Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]

Ten new U.S. spot bitcoin exchange-traded funds (ETFs) have shattered both inflow and trading volume records. The 10 funds took in $673.4 million, with Blackrock’s Ishares Bitcoin Trust (IBIT) accounting for $612.1 million of the total inflow. The 10 bitcoin ETFs also set a new record for total trading volume. Spot Bitcoin ETFs Set New […]

Source link

Trading

KoinBay is a leading crypto platform that offers diverse trading options for both seasoned and novice users. Whether you’re looking for immediate digital asset acquisition or leveraging advanced crypto trading strategies, KoinBay caters to your needs with a user-friendly interface and competitive transaction fees.

This article delves into the different types of trading available on KoinBay, equipping you with the knowledge to make informed decisions and navigate the exciting world of cryptocurrency.

Spot Trading On the KoinBay Crypto Platform

The most basic form of trading on KoinBay, spot trading, involves buying and selling cryptocurrencies for immediate delivery. You essentially aim to buy low and sell high so that you can capitalize on price fluctuations.

Key must-knows of the spot market include:

- Sellers: Individuals setting specific sell prices for their crypto holdings.

- Buyers: Placing bids at desired purchase prices.

- Order Book: A digital record of all outstanding buy and sell orders, constantly updated with the latest bids and asks.

- Bid Price: The highest price a buyer is willing to pay for a specific cryptocurrency.

- Ask Price: The lowest price a seller is willing to accept for their crypto holding.

Spot trading involves understanding concepts like the current spot price, the trade date (when the trade is executed), and the settlement date (when the assets are transferred). Your spot account balance is easily accessible under the “Balances” section on the KoinBay homepage.

When placing spot trades, you can choose between:

- Limit Order: The default option allows you to set a specific price for buying or selling, ensuring your trade is executed only at that price point or better.

- Market Order: Ideal for quick execution, market orders instantly trade your crypto at the current market price.

Margin Trading

For experienced traders seeking amplified drawings, KoinBay offers margin trading. This involves borrowing funds from the exchange to increase your trading capital and potentially magnify your gains. However, it also amplifies potential losses, so tread cautiously.

Before venturing into margin trading, ensure you’ve completed your KYC process and enabled 2FA for enhanced security.

Once approved, transfer funds from your exchange wallet to your margin wallet as collateral. Leverage is set at a fixed 5:1 ratio, meaning you can borrow up to five times your collateral amount.

The borrowing process is straightforward. Click “Borrow/Repay,” enter the desired amount, acknowledge the hourly interest rate, and confirm. Monitor your margin level, which is calculated as the total asset value divided by the total borrowed amount plus accrued interest. A margin level below 1.1 triggers automatic liquidation to repay the loan, minimizing potential losses.

Futures Trading

For advanced traders seeking to speculate on future cryptocurrency prices, KoinBay offers futures trading. Futures contracts are agreements between two parties, essentially betting on whether the price of a specific cryptocurrency will rise or fall by a certain date. These contracts have specific requirements like units, pricing, and settlement dates.

KoinBay provides a dedicated interface for viewing your futures trading activity, including open positions, margin ratios, and profit/loss details. You can also access your order history, trade history, and transaction history for comprehensive tracking.

The convenient “Close-All Positions” function exists for exiting all open positions simultaneously in volatile market conditions. Profit and loss calculations are based on the last price for better trade management.

ETF Trading

For those seeking diversified exposure to the cryptocurrency market, KoinBay offers Exchange-Traded Funds (ETFs). Similar to traditional ETFs, KoinBay ETFs track the performance of a basket of underlying cryptocurrencies, allowing you to join in a cross-section of the market with a single trade.

KoinBay currently offers a selection of leveraged ETFs, each focusing on specific cryptocurrencies or market indices.

Fees and Rebalances

Trading fees for KoinBay ETFs are similar to spot transactions, typically around 0.1%. However, a daily management fee is also applied, reflected in the ETF’s net value. This fee covers the costs associated with maintaining the underlying asset basket and rebalancing the ETF as needed.

KoinBay ETFs undergo regular rebalancing to maintain their target leverage ratio. This typically occurs daily at 00:00 UTC+8. Additionally, KoinBay may conduct irregular rebalances during periods of high market volatility to manage risk and prevent the net value from dropping significantly.

