Oil prices finished higher Thursday for a fifth straight session, buoyed by rising tensions in the Middle East after Israel’s recent strike on Iran’s consulate in Syria.

Source link

tops

Bitcoin rose above $57,000 on Monday to its highest level since November 2021, as exchange-traded funds investing directly in the cryptocurrency attract more capital into the space, while investors await the upcoming “halving” event, which has historically been bullish for bitcoin prices.

Bitcoin

BTCUSD,

rose almost 10% during the past 24 hours, according to CoinDesk data. It is roughly off 17% from its record high at $68,990, reached in November 2021.

Investors have seen significant inflows into bitcoin after the U.S. Securities and Exchange Commission approved 10 bitcoin ETFs for the first time in January.

They are also looking forward to the so-called “halving” event, which is expected to happen in April.

Halving is a mechanism written in the blockchain’s algorithm to control the supply of bitcoin, which has a cap of 21 million. At halvings, the reward for bitcoin mining is cut in half, meaning that miners will receive 50% fewer bitcoins for verifying transactions.

Halvings are scheduled to happen after every 210,000 blocks that are mined, or about every four years, until the maximum supply of 21 million bitcoins are all released. Historically, bitcoin has seen price appreciation months after halvings.

From the technical perspective, as bitcoin broke out of its sideways trading range that has been intact since Feb. 10, “this price gain should likely reach targets near $58.4 initially with a possibility of $62k which should be the last real area of resistance ahead of a possible challenge of former all-time highs,” Mark Newton, head of technical strategy at Fundstrat Global Advisors, wrote in a Monday note.

After a prolonged period of weakness for a year and a half against the Bitcoin price, the Ethereum price is currently showing strength again and could be set for an explosive move, according to several renowned analysts.

Ethereum/BTC Chart Is A ‘Stunner’

In an analysis of the ETH/BTC trading pair, renowned financial expert Raoul Pal has brought to light a compelling dual-chart pattern. The formation of both a “mega wedge” and an inner descending channel is setting the stage for what might be a significant breakout for Ethereum when priced in Bitcoin. Pal stated:

The ETH/BTC chart is an absolute stunner…and ready for the next big move, the break of the mega wedge…let’s see how it pans out….

The “mega wedge” pattern, discernible on the weekly ETH/BTC chart, showcases a contraction of price movement between two converging trend lines over an extended time frame. The upper trend line, acting as a dynamic resistance, has repeatedly pushed back ascending price attempts. Conversely, the lower trend line has provided a sturdy support base.

Within the boundaries of this one and a half year wedge, a more immediate descending channel has taken shape. This channel, characterized by a downward trajectory with price action making lower highs and lower lows, indicates a bearish sentiment within the overarching consolidation phase of the mega wedge.

However, Ethereum’s current positioning, slightly above the upper boundary of this descending channel, implies that a breakout could be on the cards (if confirmed). As of press time, Ethereum was trading at an equivalent value of over $3,059, which translates to roughly 0.06037 BTC.

The intersection of these two patterns, particularly if the breakout from the descending channel is confirmed, could be a harbinger of increased volatility and a potential trend reversal for ETH against BTC. A potential retest of the channel could catalyze a rally towards the mega wedge’s upper trend line, challenging the longer-term resistance. A successful breakout from the mega wedge could then ensue, signaling a massive bullish phase for Ethereum against Bitcoin.

More Bullish Voices On ETH

Remarkably, Raoul Pal is not the only seasoned analyst observing this major trend. Christopher Inks, founder of Texas West Capital stated via X:

The monthly ETH/ BTC chart looks crazy bullish off the lows. Bullish SFP, volume expansion at the lows, rally into descending resistance. An impulsive break out above that descending resistance will have me looking for price to target the top of the range and, likely, new ATHs.

Renowned analyst Will Clemente has also weighed in on the unfolding situation with his expert commentary, echoing the significance of the patterns observed by Raoul Pal. Clemente accentuates the breaking of a multi-year downtrend on the weekly chart, a technical milestone that carries substantial weight for market sentiment.

Clemente’s analysis further deepens the plot by highlighting several key factors currently at play in the Ethereum ecosystem. First, Ethereum’s price action has revisited and swept the lows of May 2022, a move often associated with shaking out weak hands before a potential trend reversal.

Second, the recent talk of “Ethereum obituaries” on social media timelines suggests a sentiment extreme, often seen at major turning points. Moreover, there is currently a new narrative for ETH shaping, the emergence of “restaking”.

