Corporate insiders are selling far more of their shares than buying.

Source link

theyve

CFOs are as bullish on the Dow and Fed as they’ve been in a long time

Chief financial officers at large companies see a U.S. economy and equities market that can continue to grow, even as fears about sticky inflation and a potentially overextended, and concentrated, bull run in stocks weigh on investors.

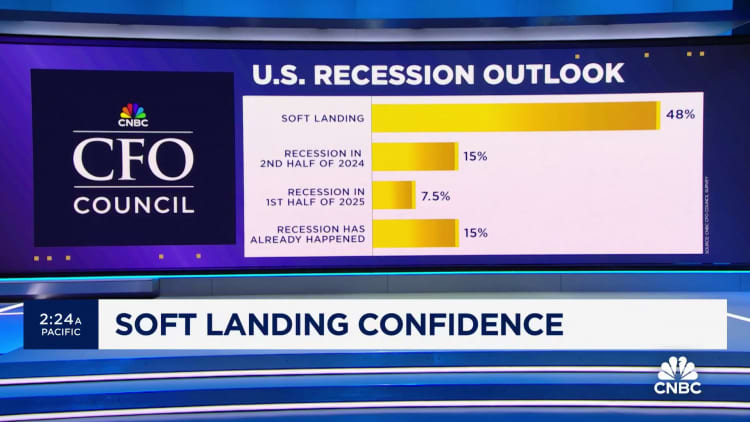

That’s according to the CNBC CFO Council Survey for the first quarter of 2024, which shows a dramatic year-over-year change in the view from CFOs about the Federal Reserve’s inflation battle. The percentage of CFOs who think the Fed will be able to achieve a soft landing has reached a five-quarter high, at 48%. It’s a marked change from where CFOs were a year ago in Q1 2023, with expectations of a soft landing tripling since the first quarter of last year.

For the first time in five quarters, not a single CFO rated the Fed’s efforts to bring inflation down as “poor,” while those who described the central bank’s policy as “good” edged higher again quarter over quarter to 55%.

The latest forecast of long-term inflation expectations came in higher than expected this week, but the market reacted positively to Tuesday’s CPI reading, and stocks closed at a new record after some days of selling. This bullishness despite continued jitters on inflation lines up with the view from CFOs on the council.

CFOs have been consistent across our surveying in their view that inflation will not return to 2% any time soon, and that’s the case again in the Q1 survey, with nearly 80% of CFOs saying inflation won’t hit the Fed’s 2% target before 2025 at the earliest.

This view of inflation remaining above the Fed’s target for considerably longer plays into a CFO outlook that the Fed will not move as quickly as the market thinks to cut interest rates. In recent months, the market has gotten the Fed’s message that March is out of the picture for the start of rate cuts, but CFOs remain more cautious on the Fed. According to the Q1 survey, the largest percentage of CFO respondents (44%) do not expect a rate cut until September. The CME FedWatch tool shows a majority of traders still betting on June as a likely target. In the Q1 CFO survey, equal groups of just under 25% of CFO respondents think the cuts will begin in June or July.

Despite CFOs expecting a slower moving Fed than traders, the latest quarterly view represents an increase in dovish expectations. The greatest swing in the survey’s interest rate outlook comes from CFOs who in the previous quarterly survey had not expected rate cuts to begin before November 2024 at the earliest.

Jerome Powell, chairman of the U.S. Federal Reserve, smiles during a press conference following the Federal Open Market Committee (FOMC) meeting in Washington, D.C., U.S. on Wednesday, May 1, 2019.

Anna Moneymaker | Bloomberg | Getty Images

CFOs don’t see rate anxiety as being a major short-term hurdle for stocks. Over 80% of CFOs believe the Dow Jones Industrial Average is more likely to continue its run up to the 40,000-point mark, with technology continuing to lead the way among sectors, than slip into a bear market.

CFO Council members, as a group, have expressed consistent concerns since the Fed began raising interest rates almost exactly two years ago, in March 2022, in keeping with a typically cautious mindset among chief financial officers and referencing recent economic history and expectations it would be repeated — restrictive monetary policy ultimately leads to a large drop in consumer credit quality and demand that damages the economy and, even if in the short-term the labor market remains solid, ultimately layoffs spiral across sectors before the Fed can reverse course and avoid a recession. Even if unemployment and consumer debt are up, and consumer demand is down, the severity of the damage that CFOs were expecting has obviously not come to pass.

The quarterly CFO survey is a snapshot of views from a select number of chief financial officers at large companies comprising the 100 member-plus council, with 27 members providing responses in Q1.

Some of the C-suite economic confidence may be playing into plans for corporate cash. Buybacks are booming again in 2024 and could reach $1 trillion next year, but there is also evidence of more appetite for deal making to start the year, despite the significant regulatory headwinds and antitrust stance of the Biden administration. Nearly one-third of CFO respondents say strategic M&A will be the top capital spending priority this year, which was the most popular response among CFOs for 2024 capex planning.

The Q1 CFO survey doesn’t come without warning signs for an economy and market that have proven more resilient than many, including CFOs, expected throughout the last year. But the biggest risk cited by CFOs this quarter is also a perennial one for major corporations. Throughout the history of CFO Council polling, consumer demand has most consistently ranked as the No. 1 external risk to business, and it is back at the top of the list now (37%), and at its highest level among risk factors in five quarters.

Opinion: Why are unsafe products still being used even after they’ve been recalled?

Even when companies have the best of intentions, anything you buy — from the exercise equipment you use to stay in shape to the vegetables you eat — potentially can pose a health hazard. While companies and the government agencies that regulate them often recall products after learning about the dangers, the process is broken.

