The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

Source link

transaction

ADA Price Ready To Soar As Cardano Network Hits New 88.6 Million Transaction Milestone

The Cardano (ADA) price looks set for a significant move to the upside. The network recently hit a new milestone in terms of transactions processed so far, in addition to other bullish fundamentals that could also contribute to the price surge.

Cardano Has Processed Over 88 Million Transactions

Data from Cardano’s latest weekly development report shows that the network has processed 88.6 million transactions to date. This is significant as sustained network activity can positively affect ADA’s price. Moreover, ADA has always been criticized as a “ghost chain,” this achievement dispels that notion and proves that people are actively using the network.

Source: Essential Cardano

Meanwhile, the report revealed that 1,353 projects are actively building on the network, which means the network will keep expanding as more users get onboarded through those projects. Additionally, Cardano’s Fund12 officially launches on April 26, with this decentralized and innovative incubator program set to usher in a new set of developers into the Cardano ecosystem.

That event also underlines Cardano’s potential to experience exponential network growth soon enough. It is also a testament to Cardano founder Charles Hoskison’s statement that the network is growing organically like Bitcoin, seeing as the team has continued to put in the work rather than solely depending on hype.

Considering these bullish developments, ADA’s price could be well primed for a significant move to the upside. This will provide a much-needed relief for ADA holders who have continued to worry about the crypto token’s lagging price action. ADA’s price had remained pretty tepid despite the broader crypto market recording massive price gains.

ADA Price Chart Says Otherwise

From a technical analysis perspective, the Cardano ecosystem is currently bearish. Technical analyst Alan Santana recently mentioned that further price declines are more feasible as ADA’s price has continued to lag. He revealed that ADA’s weekly chart is producing a “break below the EMA10 (Exponential Moving Average) with a very strong bearish candle as the RSI (Relative Strength Index) turns red. “

Santana also suggested that ADA’s price could drop to as low as $0.34 in a bid to establish support. Therefore, he stated that the “only wise decision is to remain bearish until the chart and market conditions change.” “Once support is found and established, we become bullish again,” the analyst added.

At the time of writing, ADA is trading at around $0.58, up in the last 24 hours according to data from CoinMarketCap.

ADA sees sharp drop to $0.58 | Source: ADAUSDT on Tradingview.com

Featured image from Biztech Africa, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Fluidkey Launches to Tackle the Transaction Privacy Issues on EVM Chains

Fluidkey has announced it has opened its Optimism-based alpha to more users, allowing them to test their private solutions. Fluidkey seeks to solve the transaction privacy problem in EVM chains by leveraging ENS and stealth addresses, allowing users to use a new self-custodial asset for each payment, and segregating these movements to avoid linkability. Fluidkey […]

Fluidkey has announced it has opened its Optimism-based alpha to more users, allowing them to test their private solutions. Fluidkey seeks to solve the transaction privacy problem in EVM chains by leveraging ENS and stealth addresses, allowing users to use a new self-custodial asset for each payment, and segregating these movements to avoid linkability. Fluidkey […]

Source link

Is Ripple Dumping Millions Of XRP? CTO Addresses Reasons Behind $34 Million Transaction

Ripple has always been subjected to claims of manipulating the price of XRP and its natural growth by selling coins. As the cryptocurrency’s largest holder, Ripple has faced constant criticism about the amount of XRP it holds, with detractors arguing it gives them too much control and influence over the price.

Particularly, there’s been some drama swirling around the altcoin lately and claims that Ripple has been manipulating the market and systematically dumping its large holdings. This has come in light of a large transfer of 60 million XRP tokens from Ripple to an unknown wallet address.

Ripple Accused Of Dumping XRP And Manipulating Market

Whale transaction tracker Whale Alerts recently posted on social media a transfer of 60 million XRP worth $34 million from a Ripple-controlled wallet address into a private address. A further look shows that the private recipient wallet currently holds over 138 million XRP worth $75.5 million, with this same address receiving 80 million XRP from Ripple on February 11.

