Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Source link

trends

As the first quarter of 2024 ends, the crypto industry has also seen the conclusion of major events, including ETHDenver. The 2018-launched mythical event has grown as the industry matures, becoming a crucial venue for founders and community members to observe new developments across the crypto ecosystem.

In addition, crypto and blockchain took center stage at the Mobile World Congress in Barcelona, Spain. The event, which took place last week, hosted over 100,000 attendees from over 200 countries and 2,700 exhibitors from different tech sectors.

We sat down with Claudia Richoux, Founder and CEO of Banyan, and Sheraz Ahmed, Managing Partner at STORM, to discuss these conferences, and get a behind-the-scenes look at the trends and key topics for the industry now and in the future. This is what they told us.

“… people actually really don’t know where we’re going or don’t know where we’re headed.”

Sheraz Ahmed, STORM Managing Partner

ETHDenver: A Chat With Filecoin-Based Banyan Founder Claudia Richoux

Claudia Richoux founded Banyan on top of the Filecoin network to empower users and give them control over their data. In that sense, the project is an alternative to Amazon Web Services (AWS), as it pushes for data sovereignty and price optimization for startups and companies.

In a world built on centralized data storage solutions, individuals are at risk of suffering from censorship, but companies face different risks as their operations become more and more reliable on a single point of failure. We spoke with Claudia about this and much more:

Q: What do you think about ETHDenver? What’s the sentiment and overall vibe at the conference, and what are people talking about behind the scenes?

Claudia:

(…) people have been talking a lot about crypto and AI stuff and decentralized compute because that’s really, really exciting. A lot of things like Filecoin (…) we’ve all built storage and so now it’s time to figure out compute; computes really exciting, (it’s) like 60% of most AWS bills that you’re going to see from startups.

So, being able to undercut the prices there and open up more freedom to compute on different platforms is super exciting. That’s something that I’ve seen a lot of the Filecoin stuff. And then at the Ethereum stuff, I’ve seen a lot of re-staking stuff. I went to some ZK (Zero Knowledge) and scaling events that were really interesting as well, and there were a lot of cool toolkits coming out.

Q: Why is data storage and cloud storage so important and why would they be important in the future? And maybe you can talk a little bit about Banyan and what you guys do?

Claudia:

Yeah, for sure. So I mean, a lot of people come at decentralization from the angle of, “oh, it’s so important that we can’t get censored.” And that’s important. However, it’s not important to 90% of the market because most startups are not worried they’re going to get censored. Most large enterprises are not worried that they’re going to get censored. What they are worried about coming from AWS is that AWS is just going to charge them in the same amount of money. Their business will be incredibly dependent on that, (and) there’s nothing they can do and they’re just kind of stuck and they’re (spending) a huge amount of their runway is going into the pocket of AWS.

So I think decentralization is really interesting. Less for the censorship angle, more for the idea of competition. So yeah, if you have 10 different service providers, all of which you can trust because of some combination of cryptographic incentives or notary systems or auditing systems, and they are competing for your business instead of you using AWS (…).

(…) And yeah, if you have that competition, you’re going to have hopefully way lower prices. And we’ve already seen in the open source world that open source software development where you can have one piece of software that is kind of the commons. It’s maintained by a lot of different people who are all contributing to the same piece of software, which can save costs because you’re not duplicating work as much (…).

So, with an open thing where we’re collaborating instead of competing on the development of this new cloud, we can probably drive costs down. We can probably make people fight for a more sensible margin than what AWS is charging people right now. So I think that decentralization is going to be really, really good for cutting cloud costs if we actually execute on this vision and generally just for accessibility of compute resources and making it so that you’re not having as much cloud block and dealing with that. (…) What Banyan does is we take what Filecoin has already built and we make it ready for an enterprise user to use. And that can be a big company, that can be a startup, that can be a small and medium enterprise (…).

(…) we’re very focused on that. When people ask me what I do in Web3, I say, I onboard data on Filecoin. And they’re like, is that a startup? Why is that an entire company? And I think they just, there’s an immense amount of complexity in actually bringing a decentralized startup to the enterprise, but we’re almost in GA, we’re about to launch and finally reaching the exciting part of this journey.

Mobile World Congress: Insights From STORM’s Sheraz Ahmed

Sheraz Ahmed, Managing Partner at STORM, attended the Mobile World Congress and gave us a look into the massive event. While not directly speaking with Richoux, they coincided on several points: the importance of data user ownership, and decentralize data storage solutions as a key sector for the industry. Speaking about the MWC, Sheraz told us:

Q: What do you think about the Mobile World Congress? What were the main topics of the conversation, and how do they intertwine with blockchain and cryptocurrencies? Do you think this technology and assets are important to the conversation?

