U.S. presidential candidate and former President Donald Trump has acknowledged the growing popularity of bitcoin, stating that “a lot of people are doing it” and the crypto has taken on “a life of its own.” Trump further shared: “More and more I’m seeing people wanting to pay bitcoin and you’re seeing something that’s interesting so […]

U.S. presidential candidate and former President Donald Trump has acknowledged the growing popularity of bitcoin, stating that “a lot of people are doing it” and the crypto has taken on “a life of its own.” Trump further shared: “More and more I’m seeing people wanting to pay bitcoin and you’re seeing something that’s interesting so […]

Source link

Trump

Former U.S. President Donald Trump gestures on the day of a court hearing on charges of falsifying business records to cover up a hush money payment to a porn star before the 2016 election, in New York State Supreme Court in Manhattan, New York, on Feb. 15, 2024.

Andrew Kelly | Reuters

Former President Donald Trump is gearing up to fight a massive fine in the New York business fraud case that threatens to erase most of the cash he says he has on hand.

But first, he has to secure a bond — and that might not be so easy.

Trump on Friday was ordered to pay about $355 million in penalties, plus more than $98 million in interest after a judge found the former president liable for fraud for manipulating financial statements given to lenders. Every day, the accruing interest adds $87,502 to Trump’s bill.

Unless he wants to pay the entire penalty while his expected appeal is considered, Trump will need to post an appeal bond. This is typically up to 120% of the judgment plus the current interest.

At that rate, Trump’s original ruling with interest would indicate he will need to secure a bond worth more than $540 million. But it’s unlikely that the real estate baron will be able to use his properties as collateral.

It’s “not very attractive to take real estate as collateral,” said Neil Pedersen, owner of New York-based surety bond agency Pedersen & Sons.

Trump could have to liquidate some assets to secure a bond, said Pedersen. The bond company will also charge a fee that could total millions of dollars.

An appeal of Judge Arthur Engoron’s ruling could take years to play out.

A flag supporting former U.S. President Donald Trump outside Trump Tower in New York on Oct. 1, 2023.

Yuki Iwamura | Bloomberg | Getty Images

Another complicating factor: Trump’s status as a presidential front-runner.

It’s an “unprecedented” situation for a potential bond company to commit to, Pedersen said.

“No one’s ever had to enforce an indemnity agreement against what could very well be the next U.S. president,” he said.

Trump has vowed to appeal Engoron’s ruling, which threatens not just his bottom line, but his entire persona as a mega-rich business genius, one that he has carefully cultivated for decades.

But bond agents may have reservations about working with Trump, whose business practices and claims about his wealth have been successfully challenged in court.

Appeal bonds are used to ensure that a person ordered to pay a judgment cannot misuse the courts to delay or avoid making that payment.

“Whoever is going to bond [Trump] is committing that they’re going to make good on that judgment,” said New York business attorney David Slarskey. “Who’s going to do that?”

Trump, who said in a deposition last year that he had “substantially in excess of $400 million in cash,” could technically deposit the full judgment against him, plus interest, as he challenges the judgment. But his lawyer has already said that he will secure a bond.

“We have to post the bond, which is the full amount and some,” Trump attorney Alina Habba told Fox News on Monday.

“We will be prepared to do that,” she said.

Habba said she expects to post a roughly $400 million bond within a 30-day window to file a notice of appeal, which begins after a court clerk enters Engoron’s final judgment.

Engoron also barred Trump for three years from running a business in New York or applying for loans from financial institutions registered with the state.

Habba also appeared to dismiss a question about whether Trump will have to sell off his New York real estate assets as his legal troubles mount.

But Pedersen warned that doing so could cause its own “headache.”

Those assets are not liquid, so if Trump loses the appeal, the process of converting them to cash could be difficult — perhaps even more so in a case that was centered around disputes about the value of Trump’s properties.

Habba did not immediately respond to questions from CNBC about the process of securing an appeal bond.

