The latest statistics on bitcoin reserves from the nine new spot bitcoin exchange-traded funds (ETFs) reveal they currently possess 453,503.98 bitcoins, valued at approximately $30.29 billion based on the current exchange rates. The 9 New ETFs Hold Nearly a Half Million Bitcoin Since their inception on Jan. 11, 2024, these nine spot bitcoin ETFs have […]

The latest statistics on bitcoin reserves from the nine new spot bitcoin exchange-traded funds (ETFs) reveal they currently possess 453,503.98 bitcoins, valued at approximately $30.29 billion based on the current exchange rates. The 9 New ETFs Hold Nearly a Half Million Bitcoin Since their inception on Jan. 11, 2024, these nine spot bitcoin ETFs have […]

Source link

surpass

Can Nvidia Rally 21% and Surpass Apple to Become the Second Most Valuable “Magnificent Seven” Stock?

March 8 was a wild day in the stock market. Shares of Nvidia (NVDA -0.12%) surged to an all-time high of $974 only to fall over 10% from that high to end the day at $875.28. At the peak, Nvidia was less than 9% away from surpassing Apple (AAPL -0.22%) in market cap. By close, it was a little over 20% away.

Given Nvidia’s big swings, it seems like the stock could very well surpass Apple to become the second most valuable “Magnificent Seven” stock behind Microsoft. Here’s why Nvidia could keep outperforming Apple in the short term, but why Apple is the better long-term buy.

Image source: Getty Images.

Earnings are driving the Nvidia story

Nvidia is not an unprofitable growth stock that is rallying based on optimism and greed alone (although those are contributing factors). The business is doing phenomenally well, achieving a level of sales and earnings growth paired with margin expansion.

NVDA Revenue (TTM) data by YCharts

The only concern with Nvidia is its valuation. Its price-to-earnings (P/E) ratio based on its trailing 12-month (TTM) earnings is 73.6. But consensus analyst estimates expect Nvidia’s earnings per share (EPS) to more than double from the $11.90 it earned in fiscal 2024 to $24.50 in fiscal 2025. That gives Nvidia a forward P/E of 35.7 — which is far more reasonable.

The easiest way for Nvidia to pass Apple in market cap is for investors to keep bidding up the stock. But the more realistic way is if Nvidia’s earnings live up to expectations.

Nvidia will report its full-year fiscal 2025 results some time in late February or early March next year. If it reports $24.50 in earnings, the stock would likely be far higher, especially if there is optimism for even more growth ahead. A business that is more than doubling earnings with high margins and leading the artificial intelligence (AI) revolution deserves a premium valuation, probably something like double the P/E of the S&P 500.

Nvidia deserves the highest P/E of all the Magnificent Seven companies, but the company is nearing a point where it is running up too far, too fast.

Nvidia benefited from earnings growth and a valuation expansion. It’s hard to assume the valuation will continue to expand, but the stock could still go up if the first half of fiscal 2025 goes as analysts expect. Each new quarter of high earnings will increase the trailing-12-month number and lower the P/E, leaving room for the stock to rise to fill the gap. There is nothing better in the stock market than earnings growth, and right now Nvidia has it, and Apple doesn’t.

Buying Apple when it is out of favor has historically been a genius move

So why is Apple the better buy if Nvidia has such an easy path forward? Simply put, I think the setup for Apple makes it a much better investment. Nvidia may be the better trade, but a more surefire way of building wealth is by compounding over the long term.

Market sentiment is negative toward Apple. So negative, in fact, that Apple trades at a discount to the S&P 500. The only reason that should ever happen is if something serious was going wrong with Apple. The company has its challenges, but none of them warrant an underperformance like we have been seeing for the last six months or so.

The abridged version of why Apple stock is under pressure is because it hasn’t captured the spotlight with some major AI monetization announcement (Nvidia, Microsoft, and Meta Platforms have). iPhone sales are down in China, and growth is sluggish in general. But Apple has endured these periods before and overcome competition.

