An index tracking the strength of the U.S. dollar against a basket of rivals touched its highest level since mid-November on Tuesday, adding to the headwinds facing U.S. stocks.

Source link

U.S

World’s biggest shipping firm dumps port cargo problem on U.S. companies

MSC, the largest ocean carrier in the world, has joined the list of ocean carriers terminating the delivery of diverted containers outside of the port for shipping clients as a result of the container ship accident near the Port of Baltimore that led to the tragic bridge collapse. With the Baltimore port indefinitely closed, the decision places the onus of cargo pick up at a diverted port and transport to its final destination on the shipper.

In an email to customers obtained by CNBC on Thursday, MSC explained that for customer containers already on the water bound for the Port of Baltimore, cargo will be rerouted and discharged at an alternate port where it will be made available for pick-up.

“For these shipments, the contract of carriage will be declared terminated at this alternate port and storage, D&Ds and on-carriage costs to the initially intended destination will be for the sole cargo’s account,” the MSC advisory said.

MSC added that “passage to and from Baltimore is at this time impossible and will not be reestablished for several weeks if not months.”

CMA CGM, COSCO, and Evergreen were the first carriers to announce similar moves and in some cases formally declare “force majeure,” a legal term which refers to the right to waive contract duties when events beyond a party’s control occur.

MSC said in its customer communication that it “apologizes for the disruption caused by this contingency plan which is required in response to events beyond our control, but which is taken in compliance with the terms of the contract of carriage.”

MSC did not immediately respond to CNBC’s request for comment.

Maersk is the only major carrier to say it will provide transport from diverted ports for customers.

Maersk was the charter of the Dali, 10,000-container capacity containership that lost control and crashed into the Francis Scott Key Bridge in the early hours of Tuesday.

After the pandemic boom which led to historic profits, ocean carriers have been through a period of financial and operational challenges, with vessel overcapacity, declining earnings, and the Red Sea Houthi attacks and Panama Canal drought leading to costly diversions from major global trade routes.

More about Baltimore’s Francis Scott Key Bridge collapse

Logistics companies have been scrambling since the accident to make alternate transport plans and keep up with carrier diversions, and executives told CNBC on Wednesday that the next few days will be critical in the movement of the diverted trade away from the Port of Baltimore.

The Port of Baltimore, the nation’s eleventh-largest port, is No. 1 in the U.S for auto/light truck and agriculture tractor imports and exports, in addition to handling clothing, household goods, construction materials, electronics and appliances, and produce.

Among the unresolved issues, logistics executives have cited ocean carriers not updating their vessel transits fast enough to alert them to the new diverted port so they can plan for their customer’s container pick-up.

Major ports up and down the East Coast, including Savannah, Brunswick, Virginia, Charleston, and New York/New Jersey, as well as the companies providing chassis for rail and truck transport, have told CNBC they have the capacity to ramp up operations to meet the needs of incoming cargo.

In a series of updates, MSC sent a list of 23 vessels arriving to the diverted ports from March 28-April 29. Eight have an unknown diverted port, 11 are headed to the Port of New York/New Jersey; three to Norfolk; and one to Philadelphia.

On Thursday, Transportation Secretary Pete Buttigieg had a meeting with supply chain professionals about the crisis and how to mitigate any congestion. The meeting included ocean carriers CMA CGM, Maersk, MSC, Evergreen, and railroads CSX and Norfolk Southern. The Port of New York/New Jersey, Georgia, Baltimore, Philadelphia, Jacksonville, South Carolina and Virginia were also in attendance. Shipping clients at the meeting included John Deere, Stellantis, Home Depot, Under Armour, and Volkswagen.

“We are much better equipped to mitigate supply chain disruptions than we were just a few years ago, thanks to increased coordination across the supply chain and new efforts to strengthen both our physical and digital infrastructure,” Buttigieg said, according to a readout from the meeting.

National Economic Advisor Lael Brainard, who was also in attendance, noted that in previous disruptions, the lack of complete information across different components of the private sector and the public sector hampered the decision-making capabilities and responses. She cited the recent DOT FLOW initiative as a difference maker. “It has already been activated to bring the full capacity of all the agencies in the federal government to make sure that we’re helping ocean carriers, port leaders, railroads, shippers, and unions to all come together to assess potential supply chain impacts and then work together to address them.”

