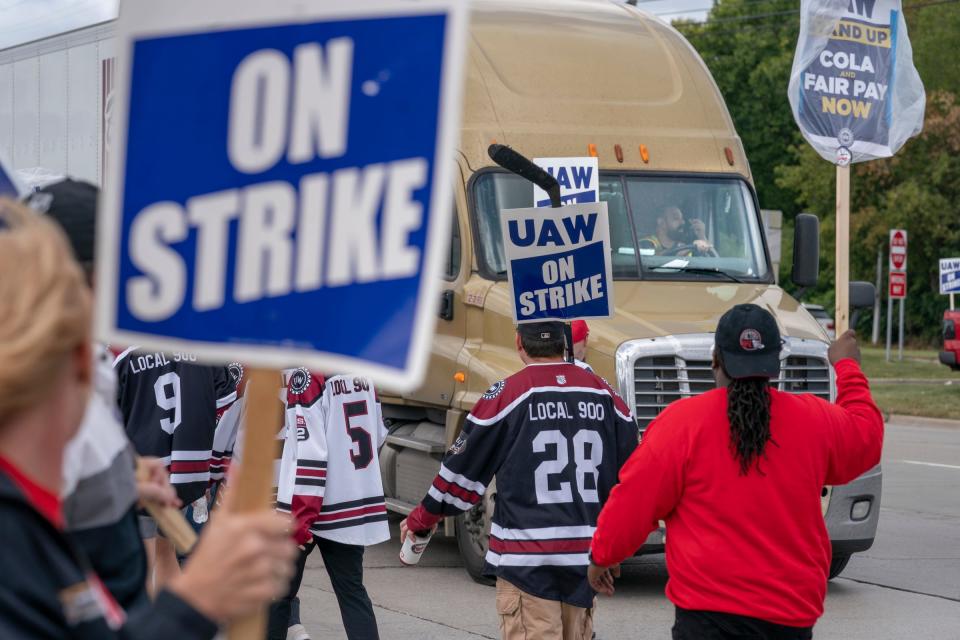

United Auto Worker employees at Ford Motor and Stellantis

are voting on a new labor deal. General Motors workers are about to vote.

By David Shepardson

(Reuters) -Toyota Motor said on Wednesday it is raising the wages of nonunion U.S. factory workers just days after the United Auto Workers union won major pay and benefit hikes from the Detroit Three automakers.

Hourly manufacturing workers at top pay will receive a wage hike of about 9% effective on Jan. 1, the company confirmed. Other nonunion logistics and service parts employees are getting wage hikes.

The largest Japanese automaker also said it is cutting the amount of time needed for U.S. production workers to reach top pay to four years from eight years and increasing paid time off.

The media and organizing project Labor Notes earlier reported the wage hikes and other details, citing a company document.

“We value our employees and their contributions, and we show it by offering robust compensation packages that we continually review to ensure that we remain competitive within the automotive industry,” Chris Reynolds, Toyota Motor North America’s executive vice president, said in a statement.

The pay of production Toyota workers in Kentucky at top scale will rise by $2.94 to $34.80 an hour.

Under the new tentative agreements with General Motors, Ford Motor and Stellantis, UAW workers will receive a wage hike of 11% upon ratification and 25% in wage hikes through April 2028. UAW workers will also be given cost-of-living adjustments. The amount of time needed for workers to hit top pay will decrease to three years from eight years.

The top pay of UAW workers at Ford will initially rise to $35.58 and hour from $32.05.

For years, the UAW has unsuccessfully sought to organize U.S. auto plants operated by foreign automakers including Volkswagen and Nissan. UAW President Shawn Fain said his goal is to organize plants operated by other automakers after the Detroit Three deal.

“One of our biggest goals coming out of this historic contract victory is to organize like we’ve never organized before,” Fain said on Sunday. “When we return to the bargaining table in 2028, it won’t just be with the Big Three, but with the Big Five or Big Six.”

The UAW declined to comment on the Toyota wage hikes.

(Reporting by David Shepardson in WashingtonEditing by Chizu Nomiyama and Matthew Lewis)

Ford Motor Co. is set to update investors after the bell today on its third-quarter profit and revenue shortly after the carmaker reached a tentative deal with the United Auto Workers to end the strike.

The striking workers at Ford

F,

are returning to work while the agreement, announced late Wednesday, goes through ratification steps.

