According to a regional report, Sony Bank of Japan is currently exploring the potential of a stablecoin tied to the yen that could be utilized by Sony Group along with its associated entities. Insiders revealed that this endeavor’s testing phase employs the Polygon blockchain, with the crypto firm Settlemint lending its support. Polygon and Settlemint […]

According to a regional report, Sony Bank of Japan is currently exploring the potential of a stablecoin tied to the yen that could be utilized by Sony Group along with its associated entities. Insiders revealed that this endeavor’s testing phase employs the Polygon blockchain, with the crypto firm Settlemint lending its support. Polygon and Settlemint […]

Source link

taps

Uzbekistan taps Tether to boost crypto, blockchain development and regulation

Stablecoin issuer Tether Limited has entered a Memorandum of Understanding (MOU) with the Republic of Uzbekistan’s National Agency of Perspective Projects (NAPP) to develop a regulatory and legal framework for digital assets in the country, according to a March 7 press release.

NAPP is the primary government agency overseeing crypto regulation and development, according to the release.

The agreement signifies a strategic effort to make Uzbekistan a central hub for blockchain and peer-to-peer telecommunication technologies, aiming to spark innovation and economic growth within the region.

Regulatory framework for crypto

A primary focus of the collaboration is to support the creation of a legal framework and regulatory policies conducive to the growth of crypto and other digital assets in Uzbekistan.

This includes facilitating the development and implementation of a digital currency, exploring asset tokenization mechanisms, and enhancing the country’s digital currency payment infrastructure for more efficient transactions.

Additionally, Tether and NAPP aim to develop a robust, independent communication and financial system that would enable cheaper, faster, and more secure transactions.

The partnership also emphasizes educational initiatives, engaging local academic institutions to develop programs that enhance understanding of blockchain technology, stablecoins, and their applications.

These educational efforts are intended to equip individuals with the knowledge and skills necessary for success in the evolving digital asset industry.

Uzbekistan aims to raise standing

The collaboration between Tether and the Republic of Uzbekistan represents a concerted effort to strengthen the blockchain ecosystem, foster innovation, and promote Uzbekistan as a global leader in blockchain and peer-to-peer technologies.

This partnership is expected to benefit the local startup community but also enhance Uzbekistan’s attractiveness as a destination for technology companies and professionals worldwide.

NAPP director Lee Dmitriy Romanovich said:

“A well-integrated and responsibly introduced blockchain ecosystem can have a profound impact on improving the lives of all Uzbekistan citizens.”

Uzbekistan began efforts to regulate the digital assets industry in 2022 through a directive that introduced a preliminary regulatory framework for the industry and included establishing the NAPP.

Since then, the country has taken significant steps to integrate digital assets into its economy while ensuring a balanced regulatory framework.

Uzbekistan’s regulatory framework legally recognizes crypto but does not consider it legal tender. The country permits trading and other activities exclusively through licensed local virtual asset service providers (VASPs) under stringent guidelines.

Additionally, the country has established a special zone that offers crypto-related firms tax benefits and streamlined regulatory procedures to attract investments.

Mentioned in this article

Ethereum Taps $3,000 Barrier Amid ETF Speculation and Upcoming Dencun Upgrade

The value of ethereum, the crypto market’s second-largest asset by market cap, eclipsed the $3,000 milestone on Tuesday, peaking at $3,014 per unit in the morning trading hours. Over the last week, ether has seen a 13.1% climb against the U.S. dollar, and over the preceding two weeks, it has surged 28%. Ether Hits Two-Year […]

The value of ethereum, the crypto market’s second-largest asset by market cap, eclipsed the $3,000 milestone on Tuesday, peaking at $3,014 per unit in the morning trading hours. Over the last week, ether has seen a 13.1% climb against the U.S. dollar, and over the preceding two weeks, it has surged 28%. Ether Hits Two-Year […]

Source link

Coinbase taps former UK Treasurer who warned of ‘run on pound’ in 2008 for Advisory Council

In a move to bolster its global expansion efforts, Coinbase has enlisted George Osborne, a prominent figure in U.K. politics and finance. Osborne, known for his tenure as the U.K.’s Chancellor of the Exchequer (Treasury) from 2010 to 2016 and his contributions to the country’s economic and financial policies, joins Dr. Mark T. Esper, former U.S. Secretary of Defense, and former Senator Patrick Toomey on the council.