Happy Trading with KoinBay Crypto Platform!

KoinBay’s diverse range of trading options caters to traders of all experience levels and risk appetites. From the simplicity of spot trading to the advanced strategies of margin and futures trading, this advanced crypto platform empowers you to confidently navigate the exciting world of cryptocurrency.

About KoinBay

KoinBay is a leading centralized crypto exchange that strives to provide a reliable and user-friendly platform for crypto enthusiasts to trade and navigate the dynamic world of cryptocurrencies. With a focus on innovation and cutting-edge features, KoinBay empowers users to make informed trading decisions and seize opportunities in the crypto space.

Follow their social media for all the latest updates and announcements:

Twitter | Facebook | Instagram | LinkedIn | Telegram | YouTube

Disclaimer:

Please be aware that trading in cryptocurrencies involves substantial risk and is not suitable for every investor. The volatility of the crypto market can lead to significant losses. We strongly advise that you trade at your own risk and discretion. It is essential to seek advice from registered legal, financial, and investment professionals before making any trading decisions. Our platform does not provide any form of trading or investment advice. All information provided on our exchange is for educational purposes only and should not be construed as financial advice. Make informed decisions and consider your individual financial situation and risk tolerance before trading.

The post Different Types of Trading Available on the KoinBay Crypto Platform appeared first on CryptoSlate.

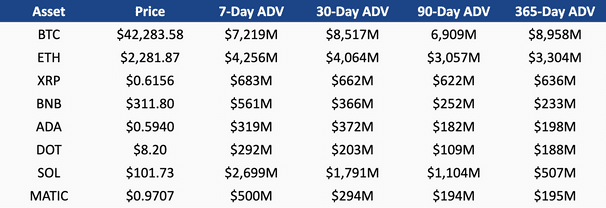

A recent report released by Ripple in its Q4 2023 XRP Markets Report unveiled that XRP experienced a substantial increase in daily trading volume, hitting roughly $600 million this quarter. According to the report, this surge represented a 75-100% growth compared to the lower trading volumes observed in Q3.

Notably, the Ripple report suggests a rejuvenation in investor interest and market activity for the altcoin, marking a notable shift from the previous quarter’s performance.

Ripple’s XRP Holdings And Other Crypto Volume In Q4 2023

Ripple’s Q4 report also provided insights into the company’s XRP holdings. As of September 30, 2023, Ripple’s total XRP holdings were more than 5.25 billion, stored in its wallets, plus another 41.3 billion XRP secured in on-ledger escrow.

However, by the close of December 2023, Ripple’s wallet holdings had slightly reduced to about 5.08 billion of this token, and the XRP in on-ledger escrow had also decreased to approximately 40.7 billion.

According to the report, Ripple’s access to the escrowed XRP is restricted until scheduled monthly releases occur, a mechanism that ensures the controlled release of tokens into the market.

Meanwhile, in addition to the surge in XRP’s trading volume, the Ripple markets report also revealed that other major cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), saw considerable increases in their trading volumes.

BTC volumes rose by 88% quarter-on-quarter (QoQ), while ETH recorded a 140% increase over the same period. These trends indicate a broader recovery and bullish sentiment across the crypto market during the quarter.

XRP’s Market Performance And Future Outlook

Despite the recent surge in trading volume, XRP’s market price has shown varying trends. In the last quarter of 2023, the altcoin traded above $0.60, but as of the latest price action, it hovers just above $0.5, indicating a decline.

Although there has been a 3.7% increase in the past week and a 2.2% rise in the past day, the asset is currently trading around $0.52.

Nevertheless, the community and analysts remain optimistic about its future potential. Crypto analyst Jaydee recently pointed out a historical pattern suggesting an imminent parabolic move for XRP. According to Jaydee, the altcoin is currently testing a 10-year trendline, similar to previous instances that led to significant price increases.

#XRP – Last two times we tested the 10-year trendline, $XRP 39x – 650x in price w/in a year! We are now testing multi-year trendline!

Can we bounce off trendline to finally break structure?! Do NOT “KNOW WHAT YOU HOLD”, 🤦♂️🤣we taking “calculated profits!”