Read more CNBC politics coverage

Engoron’s judgment in Manhattan Supreme Court came weeks after a jury in a separate civil case in New York federal court ordered Trump to pay $83.3 million for defaming writer E. Jean Carroll. That’s on top of the $5 million that Trump has already been ordered to pay in a separate defamation case brought by Carroll.

After that case was adjudicated, the former president took the unusual step of setting aside a cash deposit of $5.6 million while he pursued an appeal.

Trump critic and attorney George Conway suggested that Trump was unable to secure an appeal bond from a third party. Trump’s lawyers denied this, saying he merely wanted to avoid additional fees that would be charged by a bond company.

But as Trump’s legal penalties soar past the half-billion-dollar mark, Slarskey and others have predicted that Trump may soon declare bankruptcy.

Forbes estimated Trump’s net worth to be roughly $2.6 billion as of February.

Don’t miss these stories from CNBC PRO:

“‘I signed and was responsible for the Music Modernization Act for Taylor Swift and all other musical artists. Joe Biden didn’t do anything for Taylor, and never will. There’s no way she could endorse crooked Joe Biden, the worst and most corrupt president in the history of our country, and be disloyal to the man who made her so much money.’”

— Former President Donald Trump

That’s former President Donald Trump, who, hours before Super Bowl LVIII, was focused on the romantic partner of one of the star players.

Trump took to Truth Social, his preferred social-media platform, on Sunday afternoon, writing, “There’s no way she could endorse Crooked Joe Biden,” instead of “be[ing] loyal” to Trump, who, in his own stated view, was “the man who made her so much money.”

For what it’s worth, Swift had made quite a bit of money before Trump entered the White House. In 2016, the year before Trump’s inauguration, she was named one of Forbes’ highest-paid celebrities. The outlet said that she raked in $170 million in that year alone. She’s now worth multiples of that number.

Don’t miss (from December 2023): Taylor Swift is Time’s person of the year. Here’s why she’s also been a big financial story in 2023.

The Music Modernization Act, a bipartisan effort, passed both houses unanimously in 2017 before being signed into law by Trump.

Swift has also been at the center of conspiracy theories stirred up by various conservative commentators, including former presidential candidate Vivek Ramaswamy. In short, the theory goes that various entities had been colluding with the National Football League to ensure the Kansas City Chiefs — the team for which Swift’s boyfriend, Travis Kelce, plays tight end — would win, setting up a platform for Swift to endorse President Joe Biden for re-election, perhaps on the field in Las Vegas.

That theory was swatted down by two Republicans on Sunday.

“Taylor Swift is one of the great American success stories,” former candidate Chris Christie said on “Meet the Press” Sunday. “We should be celebrating her, not having all these crazy conspiracy theories. But this is the kind of thing that Donald Trump brings about.”

Marco Rubio, a Republican senator from Florida, said he hoped “we can get rid of these conspiracy theories about Taylor Swift” in his explanation of why he was rooting for a San Francisco 49ers victory.

Kansas City won the Super Bowl in overtime.

From the archives (from October 2018): Flanked by musicians, Trump signs music copyright bill into law

Billionaire investor Leon Cooperman said on Tuesday that he would not vote for President Joe Biden or former President Donald Trump in a hypothetical November rematch.

“We have two candidates running. One’s bad, the other one’s worse. I don’t know who’s bad, I don’t know who’s worse,” Cooperman said on CNBC’s “Squawk Box.”

Cooperman, the chair and CEO of the Omega Family office, has mostly backed Republicans in the past, but says he supported Biden in 2020 as a vote against Trump.

“I will not vote for Biden again. I think he has lost his step. He has allowed himself to be in the pocket of the progressives, which I think are destructive parties,” Cooperman said.

Cooperman, who wrote in Mitt Romney’s name for president in 2016, has been a longtime critic of Trump and said the former president belonged in jail after he was hit with more than 90 criminal charges. Cooperman was also critical of some of Trump’s policies as president and said in 2018 that the trade war he started was dangerous.

“The man has no judgment, but he understands the economy,” Cooperman said of Trump on Tuesday.

Cooperman most recently donated to the presidential campaign of former New Jersey Gov. Chris Christie, according to Federal Election Commission data. He has also donated to the congressional campaigns of Democratic Sen. Joe Manchin and Republican Sen. Rick Scott in recent years.