Osborne has historically shown a positive stance toward cryptocurrencies and blockchain technology. Over the years, he has made several statements indicating his belief in their transformative potential.

As reported by Coinbase, the company has made notable strides in global expansion. It has secured operational licenses in various countries, including France, Spain, Singapore, and Bermuda. Coinbase has expanded its reach across 20 African nations, facilitating millions of users’ access to USDC and enabling faster, more cost-effective transactions. Osborne’s extensive experience in government, international finance, and fintech investing is expected to be invaluable in this growth phase.

Coinbase’s Chief Policy Officer, Faryar Shirzad, highlighted Osborne’s diverse business, journalism, and government expertise as key to the company’s future endeavors. “George brings with him a wealth of experience… We look forward to relying on his insights and experiences as we grow Coinbase around the world,” said Shirzad.

Commenting on his appointment, Osborne said,

“There’s a huge amount of exciting innovation in finance right now. Blockchains are transforming financial markets and online transactions. Coinbase is at the frontier of these developments.

I look forward to working with the team there as they build a new future in financial services.”

George Osborne and crypto.

In 2014, Osborne announced that the U.K. government would explore the role of virtual currencies like Bitcoin and how they could help the UK become a leader in the digital economy. By 2015, Osborne expressed his belief in the potential of digital currencies, stating that they could play a significant role in finance. He emphasized his desire for London to be a world leader in FinTech and digital currencies.

Further, Osborne’s venture capital firm, 9Yards Capital, has also invested in crypto. The firm reportedly made significant gains after investing in Internet Computer (ICP.)

Given Coinbase’s recent campaign to “rebuild’ the system, Osborne is an interesting choice. In 2008, Osborne warned of a potential collapse of the fiat system in the United Kingdom,

“We are in danger, if the government is not careful, of having a proper sterling collapse, a run on the pound…

The more you borrow as a government the more you have to sell that debt and the less attractive your currency seems.”

When Osborne made this statement, the U.K.’s national debt was £530 billion; by the time he left office, it had risen to £1.6 trillion. It is estimated to be around £2.7 trillion and approximately 102% of GDP today.

This first-hand experience with spiraling national debt may uniquely position Osborne to understand the benefits of digital currencies such as Bitcoin. Between 2010 and 2016, around £500 billion was printed and added to the U.K. M1 money supply during his time as chancellor.

The U.K. failed to achieve Osborne’s 2015 vision of becoming a digital asset hub. Navigating the ever-increasing regulatory hurdles and limitations to crypto trading in the country will likely be one of Osborne’s most significant challenges in advising Coinbase in the future.

Buy the dip, sell the rip? BTC price levels to watch as Bitcoin taps $42K

Bitcoin (BTC) faces an uphill struggle to reignite its uptrend after its biggest one-day losses of 2023.

The largest cryptocurrency continues to claw back lost ground after falling to lows of $40,200 after the Dec. 10 weekly close, the latest data from Cointelegraph Markets Pro and TradingView shows.

With BTC price action taking a break from relentless gains — one which many argue was overdue — new key support and resistance levels are coming into play.

The coming days are already set to offer plenty of potential volatility triggers. United States macro data releases begin on Dec. 12, with the Federal Reserve interest rate decision and commentary from Chair Jerome Powell following a day later.

The stage is set for a showdown that may involve more than crypto markets.

Cointelegraph takes a look at some of the popular BTC price lines in the sand now on the radar for traders and analysts as Bitcoin narrowly preserves the $40,000 mark.

Bollinger Bands: BTC bounced “where it was supposed to”

While painful for late longs, the 7.5% BTC price dip which followed the weekly close offered a form of reset for frantic crypto markets.

#Bitcoin has now dropped 7.5% today, which would be the single biggest 1-day drop in 2023.

It has overtaken the drop in March during the banking collapse; -6.2%, bottomed out at $20,000.