RT/Like for updates!… pic.twitter.com/flIQcDh4Ls

— JD 🇵🇭 (@jaydee_757) February 3, 2024

Additionally, Crypto Patel, another analyst, shared his forecast, emphasizing XRP’s potential to shine and go parabolic, drawing parallels to past market trends.

Patel also referred to the legal developments involving Ripple and the US Securities and Exchange Commission (SEC), suggesting that the recent legal victory for Ripple could open doors for XRP’s breakout in the next bull run.

The analyst drew attention to a specific chart pattern from 2017 that preceded a massive rally for altcoin. If this trend repeats, Patel posits, the asset could witness an ‘extraordinary’ surge, potentially reaching over $10.

🔥 Is This Finally XRP’s Time To SHINE, WIll hit $10 ?

🔹Last bull #XRP seriously underperformed while stuck fighting the #SEC

🔹 BTC hit new highs while XRP failed to pass 2017’s $3.30 ATHBut with the SEC case now won – the floodgates may finally BE OPEN!

🔹 Similar… pic.twitter.com/joWLvBnadp— Crypto Patel (@CryptoPatel) February 7, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

What Bitcoin’s trading patterns on centralized exchanges tell us about the market

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Quick Take

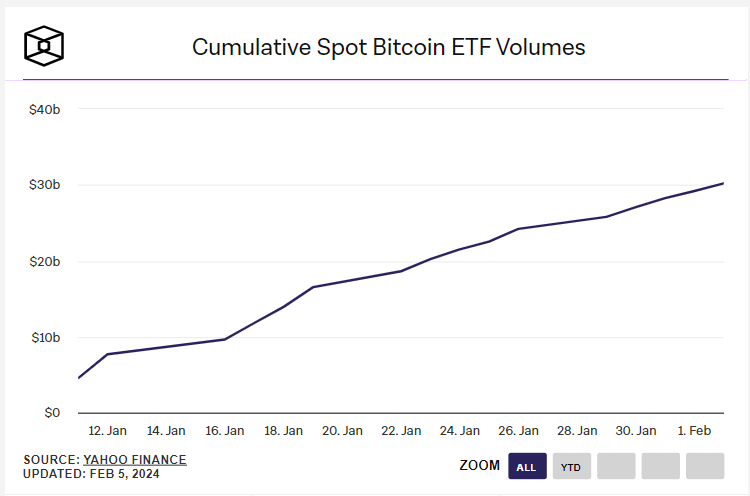

In the nascent arena of spot Bitcoin ETFs, competition is swiftly evolving. The first month saw a noteworthy $1.5 billion net inflow, representing about 32,000 Bitcoin, according to BitMEX Research. Moreover, the aggregated volume of these ETFs overpassed a landmark $30 billion threshold, according to The Block.

