They asked some good questions I couldn’t fully answer — even though I’m a “smart money person.”

Source link

Time

Disney upends activist investor Nelson Peltz. Now it’s real work time

Bob Iger, CEO, Disney at the Allen & Company Sun Valley Conference on July 11, 2023 in Sun Valley, Idaho

David A. Grogan | CNBC

Disney shareholders overwhelmingly voted to keep the company’s current board intact during Wednesday’s annual meeting, suggesting they believe current CEO Bob Iger has a plan to boost shares and install a strong successor.

Now, Iger will have to prove it, or he risks facing yet another activist campaign this time next year.

Iger can show progress in a number of areas over the next 12 months. That starts with turning his streaming services into a profitable unit, explaining ESPN’s digital strategy, scoring some box-office hits and picking a successor with a transition plan.

If Disney struggles to show investors the entertainment giant has a coherent strategy, or if Iger kicks the succession can down the road once more, activist investors may be knocking on the company’s door again during next year’s annual meeting to demand change.

“They still have the same problems they’ve had before, which are really industry problems,” said TD Cowen analyst Doug Creutz. “Direct-to-consumer streaming is just economically inferior to the old linear bundle model, which is going away. They have to try to manage through that.”

Peltz told CNBC on Thursday that he would not wage another proxy fight if Iger shows progress on his key priorities.

“I hope Bob can keep his promises,” Peltz said Thursday. ” I hope they can do all the things they assured us they were going to do. I’ll watch and wait. If they do it, they won’t hear from me again.”

‘Turning Red’ … to black

Still from Pixar’s “Turning Red.”

Disney

Disney said earlier this year it plans to turn a profit in its streaming TV businesses in its fiscal fourth quarter this year.

That would mark a milestone for the company, which launched Disney+ on Nov. 12, 2019. It would be the first time Disney showed it can make money from Disney+, Hulu and ESPN+.

Disney will need to sustain and grow streaming profit to justify Iger’s five-year-old strategy to go “all in” on the segment.

Iger’s confidence that Disney will make streaming profitable by the end of the fiscal year stems from draconian cost-cutting on content, which includes new movies, sports rights spending and TV production. Disney said in November it was targeting an “annualized entertainment cash content spend reduction target” of $4.5 billion.

“What they have to do next is fix the streaming losses,” said Needham & Co. analyst Laura Martin. “They still need to cut costs on the streaming side to get to profitability.”

ESPN’s strategy

Disney has set up a two-pronged digital strategy for ESPN. For decades, Disney reaped billions by keeping ESPN exclusive to the cable bundle.

Those days are nearly over.

In the fall of 2024, Disney plans to launch a skinny sports bundle that includes ESPN’s linear network, along with sports channels from Warner Bros. Discovery and Fox. The yet-to-be-priced digital streaming service will likely cost about $45 or $50 per month, CNBC reported in February. Disney owns one-third of it.

ESPN will then debut its own flagship streaming service in the fall of 2025. It will include new personalized features that cater to sports bettors and fantasy sports players. The Athletic reported last month that service is likely to cost $25 or $30 per month.

Disney risks confusing consumers with its multiple offers and will need to roll out its new products with clear messaging. Disney has already offered ESPN+, a sports streaming service that has some but not all of ESPN’s content. That costs $10.99 per month and can be bundled with Disney+ and Hulu.

The Disney+ website on a laptop in Brooklyn, New York, on July 18, 2022.

Gabby Jones | Bloomberg | Getty Images

ESPN will also stay an essential part of the cable bundle. Subscribers will want to know what they’re paying for and what content they do and don’t get with their additional subscription dollars.

Box-office turnaround

Disney has been mired in a yearslong box-office slump, from live-action flops to Pixar disappointments, from Marvel fatigue to the absence of Star Wars (the last movie released in theaters came in 2019).

Disney hired David Greenbaum, previously co-president of Searchlight, on Feb. 26 to take over as president of Walt Disney Motion Picture Studios, replacing Sean Bailey. He’ll report to Disney Entertainment co-Chairman Alan Bergman, who is on the hot seat to change the division’s fortunes.

Other than 2022′s “Avatar: The Way of Water,” which Disney acquired as part of its $71 billion deal for the majority of 21st Century Fox, the company has not had a movie generate more than $1 billion since the last Star Wars release in 2019, according to data from Comscore. Sony produced and distributed “Spider-Man: No Way Home,” which made $1.9 billion, although Disney’s Marvel Studios did serve as a co-producer.