Ford, General Motors Co.

GM,

and Stellantis NV

STLA,

each have had several factories and distribution centers offline due to the strike. GM and Stellantis are expected to follow with agreements of their own.

Ford was the first company to face walkouts at a key factory, as workers at Ford’s Kentucky pickup-truck plant walked out on Oct. 11.

GM earlier this week detailed some of the impacts of the strike, particular through the end of the current quarter, and investors will want Ford to do the same. Crucially, they are waiting to see if Ford follows GM in withdrawing guidance for the year due to the strike, which at Ford lasted one day more than the 40-day strike at GM in 2019.

Third-quarter earnings could come in better than expected since the impact of the strike was limited to the second half of September, CFRA analyst Garrett Nelson said.

See also: UAW strike moves to GM’s key SUV plant

But similarly to GM, “we think Ford is also likely to withdraw full-year guidance due to uncertainty” related to the strike, he said.

“The focus of the release will likely be on the UAW strike and how Ford’s longer-term strategy could change as a result, such as potentially moderating its EV growth plans,” Nelson said.

Here’s what to expect.

Earnings: Analysts surveyed by FactSet expect Ford to report third-quarter adjusted earnings of 46 cents a share. That would compare with adjusted earnings of 30 cents a share in the third quarter of 2022.

Revenue: FactSet analysts are looking at revenue of $43.9 billion, which would compare with $39.4 billion in the year-ago quarter.

Stock movement: Ford shares have underperformed the broader equity market, and are losing about 1% so far this year, which contrasts with gains of around 8% for the S&P 500 index

SPX.

The underperformance holds for the past three months, with Ford shares down 16% to the index’s 8% drop in the period.

What else to expect: Analysts at BofA Securities recently calculated that the UAW strike will have an impact of about $120 million for Ford in the third quarter “before a more sizable hit” in the current quarter, since only two weeks of the strike’s nearly six weeks fell in the July-September period.

Much more attention will be paid to Ford’s estimates for the fourth quarter and into 2024.

On Tuesday, GM estimated an impact on earnings before interest and taxation of about $600 million for the current quarter due to lost production.

Moody’s Investors Service said in a note earlier this month that a new union contract will mean higher labor costs for the Big Three, calculating that for Ford labor costs could increase by as much as $1.4 billion for Ford, assuming raises of about 20% for hourly wages.

The union said that the current four-year deal grants a 25% increase in base wages through April 2028. It will cumulatively raise the top wage by more than 30% to more than $40 an hour, and starting wages by 68% to over $28 an hour.

All this could chip away at Ford’s profit into the next year.

Analysts at Evercore ISI said in a report this week they expect Ford’s per-share earnings for 2024 may be trending between $1.50 and $1.70 as Ford’s Pro and Blue, the automaker’s segments focusing on fleet sales and services and on internal combustion-engine vehicles, respectively, “may see pressure” due to incentives, increased wages, and an “unclear” improvement on the electric-vehicle side of the business.

Updated Oct. 14, 2023 11:22 am ET

Ford Motor is considering cutting a work shift at the plant where it builds its electric F-150 Lightning pickup as demand for the EV truck falters, according to a memo from a United Auto Workers official.

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

A senior Ford executive said Thursday the automaker is “at the limit” of what it can spend on higher wages and benefits for the United Auto Workers, and warned the union’s strike at the company’s most profitable factory could harm workers and slash profits.

“We have been very clear that we are at the limit,” Kumar Galhotra, head of Ford’s combustion vehicle unit, said during a conference call Thursday. “We stretched to get to this point. Going further will hurt our ability to invest in the business.”

Ford is open to reallocating money within its current offer in further bargaining with the union to secure an agreement, Galhotra said. Ford is also working with the UAW on a way to bring workers at joint-venture electric vehicle battery plants into the UAW-Ford agreement, he said.

UAW President Shawn Fain on Wednesday ordered a strike at Ford’s Kentucky Truck factory after Ford negotiators did not present a richer contract proposal.

UAW negotiators turned their attention on Thursday to talks with Chrysler parent Stellantis, union President Shawn Fain said, confirming a Reuters report.

“Here’s to hoping talks at Stellantis today are more productive than Ford yesterday,” Fain wrote on social media. Stellantis did not immediately comment.