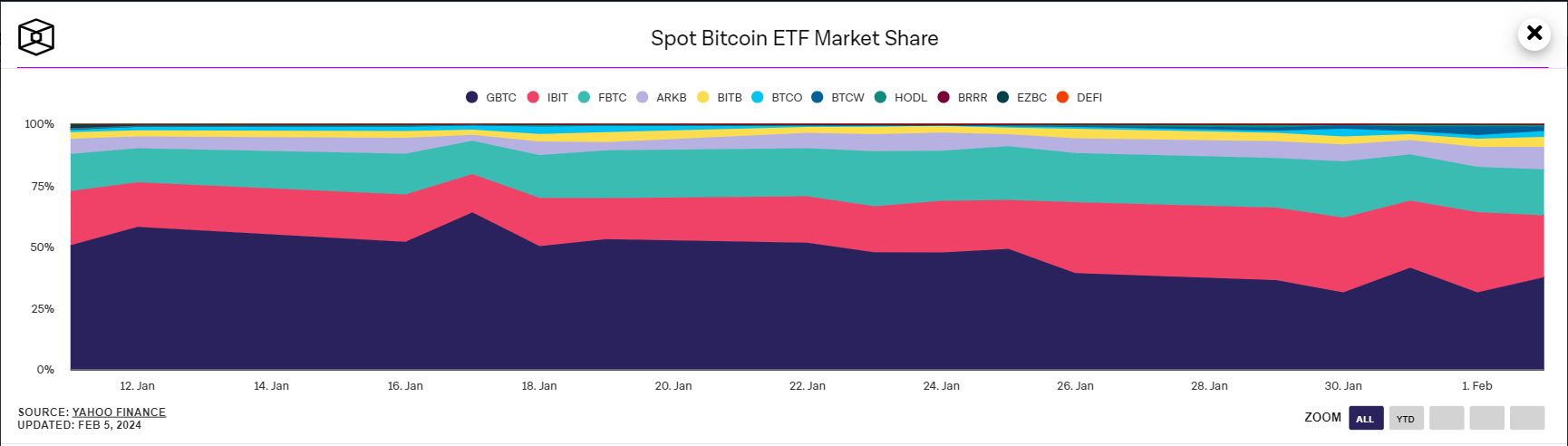

A shift in dominance among these Bitcoin ETFs was recorded. The initial supremacy of the Grayscale Bitcoin Trust (GBTC), which accounted for nearly 50% of the volume on its opening day, dwindled to 38% on Feb. 2.

Conversely, BlackRock’s IBIT and Fidelity’s FBTC ETFs have observed their shares grow by approximately 25% and 20%, respectively. This shift is primarily due to the competitive fee structures; GBTC’s fees are 1.5%, whereas FBTC and IBIT are set at a more attractive 0.25%.