🚨 🚨 60,000,000 #XRP (34,088,291 USD) transferred from #Ripple to unknown wallet

— Whale Alert (@whale_alert) February 20, 2024

At the time of writing, Ripple controls about 6% of the current circulating supply. Therefore, it is only natural that large transactions like this from Ripple would generate waves in the market and lead to speculations. Consequently, the large transfers have reignited claims of Ripple selling its holdings amidst ongoing consolidation in the price of XRP.

In addition, debates regarding XRP’s programmatic sales have resurfaced, as history shows this isn’t new to Ripple. According to details shared by a social media user, Jim_Knox, Ripple allegedly delivered XRP to three market makers in 2017 for the purpose of market sales, which resulted in a price suppression of the cryptocurrency during that particular period. Furthermore, recent accusations have taken root of Ripple using what it called the 4t and 6t bots to execute programmatic sales to exchanges.

Ripple CTO Addresses Concerns

Ripple CTO David Schwartz took to a social media thread to address the rumors of price manipulation. An XRP community member had shared a meme suggesting that Ripple’s 4t and 6t bots have always prevented the price of XRP from increasing, keeping it at the $0.50 level.

However, Schwartz pointed out that Ripple has discontinued the programmatic sales of XRP, with the company only selling its holdings through ODL transactions. The ODL transaction method is Ripple’s unique payment solution that offers instantaneous cross-border transactions. On the other hand, concerns regarding the recent large transactions from Ripple to unknown wallets are yet to be addressed, and it all remains speculative at this point.

XRP is trading at $0.5463 at the time of writing, down by 0.50% in the past 24 hours but still maintaining a meager 2% gain in a 30-day timeframe. Recent transaction alerts from Whale Alerts have shown large amounts of XRP leaving private wallets to crypto exchanges, hinting at potential selloffs.

Token price stalls at $0.54 | Source: XRPUSD on Tradingview.com

Featured image from U.Today, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Shiba Inu layer 2 blockchain platform Shibarium, has witnessed a notable surge in transaction activity carried out on the platform, with its daily transaction performance reaching a new monthly high.

Shibarium Daily Transactions Skyrocket

The number of transactions on the layer 2 blockchain has skyrocketed since Shibarium was introduced, surpassing multiple noteworthy benchmarks. Recent data from Shibariumscan has revealed an uptick in daily transactions, soaring to about 3 million.

The rise in daily transactions to the coveted 3 million milestone marks the highest the network has seen this month. This comes weeks after the number of daily transactions on the network plummeted to about 1.07 million.

Consequently, the notable rise showcases how quickly Shibarium has spread and gained widespread recognition in the past few weeks. This appears to be a significant development. However, it is still below the highest level it recorded in December.

Shibarium has seen large increases in network activity before when its daily transactions reached a peak of around 7.5 million. After crossing the 7 million mark, it managed to maintain above this level for a month before dropping by almost 50% in January.

Data from the Shibarium tracker also shows that the network has reached a major milestone in its overall transactions. According to Shibariumscan, the total number of transactions recorded on the platform since its launch has surpassed 357 million.

It is worth noting that Shibarium’s performance goes beyond the network’s transactions. There have been over 3.27 million blocks processed on the blockchain, suggesting a crucial increase in demand for scalable features.

Furthermore, the overall number of interacting wallet addresses recorded in the network has now crossed 1.35 million. In addition, the network utilization is up by over 51%, indicating an increase in adoption.

Due to this sharp rise in Shibarium network activity, investors’ interest in Shiba Inu is expected to increase. Hence, it buttresses all other projects and crypto assets in the SHIB ecosystem.

Shiba Inu Team To Burn Top Shibarium Tokens

Lucie, Shiba Inu’s head of marketing, has revealed the team’s plan to burn SHIB and several other top Shibarium tokens. She took to the X platform to share the development with the SHIB community.

Lucie noted that funds made from the sale of the new NFT collection Shiboshis will be used to burn the tokens. These include Shiba Inu (SHIB), Bone ShibaSwap (BONE), LEASH, TREAT, and SHI.