In the 2016 presidential election cycle, Cooperman gave the individual donor maximum to former Florida Gov. Jeb Bush’s campaign, but he also ended up donating to Hillary Clinton’s campaign as Trump ran away with the Republican nomination.

Biden’s campaign began the year with about $46 million in cash, according to FEC filings, more than the $33 million that Trump’s campaign had. Groups affiliated with Biden’s campaign also started the year with more money, as Trump’s affiliated committees spent almost $50 million last year on lawyers’ bills and related legal fees.

Despite Biden’s strong fundraising numbers, he has struggled in recent polls. His approval rating fell to 37% in a Sunday NBC News poll, the lowest level of his presidency. The poll also found Trump beating Biden 47% to 42% in a hypothetical 2024 rematch.

Don’t miss these stories from CNBC PRO:

Trump leads Biden in 7 swing states and is favored on handling the economy: poll

Former President Donald Trump has an advantage over President Joe Biden in the U.S. states that are likely to decide the 2024 White House race, according to a poll released Wednesday.

Trump gets 48% support on average among swing-state voters, compared with 42% for Biden, according to the Bloomberg News-Morning Consult poll that focused on seven battleground states.

The Republican former president’s edge over the Democratic incumbent was biggest in North Carolina, at 10 percentage points, and smallest in Arizona and Pennsylvania, at 3 points, as shown in the chart below.

Bloomberg News/Morning Consult

Some 51% of swing-state voters said they trusted Trump over Biden to handle the U.S. economy, while 33% said Biden would be better, according to the poll.

Related: Investors are thrilled inflation is down. Regular people aren’t so happy. Here’s why.

And see: Here’s why Biden may not get a political lift from strong GDP growth

On immigration, 52% said Trump would be better on the issue, versus 30% who favored Biden.

One bright spot for Biden’s re-election campaign: 53% of voters in the seven battleground states said they would be unwilling to support Trump in the general election if he were found guilty of a crime, and 55% said they wouldn’t back him if he’s sentenced to prison.

Trump faces charges in Washington, D.C., and in Georgia’s Fulton County in election-interference cases and also was indicted last year in a hush-money case and a classified-documents case. The 45th president has denied wrongdoing and argued the prosecutions are politically motivated. Many Republican voters share his views and have rallied around him.

Other January polls for swing states have shown Biden with an edge. The Democratic incumbent got 47% support among Pennsylvania voters compared with Trump’s 39% in a Susquehanna Polling & Research survey, and he got 45% support in a Michigan poll, versus Trump’s 41%.

But Wednesday’s poll jibes with a New York Times/Siena College survey in November that showed Trump leading Biden by between three and 10 points in five of six battleground states.

Nikki Haley remains in the race for the 2024 GOP presidential nomination, but she’s widely viewed as a longshot, so many analysts have moved on to preparing for a Trump-Biden rematch in the general election.

The main U.S. stock gauges

SPX

DJIA

COMP

were mostly retreating Wednesday as traders awaited a Federal Reserve announcement on interest-rate policy.

Now read: Haley says Trump’s new 10% tariff would mean ‘raising taxes on every single American’

And see: Trump takes credit for stocks’ rally, yet there are expectations his Fed would be ‘not just dovish, but weird’

Former South Carolina Gov. Nikki Haley drew a sharp line Monday between her views on trade and the tariffs proposed by her rival, Republican front-runner Donald Trump.

“This is a man who now wants to go and put 10% tariffs across the board, raising taxes on every single American. Think about that for a second,” Haley said on CNBC’s Squawk Box.

Trump has repeatedly proposed the idea of a blanket 10% tariff on all imported goods.

“What Donald Trump’s about to do, is he’s going to raise every household’s expenses by $2,600 a year,” said Haley, citing a figure from the fiscally conservative National Taxpayers Union.

“It’s going to raise the cost of anything from baby strollers to appliances, under Donald Trump,” she added. “Middle class families can’t afford that.”