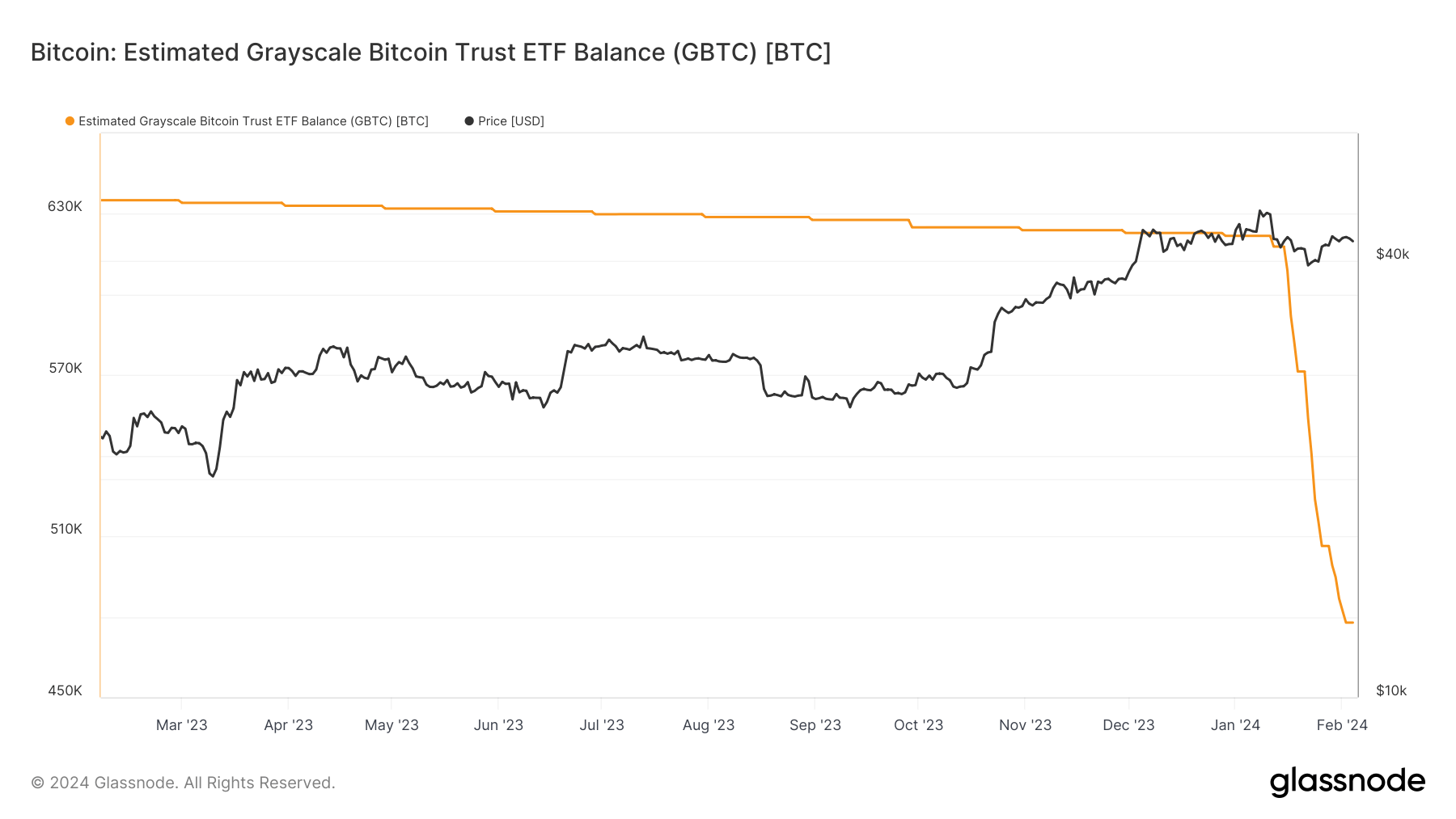

GBTC, which initially held 620,000 BTC before the ETFs started trading, now has approximately 477,000 Bitcoin, a 26% drop from the top.

This substantial decrease represents the enduring sell-off pressure within GBTC, even though the outflows are gradually decelerating. Furthermore, the potential for these coins to shift into the more cost-effective ETFs is occurring. Specifically, Bloomberg ETF analysts estimate that one-third of GBTC outflows are redirected into these spot ETFs.

The post Spot Bitcoin ETFs’ cumulative trading volume exceeds $30 billion appeared first on CryptoSlate.

Jupiter airdrop propels Solana DEXs to outpace Ethereum in daily trading activity

Solana-based Jupiter airdrop has generated substantial excitement, driving decentralized exchange (DEX) trading activity on the layer1 blockchain network beyond that of Ethereum.

Data from DeFillama shows that Solana-based DEXs facilitated trades totaling $1.14 billion in the last 24 hours, surpassing the approximately $1.13 billion traded on Ethereum-based platforms during the same period.

This achievement underlines the remarkable growth and widespread adoption witnessed within Solana’s DeFi ecosystem, capturing the crypto community’s attention. Notably, last December marked the first instance of Solana DEXs outpacing Ethereum, propelled by heightened memecoin and stablecoin activity.

While the daily figures demonstrate Solana’s momentary lead, it’s essential to note that the weekly transaction volume of Solana-based DEXs stands at $6.113 billion, slightly trailing behind Ethereum’s $7.852 billion.

Jupiter airdrop

On Jan. 31, decentralized exchange aggregator Jupiter executed a noteworthy airdrop, distributing approximately $700 million worth of its native token, JUP, to nearly a million wallets. The trading platform is the most dominant protocol on Solana, facilitating trades worth $11 billion in January.

Its airdrop garnered substantial attention from the crypto community, leading to rapid listings on major centralized exchanges like Bybit and Binance. On its first trading day, the asset witnessed an impressive volume surpassing $1.4 billion, propelling the token’s value to a peak of $0.72 before settling at $0.62 as of press time, according to CoinMaketCap data.

On-chain investigator Lookonchain identified three airdrop participants who amassed over $1 million in gains. These individuals received a collective airdrop of 5.5 million JUP tokens, valued at an estimated $3.6 million, distributed across approximately 27,600 wallets.

The launch and airdrop of Jupiter’s token significantly boosted activity on the Solana network. Notably, the web3 wallet Phantom reported unprecedented traffic levels, tripling the total volumes seen after the recent WEN meme token launch.

Blockchain analytical firm Artemis corroborated this, pointing out that the anticipation of the airdrop had driven active addresses on Solana to more than 1 million earlier in the week.

Despite the surge in activity, Solana’s network demonstrated exceptional stability, dispelling concerns of potential downtime that had plagued it in the past.

