According to Ricardo Da Ros, CEO of the crypto platform Patex, many crypto users in Latin America (LATAM) seem to prefer using centralized exchanges (CEXs) over decentralized ones. He attributes this preference to a culture in the region that “has been built on trust in authority.” Da Ros suggests that this culture, combined with the […]

According to Ricardo Da Ros, CEO of the crypto platform Patex, many crypto users in Latin America (LATAM) seem to prefer using centralized exchanges (CEXs) over decentralized ones. He attributes this preference to a culture in the region that “has been built on trust in authority.” Da Ros suggests that this culture, combined with the […]

Source link

Trust

Grayscale Aims to Launch Mini Bitcoin Trust for Lower Fees and Tax Benefits

Grayscale has revealed the submission of an S-1 form to the U.S. Securities and Exchange Commission (SEC) for the launch of a new, smaller version of its popular Grayscale Bitcoin Trust (GBTC). This initiative is designed to provide shareholders with exposure to bitcoin, reduced fees and potential tax benefits. Grayscale Unveils Bitcoin Mini Trust With […]

Grayscale has revealed the submission of an S-1 form to the U.S. Securities and Exchange Commission (SEC) for the launch of a new, smaller version of its popular Grayscale Bitcoin Trust (GBTC). This initiative is designed to provide shareholders with exposure to bitcoin, reduced fees and potential tax benefits. Grayscale Unveils Bitcoin Mini Trust With […]

Source link

My husband secretly set up a trust that includes our home. What should I do?

My husband and I married 10 years ago. It was a second marriage for both of us. I recently found out that after five years of marriage, he put all of our assets into trusts controlled by him alone. At that time, at his request, I also gave up a job that I loved passionately so we could establish a stable home for his youngest daughter. He also has three other children who had already launched.

Instead of having a high-level job with bonuses and accolades, I ran one of his companies with no pay. I also drove his daughter’s carpool, allowed his adult son and his son’s children to move in with us, and ran our home in a smooth and efficient manner. I acted as a good steward of his assets so he could maximize his retirement and investments. I also added substantial assets to our portfolio with my “hobby” of real-estate investing.

I’m a team player and thought that upon retirement we would live the life we dreamed about during the early days of our marriage — I expected he would retire at 65 and we would travel the world. Our portfolio is worth 10 times what it was when we married. His retirement account and several IRAs were opened after we were married.

Irrevocable trust for his children

He put everything, even our home and my investment properties, into a trust, with his friend as trustee. I had been the beneficiary of his retirement account, but now the trust is. I believe this change of beneficiary was forged. He invested in a company that stands to make a lot of money, and that investment was put into an irrevocable trust for his children only. His children have quit their jobs to create startups with funding from their dad. At 69, he feels he can’t retire because he’s helping his kids.

I told him that if I outlived him, I would give everything I inherited from him to his children, and my assets would go to my family. When confronted about the trusts, he said he assumed I’d be OK with that because of my promise to give his assets to his kids. I’m not even a 50% beneficiary. I’m terrified his kids will boot me out of my home or declare me incompetent when I’m a little old lady just trying to sit on the beach. I don’t even have kids of my own to look out for me.

He can’t understand why I’m upset. Now I’m nearing retirement age with no extra investments in my retirement account, no credit for the work I’ve done and no say in my assets. I don’t even have a work history for the past 10 years and can’t get a job. Is this even legal? If I bring an attorney in, it will ruin the marriage. I can’t even contest the will because it states if anyone contests the will, they will have nothing.

With most things, I’m smart. But gosh, I’ve been so stupid. What are my options?

Second-Class Wife

“Transparency is key to marital estate planning.”

MarketWatch illustration

Dear Ex-Wife,

Secret trusts and a possible forgery do not constitute a healthy marriage.

There’s nothing stopping a spouse from setting up a trust during a marriage, but they should do so with separate assets. To set up a trust with separate assets without telling your spouse is bad manners, but to create a trust with both separate and marital assets, in secret, is a recipe for a legal battle and divorce court. Marital assets are those that are accumulated during the marriage.

Sometimes in life, you have to make a choice: You can stand back and allow your husband to squirrel away marital property and thereby “save” your marriage on paper — even though he has broken your faith in him and in the marriage. Or you can call a lawyer and perhaps a forensic accountant to examine the contents of the trust and trace their origins, and thereby risk your marriage.