Sheraz:

(…) I think a core point is that it’s not only about mobile phones, it’s become about mobile technology and interconnectivity play at large. So everything from Wi-Fi 5G, satellite connection and the likes. And I think when you look at that from a broader play of data interconnectivity, because all of these companies, their main business model is the data angle. It was very interesting to discuss, see and even challenge some of those things. Honestly, when I was looking at some of the companies, seeing what they were doing and the likes, and maybe this is my perspective, but I felt like there was a lot of underlying uncertainty, so I’ve been to a few of these conferences before that have like 60,000, 80,000 people, et cetera.

I’ve never seen so much interest in the consultancy, strategic consultancy side of an industry in terms of if you look at who were some of the main pavilions, I mean you had Huawei, that was huge. Some of these huge phone makers, et cetera, et cetera, they are the mobiles of Mobile World Congress. But then if you looked at how busy they were from a retail perspective, yes people would check out the new folks, check new innovation, great. But then if you really looked behind the scenes and saw the equally big consultancy firm pavilions, Deloitte, PWC, et cetera, et cetera, they were as big. So they had invested as much money, and I saw at least twice as big in terms of, or in terms of volume of people that were going there.

And what that meant or what that triggered me to believe is the fact that people actually really don’t know where we’re going or don’t know where we’re headed. There was a huge reliance on consultants to tell big companies what to do. What is their strategy, what should they innovate in now, how should they innovate? And then speaking with some of the consultants themselves, they’re always very macro, very strategic, etc. But it was interesting to see that they themselves are moving away from just consultancy. That is like advisory report. Here you go. This is your strategy. Okay, well if we have the experts in-house, why don’t we build the technology or technology that then we can use to service/support some of these larger organizations on an ongoing basis basis. And I thought that that was quite interesting because they’re essentially innovating in their business model as the innovation landscape moves forward.

But I definitely believe that there is this large wave of, what’s the right way to put it, a form of uncontrolled technological innovation or I feel like everyone’s a bit out of their depths. Things are moving so fast that the larger organizations are building things that they believe are going to be important to the consumers over the next years to come. And they’re building layer on top of layer of innovation that is driven by the money that they’re making and some things that the consultants are telling them and the likes. But it seems like, and again, maybe this is from my perspective, but it does seem like it’s kind of getting out of their hands in some of the innovation that’s going forward (…). But there is a lot of, “oh, what the hell? Technology has definitely made a leap into its next era, it’s next phase, it’s next generation.”

And if you pull that back to the Web3 kind of angle and you look at the metaverse as an aggregation of those kind of four wave technologies, I definitely believe that that is becoming real today with how interconnected we can be through some of those mobile technologies through some of the augmented reality, virtual reality and technologies. Let’s say applications that are coming out or hardware, software that is coming out. And it was quite crazy in terms of, it didn’t necessarily feel like, there was this one kind of common one. Common direction, yes, maybe in a way. But it really felt like there was a lot happening. A lot of people are trying to shoot not in the dark, but shoot in a lot of different places to see okay, where are we headed? And it was kind of a moment as well where you can look at in each moment of uncertainty, chaos, there’s a lot of opportunity. It felt like we were at that pivotal moment and the energy of opportunism was in the air.

Q: Microsoft, JP Morgan, Accenture, and many other big names in one place talking about the emergences of new technologies, such as AI, blockchain, etc., and it seems like every year it is easier to see the likes of Google joining hands with a crypto project, but what are they contributing with? Where can we see these collaborations actually coming to life?

Sheraz:

Yeah, I think today most of the blockchain world is based on centralized cloud storage, cloud computing. And there were quite some applications at the Mobile World Congress that were looking at decentralized forms of cloud storage. Now if you look at the Amazon’s AWS or Google, these kind of companies like Google Cloud is heavily pushing for more blockchain based businesses to run their nodes on their clouds and the likes, right? So I think that was a big push there.

That is a push there definitely that’s foreseeable. I’ve seen a lot of them start pushing more kind of innovation programs that are not only blockchain led, but that some of the ideas that they’re trying to bring in, they want to have some form of distributed technology as an underlying for maybe some properties that blockchain can provide.

So I think that was a big one. It wasn’t really spoken at the Mobile World Congress, but I think the whole zero knowledge kind of privacy side is going to be super important play when it comes to data and especially when it comes to interconnectivity of different devices together and being able to, you don’t want your data to just be flown through different channels and systems left, right and center. You’re going to want to have some form of encrypted, but also privacy filtered innovation or applications that allow you to ensure that what you’re putting into a certain database isn’t going in and out and everywhere. So I think that’s an important one that is coming as well. And I think that’s something that some of the larger organizations are working towards.