Paul Brashier, vice president of drayage and intermodal at ITS Logistics, said the greatest challenges may be experienced by smaller companies that coordinate the bookings themselves and may not have relationships at these diverted ports. “You want to get your diverted container out of the port as soon as possible so you don’t incur any detention and demurrage fees. For some of these shippers they are starting from scratch,” Brashier said.

Once a container arrives at a terminal, the clock begins ticking on the free time allocated to a container. Once that free time expires, detention and demurrage fees start unless ports agree to waive them.

“We are looking to see if terminals will either give an extension of free time or waive the fees,” Brashier told CNBC on Wednesday. “That’s the rub right now.”

Warren Buffett Owns the Largest Natural Gas Pipeline System in the U.S. Want to Invest Like Him? Buy This High-Yield Pipeline Stock.

Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) is a conglomerate that directly owns a large number of companies. One, Northern Natural, is a midstream giant with a particular focus on natural gas. If you want to invest like Buffett, you can own a midstream giant focused on natural gas, too, by buying high-yielding Enterprise Products Partners (NYSE: EPD). Here’s what you need to know.

Buffett likes to collect cash

The midstream business is very boring, but that’s probably what makes it so attractive to Buffett. Northern Natural owns vital infrastructure assets and charges customers tolls for using them. That creates a reliable stream of cash flows that Berkshire Hathaway can use however it likes. Right now, that likely means building up the company’s $33.7 billion cash hoard and $130 billion in short-term investments as it searches for new acquisition candidates.

Buffett is picky with his acquisitions, preferring to wait until he finds a good company at a good price. Northern Natural obviously made the cut, with 14,200 miles of natural gas pipelines in its system. According to Berkshire Hathaway, Northern Natural owns the largest interstate natural gas pipeline system in the United States. In addition to the massive pipeline system, it also operates natural gas storage assets and liquefied natural gas storage peaking units.

None of that is at all surprising. It’s pretty much what you would expect from a midstream energy company. These are largely toll-taker businesses that generate reliable cash flows from large and expensive-to-build energy infrastructure. And many of the biggest publicly traded players in the space offer handsome dividends. One that stands out is Enterprise Products Partners.

Enterprise is an industry giant

Enterprise is one of the largest energy infrastructure players in North America, sporting a $60-billion-plus market cap. It has an investment-grade balance sheet and has increased its distribution for 25 consecutive years. Distributable cash flow covered the distribution by a very impressive 1.7 times in 2023. And — perhaps the best part for income-focused investors — the yield is a hefty 6.9%.

Enterprise Products Partners’ portfolio is a bit broader than that of Northern Natural, spanning across pipelines, storage, processing, and transportation, including facilities that export energy around the world. It also handles more than just natural gas, though it is a very big player in the natural gas arena. To give a sense of Enterprise’s scale, in 2023 it handled 34% of all U.S. waterborne natural gas liquid exports, 20% of crude waterborne exports, and 13% of waterborne petrochemical and refined product exports. In this way, it is actually more diversified than Northern Natural, which should probably be viewed as a positive by conservative investors.

To be fair, Enterprise’s distribution will likely make up the lion’s share of an investor’s total return. If you are looking to use that income to supplement your Social Security in retirement, though, this will probably not be a problem for you. That said, slow and steady distribution growth is likely, because Enterprise has the financial strength and scale to be an industry consolidator and it has around $6.8 billion worth of capital investments planned through 2026. That, of course, comes on top of regular price increases that are generally included in its contracts.

While Enterprise won’t excite you, if history is any guide, it should provide you with years of reliable income. The one fly in the ointment is that Enterprise is a master limited partnership (MLP), which can create some tax complications. MLPs don’t play well with tax-advantaged retirement accounts and you will have to deal with a K-1 form come tax time. But those are likely to be small hindrances when you weigh them against the hefty income stream you’ll be adding to your portfolio.

A Buffett-like investment of your own

You could obviously own a piece of the Northern Natural if you bought Berkshire Hathaway. But you won’t directly benefit from the cash flows it generates because Berkshire Hathaway doesn’t pay a dividend. If you buy Enterprise Products Partners, one of the largest and most reliable midstream players in North America, you can directly collect its hefty distributions and use them as you see fit. Dividend investors will probably find that to be a very attractive alternative.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Warren Buffett Owns the Largest Natural Gas Pipeline System in the U.S. Want to Invest Like Him? Buy This High-Yield Pipeline Stock. was originally published by The Motley Fool

Creditnews Research, an independent research house, released its new ranking of the fastest-selling housing markets in the U.S.