Several big-budget franchise films have flopped. “Indiana Jones and the Dial of Destiny” in 2023 generated $378 million globally. “Ant-Man and the Wasp: Quantumania” secured $476 million worldwide, unusually low for a Marvel film (until “The Marvels” reached just over $200 million late last year). And Pixar’s “Lightyear” collected less than $250 million globally in 2022.

Trian Partners’ Nelson Peltz, who failed to join Disney’s board Wednesday after securing just 31% of the vote, publicly questioned what he has called Disney’s “woke” content strategy. The company’s creative team has actively sought to create films and television shows centered on people of color as well as exploring narratives outside heteronormativity.

“People go to watch a movie or a show to be entertained,” Peltz said in an interview with the Financial Times. “They don’t go to get a message.”

Iger said Wednesday that while the company wants to instill positive messages into its content, that shouldn’t be the first priority.

“Our job is to entertain first and foremost, and by telling great stories,” Iger said during the company’s annual shareholder meeting. “We continue to have a positive impact on the world and inspire future generations, just as we’ve done for over 100 years.”

Success on succession

The biggest existential question for Disney is who follows Iger as CEO. This was Trian’s strongest argument to land Peltz a board seat. Iger has five times pushed back his retirement as CEO, and when he did leave in 2020, he stuck around as chairman for 22 months, butting heads with his successor Bob Chapek as the two jockeyed to co-run the company during the pandemic.

Iger returned in late 2022 as the CEO when the board fired Chapek. Iger’s plan to hand over Disney to a new leader has been to name a successor in or around early 2025 and then stick around to teach that person the job, CNBC reported last year.

He’ll want to make sure that person is prepared to run an expansive company, with a flourishing parks business, a declining legacy TV unit, a still young streaming division, and a struggling but legendary movie studio. Internal candidates include Bergman, ESPN Chairman Jimmy Pitaro, Parks and Resorts Chairman Josh D’Amaro, and Disney co-chairman of entertainment Dana Walden, who could be the first female CEO in the company’s 100-year history.

“The problem is how do you replace Bob Iger? They’ve been trying to do it for 10 years, and it’s very difficult for multiple reasons,” said TD Cowen’s Creutz. “Bringing someone from the outside into Disney, which has a very strong, unique culture, is risky. Then you’re down to internal candidates, and if there isn’t anyone internally you think can step into the role, you’ve got a problem.”

The board has now been given the greenlight to proceed with its search process. That’s a win for Iger, and shareholders voted Wednesday they believe it’s a win for them, too.

— CNBC’s Sarah Whitten contributed to this report.

Don’t miss these stories from CNBC PRO:

WATCH: Disney still needs to cut costs on streaming side to get to profitability, says Needman’s Martin

Bitcoin Supply In Loss Hits 10% After Crash: What Happened Last Time

On-chain data shows the Bitcoin supply in profit has plunged following the latest crash in the asset’s price towards the $65,000 level.

Bitcoin Supply In Profit Is Now Down To Around 90%

As analyst James Van Straten pointed out in a post on X, around 10% of the BTC supply is now in a state of loss. The on-chain indicator of interest here is the “Percent Supply in Profit,” which tracks the percentage of the total circulating Bitcoin supply holding an unrealized gain.

This metric works by going through the blockchain history of each coin in circulation to see the price at which it was last transferred. Assuming that this previous transaction involved a change of hands, the price at its moment would serve as the cost basis for the coin.

The coins with a cost basis that is less than the current spot price of the cryptocurrency would naturally be considered to be holding a profit, and as such, they would be counted under the supply in profit.

The Percent Supply in Profit adds up all such coins and calculates what part of the total supply they make up for. The opposite metric, the Percent Supply in Loss, adds up the coins not satisfying this condition.

Since the total circulating supply must add up to 100%, the Percent Supply in Loss can be deduced from the Percent Supply in Profit by subtracting its value from 100.

Now, here is a chart that shows the trend in the Percent Supply in Profit for Bitcoin over the last few months:

Looks like the value of the metric has taken a plunge in recent days | Source: @jvs_btc on X

As displayed in the above graph, the Bitcoin Percent Supply in Profit has seen a sharp drop recently as the cryptocurrency price has gone through a significant drawdown.

The indicator’s value has dropped to around the 90% mark, which means that about 10% of the supply is currently carrying a loss. The chart shows that the last time the metric touched these levels was back on 22 March. Interestingly, the asset also found its bottom around then.

