The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

Source link

triggers

Venom Blockchain Launch Triggers Huge Surge In User Adoption, Surpassing 1 Million In A Single Day

With the growing adoption of blockchain technology in various digital asset infrastructures, a team from Abu Dhabi, known for its wealth from the oil industry, has made a significant entry into the space with the launch of the Venom Blockchain.

Venom Blockchain Market Cap Soars

Venom operates as a foundational Layer 0 blockchain network, equipped with dynamic sharding and a proof of stake (PoS) consensus method. Designed to offer a scalable and efficient infrastructure, this advanced blockchain platform is tailored for the development of diverse products. It seamlessly bridges governmental applications and traditional Web3 projects through its sophisticated mesh network architecture.

The distinguishing feature of the Venom blockchain is its infrastructure, which, according to its official website, is capable of processing 100,000 transactions per second, with an average fee per transaction of just $0.0002.

As a result, the Venom Blockchain is currently attracting significant attention, as evidenced by various metrics. The Venom Blockchain currently boasts a market capitalization of over $5.2 billion and a trading volume of over $200 million, highlighting Abu Dhabi’s interest in the technology.

Over One Million Users In The First Year

The launch of Venom had a significant impact, attracting over one million users in 24 hours, demonstrating the platform’s appeal to investors and developers for building Web3 products.

In addition, the platform reportedly has over 20 projects ready to debut on the platform and several pilot stablecoin initiatives in different countries, underscoring the confidence developers have in its infrastructure.

Overall, the rise of Venom Blockchain underscores Abu Dhabi’s ability to adopt innovation beyond its traditional sectors and demonstrates the emirate’s interest in promoting the advancement of blockchain technology.

On March 27, the native token of the blockchain, VENOM, was listed on KuCoin, leading to a significant price surge of over 27% within 24 hours. Presently, the token is trading at $0.6580, reflecting a recent increase of 3.8% in the past trading hour.

In the past 24 hours, the trading volume of the VENOM token has reached $62,515,705, marking a notable increase of 193.60%, according to CoinGecko data.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

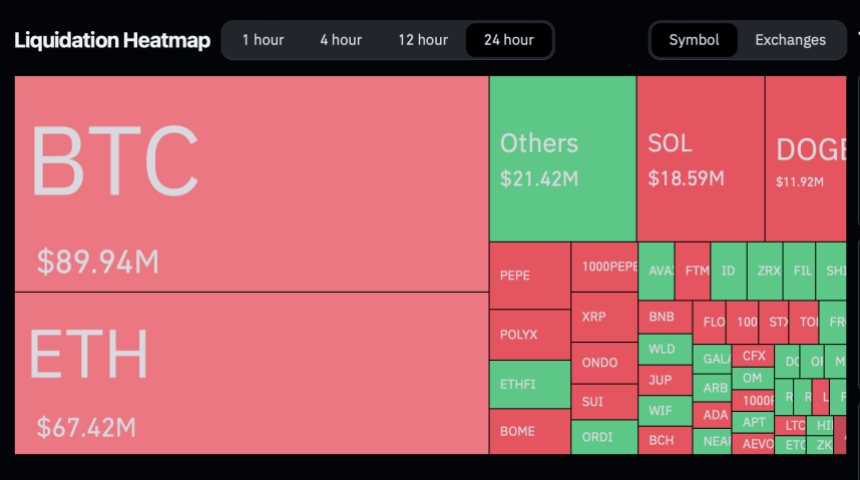

The crypto market has recently experienced a wave of liquidations, amounting to nearly $300 million, closely following Bitcoin’s sharp reclaim of the $67,000 mark.

This surge in Bitcoin’s value, a stark reversal from its previous downtrend, caught many traders off guard, especially those who had placed bets on the continuation of the market’s decline.

Over 80,000 Traders Faces Liquidation

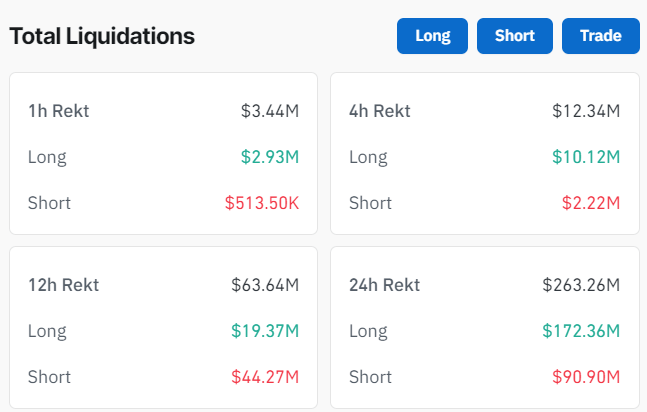

The data provided by Coinglass sheds light on the magnitude of the liquidations, revealing that approximately 86,047 traders suffered losses exceeding $250 million within a mere 24-hour period.