The standoff between the UAW and Ford could soon affect thousands of workers who are not among the nearly 34,000 Detroit Three workers Fain has ordered to walk off the job since Sept. 15.

About 4,600 Ford workers could be idled because their jobs depend on production of Super Duty pickups and large Lincoln and Ford SUVs at Kentucky Truck, said Ford manufacturing vice president Bryce Currie.

Already, 13,000 workers at Ford suppliers have been furloughed because of earlier UAW walkouts at two Ford assembly plants, Ford supply chain chief Liz Door said. The shutdown of Kentucky Truck, Ford’s largest factory, could push a fragile supply chain “toward collapse,” she said.

Fain and other UAW officials have countered that Ford, General Motors and Stellantis can afford to increase pay for UAW workers beyond the 20% to 23% they have offered, end lower wage tiers for lower seniority and temporary workers, and restore defined benefit pensions lost in 2007 if they rein in share buybacks and cut excessive executive pay.

SHARP ESCALATION

The walkout at Kentucky Truck was a sharp escalation in the UAW’s slow-building campaign of strikes, and sent a warning to Stellantis and General Motors, whose wage and benefits offers fall short of Ford’s, based on summaries the automakers and the UAW have released.

Fain has scheduled a video address for Friday at 10 a.m. EDT (1400 GMT). In past weeks, Fain has used Friday addresses to order additional walkouts, or announce progress in bargaining.

Fain has yet to tip his hand as to what actions he will take Friday, if any.

Some analysts saw Fain’s decision to shut down Ford’s Kentucky Truck plant, which builds Super Duty pickups and Lincoln Navigator SUVs, as a sign that the endgame could be starting in the nearly month-long round of coordinated walkouts at the Detroit Three.

“Pressure was always needed to force a deal,” Evercore ISI analyst Chris McNally wrote in a note on Thursday.

White House press secretary Karine Jean-Pierre said the administration was closely monitoring the economic impact of the widening strike and still hoped both sides will reach a “win-win agreement.”

Last Friday, Fain said if needed, the UAW would strike the GM assembly plant in Arlington, Texas, that builds Cadillac Escalade, Chevy Suburban and other large, high-priced SUVs. GM’s Flint, Michigan, heavy-duty truck assembly plant is another potential strike target.

High-profit targets at Stellantis include the automaker’s Ram pickup truck factories in Sterling Heights and Warren, Michigan, as well as two Jeep SUV factories in Detroit.

“This puts everybody on notice,” said Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions. “If they haven’t brought anything new to the table since last week, GM and Stellantis should be worried.”

Analysts at Wells Fargo estimated that Ford will lose about $150 million per week in core profit from the Kentucky plant strike.

Ford officials said on Thursday that cutting a deal that does not allow the company to survive makes no sense and that striking the Kentucky truck plant would also hurt the UAW’s profit-sharing checks.

In a sign of the strike’s expanding impact, Delta Air Lines said on Thursday it is feeling a pinch from the automotive and entertainment labor strikes. Delta President Glen Hauenstein said the UAW strike has curtailed a “significant” amount of business in Detroit.

Automakers have more than doubled initial wage hike offers, agreed to raise wages along with inflation and improved pay for temporary workers, but the union wants higher wages still, the abolishment of a two-tier wage system and the expansion of unions to battery plants.

The UAW has room to expand its walkouts and increase the pressure on the Detroit Three to offer bigger wage gains, richer retirement packages and more assurances that new electric vehicle battery plants will be unionized.

Even with 8,700 workers at Ford’s Kentucky Truck plant now on strike, less than a quarter of the 150,000 UAW workers at the Detroit Three automakers are now on strike. However, thousands more have been furloughed from jobs at operations that are not on strike because automakers said the walkouts made their work unnecessary.

Ford said on Thursday that it already had 13,000 layoffs at its suppliers and that 4,600 of its own workers could be laid off at other plants.

Ford warned that workers at a dozen other factories could be sent home because of the truck plant walkout. Officials said new layoffs stemming from the Kentucky strike could begin in the coming days.

Its Kentucky truck plant, the company’s most profitable operation, generates $25 billion in annual sales, about a sixth of Ford’s global automotive revenue.

Fain and other UAW officials called a meeting with Ford at on Wednesday evening and demanded a new offer, which Ford did not have, a Ford official said.