Cover image from Dall-E, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin ETFs Threaten Gold’s Dominance As Digitalization Trends Gain Momentum

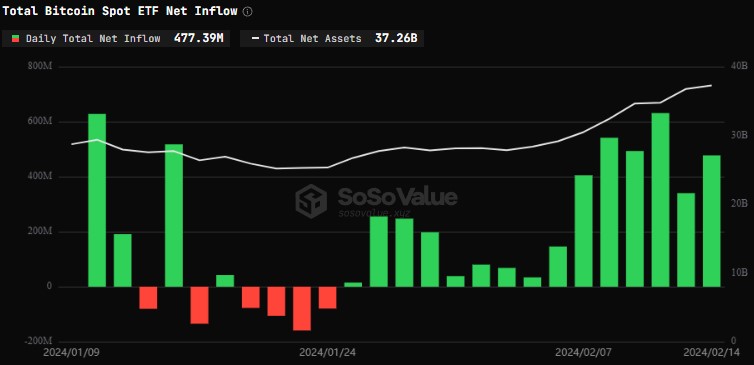

In just over a month since their approval by the US Securities and Exchange Commission (SEC), Bitcoin ETFs have swiftly gained traction in the market, posing a formidable challenge to the long-standing dominance of gold ETFs.

Bitcoin ETFs Gain Ground on Gold ETFs

The rapid rise of Bitcoin ETFs has led to a convergence in asset values, with BTC ETFs closing the gap with gold ETFs. Bitcoin ETFs hold approximately $37 billion in assets after only 25 trading days, while gold ETFs have accumulated $93 billion in over 20 years of trading.

In this regard, Bloomberg’s Senior Commodity Strategist, Mike McGlone, emphasizes the shifting landscape, stating, “Tangible Gold is Losing Luster to Intangible Bitcoin.”

According to McGlone, the US stock market’s continued resilience, the US currency’s strength, and 5% interest rates have presented headwinds for gold. Moreover, as the world increasingly embraces digitalization, the emergence of Bitcoin ETFs in the United States adds further competition to the precious metal.

McGlone further states that while the bias for gold prices remains upward, investors who solely focus on gold may risk falling behind potential paradigm-shifting digitalization trends.

Ultimately, McGlone suggests that investors should consider diversifying their portfolios by incorporating Bitcoin or other digital assets to stay ahead in the evolving investment landscape.

Bitcoin Rally Driven By Institutional Demand

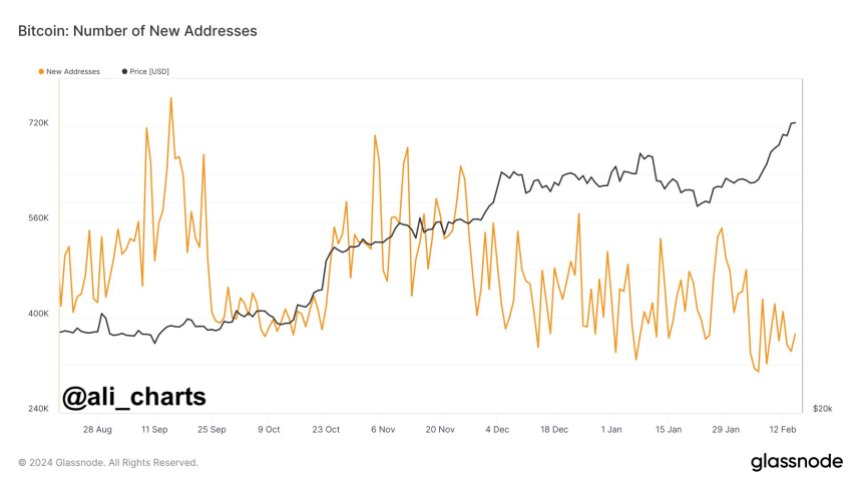

The success of Bitcoin ETFs is further demonstrated by recent data suggesting that the upward trend in Bitcoin prices is driven primarily by institutional demand. At the same time, retail participation appears to be declining.

According to analyst Ali Martinez, as the price of Bitcoin continues to hover between $51,800 and $52,100, there has been a noticeable decrease in the creation of new Bitcoin addresses daily, indicating a lack of retail participation in the current bull rally and highlighting the growing influence of institutional investors in the cryptocurrency market.

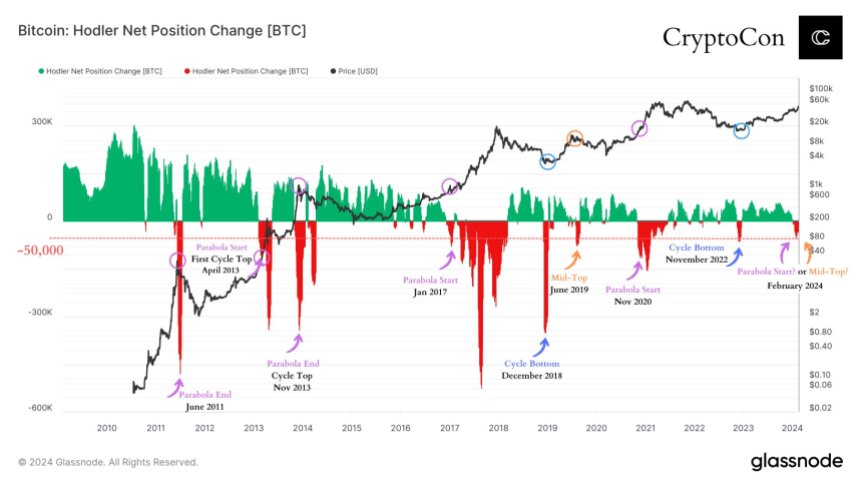

However, market expert Crypto Con points out a significant shift in Long-Term Bitcoin holder positions, signaling a potential downside movement.

