Tim Draper, a venture capitalist famous for his bitcoin price predictions, has praised El Salvador’s vision of embracing this new technology and talked about the benefits of this decision for its people. According to Draper, bitcoin will make El Salvador one of the richest countries in the world in the next 30 or 40 years. […]

Tim Draper, a venture capitalist famous for his bitcoin price predictions, has praised El Salvador’s vision of embracing this new technology and talked about the benefits of this decision for its people. According to Draper, bitcoin will make El Salvador one of the richest countries in the world in the next 30 or 40 years. […]

Source link

Tim

If You Invested $10,000 in Apple When Tim Cook Became CEO, This Is How Much You’d Have Today

Apple (AAPL -1.13%) is one of the most influential companies in history.

The iPhone heralded the era of the mobile internet, and now, the Vision Pro may kick off the next major computing platform. Most of the credit for the company’s success is usually given to co-founder and longtime CEO Steve Jobs. He led Apple through its most inventive period when it released the iPod, iPhone, and iPad in less than a decade, setting the stock on an incredible growth path that’s lasted to this day.

Current CEO Tim Cook took the helm in Aug. 2011, shortly before Jobs’ death. Cook had previously served as Chief Operating Officer, running the company’s sales operation and supply chain. While some were skeptical that Cook could fill Jobs’ shoes, he’s skillfully led Apple and its stock to new heights. Here’s how the company has fared during his tenure.

Image source: Apple.

The Tim Cook era

In 2011, the tech industry was much smaller than it is today. Smartphones were still relatively new, and the mobile economy was just developing.

True to expectations, Apple’s pace of innovation has slowed under Cook. Prior to the release of the Vision Pro earlier this month, the biggest products launched under his tenure have been accessories like the Apple Watch and AirPods.

Cook’s biggest accomplishments have likely been the growth of the company’s installed base of devices, which reached 2.2 billion in its most recent quarter, and the growth of the services business. Services generate significantly higher margins than Apple’s devices, and annual services revenue exploded from $12.9 billion in fiscal 2012 to $85.2 billion in fiscal 2023. Revenue from this segment is largely driven by the App Store, or the 30% commission Apple takes on in-app payments, as well as offerings like Apple Pay and Apple Care insurance.

These achievements have largely been incremental: Improving each iteration of the iPhone enough to keep customers coming back for an upgrade, helping to grow the services business, and selling complementary devices like Apple Watches and Airpods.

However, 2024 has set the stage for arguably the biggest risk the company has taken under Cook: the release of the Vision Pro. Though reviews have been mixed, most industry observers believe that if any company can crack the headset market, it’s Apple.

How Apple stock has performued under Cook

As most investors know, Apple has been a big winner in the Cook era.

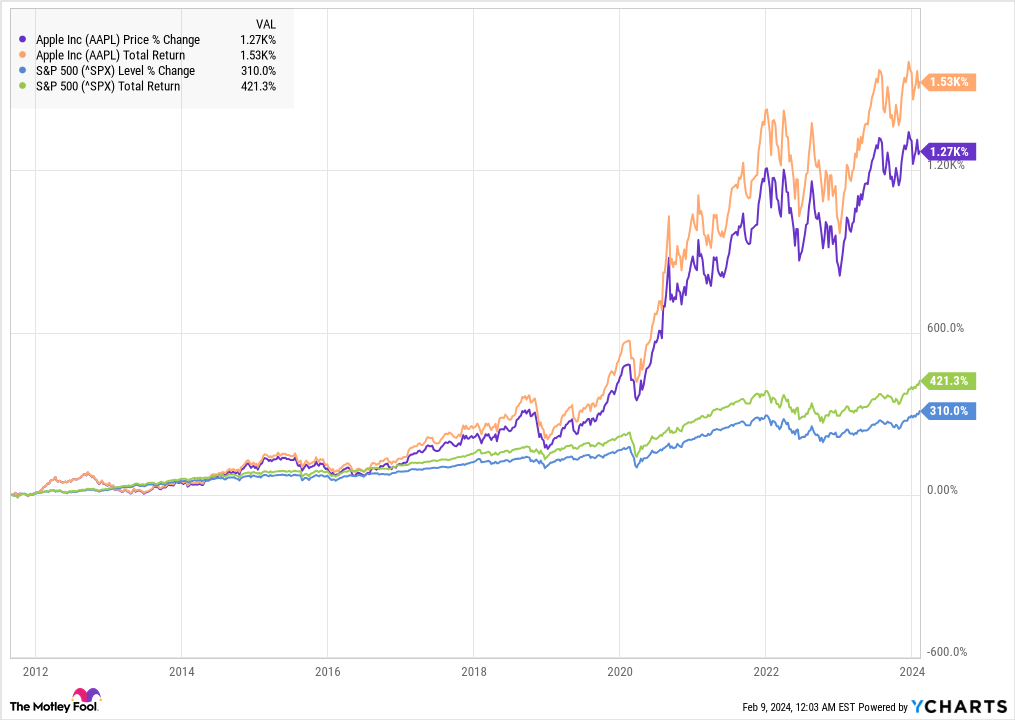

Data by YCharts.

