Four months ago, a total of 179 decentralized autonomous organizations (DAOs) boasted treasuries exceeding $1 million or more each. As of today, this figure has climbed to 211 distinct DAOs meeting the same criteria. Furthermore, since Nov. 1, 2023, the collective value of DAO treasuries has expanded by more than $20 billion across a period […]

Four months ago, a total of 179 decentralized autonomous organizations (DAOs) boasted treasuries exceeding $1 million or more each. As of today, this figure has climbed to 211 distinct DAOs meeting the same criteria. Furthermore, since Nov. 1, 2023, the collective value of DAO treasuries has expanded by more than $20 billion across a period […]

Source link

Treasuries

(Bloomberg) — A Fidelity International money manager has sold the vast majority of US Treasuries from funds he oversees on expectations the world’s biggest economy still has room to expand.

Most Read from Bloomberg

Singapore-based George Efstathopoulos, who helps manage about $3 billion of income and growth strategies at Fidelity, sold the bulk of his 10-year and 30-year Treasuries holdings in December. He is now turning to assets that typically do well in times of good economic growth to boost returns.

“We don’t expect sort of a recession anymore,” said Efstathopoulos. “The probability of no landing is still small, but it’s been increasing. If that increases much more, potentially we will not be talking about Fed cuts anymore” in 2024.

Efstathopoulos is among those cooling on Treasuries as the US economy’s resilience forces investors to rethink bets on interest-rate cuts. Some are going a step further, speculating the Federal Reserve’s next move may even be a hike, after the recent strong inflation and jobs reports.

Traders are now pricing under four quarter-point interest-rate cuts in 2024, down from wagers for 150 basis points of cuts this year starting March. Bonds are reflecting the swing in sentiment, with 10-year US yields advancing more than 40 basis points since the start of the year to 4.3%, as comments from Fed officials also reinforce expectations of higher-for-longer rates.

Fed Vice Chair Philip Jefferson warned on Thursday about the dangers of easing too much in response to easing price pressures, while Fed Minneapolis President Neel Kashkari said “we still have some work to do” on inflation.

Efstathopoulos sold Treasuries as concern over US growth faded. The asset is typically less attractive amid elevated borrowing costs, and when prices reflect the Fed’s median forecast of three quarter point interest-rate cuts this year.

He also sold bonds from other developed markets, including gilts and bunds, while leaving some exposure to inflation-linked US government debt and an idiosyncratic position in Austrian bonds.

The US economy is showing “more signs of re-acceleration than it is of slowing down,” Efstathopoulos said, adding that “I wouldn’t be surprised in a couple of quarters down the road we end up seeing sort of manufacturing PMI in a more expansion sort of territory” in developed markets.

Data on Thursday reinforced his view as US jobless claims dropped to the lowest level in a month, underscoring the strength of the economy.

Some funds such as Jupiter Asset Management are taking a different view, opting to load up on Treasuries while seeing risks of an eventual hard landing after the Fed’s most aggressive tightening cycle in decades.

Prefers Stocks

Efstathopoulos helps oversee a number of strategies, including a global multi-asset growth and income fund that gained 5% in the year to Jan. 31, according to a company factsheet.

In comparison, the Bloomberg Global-Aggregate Total Return Index of worldwide investment-grade bonds rose about 0.9% in the same period. The fund had dropped 2.31% over a three year period, the factsheet showed.

Efstathopoulos took profit on a top money-making bullish India equities trade last month as prices soared, rotating instead to US mid-cap and Greek stocks. He also likes Japanese banks.

The strategy is now more positive on stocks but “very underweight duration,” he said, referring to a measure that typically reflects the sensitivity of a bond portfolio to changes in interest rates.

“We’ve gone through a massive disinflation period and growth seems to be OK, and the labor market seems to be OK,” he said. “If this is where we land, this is a great place.”

(Updates with Fed comments in sixth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

S&P 500: 13 S&P 500 Dividend Stocks Pay 50% More Than 10-Year Treasuries

There’s nothing like a plunge in yields to 4.1% to cool the mad dash to buy 10-year Treasuries. Now you can buy S&P 500 stocks that yield much more.