Major exchanges like Binance, OKX, Bybit, and Huobi were the arenas for these significant financial setbacks, with Binance traders bearing the brunt of the liquidations.

Particularly, Binance recorded $128.7 million in liquidations, while other major platforms such as OKX, Bybit, and Huobi also experienced significant liquidations, amounting to $99.87 million, $33.18 million, and $17.70 million, respectively. Meanwhile, despite also facing liquidations, the smaller exchanges had a comparatively minor impact.

Most affected positions were short trades, reflecting a widespread anticipation of a market downturn that did not materialize as expected. Short positions recorded an estimated 57.55% of the liquidations, equivalent to $164.10 million, from traders betting against the market.

On the flip side, long position holders also faced their share of losses, contributing to nearly 40% of the total liquidations, amounting to $121.07 million.

Bitcoin Recovery And Future Prospects

The sharp recovery of Bitcoin, momentarily reclaiming highs above $67,000, has reignited interest in its market behavior and future trajectory.

Despite a 6.6% dip in its market capitalization over the past week, Bitcoin’s value saw a notable 6% increase in the last 24 hours, with its market cap presently sitting above $140 billion. This resurgence in trading activity, with daily volumes climbing from below $60 billion to heights above this mark, signifies renewed investor confidence and heightened trading interest.

Adding to the discourse, cryptocurrency analyst Willy Woo presents an optimistic outlook for Bitcoin, suggesting the possibility of a “double pump” cycle reminiscent of the market patterns observed in 2013.

According to Woo, this pattern could herald two significant price surges for Bitcoin in the coming years, with the first peak anticipated by mid-2024 and a subsequent, more substantial rise in 2025.

While such dual surge scenarios are rare, Woo’s analysis, based on current market conditions and Bitcoin’s growth potential, offers a glimpse into the future of the world’s leading cryptocurrency.

At the rate the #Bitcoin Macro Index is pumping, I wouldn’t be surprised if we get a top by mid-2024, which would hint at a double pump cycle like 2013… a second top in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin’s Swift Climb Triggers Soaring Premium in South Korea During Worldwide Rally

