If home sellers stop paying real-estate agents’ commissions, buyers may end up footing the bill.

Source link

times

Federal Reserve Chair Jerome Powell testifies during the Senate Banking, Housing and Urban Affairs Committee hearing titled “The Semiannual Monetary Policy Report to the Congress,” in the Dirksen Building in Washington, D.C., on March 7, 2024.

Tom Williams | Cq-roll Call, Inc. | Getty Images

Forecasters in the CNBC Fed Survey are increasingly confident that the U.S. economy will avoid a recession and pull off a soft landing, and unlike past surveys, don’t even see growth slowing much below potential in the next couple of years.

The potential downside of the better forecast: less Fed easing with the possibility that officials at their meeting this week forecast fewer rate cuts in 2024 than they did in December.

“For now, the narrative that the U.S. economy is so fragile that it cannot survive without ultra-low rates has been debunked and discarded into the rubbish bin of history,” wrote John Donaldson, director of fixed income at the Haverford Trust Company, in response to the survey.

The March survey finds the average probability of a soft landing at 52%, up from 47% in the January survey, and the first time that it has been above 50% since the question was first asked in July. The probability of a recession in the next 12 months fell to 32%, the lowest since February 2022, and down from 39% in January and 63% in November.

“The U.S. economy continues to move toward a modest growth and modest inflation environment,” said Scott Wren, senior global market strategist at the Wells Fargo Investment Institute. “This may take longer than initial expectations, but the trend is favorable.”

The Fed’s two-day meeting ends Wednesday, when the central bank is largely expected to keep the federal funds target rate at a range of 5.25% to 5.5%.

Forecasters in general have a bad track record of predicting recessions. The 27 respondents to this survey, among them economists, strategists and fund managers, joined other forecasters in the past year in being fairly certain a recession would hit in 2023. That turned out not to be the case. While the average recession probability is down, about 20% of respondents still say there’s an even-money chance or greater of a downturn in the next 12 months.

“The larger-than-consensus reduction in the federal funds rate in my forecast is contingent on a recession that brings inflation down,” said Robert Fry of Robert Fry Economics. He has a 60% recession probability and sees the Fed slashing rates to 3.6% by year-end from the current level of 5.38%.

Rate cut forecasts

Respondents still see three cuts this year, on average, which would bring the funds rate down to 4.6%. Survey respondents never became as euphoric as futures markets about rate cuts and so they haven’t had to backtrack from the six cuts that the markets priced in. Even then, there are those who believe the Fed could be more hawkish at the upcoming meeting.

Guy LeBas, chief fixed income strategist at Janney Montgomery Scott, said, “The last two months of slightly elevated inflation readings have slammed the door on a rate cut at the moment. …There is a high probability the dot plot will include 2 rate cuts in 2024…”

In December, the last time the Fed released its official forecasts, members called for three cuts this year.

Half of respondents believe the biggest risk is that the Fed cuts too late, while 46% worry the Fed will cut too early. But continued high inflation is judged to be the biggest risk to the economic expansion.

Respondents are a bit more optimistic about rate cuts next year, with the average funds rate forecast to decline to 3.6% compared with a 3.9% forecast in September.

One notable feature of the forecast is call for a very modest economic slowdown. GDP is predicted to grow 1.6% this year, down from 2.5% last year, but far above the 0.7% forecast for 2024 made back in July. The 1.6% is just barely below what is judged to be potential growth and, the economy is seen rising a bit above that level to around 2% in 2025. While not a boom, it’s also not nearly as much of a slowdown as has been routinely predicted for the year ahead in prior surveys.

The March forecast marks the third-straight increase in the 2024 outlook. Now, GDP is not seen below 1% in any of the next four quarters, something that had been a persistent feature of the more pessimistic forecasts of the past year.

Inflation forecast

With more growth comes only modest inflation reduction this year. The Consumer Price Index is forecast to fall to 2.7%, down from the current level of 3.2%. It is expected to fall to 2.4% next year, about equal to the Fed’s 2% target for the PCE Price Index because CPI is believed to run about a half point above PCE.

The unemployment rate ticks up to 4.2%, from 3.9% now, but stays there through 2025. Mark Zandi, chief economist at Moody’s Analytics, writes, “The Federal Reserve has all but achieved its goals of full employment … and low and stable inflation. … The Fed should declare victory and begin to slowly cut short-term interest rates and wind down its QT.”