Specifically, any Shiboshis that the holders fail to claim will be sent to Uniswap for sale. Then, the Shiba Inu team will use 10% of the total realized funds from those sales to burn the tokens. 4% of the funds will be set aside to burn BONE, LEASH, TREAT, and SHI, while 6% will be used to burn SHIB.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

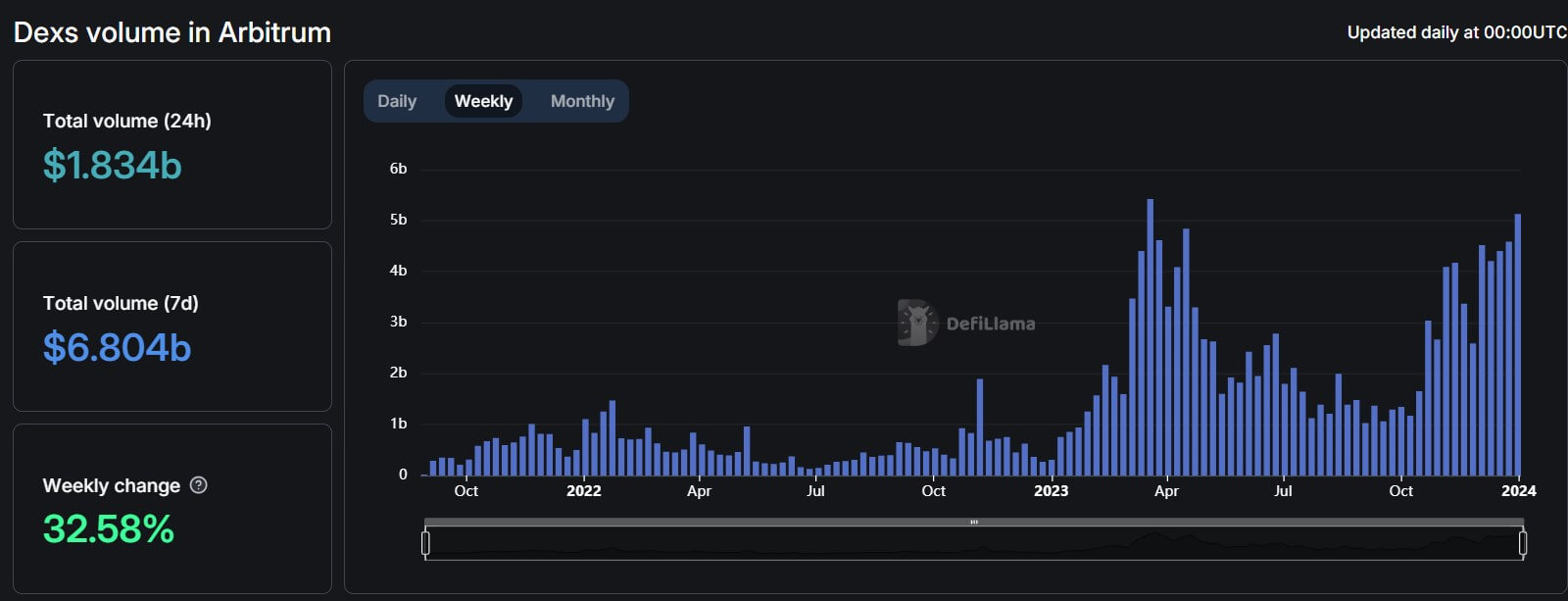

Decentralized exchanges (DEX) transaction volume on Arbitrum, a layer2 network, surpassed that of Ethereum for the first time during the past day, according to DeFillama data.

During the reporting period, DEXs on Arbitrum saw their volume soar to $1.843 billion, surpassing Ethereum’s $1.444 billion and Solana’s $683.59 million.

This surge aligns with Arbitrum’s continuous weekly growth, rising by 32.58% to $6.804 billion, a new all-time high, though still trailing Ethereum’s $9.581 billion. However, it surpasses Solana’s $5.039 billion and notably exceeds Binance Smart Chain’s daily volume by nearly fourfold.