X

Today you’ll find 13 S&P 500 stocks, including Pioneer Natural Resources (PXD), Walgreens Boots Alliance (WBA) and Altria Group (MO) yielding 6.2% or more, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith. That’s at least 50% higher than the 4.1% you’d get with a current yield on the 10-year Treasury.

Seeing so many stocks yielding more than Treasuries is a wake-up call for investors. “A market that was obsessively focused on the path of the 10-year Treasury yield, and rightly so as it quickly breached 5% on Oct. 19, has also embraced the faster than expected drop lower for yields,” said Quincy Krosby, Chief Global Strategist for LPL Financial.

S&P 500 Dividends Challenge Treasuries Again

Almost overnight, S&P 500 dividends offer real competition to Treasuries. And there’s no shortage of big yields.

Part of the new math is due to plunging 10-year Treasury yields. At 4.1%, Treasury yields are nearly 20% lower than they were just weeks ago. Meanwhile, yields on many dividend paying stocks are soaring as value stocks struggle. That’s pushing yields higher on select stocks — and fast. There are now 79 stocks in the S&P 500 that yield as much or more than 10-year Treasuries.

The average yield of the 400 S&P 500 stocks that pay a dividend is 2.64%. And you can find stocks yielding much more than that.

Top S&P 500 Yielders: Pioneer Natural

You’ll find many S&P 500 stocks yielding more than 6% if you look for them.

If all you care about is a giant yield, Irving, Texas-based Pioneer Natural is the stock to beat. It’s yielding an impressive 12.2% despite the stock falling just 2.6% this year. Just know that the dividend likely won’t stick around forever. Rival Exxon Mobil (XOM) is looking to buy Pioneer for roughly $65 billion. Exxon Mobil stock yields just 3.8% — a fraction of what Pioneer does.

Pioneer is the only S&P 500 stock paying a double-digit percentage as a dividend. But approaching that level at a 9.4% yield is ailing drugstore Walgreens Boots Alliance. Mostly due to a 43% plunge in the stock price, the company now yields 9.4%. That’s certainly an outlier. S&P 500 industry peer CVS Health (CVS), in contrast, yields just 3.4%. And the company’s growth prospects don’t inspire confidence. Walgreens Boots’ adjusted profit per share is seen falling more than 16% this fiscal year.

And that’s unfortunately the trade-off. All 13 of the S&P 500 stocks yielding more than 6.2% are down this year. You have to look hard to find high dividends from S&P 500 stocks up this year. That stings all the more given that the S&P 500 rocketed roughly 20% in 2023 so far.

But if what you want is a high dividend yield, you’ve got plenty of stocks to choose from now.

Highest Yielding S&P 500 Stocks

| Company | Ticker | Dividend yield | Sector |

|---|---|---|---|

| Pioneer Natural Resources | (PXD) | 12.21% | Energy |

| Walgreens Boots Alliance | (WBA) | 9.36 | Consumer Staples |

| Altria Group | (MO) | 9.21 | Consumer Staples |

| Invesco | (IVZ) | 8.27 | Financials |

| Verizon | (VZ) | 6.92 | Communication Services |

| Devon Energy | (DVN) | 6.5555 | Energy |

| Healthpeak Properties | (PEAK) | 6.54 | Real Estate |

| Whirlpool | (WHR) | 6.476 | Consumer Discretionary |

| Kinder Morgan | (KMI) | 6.4571 | Energy |

| AT&T | (T) | 6.45 | Communication Services |

| KeyCorp | (KEY) | 6.34 | Financials |

| Boston Properties | (BXP) | 6.32 | Real Estate |

| Truist Financial | (TFC) | 6.27 | Financials |

Sources: S&P Global Market Intelligence, IBD

Follow Matt Krantz on X (Twitter) @mattkrantz

(Bloomberg) — If 10-year US Treasury yields hit 5% or higher, that’s a good entry point for investors, according to Morgan Stanley Investment Management.

Most Read from Bloomberg

“Those will be great levels to get longer in your portfolio from a duration perspective” under current conditions, said Vishal Khanduja, money manager and co-head of the broad markets fixed-income team in Boston. “We’ll be superbly in that overshoot category” from the firm’s fair value levels for Treasuries should yields breach 5%.