As seen in the chart below shared by Crypto Con, the position change line crossed below -50.00 for the first time in over a year, a pattern that has historically occurred at critical moments in Bitcoin’s market cycles. These moments include the cycle bottom, mid-top (which occurred only once), and the start/end of a cycle top parabola (which occurred most frequently).

According to Crypto Con, this recent shift in long-term holder positions raises two possible scenarios: a mid-top or an imminent parabolic movement. Such a movement at this stage in the cycle is considered unusual.

Primarily, it indicates that long-term Bitcoin holders are exiting their positions in significant numbers, possibly anticipating a market correction or a change in the overall trend.

Overall, the shift in Bitcoin holder positions and the decline in retail participation present contrasting dynamics in the current market landscape. While institutional demand continues to drive the price of Bitcoin higher, long-term holders appear to be taking profit or adjusting their positions.

While BTC is currently trading at $51,800, it remains to be seen what the direction of the next move will be and how institutions will continue to influence the price action of the largest cryptocurrency as spot Bitcoin ETFs gain traction.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Renowned analyst Ted (@tedtalksmacro) has offered a detailed forecast for 2024 in the crypto market. His analysis on X (formerly Twitter) touches on several critical points, from macro events, the Bitcoin Halving to fresh liquidity in the market.

This is going to be quite a long post, summing up 2023 and looking ahead to the themes to watch if you’re investing in 2024 – so please bare with me 🫡

✅ Summing up 2023

– China printed almost $1 trillion dollars but failed to push their economy out of the dumps

– US…— ted (@tedtalksmacro) January 11, 2024

#1 Spot Altcoin ETFs

Following the approval of spot Bitcoin ETFs and the anticipated approval of spot Ethereum ETFs, there is an expectation for a broader range of altcoin ETFs to emerge. Ted believes that the success of these initial ETFs will pave the way for more proposals and approvals, potentially by 2025.

He states, “The SEC has laid the precedent for many other crypto products to be proposed and approved, opening up even more avenues for large capital inflows into the crypto asset class.” Ted specifically mentions Solana and XRP as likely candidates for future ETFs. This development is seen as a significant step in attracting substantial capital inflows into the crypto asset class.

#2 The Federal Reserve Ending Quantitative Tightening

Ted forecasts that the Federal Reserve might cease or significantly slow down its current quantitative tightening (QT) program by Q3 of 2024. This prediction is based on the declining cash balance in reverse repos and aims to avoid a repeat of the funding stress experienced in 2019.

“An end to or a dramatic slowdown of the current QT programme could come even earlier though, given the scars of what happened back in 2019 following the monetary tightening of 2018,” he predicts. An end to QT could inject more liquidity into the market, potentially benefiting crypto assets.

#3 Resurgence Of Liquidity In Crypto

After a challenging period of 18 months marked by the collapse of crypto funds and exchanges and central bank tightening, Ted anticipates a return of liquidity to the crypto space. He points to stablecoin liquidity deltas approaching positive territory and the role of spot Bitcoin ETFs in attracting new capital, especially from investors seeking higher returns amid inflationary pressures.

#4 Bitcoin’s Halving Event

The anticipated Bitcoin halving in April 2024 is expected to create both a supply shock (due to reduced mining rewards) and a demand shock (following the approval of spot BTC ETFs). Historically, halvings have catalyzed significant price movements in Bitcoin, and Ted expects a similar pattern in 2024, with potential for substantial price increases following a brief post-halving sell-off.

#5 Inflation Stabilization

On the topic of inflation, Ted observes, “It typically takes 12-18 months for the full effects of changes in monetary policy to be felt in the economy, and we are verging into that territory now.” Despite the base effects of the 2021/22 inflation fading, Ted foresees a slight resurgence in inflation as economies continue to operate robustly.

However, he believes the central banks’ commitment to maintaining higher interest rates will cap the inflation rate below previous highs. He views this as an integral aspect of a strong economy and market.

#6 AI Advancement

Having witnessed AI go mainstream in 2023, Ted predicts 2024 to be a year of unprecedented improvements in AI technologies. This advancement is expected to boost AI stocks, crypto, and related products, enhancing productivity and potentially leading to deflation in developed economies.