“You just lost Kentucky Truck,” Fain said, according to the Ford official and a union source, speaking on condition of anonymity because the talks are not public.

Ford said the decision was “grossly irresponsible.”

Fain has said his aim is to keep the automakers off-balance by taking targeted action rather than a full strike.

The Detroit automakers will report third-quarter financial results between Oct. 24 and Oct. 31, and the UAW could use what are expected to be robust profits to press their case for a richer contract.

Before Wednesday’s Ford announcement, the union had ordered walkouts at five assembly plants, including two Ford assembly plants, at the three companies and 38 parts depots operated by GM and Stellantis.

(Reporting by Joe White in Detroit, Abhirup Roy in San Francisco and David Shepardson in Washington; Additional reporting by Priyamvada C in Bengaluru; Editing by Peter Henderson, Ben Klayman, Nick Zieminski and Matthew Lewis)

The United Auto Workers (UAW) union strike against Detroit’s Big Three has now expanded to more than 25,000 members. According to former President Donald Trump, the future looks bleak for America’s automotive industry.

“The autoworkers will not have any jobs, Kristen, because all of these cars are going to be made in China. The electric cars, automatically, are going to be made in China,” Trump told NBC’s Kristen Welker during a recent “Meet the Press” interview.

“The auto workers are being sold down the river by their leadership and their leadership should endorse Trump,” the former president said.

Welker noted that UAW president Shawn Fain said that a second Trump term would be “a disaster.”

It appears that Trump is not a fan of Fain, either.

“I think he’s not doing a good job in representing his union because he’s not going to have a union in three years from now,” Trump said. “Those jobs are all going to be gone because all of those electric cars are going to be made in China.”

As global electric vehicle (EV) adoption rises, EV stocks have been in the spotlight. But some companies are poised to benefit from the trend regardless of where the cars are made. Here’s a look at two of them.

No matter which country makes your electric car, you need to charge it. And that’s where ChargePoint comes into play.

ChargePoint’s network has over 255,000 activated ports across North America and Europe. The company serves residential, commercial and fleet customers. It has delivered more than 188 million charging sessions to date.

Business is growing, too. In the three months ended July 31, the company brought in $150 million of revenue, representing a 38% increase year over year.

But the stock hasn’t been a hot commodity. Year to date, ChargePoint shares have fallen by nearly 50%.

Evercore ISI Group analyst James West has an Outperform rating on ChargePoint and a price target of $17.

Considering that shares are trading at around $4.56, the price target implies a potential upside of 273%.

Blink is another company that focuses on the charging side of the EV business. It operates the Blink Network, a proprietary cloud-based software that operates, maintains and tracks all the Blink EV charging stations and the associated charging data.

The company said it has contracted, sold or deployed almost 78,000 charging ports worldwide.

In the second quarter of 2023, revenue surged 186% year over year to $32.8 million. Management recently raised the company’s full-year revenue target from $100 million-$110 million to $110 million-$120 million.

Yet, much like ChargePoint, Blink is a beaten-down stock. Shares have tumbled 72% in 2023.

H.C. Wainwright & Co. analyst Sameer Joshi has a Buy rating on Blink and a price target of $50, implying a potential upside of 1,567%.

Blackstone made a $13 billion bet on the growth in student housing. Here’s how you can carve out your own piece of the student housing market with just $500.

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article ‘Autoworkers Will Not Have Any Jobs’: Donald Trump Slams UAW President, Warns That All EVs ‘Will Be Made In China’ — 2 Top EV Stocks No Matter Where The Cars Are Made originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

United Auto Workers (UAW) President, Shawn Fain addresses picketing UAW members at a General Motors Service Parts Operations plant in Belleville, Michigan, on September 26, 2023, as US President Joe Biden joined the workers.

Jim Watson | Afp | Getty Images

DETROIT – United Auto Workers President Shawn Fain doubled down on his criticism of former President Donald Trump ahead of the Republican presidential front-runner’s rally Wednesday night at an auto parts supplier in Michigan.

During national media interviews following Fain’s appearance with President Joe Biden on a UAW picket line Tuesday afternoon in suburban Detroit, the outspoken union leader denounced Trump’s track record with automotive unions. He also criticized the fact that Trump’s Wednesday visit will be at a nonunion company called Drake Enterprises.

“I find a pathetic irony that the former president is going to hold a rally for union members at a nonunion business,” Fain said in an interview Tuesday night on CNN. “All you have to do is look at his track record — his track record speaks for itself.”