Benchmark US yields are fast closing in on the 5% mark, fueling debate about how much further they can rise as Federal Reserve officials pledge to keep interest rates higher for longer. Traders trying to time an entry into the market have to weigh opposing factors, as the conflict in the Middle East fuels haven bids while a swelling US deficit boosts the supply of securities.

US 10-year yields have soared over 30 basis points this week and reached 4.98% on Thursday, the highest since July 2007. Traders are looking to Fed Chair Jerome Powell’s upcoming remarks at the Economic Club of New York to shed more light on the policy outlook.

While Khanduja is eyeing 5% as a decent entry point, he also has a steepener trade among his favored bets. Morgan Stanley Investment is positioned for the yield curve between the two and 10-year bonds to steepen.

That trade has paid off as the 10-year bond yield surged, narrowing the negative spread with the two-year note from more than 100 basis points when Khanduja put that strategy in place to minus 28 basis points.

“We definitely think it’ll flip,” back to a positive spread, Khanduja said. “But I think the timeline for that is going to be a little longer.” The firm now thinks the Fed may only cut rates at the end of 2024 or the start of 2025, he said.

Beware the New Treasury Buyers Sparking Fear 5% Is Just a Start

Still, the Fed’s most aggressive rate-hike cycle since the 1980s is likely over, as a steeper curve and term premium have “done the job for them” in tightening policy, he said.

Khanduja helps oversee a number of strategies at Morgan Stanley Investment, including the Calvert Bond Fund that’s gained 1.1% in the past year to beat 85% of its peers.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Stablecoin companies now 16th largest holder of U.S. treasuries globally – report