“While there are legitimate reasons for a spouse to set up a trust during marriage, sometimes it is done in order to improperly shield assets from equitable distribution,” according to Jewell Law PLLC in New York. “Often, the non-beneficiary spouse is not aware of the trust or thinks the money came from another source such as a family member.”

Transparency is key to marital estate planning. “A trust set up in one spouse’s name can be considered separate property regardless of whether it is set up before or after marriage,” the law firm adds. “However, when it is created during a marriage, the non-beneficiary spouse must raise the question of whether any marital assets have been put into the trust.”

“This is a situation in which a prenuptial agreement could have been helpful to confirm — and protect — the rights of each spouse in the event of divorce or death,” says Neil V. Carbone, a partner at Farrell Fritz, P.C. ”State law governs a spouse’s inheritance rights. Most states provide a surviving spouse with a minimum ‘elective’ share, that is, the right to take a share of a deceased spouse’s property regardless of what a will or revocable lifetime trust agreement provides.”

“The idea of the elective share is to avoid the complete disinheritance of a surviving spouse, so ‘no contest’ clauses are ineffective to defeat the demand for an elective share,” he adds. “What goes into the elective share ‘pot’ will vary from state to state. For example, in New York, life insurance is not included in determining the elective share. Some people may seek to defeat a spouse’s elective share rights by transferring property to an irrevocable trust, but they generally must survive a look-back period in order for the transferred property to be excluded.”

Potential forgery

Some retirement plans require a spouse to be the primary beneficiary. If your husband changed the beneficiary on a qualified retirement plan without your consent this should be challenged. Other retirement plans, such as IRAs, do not carry the same spousal-consent requirements. You can read more about what plans are covered under the Retirement Equity Act here.

Many people are surprised to learn that 401(k)s and IRAs are treated differently,” Carbone says. The former are governed by the Employee Retirement Income Security Act of 1974 and, typically, a spouse must consent in writing to have someone else named as beneficiary, he adds. “IRAs are not governed by ERISA and the spouse’s consent is not required to designate a non-spouse as a beneficiary.” If your husband did forge your consent on a 401(k) beneficiary designation form, you should act ASAP.

While you process that information, I have other questions for you to mull over: What are you hanging onto? The illusion of a happy marriage? The promise of financial security, even though that seems increasingly unlikely? The damage to your marriage has already been done by your husband. By hiring a lawyer after so many years of acquiescing to his requests, you would be merely cleaning up the fallout from his actions.

One final piece of advice: If you are considering divorce, you would be better off waiting until your 10th wedding anniversary. After that date, you will be able to receive spousal Social Security benefits. If he earned more than you during your marriage, you are entitled to a maximum of 50% of your husband’s full retirement benefit.

You’ve given up a lot for your husband. Yes, you did it willingly, but you contributed your time and financial expertise to your husband’s businesses, and any right-thinking divorce court would not be likely to look kindly on your husband’s actions. Not all stepmothers abide by their promise to distribute assets to their late spouse’s children, but this is not an excuse for his actions.

In addition to forgery and financial skullduggery, you can add gaslighting to the list of his misdeeds.

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter.

The Moneyist regrets he cannot reply to questions individually.

Previous columns by Quentin Fottrell:

I have $1.5 million in stocks and bonds. I asked my broker to convert my bonds to cash. He didn’t and my portfolio fell by $100,000. Can I sue?

‘She was very special to me’: My late 98-year-old cousin was targeted by grifters. They stole $800,000. Do I have any recourse?

‘It was a mistake’: My father set up a revocable trust, leaving everything to my stepmother. She’s cutting me out completely. What can I do?

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to the Moneyist or posting your dilemmas on the Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Grayscale Debuts Privacy-Focused ETF Featuring Zcash Trust Allocation

According to a recent Form N-1A, Grayscale has approached the U.S. Securities and Exchange Commission (SEC) with a proposal for a unique exchange-traded fund (ETF) dedicated to the privacy and cybersecurity realm. The Grayscale Privacy ETF aims to be the first to encapsulate the burgeoning sector of privacy technology and cybersecurity. Privacy Takes Center Stage […]

According to a recent Form N-1A, Grayscale has approached the U.S. Securities and Exchange Commission (SEC) with a proposal for a unique exchange-traded fund (ETF) dedicated to the privacy and cybersecurity realm. The Grayscale Privacy ETF aims to be the first to encapsulate the burgeoning sector of privacy technology and cybersecurity. Privacy Takes Center Stage […]

Source link

My father accidentally set up a revocable trust leaving everything to my stepmom

My late father was under the impression that he and my stepmother had an irrevocable trust set up. He was wrong. He passed away in September and now we have learned it is actually a revocable trust. It was a mistake. My stepmom is letting her son handle things for her, and has talked her into changing the trust so that he will get everything when she passes, so he can help take care of her sister who has mental-health issues.