As you can see, the stock has outperformed the S&P 500 by a wide margin since Cook took over in Aug. 2011 — up 1,270% (or 1,530% on a total return basis). That means an investor who bought $10,000 of Apple stock at the start of Cook’s tenure would have $163,000 today after enjoying a compound annual return of 25%. An equal investment in the S&P 500 would be worth just $52,100 today.

Can Apple keep winning?

Apple held the title of the world’s most valuable company for most of the past several years, but it recently lost the crown to longtime rival Microsoft. Nonetheless, Apple is still in good shape to deliver solid profit growth as it grows services revenue, repurchases stock, and refreshes its device lineup.

The company dominates the consumer tech industry, and it’s grown its share of the smartphone market in recent years.

While the stock commands premium to the broad market with a price-to-earnings ratio of 29, Apple has proven itself time and again, and its core businesses look as strong as ever. Cook teased a generative AI announcement for later this year, which could be transformative for the company. And the Vision Pro, if successful, could reshape Cook’s legacy as an innovator.

Maintaining a pace of 25% average annual returns might be difficult, but the company is still well-positioned to outperform the market for the foreseeable future.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Microsoft. The Motley Fool has a disclosure policy.

Why did Tim Cook’s pay package hold up in court while Elon’s failed?

Just a week after Elon Musk’s $55 billion Tesla payday was struck down by a Delaware judge, a New York court dismissed a challenge to Apple CEO Tim Cook’s compensation package, which clocked in at under $100 million. Some coincidence.

At face value, the two cases seem to have a lot in common. Both were shareholder suits waged against some of the highest-paid superstar tech CEOs in the world. And both were filed amid a backdrop of increased public scrutiny over executive compensation in recent years, which is near all-time highs across S&P 500 companies.

But for all their similarities, from a legal standpoint the two cases are apples and oranges—and Cook was always going to stand a better chance of holding on to his paycheck.

Elon Musk’s $55 billion compensation package at Tesla made headlines last month after Delaware chancellor Kathaleen McCormick ruled in favor of a shareholder who argued that Tesla was paying its CEO an unfairly high amount with the moonshot grant. Plaintiff Richard Tornetta argued that because Musk wields so much power at Tesla and maintains close relationships with his board members, the supposedly independent board of directors’ vote approving his massive pay scheme was anything but.

“Chancellor McCormick found that the process for setting Elon Musk’s pay was essentially controlled by Elon Musk,” said Tulane University law professor Ann M. Lipton in an interview with Fortune. “The board didn’t engage in any kind of pushback or real bargaining.”

In response, Musk has threatened to relocate Tesla from Delaware (where almost 70% of Fortune 500 companies are incorporated) to Texas, where a more favorable political climate could leave him less exposed to these types of challenges.

While the Musk case was focused on a broad, more abstract legal question related to the Tesla board of directors’ degree of independence, the Cook case resolved yesterday was much simpler.

“The question before Delaware [in the Musk case] was simply, ‘Was the pay substantively unfair?’ whereas the question in the Tim Cook case was solely, ‘Was the proxy statement misleading?’” said Lipton.

The Teamsters’ pension fund sued Apple last year, arguing that the company had misled investors by misrepresenting Cook’s 2021 and 2022 pay in its proxy statements and paying him more than it had initially proposed.

Because Cook and other Apple executives are primarily paid in equity known as RSUs, the company enlists financial models to estimate what Cook’s actual pay will be for shareholders’ approval each year.

(For CEOs, being compensated primarily with stock isn’t uncommon. Mark Zuckerberg famously earns just $1 in annual salary, but he’s made billions through Meta stock grants included in his compensation package. The Economic Policy Institute found in a report last year that stock-related pay accounts for over 80% of CEO compensation.)

The pension fund that sued Cook argued that Apple misrepresented its CEO’s actual compensation package by downplaying the value of his equity. Cook and other Apple executives netted over $90 million in compensation for 2021 and 2022, higher than the $77.5 million estimate the company initially asked shareholders to vote on for approval.

(Both of those figures are well below Cook’s current annual compensation; at his own request, the Apple CEO took a 40% pay cut last year. That change was approved by shareholders and the Apple board’s compensation committee, which counts former Vice President Al Gore as one of its members.)