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

Source link

Quick Take

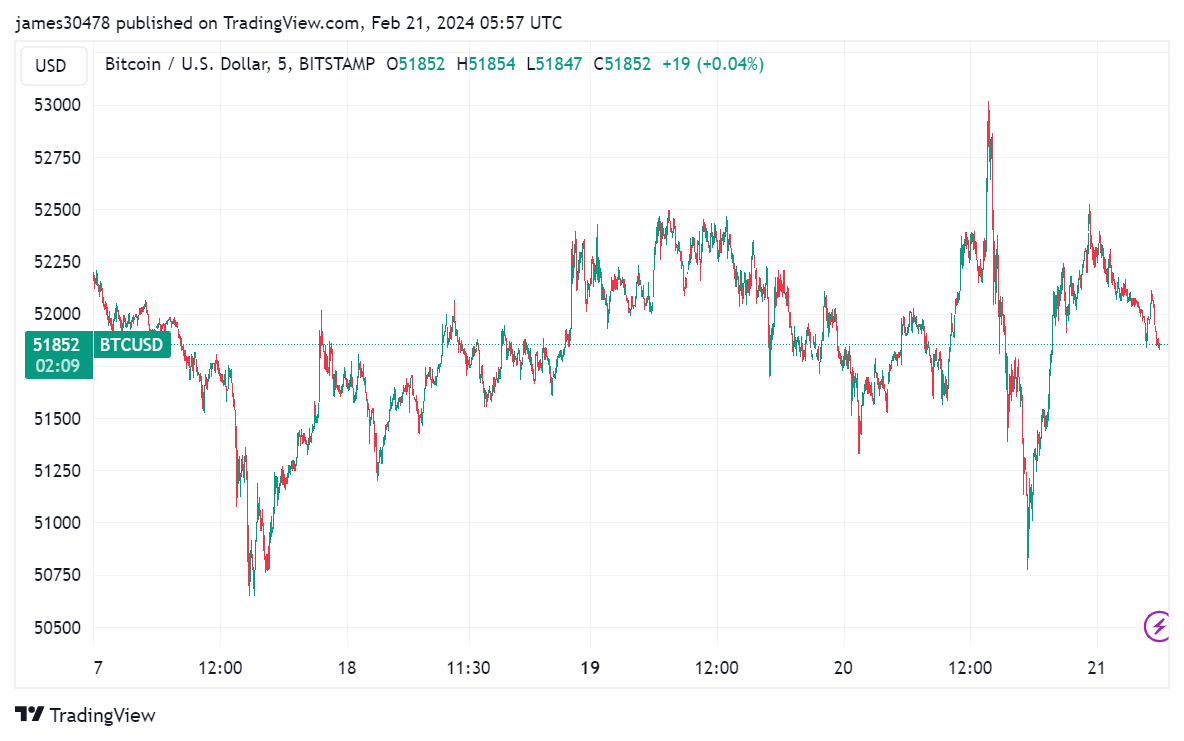

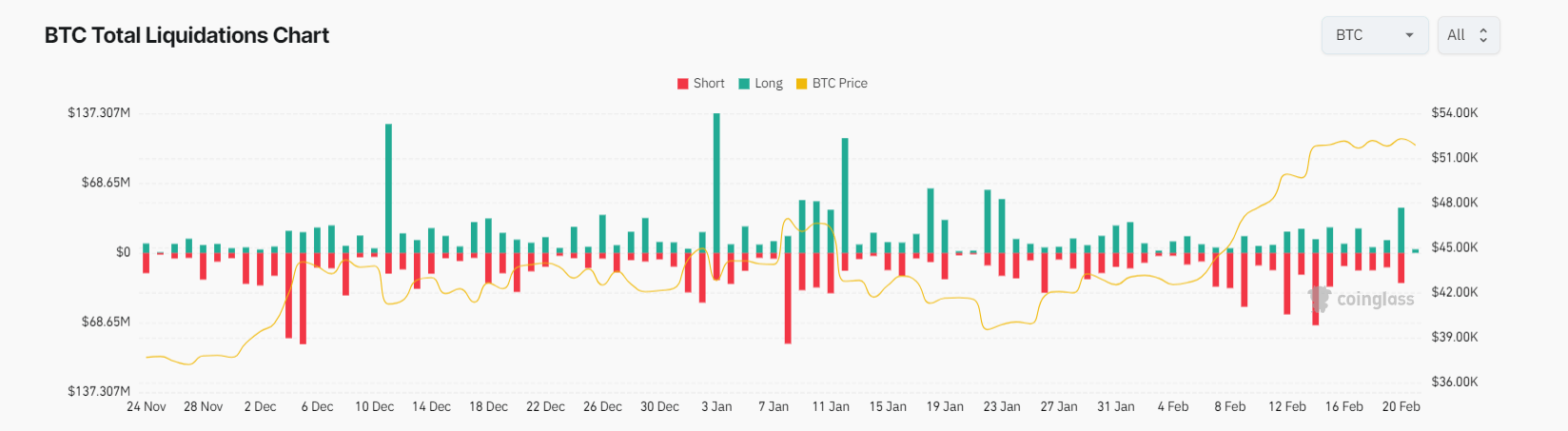

On Feb. 20, just before the US market opened, Bitcoin reached a yearly peak of $53,000, only to retreat into the $50k-$52k range shortly thereafter.

CryptoSlate reports indicate that approximately $1 billion worth of market liquidations were concentrated around Bitcoin’s $53,000 mark. Interestingly, during its short-lived surge to this value, Bitcoin experienced an estimated $70 million worth of these liquidations. While some of these liquidations happened during the rise, the majority are still impending.

In the broader digital asset market, Coinglass reported that the past 24 hours have seen an estimated $260 million in liquidations, with approximately $170 million from longs and $90 million from shorts. Bitcoin bore the brunt of these liquidations, accounting for around $70 million. While, Binance saw the majority of the liquidations from an exchange at approximately $117 million.

Out of Bitcoin’s $70 million liquidation, approximately $40 million was derived from long positions. This accounts for the largest long liquidation since Jan. 23, when Bitcoin was trading around the $40,000 mark.

The post Bitcoin’s climb to a yearly high triggers market shakeup appeared first on CryptoSlate.

Bitcoin’s dive to $40k triggers massive liquidations amid shifting margin trends

Quick Take

The digital asset market has witnessed Bitcoin’s significant fall in the past 24 hours, dropping from $45,000 to roughly $40,000, resulting in more than $660 million being liquidated, according to Coinglass.