The balance sheet runoff, or QT, is now forecast to end in January, compared with November in the prior survey. The Fed is seen reducing its total reserves by about a trillion dollars to $6.7 trillion before quitting quantitative tightening and letting bank reserves decline to $2.9 trillion, from the current level of $3.6 trillion.

One-third of respondents say the bigger risk is the Fed stopping too early and leaving its balance sheet too large, 19% are worried about the Fed stopping the runoff too late and a 37% plurality say neither is much of a risk.

While a soft landing has for the first time become the bet of a majority in the survey, 58% also believe equities may be “somewhat overpriced” for that scenario. As a result, respondents see only muted gains in the S&P of 1.8% this year and 5.8% next year from the current level. Those returns are not far off or even better than what investors could receive by buying risk-free one- or two-year treasury notes, offering a persistent challenge to equities from bonds if rates remain high. The 10-year is expected to remain around 4% for this year and the next.

Economist Hugh Johnson believes markets have come too far, too fast and sees “a somewhat more difficult equity market environment in 2024 … before beginning a recovery to the upside…”

Others see a challenge to equity markets directly from the Fed. “The Fed is in no hurry to cut rates,” wrote Richard Sichel, senior investment strategist at The Philadelphia Trust Company. “Current interest rates are more normal than they have been in fifteen years. A diversified high quality stock portfolio should continue to provide good returns.”

Don’t miss these stories from CNBC PRO:

Oh! So close!

SpaceX missed it by that much!

Twelve months ago (if you recall), SpaceX entered 2023 with a list of ambitious goals, the most quotable of which was its promise to launch 100 rockets in a single year and beat its 2022 launch record by a whopping 60%. Now that 2023 is in the history books, we know SpaceX missed that target. But even so, the 98 launches SpaceX did accomplish in the year — including 91 launches of Falcon 9 rockets, five Falcon Heavy launches, and two (explosive) test flights of its new Starship-Super Heavy combination rocket — came really close to delivering on SpaceX’s promise.

So will Elon Musk try again to hit the magic “100” number in 2024?

Yes, and he doesn’t plan to stop there. He’s aiming higher — for 144 rocket launches in 2024.

Image source: Getty Images.

What to expect in 2024

Testifying before the U.S. Senate Subcommittee on Space and Science in October, SpaceX VP for Build and Flight Reliability Bill Gerstenmaier (formerly NASA’s associate administrator for human exploration and operations) said that SpaceX aims to launch once every 2.8 days in 2024 — 12 times per month in 2024, or 144 launches in total.

Most of these launches will feature Falcon 9 rockets carrying Starlink satellites to orbit. Sixty-five percent of the company’s launches in 2023 involved such missions. While it’s true that SpaceX already has the largest constellation of satellites in orbit — roughly 5,000 Starlinks — the company has permission from the government to put 12,000 satellites up there, and it’s seeking permission to launch a total of 42,000. What’s more, SpaceX is now launching larger versions of Starlink, which limits each launch to carrying at most 23 Starlink satellites to orbit. (Earlier, smaller Starlink payloads meant that each launch could carry 60 of the smaller satellites at a time.)

As a result, even with so many satellites already in orbit, SpaceX will actually need to launch more missions — not fewer — and accelerate its launch cadence to grow its constellation going forward.

At the same time, SpaceX will launch plenty of missions not named “Starlink” this year. These will include:

- The third launch of Axiom private astronauts on a Falcon 9 to work aboard the International Space Station (gathering experience for Axiom to build its own private space station) later this month.

- A February Falcon 9 launch carrying Intuitive Machines‘ (LUNR 9.01%) IM-1 lunar lander to search for water on the moon.

- The first of three planned Polaris missions — private flights chartered by Shift4 (FOUR 0.53%) CEO Jared Isaacman — launching in April, which may include the first spacewalk by private astronauts. (Interestingly, this mission was supposed to happen in 2023, but was delayed by complications developing a new spacesuit.)

- And the Europa Clipper Falcon Heavy, launching in October, to search for life in the oceans of Jupiter’s moon of the same name.

And then there’s Starship.