This will effectively cut me and my siblings out of any part of my father’s estate. Everything, including their home was supposed to go into the trust, and when both my father and stepmother ended up passing, the home was supposed to be sold and all proceeds split evenly between all of their beneficiaries, including my siblings and me. Is there anything we can do to assure my father’s wishes are granted?

Daughter/Stepdaughter

Related: My estate is worth millions of dollars. How do I stop my daughters’ husbands from getting their hands on it?

“Many obstacles lie ahead. The burden of proof lies on your doorstep, and you should be cognizant of the statute of limitations in your state.”

MarketWatch illustration

Dear Daughter,

It is stories such as this that give all the wonderful stepmothers out there a bad rap.

There are a few possibilities here: 1) Your father set up a revocable trust by accident and did not properly understand the difference between the two trusts; 2) he set up a joint trust where only his portion of the assets became irrevocable upon his death; or 3) he at some point changed his mind and set up a revocable trust, and left his assets for his second wife to distribute to his respective heirs. Even if #1 occurred, it would be up to you to prove this in a court of law, with the help of an attorney, in the event you contested the terms of this trust. Keep in mind, there are many variables that go into creating a trust, so it highly depends on the terms laid out.

But many obstacles lie ahead. The burden of proof lies on your doorstep, and you should be cognizant of the statute of limitations in your state. “Trust contests must be brought within a certain period following the grantor’s death,” says Brian Liberis, senior estate planner at EP Wealth Advisors, based in Boston, Mass. “So if a court action is necessary, it should be undertaken as soon as possible. In addition, you would likely have the burden to prove that the trust did not reflect your father’s intentions and that a mistake was indeed made.”

“However, some revocable trusts are drafted so that they continue to be revocable until the death of the second spouse,” Liberis told MarketWatch. “If that were the case here, then your stepmother would likely have the authority to change the entire trust and redirect the assets to her children. If that is how this trust was drafted, then your only recourse would be to contest the trust in court, on the grounds that it should be modified/reformed due to a ‘mistake.’ That is, the trust as drafted did not reflect your father’s intentions.”

Principles of fairness

Obtain a copy of the trust, so your attorney can review the terms, and see if there was any evidence that it was poorly constructed and/or if only a share of the assets are revocable. “You would be asking the court to modify/reform the trust on principles of ‘equity,’ or fairness,” Liberis adds. “If, at the time it was executed, it was intended that, upon the death of the second spouse, the property passed 50/50 to the children of each spouse, then principles of fairness would dictate that the trust be reformed to ensure that result — or, at least, so you would argue.”

Your stepmother appears to be intent on ensuring the assets in the revocable trust — or the part of the trust that is revocable — will be inherited by her son. That may be an expensive lesson for you and your father; the surviving spouse will not always adhere to their late partner’s wishes. Whether it’s a large or a small amount of money, the second wife or husband can come to believe that they deserve or are entitled to their late partner’s entire estate. We could argue about the ethics of cutting you out of the picture, but your focus should be her legal entitlement.

If you are successful in your endeavors, be aware that assets deposited in a revocable trust typically receive a step-up in basis, so any capital gains are effectively wiped out. That would, of course, benefit your stepmother. So if he left a $1 million home that was originally purchased for $500,000, any capital gains would be calculated on the home’s value at the time of your father’s death, thus saving her money if she sold it. However, assets in an irrevocable trust may not receive a step-up in basis if they were not included in your father’s taxable estate.

If men were more likely to outlive their wives — women tend to outlive men by about six years, a gap that could narrow or widen depending on the age gap between a couple — step children would be writing more letters about their stepfather. In this column, letters about stepmother’s emptying bank accounts are more prevalent than stepfather’s doing the same thing. But children are also likely to disagree with their father’s wishes, if they believe he has been too generous to his second wife. In the meantime, I wish you a painless resolution to your trust debacle.

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter.