Piper Sandler‘s fall 2023 survey found that 87% of Gen Z had an iPhone, 88% expected their next phone to be an iPhone, and 34% owned an Apple Watch. The iPhone is essentially a consumer staple in the U.S. and is growing well across international markets outside of China.

Investors should focus less on the competition and more on Apple’s ability to further monetize its existing devices through services and AI. The key for Apple has always been to increase the depth (services) and breadth (more products like phones, computers, tablets, wearables, ear buds, and more) of its ecosystem. Having lifetime customers consistently increase their spending relies on product improvements.

The pressure is on Apple to make a splash this summer to drive iPhone demand and upgrades. If Apple delivers the improvements that drive growth, the stock could soar. But even if it doesn’t, it generates plenty of extra cash to make an acquisition and grow that way, or return cash to shareholders while maintaining a rock-solid balance sheet.

Apple’s brand, market position, and financial health give it the time and the wiggle room needed to make mistakes. The company is known for not leading investors on and only makes announcements when it feels the product or service is ready.

Apple has a better risk/reward profile than Nvidia

Nvidia has to hit sky-high earnings forecasts to keep going up. The semiconductor industry is also highly cyclical, and a downturn in customer spending could stall its growth trajectory. Nvidia may keep growing at a breakneck pace in the near term, but eventually, it will slow down. When that time comes, investors may be less willing to give Nvidia a multiple that is triple the market average.

Meanwhile, Apple is already a good value and has a clear path toward regaining Wall Street’s favor.

I don’t have a crystal ball, but if I had to guess, I would say Nvidia will briefly become more valuable than Apple. But three to five years from now, I think Apple will be worth more than Nvidia while also being a safer and less volatile investment.

Nvidia stands out as a high-risk/high-potential-reward play, while Apple is more like a low-risk/medium-potential-reward investment. Investors who are confident about sustained high demand for Nvidia’s products will want to watch each quarterly earnings report, understanding the importance earnings play in the story. The big gains have already been made in Nvidia, and investors should expect more reasonable returns going forward.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

After a six-week run, altcoins are cooling off, leading some to fear the worst. However, in a post on X, one crypto analyst urges calm, saying the dip is a normal part of any bull market and may even present opportunities for discerning traders and investors.

Altcoins Drop, Follow Bitcoin

After posting solid gains and rallying to as high as $73,800 on March 13, Bitcoin edged lower on March 14 and continues under pressure when writing. Considering the positive correlation between Bitcoin and altcoins, leading altcoins like Ethereum, XRP, Cardano, and Solana retraced slightly.

Related Reading: Bitcoin Crash Triggered By Failed $1 Billion Hedge Fund Spread Trade: Expert

When writing, Ethereum is far from the $4,090 recorded last week. At the same time, the Solana uptrend has slowed, with $200 proving elusive for optimistic traders. Meanwhile, XRP, despite the high optimism when prices roared higher on March 11, is struggling for momentum and is currently trending lower.

While the altcoin has been drawn down, the total crypto market cap drop and fear creep in have caused the analyst to remain bullish. Despite the correction, the altcoin uptrend remains, and most coins, including Ethereum, Solana, and Cardano, could post more gains.

Ethereum, Solana, and BNB Fundamentals Are Solid

To illustrate, the crypto community remains upbeat because of Dencun and its potential to enhance Ethereum and the broader layer-2 ecosystem. Ethereum rollup platforms, including Base and Optimism, that have activated Dencun features have seen decentralized applications (dapps) launching on their platforms benefit.

Uniswap Labs, the team behind Uniswap, a leading decentralized exchange, reported that transaction fees on users trading on Optimism have fallen even further after activating Dencun. This reduction in fees may be a catalyst to drive more activity on-chain, propping up prices.

On the other hand, Solana bulls are upbeat. Since September 2023, SOL has been on a sharp uptrend. At spot rates, the coin roared to register fresh 2024 highs.

With this performance, Solana outperforms Bitcoin and other altcoins, including ETH. CoinMarketCap data shows that SOL has risen by 15% in the past week, closely trailing BNB, the native currency of the BNB Chain ecosystem.