This plunge has brought into focus on the margin used for the open interest in futures contracts. It is noteworthy that the margin in native coins like Bitcoin, rather than USD or stablecoin, has been on a decline. Conversely, cash margins, which are employed by platforms like CME for futures, have seen an upward trend, marking a difference from more retail-focused platforms like Binance, which primarily use more volatile crypto margins.

Since Jan 2, there has been a remarkable increase in cash margin from 275,000 Bitcoin equivalent to 295,000, which has now been reset due to the liquidation event. This is reflective of the total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins such as USDT and BUSD.

Despite the recent price drop, there’s a slight resurgence in the crypto margin, which needs to be closely observed for potential implications.

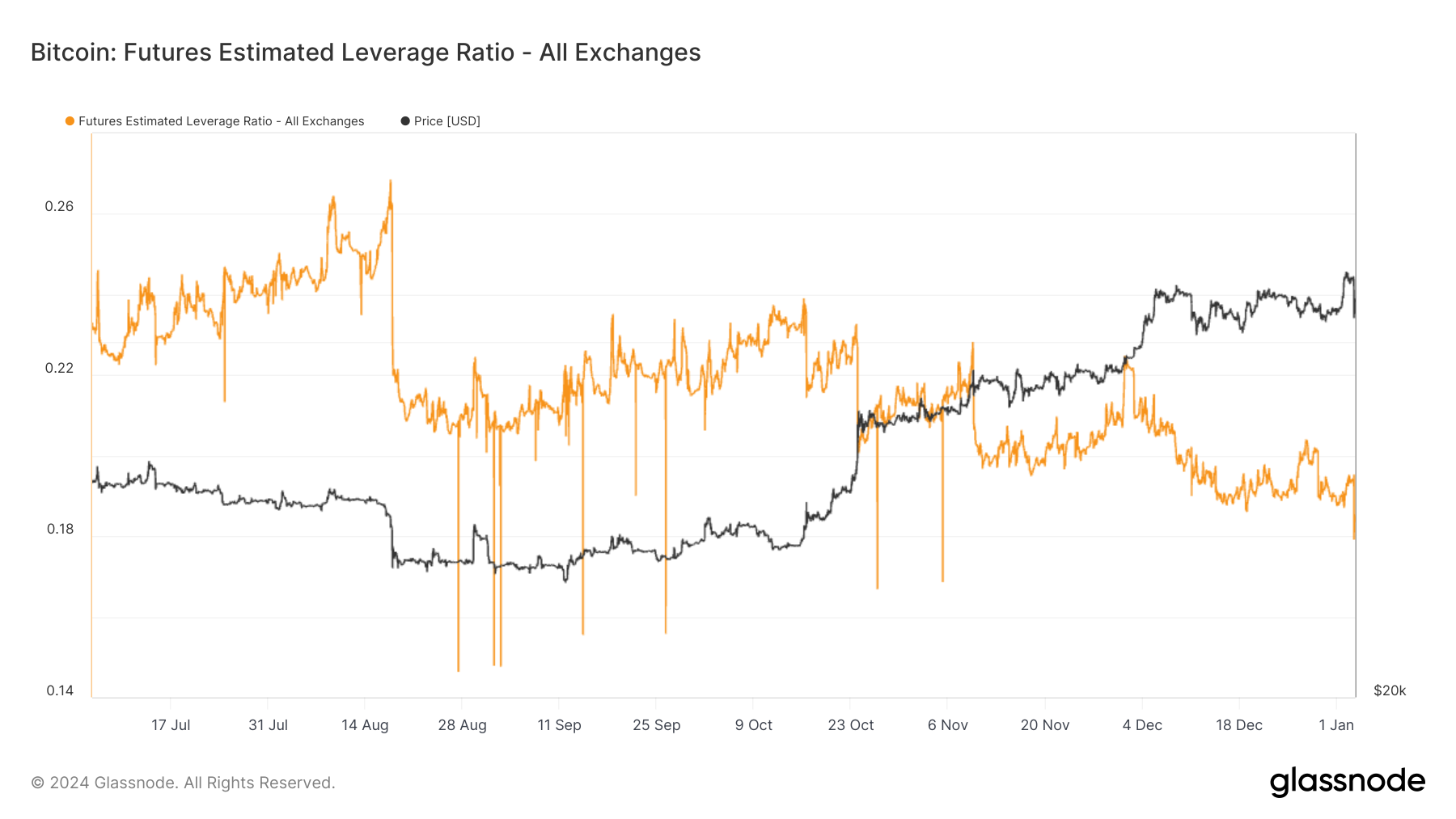

In addition, the Estimated Leverage Ratio, a critical measure of the open interest in futures contracts relative to the exchange’s balance, has dropped to a new low of 0.17, indicating a cleansing of leverage in the system.