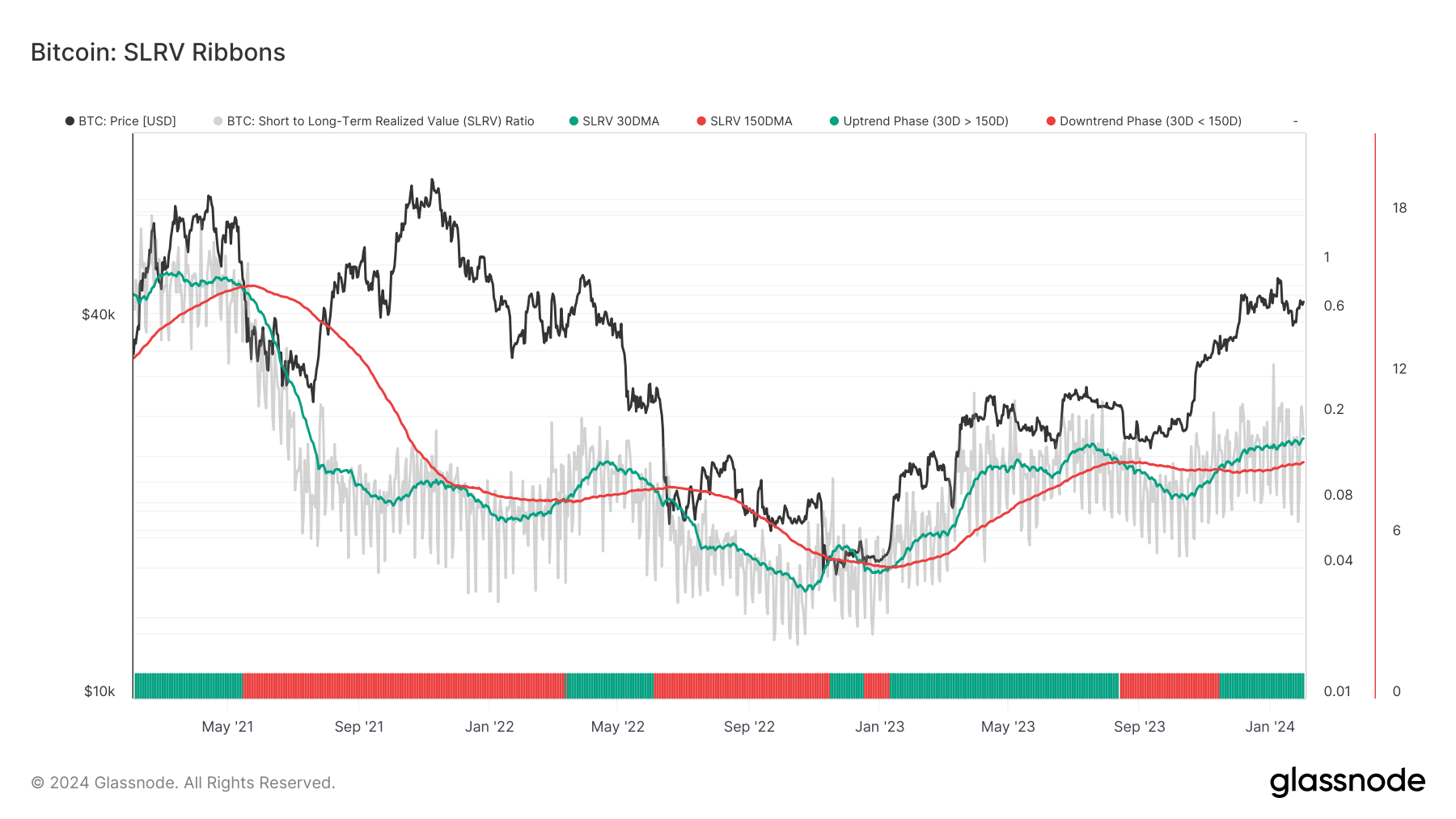

The short-to-long-term realized value (SLRV) ratio is an often-overlooked metric that provides nuanced insights into investor sentiment. The ratio compares the percentage of Bitcoin that was last moved within a short timeframe (24 hours) against the percentage moved in a longer timeframe (6-12 months) to show whether the market leans more towards hodling or trading.