In addition to his proposed 10% universal tariff, Trump has also privately discussed a massive 60% tariff that would be applied to all imports from China, The Washington Post reports.

Over the weekend, Trump suggested tariffs were the way to force automobile manufacturers to build cars in the United States.

“[I] would require China, and other countries, through TARIFFS, or otherwise, to build plants here, with our workers,” Trump wrote on Truth Social.

Experts say the impacts of the scale of trade wars that Trump is proposing are difficult to quantify.

“They can’t model that, because they don’t really understand what the second and third order effects are, and more importantly, they don’t grasp that Trump isn’t talking about a 10% tariff just because it’s a 10% tariff,” Michael Every, a global strategist at Rabobank. recently told CNBC.

Trump “is talking about structurally breaking the global system, by hook or by crook, to basically re-industrialize the U.S. … putting up a barrier between it and the rest of the world so it’s cheap to produce in America and more expensive to produce everywhere else if you’re importing into America,” said Every.

The trade war that Trump waged with China while he was in office is estimated to have cost 245,000 American jobs, according to the U.S.-China Business Council.

This, and Trump’s proposed tariffs if he were elected to a second term have left many Wall Street investors deeply concerned about what the global economy would look like in a second Trump administration.

These concerns have accrued to Haley’s benefit, and she has consistently enjoyed backing from Wall Street donors.

Haley was under pressure from these donors to win in New Hampshire after her third-place finish in the Iowa caucuses. Last week, CNBC reported that LinkedIn co-founder Reid Hoffman did not plan to give more money to Haley after her second place finish in New Hampshire.

But this has not slowed down Haley’s fundraising juggernaut. The Haley campaign says it raised $4 million just last week, a massive haul for the former U.N. ambassador’s presidential bid.

The campaign also has more than 10 high-dollar fundraisers scheduled in the coming weeks, several of which will be in New York City on Monday and Tuesday.

The hosts of a Tuesday night event include Home Depot Co-Founder Ken Langone and billionaire investor Stanley Druckenmiller.

Haley also vowed to stay in the race and said her campaign would keep building up to the Feb. 24 South Carolina primary in her home state.

“It’s far from over. And what I’ll tell you is, look, (Trump) has been literally unhinged ever since I got 43% of the vote in New Hampshire,” Haley told CNBC.

Markets ‘complacent’ about the risks of a Trump win, strategist says

Former U.S. President and Republican presidential candidate Donald Trump holds a rally in advance of the New Hampshire presidential primary election in Rochester, New Hampshire, U.S., January 21, 2024.

Mike Segar | Reuters

Markets are “fairly complacent” about the risks of a second Donald Trump presidency, which could trigger a “tantrum” in long-duration bond markets, according to Guillermo Felices, principal and global investment strategist at PGIM.

Wall Street has enjoyed a remarkable rally since November last year, culminating in both the Dow Jones Industrial Average and the S&P 500 hitting record highs on Monday.

Much of the market focus remains on short-term economic data and on what it means for the Federal Reserve’s potential interest rate cutting path this year.

Bullishness in risk assets is driven largely by the consensus that the Fed will begin cutting rates rapidly in the early part of the year, and that the U.S. economy will manage a “soft landing” — bringing inflation back to the Fed’s 2% target without triggering a recession.

Some analysts are also looking ahead through a fiscal and geopolitical lens to November’s U.S. presidential election and beyond.

Trump’s tax reform bill in 2017 cut the top corporate tax rate from 35% to 21%, and he has vowed on the campaign trail to lower it further to 15%, if he is elected to a second spell in the White House.

Risk of a ‘duration tantrum’ in bond market

In an email to CNBC on Monday, Felices said one of the developments that limited PGIM’s optimism versus the market consensus for an economic “soft landing” in the U.S. was that the market has been “fairly complacent about the risks associated with a Trump win, fiscal expansion (e.g. tax cuts, defence budgets) and military conflict escalation.”

“A Trump presidency we think would be positive for the economy in the sense that there would be probably more fiscal stimulus through state tax cuts — the question is what that stimulus does to the bond market, and what’s the backdrop for the economy?”