Starship 2024

Musk’s dream of building a fully reusable Starship spaceship that can launch into orbit atop a Super Heavy booster, and then land both booster and spaceship back on Earth, continues to progress. Twice last year, SpaceX conducted test flights that resulted in dramatic explosions of both Super Heavy and Starship.

Will the third time be the charm? We hope to find that out sometime in Q1, when SpaceX makes its third flight test with Starship and Super Heavy. If the flight goes as planned, it will move SpaceX one step closer to cutting the cost of space launch by a factor of 40x. (Before SpaceX arrived on the scene, Boeing (BA 1.66%) and Lockheed Martin (LMT -0.30%) were charging as much as $400 million for a rocket launch. But SpaceX has boasted that Starship will cost about $10 million per launch.)

What it means for investors

Granted, Musk has something of a reputation for overpromising and underdelivering on his promises, but that’s not necessarily a bad thing. Setting wildly fantastic goals, such as launching 100 times in a year, and then missing said target by only two flights has turned out to be a pretty successful strategy for advancing the goal of cheap access to space.

It’s also turned SpaceX into the dominant provider of launch services in the world.

Consider that in missing its goal of 100 flights in 2023, SpaceX still utterly dwarfed the performance of his biggest rivals last year. In 2023, for example, Russia’s Roscosmos hoped to launch as many as two dozen times, but managed fewer than one dozen launches. The entire nation of China, with multiple space companies, launched 67 times in 2023. That’s roughly two-thirds as many launches as SpaceX accomplished (and only three launches more than in 2022).

Meanwhile, in the private sphere, Boeing and Lockheed’s United Launch Alliance launched only three times in 2023. Europe’s Arianespace similarly lifted off only thrice. As it turned out, America’s Rocket Lab (RKLB -1.28%) came closest to SpaceX in the number of launches performed by a public company, managing to do so 10 times in the year.

As SpaceX continues to beat out rival space companies by a factor of 10x and expands its lead in 2024, it’s looking more and more certain like no one can catch the undisputed leader in space launch.

Now, if only we could figure out how to invest in SpaceX. (Hint: We’ve figured out a way for individual investors to invest in SpaceX.)

Rich Smith has positions in Rocket Lab USA. The Motley Fool recommends Lockheed Martin, Rocket Lab USA, and Shift4 Payments. The Motley Fool has a disclosure policy.

The S&P 500 Is Poised to Do Something It’s Only Done 3 Times Ever. Here’s What History Says It Could Mean for Stocks in 2024.

Investors should enjoy especially happy holidays this year. Barring a stunning late December collapse, the stock market will deliver hefty gains in 2023.

The big question now is: Can the momentum continue into the new year? For those who look to the past to try to discern what might happen in the future, there could be an intriguing answer to that question. The S&P 500 is poised to do something it’s only done three times ever. Here’s what history says it could mean for stocks in 2024.

Image source: Getty Images.

A rare occurrence for the S&P 500

Standard Statistics Company, which later merged with Poor’s Publishing to form Standard & Poor’s (now S&P Global (SPGI 0.50%)), first created a stock market index of U.S. companies back in the 1920s. However, the S&P 500 in its current form with 500 companies dates back to 1957.

During its 66-year history, the S&P 500 has delivered positive annual gains roughly 70% of the time. Down years aren’t unusual, but positive years are much more common. What is rare, though, is for the S&P 500 to experience a large decline in one year followed by a huge gain in the following year.