Probably the strongest catalyst for the ETH price in the coming months could be the potential approval of an spot Ethereum ETF in the United States. Similar to the Bitcoin ETF euphoria, Clemente speculates that the approval has not yet been priced in.

Lastly, Uniswap’s governance proposal to switch on fees could redirect significant value to token holders, potentially adding further bullish momentum to ETH’s valuation. Clemente caps his commentary with a forecast that resonates with the sentiments of many observers: “ETH & ETH shitcoin rotation is probably upon us.”

At press time, ETH traded at $3,059.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Donald Trump’s Cryptocurrency Portfolio Tops $5M, Thanks to $2.9M in Trump-Branded Tokens

Just recently, the 45th President of the United States, Donald Trump, has expressed a neutral stance towards bitcoin, stating he could live with it “one way or the other.” Meanwhile, Trump’s holdings in crypto assets have seen a significant increase in value. A substantial portion of his digital wealth is currently in a digital currency […]

Just recently, the 45th President of the United States, Donald Trump, has expressed a neutral stance towards bitcoin, stating he could live with it “one way or the other.” Meanwhile, Trump’s holdings in crypto assets have seen a significant increase in value. A substantial portion of his digital wealth is currently in a digital currency […]

Source link

The price of Bitcoin (BTC) surpassed $47,100 on Jan. 8 amidst expectations of spot Bitcoin ETF approvals over the coming days.

Bitcoin was priced at $47,162 at 7:15 p.m. UTC. At the time, its market cap is roughly $918 billion.

The latest high represents daily gains for Bitcoin and other top-ten crypto assets. Bitcoin (BTC) is up 6.2% over 24 hours, while Ethereum (ETH) is up 4.8% over the same period. Additionally, Cardano (ADA) is up 4.6%, Avalanche (AVAX) is up 2.6%, Solana (SOL) is up 3.8%, and XRP is up 2.0%. The entire cryptocurrency market is up 4.0% over a 24-hour period.

Bitcoin’s current value represents a 21-month high not seen since April 2022. In May 2022, shortly after that previous high, an extended market crash occurred following collapse of TerraUSD and various crypto lending services. The market’s long-term price recovery began in January 2024 and has continued until today.

Possible ETF approval may be linked to gains

Though numerous factors affect Bitcoin’s price, optimism around the likely approval of a spot Bitcoin exchange-traded fund (ETF) may be one factor.

CNBC, notably, reported at 3:54 p.m UTC that multiple ETFs are expected to be approved in the coming days based on two sources close to the matter. The news outlet said that the funds will likely be approved on Wednesday, Jan. 10 and that trading will likely begin on Thursday, Jan. 11, or Friday, Jan. 12.

Other positive news around ETFs has also emerged. Standard Chartered predicted that Bitcoin ETFs could bring $50 billion to $100 billion of inflows into the crypto market throughout 2024. VanEck bought $72.5 million of Bitcoin to seed its ETF, while Grayscale and other companies entered a ‘fee war’ to offer competitive rates.

SEC Chair Gary Gensler warned about Bitcoin investments, implicitly hinting about new crypto products despite his negative tone.

Previous weeks have seen the U.S. Securities and Exchange Commission (SEC) meet with asset managers and accept amendments from those applicants, which are important steps toward product approvals.

Any of those events and countless others may have affected investor sentiment, driving up demand for Bitcoin and, in turn, its market value.

At the time of press, Bitcoin is ranked #1 by market cap and the BTC price is up 6.09% over the past 24 hours. BTC has a market capitalization of $919.75 billion with a 24-hour trading volume of $42.53 billion. Learn more about BTC ›

Market summary

At the time of press, the global cryptocurrency market is valued at at $1.73 trillion with a 24-hour volume of $87.67 billion. Bitcoin dominance is currently at 53.20%. Learn more ›

Want To Predict Bitcoin Tops And Bottoms? ‘The Rainbow Chart’ Is For You

The Bitcoin Rainbow Chart has emerged as a universally used analytics tool that helps crypto investors and traders predict BTC’s ever-changing market trends and cycles.

Bitcoin Rainbow Chart BTC Analysis

Throughout the year, the price of Bitcoin has experienced several uptrends and downsides. Starting from the last three months of 2023, BTC’S price has experienced a major surge, hitting above $35,000 in October and surging past $44,000 in December.