Analysts are looking at the upcoming Firedancer upgrade to fortify Solana’s infrastructure further and increase reliability. Meanwhile, regulatory developments in the United States are evolving positively, propping up altcoins, mainly BNB.

Overall, the crypto uptrend remains even with prices cooling off. More importantly, even with falling prices, sentiment remains bullish. In the past week, CoinMarketCap data shows that the Crypto Fear and Greed Index is at “extreme greed” territory.

Feature image from Shutterstock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Quick Take

The rapid growth and success of Bitcoin ETFs, specifically the group termed the ‘Newborn Nine,’ excluding GBTC, is reshaping the dynamics of Bitcoin holdings. In just one month since their inception, according to Bitcoin website Apollo, these ETFs have outpaced MicroStrategy by acquiring 192,000 Bitcoins compared to MicroStrategy’s 190,000 in its corporate treasury. This remarkable growth signifies a shift in Bitcoin ownership from individual entities to ETFs.

Data from Applo shows that the new challenge for the ‘Newborn Nine’ is GBTC, holding 469,000 Bitcoins. Furthermore, BlackRock’s IBIT, with 78,000 Bitcoins, indicates potential competition for MicroStrategy in the upcoming months. These trends underscore the strong performance of Bitcoin ETFs.

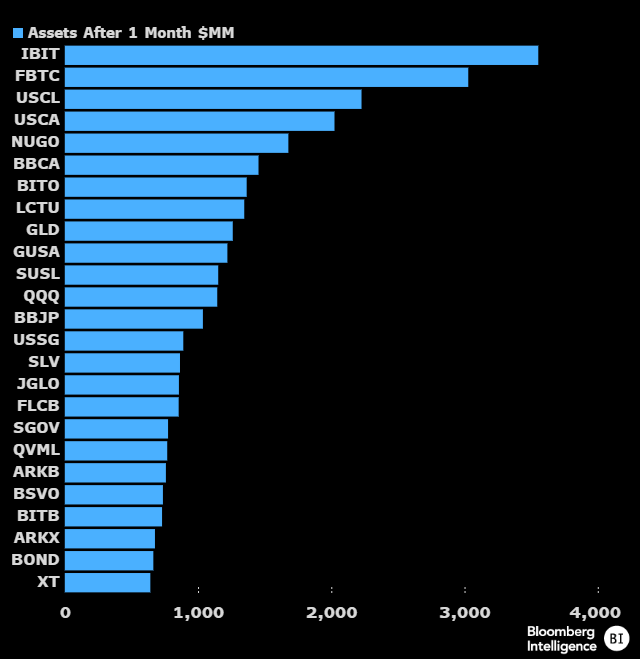

In addition, Bloomberg Analyst Eric Blachunas highlighted the impressive standing of these ETFs, with IBIT and FBTC leading the ETF pack with assets of around $3 billion each within a month of their launch. This places them at the top of the league of the top 25 ETFs by assets, among 5,535 launches in 30 years. ARKB and BITB also made the list, Balchunas goes on further to say.

The post Bitcoin ETF newcomers surpass Microstrategy in BTC holdings appeared first on CryptoSlate.

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Blackrock bolsters Bitcoin ETF holdings to surpass $1.2 billion milestone