The Moneyist regrets he cannot reply to questions individually.

Previous columns by Quentin Fottrell:

‘I grew up pretty poor’: I got an annual bonus. After I pay off my credit cards, I’ll have $10,000. What should I do with it?

‘I received an insurance-claim check for $22,000’: Why on earth does it take five days for my check to clear?

‘I want to protect my family’: My wealthy father, 49, is marrying his third wife. How do I broach the subject of my inheritance?

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to the Moneyist or posting your dilemmas on the Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Grayscale Bitcoin Trust hits new low for outflows with $429 million leaving fund

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

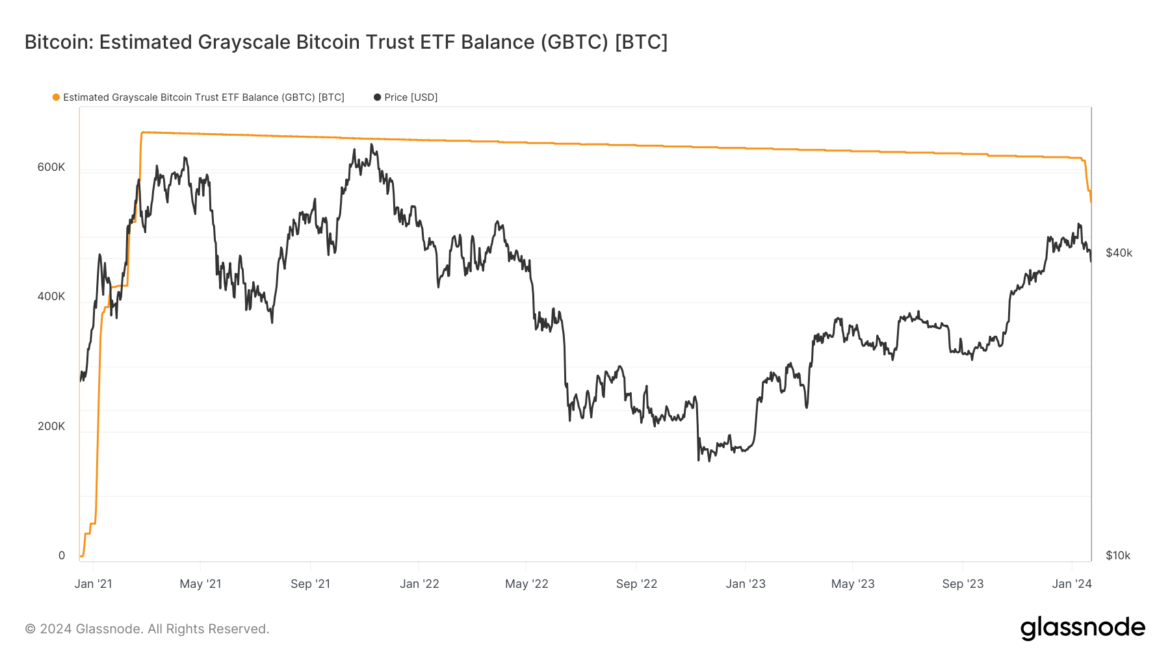

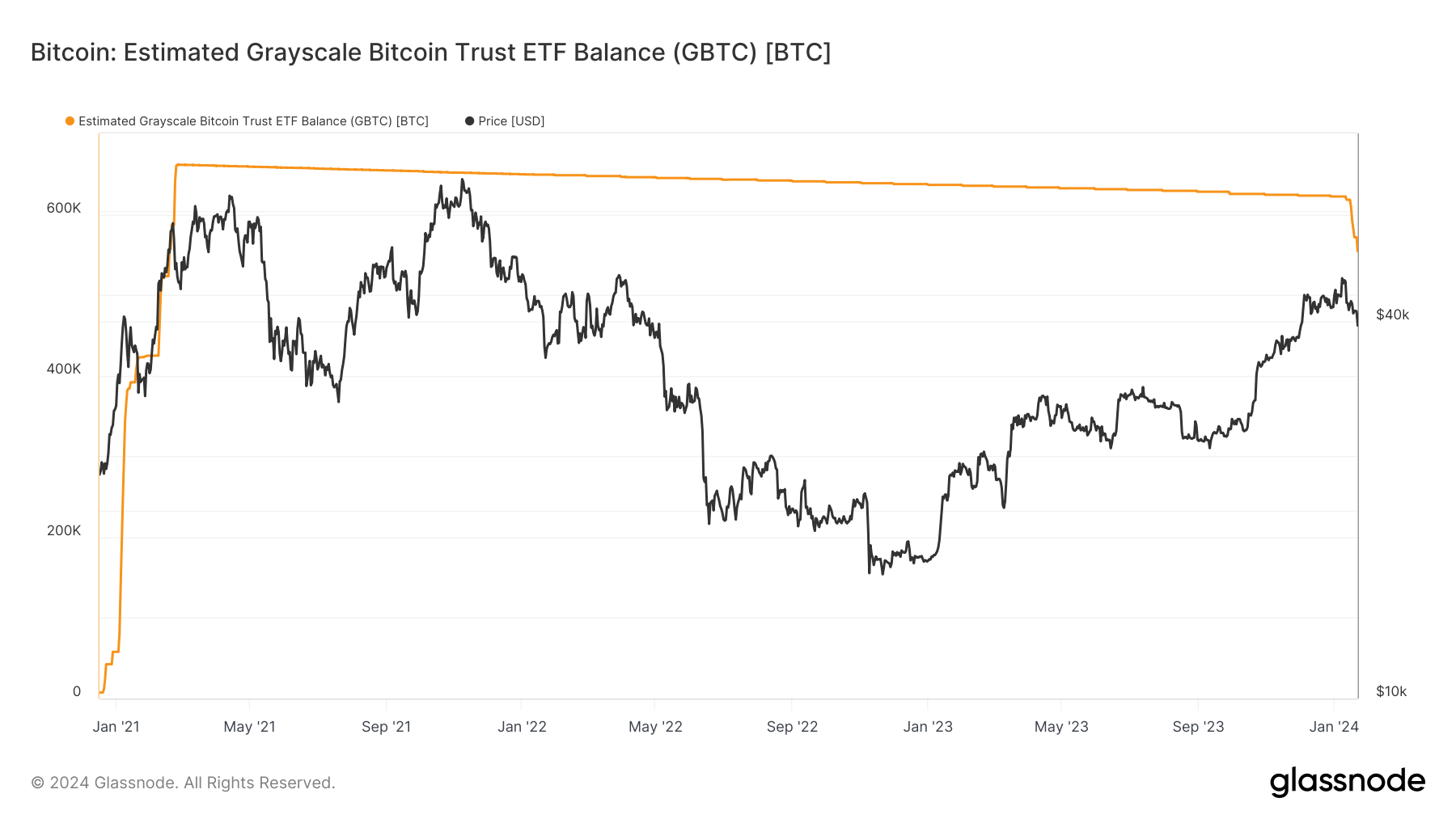

Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow

Quick Take

Recent data analysis from Glassnode reveals a substantial decrease in the balance of the Grayscale Bitcoin Trust ETF (GBTC), now estimated at around 553,000 Bitcoin, which is roughly 12% down from its high of 630,000 Bitcoin.

A key contributing factor to this decline appears to be the increasing outflows, which have been estimated at around $3.5 billion over its seven most recent trading days. These outflows are on the rise while the discount to the Net Asset Value (NAV) continues to close, currently roughly -0.11%, according to Y Charts. As this discount continues to narrow, the market may witness a further surge in GBTC selling.

Similarly, the digital asset exchange FTX reports significant sales nearing $1 billion, resulting from FTX’s bankruptcy estate offloading approximately 22 million shares, according to CoinDesk. Some of the outflows from GBTC have been redeemed into spot Bitcoin ETFs, roughly a third, according to Bloomberg analysts. However, it is noteworthy that about a third of the GBTC outflows ended up in USD, not in ETF vehicles, due to the FTX bankruptcy.

The post Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow appeared first on CryptoSlate.

Recently, the blockchain intelligence firm ChainArgos brought to light some unsettling findings about the Polygon network. According to ChainArgos, suspicious transaction patterns have emerged, raising questions about Polygon’s adherence to its initial token allocation plan.

ChainArgos’ investigation revealed multiple transactions from Polygon’s network to various exchanges seemed “questionable.” Particularly, the firm pointed out “anomalies” in the flow of tokens from Polygon’s vesting contract, which is responsible for the systematic release of tokens.

This contract, distinct from the foundation contract that governs overall allocations, displayed inconsistencies in outflow patterns. The firm’s latest analysis, detailed in a series of posts on X, scrutinizes the movement of significant quantities of MATIC tokens, Polygon’s native cryptocurrency.