With the market moving up rapidly, many crypto investors and market watchers look for various crypto analytics tools to enhance their understanding of the Bitcoin market trends.

The Bitcoin Rainbow Chart is one of the many analytics tools available for predicting the potential prices of BTC. This color-coded chart is a long-term valuation tool for BTC that uses a logarithmic growth curve to forecast the potential price of BTC.

Source: Blockchain Center

Currently, according to the rainbow chart, Bitcoin is positioned around the “Accumulate” and “Still cheap” zones. This implies that the chart is showing the best timeline to purchase BTC before the selling phase begins.

The Bitcoin Rainbow Chart simplifies BTC price predictions, helping investors identify potential BTC buying and selling opportunities. However, it’s important to note that the Bitcoin Rainbow Chart is not investment advice and does not predict the exact price of Bitcoin.

BTC price readies to retest $43,000 | Source: BTCUSD On Tradingview.com

History Of The BTC Rainbow Chart

The Bitcoin Rainbow Chart first started as a fun project created by a Reddit user, Azop to visually represent Bitcoin’s price history. However, the chart became more mainstream after a second version was developed by trader Trololo and transformed into a crypto technical analysis tool.

The chart is designed using a color coding scheme and highlights each Bitcoin halving cycle and diverse BTC price ranges. With its seven color bands, the rainbow chart identifies strategic points to buy, sell, or hold BTC.

The dark red band signals a maximum bubble territory, the red band indicates a robust selling phase, while orange and yellow signify FOMO intensification and HODL periods respectively. The Green band indicates a favorable buying and accumulation window and lastly, the blue color band represents a fire sale opportunity.

While the Bitcoin Rainbow Chart does not provide financial advice, it is a widely recognized tool used by crypto traders and investors to gain a simpler understanding of BTC market movements. Ultimately, the accuracy of the chart’s predictions depends on how it is applied and in what context.

Featured image from Crypto.com, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Dow tops 36,000 as stocks end with gains following remarks by Fed’s Powell, S&P 500 clinches highest close since March 2022

U.S. stocks ended higher Friday, with the Dow Jones Industrial Average scoring a fifth straight week of gains, as Treasury yields fell even after Federal Reserve Chairman Jerome Powell said it was too soon to begin talking about rate cuts.

How stock indexes traded

-

The Dow Jones Industrial Average

DJIA

rose 294.61 points, or 0.8%, to close at 36,245.50. -

The S&P 500

SPX

gained 26.83 points, or 0.6%, to finish at 4,594.63, scoring its highest close since March 30, 2022. -

The Nasdaq Composite

COMP

climbed 78.81 points, or 0.6%, to end at 14,305.03.

For the week, the Dow gained 2.4%, the S&P 500 rose 0.8% and the Nasdaq increased 0.4%. All three major U.S. stock indexes booked a fifth straight week of gains, according to Dow Jones Market Data.

What drove markets

U.S. stocks advanced Friday, with the S&P 500 seeing its highest close of the year and the Dow breaking above 36,000 for the first time since January 2022, according to Dow Jones Market Data.

Falling bond yields are helping to lift the U.S. equities market, with the Dow rising for a fifth straight week in its longest winning streak since Nov. 5, 2021, FactSet data show.

The 10-year Treasury yield has come down “pretty substantially” over the past month and that decline is continuing, said Josh Jamner, investment strategy analyst at ClearBridge Investments, in an interview Friday. “The lower 10 year is what’s driving the stock market higher.”

Treasury yields have declined on investor expectations that the Federal Reserve may begin cutting interest rates next year.

See: Dow near record high because traders are calling bluff on ‘higher-for-longer’ Fed

Yet Fed Chair Jerome Powell said Friday in remarks at Spelman College in Atlanta that “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.”

Despite Powell’s tough talk on rates, Treasury yields continued to fall, while the S&P 500 swung higher after in November booking its biggest monthly gain since July 2022, FactSet data show.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

fell 12.4 basis points on Friday to 4.225%, the lowest rate since Sept. 1 based on 3 p.m. Eastern Time levels, according to Dow Jones Market Data. That’s down from around 5% in October.

Markets viewed Powell’s comments on Friday as “inching toward the dovish camp,” said Jeffrey Roach, chief economist at LPL Financial, in emailed commentary. “A few weeks ago, Powell said policy is restrictive but today, he believes policy is ‘well into restrictive territory.’ I think it’s fair for markets to latch on to that subtlety.”