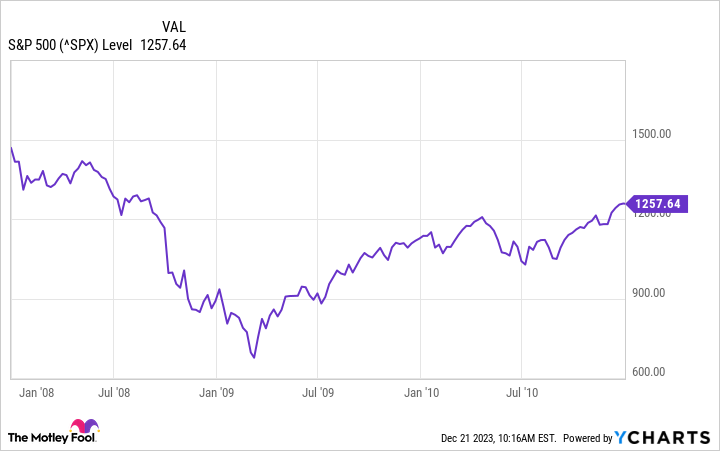

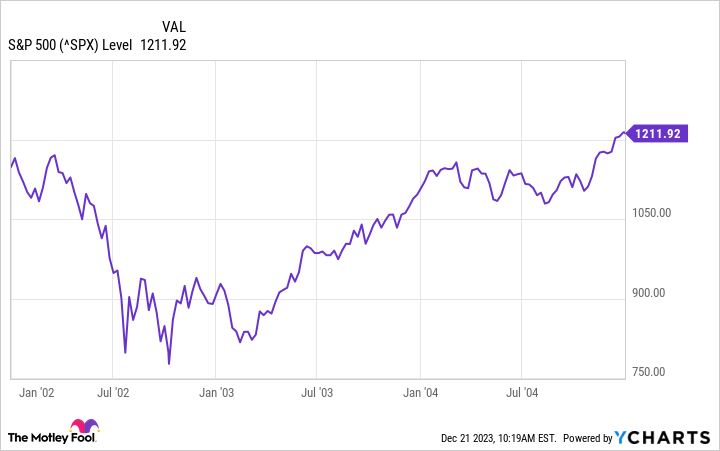

From 1957 through 2022, the S&P 500 fell by 15% or more five times. The index rebounded by 15% or more in the following year only three times. The most recent example was in 2008 and 2009 with the stock market crash and subsequent comeback. Now, this rare occurrence appears to be about to happen again. The S&P plunged 19% in 2022 but is set to finish 2023 up more than 20%.

Even if we look at the indexes that were predecessors to the modern S&P 500, such steep declines followed by significant bounces are infrequent. There have been only five previous times since the 1920s when the S&P 500 and its previous versions fell by 15% or more, then rose by 15% or more in the next year.

Historical precedents

So has the S&P 500 been like a yo-yo in the past — falling, rising, then falling again? Nope. Let’s look at how the index has performed in the year following a big rebound.

In 2008, the S&P 500 plunged over 38% with markets roiled by the financial crisis. The next year, it bounced back by more than 23%. That momentum continued, albeit at a moderated pace, in 2010 with the S&P rising nearly 13%.

It was a similar story early in the 21st century. The S&P 500 fell 23% in 2002 in the continued aftermath of the dot-com bubble bursting. In 2003, the index roared back with a 26% jump. The S&P rose more in 2004, but with a smaller gain of close to 9%.

The same pattern emerged during the 1970s. In 1974, the S&P 500 plummeted nearly 30%. It rebounded by almost 32% in the next year. The index then rose another 19% in 1976 — a strong but smaller gain.

If history is a guide, we could see the same thing happen in 2024. The S&P 500 could continue its positive momentum in the new year but deliver a performance that isn’t as impressive as that of 2023.

Will stocks really jump again in 2024?

Unfortunately, there’s no guarantee that history will repeat itself. From a statistical standpoint, the trends from the past are virtually meaningless because of the low sample size.

Granted, some Wall Street analysts think that the S&P 500 will rise, but at a more modest rate, next year. For example, Bank of America (BAC 0.69%) analysts set a target price for the index of 5,000, reflecting an increase of nearly 6% from its current level. Goldman Sachs (GS 0.02%) expects the S&P 500 to hit 5,100 next year, a gain of nearly 8%. No one knows for sure what the stock market will do over the next year, though.

The good news is that long-term investors don’t have to be concerned about it. Over a long period, the S&P 500 almost always goes up. As Warren Buffett once stated: “In aggregate, American business has done wonderfully over time and will continue to do so (though, most assuredly, in unpredictable fits and starts).” Whatever happens in 2024, the long-term outlook for the stock market should be bright.

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global. The Motley Fool has a disclosure policy.

The S&P 500 Just Did Something It Has Only Done 30 Times Since 1950. History Says the Stock Market Will Do This Next

The S&P 500 (SNPINDEX: ^GSPC) is widely viewed as a benchmark for the broader U.S. stock market. The index was introduced in March 1957, but the methodology used to create it can be applied to earlier years to generate back-tested values that predate its conception. For that reason, its proprietor, S&P Global, lists the first value date for the index as Jan. 3, 1928.