The report analyzed the top 100 largest metros in the U.S. by population to determine the country’s fastest-selling housing markets and used data sourced from Zillow to establish the number of days before a listing goes into sale-pending status.

To do a pre-Covid versus 2024 comparison, the study used metrics from January 2020 to January 2024.

All of the top 10 cities on the list are on the East Coast and in the Midwest. Five of the top 10 fastest-selling metros were also among the top areas that lost the most per-capita housing inventory since the beginning of the pandemic.

Florida had one of the strongest housing markets during the pandemic, according to CNBC’s America’s Top States for Business ranking, but not a single city in the state ranked in Creditnews Research’s top 10. It’s a signal that the housing market in the Sunshine State isn’t what it used to be.

No. 1 fastest-selling housing market: Hartford, Connecticut

As of January 2024, the fastest-selling housing market in the U.S. is Hartford, Connecticut.

The metro area’s median “days-to-pending” was eight days, down from 52 days in January 2020. This was the biggest percentage drop (-84.62%) of all the metros in the study. The state also had the second-biggest decline in per-capita housing inventory (-67.20%) since 2020.

Hartford, Connecticut has the fastest-selling housing market in the U.S., according to Creditnews Research.

Seanpavonephoto | Istock | Getty Images

Hartford’s cost of living is 6% higher than the national average, while housing expenses are 2% lower, according to PayScale.

Despite lower housing costs, the average amount that residents pay in utilities in Hartford is 26% higher than the national average, and groceries are 2% higher.

The average monthly rent in Hartford is $1,501, while home prices are around $429,687, according to RentCafe.

In 2023, Hartford was one of Realtor.com’s top 10 markets of the year. It is known as the world’s insurance capital because it is home to the headquarters of more than 100 insurance companies.

Top 10 fastest-selling housing markets

- Hartford, Conn.

- Rochester, N.Y.

- Syracuse, N.Y.

- Harrisburg, Penn.

- Richmond, Va.

- Grand Rapids, Mich.

- New Haven, Conn.

- Boston, Mass.

- Columbus, Ohio

- Worcester, Mass.

Rochester, New York, has the second fastest-selling housing market in the U.S., according to Creditnews Research.

The city, located in upstate New York, has a median days-to-pending of nine days. The nine days represent a decline of 73.53% compared to January 2020. Rochester also had the fifth-largest percentage drop in inventory per capita compared to pre-covid.

Rochester, New York has the second fastest-selling housing market, according to Creditnews Research.

Ideeone | E+ | Getty Images

Unlike New York City, the cost of living in Rochester, NY, is 21% lower than the state average and the same as the national average, according to RentCafe.

Rochester is 24.4% less expensive than New York City, and the average Rochester home value is $230,034, up 9.4% over the past year, according to Zillow.

Want to make extra money outside of your day job? Sign up for CNBC’s new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.

This week, bill pay service doxo released its annual Household Bill Pay report, which breaks down how much the average U.S. household spends on essentials, including auto loans, utilities, health insurance, rent and mortgages. The average amount consumers spend per year on household bills grew 4% year over year.

The doxo report found that 40% of households in the U.S. have to pay a monthly mortgage and that the average monthly payment is $1,402. It was the most expensive common household bill, with Americans spending an average of $885,000,000,000 a year on it.

Doxo used U.S. Census mortgage data, inclusive of taxes and homeowners insurance, to rank the states with the highest and lowest average monthly mortgage payments.

The U.S. state with the highest average monthly mortgage: California

Not only is California the state with the second-highest average rent payment, but it also boasts the highest average monthly mortgage payment, according to doxo’s report.

The average monthly mortgage in the West Coast state is $2,576, which is $1,174 above the national average. The average cost of bills in California is 38.7% above the national average, according to a 2023 doxo report.

These numbers show that California is indeed one of the most expensive states to live in.

California ranked as the state with the highest average monthly mortgage payments, according to doxo.