The post Bitcoin’s dive to $40k triggers massive liquidations amid shifting margin trends appeared first on CryptoSlate.

OKX delisting triggers price fall for privacy coins Zcash and Monero

The price of several privacy-focused cryptocurrencies, including Zcash (ZEC) and Monero (XMR), fell the past day after crypto exchange OKX said on Dec. 29 that it would delist them on Jan. 5 because they do not align with its listing criteria.

Data from CryptoSlate shows that the entire ‘privacy cryptos’ sector witnessed a decline of 3.4%, impacting major cryptocurrencies across the board. During the reporting period, stalwart privacy coins like Monero and Zcash dipped by 2.4% and 9.37%, respectively.

Other tokens to be delisted by OKX include Dash, Powerpool, and Horizen, which fell by as much as 14% during the reporting period.

“We will delist the above-mentioned trading pairs at the delisting times listed above. We advise users to cancel orders pertaining to these trading pairs before the delisting. Otherwise, the system will automatically cancel these orders. The cancellation may take 1-3 working days,” OKX added.

Concurrently, OKX has halted deposits for the affected cryptocurrencies and intends to cease withdrawals by March 5, 2024, allowing holders adequate time to withdraw their assets. Nevertheless, once the delisting process is complete, trading these digital assets will become impossible.

Curiously, certain privacy coins like MINA remain listed on the exchange, experiencing a 7.5% increase following this delisting announcement.

However, it’s worth noting that OKX is not exclusively delisting privacy tokens. The exchange also included other trading pairs belonging to digital assets like Kusama, Flow, Kyber Network, and Aragon in the assets to be delisted.

Why is OKX delisting privacy coins?

While OKX hasn’t explicitly detailed the reasons behind its decision, observers have suggested that the move might have been influenced by the exchange’s effort to comply with regulatory measures.

Privacy coins have attracted regulatory scrutiny due to concerns about their potential use in illicit activities within the crypto space.

Earlier in the year, Binance said it would delist several privacy coins in compliance with local laws and regulations.

Bitcoin post-Christmas dip under $43k triggers marketwide liquidation of $170M

The crypto market faced significant liquidations of nearly $170 million post-Christmas, triggered by a slight decline in the values of major cryptocurrencies.

Data from CryptoSlate indicates that the largest cryptocurrency by market capitalization, Bitcoin, declined 1.18% to $42,639, reminiscent of its run in the previous week.

Similarly, Ethereum and other large-cap alternative cryptocurrencies like Tron, Avalanche, XRP, and others recorded slight losses during the reporting period.

Conversely, some digital assets like Binance-backed BNB, high-flying Solana, and ORDI showed strength with gains of 5%, 3%, and 13%, respectively.

Solana’s SOL and ORDI are two of the best-performing digital assets of the current year. These cryptocurrencies have generated much interest and adoption from the crypto community heavily investing in them.

$170M liquidated

Coinglass data shows that these asset price movements liquidated $168 million across all assets from more than 70,000 crypto traders during the past day. Long position holders—traders betting on price increases—lost $92.16 million, while traders with bearish sentiments were liquidated $76 million during the reporting period.

Across assets, speculators on BTC price saw the most losses of about $26 million within the last 24 hours, with long traders losing $12.48 million and short positions losing $13.03 million. Notably, the most significant single liquidation order was a $3.15 million long BTC position held on BitMEX.

Similarly, Ethereum traders faced around $21 million in losses, while Solana traders also lost approximately $24 million, with most losses suffered by long traders.

Traders speculating on ORDI price also experienced losses totaling about $22 million. Long traders of the token faced losses of approximately $7.5 million, while those betting against its price lost $13.83 million.

Meanwhile, crypto traders using the embattled Binance platform accounted for more than 40% of the total losses suffered in the market. The exchange users lost $72.25 million, followed by OKX with $51.65 million.

Additionally, traders on Bybit were liquidated for $22.92 million, while Huobi users incurred a total loss of $17.51 million.

Bitcoin, Solana price breakout triggers $180 million in liquidations

The crypto industry saw over $180 million in liquidations between Dec. 20 and Dec. 21, as Bitcoin’s rally pulled the rest of the market upward.