Building on that, the S&P 500 just achieved one of its best monthly performances since 1950. The index skyrocketed 8.9% in November 2023, driven higher by encouraging economic data regarding inflation and the jobs market, both of which show signs of cooling. The upshot of those data points is that the Federal Reserve may be done raising interest rates and could be preparing to cut — as Fed Chair Jerome Powell indicated Wednesday.

The S&P 500’s 8.9% return in November is particularly impressive in context. A total of 886 months have elapsed since January 1950, and the S&P 500 has recorded a monthly increase exceeding 8% just 30 times.

There’s good reason to think the market can continue to climb from here, too. Read on to learn more.

History says the S&P 500 could move higher over the next 12 months

The S&P 500 recorded three consecutive monthly declines in August, September, and October as investors fretted about stubborn inflation and soaring bond yields. But the index reversed course and rebounded 8.9% in November.

If you’re worried that November’s surge might just be a blip, history tells us that there’s reason to be optimistic:

-

Since 1950, the S&P 500 has moved higher 90% of the time during the 12-month period following a monthly increase exceeding 8%, according to Carson Group.

-

Since 1950, the S&P 500 returned an average of 15.8% during the 12-month period following a monthly increase exceeding 8%, according to Carson Group.

In short, history says the S&P 500 could gain about 16% through November 2024. The key word there is could. Past performance is not a reliable predictor of future returns because every situation is unique, especially the current situation.

Now, it’s not unusual to see such a big monthly gain after a sharp pullback. For instance, the Carson Group’s data shows some of these monthly surges around the end of the bear markets in the mid-’70s; the early ’80s; the early 2000s; the global financial crisis; and the brief one early in the Covid-19 pandemic. It makes sense that when a recovery takes hold, it can happen quickly.

The bear market we may be about to exit has had its own combination of challenges. Time has passed, but the U.S. economy is still emerging from the pandemic. Business closures, supply chain disruptions, and government stimulus programs pushed consumer prices higher at the fastest pace in decades, prompting an aggressive response from the Federal Reserve (as discussed in the next section). There is simply no historical precedent for that sequence of events, at least not recently. So investors should take comparisons between the past and present with a grain of salt.

That said, there is another reason to think the S&P 500 might move higher in the coming year.

The Federal Reserve may be done raising interest rates

The Federal Reserve is tasked with maintaining price stability and maximum employment. One way policymakers pursue that two-sided economic goal is by adjusting the target federal funds rate, a benchmark that influences other interest rates across the economy.

Here’s how it works: Policymakers can increase the target federal funds rate to discourage spending through higher borrowing costs, which slows the economy. Or policymakers can reduce the target federal funds rate to encourage spending through lower borrowing costs, which stimulates the economy.

Lately, the Federal Reserve has raised rates at a nearly unprecedented pace to combat inflation. Policymakers moved so aggressively that many economists began sounding recession alarms last year, but a downturn has yet to materialize. In fact, the economy has remained remarkably resilient, so much so that investors see the situation as a double-edged sword.

Specifically, economic resilience is a good thing because it should drive revenue and earnings growth across the stock market. But economic resilience is also a bad thing because it gives the Federal Reserve license to keep raising interest rates, and that could cause a recession.

For that reason, investors were pleased when October data showed cooler inflation, slower wage growth, and fewer jobs created, all combined with an uptick in unemployment. The implication behind those trends is that policymakers are bumping up against one end of their two-sided economic goal (i.e., maintain maximum employment), which means the Federal Reserve may be done raising interest rates.

Indeed, the Federal Open Market Committee indicated Wednesday that no hikes were in the offing for 2024, and rates could begin coming down. The S&P 500 rose 1.37% to come within 2% of a new high.

The S&P 500 tends to rise sharply when rate hikes stop

CME Group‘s Fed Watch tool analyzes the probability of future rate hikes using pricing data from federal funds futures contracts. It currently signals (1) a 100% chance that the Federal Reserve is done raising rates, and (2) a 68% chance that policymakers will cut rates by at least 100 basis points in 2024.

Similar shifts in monetary policy have historically driven the stock market higher. Indeed, the Federal Reserve has engaged in six rate hike cycles since 1982, and the S&P 500 returned an average of 17.6% during the 12-month period following the end of those cycles, according to JPMorgan Chase.