Quick Take

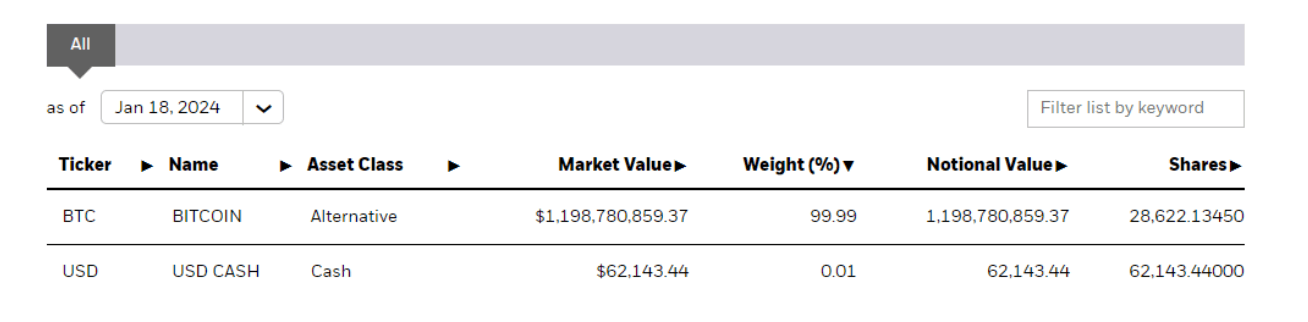

Blackrock has increased its Bitcoin holdings in its Exchange-Traded Fund (ETF) as the fund now retains an impressive count of 28,622 Bitcoin, with an addition of approximately 3,555 Bitcoin.

The Blackrock iShares Bitcoin ETF not only made headlines as the inaugural fund to surpass the $1 billion threshold but continued its upward trajectory to amass a notional value now standing at $1.2 billion.

The last update was on Jan. 16, when BlackRock added 8,705 BTC to the fund. Today’s update marks the lowest amount of Bitcoin added to the fund since launch day where 2,621 BTC were added.

The post Blackrock bolsters Bitcoin ETF holdings to surpass $1.2 billion milestone appeared first on CryptoSlate.

ADA Price Faces Key Hurdle, Can Cardano Surpass This To Start Fresh Rally?

Cardano (ADA) is attempting a recovery wave from the $0.4650 zone. ADA could start a fresh rally if there is a close above the $0.550 resistance.

- ADA price is moving higher from the $0.4650 zone.

- The price is trading below $0.570 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance near $0.545 on the 4-hour chart of the ADA/USD pair (data source from Kraken).

- The pair could accelerate higher if there is a clear move above $0.545 and $0.550.

Cardano Price Attempts Fresh Increase

After a strong rally, Cardano faced sellers near the $0.675 zone. ADA started a fresh decline below the $0.620 and $0.600 support levels, unlike Bitcoin and Ethereum.

There was a drop below the $0.550 support and the 100 simple moving average (4 hours). Finally, the price found support near the $0.4650 zone. The price is now attempting a fresh increase above the $0.500 resistance zone. The price tested the 23.3% Fib retracement level of the downward move from the $0.6768 swing high to the $0.4650 low.

ADA is now trading below $0.570 and the 100 simple moving average (4 hours). There is also a key bearish trend line forming with resistance near $0.545 on the 4-hour chart of the ADA/USD pair.

On the upside, immediate resistance is near the $0.532 zone. The first resistance is near $0.545 and $0.550. The next key resistance might be $0.570 or the 50% Fib retracement level of the downward move from the $0.6768 swing high to the $0.4650 low.

Source: ADAUSD on TradingView.com

If there is a close above the $0.570 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.620 region. Any more gains might call for a move toward $0.650.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.545 resistance level, it could start a fresh decline. Immediate support on the downside is near the $0.500 level.

The next major support is near the $0.465 level. A downside break below the $0.465 level could open the doors for a test of $0.432. The next major support is near the $0.420 level.

Technical Indicators

4 hours MACD – The MACD for ADA/USD is losing momentum in the bearish zone.

4 hours RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.500, $0.465, and $0.432.

Major Resistance Levels – $0.532, $0.545, and $0.570.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bill Gates’ Former Assistant Is Now One Of The Richest People In The World And Could Even Surpass Him In Net Worth — But You Probably Have No Idea Who He Is

Steve Ballmer, once an assistant to Bill Gates at Microsoft, is now ranking just a few spots away from his former boss on the list of the world’s richest people. According to Bloomberg, Ballmer’s net worth soared to $117 billion in October 2023, placing him as the fifth-richest globally, just $5 billion short of Gates’ wealth. Gates has donated a substantial part of his fortune to charity since leaving Microsoft.

According to Forbes’ real-time billionaires list on Nov.8, 2023, Steve Ballmer’s net worth has recently decreased to $108.7 billion, with Bill Gates maintaining a narrow lead at $113.9 billion.