When asked if he would meet with Trump during his trip, Fain said he sees “no point” in doing so “because I don’t think the man has any bit of care about what our workers stand for, what the working class stands for. He serves a billionaire class and that’s what’s wrong with this country.”

In response to Fain’s comments, a Trump spokesman generally criticized the “political leadership of some of the labor unions and the working middle class employees that they purport to represent.”

“President Trump will be in Michigan talking with union workers and ensuring American jobs are protected. He has always been on the side of American workers and will do everything in his power to be their voice as Crooked Joe Biden is on the side of our foreign adversaries,” Trump spokesman Steven Cheung said in an emailed statement.

Trump recently accused UAW leaders of failing their members. He has also heavily criticized Biden for the timing of his visit to Michigan, as well as the current administration’s support of electric vehicles.

“Crooked Joe Biden had no intention of going to visit the United Autoworkers, until I announced that I would be heading to Michigan to be with them, & help then out. Actually, Crooked Joe sold them down the river with his ridiculous all Electric Car Hoax,” Trump posted early Saturday on his social media platform Truth Social.

Biden and Trump visited the presidential swing state amid a UAW strike against General Motors, Ford Motor and Stellantis, after the sides failed to reach new contracts by Sept. 14. The strikes currently involve about 18,300 workers, or 12.5%, of the UAW’s 146,000 members with the automakers.

In the Saturday post, Trump, who has gained the support of many blue-collar workers who helped him win the presidency in 2016, also urged the UAW to endorse him, claiming “autoworkers are ‘toast'” if they don’t.

Though Fain has condemned Trump and voiced support for Biden during his picket line visit Tuesday, the UAW is withholding an endorsement in the 2024 presidential election. Fain has said the union is doing so until the UAW’s concerns about the auto industry’s transition to EVs are addressed.

“Our focus right now is 100% on getting a great agreement for our members,” Fain told CNN. “Endorsements and things like that, we’ll do those things at the appropriate time … there’s still work to be done.”

Former U.S. President Donald Trump gestures during a rally in Warren, Michigan, U.S., October 1, 2022.

Dieu-nalio Chery | Reutersm

The UAW for several years has been concerned about how to transition traditional auto workers into new jobs for EVs. A 2018 study by the union found mass adoption of EVs could cost the UAW 35,000 jobs. However, the union has more recently said that number could be lower.

Fain, on the picket line with Biden at the Willow Run Redistribution Center, called the president joining the striking workers a “historic moment.” But he did not officially endorse the commander in chief for next year’s presidential election.

Fain invited Biden to join the UAW picket lines days after Trump announced he would skip the second GOP debate to hold a rally in Macomb County, Michigan, where a large contingent of blue-collar autoworkers live.

UAW is not affiliated with Trump’s Wednesday rally. But UAW members have previously attended and participated in Trump’s events in Michigan.

In 2016, when the union endorsed Democratic candidate Hilary Clinton, the UAW said about 1 in 4 of its 412,000 members supported Trump, according to an internal survey by the union.

The UAW followed Fain’s comments about Trump by releasing an online video criticizing plant closures, including GM’s decision four years ago to shutter its Lordstown Assembly plant in Ohio. The video included a 2017 clip of Trump telling area residents that jobs lost in the region were “all coming back.”

“I’ll tell you what, I rode through your beautiful roads coming up from the airport, and I was looking at some of those big, once-incredible job producing factories. My wife, Melania, said ‘What happened?’ I said ‘Those jobs have left Ohio,'” Trump said on July 25, 2017. “They’re all coming back. They’re all coming back. Coming back. Don’t move. Don’t sell your house. Don’t sell your house.”

U.S. President Donald Trump speaks next to Lordstown Motors employees Michael Fabian and Rich Schmidt while inspecting the Lordstown Motors 2021 endurance truck, an electric pickup truck, on the South Lawn at the White House in Washington, U.S., September 28, 2020.

Carlos Barria | Reuters

The comments came before GM’s closure of the plant, which Trump criticized publicly. He demanded GM CEO Mary Barra “sell it or do something quickly.”

GM sold the plant to EV startup Lordstown Motors, a decision Trump hailed. However, the company was not successful and filed for bankruptcy in June.