#7 Dispelling Recession Fears

Contrary to predictions of a major recession, Ted anticipates continued economic growth, albeit at a slower pace than in 2023. Ted says, “Those calling for a recession akin to 08 or the Great Depression are likely to be disappointed… again.” He attributes this resilience to governments’ aggressive fiscal policies, including substantial cash injections and running large deficits.

#8 China’s Continued Monetary Expansion

Ted notes that China, struggling in the post-COVID era, is likely to continue its aggressive monetary policy, as evidenced by nearly $1 trillion printed in 2023. He draws parallels with Japan’s situation in the 1990s, highlighting China’s focus on stimulating production over its flailing property market.

In summary, Ted’s analysis for 2024 presents a complex and dynamic picture of the crypto market, influenced by macroeconomic factors, regulatory developments, technological advancements, and geopolitical forces. These trends suggest a year of significant opportunities for investors in the crypto space.

At press time, BTC traded at $47,244, up 5.1% in the last 24 hours.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

7 buzzy dining trends for 2024: ‘Porn star’ martinis and a vegan take on Nutella

Are you hungry for change — in the most literal sense?

The new year will likely see many shifts in what Americans eat and sip. It’s the inevitable out-with-the-old and in-with-the-new pattern that has come to define the dining and drinking scene. In fact, some of these trends were already rising to the fore in 2023, but we expect them to fully take hold in 2024. Here are seven examples of what to expect.

The ‘porn star’ martini is the new espresso martini

Americans love their martinis — and especially their martini variations. The espresso martini (which usually mixes vodka, espresso and coffee liqueur) has been all the rage for the last couple of years. Now, the “porn” star” martini, a passion fruit-flavored version, is quickly becoming the “it” one to sip. The drink, a British favorite that is often served with a small glass of Prosecco, dates back to the early 2000s, but has been finding new fans in America of late. A survey from Liquor.com had it ranking as the sixth most popular cocktail, beating out the margarita and the negroni, among other drinks. And Chinola, a Dominican-made passion-fruit liqueur that’s sometimes used in the cocktail, is quickly becoming a staple in the U.S., with distribution growing to at least 20 states.

An assortment of tinned fish offered by the José Gourmet’s ABC+ brand.

José Gourmet

Fancy tinned fish is the new king of the sea

Americans also love their fish, be it fried, broiled or served in a soup or stew. But these days, they’re increasingly looking to tinned (or canned) fish as an alternative. Want proof? Annual U.S. sales have grown from $2.3 billion to $2.7 billion in recent years, according to a recent report. And we’re not just talking about that budget brand of sardines you remember from years ago. Instead, the focus is on fancier imported varieties with creative packaging. The ABC+ line of tinned fish from the Portugal-based José Gourmet company includes such options as croaker in spiced olive oil and fried mussels in marinade.

This Nutella-like spread has the vegan stamp of approval.

Voyage Foods

A vegan Nutella-inspired spread is the new Nutella

Vegan foods have found their way increasingly into the American — and global — diet, with worldwide sales expected to reach $22 billion by 2025, up from $15 billion in 2021. And that has led brands to get creative and find all sorts of alternatives to non-vegan products. A case in point: Voyage Foods’ Hazelnut-Free Roasted Seed Spread. It’s essentially a vegan Nutella, and it tastes just like the real thing. And because it’s nut-free, it’s also a good option for those with nut allergies.

Chanterelle mushrooms are the new portobellos

There was a time when portobellos were considered the “fancy” mushroom. Not anymore, Americans are gravitating to a range of fungi. Baldor, a prominent supplier of gourmet foods, says its sales of three mushroom varieties — chanterelles, pom poms and king trumpets — have each grown by more than 200% in recent months. The chanterelles, with their fruity-nutty flavor, top them all, with a 255% spike.

How about a little truffle flavor to balance the heat?

Truff

Not-so-spicy is the new spicy

Sure, we crave spicy foods, but perhaps only to a point. Those burn-your-mouth-till-it-bleeds sauces and food products (think: the One Chip Challenge) appear to be taking a backseat to more balanced or subtle forms of heat. Consider the growing popularity of the Truff line of sauces that blend heat with truffles. Or consider what spice expert Tony Reed, a culinary director at Spiceology, a retail food chain with an online store, calls the chili of 2024 — namely, guajillo, a pepper with a sweet, tangy and smoky taste and milder heat.

Sauvignon blanc is the new cabernet sauvignon

So much for those hearty red wines, such as cabernet sauvignon, that some of us love to savor — say, alongside a juicy steak. Some white wines are increasingly finding their way onto our tables, experts say, and sauvignon blanc has become an especially popular varietal. The “grape has built a solid reputation for making refreshing, consistent and reasonably priced wines, offering an exciting array of styles, from direct, fruit-forward examples to versions with more complexity and nuance,” said Wine Spectator senior editor MaryAnn Worobiec in a recent story. Fetzer, a popular value-priced brand, has enjoyed so much success with its sauvignon blanc that it added a low-calorie version a couple of years ago.