Earlier, the Percent Supply In Profit had pushed towards the 100% mark, which was a natural consequence of the price setting a new all-time high (ATH), since at fresh highs, all of the supply must be out of the red.

Generally, the investors in profit are more likely to sell their coins, so if many come into gains, the possibility of a mass selloff rises. Due to this reason, high levels of the Percent Supply In Profit have often led to tops.

Similarly, bottoms become more likely when investor profitability levels drop relatively low. The current value of 90% is still quite high, but this isn’t unusual during bull runs, as there is strong demand and ATHs are being explored.

The fact that the profitability has cooled off compared to earlier levels may be constructive for the rally’s chances to see a continuation, just like it did last month.

BTC Price

At the time of writing, Bitcoin has been trading at around the $65,700 level, down more than 5% over the past week.

The price of the asset seems to have been tumbling down over the past couple of days | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

How Sam Bankman-Fried’s 25-year sentence compares to Bernie Madoff and Elizabeth Holmes’s jail time

With a sentence of 25 years in prison, Sam Bankman-Fried joins a list of notorious white-collar criminals like Bernie Madoff and Jeffrey Skilling who have received severe penalties for financial fraud.

Most Read from MarketWatch

The punishment meted out by a federal judge places Bankman-Fried’s failed cryptocurrency exchange FTX alongside Enron and WorldCom as a defining example of corporate greed.

The sentence also closes a chapter in the spectacular fall of Bankman-Fried, who went from crypto wunderkind to convicted felon in just two years following the collapse of FTX, amid allegations he had stolen billions of dollars from the exchange’s customers.

Prosecutors had asked for a sentence of 40 to 50 years, saying in court filings that the “sheer scale of Bankman-Fried’s fraud calls for severe punishment.”

In their sentencing request, they wrote: “The amount of loss — at least $10 billion — makes this one of the largest financial frauds of all time.”

A presentencing report drawn up by the U.S. Probation Office went even further, recommending a sentence of 100 years. That would have meant the 32-year-old Bankman-Fried would never see freedom again.

Bankman-Fried’s lawyers had asked for a much more lenient sentence of between five years, three months, and six and a half years, asking the court to “resist the temptation to compare Sam’s case to some of the more notorious scandals of the recent past.”

They argued that most of FTX’s customers would be made whole through a bankruptcy proceeding that had recovered much of the money, meaning that Bankman-Fried’s actions were essentially a victimless crime, a notion rejected by Judge Lewis Kaplan.

In court filings, Bankman-Fried’s attorneys said his case aligned more closely to that of Theranos founder Elizabeth Holmes, who was sentenced to 11 years for fraud, rather than that of Bernie Madoff, who was sentenced to 150 years for stealing billions from investors in a massive Ponzi scheme.

An even better comparison, they argued, was Michael Milken, the 1980s Wall Street investment titan who served two years in prison for securities fraud and later became a noted philanthropist. Bankman-Fried, they said, also intended to dedicate his life to charitable work after serving his sentence.

Prosecutors countered by saying Bankman-Fried actually stood out among well-known fraudsters.

“Unlike other white collar offenders, the losses the defendant is responsible for are not borne exclusively by sophisticated investors or extrapolated based on a stock price drop. The victims, on the other hand, include tens of thousands of everyday people. People who entrusted the defendant with their money,” they wrote in court filings.

“The fact that two years later victims may receive some money back through FTX’s bankruptcy is of little comfort for those victims who needed the money in November 2022. The suffocating sense of dread and despair that victims felt when they could not withdraw their money, their shame and embarrassment, and the resulting damage to lives and businesses, cannot be undone,” prosecutors wrote.

At his sentencing hearing, Bankman-Fried acknowledged the reality of his situation.

“My useful life is probably over. It’s been over for a while now,” he said, according to reports.

Here’s how Bankman-Fried’s sentence compares to some of the biggest corporate-fraud cases in history.

Sholam Weiss, 845 years

In 1999, Sholam Weiss received what is believed to be the longest-ever sentence for a white-collar crime following his conviction in absentia for stealing $450 million in a complex mortgage and stock fraud. The scam bankrupted the National Heritage Life Insurance Company and wiped out the life savings of thousands of elderly victims.

Shortly before trial, Weiss rejected a plea deal that would have put him behind bars for five years. After his conviction and before his sentencing, Weiss fled the country and remained on the lam for three years before being arrested in Austria.