The location of Trump’s Wednesday visit to Drake Enterprises “was chosen to host the former president because of its entrepreneurial spirit and its exposure to the gasoline engine business,” a co-owner of the company, which employs roughly 125 people, told Crain’s Detroit Business.

The rally is scheduled to begin at 8 p.m. ET, an hour before the second GOP debate is scheduled to start. Trump also skipped the first GOP debate last month, opting instead to release a prerecorded interview online with former Fox News host Tucker Carlson.

Pat Green is nervous. He has spent the past two years trying to hire talented people to fill the two plants in Grand Rapids operated by Cascade Die Casting Group, which makes aluminum and zinc diecasting for the automotive and appliance industries.

“We’ve got a good team now and I don’t want to lose people because it was hard to find good people,” Green, who is CEO of the company, told the Detroit Free Press, part of the USA TODAY Network, on Monday.

That’s why on the fourth day of a historic United Auto Workers strike against the Detroit Three automakers, Green was intensely planning for ways to ride it out without having to lay off workers if the strike grows and stretches into weeks. He has good reason for planning. On Monday night, UAW President Shawn Fain announced a new strike deadline of this Friday at noon. If Ford Motor Co., General Motors or Stellantis have not made substantial progress toward an agreement with the UAW by that time, Fain will expand the Stand Up Strike to more plants.

‘If not now, when?’ Here’s why the UAW strike may have come at the perfect time for labor

For Green’s part, if that happens, he’ll start by ending overtime at the company and then he’ll ask for volunteers to take some time off with a reduced pay plan. It’s something he started contemplating late last week.

The UAW’s strike started at 11:59 p.m. Thursday when nearly 13,000 UAW workers across the three Detroit automakers walked out of three plants as part of the first wave of shutdowns until a new labor agreement is reached. Those plants are Ford Michigan Assembly Plant (Final Assembly and Paint only) in Wayne, Stellantis Toledo Assembly Complex in Ohio and GM’s Wentzville Assembly in Missouri.

If the union and the automakers can’t reach a tentative agreement, at some point the UAW has said it plans to strike more plants across the three companies. A broader and prolonged strike would mean parts suppliers couldn’t keep production going if the vehicle assembly plants that use their parts are idled. No one is sure of just how long suppliers could hold out.

See the picket lines: UAW launches a strike, targeting three Detroit automakers

“We’re in better shape than most, but if others in the supply chain go down, we’ve got another crisis on our hands just like the chips crisis,” Green said, referring to a recent shortage of semiconductor chips that crippled the industry. “If this stretches out to five or six weeks, there’s going to be real problems in the supply chain. And I could be wrong; it could be shorter than that.”

The Biden administration has been preparing to offer emergency economic aid to auto suppliers to mitigate any long-term damage caused by a prolonged strike, according to published reports.

But the strike has already had some impact. A component maker in Michigan, CIE Newcor, warned it may have to lay off 293 people.

German-based supplier ZF said that it has already had to lay off some workers at various sites, including in Michigan, said Tony Sapienza, ZF North America, Inc.’s head of communications. ZF supplies components for all the vehicles made at the three plants targeted so far in the strike, including the hybrid transmission to the Jeep Wrangler 4xe hybrid made at the Toledo facility.

Sapienza declined to say which of ZF’s facilities have been affected or how many people ZF has laid off. ZF, which has North American offices in Northville, employs 11,000 people at five manufacturing sites and four technology centers in Michigan.

“The impact was immediate; we’ve had to slow production in a couple of areas,” Sapienza told the Free Press. “If the strike were to broaden or last anything longer than one or two weeks, that would be a crisis for the supply chain. I’d be really concerned with tier 2 and tier 3 and their ability to stay solvent.”

Sapienza said a bigger and prolonged strike “would hurt” his company, but because of its size, it would be OK.

But “every plant that goes offline creates additional stress in the supply chain, and we really hope our customers and the UAW are taking this into consideration,” Sapienza said.

U.S. Steel said Monday it is temporarily idling furnace B at the Granite City steel plant in Illinois as a “risk mitigation” in response to the UAW strike. The company said it is evaluating how many of its 1,450 employees there will be affected.

All of this news comes as the UAW’s counterpart in Canada, Unifor, is negotiating a new contract with Detroit automakers as well. Its current contract was slated to expire at 11:59 p.m. Monday. But in the early hours Tuesday morning, Unifor said it would keep talking with Ford, after the automaker made a “substantive offer” on a new labor contract as the former deal expired. Unifor is extending negotiations for a 24-hour period.