Read: Dow near record high because traders are calling bluff on ‘higher-for-longer’ Fed

Earlier in the week, encouraging inflation data and comments from Fed Gov. Christopher Waller helped fuel investor hopes for rate cuts in the first half of next year.

Investors also weighed a fresh reading of business conditions at American factories, with the Institute for Supply Management saying Friday that economic activity in the manufacturing sector contracted in November for a 13th straight month.

See: Manufacturers still treading water, ISM survey shows: ‘Demand remains soft.’

“I think investors feel more confident that a soft landing is definitely a possibility” for the U.S. economy, said Anthony Saglimbene, chief market strategist at Ameriprise Financial, in a phone interview Friday. “The hard-landing scenario is kind of coming off the table.”

Next week investors will be watching for the U.S. employment report, due out on Dec. 8, for jobs growth data in November.

Markets had a memorable November, with big rallies in stocks and bonds. Ten of the S&P 500’s 11 sectors finished the month in the green, with energy being the sole to fall amid a drop in crude-oil prices.

“We had a very strong November,” with stock-market breadth improving, said Saglimbene. “If the rally is going to build steam, you want to see more areas of the market start to participate.”

Most of the S&P 500’s sectors climbed higher on Friday, except for communication services

XX:SP500.50,

which finished with a modest decline of 0.2%, according to FactSet data.

Companies in focus

-

Tesla Inc.

TSLA,

-0.52%

shares slipped 0.5% following Thursday’s Cybertruck delivery event. -

Salesforce Inc.

CRM,

+3.22%

shares climbed 3.2% a day after they helped propel the Dow’s rise on Thursday. The blue-chip gauge also benefited from gains in Walgreens Boots Alliance Inc.

WBA,

+4.26%

and Nike Inc.

NKE,

+3.26%

shares. -

Shares of Fisker Inc.

FSR,

+9.49%

jumped 9.5% after the electric-vehicle maker said it decided to cut December production to free up more than $300 million of liquidity. -

Ulta Beauty Inc.’s

ULTA,

+10.81%

stock surged 10.8% after the beauty company’s latest earnings report beat third-quarter consensus estimates. -

Pfizer Inc.

PFE,

-5.12%

shares dropped 5.1% after the company said it would not move to a Phase 3 trial of a twice-daily formulation of a weight-loss drug after patients in an earlier study had a lot of side effects.

Steve Goldstein contributed to this article.

BioNTech stock rallies after it posts surprise profit, revenue tops estimates

BioNTech SE’s stock rose more than 5% early Monday after the company posted a surprise profit for the third quarter and revenue that beat estimates, even as it was hit by lower COVID-19 vaccine revenue.

The Mainz, Germany-based company

BNTX,

said it had net profit of 160.6 million euros ($172.7 million), or 67 cents a share, down from EUR1.785 billion, or EUR6.98 a share, in the year-earlier period.

Revenue fell to EUR895.3 million from EUR3.461 billion a year ago.

The FactSet consensus was for a loss of 59 cents and revenue of EUR851.0 million.

The company said inventory writedowns by its partner Pfizer Inc.

PFE,

shaved EUR507.9 million off revenue for the period.

Pfizer shocked investors in October with a late-Friday announcement that it was cutting $9 billion from its full-year sales outlook due to a slump in demand for its COVID treatment Paxlovid and COVID vaccine Cormirnaty, which it co-developed with BioNTech. Pfizer said it would take a $5.5 billion charge for overall COVID product inventory writedowns.

BioNTech is now expecting full-year COVID revenues to total EUR4 billion, down from prior guidance of EUR5 billion. It also lowered guidance for R&D spend and sales, general and administration costs.

Like other vaccine makers, including Moderna Inc.

MRNA,

and Novavax Inc.

NVAX,

BioNTech is looking for combination vaccines to help drive future growth. BioNTech plans to advance its experimental COVID and flu combination vaccine, which it is developing in collaboration with Pfizer, to a phase 3 trial in the coming months, chief strategy officer Ryan Richardson said on a call with analysts Monday.

There’s “substantial potential” for combination vaccines to improve uptake of the COVID shot, Richardson said on the call, and if successful, such vaccines could have an impact from 2025 onwards. BioNTech has not yet disclosed the financial details of its collaboration with Pfizer on the combination vaccines, but “we plan to do that in the near future,” Richardson said.