His supporters argued that Weiss’s sentence was excessive and had been handed down only because he had rejected the plea offer and then fled. The sentence was later reduced on appeal to 835 years.

In 2021, after serving 18 years, Weiss, who was then 66, had his sentence commuted by then President Donald Trump on his last day in office. Trump cited the “unduly harsh” length of the sentence and Weiss’s poor health.

Bernie Madoff, 150 years

If there is a poster boy for financial crime, it is Bernie Madoff.

Once a respected titan of Wall Street, Madoff’s web of lies came undone amid the 2008 financial crisis, when it was revealed that his popular investment fund had been a Ponzi scheme all along.

At the time, it was believed that some $65 billion had gone missing, devastating tens of thousands of people, including celebrities and sophisticated investors. Once his scheme had collapsed, Madoff quickly acknowledged his guilt and, at the age of 71, was sentenced to 150 years in prison.

In 2021, after serving 11 years, Madoff died in prison at the age of 82.

The amount that Madoff was alleged to have stolen was eventually revised to about $18 billion, after phony paper profits were deducted from the total. Following years of lawsuits and asset seizures, over $14.7 billion has been recovered.

Allen Stanford, 110 years

The second-largest case of investor fraud in history — after that of Bernie Madoff — was that of Allen Stanford.

Stanford’s rags-to-riches story was impressive. Born into poverty in rural Texas, he had built a finance empire from nothing, becoming a billionaire and even receiving a knighthood.

In 2009, just months after Madoff’s empire had come crashing down, investigators raided the headquarters of the Stanford Financial Group in Houston. The raid was based on charges brought by the Securities and Exchange Commission alleging Stanford had defrauded thousands of investors through the issuance of more than $7 billion worth of fraudulent certificates of deposit as part of an extensive Ponzi scheme.

Criminal charges followed, and in 2012 Stanford was convicted of fraud and sentenced to 110 years in prison. Stanford, now 74, remains behind bars.

Lawrence Duran, 50 years

In what is believed to be the longest prison sentence ever involving Medicare fraud, Lawrence Duran was sentenced to 50 years in 2011 for orchestrating a scheme that generated $205 million.

Prosecutors said Duran, who had run a national chain of mental-health centers, preyed on patients with advanced dementia by submitting false claims for expensive therapies that they never received.

In some cases, prosecutors said elderly and infirm patients were left in rooms for hours under the guise of receiving high-priced treatment, even though they didn’t know where they were or what was happening around them.

Duran and several co-conspirators pleaded guilty and were ordered to pay back tens of millions of dollars. Duran, who is now 62, remains behind bars.

Bernie Ebbers, 25 years

Dubbed the “Telecom Cowboy,” Ebbers presided over the collapse of WorldCom in 2002, which resulted from widespread accounting irregularities involving loans Ebbers took from the company.

Ebbers, who had helped build WorldCom into the second-largest telecom company in the U.S. behind AT&T, blamed his subordinates for the suspect bookkeeping practices, but he was convicted of fraud and conspiracy in 2005 and was sentenced to 25 years in prison.

In 2019, after serving 13 years, Ebbers was released due to declining health and died a month later at the age of 78.

Jeffrey Skilling, 24 years

Jeffrey Skilling was chief executive of Enron during the ill-fated energy company’s collapse in 2001 amid allegations that the company had egregiously cooked its books.

When the company filed for chapter 11 that year, it was the largest corporate bankruptcy proceeding in history, costing more than 20,000 people their jobs. The bookkeeping scandal was so broad that it triggered the dissolution of Arthur Andersen, then one of the Big Five global accounting firms.

Skilling and Enron Chair Ken Lay were both hit with criminal charges and convicted of fraud, conspiracy and insider trading in 2006. Lay died while awaiting sentencing. Skilling was sentenced to 24 years in prison.

Over the course of several appeals, Skilling’s sentence was reduced to 14 years and in 2019, he was released from prison. Following his release, Skilling, who is now 70, returned to Texas and attempted to get back into the oil and gas business.

Most Read from MarketWatch

Bitcoin, the world’s most valuable coin, is once again deviating from historical norms. According to an analysis by one crypto analyst, the coin is in the “overbought” territory of the Relative Strength Index (RSI) for the first time in the lead-up to halving. The RSI is a popular technical indicator analysts use to gauge the price momentum of traded instruments.