Concerns Over Large MATIC Transfers

The investigative reports from ChainArgos delved deeper into the token flows. The firm noted that a specific wallet received approximately 470 million MATIC from two sources – the foundation and an insider wallet, particularly 340 million and 170 million, respectively.

The largest transfer identified was linked to a wallet associated with the plasma bridge, including two additional transactions to untagged wallets.

Adding to the intrigue, ChainArgos observed that a sum of 178 million MATIC was transferred to the prominent exchange Binance, with the last transaction dated May 23, 2021. These findings were substantiated by a chart from Etherscan, illustrating the token movements.

5/ All 178mm were sent from 0x30b7 to binance.

Last transfer 23-May-2021. Check the price chart friends. pic.twitter.com/iT6CVCOxtz

— ChainArgos (@ChainArgos) January 18, 2024

In the wake of these revelations, Polygon’s native token, MATIC, has experienced significant market turbulence. Over the past week, the cryptocurrency decreased by exceeding 10%, with a 4.2% drop in just the past 24 hours.

MATIC is valued at $0.81 at the time of writing, marking a mere 2.5% increase over the past month. This bearish performance contrasts sharply with the broader altcoin market, which has generally shown substantial gains during the same period.

The declining market position of MATIC is reflected in its slide to the 16th rank among cryptocurrencies by market capitalization. Furthermore, its trading volume has plummeted from over $1 billion last Thursday to a mere $493 million, indicating a significant reduction in trading activity.

Analysts’ Take On MATIC’s Future

Despite these challenges, some analysts remain optimistic about MATIC’s prospects. Crypto analyst Ali, for instance, predicts a potential rebound for MATIC soon. Ali’s bullish stance is grounded in the TD Sequential indicator, a tool to pinpoint trend exhaustion and imminent price reversals.

Ali’s analysis suggests that the TD indicator currently signals a buy opportunity for MATIC. He contends that if buying pressure intensifies around its current price levels, MATIC could experience a notable upswing.

#Polygon | The TD Sequential presents a buy signal on $MATIC 4-hour chart.

A spike in buying pressure around the current levels could see #MATIC rebound, potentially toward $0.88, and even as high as $0.96. pic.twitter.com/lj96zgPh7k

— Ali (@ali_charts) January 6, 2024

His projections point to a potential climb towards the $0.88 to $0.96 range, translating to an approximate 16% increase from its current valuation. This optimistic forecast assumes that Polygon’s underlying technology and market position can outweigh the recent concerns raised by ChainArgos’ findings.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Should I give up my job to spend time with my son — and dip into my trust fund?

My long-term boyfriend and I, both 45, finally had our first child last year after years of trying.

Due to our age and some other factors, he is likely to be our only child. He is the light of my life, and I’m realizing that as I only get one chance to experience these magical early years with him, I hate that I’m doing it while also working full-time, robbing me of the precious little time I have with him as a toddler.

I am the primary earner in our household, making about $150,000 a year in an intense job. My boyfriend has been out of work for over a year after a failed attempt at switching industries, and probably won’t have a new job for a little while longer as he recalibrates what’s next.

Though I’m very successful in my career, the birth of my son has cemented for me that I hate the 9-to-5 grind, and it’s not what I want to do for the next 20 years. I would love to work for myself, with a flexible schedule that allows me to spend more time with my son each day.

Passive-income streams

Since he’s been born, I’ve been researching ways to both do that as well as building some other passive-income streams. In an ideal world, I’d love to start those up and get them moving so that I can leave my job in the next 7 to 8 months.

My main concern is that I’m terrified that, no matter what I cobble together, I won’t match my current income with the new plan. While I’m hopeful my boyfriend will also get a new job in that time period, I’m thinking conservatively and only accounting for one income (mine) in this plan.

Before we had our son we were in a great financial spot — all housing costs were coming in at under 30% of my pay and I was maxing out my 401(k). However, with childcare costs and his lack of income we’re now basically living paycheck to paycheck. If I am able to take on this new self-employed dream some costs (childcare) would go down, but others would increase.

Six-figure trust fund

There’s one catch, though. I have a trust fund that is worth a very high six figures. I rarely ever touch it: I mainly look at it as an enormous emergency savings fund should the bottom fall out of the economy like it did in 2008.