Steve Proehl | The Image Bank | Getty Images

The cost of living in California is 38% higher than the national average and housing is 97% higher than the national average, according to RentCafe.

Some of the most expensive cities to live in the state include Sunnyvale, San Jose, and San Francisco. All of these cities have deep ties to the tech industry, which is a big reason for the higher cost of living.

Sunnyvale’s cost of living is 63% higher than the state average and 125% higher than the rest of the U.S. The city is home to tech giants like Google, LinkedIn and Oracle.

10 U.S. states with the highest average monthly mortgage payments

- California

- New Jersey

- Hawaii

- Massachusetts

- New York

- Connecticut

- New Hampshire

- Maryland

- Washington

- Colorado

New Jersey has the second-highest average monthly mortgage payments — residents of the state pay around $2,460. Driven in part by its proximity to New York City, New Jersey has pretty high home prices compared to other places in the U.S. The median home value in the state is $497,292.

New Jersey ranked as the No. 2 state with the highest average monthly mortgage, according to doxo.

Wirestock | Istock | Getty Images

The U.S. state with the lowest average monthly mortgage: West Virginia

West Virginia has the lowest average monthly mortgage — the average payment is $961, according to doxo. Residents of the state also pay the lowest average monthly rent.

The most expensive city in the state is Clarksburg, where the cost of living is 5% higher than the state average. The cheapest major city in West Virginia is Charleston, with the cost of living 5% lower than the state average and 14% lower than the national average, according to RentCafe.

West Virginia ranked as the state with the lowest average monthly mortgage, according to doxo.

Ali Majdfar | Moment | Getty Images

10 U.S. states with the lowest average monthly mortgage

- West Virginia

- Arkansas

- Alabama

- Indiana

- Kentucky

- Mississippi

- Oklahoma

- Ohio

- New Mexico

- Iowa

Arkansas ranked as the No. 2 state with the lowest average monthly mortgages. Households pay an average of $1,022 a month, according to doxo. The state also has the second-lowest average monthly rent payment in the U.S.

Arkansas ranked as the No. 2 state with the lowest average monthly mortgage, according to doxo.

Philip Gould | Corbis Documentary | Getty Images

While Arkansas has a lower mortgage rate than other places in the U.S., the sales tax is higher.

According to SmartAsset, Arkansas is also considered a tax-friendly state. The state does not tax Social Security retirement benefits and property taxes are among the lowest in the U.S.

Want to land your dream job in 2024? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay. CNBC Make It readers can save 25% with discount code 25OFF.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.

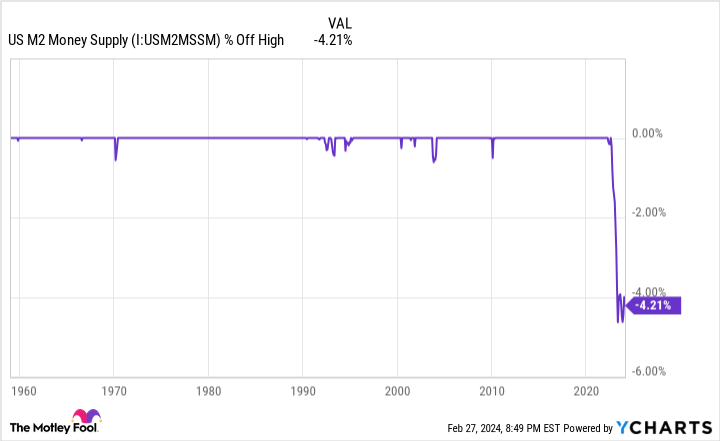

U.S. Money Supply Is Making History for the First Time Since the Great Depression, and It Implies a Big Move in Stocks Is on the Way

Over lengthy periods, it’s tough to outpace equities in the return column. Compared to gold, oil, housing, and Treasury bonds, the annualized return of stocks trumps them all over the long run.

However, the predictability of directional moves in the Dow Jones Industrial Average (DJINDICES: ^DJI), S&P 500 (SNPINDEX: ^GSPC), and Nasdaq Composite (NASDAQINDEX: ^IXIC) gets thrown out the window when the time frame is narrowed. Since the start of 2020, these three indexes have traded off bear and bull markets in successive years.