Bitcoin Overheating? RSI Stands Above 70

The analyst points out that the Bitcoin RSI on the monthly chart is currently above 70, indicating an overbought condition and overheating. This is a significant development as it’s the first time in Bitcoin’s history that this has happened before a halving.

The Bitcoin network is set to halve miner rewards in mid-April. This event, which occurs roughly every 200,000 blocks, will cut rewards distributed to miners by 50% from the current level of 6.125 BTC. Miners play a vital role in confirming transactions and maintaining network security.

The fact that Bitcoin prices appear to be “overheating” just before halving is net bullish for the coin. It suggests that prices are not only breaking from historical trends but also building strong momentum.

Besides the strong upside momentum, the analyst notes that Bitcoin now trades above a critical dynamic level on the monthly chart.

The confluence of these positive developments could explain why traders are upbeat. Most analysts agree that the coin will likely break higher in the weeks ahead, clearing the recent all-time high of around $73,800.

BTC Pinned Below $73,000 And Consolidating

Thus far, Bitcoin prices are firm, increasing as evident in the daily chart. After sharp contractions in the past few trading sessions, the welcomed reversal over the weekend lifted the coin towards the elusive $70,000 level and a previous all-time high.

However, judging from the candlestick arrangement in the daily chart, a break above $73,800 would likely catalyze more demand. So far, prices are moving sideways within a broad range despite signals of strength relayed from other indicators.

While some investors are bullish, expecting prices to rise, caution should prevail. A close above $74,000 would thrust Bitcoin into unchartered territory. Beyond this, the analyst uses technical indicators to make projections. These tools use historical parameters and lag. As such, they may not be as accurate and, thus, misleading in some instances.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Breakthroughs in the biotech industry sometimes come from relatively small drugmakers. Competing with the largest companies in significantly crowded areas, such as oncology, can be difficult. That’s why relatively unknown biotechs often opt to develop medicine where there are few (if any) approved therapies.

Madrigal Pharmaceuticals (MDGL -3.44%), a mid-cap biotech, has followed this blueprint. The company was recently awarded the first approval from the U.S. Food and Drug Administration (FDA) for a treatment for non-alcoholic steatohepatitis (NASH). Let’s look deeper at this important milestone and determine whether it makes Madrigal’s shares attractive.

Madrigal’s product boasts exciting sales potential

First, a primer on NASH. It is caused by a buildup of fat in the liver. As its name suggests, patients don’t owe it to excessive alcohol abuse, although the liver damage the illness causes is similar to that of heavy alcohol users. Instead, obesity and diabetes are thought to be some of the major risk factors. NASH can cause serious, life-threatening problems. That’s why the approval of Madrigal’s Rezdiffra to treat NASH is such a big deal.

The commercial opportunity looks attractive, too. Madrigal will go after 315,000 U.S. patients. Importantly, the FDA is not requiring a liver biopsy before prescription — a somewhat invasive procedure that likely would have limited the number of patients willing to take the medicine.

Rezdiffra will cost $47,400 per year although insurance will pick up most of the tab for most patients. The point, though, is that Rezdiffra’s potential vastly exceeds the $1 billion mark, so things are looking good for Madrigal Pharmaceuticals.

A few things to consider before buying

Rezdiffra is the only approved NASH medicine for now, but how long will that last? Analysts expect this area to rise rapidly in the coming years as more drugmakers join the fray. Several of the largest pharmaceutical companies in the world are on Madrigal’s trail. That includes Eli Lilly, Novo Nordisk, and Pfizer, just to name a few.

While earning the first approval might be an advantage to Madrigal, facing fierce competition from these larger companies with deeper pockets, stronger footprints and connections in the industry, and bigger sales teams won’t be easy. Will funding be an issue for Madrigal? The company conducted a secondary offering following Rezdiffra’s approval. The biotech expects gross proceeds of about $600 million from this move.

Before that, it ended 2023 with about $634 million in cash, equivalents, and marketable securities. So, the company should have in the neighborhood of $1 billion in cash after its latest round of financing. In my view, Madrigal Pharmaceuticals will no longer need to resort to dilutive forms of financing. It shouldn’t take too long for Rezdiffra to gain significant traction given its positive phase 3 results, convenient once-daily tablet dosing, and the fact that, for now, it is the only game in town for NASH patients who do not have to undergo a live biopsy to get access to the medicine.

Does all of this make Madrigal Pharmaceuticals stock a buy? On the one hand, the company displayed its innovative qualities, but it has no other products in development. Long-term biotech investors will want that to change with time; relying on a single medicine to drive growth over long periods is a somewhat dangerous, although not unprecedented, strategy. So, Madrigal Pharmaceuticals certainly boasts massive potential, although its overreliance on Rezdiffra is a risk.