However, the SLRV ratio alone usually isn’t enough to identify broader trends, as there are significant daily variations in the metric. Applying and analyzing the ratio through moving averages, especially the 30-day simple moving average (SMA) and the 150-day SMA, allows us to get a clear picture of sustained market trends.

On Feb. 1, the SLRV 30D SMA reached its highest level since July 2021 as Bitcoin’s price crossed $43,000. This peak represents a continuation of a positive uptrend that began on Nov. 14, 2023, when the SLRV 30D SMA crossed above the 150D SMA.

The SLRV 30D SMA reaching levels not seen in two and a half years shows a significant increase in short-term transactional activity relative to long-term holding. This could be attributed to a myriad of different factors, but it’s usually a result of price volatility. The rise in short-term transactional volume often correlates with heightened market speculation as investors and traders rush to capitalize on price movements. It can indicate a market driven by bullish sentiment or increased speculative interest spurred by recent market developments.

The introduction and adoption of spot Bitcoin ETFs in the U.S. most likely played a significant role. The highly-anticipated trading product has pushed Bitcoin into the mainstream, bringing institutions and advanced investors from tradfi into the market. Aside from having a psychological effect on the market and boosting investor confidence in BTC, these ETFs also provide liquidity to Bitcoin. This increased liquidity can cause higher trading volumes, as investors can enter and exit their positions in Bitcoin through the ETFs more quickly, causing spikes in the SLRV 30D SMA as a result.

It’s not just the rise in the SLRV 30D SMA that shows a change in market sentiment. Its sustained position above the 150D SMA since mid-November shows that short-term transactional activity not only spiked but maintained a higher level over an extended period.

The durability of this trend, which is on its way to enter its third consecutive month, shows that market activity isn’t a short-lived speculative burst but a more entrenched behavior pattern among investors.

Historically, short-term SMAs crossing above long-term SMAs have been used as a technical indicator for positive momentum and potential bullish trends in various assets, including Bitcoin. The extended period where the SLRV 30D SMA remains above the 150D SMA could show a broader market transition from risk-off to risk-on allocations, where investors are more willing to engage in speculative investments or allocate a larger portion of their portfolio to Bitcoin.

The post Short-term trading volume peaks as Bitcoin crosses $43,000 appeared first on CryptoSlate.

Quick Take

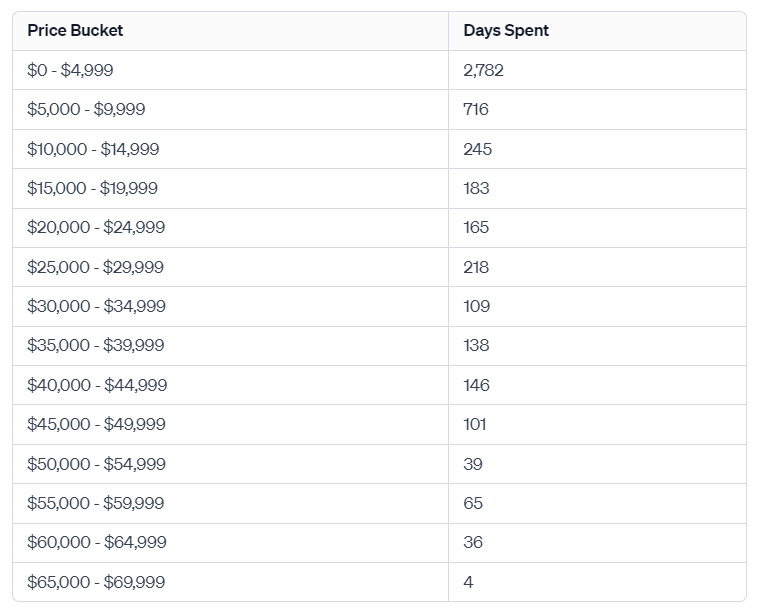

Bitcoin’s price rally from October 2023, which saw it soar from $25,000 to $49,000 in January 2024, witnessed the digital asset hitting the $40,000 mark for the first time since April 2022 on Dec. 4.

From then on, it steadily consolidated above $40,000 for 49 consecutive days. However, it lost the $40,000 support level on Jan. 22. Bitcoin’s trading price currently hovers around $42,000.