Also dropped -7.2% in August when Bitcoin bottomed out at $26,000. pic.twitter.com/WFYiyURO3J

— James Van Straten (@jimmyvs24) December 11, 2023

This was needed, consensus agrees, as unchecked upside typically results in a violent reaction the longer it continues.

“Very overextended, so a pullback was due,” John Bollinger, creator of the Bollinger Bands volatility indicator, argued in a reaction on X (formerly Twitter).

“Stopped right were it was supposed to. That doesn’t happen too often. Now we look to see if support can hold.”

Bollinger referred to Bollinger Bands data, with an accompanying chart showing, among other things, the forcefulness of the latest upside within the context of broader recent BTC price strength.

On daily timeframes, the dip took Bitcoin straight to the middle band within the Bollinger channel, making the correction something of a textbook move and cause for optimism going forward.

The air is getting a bit thin up here, but all we see as of now are signs of strength. We are outside both the daily and weekly BBs with no divergences. The last controlling formation was the 2 bar reversal at the middle BB completed on 21 Nov. $BTCUSDhttps://t.co/B4ZU3vpTvV

— John Bollinger (@bbands) December 5, 2023

Meanwhile, Bollinger warned of increasingly constrictive conditions the week prior, which could be a warning over a local top in advance.

Large Bitcoin buyers may play “buy the dip, sell the rip”

Looking at the behavior of large-volume traders, some commentators see encouraging signs after the open interest flush at the hands of the dip.

Uploading a print of BTC/USDT order book liquidity on the largest global exchange Binance overnight, trading resource Material Indicators revealed a new band of support at $38,500.

While lower than both $40,000 and this week’s bottom, Material Indicators suggested that “institutional sized” bids could now be returning — but there could be a caveat.

Accompanying analysis concluded that “it’s not yet clear whether they are legitimately starting to accumulate at these levels or just buying dips and selling rips.”

“After all, we have a Fed Rate Hike decision coming this week and # JPow’s speeches are typically good for some volatility,” it added.

Continuing on Dec. 12, popular trader Skew likewise considered the odds of manipulation among larger players.

“Seeing a bit of change in the mindset of large spot players whom were actively chasing price before,” he told X followers about the Binance order book.

“Current mindset seems to be buy the dip & sell the rip till bid depth & liquidity improves for large capital to return.”

Skew put the key BTC price areas to watch at $38,000–$40,000 and $44,000–$45,000, respectively.

Analyst: Bitcoin will greet yearly close in “new range”

In terms of major support, popular trader Ali additionally noted the range around $38,000 as a formidable barrier against major downside.

Related: Price analysis 12/11: SPX, DXY, BTC, ETH, BNB, XRP, SOL, ADA, DOGE, AVAX

“In case of a deeper correction, Bitcoin finds solid support between $37,150 and $38,360. This zone is backed by 1.52 million addresses holding 534,000 $BTC,” he showed alongside data.

“Also, watch out for two resistance walls that could keep the BTC uptrend at bay: one at $43,850 and another at $46,400.”

Michaël van de Poppe, founder and CEO of MN Trading, meanwhile flagged a floor zone slightly lower at $36,500.

Bitcoin, he believes, should end 2023 in a “new range.”

Crucial levels to hold for #Bitcoin are, on higher timeframes, $36,500-38,000.

With this correction, we’ll see bounces coming from $39,500-40,000 back to the $42K+ mark.#Bitcoin is likely going to create a new range before the end of the year. pic.twitter.com/bmQIREzEW8

— Michaël van de Poppe (@CryptoMichNL) December 11, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

NHN said it chose the Sui blockchain for its crypto game development thanks to its low transaction fees, fast processing time, and high scalability.

South Korean mobile game developer NHN has joined the crypto bandwagon through a partnership with Mysten Labs, the owner of the Sui blockchain, to develop games for players in the industry.

In an official press release dated September 21, the company’s gaming division announced its expansion into the Web3 ecosystem, joining the ranks of South Korean gaming companies such as Krafton, Com2us, Wemade, Nexon, Neowiz, NCSoft, and OneUniverse, all of which have embraced blockchain technology in game development.