Walk-ins are the new reservations

Who wants to worry about booking a restaurant table days, if not weeks, in advance? The walk-in is becoming the new way to dine. BentoBox, a restaurant technology company, says walk-in parties are now accounting for nearly 75% of dining traffic. Of course, that doesn’t mean very popular restaurants will be able to accommodate you at the last minute. As always, it never hurts to check before you arrive.

Bitcoin’s dive to $40k triggers massive liquidations amid shifting margin trends

Quick Take

The digital asset market has witnessed Bitcoin’s significant fall in the past 24 hours, dropping from $45,000 to roughly $40,000, resulting in more than $660 million being liquidated, according to Coinglass.

This plunge has brought into focus on the margin used for the open interest in futures contracts. It is noteworthy that the margin in native coins like Bitcoin, rather than USD or stablecoin, has been on a decline. Conversely, cash margins, which are employed by platforms like CME for futures, have seen an upward trend, marking a difference from more retail-focused platforms like Binance, which primarily use more volatile crypto margins.

Since Jan 2, there has been a remarkable increase in cash margin from 275,000 Bitcoin equivalent to 295,000, which has now been reset due to the liquidation event. This is reflective of the total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins such as USDT and BUSD.

Despite the recent price drop, there’s a slight resurgence in the crypto margin, which needs to be closely observed for potential implications.

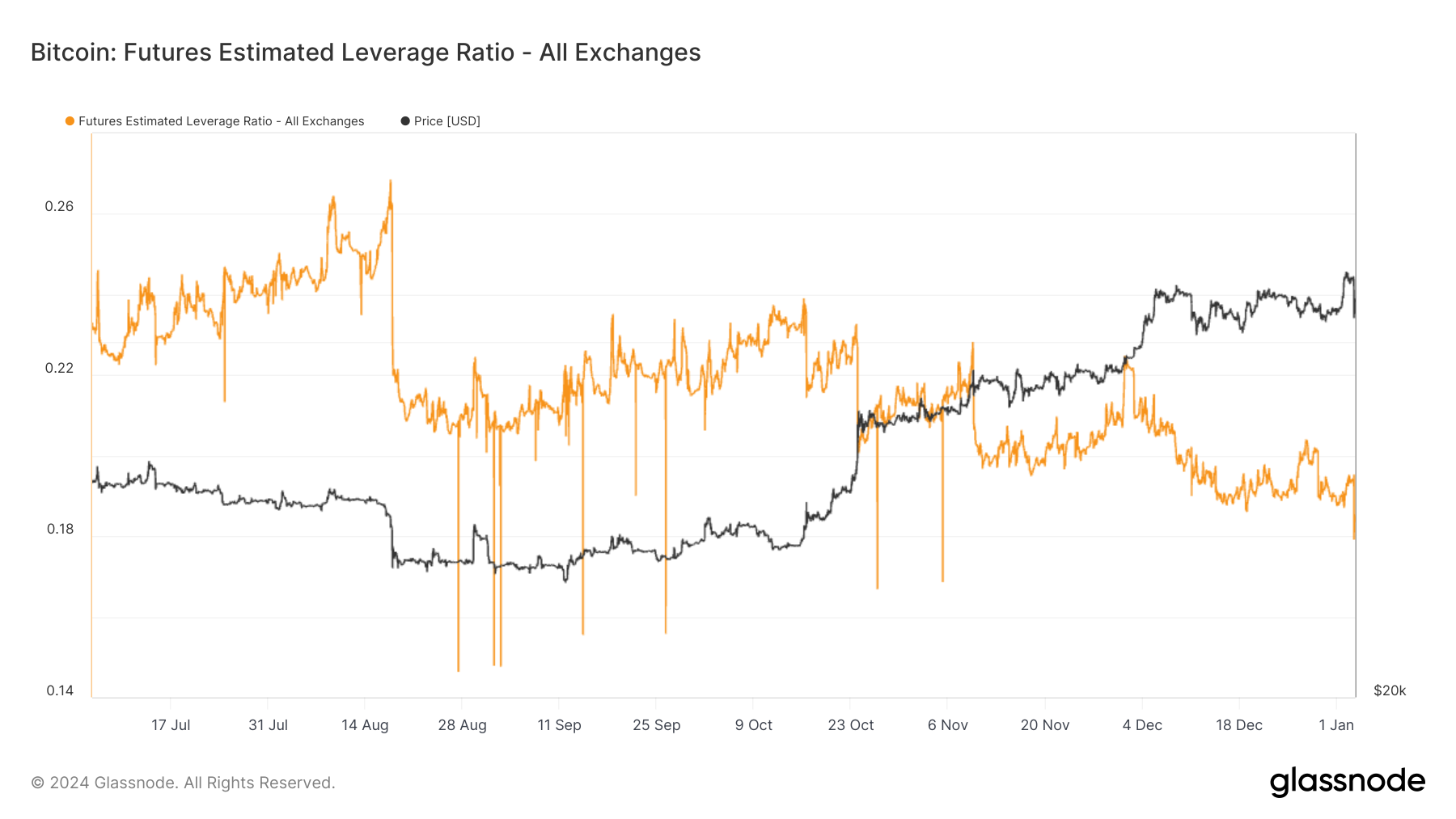

In addition, the Estimated Leverage Ratio, a critical measure of the open interest in futures contracts relative to the exchange’s balance, has dropped to a new low of 0.17, indicating a cleansing of leverage in the system.