Unlike the UAW, Unifor is following tradition and has selected a target company — Ford — to negotiate a deal with first. It would use that agreement as a template for contracts with the other two. In the U.S., the UAW is negotiating with all three automakers separately, but simultaneously.

Around 4 p.m. Monday, Unifor National President Lana Payne said there was still no tentative agreement with Ford.

“While we remain at the table the likelihood of a strike increases with each passing hour,” Payne said, adding that the union has advised more than 5,600 members at Ford facilities in Canada to prepare for all scenarios, including a strike.

After Ford’s eleventh-hour “substantive offer,” Unifor said it would negotiate through the night, but members should continue to maintain strike readiness.

If Unifor does not get a tentative agreement and strikes in solidarity with the UAW, that will be a double whammy for parts suppliers.

“These are not normal times,” Sapienza said. “We’re coming off of three years of stress on the supply chain and so we’re already in a fragile state. We’re keeping an eye on Unifor, for sure. … There’s only so much more stress the system can take.”

The state of the supply chain is delicate. That’s because it has had to recover from the COVID-19 pandemic, which shut down the industry for eight weeks, then suppliers faced a massive shortage of semiconductor chips used in a variety of car parts. Since early last year, many suppliers have struggled to hire and retain workers.

Joe Petrillo, director of business development and advanced engineering at Meridian Lightweight Technologies in Plymouth, said the company is a global supplier of lightweight cast metal parts to many automakers including the Detroit Three. So the strike is a concern because of the interconnection of the supply chain from the tier 1 suppliers — those that supply parts directly to the carmakers — down to the smaller tier 2 and tier 3 suppliers, those who supply components to the tier 1 group.

“We are monitoring the events and checking in with our suppliers and customers,” Petrillo said. “In our view, an escalation of events that leads to a prolonged strike that possibly idles all the Detroit Three (manufacturing) plants, may prove to be the last Jenga block on a supply base that has been stressed to the max, having to overcome COVID shutdowns, ‘stop-and-go production’ due to chip and part shortages, while still trying to work its way through a constrained manufacturing labor market.”

Glenn Stevens, executive director of MICHauto, the group that advocates for the statewide automotive industry, said he has been talking to suppliers for a couple months and they have all been preparing for a strike scenario for some time.

“Some much more proactively than others, but nobody was flying blind anticipating that there might not be a work stoppage,” Stevens said.

There are about 1,000 supplier facilities in Michigan, he said, noting that 96 of the top 100 suppliers to the North American auto market either have their headquarters or a facility in Michigan. So if the strike expands to other automaker plants and lasts into weeks, the job layoffs could reach into tens of thousands.

“You have the direct employment and you have the multiplier affect of each of the automotive jobs and that is between six to 10 people for every one automaker job, so it’s substantial,” Stevens said. “This is the largest industry in our economy. It has an economic contribution of over $300 billion annually to the state of Michigan.

The larger suppliers are likely more protected than the smaller ones from strike fallout, said Laurie Harbour, CEO of Harbour Results, Inc. That’s because they often have other customers from other industries to keep business going. They can move people around and change up schedules to avoid massive layoffs.

“I talked to several companies last Friday and most said little to no impact yet,” Harbour said. “Any one program, which is what you’re looking at with the (automakers), is not going to create massive layoffs but come tomorrow or the next day if (UAW’s Fain) closes more plants and we get to a significant product like the (Ford) F-150 pickup, then you’re going to see more layoffs.”

Because the sales volume of the F-150 is so important, if the union were to strike the plants that build Ford’s big seller, “you’ll see thousands of layoffs because you have so many supplier plants and sub-suppliers,” Harbour said.

“The fact that it’s happening in this spotty fashion is actually better for the supplier community,” Harbour said. “But every day or week that goes by you could see more and more layoffs.”

At giant tier 1 auto supplier Magna International, leaders are closely monitoring the situation, said Dave Niemiec, Magna spokesman. The company has about 12,450 employees in Michigan. Niemiec said it is premature to comment on any specific impact the strike may have on its operations.