He explained, “If the economy is still very strong and it doesn’t really require that further fiscal stimulus, the bond market could start getting nervous about debt sustainability and higher interest rates, and therefore we could see higher yields, a bit of a duration tantrum, and risky assets wouldn’t like that.”

The U.S. economy has proven surprisingly resilient in the face of a steep increase in interest rates to combat high inflation over the last two years, with growth and employment remaining robust. Thursday’s fourth-quarter GDP growth estimate will offer further insight into how activity is faring, as the Fed tries to wrestle price increases back to target.

“If the backdrop is one where the economy is a lot weaker, and it deserves that extra fiscal push, then I think the market would be okay and would handle that in a good way — it would be supported. But it really depends on the economic backdrop that the U.S. economy is facing at that time.”

‘Fiscal risk’ at a time of high deficit

The crucial point, Felices acknowledged, is America’s deteriorating fiscal position in recent decades. The U.S. government deficit is projected to run at between 6% and 8% through to the end of the decade, and Fitch projected on Monday that this shortfall would exceed 8% of GDP annually from 2023 to 2025.

This would mean that whoever occupies the White House from January 2025 would have little room for either big government spending pledges or the type of tax cuts Trump is promising, he suggested.

“The market at the moment is not really seeing that two-sided risk. At the moment, the market is pricing in ‘Oh, central banks will save the day again, they will cut rates, and if there is some weakness in the economy, they will cut by more’,” said Felices, a former senior economist at the Bank of England.

“The market is not really focusing too much on the potential upside risks to yields that are associated with this potential repricing of term premia. [Having] fiscal risks with the sort of deficit that the U.S. is running is a really, really important one that the market will have to come to terms with again.”

As such, he suggested that both risk assets and fixed income face a “much choppier” period ahead than investors have experienced over the last year.

As well as the tax cuts, analysts have also flagged risks associated with Trump’s proposed 10% tariff on all U.S. imports, widely criticized as a net negative for the U.S. economy and consumers.

Along with a very different macroeconomic environment, particularly much higher interest rates, the broader geopolitical landscape is also unrecognizable since Trump was last in office.

Felices joined several strategists over the past week, who have argued that the former president’s famously erratic approach to foreign policy decisions carries an added risk to markets and to the economy in the current environment.

Dan Boardman-Weston, CEO of BRI Wealth Management, told CNBC on Monday that Trump’s tendency to “change his mind” on geopolitical alliances — in a world of simmering tensions between China and Taiwan alongside Russia’s war in Ukraine — would lead to “heightened risks” and an added level of uncertainty that would impact market valuations.

Trump NFTs trading volume spike following DeSantis endorsement of Trump’s re-election moves

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

“‘I think they’re both threatening for the markets.’”

— Ray Dalio, founder, Bridgewater Associates

That’s a pessimistic take on the prospect of a 2024 presidential election rematch between President Joe Biden and Donald Trump from billionaire investor Ray Dalio, founder of Bridgewater Associates, in a Tuesday interview with CNBC on the sidelines of the World Economic Forum annual meeting in Davos, Switzerland.

Dalio said his “biggest worry” is over whether both sides will accept the outcome of the election and, moreover, the potential for clashes between the far left and far right that could threaten the authority of other institutions.

Trump was the runaway winner in Iowa’s Republican presidential caucus on Monday, strengthening his status as the front-runner for the party’s nomination and setting the stage for a potential rematch with Biden.

Dalio said concerns around Biden’s vigor underlines the possibility of a “more progressive” Democratic Party vying with a “conservative, nationalistic” Republican party.

Dalio has previously sounded the alarm on an increasingly stark partisan divide, even raising the prospect of “civil war.”

Earlier: Ray Dalio calls McCarthy’s ouster ‘another step away from democracy and toward civil war’ (Oct. 6)

So what’s an investor to do? “You go closer to your neutral portfolio,” Dalio said, observing that aside from concerns about politics he finds that markets right now “are not either super attractive or super unattractive.”