The plaintiffs claimed that Apple used an unusual financial model to artificially deflate Cook’s pay estimate, and also buried the compensation tables in a drab, gray section of the proxy statement, where shareholders would be less likely to notice it before casting their Say-on-Pay votes. The court didn’t buy it.

“What happened with Tim Cook is very common in public companies,” said Marc Hodak, partner at executive compensation consultancy Farient Advisors. “They award performance shares based on the face value of the stock. And each of those performance share units has a market value that’s higher than the face value stock at the time of grant.”

One key difference between the two cases was the size of the contested pay package. Musk’s $55 billion award from Tesla was part of the largest compensation plan in corporate history. While Cook’s $100 million annual pay is by no means a small sum, it’s on par with his peers. In fact, Apple uses a group of its competitors, including Meta, Netflix, Visa, and Cisco, to benchmark its executives’ compensation. (Notably, it added Tesla to that peer group last year.)

“I don’t have any question that the size and scale of [Musk’s] pay package was a driver, both in terms of the litigation and the decision that we saw,” said Hodak. “[$55 billion] is automatically going to attract an unusual amount of scrutiny.”

Taken together, these two cases do seem to hint at a broader trend toward greater scrutiny of bloated CEO pay—but Lipton advised against reading the tea leaves prematurely.

“Elon Musk is beating this drum that everyone should leave Delaware, to suggest that somehow this is a trend,” said Lipton. “I think this is an Elon Musk problem. That Tim Cook thing, it was a different law. It was a different argument.”

Representatives from Apple did not immediately respond to a request for comment.

This story was originally featured on Fortune.com

Apple CEO Tim Cook meets Chinese vice-premier, renews commitment to China

Chinese Vice-Premier Ding Xuexiang and Apple CEO Tim Cook have met in Beijing, with both committing to Apple’s participation in developing the country’s digital economy and hi-tech supply chain, as the US tech giant attempts to shift its China narrative amid controversies over national security and censorship.

After a quiet start, Cook’s surprise China trip has ramped up over the past few days, to include meetings with Ding and other high ranking officials such as Ministry of Industry and Information Technology head Jin Zhuanglong and chairman of the China Council for the Promotion of International Trade Ren Hongbin, according to a report from the state-run outlet The Global Times.

While high profile meetings are typical of a visit by the Apple CEO, the latest closed-door discussions come against the backdrop of Beijing’s recent restrictions on government worker’s use of iPhones over national security risks, and controversy surrounding the Chinese iOS Store and its need to better comply with local censorship regulations.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

However, in their meeting, Ding told Cook that China’s doors are “open” and that the country is willing to provide more opportunities and create a better environment for foreign enterprises, including Apple, according to a report by Chinese state radio.

Cook reportedly stated that Apple remains confident in the prospects of the Chinese market, with the company willing to strengthen cooperation with China in high-end manufacturing, the digital economy and other fields.

Cook’s statements are consistent with recent evidence that China will remain Apple’s most important supply chain for iPhones and newer product lines in the near term despite its recent efforts to diversify its supply chain following Covid-related supply difficulties in the country last year.

Before meeting with Ding, Cook had made a stop at manufacturing facilities run by Luxshare Precision Industry Co, a major Apple AirPods supplier that also won orders to make the iPhone 15, and was more recently given assembly work for the upcoming Vision Pro mixed-reality headset.

At an Apple retail store in China last week, Cook told reporters that he was excited about the work Chinese-based developers had done on apps for the Vision Pro headset, according to state media China Daily.

Ding’s remarks on China’s openness to Apple, one of the largest foreign companies operating in the country, align with Beijing’s broader efforts to attract more foreign investment as part of its post-pandemic economic recovery.

Jin Zhuanglong (right), head of China’s Ministry of Industry and Information Technology, meets Apple CEO Tim Cook in Beijing, on October 19, 2023. Photo: Handout alt=Jin Zhuanglong (right), head of China’s Ministry of Industry and Information Technology, meets Apple CEO Tim Cook in Beijing, on October 19, 2023. Photo: Handout>

According to data from the Chinese Ministry of Commerce reported by Xinhua on Friday, foreign direct investment in the Chinese mainland was down more than 8 per cent year on year in the first nine months. However, hi-tech manufacturing was up 12.8 per cent for the same period.

Cook’s last trip to China was a week-long whistle-stop tour in March when he met Chinese Premier Li Qiang, Minister of Commerce Wang Wentao and other top officials at a government-organised China Development Forum in Beijing.

The end date of the CEO’s latest China tour and the rest of his agenda is unknown. Apple did not reply to a request for comment from the Post outside regular office hours.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2023 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2023. South China Morning Post Publishers Ltd. All rights reserved.