In my view, somewhat aggressive investors should seriously consider initiating a position in the stock, whereas more conservative ones should look elsewhere.

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

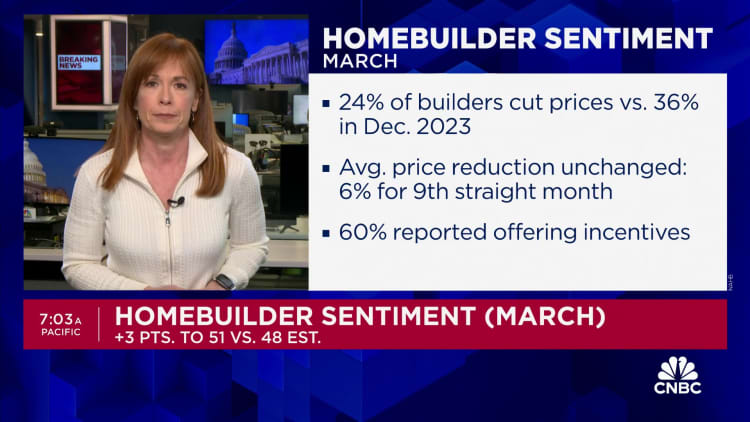

U.S. homebuilders are feeling more confident about their businesses than they have since last summer, as they see better demand despite stubbornly high mortgage rates.

Homebuilder sentiment rose 3 points in March to 51 on the National Association of Home Builders/Wells Fargo Housing Market Index. The reading gained for the fourth-straight month, hitting its highest level since July.

Sentiment also moved into positive territory for the first time since July. Fifty is the line between positive and negative sentiment.

Mortgage rates came down in the first week of March, only to shoot back up in the second week. The average rate on the popular 30-year fixed mortgage has hovered around 7% since early February.

“Buyer demand remains brisk and we expect more consumers to jump off the sidelines and into the marketplace if mortgage rates continue to fall later this year,” said NAHB Chairman Carl Harris, a custom homebuilder from Wichita, Kansas. “But even though there is strong pent-up demand, builders continue to face several supply-side challenges, including a scarcity of buildable lots and skilled labor, and new restrictive codes that continue to increase the cost of building homes.”

Of the index’s three components, current sales conditions rose 4 points to 56, expectations in the next six months rose 2 points to 62 and buyer traffic increased 2 points to 34.

Regionally, on a three-month moving average, sentiment rose most in the Midwest and West.

The report also noted that fewer builders are lowering home prices to attract buyers. In March, 24% of builders reported cutting home prices, down from 36% in December 2023 and the lowest share since July.

The average price cut remains steady at around 6%. Builders are still using sales incentives such as buying down mortgage rates.

“With the Federal Reserve expected to announce future rate cuts in the second half of 2024, lower financing costs will draw many prospective buyers into the market,” said Robert Dietz, chief economist for the NAHB. “However, as home building activity picks up, builders will likely grapple with rising material prices, particularly for lumber.”

Don’t miss these stories from CNBC PRO:

It’s Time for This “Magnificent Seven” Stock to Join Its Rivals and Start Contributing to This $1.7 Trillion Payout

Last year, companies around the world paid a record $1.7 trillion in dividends to their shareholders, a 5% increase from the prior year. Leading the way were tech titans Microsoft (MSFT -2.07%) and Apple (AAPL -0.22%) at $20.7 billion and $14.9 billion, respectively.

Dividend payments are likely to set a new record this year. One catalyst is that fellow tech titan Meta Platforms (META -1.57%) initiated a dividend, which should total more than $5 billion this year. It’s now the fourth member, along with Nvidia, of the vaunted “Magnificent Seven” to join the bandwagon of dividend-paying stocks.

Among the holdouts is Alphabet (GOOG -1.50%) (GOOGL -1.34%). It’s high time for the search giant to start paying dividends. Here’s why.

It rivals its peers in producing cash

Microsoft, Apple, and Meta Platforms can afford to pay massive dividends because they generate huge cash flows. Over the past six months, Microsoft has produced $49.4 billion in operating cash flow. It returned $19.5 billion to shareholders through dividend payments ($10.6 billion) and share repurchases ($8.8 billion). Apple is also a cash flow machine. It generated $39.9 billion in cash from operating activities in its fiscal first quarter. It paid $3.8 billion in dividends and repurchased $20.1 billion in stock. Meanwhile, Meta Platforms produced $40.8 billion in net cash from operating activities last year and used $20 billion to repurchase shares.