Quick Take

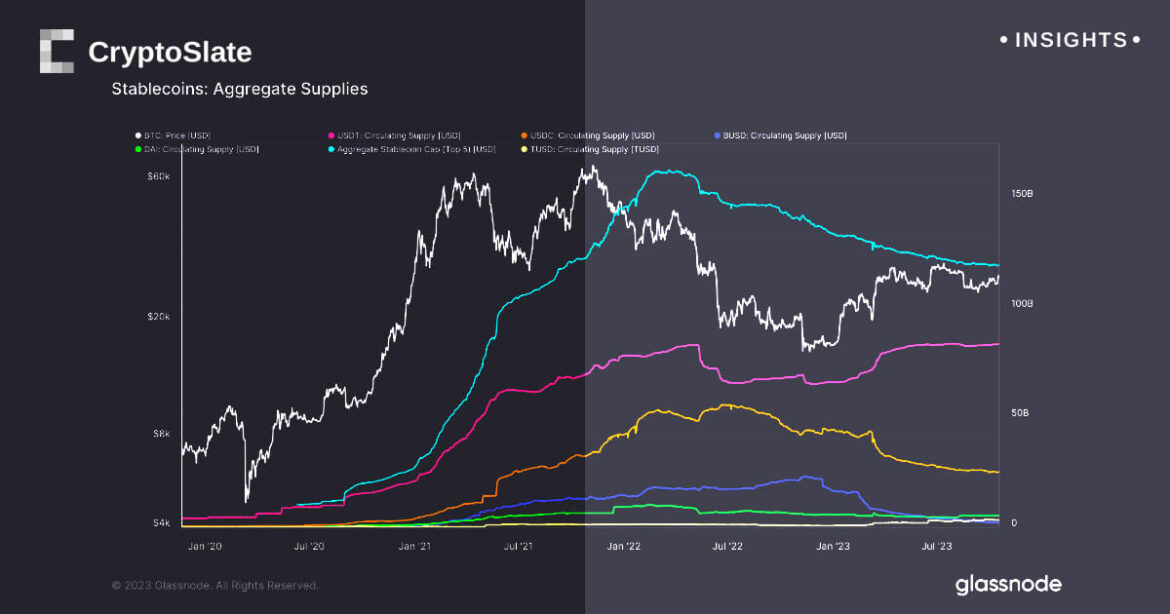

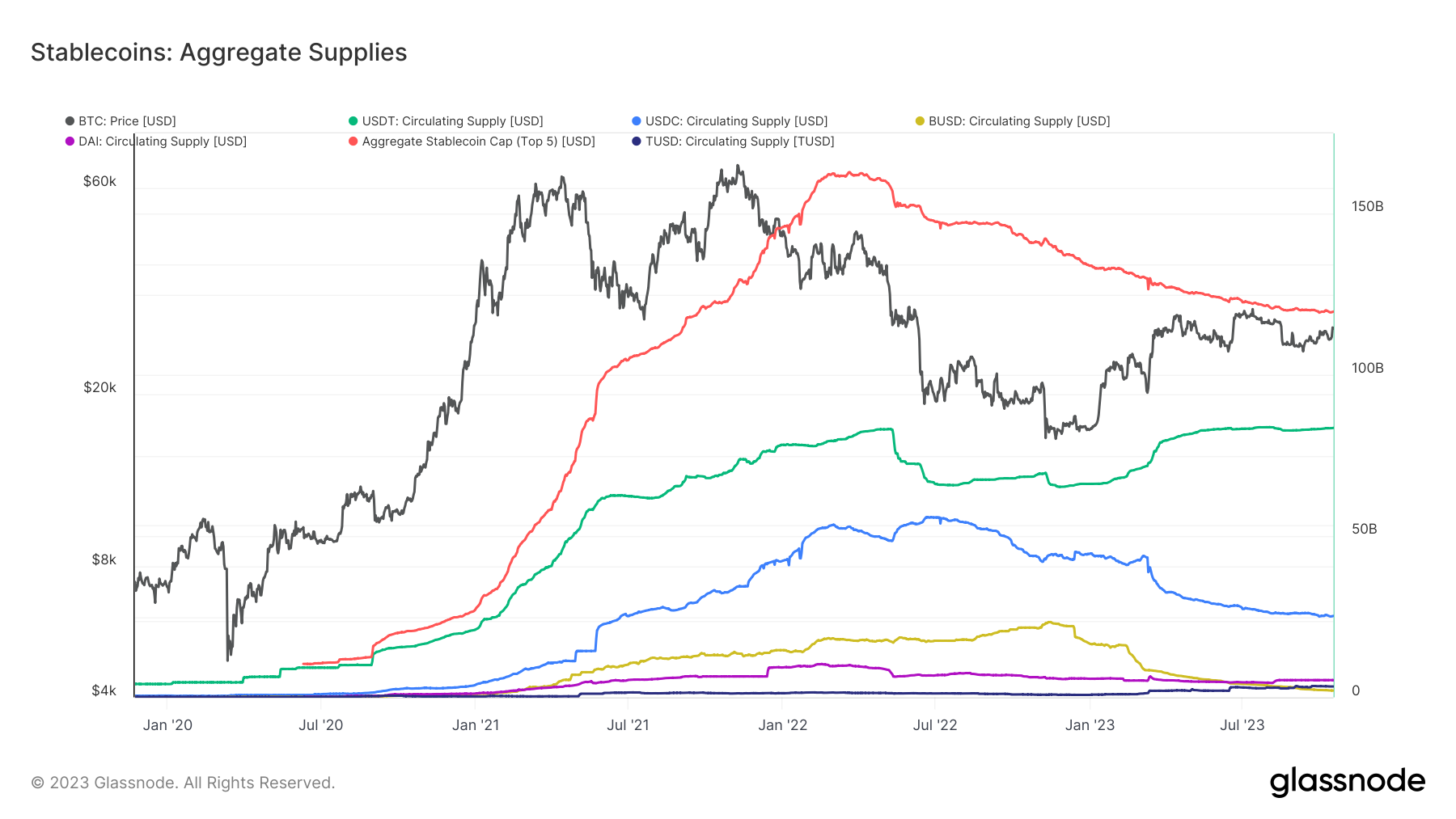

With the aggregate valuation of the top five stablecoins – USDT, USDC, BUSD, DAI, and Tron – currently amounting to approximately $120 billion, stablecoins have become major holders of US Treasuries.

Following concerns over the “cash and cash equivalents” of stablecoin reserves earlier in the current Bitcoin cycle, stablecoin issuers like Tether began migrating to US Treasuries to reduce the risk exposure of reserves.