Even though forecasting directional moves for the major indexes can’t be done with 100% accuracy, it doesn’t stop investors from trying to gain an edge. This is where a very select group of economic data points and predictive indicators comes into play. Though Wall Street offers no short-term guarantees, a couple of data points and indicators do have exceptional track records of correlating with moves higher or lower in the broader market.

One such data point that speaks volumes at the moment is U.S. money supply.

U.S. money supply hasn’t done this since 1933

Among the five money supply measures, two receive the bulk of the attention from economists and investors: M1 and M2. M1 factors in all the cash and coins in circulation, as well as demand deposits in a checking account. Think of M1 as cash that’s easily accessible and can be spent in the blink of an eye.

Meanwhile, M2 takes into account everything in M1 and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000. M2 is still factoring in cash that consumers can spend, but it’s adding in capital that takes a bit more effort to get to. It’s this figure, M2, that is causing alarm in the investing world.

For well over a century, U.S. money supply has been rising with little interruption. Since a growing economy requires more cash and coins in circulation to complete transactions, rising money supply is something economists and investors tend to take for granted and assume is a given.

But on rare occasions, U.S. money supply contracts in a big way — and that’s historically portended bad news for the U.S. economy and stock market.

In July 2022, U.S. M2 money supply peaked at an all-time high of roughly $21.7 trillion. Based on the Feb. 27 data release from the Board of Governors of the Federal Reserve, M2 stood at $20.78 trillion, as of January 2024. All told, we’re looking at a year-over-year drop of 1.44% and an aggregate decline from the July 2022 peak of 4.21%. This is the first significant drop in M2 since the Great Depression.

The caveat to the decline since July 2022 is that M2 expanded at a truly historic pace during the COVID-19 pandemic. Fiscal stimulus increased M2 by a record 26% on a year-over-year basis. Thus, a case could be made that a 4.21% retracement is merely a reversion to the mean. Then again, history has been incredibly unforgiving when M2 money supply has fallen by at least 2% on a year-over-year basis.

According to research conducted by Reventure Consulting CEO Nick Gerli, which relied on data from the U.S. Census Bureau and the Federal Reserve, there have only been five instances, when back-tested to 1870, where M2 has declined by at least 2%: 1878, 1893, 1921, 1931-1933, and July 2022 through at least January 2024. The previous four instances all coincided with deflationary depressions and double-digit unemployment rates.

WARNING: the Money Supply is officially contracting. 📉

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

If I can offer a ray of hope, two of the four previous incidences occurred prior to the creation of the nation’s central bank, and the other two date back more than nine decades. The Federal Reserve’s knowledge of monetary policy, and the fiscal tools available to the federal government, make it highly unlikely that a depression would materialize today.

On the flip side, declining money supply isn’t something that should be swept under the rug. If the core inflation rate remains above the Fed’s 2% long-term target and M2 continues to decline, there will be less discretionary income to go around.

Based on data from Bank of America Global Research, about two-thirds of the S&P 500’s max drawdowns occur after, not prior to, a U.S. recession being declared. In short, a persistent decline in M2 money supply could spell trouble for a currently red-hot stock market.

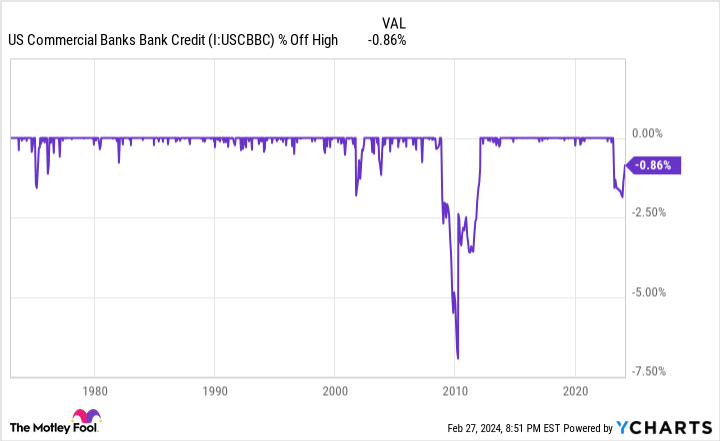

Following the money has been a problem for the past year

The worry for investors is that M2 represents just one money metric that looks to be working against the U.S. economy and stocks, as a whole. Another key money-based data point that’s cause for concern is commercial bank credit.