Don’t Miss:

Despite a dip reported by Forbes, Ballmer’s net worth surge earlier in the year positioned him alongside esteemed billionaires such as Elon Musk, Bernard Arnault and Jeff Bezos. He ranks just after tech giants Larry Page and Mark Zuckerberg in wealth. Among these titans of industry, Ballmer stands out as the sole individual in the top 10 who isn’t a company founder.

His journey began at Harvard University, where he crossed paths with Gates. After graduating in 1977, Ballmer joined Microsoft as its 24th employee. Starting as a business manager, he climbed the ranks to become president and later CEO, taking the reins from Gates himself.

Even after stepping down as CEO and purchasing the Los Angeles Clippers in 2014, Ballmer’s fortunes are still heavily invested in Microsoft, where he holds about a 4% stake. Microsoft’s stock has surged, particularly in 2023, thanks to an AI-driven boost in the tech sector, greatly benefiting Ballmer’s financial portfolio.

Trending: Until 2016 it was illegal for retail investors to invest in high-growth startups. Thanks to changes in federal law, this Kevin O’Leary-backed startup lets you become a venture capitalist with $100.

The strength of Ballmer’s wealth is significantly tied to Microsoft’s performance, with the company’s expansion into AI and cloud services boosting its market value and his personal net worth. His 4% stake in Microsoft is a testament to his enduring confidence in the company he helped elevate.

The opportunity to invest in promising AI or tech startups is accessible to anyone, not just wealthy investors. Take Kliken, for instance, which leverages GPT AI technology to offer small businesses top-tier digital marketing services at a significantly reduced cost, and it’s possible to invest in this potential with as little as $200.

Ballmer’s ownership of the Los Angeles Clippers adds a substantial non-tech asset to his portfolio. The Clippers’ valuation, combined with the NBA’s profitable broadcasting agreements, bolsters his financial standing.

In contrast, Bill Gates has shifted focus towards philanthropy and invested billions in health, education and climate change initiatives through his foundation. This philanthropic approach has redistributed a portion of Gates’ wealth, differing from Ballmer’s investment strategy.

While market changes and economic trends can affect the net worth of the world’s richest, Ballmer’s diversified investments and Microsoft’s ongoing success provide him with a stable position in the upper echelons of global wealth, showcasing the vast potential for growth among the tech elite.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

This article Bill Gates’ Former Assistant Is Now One Of The Richest People In The World And Could Even Surpass Him In Net Worth — But You Probably Have No Idea Who He Is originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

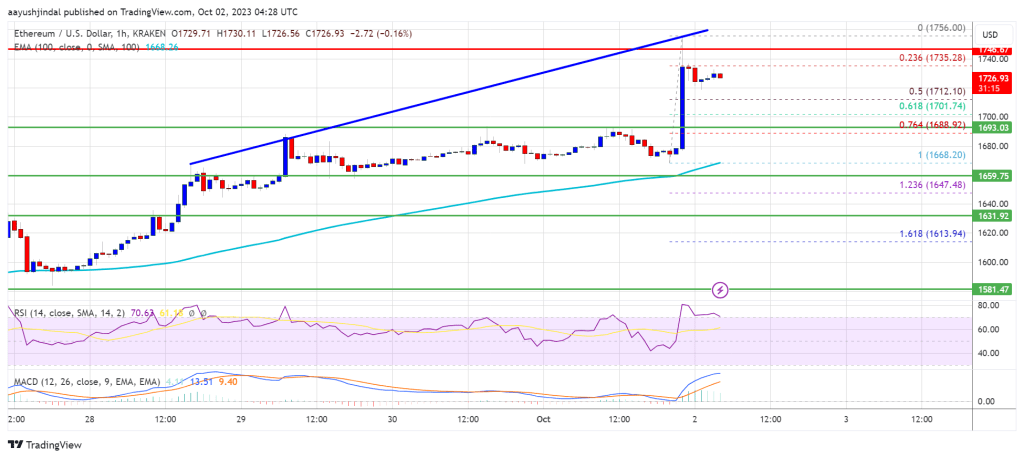

Ethereum Price Increase Could Soon Fade If ETH Fails To Surpass $1,750

Ethereum price is attempting a fresh increase above $1,720 against the US Dollar. ETH could accelerate higher if it clears the $1,750 resistance.