The rising DEX volume also coincided with high-network activity on the layer2 network. During the past day, Arbitrum’s daily transaction per second stood at 14.05, while Ethereum mainnet’s was 12.92, according to L2beat data.

Uniswap dominates

The increased trading volume can be attributed to heightened activity on Arbitrum’s DEXs like Uniswap, Camelot, Ramses Exchange, and Trader Joe. Data from DeFillama shows that these protocols have enjoyed double-digit growth to new highs during the past week.

Uniswap Labs, the developers of the popular decentralized trading protocol Uniswap, revealed that Arbitrum became the first layer2 network to cross a billion in daily volume on the platform on Jan. 4.

Uniswap is the largest DEX protocol by trading volume across all chains, with an average volume of more than $1.5 billion during the past week.

Arbitrum’s rising TVL

The rising DEX volume has also coincided with a sharp increase in the total value of assets locked on the Ethereum-based layer2 network.

Data from DefiLlama shows the TVL on Arbitrum-based applications has increased by around $1 billion in the last six months to nearly $2.5 billion, with the dominant DeFi protocol being GMX, a decentralized spot, and perpetual exchange, which controls about 20% of the network’s total TVL.

Additionally, Arbitrum’s native ARB token recently reached a new all-time high of more than $2 on Jan. 4 but has retraced to $1.94 as of press time, according to CryptoSlate’s data.