Here’s the bottom line: Similarities between the past and present imply meaningful upside in the S&P 500, but those similarities are superficial. Whether stocks move higher or lower over the next year ultimately depends on the economy and investor sentiment. However, the stock market has consistently created wealth for patient investors, and there is no reason to think that trend will change. For that reason, now is a good time to buy stocks no matter what happens during the next 12 months.

Should you invest $1,000 in S&P 500 Index-Price Return (USD) right now?

Before you buy stock in S&P 500 Index-Price Return (USD), consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index-Price Return (USD) wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 7, 2023

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase and S&P Global. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

The S&P 500 Just Did Something It Has Only Done 30 Times Since 1950. History Says the Stock Market Will Do This Next was originally published by The Motley Fool

I’ve Bought Shares of This Magnificent Growth Stock 6 Times in 5 Years. Here’s Why I Just Added More.

One of my earliest lessons as an investor is one that has stayed with me and served me well over the past 16 years. It’s adapted from Sir Isaac Newton’s first law of motion, which states in part, “An object in motion tends to stay in motion unless acted upon by an outside force.” In the context of investing, that can be distilled down to this simple idea: Winners keep winning.

While that’s clearly an oversimplification and not a universal truth, the concept is sound. If a company has cracked the code of success, it will likely continue to gain ground for years. That’s why I tend to add to my winners over time and rarely buy on the dip.

One such stock I have added to on multiple occasions is The Trade Desk (TTD 0.26%). I first bought the stock in early 2018 and have subsequently added to my position five more times, making it my seventh-largest holding. It accounts for 5% of my total portfolio. However, last week, in response to tepid guidance, investors punished the stock, sending it down as much as 31% in after-hours trading, and 17% on the day following its Q3 earnings report.

After reviewing the company’s results, I happily — and without hesitation — bought shares of The Trade Desk a seventh time. Here’s why.

Image source: Getty Images.

A history of disruption

To understand the reason for my enthusiasm, it’s worth taking a minute to review just what The Trade Desk does. CEO Jeff Green pioneered the world’s first online ad exchange, in essence a marketplace for the buying and selling of online ads in real time. It was eventually sold to Microsoft.

Green then went on to build The Trade Desk, which offers a self-service platform that simplifies ad buying. This programmatic advertising system uses cutting-edge artificial intelligence (AI) to help marketers create and manage their ad campaigns and target the right customer at the right time.

Over the years, the company has continued to improve its technology, disrupting the digital advertising industry in the process. Furthermore, The Trade Desk uses transparent pricing, bucking the industry trend and winning rave reviews in the process.

Why did the stock fall?

When The Trade Desk reported its third-quarter results, they were what I’ve come to expect from the company. Revenue grew 25% year over year to $493 million, while its adjusted earnings per share (EPS) of $0.33 climbed 27%. The figures were comfortably ahead of analysts’ consensus estimates, which called for revenue of $479 million and EPS of $0.29. Investors tend to like when a company beats expectations. So far, so good.

However, The Trade Desk’s outlook was disappointing. Management forecast revenue of at least $580 million and adjusted EBITDA of about $270 million, representing growth of 18% and 10%, respectively. The guidance caught Wall Street off guard, and some investors tend to sell first and ask questions later.

When an analyst on the conference call asked for an explanation regarding the rapid deceleration, Green provided important context for The Trade Desk’s conservative outlook. After pointing out that the company continued to gain market share at the expense of its rivals, he noted the recent auto and Hollywood strikes caused a temporary industrywide lull in ad spending, which has since stabilized. Indeed, the transitory nature of the strikes — which have now ended — are merely passing hurdles that will have virtually no impact on The Trade Desk’s trajectory over the long term.

An overreaction by investors

Green’s explanation certainly makes sense in terms of a temporary lull in ad spending. Furthermore, two of the biggest names in digital advertising, Alphabet and Meta Platforms, reported third-quarter revenue growth of 11% and 23%, respectively — notably both below The Trade Desk’s result. That supports Green’s conclusion that the company continues to take market share.

Data by YCharts.

Finally, the sell-off represents a compelling opportunity for investors. To be clear, the stock has never been cheap, but its current price-to-sales ratio of 18 is well below its three-year average of 30.