“However, we have focused considerable attention on contingency planning to proactively address any temporary business disruptions to our operations,” Niemiec said. “If that time comes, we are prepared in terms of temporarily scaling back production on affected programs as efficiently as possible, while being equally prepared to ramp up quickly when ready. In the meantime, we remain hopeful that the parties will be able to reach amicable agreements and the disruption and potential impact will be minimal.”

When asked of any impact from the strike on Lear, spokesman Brian Corbett said, “At this time, we’re not commenting on the UAW strike.”

Harbour said most suppliers she’s talked to are prepared or at least forming plans if the strike grows that include considering how to effectively keep producing, make scheduling changes to their shifts and have layoff strategies in place, even offering supplemental pay up to 70% of workers’ salaries if they are laid off.

“Those are the ones who are financially strong and don’t want to lose their people,” Harbour said. “It’s a daily challenge and you’ll evaluate everything every day: What is my forecast? What can I deliver to my customer? And run a little bit of inventory so that when the spigot comes back on, I have parts and ready to go.”

At Cascade Die Casting Group, Green said the company makes parts for the Detroit Three’s SUVs and pickups. For example, it makes parts for the Jeep Grand Cherokee that Stellantis builds at the Mack Avenue Assembly Plant in Detroit. If the UAW strikes that plant or any of the plants that make the Detroit Three’s heavy duty pickups, Green has to be ready.

Contact Jamie L. LaReau: jlareau@freepress.com. Follow her on X, formerly Twitter: @jlareauan.

This article originally appeared on Detroit Free Press: UAW strikes: Auto suppliers warn of closures if more plants involved

Blue Cross Blue Shield employees show their support to members of the United Auto Workers (UAW) union as they march through the streets of downtown Detroit following a rally on the first day of the UAW strike in Detroit, Michigan, on September 15, 2023.

Matthew Hatcher | AFP | Getty Images

DETROIT – The United Auto Workers union will announce additional strikes at General Motors, Ford Motor and Stellantis plants if the sides don’t make “serious progress” in negotiations by noon ET Friday, UAW President Shawn Fain announced Monday night.

The timing of the additional plants would come just over a week after the union announced targeted strikes at assembly plants for each of the Big Three Detroit automakers, sending about 12,700 workers to picket lines.

“Autoworkers have waited long enough to make things right at the Big Three. We’re not waiting around, and we’re not messing around. So, noon on Friday, Sept. 22, is a new deadline,” Fain said in a video released online by the union.

Fain previously said the union planned to increase the work stoppages, based on how negotiations with the companies were going. The announcement follows the union meeting with each of the automakers since the targeted strikes began Friday.

Unlike the original contract deadlines, Fain did not say tentative agreements needed to be reached at the companies to avoid additional strikes, just “serious progress.” A union spokesman did not immediately respond for comment regarding what defines that aside from a tentative deal.

Currently on strike are workers from GM’s midsize truck and full-size van plant in Wentzville, Missouri; Ford’s Ranger midsize pickup and Bronco SUV plant in Wayne, Michigan; and Stellantis’ Jeep Wrangler and Gladiator plant in Toledo, Ohio.

The union selected the plants as part of targeted strike plans, as Fain and UAW leaders unconventionally negotiate with all three automakers at once. It’s calling the work stoppages “stand-up strikes,” a nod to historic “sit-down” strikes by the UAW in the 1930s.

“The ‘Stand Up Strike’ is a new approach to striking. Instead of striking all plants all at once, select locals have been called on to ‘Stand Up’ and walk out on strike. If the automakers fail to make progress in negotiations and bargain in good faith going forward, more locals will be called on to Stand Up and join the strike,” Fain said Monday.

Targeted strikes typically focus on key plants that can then cause other plants to cease production due to a lack of parts. They are not unprecedented, but the way the union is conducting them is not typical.

GM and Ford released general statements on the ongoing talks, but both declined to comment directly on the union-imposed deadline Monday night. Stellantis referred to a statement released Monday afternoon about discussions with the union earlier in the day being “constructive and focused on where we can find common ground to reach an agreement.”

The additional strike plans are despite automakers making record offers to the union that include roughly 20% hourly wage increases, thousands of dollars in bonuses, retention of the union’s platinum health care and other sweetened benefits.

Key demands from the union have included 40% hourly pay increases, a reduced 32-hour workweek, a shift back to traditional pensions, the elimination of compensation tiers and a restoration of cost-of-living adjustments, among other items.