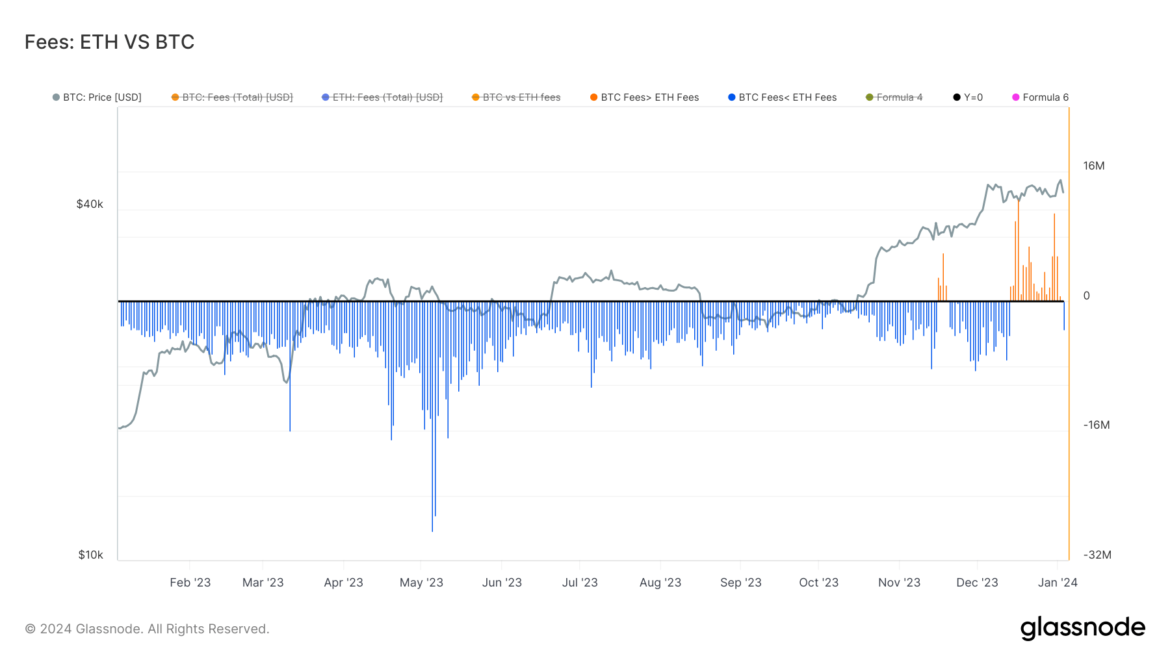

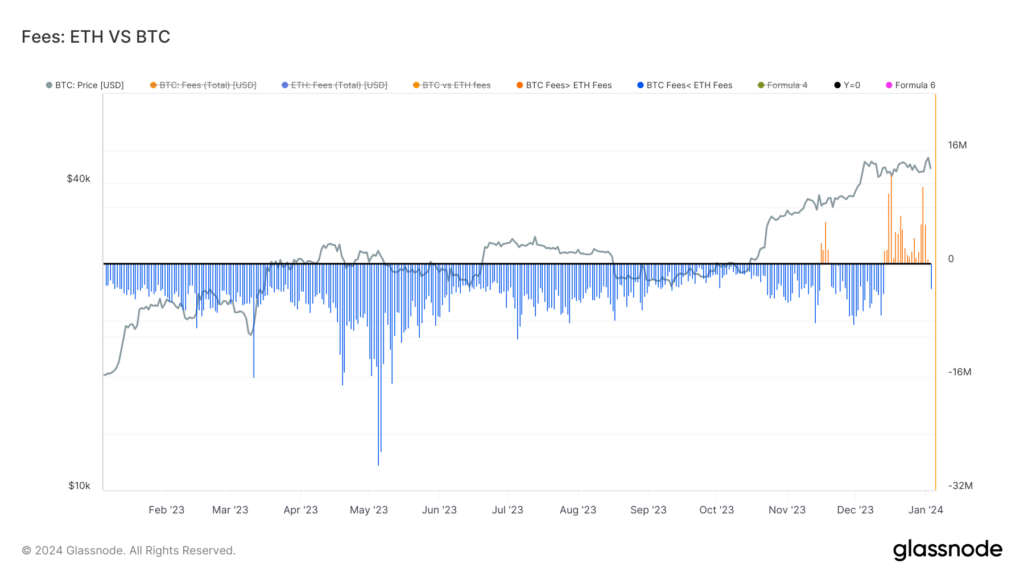

The three-week trend of Bitcoin surpassing Ethereum in transaction fees has come to an end

Quick Take

A recent uptrend in Bitcoin transaction fees is a development that has proven beneficial for miners. From Dec 14 to Jan 3, Bitcoin consistently surpassed Ethereum regarding transaction fees, marking three weeks.

While not unprecedented, this phenomenon was noteworthy given the typically lower Bitcoin transaction fees. Interestingly, a similar trend surfaced briefly in November when Bitcoin transaction fees outpaced Ethereum’s for three days.

However, this recent streak fell short of the record set in 2017, when Bitcoin transaction fees outperformed Ethereum’s for roughly a year. While the recent trend has concluded, the fluctuation in transaction fees between the two digital assets remains a point of interest.

Stakeholders are urged to monitor these trends as they could have significant implications for mining profitability and the broader digital asset market dynamics.

The post The three-week trend of Bitcoin surpassing Ethereum in transaction fees has come to an end appeared first on CryptoSlate.