Yesterday, Bitcoin’s price broke past the $44,000 barrier for the first time since early December before retracing to its current value of $43,735, according to CryptoSlate’s data.

Data from Coinglass showed that this price movement resulted in massive losses for traders who were betting against further price increases in the market. Short traders lost $105 million during the last 24 hours.

Meanwhile, traders who thought the bullish movement would continue across the market lost approximately $76 million during the reporting period.

Bitcoin traders lost $48 million, with 70% of the losses coming from short traders.

On the other hand, speculators on the price of Ethereum were liquidated for a total of $38 million. Interestingly, traders betting on ETH price increases contributed to most losses, losing around $23 million.

Traders on Binance, the largest cryptocurrency exchange by trading volume, collectively lost $73 million, while those on OKX were liquidated for $65 million. Traders on other crypto platforms like ByBit and HTX lost a combined sum of $40 million.

Solana leads market

During the past day, Solana’s price broke past the $80 barrier, rallying by 13% to reach a 19-month high of $86, according to CryptoSlate’s data.

Traders who held positions against further SOL price increases lost more than $11 million during the past day.

CryptoSlate reported that SOL’s upward price movement catapulted it to the fifth-largest cryptocurrency by market capitalization, above Ripple’s XRP and other large-cap alternative cryptocurrencies like Avalanche’s AVAX.

ETF optimism continues

Meanwhile, hopes that the U.S. Securities and Exchange Commission (SEC) would approve a spot Bitcoin exchange-traded fund (ETF) remains high as the regulator recently held meetings with BlackRock and Grayscale.

Over the past months, the Gary Gensler-led Commission has consistently engaged with the ETF applicants, fueling speculations that the market might soon witness its first ETF approval. For context, the regulator has met these two applicants nine times within the past month, resulting in the amendments of their applications.

Amid these regulatory engagements, several applicants like Bitwise have rolled out multiple advertisements for their ETFs, stirring further anticipation and interest in the market.

Bitcoin developer’s ‘bug’ claim triggers ORDI token brief dip below $50

Bitcoin (BTC)-based Ordinals (ORDI) price briefly fell under $50 after renowned BTC core developer Luke Dashjr described Inscriptions as bugs on the blockchain network that must be fixed.

In a Dec. 6 post on social media platform X, Dashjr said inscriptions’ were exploiting a vulnerability in Bitcoin Core to spam the blockchain.

Ordinal Inscriptions are digital assets similar to NFTs inscribed on a satoshi, BTC’s lowest denomination. These assets had gained popularity earlier in the year and heralded Bitcoin’s foray into the NFT space.

However, these assets have ignited several debates within the community, with some describing it as an attack on Bitcoin due to its ability to flood the blockchain with data. In contrast, others see it as an evolution of the network.

Dashjr, one of the most prominent critics of Ordinals, stated:

“Bitcoin Core has, since 2013, allowed users to set a limit on the size of extra data in transactions they relay or mine (`-datacarriersize`). By obfuscating their data as program code, Inscriptions bypass this limit.”

CryptoSlate Research previously highlighted how the presence of Ordinals Inscriptions on the network led to longer wait times for transaction confirmations.

For context, data from mempool shows that more than 270,000 transactions were unconfirmed as of press time.

ORDI price briefly fall

Following Dashjr’s statement, Bitcoin Ordinals-based ORDI token price fell below $50 before recovering to $51.49 as of press time, according to CryptoSlate’s data.

Data from CoinGlass shows that the price retracement resulted in nearly $5 million in losses for long traders within the past 4 hours.

The token is one of the best-performing digital assets of the current crypto market bull run, gaining around 377% during the last 30 days to rally to an all-time high of $65, and its market capitalization shot to $1.08 billion during the period.

Despite its price retracement, ORDI’s price is over 2,000% higher than its Sept. 11 all-time low of $2.86.

What next for Ordinals?

Dashjr hinted that the network might soon see an end to Ordinal Inscriptions if the bug is fixed. He said the bug was fixed in Bitcoin Knots v25.1, but the Bitcoin Core remains vulnerable in the upcoming v26 release. He added:

“I can only hope it will finally get fixed before v27 next year.”

However, some community members have described the action as network censorship. Trevor Owens, a venture capital investor in BTC startups, said:

“Whether it gets added to Bitcoin Core v27 or not (hint: it won’t) the inscriptions will never stop. People will pay for them and miners will mine them. As long as the market demands it, there is nothing you can do to stop it.”