Alphabet is just as good at generating cash as its dividend-paying Magnificent Seven peers. Last year, the search giant produced a prodigious $101.7 billion in net cash from operating activities. While the company didn’t use any of that money to pay dividends, it did return $61.5 billion to shareholders through repurchases.

However, the company could easily follow Meta’s approach when it initiated its dividend earlier this year. CFO Susan Li commented on Meta’s new dividend policy on the fourth-quarter earnings conference call:

Aside from organic investments, returning capital to shareholders remains important to us. We believe our strong financial position and performance will enable us to invest in the business while also continuing to return capital to investors over time. We’ve historically done so through share repurchases, and while we expect to maintain an active share repurchase program, we are modestly evolving our approach going forward by returning a portion of capital through a regular dividend.

It’s also a financial fortress

Another reason tech titans Microsoft, Apple, and now Meta Platforms are paying dividends is that they have a lot of cash on their balance sheets.

|

Magnificent Seven Dividend Stock |

Cash, Cash Equivalents, and Short-Term Investments |

Total Debt Outstanding |

Net Cash Position |

|---|---|---|---|

|

Apple |

$172.6 billion |

$108 billion |

$64.6 billion |

|

Microsoft |

$81 billion |

$74.2 billion |

$7 billion |

|

Meta Platforms |

$65.4 billion |

$18.4 billion |

$47 billion |

Data sources: Company websites. Data as of the end of 2023.

Apple’s net cash position alone could fund its current dividend outlay for more than four years, while Meta’s would last nearly a decade.

Alphabet has an equally enormous cash position. It ended last year with $110.9 billion of cash, equivalents, and marketable securities against only $13.3 billion in debt.

Ramping its cash returns seems inevitable

Like its peers, Alphabet produces more cash than it needs to grow its business. The money it doesn’t return to shareholders through buybacks is piling up on its balance sheet. While the company might be strategically holding cash to make a sizable acquisition, that seems unlikely, since mergers and acquisitions aren’t a big part of its growth strategy. The company’s biggest deal was its $12.5 billion acquisition of Motorola Mobility in 2012. Other notable deals were relatively smaller including Nest at $3.2 billion in 2014, Fitbit at $2.1 billion in 2021, and YouTube at $1.7 billion in 2005. Between that and the increased regulatory scrutiny of acquisitions in the tech sector, Alphabet probably won’t use its cash position to make a big deal.

That leaves returning it to shareholders as the most likely outcome. On one hand, it’s hard to argue with its share repurchase program. Alphabet has reduced its outstanding shares by 10% over the past five years, second only to Apple in this group. Alphabet could buy back even more shares, which wouldn’t be a bad idea, since it has the lowest forward P/E ratio in this group at 21. However, a dividend could broaden its appeal to more investors, which could boost its valuation. Meanwhile, paying a dividend would put cash in the pockets of long-term holders, not those selling shares to Alphabet as part of the repurchases.

It’s time Alphabet initiated a dividend

Microsoft and Apple pay their investors billions of dollars in dividends each year. Meta is joining them this year. It’s time for Alphabet to get on board, too. Like its peers, it produces massive cash flows, which are piling up on its balance sheet. It really doesn’t have much use for that money, other than returning it to investors. While its buyback is doing a good job, the company can easily squeeze in a dividend to provide its investors with a little income.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Matt DiLallo has positions in Alphabet, Apple, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

CFOs are as bullish on the Dow and Fed as they’ve been in a long time

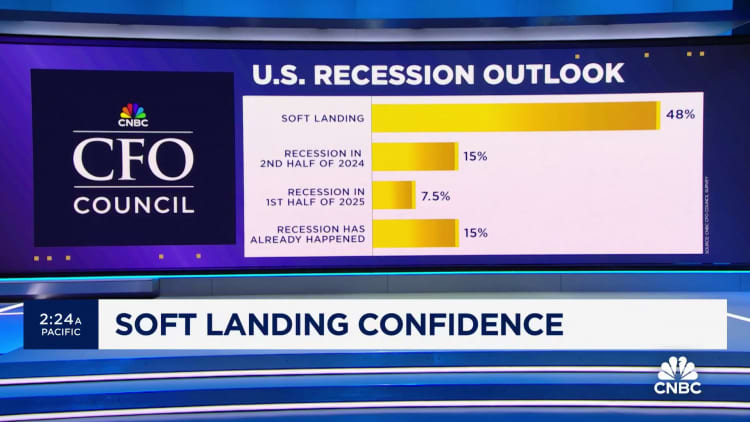

Chief financial officers at large companies see a U.S. economy and equities market that can continue to grow, even as fears about sticky inflation and a potentially overextended, and concentrated, bull run in stocks weigh on investors.