The post Bitcoin’s dive to $40k triggers massive liquidations amid shifting margin trends appeared first on CryptoSlate.

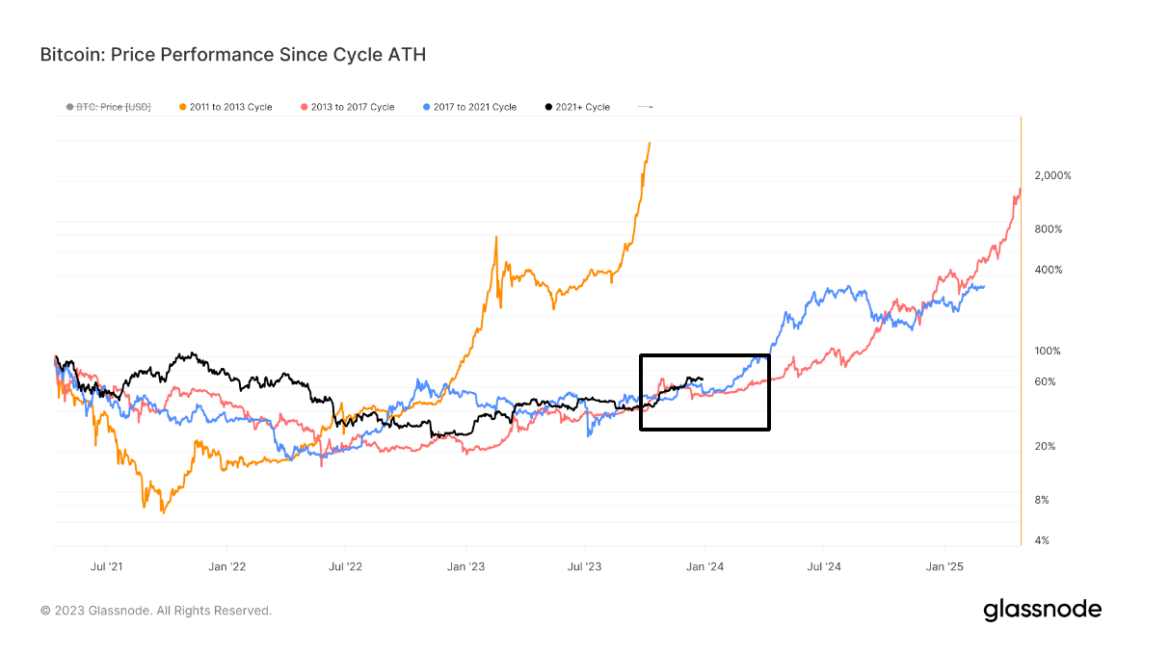

Current Bitcoin cycle outpaces previous market trends while cautiously eyeing historical retracement risks

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

At present, the training and operation of AI models is restricted to large tech companies. Crypto has the potential to help create multi-sided, global, permissionless markets where anyone can contribute data and be compensated for it.

Venture capital firm Andreessen Horowitz (a16z) has released its “big ideas” for 2024, with its crypto arm composing a list of trends to look forward to in crypto in 2024. The list contains trends that the firm’s crypto partners are looking forward to across sectors such as artificial intelligence (AI), decentralization, and modular technology. We spotlight some of them here.

A New Era of Decentralization

Decentralization has been lauded for its use in democratizing systems, fostering competition and ecosystem diversity, and allowing users more choice and ownership. In reality, achieving decentralization at scale has been a challenge, especially when compared to the efficiency and stability offered by centralized systems.

a16z Crypto’s General Council and Head of Decentralization Miles Jennings claimed:

“Over the past few years, more best practices for decentralization have been emerging. These include models for decentralization that can accommodate applications with richer features; and also include methods such as DAOs embracing Machiavellian principles to design more effective decentralized governance that holds leadership accountable.”

Jennings predicts that with the development of such models, we can expect unparalleled levels of decentralized coordination, operational functionality, and innovations.

NFTs Become Ubiquitous Brand Assets

Popular brands such as Starbucks, Nike and Reddit have used NFTs as collectibles and as part of loyalty programs. According to a16z Crypto Research Partner Scott Duke Kominers, brands can use NFTs “to represent and reinforce customer identity and community affiliations; bridge physical goods and their digital representations; and even co-create new products and experiences alongside their most dedicated enthusiasts.”