Investors need to figure out what their “neutral” portfolio is and move toward it, he said, emphasizing that such a shift doesn’t mean going to cash “because cash is a trashy investment over a long period of time.”

Stocks were down Monday, with the Dow Jones Industrial Average

DJIA

off around 220 points, or 0.6%, while the S&P 500

SPX

shed 0.3%.

Mark Hulbert: Why Donald Trump is unlikely to get his wish for a 2024 U.S. stock-market crash

Iowa GOP caucuses: Haley now 2nd in latest polls, and here’s key level for Trump

Republican voters in Iowa are getting their customary moment in the spotlight right now, as they’re due to convene their first-in-the-nation caucuses at 8 p.m. Eastern Monday, kicking off the 2024 GOP presidential race.

But it’s not looking like much of a contest, as former President Donald Trump has big leads in most polls over rivals such as Nikki Haley, his former ambassador to the United Nations, and Florida Gov. Ron DeSantis.

So a main focus is whether DeSantis or Haley could get second — and how close they’ll get to the former president.

Another key is what level of support should Trump’s 2024 campaign want to see among Iowa GOP voters? There’s an expectations game in presidential primaries, just as there is with quarterly earnings or economic data.

“The 50% barrier is really critical for him,” said Jim Ellis, president of election analysis firm Ellis Insight and a former GOP congressional aide. “Most of the polling indicates that he can reach or exceed that, and I think he needs to. If he does, that gives him good momentum going the rest of the way.”

Getting support in the low 40s “could be a warning sign” for Trump, but it’s not likely, Ellis added.

The 45th president has 53% support in Iowa polls, according to a RealClearPolitics moving average of surveys as of Friday. DeSantis, whose campaign has bet big on Iowa, has been second in RCP’s average of Iowa polls up until last week. Haley is now No. 2 with 18% support, ahead of DeSantis at 16%.

In New Hampshire, which is scheduled to hold its GOP primary on Jan. 23, Trump gets 44% support vs. 29% for Haley, 11% for former New Jersey Gov. Chris Christie — who recently dropped out of the White House race —- and 7% for DeSantis.

Related: Christie drops out of 2024 GOP presidential race, a move that could help Haley vs. Trump in New Hampshire

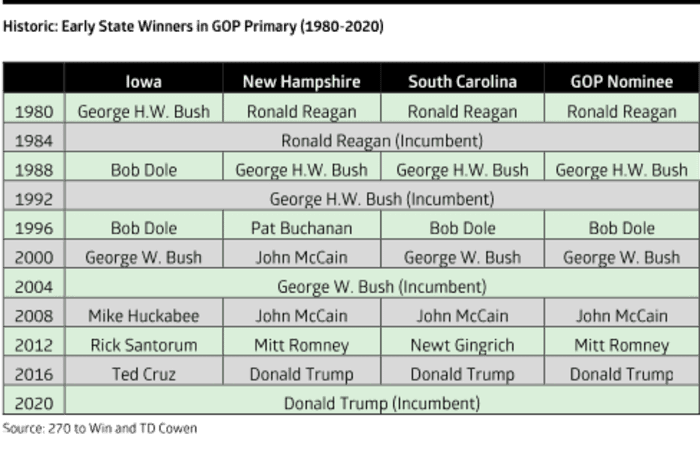

Trump is attempting to become the first non-incumbent Republican presidential candidate to win in both Iowa and New Hampshire, noted Chris Krueger, an analyst at TD Cowen Washington Research Group. Krueger has offered the chart below that illustrates how the Hawkeye State often hasn’t been kind to the candidate who goes on to become the GOP nominee.

If Haley were to get second to Trump in Iowa, topping DeSantis, that would give her momentum going into New Hampshire, where she might be able to score a surprise win, Krueger said in a recent report. The Granite State is “a prime location for a potential Trump ambush” given Haley has been endorsed by popular GOP Gov. Chris Sununu and the primary’s open structure allows Democrats and independents to vote in it.

Haley then might keep her momentum going into her home state of South Carolina’s Feb. 23 primary, as well as into the Super Tuesday races on March 5, but overall this is a “fraught” path, the TD Cowen analyst said. It’s “possible — just not probable,” he wrote.