Quick Take

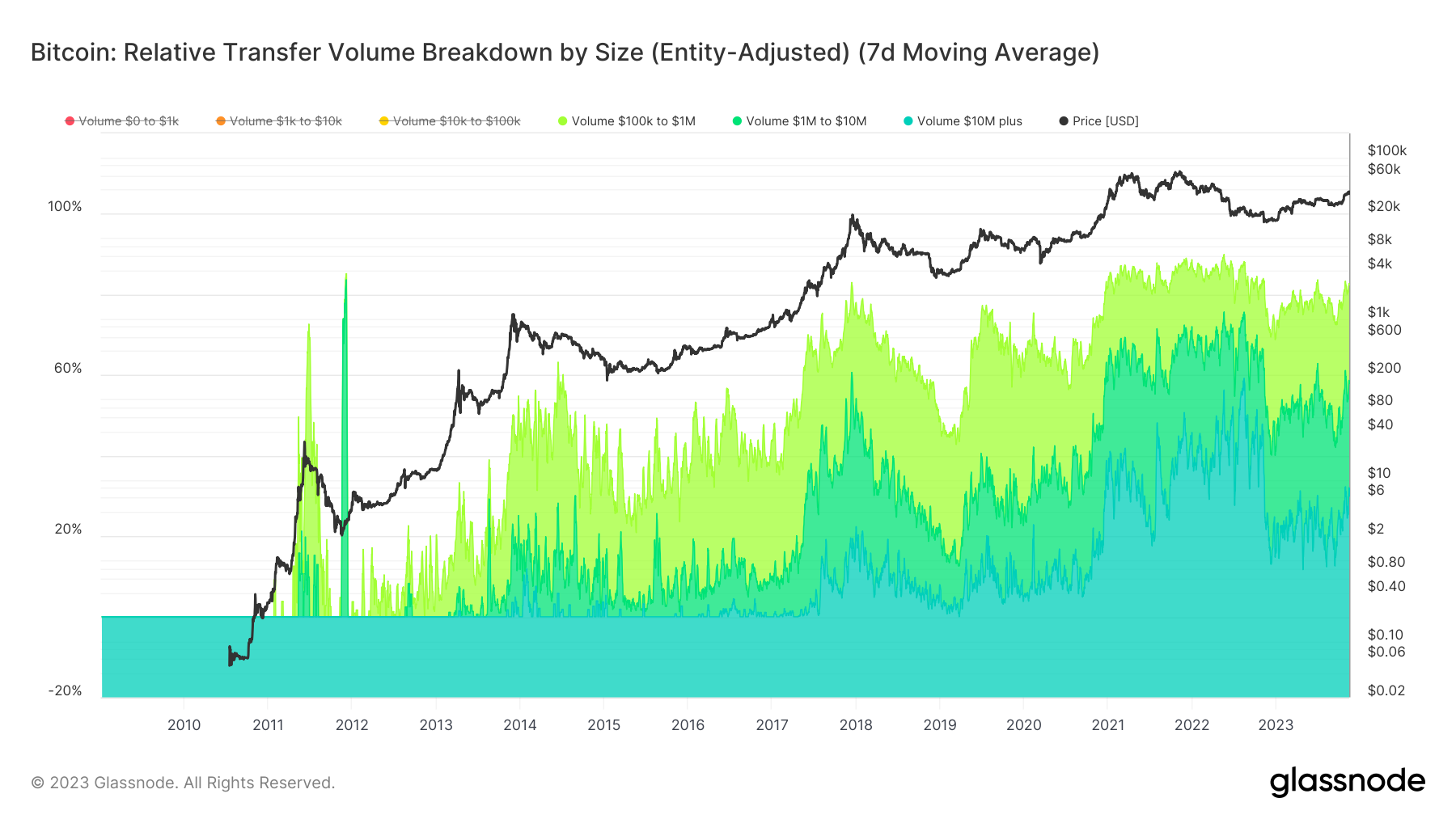

A noticeable resurgence of whale activity, involving transactions of $10 million or more, has been observed in the entity-adjusted relative on-chain volume breakdown.

The volume of these large-scale transactions recently breached the 30% mark of all transactions, an occurrence only seen once this year during a brief period in October. Currently, in 2023, Bitcoin has rebounded with an impressive 120% increase year to date, restoring confidence within the market.

In addition, the aggregated volume of transactions ranging from $100k to $1M stands at 24%, while that of $1M to $10M is at 28%. These figures are nearing the peak seen during the bull market of 2021, emphasizing that these high-value transactions, or ‘whale’ activities, are an integral part of the Bitcoin network’s financial ecosystem.

| Volume Size | % |

|---|---|

| Volume $0 to $1K | 2% |

| Volume $1K to $10K | 4% |

| Volume $10k to $100K | 12% |

| Volume $100k to $1M | 24% |

| Volume $1M to $10M | 28% |

| Volume $10M or more | 30% |

Source: Glassnode

The post Bitcoin whale activity surges, hits 30% of total transaction volume appeared first on CryptoSlate.

Major Aussie bank takes next step to AUD stablecoin after Chainlink test transaction

Australia and New Zealand Banking Group is one step closer to launching its bank-issued stablecoin A$DC after the bank successfully executed a test transaction on Chainlink’s Cross-Chain Interoperability Protocol.