Digging deeper, the price analysis in $5,000 increments reveals a pattern. Bitcoin has been trading within the price range of $40,000 to $44,999 for 146 days. This duration has recently overtaken its previous stint in the $35,000 to $39,999 range, which spanned approximately 138 days.

When assessing price increments from $10,000 and upwards until $49,999, it becomes apparent that Bitcoin typically trades within these ranges for a period between 100 and 250 days. Thus, the current sideways price action aligns with Bitcoin’s historical trading patterns and can be considered characteristic behavior, not an anomaly.

The post Bitcoin’s steady stand: 146 days of trading between $40k and $45k appeared first on CryptoSlate.

Binance allows customers to custody trading collateral off exchange as market share recovers

A Binance representative confirmed in a Jan. 30 email statement sent to CryptoSlate that the platform is now allowing institutional investors to secure their trading collateral through a third-party banking partner.

Binance’s solution, described as a “banking triparty” arrangement, has been under development for the past two years and directly addresses the primary concern of counterparty risk, a significant consideration for institutional investors. This model enables investors to manage risk effectively while optimizing capital efficiency by pledging collateral in traditional assets.

While details about the specific banking partners remain undisclosed, Binance emphasized active engagement with various banking entities and institutional investors expressing interest in the arrangement.

The platform introduced the pilot scheme for this solution last November, allowing collateral held with the banking partner to be in fiat equivalents, such as Treasury Bills.

Before this development, Binance clients were limited to holding their assets on the exchange itself or through its custodial service provider, Ceffu. However, concerns arose following the U.S. Securities and Exchange Commission’s lawsuit against Binance, questioning the exchange’s crypto wallet custody practices and its relationship with Ceffu.

Binance market share recovers.

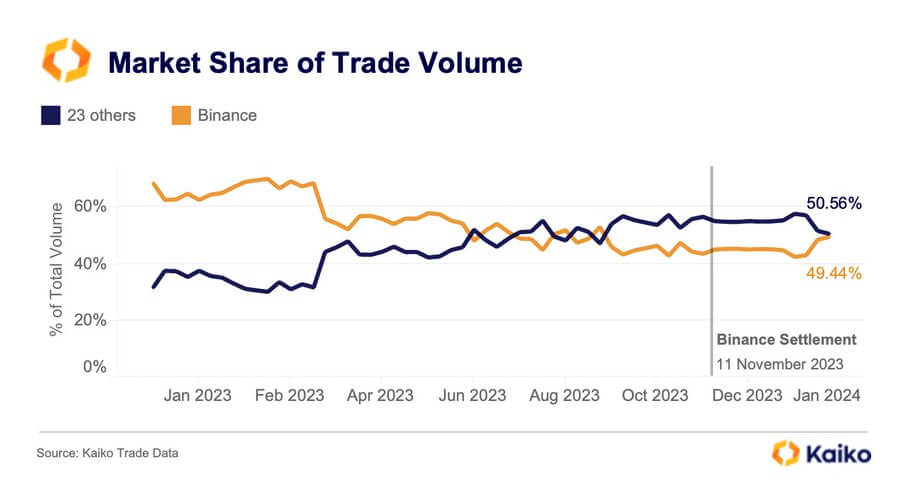

Binance market share is steadily growing to previous heights after its run-in with several financial regulators across different jurisdictions impacted its operations last year.

Last year, the platform strategically withdrew from Canada, the United Kingdom, and several European nations, including Austria, Cyprus, and the Netherlands, due to regulatory non-compliance issues.

Furthermore, it faced a substantial $4.3 billion settlement with U.S. authorities, leading to a market share dip to 44.5% by the close of the same year.

However, recent findings from Kaiko Research indicate a noteworthy comeback for Binance this year.

Data reveals that Binance’s trading volume has climbed to 49.44% from its previous multi-year low, while 23 other centralized exchanges collectively account for 50.56% of trading activities.

In response to this significant turnaround, Binance CEO Richard Teng expressed his optimism with a succinct “Keep Building” post on social media platform X.

The post Binance allows customers to custody trading collateral off exchange as market share recovers appeared first on CryptoSlate.

Trump NFTs trading volume spike following DeSantis endorsement of Trump’s re-election moves

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.