Looking beyond COVID, BioNTech is also following the pattern established by other vaccine makers in seeking to emphasize other pipeline products, including in other infectious diseases and oncology.

The company highlighted positive clinical data updates across drug classes including antibody-drug conjugate (ADC) candidates BNT323/DB-1303 and BNT325/DB-1305, CAR-T candidate BNT211, T cell therapy candidate BNT221 and mRNA cancer vaccine candidate BNT116, in the quarter. An update on the cancer vaccine candidate is “just around the corner,” Richardson said on the call Monday.

BioNTech will hold an Innovation Series Day on Tuesday in Boston to offer analysts an update on its pipeline.

The stock has fallen 36% in the year to date, while the S&P 500

SPX,

has gained 13.5%.

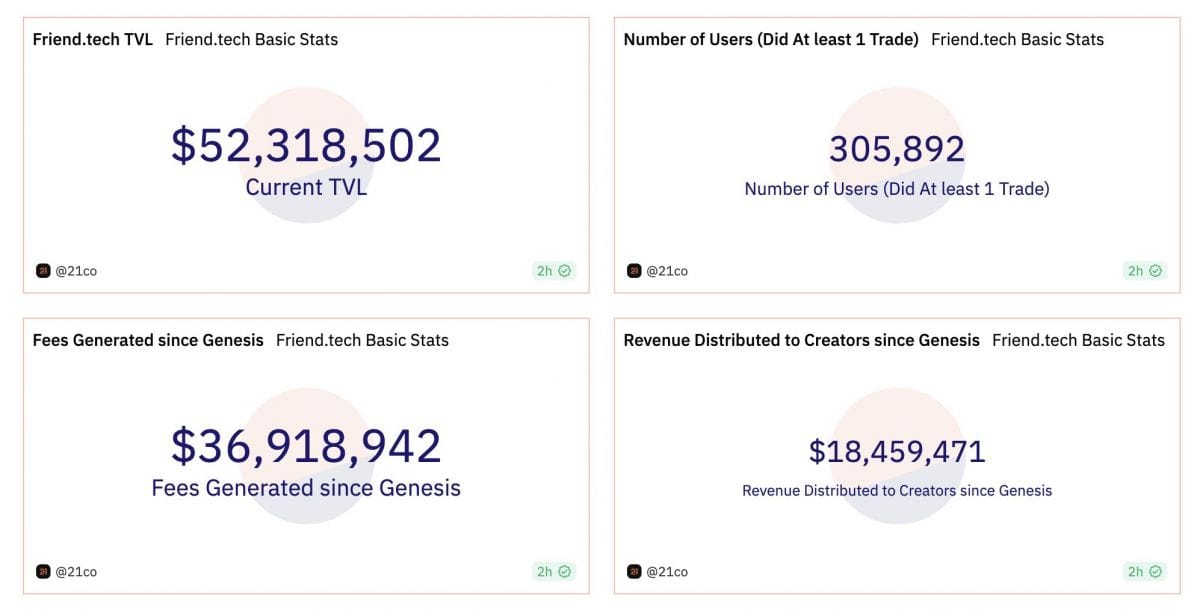

Decentralized social media platform Friend.tech, based on Coinbase’s layer-2 protocol, Base, has touched new heights in terms of revenue growth and total value locked on its platform.

According to data from Dune Analytics, Friend.tech’s revenue has surged to 10,663 Ether (ETH), and its total value locked (TVL) grew to over 30,000 ETH on Oct. 2. The recent boom in its revenue and trading activity comes amid a decline in hype from its early days of launch.

As a decentralized social network platform launched in August 2023, Friend.tech enables users to swap “keys” associated with X accounts (formerly Twitter) belonging to their friends or influencers. These keys give users access to private in-app chatrooms and content only available to the corresponding X user. Users can buy shares of their friends and influencers on the platform.

While the concept of a decentralized social network platform with a revenue-sharing model was lauded by many in the Web3 space, the platform has also grabbed the attention of critics.

Let me tell you one thing.

Something isn’t right about @friendtech.

Creators making money from a group chat that doesn’t even work when you can’t even reply directly to people?

The way pricing works is ridiculous and can be easily taken advantage of.