ANZ’s banking services portfolio lead Nigel Dobson said in a Sept. 14 statement that the transaction was a “milestone” moment for the bank:

“ANZ recently worked with Chainlink CCIP to complete a test transaction to simulate the purchase of a tokenised asset, facilitated using A$DC and an ANZ-issued NZ-dollar-denominated stablecoin.”

Dobson said the firm has been experimenting with several networks — presumably to test out where the ANZ’s Australian dollar stablecoin can be best utilized:

“We’re actively exploring the use of decentralised networks through a ‘test-and-learn’ approach,” the ANZ executive said.

As Australia and New Zealand Banking Group (ANZ), one the world’s largest global banks with over $1 trillion in total assets under management, demonstrates the use of CCIP for secure cross-chain stablecoin transactions, the role of Chainlink and CCIP as a standard for interbank… pic.twitter.com/qdehsUX4rQ

— Sergey Nazarov (@SergeyNazarov) September 14, 2023

Dobson said ANZ sees “real value” in tokenizing real-world assets like the Australian dollar, a move that could potentially transform the banking industry:

“Tokenised assets are already changing the way banking works, and the technology has the potential to do more — if the right pieces can come together.”

ANZ minted the first A$DC stablecoin in March 2022, becoming the first Australian bank to do so. National Australia Bank became the second a year later with its AUDN stablecoin on Ethereum.

Related: Don’t follow the US: Blockchain Aus CEO hammers ‘regulation by enforcement

These banks cited the need to protect customers against cryptocurrency scams as the main reason behind imposing the restrictions.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

Cryptocurrency-friendly bank DBS is introducing new solutions for its customers in mainland China related to the digital yuan, also known as e-CNY.

DBS Bank China officially announced on July 5 the launch of the e-CNY merchant solution, allowing mainland businesses to receive payments in the central bank digital currency (CBDC).

DBS told Cointelegraph that the new service will allow DBS’ clients in mainland China receive or collect the e-CNY and have it automatically settled into their CNY bank deposit accounts. The company refers to this service as a “merchant collection solution” rather than a payment solution, as the merchant “collects” the final amount in CNY in their bank deposit account.

DBS’ solution is designed to enable a number of benefits, allowing businesses to collect CBDC “without having to go through manual settlement processes,” the announcement notes. The tool also features e-CNY’s capabilities allowing users to receive payments in underserved regions with limited internet connectivity.

Additionally, the solution provides reconciliation through consolidated merchant reports with itemized e-CNY transactions available via DBS’ digital platform for business banking.

According to DBS Bank China CEO Ginger Cheng, the company has completed the first e-CNY transaction involving a catering company in Shenzhen. She said:

“By seamlessly integrating a CBDC collection and settlement method into our clients’ existing payment systems, this will help position their business for a digital future where consumers in China use e-CNY for their daily activities.”

She added that the development showcases the firm’s commitment to improving user experience while “actively supporting the development of China’s financial market innovation.”

Lim Soon Chong, DBS Bank head of global transaction services, noted that the new CBDC service marks another milestone in the firm’s efforts of enabling instant and frictionless 24/7 payments. “We look forward to building on this launch to explore new digital payment solutions, such as cross-border CBDC payments,” the exec added.

Related: Chinese city of Jinan accepts CBDC payments for bus rides

Since launching the CBDC in 2019, China has significantly progressed in promoting and expanding the digital yuan. According to the country’s central bank, there were 13.6 billion e-CNY in circulation, or about $2 billion by the end of 2022. The CBDC is currently accepted across 26 cities and 17 provinces in China, with adoption expected to scale further as the program gradually expands to more regions.

DBS Bank is known for its pro-crypto stance. In 2020, the Singaporean megabank launched cryptocurrency trading and custody services for institutional clients. The firm was reportedly among the few companies in the world that reaped benefits from massive collapses in the crypto industry, seeing a 80% spike in Bitcoin (BTC) trading volumes in 2022.

DBS also participated in various government-related blockchain initiatives in Singapore, including Project Orchid, Project Guardian and Project Ubin.

Magazine: Asia Express: HK crypto ETFs on fire, Binance warns on Maverick FOMO, Poly hack