Tether (USDT) leads the pack with a circulating supply of $83.5 billion, accounting for about 70% of the stablecoin market. Interestingly, this dominance has been on an upward trajectory, while the influence of USDC witnessed a decline from 38% to 21% within 16 months.

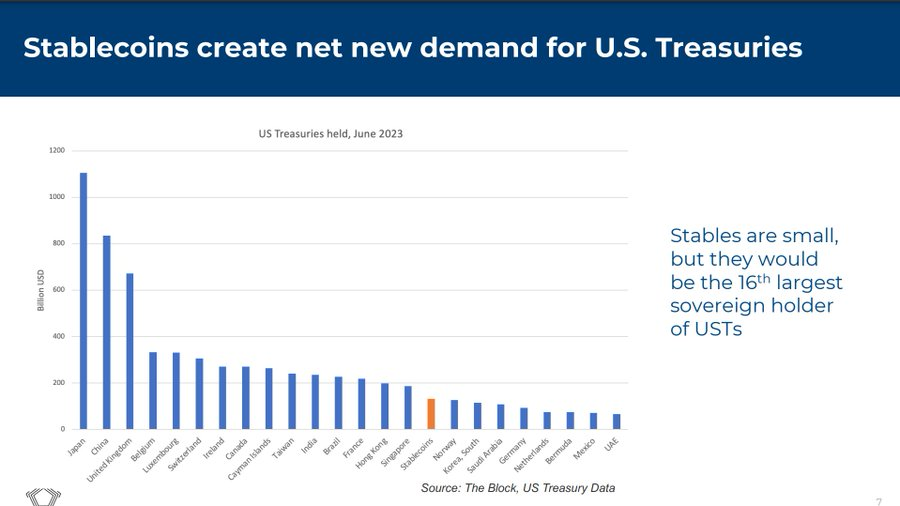

This high valuation places stablecoins as the 16th largest sovereign holder of U.S. treasuries, according to Will Clemente’s analysis using The Block’s data. Clemente suggests that as demand for these digital currencies escalates, they could become even more significant.

This evolving trend aligns with CryptoSlate’s analysis conducted in July, which revealed that Japan and China, the two largest foreign holders of U.S. treasuries, have been reducing their holdings. Consequently, if stablecoin demand continues to surge, they could constitute a more critical segment of U.S. treasury holders, accentuating their influence in the global financial market.

The post Stablecoin companies now 16th largest holder of U.S. treasuries globally – report appeared first on CryptoSlate.

(Bloomberg) — US Treasuries are seen globally as the world’s favored haven asset. Yet it’s short maturities that best fit that definition, according to a Federal Reserve Bank of Dallas paper.

Most Read from Bloomberg

“Not all Treasury securities are equally safe,” according to the paper published Tuesday by economist J. Scott Davis. “Long-term Treasury bonds may have no default risk, but they have liquidity risk and interest-rate risk — when selling the bond prior to maturity, the sales price is sometimes uncertain, especially in times financial market stress.”

“Short-term US safe assets are the assets that are truly safe, and safe haven flows lead to an increase in these short-term inflows, even while long-term inflows fall,” Davis concluded.

These risks were underscored in March amid the US regional banking crisis, when losses on long-term Treasuries and other government-related debt became key forces that brought down several regional banks. There was of course a run on deposits, yet clients’ realization that banks were sitting on large unrealized losses on long-term government debt helped spark the tumult.

World’s Favorite Risk-Free Asset Is Looking Riskier After SVB

The US has a large external debt, particularly in safe assets, Davis writes. In times of crisis, investors view US debt – especially short-term Treasuries — as a harbor.

“In a crisis, when investors prize safety and liquidity, they flock to safe short-term T-bills,” Davis wrote. He laid out how in two recent major financial crises, from 2007 to 2009 and during the onset of the pandemic in 2020, “long-term US portfolio debt inflows fell but short-term portfolio debt inflows increased.”

Supporting US assets overall during these turbulent periods is the fact that the dollar is the world’s reserve currency, tending to appreciate during crises, the economist writes.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.