In my experience, every time The Trade Desk stock has experienced a decline of this magnitude, it has gone on to recover and reach new highs.

With all that as a backdrop, I couldn’t resist adding to my position in The Trade Desk for a seventh time.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Meta Platforms, Microsoft, and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Microsoft, and The Trade Desk. The Motley Fool has a disclosure policy.

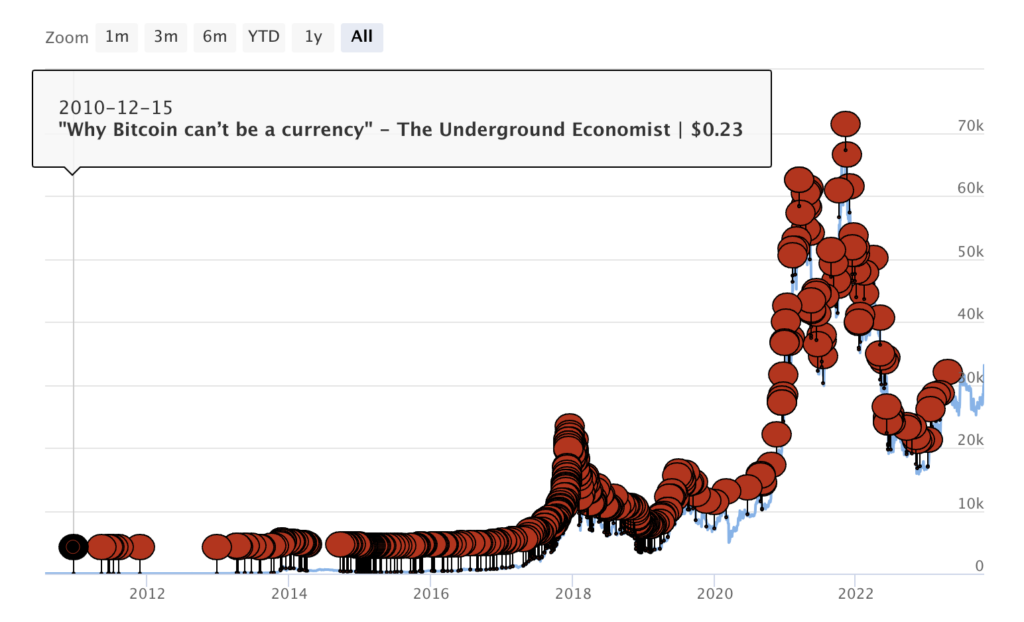

CNBC leads Bitcoin ‘obituaries’ declaring it dead 35 times as it rises 78% YoY

Like a phoenix rising from the ashes, Bitcoin has once again defied critics and bounced back from predictions of its demise.

The leading cryptocurrency has faced hundreds of so-called “obituaries” declaring it dead or doomed to fail since its creation in 2009. Yet Bitcoin has shown longevity and resilience in the face of constant critiques. According to 99bitcoins, the latest recorded ‘death’ was back in April when the price declined from $31,000 to $27,500.

Reviewing the historical ‘obituaries,’ CNBC and Bloomberg appear most frequently, with 35 and 24 articles calling for the death of Bitcoin, respectively. Headlines included ‘Bitcoin Is Still Doomed, ‘Bitcoin Is A Decentralized Ponzi Scheme,’ and ‘Bitcoin Isn’t The Future Of Money.’

While the cryptocurrency’s long-term trajectory depends on many factors, its ability to repeatedly recover from crashes and criticism is noteworthy. The cryptocurrency continues to find renewed life after each metaphorical funeral.

Bitcoin’s recent bullish movement and endorsement from BlackRock brings its price to around $34,000 as of Oct. 24, following a period of stability around the $27,000 mark between March and October, up 78% over the past year.

Accompanying the latest peak was a spike in trading volume, signaling increased buying pressure.

Bitcoin died and rose again.

The number of predictions of Bitcoin’s demise generally increased over time as crypto went more mainstream. From just a handful in the early years, obituaries numbered in the hundreds starting in 2017 when Bitcoin prices spiked.