Betting markets tracked by RealClearPolitics put Trump’s chances for winning the 2024 GOP presidential nomination at 74%, while Haley is at 15% and DeSantis, 5%.

In South Carolina, the former president has 52% support, according to RCP’s moving average, followed by 22% for Haley, a former governor of the state, and 11% for DeSantis.

Related: How betting markets got the 2022 midterm elections wrong

When Trump might clinch the nomination

When might the front-runner put the nomination fight to bed and move on to the general-election battle against President Joe Biden?

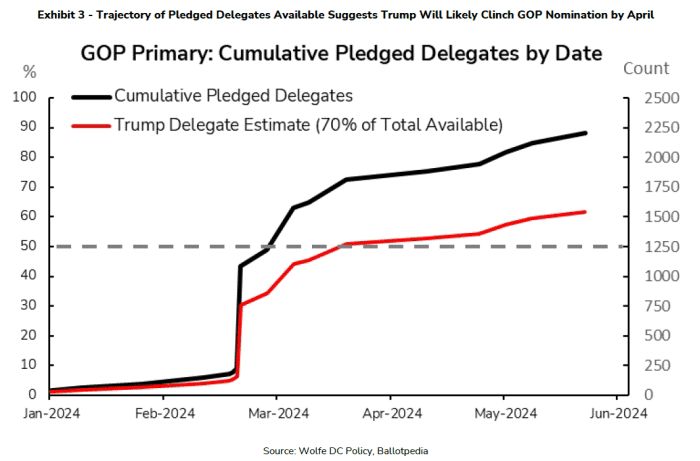

Wolfe Research has offered an assessment of that question that’s illustrated in the chart below. The chart shows the “cumulative percentage of delegates awarded as the nomination calendar proceeds, along with a rough ballpark of where Trump’s delegate count might be tracking if he wins around 70% of the delegates, representing a mix of winner-take-all victories and narrow majorities or strong pluralities in states where Haley makes a good showing,” said Wolfe’s head of policy and politics, Tobin Marcus.

“On this trajectory, even if Haley and/or DeSantis attempt to go the distance rather than dropping out, Trump would formally clinch the nomination by early April, and the writing will be on the wall by early March,” Marcus added. “Note this puts him on track to win the nomination before a verdict is delivered in any of his criminal prosecutions.”

Non-Trump Republican presidential hopefuls might keep their campaigns going because of the former president’s legal troubles.

“There’s an incentive to stay in the race because of the possibility that Trump may be convicted of a criminal offense,” said Stephen Farnsworth, a professor of political science at the University of Mary Washington in Virginia.

“It isn’t just about what the voters in Iowa and New Hampshire think. It’s also what the jurors in various courtrooms around the country think.”

The former president’s GOP rivals are “hoping for a Hail Mary — some dramatic change in circumstances — that allows you to win over support that is now pretty much locked in for Trump,” Farnsworth told MarketWatch.

Trump faces charges in Washington, D.C., and Georgia’s Fulton County in election-interference cases and also was indicted last year in a hush-money case and a classified-documents case. He has denied wrongdoing and argued the charges are politically motivated, and many Republican primary voters share his views and have rallied around him.

Don’t miss: DeSantis says his Disney fight was to ‘protect our kids,’ while Haley says government shouldn’t bully businesses

And see: Here’s how the Iowa caucuses work

Economic plans from DeSantis, Haley and Trump

In his economic plan, DeSantis has leaned heavily into energy

XLE

policy for addressing inflation, and he’s promised to rein in spending and criticized the Trump administration’s outlays.

Haley’s economic proposals include raising Social Security’s retirement age but only for younger people just entering the system, along with eliminating the federal tax on gasoline

RB00,

Trump’s ideas for a second term include a 10% tariff on all imports, making another attempt to end Obamacare

XLV

and addressing student debt by launching a free online college called the American Academy.

Now read: Here’s how the 2024 presidential candidates say they’ll tackle elevated home prices

And see: As Biden touts his Inflation Reduction Act, analysts size up how Trump might repeal it