Commercial bank credit is reported by the Board of Governors of the Federal Reserve on a weekly basis and factors in all of the loans, leases, and securities held by U.S. commercial banks. Over the past 51 years, commercial bank credit has expanded from around $567 billion to roughly $17.44 trillion, as of the week ended Feb. 14, 2024.

Just as M2 rising over time makes complete sense, so does the regular expansion of commercial bank credit. As the U.S. economy grows, it’s only natural that consumers and businesses are going to increase their borrowing. Furthermore, commercial banks offset the cost of taking in deposits by lending.

Trouble arises when this steadily climbing metric heads decisively south.

Since data reporting began in January 1973, there have only been three instances where commercial bank credit has pulled back at least 2% from its all-time high:

-

In October 2001, during the dot-com bubble, commercial bank credit slipped a maximum of 2.09%.

-

In March 2010, shortly after the Great Recession, commercial bank credit troughed at a 6.94% decline.

-

In November 2023, commercial bank credit hit a peak drop of 2.07%.

While it is worth noting that commercial bank credit has begun climbing in recent weeks, the drop throughout 2023 pretty clearly shows that banks have tightened their lending standards. When lending institutions become pickier about how they lend their money, it’s not uncommon for businesses to pare back hiring, innovation, and acquisitions. Put another way, a notable decline in commercial bank credit can be a precursor to an economic downturn.

Although Wall Street and the economy aren’t intertwined, recessions tend to negatively impact corporate earnings, which in turn would be expected to send the Dow Jones, S&P 500, and Nasdaq Composite lower. For context, the S&P 500 lost around half of its value during the previous two sizable contractions in commercial bank credit.

History is actually a long-term investors’ best friend

Considering that the Dow Jones Industrial Average and S&P 500 have rocketed to record-closing highs in 2024, a prognostication of downside in the broader market probably isn’t what you want to hear. But just as history can, at times, serve as a short-term guide that portends downside in stocks, it’s often the greatest ally of patient investors.

As much as workers and investors might dislike recessions, the fact remains that they’re a normal and unavoidable part of the economic cycle. They’re also notoriously short-lived. Only three recessions of the 12 that have occurred since the end of World War II made it to the 12-month mark, and none of the remaining three lasted longer than 18 months. In other words, downturns in the U.S. economy are fleeting.

Compare this to periods of growth over the past 78 years and change. Though there are a couple of growth spurts that lasted around a year, most expansions were multiyear events. In fact, two periods of growth surpassed the 10-year mark.

This disparity between U.S. economic growth and contractions is seen in Wall Street’s major indexes. As an example, the S&P 500 has endured 40 separate double-digit percentage corrections since the start of 1950. However, each and every one of these downturns was eventually put in the back seat by a bull market rally. Despite never knowing precisely when these declines will occur, history has pretty conclusively shown that the major indexes will rise in value over time.

To add to the above, the analysts at Bespoke Investment Group put out a dataset in June 2023 that compared the average length of bear markets in the benchmark S&P 500 to bull markets since the start of the Great Depression in September 1929. While the average bull market has endured 1,011 calendar days, the 27 bear markets over the past 94 years have stuck around for an average of only 286 calendar days (about 9.5 months).

The final data set that overwhelmingly demonstrates the power of time and perspective for investors is updated annually by Crestmont Research.

The researchers at Crestmont analyzed the rolling 20-year total returns, including dividends, of the S&P 500 dating back to 1900. Even though the S&P didn’t come into existence until 1923, researchers were able to trace its components to other major indexes at the time, thereby allowing total returns data to be back-tested to the start of the 20th century. This left Crestmont with 105 rolling 20-year periods (1919-2023) to analyze.

What Crestmont’s dataset showed is that all 105 rolling 20-year periods produced a positive total return. Hypothetically speaking, as long as an investor purchased an S&P 500 tracking index since 1900 and held that position for 20 years, they made money, without fail, every time.

No matter what M2 money supply and commercial bank credit suggest will happen with stocks, long-term investors are perfectly positioned to succeed.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has nearly tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of February 26, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

U.S. Money Supply Is Making History for the First Time Since the Great Depression, and It Implies a Big Move in Stocks Is on the Way was originally published by The Motley Fool