Critics often declared Bitcoin dead during major price crashes, with clusters of obituaries around events in late 2017, early 2018, March 2020, and mid-2021. Volatility prompted accusations of bubbles bursting, like the 2013 headline “The Bitcoin Bubble Has Burst,” when the price was just $84.

Both experts and casual commentators have foretold Bitcoin’s failure. Sources range from mainstream media to individual bloggers, showing broad skepticism.

Initially more measured, criticism grew more hyperbolic over time. Early headlines expressed doubt, while later proclamations labeled Bitcoin a scam, Ponzi scheme, or a bubble ready to pop like 2021’s “Bitcoin Is Worse Than A Madoff-style Ponzi Scheme” in the Financial Times.

Some sources persistently predict Bitcoin’s downfall despite being proven wrong by its continued survival. An ongoing desire by some to see cryptocurrency fail appears present.

The reasons cited evolved from Bitcoin’s inability to function as money to lack of regulation, environmental harm, and competition from other coins. Yet, the core narrative of impending collapse persisted.

While Bitcoin has been proclaimed dead 474 times, it endures, whether rising from ashes or emerging from each’ death.’ The recurring story of underestimation remains unfinished, with Bitcoin’s next chapter still unwritten.

All eyes fall on the highly anticipated spot Bitcoin ETF from BlackRock as the investment firm looks to add Bitcoin to its trillions of dollars worth of assets under management.

If Bitcoin is dead, why did no one tell Larry Fink?

Fool.com contributor Parkev Tatevosian discusses why Nvidia (NVDA -1.71%) management expects surging revenue for the rest of 2023.

*Stock prices used were the afternoon prices of Aug. 29, 2023. The video was published on Aug. 31, 2023.

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

DoJ says SBF has tried to ‘corruptly influence witnesses’ multiple times; urges bail revocation

The U.S. Department of Justice (DoJ) urged federal judge Lewis Kaplan to revoke FTX founder Sam Bankman-Fried’s bail in a filing on July 28. The DoJ argued that SBF has “flouted even the increasingly strict conditions” placed on him multiple times.

The DoJ’s request comes after SBF surrendered 8 pages of former CEO of Alameda Research Caroline Ellison‘s diary entries in court on July 27.

The DoJ stated that SBF leaked Ellison’s diary to the New York Times to “intentionally harass” her. The DoJ claimed that SBF’s goal in leaking the documents was to “hinder, prevent, or dissuade” Elisson from testifying against him. Ellison signed a plea deal in December and is set to testify in SBF’s trial scheduled in October.

With multiple infractions of bail conditions and his recent conduct, which “reinforces his intent to influence witnesses,” it is necessary to jail SBF, the DoJ said, adding:

“…no set of pretrial release conditions can adequately assure the safety of the community and that the defendant is unlikely to fully abide by any conditions of release.”

Witness tampering and evading bail conditions

SBF was first accused of witness tampering in January for contacting the General Counsel for FTX US Ryne Miller over the messaging app Signal. In the same month, SBF was accused of violating his bail conditions by using a virtual private network (VPN).

At the time, SBF claimed he used the VPN to “watch football.” However, prosecutors discovered that the football matches he purportedly watched using a VPN were freely available on television, per the DoJ filing. Following these infractions, SBF’s bail conditions were modified to increase restrictions twice in January, twice in February, and a fifth time in March.

SBF leaking Ellison’s diary to the media was not just a second attempt at witness tampering but also an attempt to influence prospective jurors, the DoJ claimed, noting:

“…the defendant’s communications with the media were intended to affect the public’s—including prospective jurors’—impression of the defendant’s guilt.”

The DoJ added that SBF intended to “portray a key cooperator testifying against him in a poor and inculpatory light” by leaking the diary, which was not part of the prosecution’s discovery material. It was also an “effort to influence or prevent the testimony of other potential trial witnesses by creating the specter that their most intimate business is at risk of being reported in the press,” the filing noted.

Although SBF has no criminal history, the DoJ argued that he faces a potential sentence of over 100 years, demonstrating the issue’s seriousness and the need for a fair trial.

The DoJ concluded:

“What the defendant may not do, and what he has now done repeatedly, is seek to corruptly influence witnesses and interfere with a fair trial through attempted public harassment and shaming.”

The post DoJ says SBF has tried to ‘corruptly influence witnesses’ multiple times; urges bail revocation appeared first on CryptoSlate.