NHN to Venture into Crypto Games

NHN, a globally recognized IT company and one of the leading developers of casino games in the APAC region, boasts a rich history of success in the gaming industry. With deep expertise in creating engaging gaming experiences and retaining users, the company has developed popular titles in the Web2 ecosystem, including Hangame Poker and Crusaders Quest.

Furthermore, the mobile game developer has cultivated a substantial user base of approximately 37 million players across various gaming platforms on mobile and desktop devices.

Building on this foundation, the South Korean company is now venturing into the crypto gaming realm to cater to a growing Web3 audience.

NHN to Introduce NFTs as In-Game Rewards for Players

As part of its Web3 strategy, the South Korean company will leverage the Sui blockchain to develop new games that will introduce non-fungible tokens (NFTs) and crypto tokens designed specifically for these games.

While the precise details of how NHN plans to integrate NFTs and crypto tokens are still being finalized, Jine Lee, the company’s head of business development, hinted at the possibility of enabling gamers to trade in-game items such as NFTs and introducing crypto token-based rewards.

Ujin Chung, the CEO of NHN Corporation, described the company’s motivation for entering into the emerging economy as a “paradigm shift” in the gaming industry. He also emphasized the company’s aim to merge the inherent value of game content with the in-game economy through the concept of tokenomics.

“Up to this point, there has been a lack of synergy between web3 and gaming. This synergy will be driven by growth and sustainability, the kind of which is best served by the minds who honed this skill in web2 and have a proven track record of success in creating experiences that users enjoy,” said Chung.

Low Transaction Fees and High Scalability

NHN said it chose the Sui blockchain for its crypto game development thanks to its low transaction fees, fast processing time, and high scalability. CEO Chung revealed that the network stood out for the company due to its expertise and the innovative capabilities of Sui.

The protocol, launched by Mysten Labs in May 2023, is built on an object-centric model based on the Move programming language, enabling parallel execution, sub-second finality, and rich on-chain assets.

Commenting on the partnership with NHN, Mysten Labs CEO Evan Cheng said that the company aims to create products that attract a substantial user base and make Web3 accessible to billions of users worldwide.

“What excites me about building with NHN is what we’re beginning to refer to as ‘stickiness’ for users. It’s a code web3, which has not cracked with daily active users on the most popular chains barely topping 300K. At Mysten Labs, our mission is to bring the benefits of web3 to the masses by the billions,” said he.

next

Blockchain News, Cryptocurrency News, Gaming News, News, Technology News

Chimamanda is a crypto enthusiast and experienced writer focusing on the dynamic world of cryptocurrencies. She joined the industry in 2019 and has since developed an interest in the emerging economy. She combines her passion for blockchain technology with her love for travel and food, bringing a fresh and engaging perspective to her work.

You have successfully joined our subscriber list.

Bitcoin Price Taps $28,000 On Grayscale Ruling, Soaring Stock Market

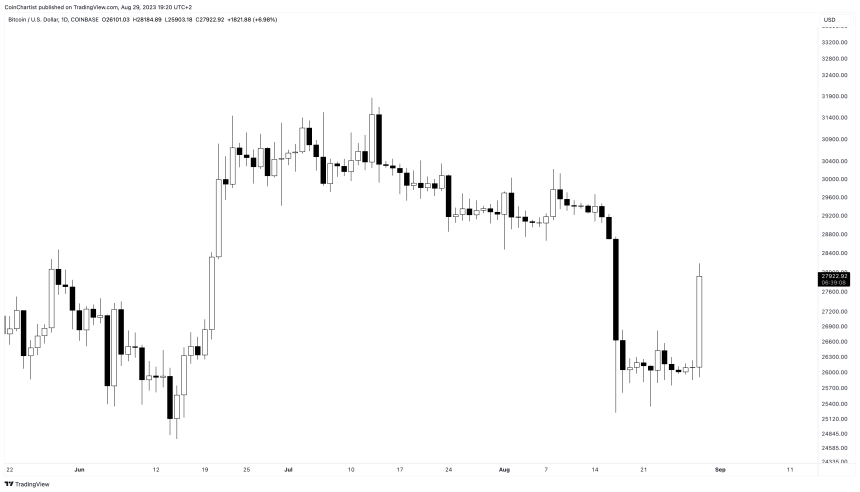

Bitcoin price has thus far made a 7% intraday move following news that a US court ruled in favor of Grayscale against the SEC. At the same time, the stock market is surging.