Dangerous products almost never get recalled quickly. Even after people notify companies or federal regulators about illnesses, injuries or deaths, recalls can take months or years.

Even when the government or companies announce recalls, too many people don’t hear about them. These recalled products may catch fire, poison people or suffocate babies months and years later because consumers didn’t learn about the harm they can cause.

For example, Fisher-Price earlier this year reannounced its recall of Rock ‘n’ Play Sleepers, which have been linked to the deaths of about 100 babies before and after the original recall in 2019. Publicly available reports of babies who died while using this inclined sleeper go back to at least January 2018.

Parents and doctors filed reports with the Consumer Product Safety Commission, but the sleepers weren’t recalled until more than a year later, in April 2019. By that time, more than 30 infant deaths had occurred in Rock ‘n Plays. Almost four years later, about 70 more babies have reportedly died while using this product, according to the U.S. Consumer Product Safety Commission (CPSC).

Food recalls from the U.S. Food and Drug Administration (FDA) and U.S. Department of Agriculture (USDA) encounter similar delays, during which more people can get sick. After one of the worst foodborne illness outbreaks in recent years, the Centers for Disease Control and Prevention (CDC) on Feb. 2, 2022, said a Salmonella outbreak was over.

Recalls of whole onions from two distributors connected to the outbreak had been announced more than three months earlier, with 652 illnesses nationwide. By February 2022, the CDC had tallied 1,040 illnesses in 39 states, plus Washington D.C. and Puerto Rico. Among those, 260 people were hospitalized.

The CDC said the last illness onset was Jan. 1, 2022, more than two months after the final recall. The incubation period for Salmonellosis is generally 12- to 72 hours. Clearly, people were getting sick long after the recall announcement. How many of those nearly 400 additional illnesses could have been prevented by a more efficient food recall system that notifies consumers more quickly?

“ Why does it take so long to recall a product or simply warn product owners, especially parents of young children? ”

This prompts two agonizing questions:

First: Why does it take so long to recall a product or simply warn product owners, especially parents of young children? The Rock ‘n’ Play Sleeper isn’t an isolated case. Numerous products that regulators were told caused injuries and deaths weren’t recalled for months or sometimes years.

Of course, the U.S. government wants to investigate and determine whether a product needs to be taken off store shelves, replaced, repaired or refunded. However, when it comes to the products regulated by the CPSC, once the agency decides to act, there’s an enormous obstacle: Section 6(b) of the Consumer Product Safety Act, which prohibits the agency from publicly disclosing derogatory information about a product unless it has notified the company and waited 15 days.

This gives companies enough time to file lawsuits to block the disclosure. To avoid court battles, the CPSC often negotiates recalls with companies, which can take weeks or months.

“ Allow the Consumer Product Safety Commission to warn Americans about hazardous products sooner. ”

The Sunshine in Product Safety Act, a bill first proposed in 2021, would repeal Section 6(b) restrictions and allow the CPSC to warn Americans about hazardous products sooner. It was reintroduced in March 2023. Congress should pass it — or similar legislation.

Second: Why did babies continue to die after the Rock ‘n’ Play recall in 2019 and why did so many people eat Salmonella-tainted onions after that recall? Injuries and deaths after recalls aren’t confined to these products. Consumers don’t have a sure-fire way to learn about recalls that affect them. While news media feature warnings about many large recalls, those only inform people who happen to see that broadcast or read that article. What about everyone else?

Some may find out from the manufacturer, if the company has their contact information. Some may find out from relatives or friends. But what about the 663,000 Samsung washing machines recalled last year because of fires? Do your friends or relatives know what model washing machine you have? What about the recall of 321,000 portable generators that was reannounced last year because of finger amputations? Do your friends or relatives even know whether you have a portable generator?

U.S. Sen. Maria Cantwell, (D-Wash.), chair of the Senate Committee on Commerce, Science and Transportation, called America’s product recall system “ineffective.” In a November 2021 subcommittee hearing on holiday season product safety issues, she said the CPSC has reported that consumers follow through with recalls in only about 6% of cases.

“ Something needs to change or people will continue to get injured or killed by products we use every day. ”

This complex problem has no single, easy solution. But something needs to change or people will continue to get injured or killed by products we use every day.

Here are some suggestions:

First, we should require companies with recalls to use the marketing data they have on us to inform us about the product-safety concern. If a store or company you’ve bought something from has enough information to send you coupons or online ads for products they think you’ll buy, they definitely know the item you bought from them has been recalled and should be obligated to inform you.

Second, to plug the gaps, we should require companies whose products are recalled to notify the general public through social media, online advertising, newspaper legal notices or targeted advertising — in doctors’ offices or on the grocery shelf where the item is sold, for example.

Finally, the CPSC needs more funding to fulfill its titular mission: consumer safety. The CPSC’s $135 million annual budget in 2021 was the smallest of all federal health and safety regulatory agencies — just 40 cents per American. More money could pay for things such as an upgraded website with better options for consumers to learn about recalls. And though the FDA’s 2021 budget works out to $10 per person, it needs to spend that money more wisely by improving its website recall notifications and implementing the part of the Food Safety Modernization Act that requires retailers to post recall notices in a consistent manner.

In an ideal world, no one would sell unsafe products. But since dangerous items will always be on the market, whether by honest mistake, negligence or intention, we have to fix our broken recall system as soon as possible.

Teresa Murray directs the U.SPublic Interest Research Group’s (PIRG) Consumer Watchdog office, which looks out for consumers’ health, safety and financial security.

More: Your family’s meat might not be antibiotic-free, despite what it says on the label

Also read: White House targets junk fees — but why do we pay them?