Pumps and dumps. pic.twitter.com/TJqcktEM6P

— Yazan (@YazanXBT) August 20, 2023

The decentralized social media platform has been declared “dead” on numerous occasions since its launch a couple of months ago. One crypto commentator questioned its revenue model and gave the platform six to eight weeks before the charm fizzles out. Critics pointed out that the rate at which the share prices increased in the first couple of weeks makes it unsustainable in the long run.

Related: Pepecoin — Insider trading claims surface amid token theft

However, despite the criticism, the Friend.tech platform has continued to see new record surges in revenue and user growth.

The latest boom in its revenue comes amid communicative transactions on the platform surging to 9,200,882. The current trading metrics have marked a dip from the highs seen in the first week of September; however, the steady growth in revenue and TVL suggests the platform is still garnering traction from users.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Journeys: Hervé Larren on Bitcoin, Apes and the psychology of ‘blue-chip’ NFTs

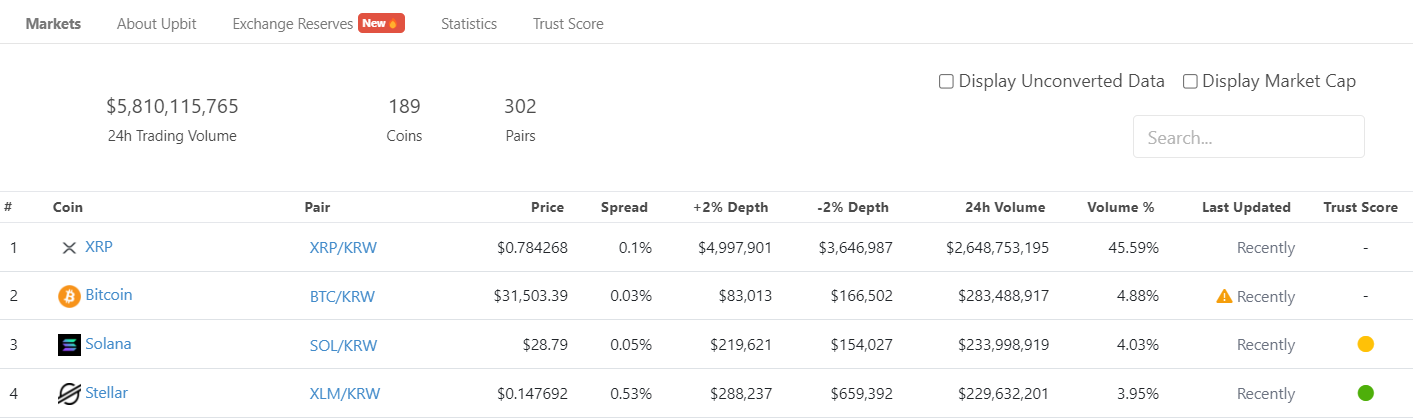

Trading volume of XRP (XRP) tokens on the South Korean crypto exchange Upbit has surpassed Bitcoin (BTC) in the past 24 hours. The XRP/KRW trading pair saw $2.6 billion in trading volume in the last 24 hours following Ripple’s partial win against the United States Securities and Exchange Commission (SEC) in its long-running court battle.

The XRP buying frenzy saw the token account for 46% of all trading volume on Upbit, followed by Bitcoin with just 5% of the total share. XRP led the bullish momentum in the crypto market in the past 24 hours, helping other altcoins hit double-digit surges.

The buying frenzy was not just limited to South Korea. XRP price saw a 92% surge on July 13, reaching a new one-year high of $0.91. This surge helped XRP to climb to fourth place in the crypto market cap rankings. Within hours of the court ruling, XRP’s market cap soared by as much as $21.2 billion to reach a new yearly high of $46.1 billion.

Related: Why is XRP price up today?

On July 13, Judge Analisa Torres issued a summary judgment in favor of Ripple Labs, ruling that the XRP token is not a security. However, the ruling refers only to the token’s sales on digital asset exchanges. The judgment was greeted with relief by the XRP community, as the SEC lawsuit filed in 2020 forced several crypto exchanges in the U.S. to delist the XRP token. Coinbase, Kraken, OKX, Gemini and other exchanges have already announced relisting plans.

The crypto community celebrated the win, with many describing it as a watershed moment, while others cautioned it was only a partial victory. Stephen Palley, a lawyer, noted that the summary judgment is only partial and that the ruling by Torres may not set a precedent. He also reminded the crypto community that the SEC may very well appeal the judgment.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How smart people invest in dumb memecoins — 3-point plan for success