Could a perfect storm for the top cryptocurrency by market cap be building?

Back At $28,000: Grayscale Court Ruling Causes BTC To Bounce

In an asset class as volatile as crypto, prices — and moods — can change in a flash. That’s exactly what we’ve witnessed on a small scale today, moments after news broke that a US court is forcing the SEC to reconsider Grayscale’s Bitcoin ETF.

The news is significant because not only does it increase the chance Grayscale can move ahead with an ETF, but it also improves the likelihood of other ETFs like

BlackRock getting the green light.

Green is definitely the color of the day, with BTCUSD climbing back to $28,000 per coin on the heels of the news.

Bitcoin price rockets 7% higher in a day | BTCUSD on TradingView.com

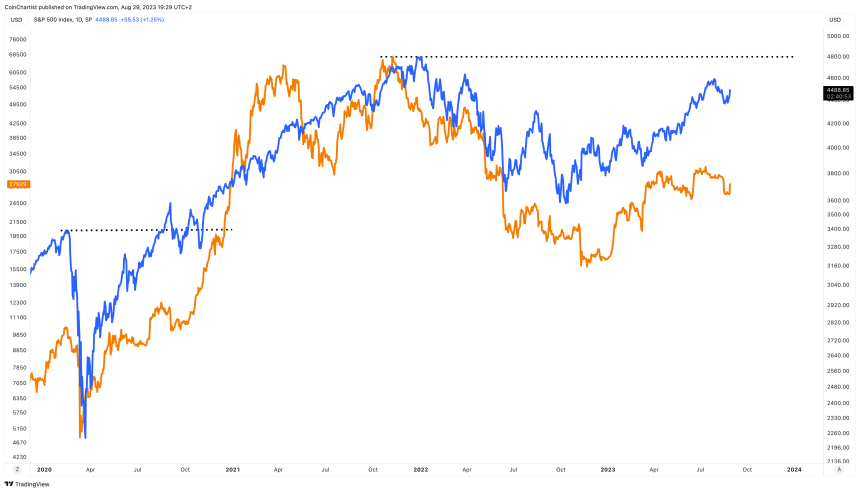

Bitcoin Price Could Benefit From A New Stock Market High

It isn’t just crypto getting a major boost today. US stock indexes are also soaring today. The S&P 500 is up over 1.2%, the tech-heavy Nasdaq over 1.88%, and the Dow Jones Industrial Average at 0.63%. The latest bounce in stocks puts traditional markets within striking distance of a new all-time high.

This is important because if Bitcoin price is already turning bullish in the wake of the Grayscale news, then a simultaneous stock market all-time high could cause crypto to go ballistic.

BTC versus the SPX | BTCUSD on TradingView.com

Cryptocurrencies have a ton of catching up to do relative to the stock market. Furthermore, back in 2020, after the S&P 500 made a new all-time high, Bitcoin price followed in the weeks to come and set a record of its own. Is this what we can expect if the stock market sets new record highs, and a slew of ETFs are approved?

In a filing dated August 4, Valkyrie applied to add an Ethereum futures ETF to its Bitcoin Strategy ETF (BTF). However, it would seem this move was pushed back by the SEC as the asset manager has now filed a separate application to offer an Ether futures ETF.

Valkyrie Moves To Offer Ethereum Futures ETF

In an application dated August 16, Valkyrie seeks the United States Securities and Exchange Commission’s (SEC) approval to offer an Ethereum futures exchange-traded fund (ETF).

If approved, the fund will not directly invest in Ether. Instead, it will focus on purchasing several ether futures contracts to match the total value of the ether underlying the futures contracts with the net assets of the fund.

While this fund is relatively similar to the Bitcoin futures ETF, which has existed since 2021, it differs from the Spot Bitcoin ETF, which prominent institutional firms have filed for. Spot ETFs track the crypto asset’s price, while futures ETFs focus on the asset’s future contracts.

Valkyrie categorically noted this fact as part of its application and stated that investors looking to invest in the price of ether directly should consider investments other than this particular fund.

