barrier could catapult the token’s price to $25.5.

Artur Hayes Predicts $100 As FIL Continues To Rise

After the token’s recent surge, BitMEX co-founder Arthur Hayes shared his FIL prediction. On an X (former Twitter) post, Hayes forecasted that FIL’s price would rally to $100, also calling the arrival of the bull market.

Welcome to the bull market. May all things AI related levitate. $FIL = $100

Yachtzee 😘😘😘😘 pic.twitter.com/oggCeY8IGc

— Arthur Hayes (@CryptoHayes) February 23, 2024

Filecoin, a decentralized storage network, recently integrated with Ethereum’s rival Solana to make its blockchain history more accessible and usable. According to the announcement, the integration is a significant move away from centralized storage solutions, which seek to improve reliability and scalability in the Solana blockchain.

This move has considerably fueled the ongoing upward momentum for FIL. The token has shown a considerable performance in recent weeks, with FIL increasing 53.9% in the last two weeks and 67.7% in 30 days.

The token trades at $8.19 at writing time, representing a 9.6% surge in 24 hours and 39.0% in the last seven days. FIL is currently the 25th largest cryptocurrency by market capitalization, at $4.2 billion, a 12.38% increase from yesterday. Its trading activity also saw a recent rise, with its daily trading volume at $895.2 million, 44% more than the day before.

FIL performance in the 1-day chart. Source: FILUSDT on TradingView.com

Featured image from Unsplash.com, Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Decentralized exchange (DEX) Uniswap’s native token UNI climbed 60% on Feb. 23 to a two-year high of $12.48 following a governance proposal to introduce a fee reward mechanism for holders.

The token has since given up some of its gains and was trading at $11 as of press time — up 48% on a daily basis, according to CryptoSlate data.

UNI was last trading at these price levels in January 2022.

The primary driver behind the price rise is a new proposal to overhaul the DEX’s governance system. It aims to tackle the crucial issue of low engagement and “stale” delegation by directly incentivizing active participation.

Active governance

According to the proposal, Uniswap currently faces a troubling reality: despite its governance system holding the reins of the protocol’s future, participation remains sluggish.

Less than 10% of UNI tokens, the lifeblood of voting, are actively used, and a significant portion of existing delegation stands idle, failing to contribute to crucial decisions. The lack of engagement poses a potential threat to Uniswap’s long-term stability.

The proposal wants to solve this issue by creating a compelling incentive for token holders that involves linking UNI token delegation and staking to a share of the protocol’s fee revenue. This creates a direct connection between active participation and potential rewards, aiming to foster a more engaged community and attract new delegates.

The mechanism will be implemented via two new smart contracts that are meticulously designed to automate protocol fee collection and distribute them fairly to stakers based on their delegated UNI tokens.

The proposal lays out every detail of these contracts, including security audits and code descriptions, to remain fully transparent with the community.

Voting scheduled

The community has reacted positively to the development, and the surge in UNI’s value indicates a buying frenzy ahead of the voting snapshot.

After open discussion and refinement on the Uniswap forum, the community will hold two votes to determine whether it should be adopted — a snapshot vote on March 1 and an on-chain vote on March 8.

If successful, the community will then have the final say on activating the fee mechanism through a separate vote. This ensures every voice is heard and allows for further deliberation before taking the final step.

This proposal’s potential ramifications extend beyond Uniswap itself. Should it be implemented successfully, it could become a reference point for other decentralized protocols seeking to enhance active participation and responsible governance practices.

However, careful evaluation is necessary to understand the potential effects on liquidity and trade execution, as acknowledged within the proposal itself.

The proposal mirrors Osmosis DEX’s recent prop 651, which introduced similar incentives for token holders. The protocol has generated and distributed a little over $4 million in taker fees to OSMO stakers.

Osmosis Lead Llama Emperor Osmo told CryptoSlate:

“The recently suggested changes within Uniswap only help to cement that Osmosis governance acted with the sustainability and long-term viability of the Osmosis DEX in mind. Similar to what Prop 651 did for Osmosis, Uniswap aims to transform its UNI token from a governance-only token to one with a legitimate value accrual mechanism.”

Uniswap Market Data

At the time of press 7:51 pm UTC on Feb. 24, 2024, Uniswap is ranked #16 by market cap and the price is up 2.14% over the past 24 hours. Uniswap has a market capitalization of $6.68 billion with a 24-hour trading volume of $1.53 billion. Learn more about Uniswap ›

Crypto Market Summary

At the time of press 7:51 pm UTC on Feb. 24, 2024, the total crypto market is valued at at $1.98 trillion with a 24-hour volume of $50.3 billion. Bitcoin dominance is currently at 51.21%. Learn more about the crypto market ›