But the other day, as I struggled to crank out numbers for this new life plan, it hit me that I could just take from the trust to supplement any shortfall. In four to five years when my son is in school, if my self employment isn’t working out I could always reenter the traditional labor force.

But this plan scares me, simply because I’ve always viewed my trust fund as my safety net, and I’d be depleting it. Is this a good idea? A bonkers idea? What else should I be thinking about?

For context, it’s not my only source of investments: I currently have about $395,000 in my 401(k) and Roth IRA, a $10,000 “slush fund” investment account, and about $80,000 in company stock, with more stock due to vest over the course of my (potential) remaining time at the company.

I have an emergency cash fund in a high-yield savings account, but I’ve had to pull from it lately so it doesn’t even cover three months of expenses right now. So should I go for it? Money I can always earn, but this time with my son I will never get back.

Time is Fleeting

“Wait until your boyfriend finds a job before making any move.”

MarketWatch illustration

Dear Time is Fleeting,

First, a warning: There’s no magic bullet.

Of course, we should all — in an ideal world — feel fulfilled by our jobs and partners and life, but our wantonness will keep us looking for more ways to find that magic elixir. Happiness is an inside job. When you change one thing in your life, you may realize that there is something else that you need to fix, and then something else, like a house that always needs repairs, and never quite suits your needs. One of my favorite pieces of advice: “Listen to your body because your mind lies through its teeth.” Don’t act from a place of fear, anger or ego. Listen to how you feel.

If your trust fund can buy anything, however, it’s peace of mind for the future. I agree that it should be used to help you maintain a semblance of contentment for the here-and-now. There’s no point having a six-figure trust fund with high six figures if — like a treasured china tea set — you are not going to tap it at the most critical and important times of your life. If you want to spend the next couple of years with your son, instead of paying for childcare, you could do it. One major caveat: Wait until your boyfriend finds a job before making any move.

Millions of parents are in your boat. Weekly daycare costs for children in the U.S. are now running at $284 per week, up 54% over the previous decade, according to Care.com. If you can save that money, and withdraw from your trust fund over, say, the next two years, it is essentially fulfilling part of its purpose. You don’t say what profession you are in, but women who take time out of their careers to raise their children obviously lose promotional opportunities and, when they return to the workforce, their pay tends to fall behind that of their peers.

MarketWatch recently built a tool that uses Department of Labor data to show the average cost of childcare by county and how that compares to your income. As MarketWatch reported when the tool was launched: The average cost of center-based group care infant childcare in Queens County, N.Y. was $23,635 in 2022. A family would need to make at least $337,647 per year for that to be 7% of their income. The median annual income for families in Queens in 2020 was $81,193, so they would need to spend roughly 26% of their income on childcare.

In the meantime, ask your employer if you can work remotely two days a week and/or see if you can move to a part-time schedule. It may be that you can keep your job and spend more time with your son, too. It may not be an all-or-nothing scenario. If you do decide to give up your job for now, and you are in a career that you could easily return to in the event that your business idea does not work out, and your boyfriend finds work, you will be in a more secure position to take a career break. So many “ifs.” But you’re right. You won’t get this time again.

Talk to a financial adviser and a therapist because it’s almost always a bad idea to make a financial decision based on emotion. Of course, we should have agency over our own lives, but bringing in third-party help will bring a fresh, independent perspective. Sometimes, we often think, ‘If I could just change this one thing, I’d be happy.’ But that’s often our mind and emotions playing tricks on us. What you don’t want to happen is one year down the line, feeling overwhelmed with full-time childcare, and wondering why you gave up a $150,000 job.

Give yourself some time to get used to having this new person in your life, and see how the next six months play out.

More from Quentin Fottrell:

My father has dementia and ‘forgave’ my brother’s $200,000 house loan. The nursing-home notary said he was of sound mind. What can we do?

My husband bought our house with an inheritance. I signed a quitclaim. He said I could live there after he dies, but changed his mind. What now?

Low-paying jobs are the economy’s way of saying you should get a better job’: I’ve decided to stop tipping, except at restaurants. Am I wrong?

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter. The Moneyist regrets he cannot reply to questions individually.

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Readers write to me with all sorts of dilemmas. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to the Moneyist or posting your dilemmas on the Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Grayscale’s Bitcoin Trust (GBTC) has seen a 4% increase in its value during pre-market trading

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.