The application also highlighted the risks involved in investing in this fund as, according to Valkyrie, “the Fund’s investments could decline rapidly, including to zero.” As such, investors should understand that they could lose their entire investment.

As is common with applications such as this, applicants must prove to the SEC that the underlying asset has a regulated market of significant size. And Valkyrie’s filing stated that its fund would be guided by the futures contracts traded on the Chicago Mercantile Exchange (CME).

ETH price recovers to $1,685 | Source: ETHUSD on TradingView.com

No First Mover Advantage?

Valkyrie failed to clarify the status of its initial filing in its most recent application. The asset manager had previously tried to add ETH futures contracts to its Valkyrie Bitcoin Strategy ETF (BTF) in a bid to gain a first-mover advantage over other applicants.

Several other asset managers, including Bitwise, ProShares, Grayscale, and Volatility Shares, have also applied to offer an Ethereum futures ETF. However, it remains uncertain in what order the SEC is likely to approve (if it does) these applications, especially with this recent development.

Just like Cathie Wood has suggested regarding the pending Spot Bitcoin ETF applications, the SEC can approve multiple applications at once, which will likely eliminate the first mover advantage, or it can decide to approve them in the order in which these applications came in.

Despite expectations that the regulator will approve an Ether ETF this year, the probability of the SEC approving any of these applications remains uncertain as optimism dwindles.

Featured image from iStock, chart from TradingView.com

Bitcoin price taps $29.3K as data shows ‘most resilient’ US jobs market

Bitcoin (BTC) inched higher at the Aug. 4 Wall Street open as mixed United States unemployment data rocked U.S. dollar strength.

U.S. unemployment gives mixed picture

Data from Cointelegraph Markets Pro and TradingView followed BTC price action as BTC/USD set daily highs of $29,273.

U.S. jobless figures came in below expectations on the day, at 3.5% versus an estimated 3.6%, while the number of jobs added was less than forecast.

Responding, financial commentator Holger Zschaepitz said that the data had “no clear message.”

“Despite the fastest rising rates of all time, the labor market remains strong,” financial commentary resource The Kobeissi Letter continued in part of its own synopsis.

“This is the most resilient labor market in history.”

While U.S. stocks and Bitcoin managed to eke out modest gains as a result, the U.S. dollar felt the pressure in what could still aid a more pronounced BTC price rebound.

The U.S. Dollar Index (DXY) was down 0.6% on the day at 101.8, setting new lows for August.

For Michaël van de Poppe, founder and CEO of trading firm Eight, there was reason to believe that BTC/USD could improve into the next round of macroeconomic data releases.

“This means $DXY down, stocks up & Bitcoin potentially up awaiting CPI next week,” he wrote about the jobs data.

Van de Poppe referenced the upcoming Consumer Price Index inflation print for June, due Aug. 10.

BTC price range to stick into weekend, says trader

Turning to Bitcoin itself, popular trader Skew tracked rash moves among traders as brief BTC price volatility appeared.

Related: BTC price upside ‘yet to come’ at $29K after Bitcoin RSI reset — Trader

$BTC

Short taken out, some short float left still pic.twitter.com/zARYYyIZy8— Skew Δ (@52kskew) August 4, 2023

He nonetheless described the broader market reaction to the data as “very interesting.”

On-chain monitoring resource Material Indicators likewise followed changes in bid and ask liquidity on the Binance BTC/USD order book.

Was watching the #Bitcoin PA in real time on #FireCharts 2.0 (beta) as the Economic Reports came across the wire. Purple Whales started eating resistance as the numbers came in, then a column of bids and asks were pulled and a few minutes later moved.

Out of respect and… pic.twitter.com/5bjloZM7DW

— Material Indicators (@MI_Algos) August 4, 2023

Going into the weekend, few expected a significant change in the overall sideways trading environment.

“I feel we will be stuck above this support zone for this weekend. For now no entry for now as we just remain range bound,” a typical prediction from popular trader Crypto Tony read earlier in the day, alongside a chart showing relevant levels.

Magazine: Experts want to give AI human ‘souls’ so they don’t kill us all

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.