That’s according to the CNBC CFO Council Survey for the first quarter of 2024, which shows a dramatic year-over-year change in the view from CFOs about the Federal Reserve’s inflation battle. The percentage of CFOs who think the Fed will be able to achieve a soft landing has reached a five-quarter high, at 48%. It’s a marked change from where CFOs were a year ago in Q1 2023, with expectations of a soft landing tripling since the first quarter of last year.

For the first time in five quarters, not a single CFO rated the Fed’s efforts to bring inflation down as “poor,” while those who described the central bank’s policy as “good” edged higher again quarter over quarter to 55%.

The latest forecast of long-term inflation expectations came in higher than expected this week, but the market reacted positively to Tuesday’s CPI reading, and stocks closed at a new record after some days of selling. This bullishness despite continued jitters on inflation lines up with the view from CFOs on the council.

CFOs have been consistent across our surveying in their view that inflation will not return to 2% any time soon, and that’s the case again in the Q1 survey, with nearly 80% of CFOs saying inflation won’t hit the Fed’s 2% target before 2025 at the earliest.

This view of inflation remaining above the Fed’s target for considerably longer plays into a CFO outlook that the Fed will not move as quickly as the market thinks to cut interest rates. In recent months, the market has gotten the Fed’s message that March is out of the picture for the start of rate cuts, but CFOs remain more cautious on the Fed. According to the Q1 survey, the largest percentage of CFO respondents (44%) do not expect a rate cut until September. The CME FedWatch tool shows a majority of traders still betting on June as a likely target. In the Q1 CFO survey, equal groups of just under 25% of CFO respondents think the cuts will begin in June or July.

Despite CFOs expecting a slower moving Fed than traders, the latest quarterly view represents an increase in dovish expectations. The greatest swing in the survey’s interest rate outlook comes from CFOs who in the previous quarterly survey had not expected rate cuts to begin before November 2024 at the earliest.

Jerome Powell, chairman of the U.S. Federal Reserve, smiles during a press conference following the Federal Open Market Committee (FOMC) meeting in Washington, D.C., U.S. on Wednesday, May 1, 2019.

Anna Moneymaker | Bloomberg | Getty Images

CFOs don’t see rate anxiety as being a major short-term hurdle for stocks. Over 80% of CFOs believe the Dow Jones Industrial Average is more likely to continue its run up to the 40,000-point mark, with technology continuing to lead the way among sectors, than slip into a bear market.

CFO Council members, as a group, have expressed consistent concerns since the Fed began raising interest rates almost exactly two years ago, in March 2022, in keeping with a typically cautious mindset among chief financial officers and referencing recent economic history and expectations it would be repeated — restrictive monetary policy ultimately leads to a large drop in consumer credit quality and demand that damages the economy and, even if in the short-term the labor market remains solid, ultimately layoffs spiral across sectors before the Fed can reverse course and avoid a recession. Even if unemployment and consumer debt are up, and consumer demand is down, the severity of the damage that CFOs were expecting has obviously not come to pass.

The quarterly CFO survey is a snapshot of views from a select number of chief financial officers at large companies comprising the 100 member-plus council, with 27 members providing responses in Q1.

Some of the C-suite economic confidence may be playing into plans for corporate cash. Buybacks are booming again in 2024 and could reach $1 trillion next year, but there is also evidence of more appetite for deal making to start the year, despite the significant regulatory headwinds and antitrust stance of the Biden administration. Nearly one-third of CFO respondents say strategic M&A will be the top capital spending priority this year, which was the most popular response among CFOs for 2024 capex planning.

The Q1 CFO survey doesn’t come without warning signs for an economy and market that have proven more resilient than many, including CFOs, expected throughout the last year. But the biggest risk cited by CFOs this quarter is also a perennial one for major corporations. Throughout the history of CFO Council polling, consumer demand has most consistently ranked as the No. 1 external risk to business, and it is back at the top of the list now (37%), and at its highest level among risk factors in five quarters.