Kominers predicts that NFTs will become ubiquitous as digital brand assets in the coming year.

The Shift from Play-to-Earn to “Play-and-Earn”

a16z General Partner Arianna Simpson notes that play-to-earn (P2E) is “increasingly morphing into “play-and earn”, setting an important distinction between gaming and workplace. The dynamics of how resulting gaming economies are managed will continue to shift as we see P2E evolve beyond its initial growing pains. Ultimately, however, this will not be a separate trend and will just become part of games.

Improved User Experience (UX)

Eddy Lazzarin, Chief Technology Officer at a16z Crypto, reveals that “developers are actively testing and deploying new tools that could reset frontend UX (user experience) for crypto in the year ahead.”

One such tool is automatically, cryptographically-generated passkeys that simplify signing into websites and sites across devices. Others include programmable, easy-to-manage smart accounts, embedded wallets built into an app for seamless onboarding, MPC (multi-party computation) that helps third parties to support signing without custodying users’ keys and advanced RPC (remote procedure call) endpoints that predict user needs and fin in the gaps.

The Rise of the Modular Tech Stack

A16z Crypto General Partner Ali Yahya states that while monolithic architecture allows deep integration and optimization across what would otherwise be modular boundaries, causing better performance initially, an open-source, modular tech stack is more advantageous. He writes that modular tech “unlocks permissionless innovation; allows participants to specialize; and incentivizes more competition”.

Democratizing of AI Innovation through Blockchain Technology

At present, the training and operation of AI models is restricted to large tech companies. Crypto has the potential to help create multi-sided, global, permissionless markets where anyone can contribute data and be compensated for it. Blockchain can also be used to combat misinformation that could potentially affect society, culture, politics and the economy by, among other things, tracking the origin of online content.

Blockchain-Driven Integrity in AI-Generated Games

Carra Wu, an Investing Partner at a16z, notes that when core game components such as lore, terrain, narrative, and logic are all AI-generated, we will need a way to guarantee that the game maker was credibly neutral. Crypto, with its ability to “understand, diagnose, and penalize when something goes wrong with AI,” helps in this regard.

next

Artificial Intelligence, Blockchain News, Cryptocurrency News, News, Technology News

You have successfully joined our subscriber list.

Bitcoin (BTC), the largest cryptocurrency on the market, has again failed to consolidate and reach the $38,000 level for the third time, as it is currently experiencing a 3% pullback. This has led the community to speculate that a significant retracement may occur before the bullish momentum resumes and the next uptrend begins.

However, renowned crypto analyst Adrian Zduńczyk has recently shed light on Bitcoin’s potential next target of $50,000. Zduńczyk’s analysis considers several crucial factors, including the prevailing bullish market sentiment, the ongoing uptrend, the short-term outlook, miner sentiment, and seasonal trends.

Evidence Of Dominant Bull Market

Zduńczyk notes that the cryptocurrency industry is in a bull market, with Bitcoin reaching a new 52-week high close and experiencing the third wave of the bullish cycle. The correlation between Bitcoin and the S&P 500 has risen, indicating a favorable environment for Bitcoin. High time frame trends are also rising.

Zduńczyk identifies key macro support levels for Bitcoin at $29,000 and $27,000, highlighting growing demand fueled by the anticipation of the approval of spot Bitcoin exchange-traded funds (ETFs) and the upcoming halving event expected in April 2024.

Notably, the daily chart for BTC remains in an uptrend, according to Zduńczyk. He points to a target of $40,000, supported by the appearance of a “golden cross” pattern.

Furthermore, Zduńczyk believes that the rising Simple Moving Average (SMA) 200 serves as “irrefutable evidence” of a dominant bull market since January. These indicators suggest a continuation of the upward trajectory for Bitcoin.

Zduńczyk also identifies key support levels at $35,000 to $35,800, emphasizing that a bullish sentiment prevails as long as Bitcoin remains above these levels.

Zduńczyk Eyes Bitcoin November Target Of $50,000

Currently, Bitcoin is ranging between $35,500 and $38,000, Zduńczyk notes that the momentum bands are widening, indicating an increase in volatility. The rising 50-day Average True Range (ATR) trend supports this observation.

Fear & Greed Index stands at 69, indicating a mixed sentiment among market participants. Miners, on average, are enjoying a profit increase of 23%. Zduńczyk maintains a positive outlook based on these factors.

Regarding seasonal trends, October demonstrated a gain of 27%, exceeding the average performance. Historically, November has been the best month for Bitcoin, which has an average gain of 43%, with a target of around $50,000. Notably, December typically adds 7% to November’s closing price.

Currently, BTC is trading at $36,400, reflecting a 5% and 22% profit over the past fourteen and thirty days, respectively. The focus now shifts to whether BTC’s price can maintain its crucial support levels and sustain its bullish uptrend, potentially reaching the $50,000 milestone supported by historical patterns.

Featured image from Shutterstock, chart from TradingView.com