- Ethereum is attempting a fresh increase above the $1,720 level.

- The price is trading above $1,700 and the 100-hourly Simple Moving Average.

- There is a connecting trend line forming with resistance near $1,750 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to rise if it clears the $1,750 resistance zone.

Ethereum Price Gains Traction

Ethereum’s price settled above the $1,650 level. ETH formed a base above $1,650 and recently started a decent increase above the $1,700 level, like Bitcoin.

There was a move above the $1,720 resistance level and the price tested the $1,750 zone. A high was formed near $1,756 and there was a minor downside correction. The price declined below the $1,735 level. However, it is still above the 50% Fib retracement level of the recent rally from the $1,668 swing low to the $1,756 high.

Ethereum is trading above $1,700 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1,750 level. There is also a connecting trend line forming with resistance near $1,750 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

The next major resistance is $1,800. A clear move above the $1,800 resistance zone could set the pace for a larger increase. In the stated case, the price could visit the $1,850 resistance. The next key resistance might be $1,920. Any more gains might open the doors for a move toward $2,000.

Are Dips Supported in ETH?

If Ethereum fails to clear the $1,750 resistance, it could start a downside correction. Initial support on the downside is near the $1,710 level. The next key support is $1,680.

The 76.4% Fib retracement level of the recent rally from the $1,668 swing low to the $1,756 high is also near $1,685 to provide support, below which the price could test the $1,650 support. A downside break below the $1,650 support might start another bearish wave. In the stated case, there could be a drop toward the $1,600 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,700

Major Resistance Level – $1,750

Cocaine is about surpass oil as Colombia’s top export as revenues near $20 billion

-

Cocaine is set to become Colombia’s top export this year, edging out oil products, according to a note from Bloomberg Economics.

-

Revenue derived from Colombia’s cocaine business is nearing $20 billion, ahead of the country’s $19.1 billion in 2022 oil exports.

-

Cocaine production in Colombia is at its highest level since 1991 amid lenient policies from Colombian President Gustavo Petro.

Colombia’s top export is about to shift from oil to cocaine, according to a recent note from Bloomberg Economics.

The shift comes as Colombian President Gustavo Petro keeps a lenient policy towards the coca crop industry in place that dates back to 2013, when the cocaine industry generated just $2.2 billion in export revenues, according to Bloomberg estimates.

Fast forward to 2022, and Colombia’s cocaine industry generated an estimated $18.2 billion in export revenues, just behind oil export revenue of $19.1 billion. With the country’s oil exports dropping 30% in the first half of this year, and its cocaine industry still growing steadily, Bloomberg estimates that 2023 will be the year when Colombia’s cocaine revenues outpace revenues from oil.

Colombia, which is the world’s largest producer of the drug, has seen its cocaine production jump to its highest level since 1991. The country produced 1,738 tons of the drug in 2022, with a total street value of $193 billion.

“From a purely economic standpoint, higher cocaine production and exports have supported short-term activity, domestic demand and external accounts,” Bloomberg economist Felpi Hernandez said.

Instead of attempting to eradicate coca bush farms, as it did in the past, the Colombian government is instead targeting exporters and laboratories that turn the coca leaf into cocaine. That’s led to a surge in crop yields for coca bushes in the past few years, with 230,028 hectares of the plant being cultivated in 2022.

As the country’s drug war shifts from the growers to the producers, the growers are getting more efficient.

“More bushes are reaching their full potential. Producers are also investing in irrigation and fertilizers to boost output and productivity,” Hernandez said. “The average crop yield rose steadily from 4.3 tons of coca leaves per hectare in 2013 to 7.0 in 2020.”

Colombia’s illicit cocaine business represented 5.3% of the country’s GDP last year, Hernandez estimates.

Correction: September 15, 2023 — An earlier version of this story misspelled the name of the country Colombia.

Read the original article on Business Insider