Apple CEO Tim Cook visits China as iPhone 15 faces challenging start

Apple CEO Tim Cook holds up a new iPhone 15 Pro during an Apple event on Sept. 12, 2023, in Cupertino, California.

Justin Sullivan | Getty Images News | Getty Images

Apple CEO Tim Cook cheered on gamers at an event during a surprise visit to China, underscoring the market’s importance to the iPhone giant at a time when it faces mounting challenges.

Gamers gathered at an Apple store in Chengdu in southwestern China to play “Honor of Kings,” a game developed by TiMi Studio, which is owned by Chinese tech giant Tencent.

“The action-packed Honor of Kings started here in Chengdu and is now a global phenomenon on the App Store,” Cook said in a post on Chinese social media service Weibo.

Cook also posted a video of himself cheering on gamers at the tournament. Honor of Kings is one of the biggest mobile games in China and a substantial revenue driver for Apple’s App Store in the country.

The Apple CEO’s visit to the company’s third-largest market comes just under a month after the iPhone 15, the company’s flagship smartphone, went on sale to a seemingly lukewarm reception, and as a beaten down Huawei attempts to make a comeback in the mobile market.

“It’s a tough start for Apple to be sure and it’s a combination of factors driving this,” Ethan Qi, associate director at Counterpoint Research, told CNBC via email.

Qi attributed Apple’s challenges to poor consumer sentiment, the iPhone 15’s poorer performance than the iPhone 14 and increasing competition in the high-end smartphone market.

“All of these things are working together to take some of the shine away from Apple’s lustre during the first few weeks of iPhone 15 sales,” Qi said.

CEO paid more than Apple’s Tim Cook last year—and Harvard Law’s youngest-ever graduate—unexpectedly leaves his $110 million gig

Kiwi Camara, the chief executive of legal tech firm CS Disco, turned heads earlier this year when data highlighted him as one of just nine CEOs to get a bigger paycheck than Apple’s Tim Cook last year.

Camara’s compensation totaled $110 million last year, compared to Cook’s $99 million, according to the Wall Street Journal in July, citing data from analytics company C-Suite Comp. In the company’s rankings, Camara came in just below Pinterest CEO Bill Ready (who received $123 million in pay), while Blackstone’s Stephen Schwarzman topped the list with a $253 million paycheck.

But the bumper pay wasn’t enough for Camara to stay in the role.

On Monday, CS Disco revealed in a stock filing that Camara was stepping down as CEO, with immediate effect. The filing gave few details of the circumstances of Camara’s exit, only saying that it was not due to “any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.”

Yet much of Camara’s sizable paycheck may not come to fruition, given the terms of his exit. Almost all of Camara’s compensation came in the form of stock options, which would normally only vest when the company’s stock passed certain thresholds, the lowest being $150, according to the Wall Street Journal. CS Disco’s shares have not even reached half that level since it started trading in 2021.

Shares in CS Disco have fallen by over 26% since Monday, when the company disclosed that Camara was leaving the company. The company now has a market capitalization of just $422 million. CS Disco’s shares are now almost 90% below their peak of $65.88 in September 2021.

CS Disco did not immediately respond to a request for comment.

Founded in 2013, CS Disco provides technologies like artificial intelligence to law firms, thus saving time on tasks like legal discovery.

On Monday, CS Disco appointed board member Scott Hill as its interim CEO. Hill previously served as CFO and special advisor to the CEO of Intercontinental Exchange. Hill will be paid a salary of $50,000 and restricted stock options of around 32,000 shares (worth about $225,000 at Thursday’s closing price).

CS Disco reported $34.3 million in revenue for the quarter ending June 30, 2023, a rise of 2% year-on-year. It also narrowed losses to $14.9 million, compared to $20.2 million a year earlier. The company has never reported a profit since it went public.

Kiwi Camara’s career

Camara has had a prominent and, at times, controversial career. He’s the youngest-ever graduate of Harvard Law School, getting his degree at the age of 19. Yet his schooling was marked by a scandal when, at the age of 16, he shared class notes that included a racial slur. Camara apologized for the mistake, yet thinks the resulting controversy denied him opportunities at major law firms.

Camara then set up a firm with his Law School classmate Joe Sibley. The two gained prominence again in one of the earliest cases of file-sharing: The two defended Jammie Thomas-Rassett after record companies sued her in 2006 for downloading and sharing 24 songs on the platform Kazaa. Thomas-Rassett was, as one point, liable for $1.92 million in damages, which was eventually whittled down to $222,000 by 2013, seven years after the suit was first filed.

Camara’s former law partner now thinks he’ll be taking a break after his time leading CS Disco. “He just had so much on his plate with work that it was very difficult for him to find any leisure time,” Sibley told the Wall Street Journal.

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Want more for your money? These 14 savings accounts have rates of 5% APY (and higher)

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home